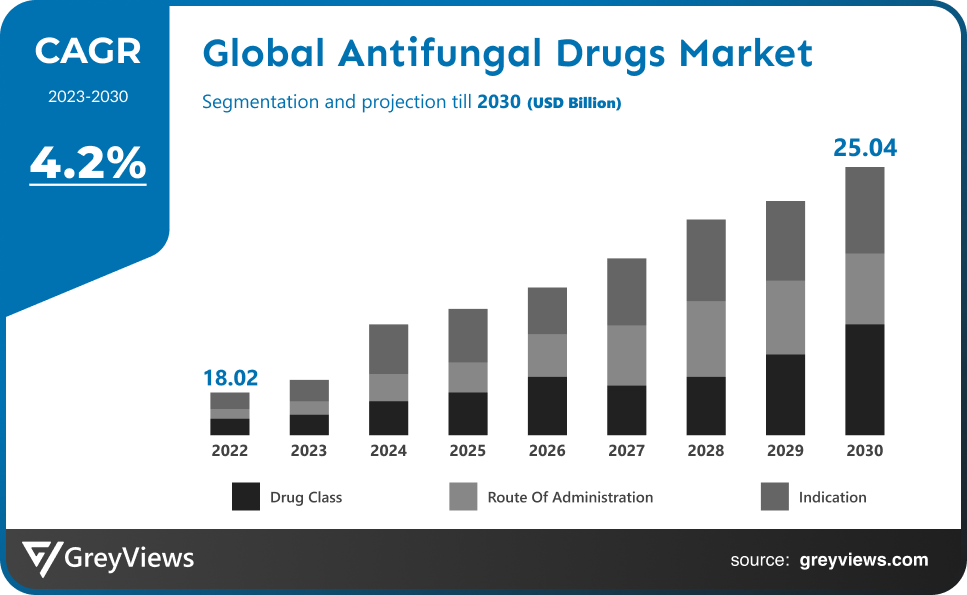

Antifungal Drugs Market Size By Drug Class (Allylamines, Azoles, Polyenes, Echinocandins, and Others), By Route of Administration (Parenteral, Oral and Topical), By Indication (Candidiasis, Dermatophytosis, Aspergillosis and Others), Regions, Segmentation, and Projection till 2030

CAGR: 4.2%Current Market Size: USD 18.02 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2023-2030Base Year: 2022

Global Antifungal Drugs Market- Market Overview:

The global antifungal drugs market is expected to grow from USD 18.02 billion in 2022 to USD 25.04 billion by 2030, at a CAGR of 4.2% during the Projection period 2023-2030. The growth of this market is mainly driven owing to the increasing cases of infectious fungal diseases and rising awareness among patients.

Medications that remove fungal infections from the host are known as antifungal drugs. These fungal agents multiply by spreading spores, infecting the skin, hair, and other body parts. As a result of robust developmental efforts made by researchers and market players in the field, the antifungal drugs market is continuously growing and evolving, resulting in candidiasis, mucormycosis, and other diseases. These medications treat fungal infections without damaging human body cells because they target the membrane of the fungal cells and the wall of the fungal cells in order to fight fungal infections. As a result of a rising prevalence of fungal infections, a heightened awareness of a wide range of fungal infections, and an increase in demand for generic drugs, the market is expected to grow substantially. Moreover, the antifungal drug market is expected to see lucrative growth opportunities with an increase in R&D expenditures and funding from both the public and private sectors. In the Projection period, the market for over-the-counter antifungal medications for cutaneous infections is expected to grow quickly. However, patents on branded treatments are expected to expire soon, and counterfeit medicines are anticipated to become increasingly available, which is hampering the market growth.

Sample Request: - Global Antifungal Drugs Market

Market Dynamics:

Drivers:

- Rising research and development activities

Researchers and developers have been actively pursuing research and development activities, which will contribute to the growth of the antifungal drugs market. As well as this, the market's growth rate will be further accelerated by the increasing approvals and launches of drugs for treating fungal infections. Market players are increasingly focused on launching generic products for treating fungal infections, which is expected to further boost the market's growth.

Restraints:

- High cost

The high cost of antifungal drugs will hinder the growth rate of the market. As antifungal drug resistance increases and healthcare infrastructure in developing economies lacks, the antifungal drug market will be challenged. The availability of counterfeit antifungal drugs as well as the side effects associated with them will restrain and further impede the market growth rate during the Projection period.

Opportunities:

- Rising healthcare expenditure

As healthcare expenditure increases, so does infrastructure improvement, which contributes to the growth rate of the antifungal drugs market. As well, rising efforts by public and private organizations to raise awareness of a variety of fungal infections will boost the growth rate of the antifungal drugs market. Furthermore, ageing populations and increasing consumption of antifungal drugs for various medical conditions in developing regions will also contribute to the market's growth.

Challenges:

- Supply chain disruptions

The antifungal medicine business has been disrupted by supply chain disruption and strict social distancing rules. As a result of the unblocking of economies during the 2nd quarter of 2020, the market for antifungal drugs, which had stalled, has been revived. Also, government authorities have ordered nationwide lockdowns in a majority of countries in an effort to curb COVID-19's spread.

Segmentation Analysis:

The global antifungal drugs market has been segmented based on drug class, route of administration, indication, and region.

By Drug Class

The drug class segment includes allylamines, azoles, polyenes, echinocandins, and others. The azoles segment led the largest share of the antifungal drugs market with a market share of around 31% in 2022. Azoles have a leading position in the market because of their broad-spectrum activity. These agents act as fungistatic agents by inhibiting fungal enzymes. Azoles are commonly used for treating candidemia, blastomycosis, and ocular fungal infections. As well as offering a wide spectrum of activity and enhanced safety levels, triazoles also offer fewer adverse effects, less serious drug interactions, and improved absorption and distribution.

By Route of Administration

The route of administration segment includes parenteral, oral and topical. The topical segment led the largest share of the antifungal drugs market with a market share of around 43% in 2022. There is a huge market share for topical medication due to the growing use of topical medication worldwide. Topical antifungal medications are able to treat most epidermis-confined cutaneous dermatophyte infections.

By Indication

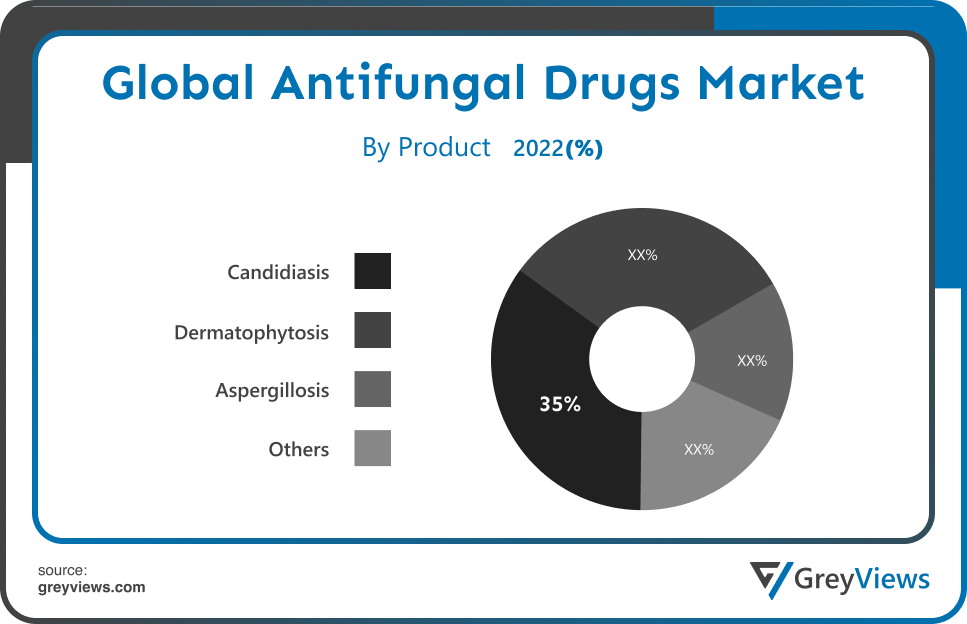

The indication segment includes candidiasis, dermatophytosis, aspergillosis and others. The candidiasis segment led the largest share of the antifungal drugs market with a market share of around 35% in 2022. In the Projection period, Candidiasis is expected to grow at the fastest rate due to its yeast infection caused by the genus Candida, which has evolved over time. Some of the changes include the appropriate use of echinocandins and broad-spectrum azoles for treating candidemia, and invasive candidiasis, Increasing numbers of patients are becoming more susceptible to fungal infections, driving the segment.

Global Antifungal Drugs Market- Sales Analysis.

The sale of antifungal drugs expanded at a CAGR of 3.8% from 2016 to 2022.

Increased prevalence of fungal infections among the population, individuals' increasing awareness of antifungal medications has aided market expansion, and increased research into antifungal medications has propelled the market.

Also, the antifungal drugs market growth is complemented by the rise of common fungal infections like candidiasis. However, echinocandins are expected to grow rapidly over the Projection period due to the rise in hospital-acquired infections and the increase in life expectancy of people.

Additionally, the antifungal drugs market is expected to grow as pharmaceutical industries develop and healthcare spending improves.

Thus, owing to the aforementioned factors, the global antifungal drugs market is expected to grow at a CAGR of 4.2% during the Projection period from 2023 to 2030.

By Regional Analysis:

The regions analyzed for the antifungal drugs market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North American region dominated the antifungal drugs market and held a 38.5% share of the market revenue in 2022.

- The North American region witnessed a major share. Increasing incidences of infectious diseases contribute to the growth of the region. The growing prevalence of the diseases has led to an increased usage of these drugs and the development of innovation-based drugs that have received fast-track approval by the FDA. Moreover, established pharmaceutical companies that strive to expand their geographic reach and commercialize their drugs will play a crucial role in growing the market in the region.

- Asia Pacific is anticipated to experience significant growth during the predicted period. There are many factors contributing to the regional market's growth, including high unmet clinical needs, growing disposable income, and easy availability of drugs. Global players are investing heavily in R&D and commercializing branded drugs at a relatively low price in the region in order to attract consumers.

Global Antifungal Drugs Market - Country Analysis:

- Germany

Germany's antifungal drugs market size was valued at USD 1.35 billion in 2022 and is expected to reach USD 1.9 billion by 2030, at a CAGR of 4.4% from 2023 to 2030.

A major driver of the antifungal drugs market growth is the rising incidence of fungal and nosocomial infections. Developed healthcare infrastructure is spurring market growth, and antifungal agents are effective against systemic and superficial infections that result from exposure to contaminated surfaces in hospitals or humid environments.

- China

China’s antifungal drugs market size was valued at USD 1.4 billion in 2022 and is expected to reach USD 2 billion by 2030, at a CAGR of 4.6% from 2023 to 2030.

Despite significant progress in the field of fungal treatments, the incidence and mortality associated with fungal infections have remained virtually unchanged for the past decade. As a result of this continued fungal spread, pharmacists in the country will have an opportunity to develop novel antifungal drugs that will increase market demand.

- India

India's antifungal drugs market size was valued at USD 1.08 billion in 2022 and is expected to reach USD 1.5 billion by 2030, at a CAGR of 4.5% from 2023 to 2030.

Especially in India, there is an expectation that the antifungal drug market will flourish in the Asia-Pacific region. This is because India is home to a tropical environment that is ideal for breeding fungi. As a result of this factor, India's pharmaceutical vendors are enjoying lucrative opportunities to supply antifungal drugs to the drug market.

Key Industry Players Analysis:

To increase their market position in the global antifungal drugs market business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Astellas Pharma, Inc.

- Merck & Co., Inc.

- Enzon Pharmaceuticals

- Novartis AG

- Hikma Pharmaceuticals PLC

- Bausch Health Companies Inc.

- Reddy's Laboratories Ltd.

- Pfizer, Inc

- Gilead Sciences, Inc.

- Hoffmann-La Roche Ltd.

- Cipla Inc.

Latest Development:

- In June 2021, an antifungal drug called Posaconazole has been launched by Cadila Pharmaceuticals. It is effective against a wide range of invasive fungal diseases, including Mucormycosis.

- In June 2021, US Food and Drug Administration approved Brexafemme by Scynexis for the treatment of vaginal yeast infections.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2022-2030 |

|

Base year |

2022 |

|

CAGR (%) |

5.5% |

|

Market Size |

1.8 billion in 2022 |

|

Projection period |

2023-2030 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Drug Class, By Route of Administration, By Indication, and By Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Astellas Pharma, Inc., Merck & Co., Inc., Enzon Pharmaceuticals, Novartis AG, Hikma Pharmaceuticals PLC, Bausch Health Companies Inc., Dr. Reddy's Laboratories Ltd., Pfizer, Inc, Gilead Sciences, Inc., F. Hoffmann-La Roche Ltd., and Cipla Inc. |

|

By Drug Class |

|

|

By Route of Administration |

|

|

By Indication |

|

|

Regional scope |

|

Scope of the Report

Global Antifungal Drugs Market by Drug Class:

- Allylamines

- Azoles

- Polyenes

- Echinocandins

- Others

Global Antifungal Drugs Market by Route of Administration:

- Parenteral

- Oral

- Topical

Global Antifungal Drugs Market by Indication:

- Candidiasis

- Dermatophytosis

- Aspergillosis

- Others

Global Antifungal Drugs Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

How big will be antifungal drugs market in 2030?

Global antifungal drugs market is expected to reach USD 25.04 billion by 2030, at a CAGR of 4.2% from 2023 to 2030.

How many segments are there in the antifungal drugs market?

The antifungal drugs market includes drug class, route of administration, indication and region segment.

What are the driving factors of the antifungal drugs market?

Rising research and development activities and rising healthcare expenditure.

Which region will witness more growth in the antifungal drugs market?

North American region will witness more growth in the antifungal drugs market.

Which are the leading market players active in the antifungal drugs market?

Leading players in the antifungal drugs market are Astellas Pharma, Inc., Merck & Co., Inc., Enzon Pharmaceuticals, Novartis AG, Hikma Pharmaceuticals PLC, Bausch Health Companies Inc., Dr. Reddy's Laboratories Ltd., Pfizer, Inc, Gilead Sciences, Inc., F. Hoffmann-La Roche Ltd., Hikma Pharmaceuticals PLC, Gilead Sciences, Inc., Cipla Inc. among others.

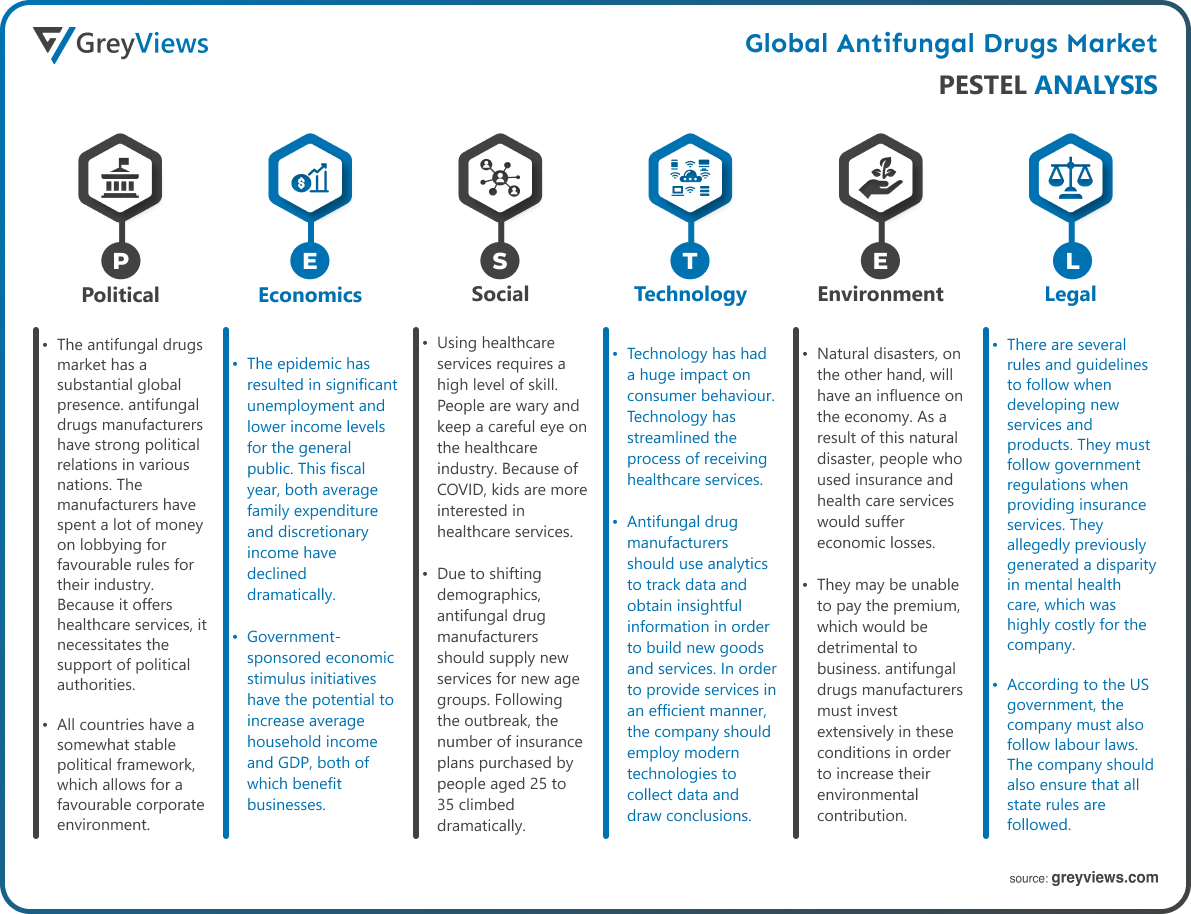

Political Factors- The antifungal drugs market has a substantial global presence. antifungal drugs manufacturers have strong political relations in various nations. The manufacturers have spent a lot of money on lobbying for favourable rules for their industry. Because it offers healthcare services, it necessitates the support of political authorities. All countries have a somewhat stable political framework, which allows for a favourable corporate environment. The antifungal drugs industry should consider the new government's goals.

Economical Factors- The epidemic has resulted in significant unemployment and lower income levels for the general public. This fiscal year, both average family expenditure and discretionary income have declined dramatically. Government-sponsored economic stimulus initiatives have the potential to increase average household income and GDP, both of which benefit businesses. The antifungal drugs market should keep a watch on the rate of inflation, GDP growth, and the country's vaccination programme.

Social Factor- Using healthcare services requires a high level of skill. People are wary and keep a careful eye on the healthcare industry. Because of COVID, kids are more interested in healthcare services. Due to shifting demographics, antifungal drug manufacturers should supply new services for new age groups. Following the outbreak, the number of insurance plans purchased by people aged 25 to 35 climbed dramatically. antifungal drugs manufacturers should be mindful of the rapid change. The outbreak also taught us to be more proactive in our health-care systems and to avoid wasting money.

Technological Factors- Technology has had a huge impact on consumer behaviour. Technology has streamlined the process of receiving healthcare services. Antifungal drug manufacturers should use analytics to track data and obtain insightful information in order to build new goods and services. In order to provide services in an efficient manner, the company should employ modern technologies to collect data and draw conclusions. They can employ cutting-edge technologies such as AI and blockchain to protect the information.

Environmental Factors- The antifungal drugs industry did not emit enough CO2 to significantly contribute to climate change. Natural disasters, on the other hand, will have an influence on the economy. As a result of this natural disaster, people who used insurance and health care services would suffer economic losses. They may be unable to pay the premium, which would be detrimental to business. antifungal drugs manufacturers must invest extensively in these conditions in order to increase their environmental contribution. Natural disasters will also have an impact on the company's operations. The creators must take risk management safeguards and be aware of this hazard.

Legal Factors- antifungal drugs manufacturers must follow all applicable legislation in their country. There are several rules and guidelines to follow when developing new services and products. They must follow government regulations when providing insurance services. They allegedly previously generated a disparity in mental health care, which was highly costly for the company. According to the US government, the company must also follow labour laws. The company should also ensure that all state rules are followed.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Drug Class

- 3.2. Market Attractiveness Analysis By Route of Administration

- 3.3. Market Attractiveness Analysis By Indication

- 3.4. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Rising research and development activities

- 3. Restraints

- 3.1. High cost

- 4. Opportunities

- 4.1. Rising healthcare expenditure

- 5. Challenges

- 5.1. Supply chain disruptions

- Global Antifungal Drugs Market Analysis and Projection, By Drug Class

- 1. Segment Overview

- 2. Allylamines

- 3. Azoles

- 4. Polyenes

- 5. Echinocandins

- 6. Others

- Global Antifungal Drugs Market Analysis and Projection, By Route of Administration

- 1. Segment Overview

- 2. Parenteral

- 3. Oral

- 4. Topical

- Global Antifungal Drugs Market Analysis and Projection, By Indication

- 1. Segment Overview

- 2. Candidiasis

- 3. Dermatophytosis

- 4. Aspergillosis

- 5. Others

- Global Antifungal Drugs Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Antifungal Drugs Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Antifungal Drugs Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Technology Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Astellas Pharma, Inc.

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Technology Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Merck & Co., Inc.

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Technology Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Enzon Pharmaceuticals

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Technology Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Novartis AG

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Technology Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Hikma Pharmaceuticals PLC

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Technology Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Bausch Health Companies Inc.

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Technology Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Reddy’s Laboratories Ltd.

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Technology Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Pfizer, Inc

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Technology Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Gilead Sciences, Inc.

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Technology Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Hoffmann-La Roche Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technology Portfolio

- Recent Developments

- SWOT Analysis

- Cipla Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technology Portfolio

- Recent Developments

- SWOT Analysis

- Astellas Pharma, Inc.

List of Table

- Global Antifungal Drugs Market, By Drug Class, 2023–2030 (USD Billion)

- Global Allylamines, Antifungal Drugs Market, By Region, 2023–2030 (USD Billion)

- Global Azoles, Antifungal Drugs Market, By Region, 2023–2030 (USD Billion)

- Global Polyenes, Antifungal Drugs Market, By Region, 2023–2030 (USD Billion)

- Global Echinocandins, Antifungal Drugs Market, By Region, 2023–2030 (USD Billion)

- Global Others, Antifungal Drugs Market, By Region, 2023–2030 (USD Billion)

- Global Antifungal Drugs Market, By Route of Administration, 2023–2030 (USD Billion)

- Global Parenteral, Antifungal Drugs Market, By Region, 2023–2030 (USD Billion)

- Global Oral, Antifungal Drugs Market, By Region, 2023–2030 (USD Billion)

- Global Topical, Antifungal Drugs Market, By Region, 2023–2030 (USD Billion)

- Global Antifungal Drugs Market, By Indication, 2023–2030 (USD Billion)

- Global Candidiasis, Antifungal Drugs Market, By Region, 2023–2030 (USD Billion)

- Global Dermatophytosis, Antifungal Drugs Market, By Region, 2023–2030 (USD Billion)

- Global Aspergillosis, Antifungal Drugs Market, By Region, 2023–2030 (USD Billion)

- Global Others, Antifungal Drugs Market, By Region, 2023–2030 (USD Billion)

- Global Antifungal Drugs Market, By Region, 2023–2030 (USD Billion)

- North America Antifungal Drugs Market, By Drug Class, 2023–2030 (USD Billion)

- North America Antifungal Drugs Market, By Route of Administration, 2023–2030 (USD Billion)

- North America Antifungal Drugs Market, By Indication, 2023–2030 (USD Billion)

- USA Antifungal Drugs Market, By Drug Class, 2023–2030 (USD Billion)

- USA Antifungal Drugs Market, By Route of Administration, 2023–2030 (USD Billion)

- USA Antifungal Drugs Market, By Indication, 2023–2030 (USD Billion)

- Canada Antifungal Drugs Market, By Drug Class, 2023–2030 (USD Billion)

- Canada Antifungal Drugs Market, By Route of Administration, 2023–2030 (USD Billion)

- Canada Antifungal Drugs Market, By Indication, 2023–2030 (USD Billion)

- Mexico Antifungal Drugs Market, By Drug Class, 2023–2030 (USD Billion)

- Mexico Antifungal Drugs Market, By Route of Administration, 2023–2030 (USD Billion)

- Mexico Antifungal Drugs Market, By Indication, 2023–2030 (USD Billion)

- Europe Antifungal Drugs Market, By Drug Class, 2023–2030 (USD Billion)

- Europe Antifungal Drugs Market, By Route of Administration, 2023–2030 (USD Billion)

- Europe Antifungal Drugs Market, By Indication, 2023–2030 (USD Billion)

- Germany Antifungal Drugs Market, By Drug Class, 2023–2030 (USD Billion)

- Germany Antifungal Drugs Market, By Route of Administration, 2023–2030 (USD Billion)

- Germany Antifungal Drugs Market, By Indication, 2023–2030 (USD Billion)

- France Antifungal Drugs Market, By Drug Class, 2023–2030 (USD Billion)

- France Antifungal Drugs Market, By Route of Administration, 2023–2030 (USD Billion)

- France Antifungal Drugs Market, By Indication, 2023–2030 (USD Billion)

- UK Antifungal Drugs Market, By Drug Class, 2023–2030 (USD Billion)

- UK Antifungal Drugs Market, By Route of Administration, 2023–2030 (USD Billion)

- UK Antifungal Drugs Market, By Indication, 2023–2030 (USD Billion)

- Italy Antifungal Drugs Market, By Drug Class, 2023–2030 (USD Billion)

- Italy Antifungal Drugs Market, By Route of Administration, 2023–2030 (USD Billion)

- Italy Antifungal Drugs Market, By Indication, 2023–2030 (USD Billion)

- Spain Antifungal Drugs Market, By Drug Class, 2023–2030 (USD Billion)

- Spain Antifungal Drugs Market, By Route of Administration, 2023–2030 (USD Billion)

- Spain Antifungal Drugs Market, By Indication, 2023–2030 (USD Billion)

- Asia Pacific Antifungal Drugs Market, By Drug Class, 2023–2030 (USD Billion)

- Asia Pacific Antifungal Drugs Market, By Route of Administration, 2023–2030 (USD Billion)

- Asia Pacific Antifungal Drugs Market, By Indication, 2023–2030 (USD Billion)

- Japan Antifungal Drugs Market, By Drug Class, 2023–2030 (USD Billion)

- Japan Antifungal Drugs Market, By Route of Administration, 2023–2030 (USD Billion)

- Japan Antifungal Drugs Market, By Indication, 2023–2030 (USD Billion)

- China Antifungal Drugs Market, By Drug Class, 2023–2030 (USD Billion)

- China Antifungal Drugs Market, By Route of Administration, 2023–2030 (USD Billion)

- China Antifungal Drugs Market, By Indication, 2023–2030 (USD Billion)

- India Antifungal Drugs Market, By Drug Class, 2023–2030 (USD Billion)

- India Antifungal Drugs Market, By Route of Administration, 2023–2030 (USD Billion)

- India Antifungal Drugs Market, By Indication, 2023–2030 (USD Billion)

- South America Antifungal Drugs Market, By Drug Class, 2023–2030 (USD Billion)

- South America Antifungal Drugs Market, By Route of Administration, 2023–2030 (USD Billion)

- South America Antifungal Drugs Market, By Indication, 2023–2030 (USD Billion)

- Brazil Antifungal Drugs Market, By Drug Class, 2023–2030 (USD Billion)

- Brazil Antifungal Drugs Market, By Route of Administration, 2023–2030 (USD Billion)

- Brazil Antifungal Drugs Market, By Indication, 2023–2030 (USD Billion)

- Middle East and Africa Antifungal Drugs Market, By Drug Class, 2023–2030 (USD Billion)

- Middle East and Africa Antifungal Drugs Market, By Route of Administration, 2023–2030 (USD Billion)

- Middle East and Africa Antifungal Drugs Market, By Indication, 2023–2030 (USD Billion)

- UAE Antifungal Drugs Market, By Drug Class, 2023–2030 (USD Billion)

- UAE Antifungal Drugs Market, By Route of Administration, 2023–2030 (USD Billion)

- UAE Antifungal Drugs Market, By Indication, 2023–2030 (USD Billion)

- South Africa Antifungal Drugs Market, By Drug Class, 2023–2030 (USD Billion)

- South Africa Antifungal Drugs Market, By Route of Administration, 2023–2030 (USD Billion)

- South Africa Antifungal Drugs Market, By Indication, 2023–2030 (USD Billion)

List of Figures

- Global Antifungal Drugs Market Segmentation

- Antifungal Drugs Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Antifungal Drugs Market Attractiveness Analysis By Drug Class

- Global Antifungal Drugs Market Attractiveness Analysis By Route of Administration

- Global Antifungal Drugs Market Attractiveness Analysis By Indication

- Global Antifungal Drugs Market Attractiveness Analysis By Region

- Global Antifungal Drugs Market: Dynamics

- Global Antifungal Drugs Market Share By Drug Class (2023 & 2030)

- Global Antifungal Drugs Market Share By Route of Administration (2023 & 2030)

- Global Antifungal Drugs Market Share By Indication (2023 & 2030)

- Global Antifungal Drugs Market Share by Regions (2023 & 2030)

- Global Antifungal Drugs Market Share by Company (2021)