Automotive Cybersecurity Market Size By Vehicle Type (Passenger Vehicles and Commercial Vehicles), By Security (Wireless Network Security, Endpoint Security and Application Security), By Application (Telematics, Communication System, ADAS Technology, Powertrain System and Others), Regions, Segmentation, and Projection till 2030

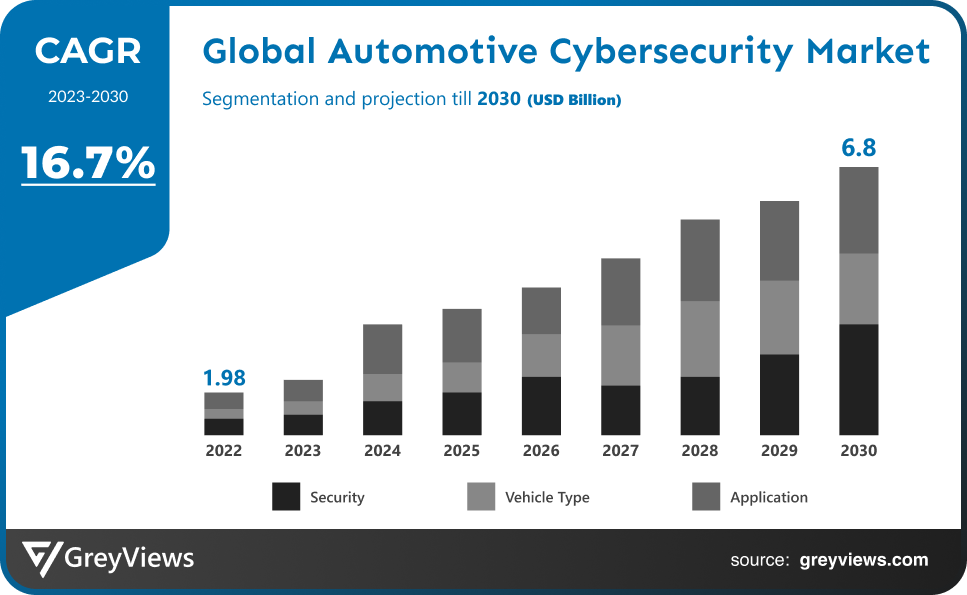

CAGR: 16.7%Current Market Size: USD 1.98 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2023-2030Base Year: 2022

Global Automotive Cybersecurity Market- Market Overview:

The global automotive cybersecurity market is expected to grow from USD 1.98 billion in 2022 to USD 6.8 billion by 2030, at a CAGR of 16.7% during the Projection period 2023-2030. The growth of this market is mainly driven owing to the rising demand for electric vehicles.

A key element of automotive cyber security is the protection of connected vehicle systems, including software and communication networks, from tampering of any kind. The complexity of modern vehicles explains the need for automotive cyber security. In the coming years, automotive security solutions are expected to see an increase due to the rapid adoption of technologies like autonomous driving, keyless entry, wireless connectivity, and other similar technologies, as well as the increased electrification of existing fleets via ADAS features. As a condition of approval for new designs, automotive manufacturers and suppliers are increasingly being forced to implement cybersecurity solutions. Many automotive manufacturers and their suppliers are updating their processes and systems in advance of regulations becoming effective. An adaptive cybersecurity technology examines actions and occurrences in order to protect against and stop threats before they occur. Companies can use an adaptive security architecture to enforce proportionally while continuously analyzing risks, giving proportional enforcement. Auto manufacturers often lack adaptive security throughout their operations, making it easier to defend a scattered workforce. By introducing and progressing connected automobiles and reinforcing vehicle data security rules by regulatory bodies, market growth is expected to continue. There are a number of factors limiting the growth of the automotive cybersecurity market, including a lack of standards, poor component integration, which may lead to a cyberattack, and other security issues.

Sample Request: - Global Automotive Cybersecurity Market

Market Dynamics:

Drivers:

- Rising government initiatives

The growing demand for connected car technology and cybersecurity standards in government initiatives further influences the market. In addition, the automotive cybersecurity market is positively impacted by the expansion of the automotive sector, the increase in investments, and the increase in disposable income.

Restraints:

- Difference in pricing

In connected cars, there are additional services such as E-calls, multimedia streaming, and remote diagnostics that are changing the entire automotive industry. In the automotive industry, the ecosystem has evolved from static to dynamic, where each actor is responsible for a share of the revenue. The fact that the ecosystem is populated with so many stakeholders makes it difficult to implement a pricing model.

Opportunities:

- Increasing electric vehicle sales

In addition to the growing sale of electric vehicles worldwide, one of the major factors driving the growth of the automotive cybersecurity market is the fact that electric vehicles are more likely to be attacked by hackers. As the market grows, the demand for personalization and connectedness increases in software. Because connected vehicles are connected to the internet and wireless networks, they are as vulnerable as smartphones and smart appliances.

Challenges:

- High cost

Market growth is expected to be stymied by the high cost of automotive cybersecurity solutions and the increasing complexity of vehicle electronic systems. Aside from pricing strategy discrepancies among stakeholders and a delay in cybersecurity updates, the automotive smart antenna market is expected to face challenges in the near future.

Segmentation Analysis:

The global automotive cybersecurity market has been segmented based on vehicle type, security, application, and region.

By Vehicle Type

The vehicle type segment includes commercial vehicles and passenger vehicles. The passenger vehicles segment led the largest share of the automotive cybersecurity market with a market share of around 58% in 2022. A growing number of connected automobiles will drive demand for network security via restricted device management in-vehicle terminals, resulting in an increased risk of network interface attacks. Demand for cybersecurity software is increasing in passenger vehicles as government support for autonomous vehicles takes the form of mandatory legislation.

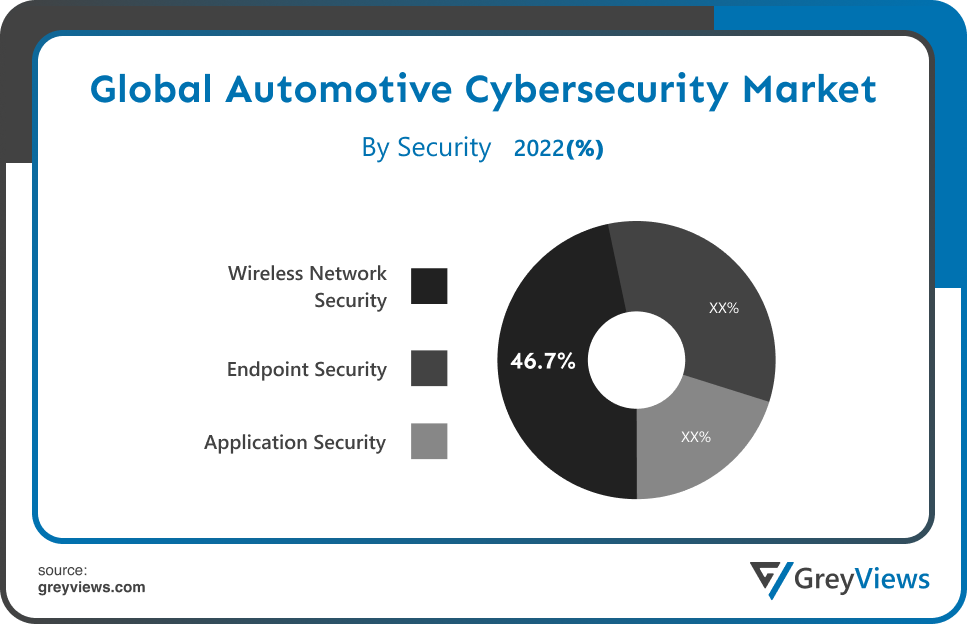

By Security

The security segment includes wireless network security, endpoint security and application security. The wireless network security segment led the largest share of the automotive cybersecurity market with a market share of around 46.7% in 2022. A growing number of cyber security threats have fueled the demand for wireless network security. Also, market growth is expected to accelerate over the projected period as security flaws and data loss are avoided. Over the next few years, the wireless network security industry is also likely to benefit from several firms' increased reliance on wireless networks in order to reduce maintenance costs and increase operating income.

By Application

The application segment includes telematics, communication system, ADAS technology, powertrain system and others. The ADAS technology segment led the largest share of the automotive cybersecurity market with a market share of around 28% in 2022. A combination of sensors, actuators, processors, mapping systems, and different software systems allows cars to be safer, automated and strengthened for safe driving. This has been possible through the use of ADAS technology. One of the reasons ADAS are in high demand is the growing concern for road and traffic safety among individuals and governments alike.

Global Automotive Cybersecurity Market- Sales Analysis.

The sale of automotive cybersecurity expanded at a CAGR of 16.2% from 2016 to 2022.

It is expected that the automotive cybersecurity market will grow due to factors such as an increase in demand for automotive cybersecurity, government efforts to integrate connected car technologies, and the imposition of mandatory cybersecurity requirements. It is anticipated that adaptive security will be used in future years to improve vehicle security, as well as the increasing complexity of automobile electronic systems will continue to increase.

Consumer expectations for customized experiences are transforming the automobile industry and driver preferences. Personalization and connectivity lead to increased software, which increases risk. As with smartphones and smart appliances, connected cars are capable of sharing the internet and wireless network access with other cars and external devices in a similar way.

A downside of connected vehicles is their vulnerability to possible hacking attacks. Due to their added features over conventional vehicles, they are constantly in demand. It is, therefore, necessary to take appropriate security measures to protect the functions of connected cars from manipulation as more and more connected cars appear on the road.

Thus, owing to the aforementioned factors, the global automotive cybersecurity market is expected to grow at a CAGR of 16.7% during the Projection period from 2023 to 2030.

By Regional Analysis:

The regions analyzed for the automotive cybersecurity market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North American region dominated the automotive cybersecurity market and held a 38.3% share of the market revenue in 2022.

- The North American region witnessed a major share. Connected vehicle solutions are booming in the region due to the presence of developed countries like the U.S. and Canada. Additionally, increasing government regulations are contributing to market growth in the region. For commercial vehicles in the U.S., the Federal Motor Carrier Safety Administration has mandated the installation of electronic logging devices. During the Projection period, the regional automotive cybersecurity market would also benefit from an increase in sales of long-haul trucks with pre-installed telematics and fleet management solutions.

- Asia Pacific is anticipated to experience significant growth during the predicted period. Over the Projection period, the Asia Pacific automotive cybersecurity market is expected to grow at the fastest pace. As the largest market for automobiles, Asia Pacific is home to developing nations such as China and India, along with developed economies such as Japan. As a result of continuous infrastructure constructions and industrial development activities in emerging economies, the region has become a center for automobile production in recent years.

Global Automotive Cybersecurity Market - Country Analysis:

- Germany

Germany's automotive cybersecurity market size was valued at USD 0.14 billion in 2022 and is expected to reach USD 0.48 billion by 2030, at a CAGR of 16.8% from 2023 to 2030.

On account of its presence of prominent automobile manufacturers, such as Porsche, Audi, Ford, Mercedes-Benz, etc., Germany led the European market in 2018. Moreover, as cloud-based applications become more prevalent in the automotive industry, market players will have profitable opportunities in the Projection period. The introduction of wireless battery management systems for electric vehicles will also contribute to the growth of the automotive cybersecurity market.

- China

China’s automotive cybersecurity market size was valued at USD 0.15 billion in 2022 and is expected to reach USD 0.52 billion by 2030, at a CAGR of 17% from 2023 to 2030.

The country's auto industry has been boosted even more by the growing demand for connected and semi-autonomous vehicles, as well as significant investments by manufacturers in cybersecurity solutions. Additionally, the threat of cyberattacks is on the rise exponentially, which calls for the development of advanced automotive cyber security systems in the future.

- India

India's automotive cybersecurity market size was valued at USD 0.11 billion in 2022 and is expected to reach USD 0.38 billion by 2030, at a CAGR of 16.9% from 2023 to 2030.

Technology advancements in the automotive industry that utilize Battery Management Systems and sensors are leading to an increasingly viable cybersecurity solution. Therefore, technological advancements in autonomous and semi-autonomous vehicles raise the need for automotive cybersecurity policies, resulting in an increase in data volume and a growth in networking capabilities.

Key Industry Players Analysis:

To increase their market position in the global automotive cybersecurity market business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Capgemini

- Intel Corporation

- Argus Cyber Security Ltd.

- Lear Corporation

- ESCRYPT

- HARMAN International

- Aptiv

- SafeRide Technologies

- GUARDKNOX

- Bosch Limited

- DENSO CORPORATION

Latest Development:

- In January 2020, As part of Aptiv PLC's new vehicle architecture, automakers can increase vehicle efficiency, improve safety, and offer consumers a software-defined, intelligent, connected experience. With Aptiv's Smart Vehicle Architecture, the total cost of ownership of a vehicle is reduced, and feature-rich, highly automated vehicles can be delivered. Additionally, it meets the prevalent standards of functional safety and cybersecurity.

- In January 2020, an online platform developed by Continental AG automates the development and integration of software into vehicles and standardizes them. In addition to saving time and money in the vehicle development process, the Continental Cooperation Portal also improves software quality and security. The development of complex hardware and software for future generations of vehicles requires system integration as a key competency.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2022-2030 |

|

Base year |

2022 |

|

CAGR (%) |

16.7% |

|

Market Size |

1.98 billion in 2022 |

|

Projection period |

2023-2030 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Vehicle Type, By Security, By Application, and By Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Capgemini, Intel Corporation, Argus Cyber Security Ltd., Lear Corporation, ESCRYPT, HARMAN International, Aptiv, SafeRide Technologies, GUARDKNOX, Bosch Limited, and DENSO CORPORATION. |

|

By Vehicle Type |

|

|

By Security |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Automotive Cybersecurity Market by Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

Global Automotive Cybersecurity Market by Security:

- Wireless Network Security

- Endpoint Security

- Application Security

Global Automotive Cybersecurity Market by Application:

- Telematics

- Communication System

- ADAS Technology

- Powertrain System

- Others

Global Automotive Cybersecurity Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the expected market size of the automotive cybersecurity market in 2030?

Global automotive cybersecurity market is expected to reach USD 6.8 billion by 2030, at a CAGR of 16.7% from 2023 to 2030.

What are the driving factors of the automotive cybersecurity market?

Rising government initiatives and increasing sales of electric vehicles.

Which region will witness more growth in the automotive cybersecurity market?

North American region will witness more growth in the automotive cybersecurity market.

What is the vehicle type segment of the automotive cybersecurity market?

Based on the vehicle type, the automotive cybersecurity market is segmented into passenger vehicles and commercial vehicles.

Which are the leading market players active in the automotive cybersecurity market?

Leading players in the automotive cybersecurity market are Capgemini, Intel Corporation, Argus Cyber Security Ltd., Lear Corporation, ESCRYPT, HARMAN International, Aptiv, SafeRide Technologies, GUARDKNOX, Bosch Limited, DENSO CORPORATION among others.

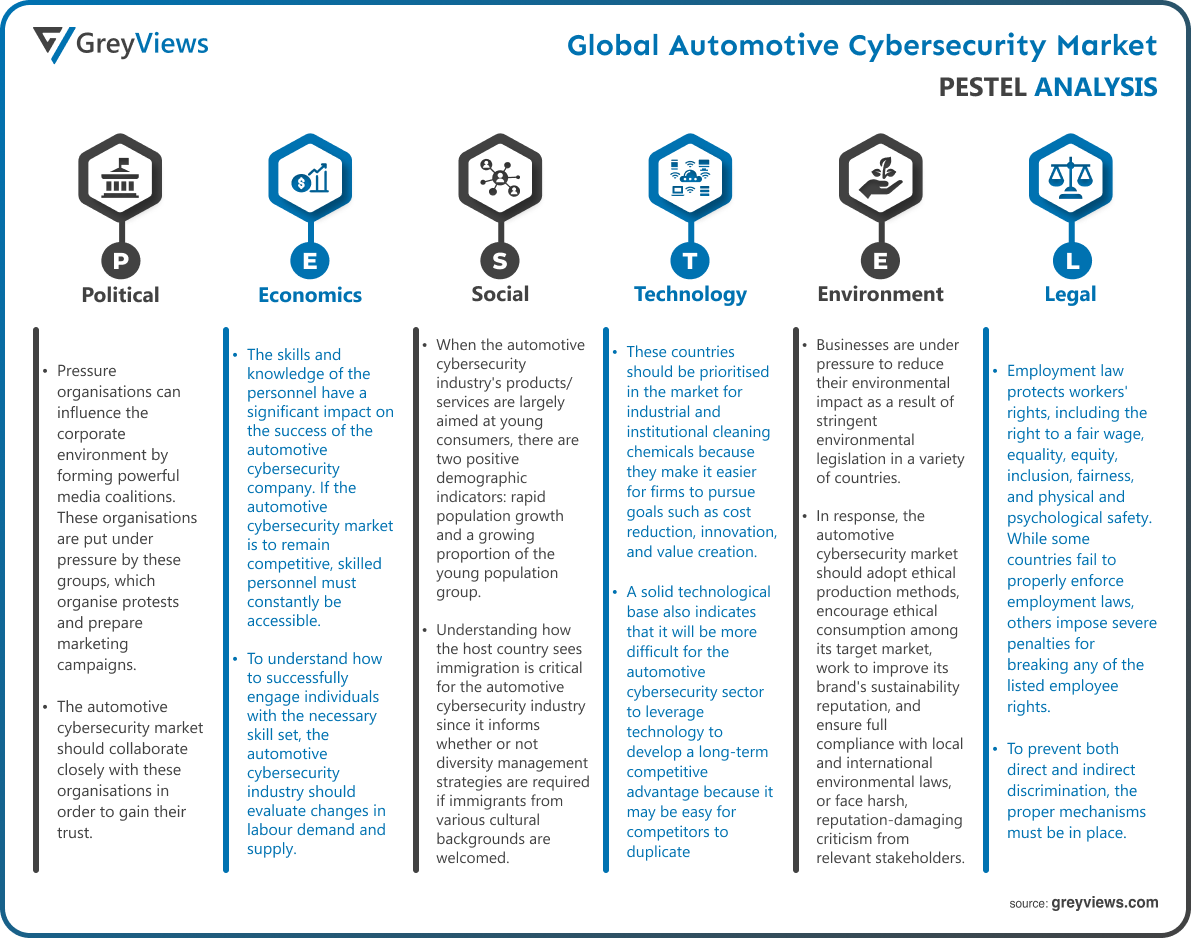

Political Factors- Pressure organisations can influence the corporate environment by forming powerful media coalitions. These organisations are put under pressure by these groups, which organise protests and prepare marketing campaigns. These pressure groups have the ability to influence government legislation, which can have an impact on the general business climate, so the automotive cybersecurity market should keep a watch on them. The automotive cybersecurity market should collaborate closely with these organisations in order to gain their trust. It should also invest in ethical and philanthropic projects in order to strengthen ties with the community.

Economic Factors- The skills and knowledge of the personnel have a significant impact on the success of the automotive cybersecurity company. If the automotive cybersecurity market is to remain competitive, skilled personnel must constantly be accessible. To understand how to successfully engage individuals with the necessary skill set, the automotive cybersecurity industry should evaluate changes in labour demand and supply. As a result of a tight labour market and strong worker unions, the automotive cybersecurity market firm may confront a number of challenges. It may, for example, exert pressure on the automotive cybersecurity market to accept an exorbitant pay increase, or it could halt output by launching a strike.

Social Factors- When the automotive cybersecurity industry's products/services are largely aimed at young consumers, there are two positive demographic indicators: rapid population growth and a growing proportion of the young population group. Understanding how the host country sees immigration is critical for the automotive cybersecurity industry since it informs whether or not diversity management strategies are required if immigrants from various cultural backgrounds are welcomed. To encourage inclusiveness and diversity, the automotive cybersecurity industry's marketing strategies should be revised. A positive outlook on migration also demonstrates how simple it is for enterprises in the automotive cybersecurity sector to hire people from varied cultural backgrounds.

Technological Factors-These countries should be prioritised in the market for industrial and institutional cleaning chemicals because they make it easier for firms to pursue goals such as cost reduction, innovation, and value creation. A solid technological base also indicates that it will be more difficult for the automotive cybersecurity sector to leverage technology to develop a long-term competitive advantage because it may be easy for competitors to duplicate. By making the right technology investments, the automotive cybersecurity sector may increase customer satisfaction, increase operational efficiency, and distinguish itself as an innovative firm.

Environmental Factors- Businesses are under pressure to reduce their environmental impact as a result of stringent environmental legislation in a variety of countries. In response, the automotive cybersecurity market should adopt ethical production methods, encourage ethical consumption among its target market, work to improve its brand's sustainability reputation, and ensure full compliance with local and international environmental laws, or face harsh, reputation-damaging criticism from relevant stakeholders.

Legal Factors- Employment law protects workers' rights, including the right to a fair wage, equality, equity, inclusion, fairness, and physical and psychological safety. While some countries fail to properly enforce employment laws, others impose severe penalties for breaking any of the listed employee rights. Before entering or operating in such countries, the automotive cybersecurity market should investigate the safety of the working environment. To prevent both direct and indirect discrimination, the proper mechanisms must be in place. Employer brand recognition in the automotive cybersecurity business can be improved by effective adherence to employment rules, which is required for attracting and retaining top talent in the market.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Vehicle Type

- 3.2. Market Attractiveness Analysis By Security

- 3.3. Market Attractiveness Analysis By Application

- 3.4. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Rising government initiatives

- 3. Restraints

- 3.1. Difference in pricing

- 4. Opportunities

- 4.1. Increasing electric vehicle sales

- 5. Challenges

- 5.1. High cost

- Global Automotive Cybersecurity Market Analysis and Projection, By Vehicle Type

- 1. Segment Overview

- 2. Passenger Vehicles

- 3. Commercial Vehicles

- Global Automotive Cybersecurity Market Analysis and Projection, By Security

- 1. Segment Overview

- 2. Wireless Network Security

- 3. Endpoint Security

- 4. Application Security

- Global Automotive Cybersecurity Market Analysis and Projection, By Application

- 1. Segment Overview

- 2. Telematics

- 3. Communication System

- 4. ADAS Technology

- 5. Powertrain System

- 6. Others

- Global Automotive Cybersecurity Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Automotive Cybersecurity Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Automotive Cybersecurity Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Technology Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Capgemini

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Technology Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Intel Corporation

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Technology Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Argus Cyber Security Ltd.

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Technology Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Lear Corporation

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Technology Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- ESCRYPT

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Technology Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- HARMAN International

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Technology Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Aptiv

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Technology Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- SafeRide Technologies

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Technology Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- GUARDKNOX

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Technology Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Bosch Limited

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technology Portfolio

- Recent Developments

- SWOT Analysis

- DENSO CORPORATION

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technology Portfolio

- Recent Developments

- SWOT Analysis

- Capgemini

List of Table

- Global Automotive Cybersecurity Market, By Vehicle Type, 2023–2030 (USD Billion)

- Global Passenger Vehicles, Automotive Cybersecurity Market, By Region, 2023–2030 (USD Billion)

- Global Commercial Vehicles, Automotive Cybersecurity Market, By Region, 2023–2030 (USD Billion)

- Global Automotive Cybersecurity Market, By Security, 2023–2030 (USD Billion)

- Global Wireless Network Security, Automotive Cybersecurity Market, By Region, 2023–2030 (USD Billion)

- Global Endpoint Security, Automotive Cybersecurity Market, By Region, 2023–2030 (USD Billion)

- Global Application Security, Automotive Cybersecurity Market, By Region, 2023–2030 (USD Billion)

- Global Automotive Cybersecurity Market, By Application, 2023–2030 (USD Billion)

- Global Telematics, Automotive Cybersecurity Market, By Region, 2023–2030 (USD Billion)

- Global Communication System, Automotive Cybersecurity Market, By Region, 2023–2030 (USD Billion)

- Global ADAS Technology, Automotive Cybersecurity Market, By Region, 2023–2030 (USD Billion)

- Global Powertrain System, Automotive Cybersecurity Market, By Region, 2023–2030 (USD Billion)

- Global Others, Automotive Cybersecurity Market, By Region, 2023–2030 (USD Billion)

- Global Automotive Cybersecurity Market, By Region, 2023–2030 (USD Billion)

- North America Automotive Cybersecurity Market, By Vehicle Type, 2023–2030 (USD Billion)

- North America Automotive Cybersecurity Market, By Security, 2023–2030 (USD Billion)

- North America Automotive Cybersecurity Market, By Application, 2023–2030 (USD Billion)

- USA Automotive Cybersecurity Market, By Vehicle Type, 2023–2030 (USD Billion)

- USA Automotive Cybersecurity Market, By Security, 2023–2030 (USD Billion)

- USA Automotive Cybersecurity Market, By Application, 2023–2030 (USD Billion)

- Canada Automotive Cybersecurity Market, By Vehicle Type, 2023–2030 (USD Billion)

- Canada Automotive Cybersecurity Market, By Security, 2023–2030 (USD Billion)

- Canada Automotive Cybersecurity Market, By Application, 2023–2030 (USD Billion)

- Mexico Automotive Cybersecurity Market, By Vehicle Type, 2023–2030 (USD Billion)

- Mexico Automotive Cybersecurity Market, By Security, 2023–2030 (USD Billion)

- Mexico Automotive Cybersecurity Market, By Application, 2023–2030 (USD Billion)

- Europe Automotive Cybersecurity Market, By Vehicle Type, 2023–2030 (USD Billion)

- Europe Automotive Cybersecurity Market, By Security, 2023–2030 (USD Billion)

- Europe Automotive Cybersecurity Market, By Application, 2023–2030 (USD Billion)

- Germany Automotive Cybersecurity Market, By Vehicle Type, 2023–2030 (USD Billion)

- Germany Automotive Cybersecurity Market, By Security, 2023–2030 (USD Billion)

- Germany Automotive Cybersecurity Market, By Application, 2023–2030 (USD Billion)

- France Automotive Cybersecurity Market, By Vehicle Type, 2023–2030 (USD Billion)

- France Automotive Cybersecurity Market, By Security, 2023–2030 (USD Billion)

- France Automotive Cybersecurity Market, By Application, 2023–2030 (USD Billion)

- UK Automotive Cybersecurity Market, By Vehicle Type, 2023–2030 (USD Billion)

- UK Automotive Cybersecurity Market, By Security, 2023–2030 (USD Billion)

- UK Automotive Cybersecurity Market, By Application, 2023–2030 (USD Billion)

- Italy Automotive Cybersecurity Market, By Vehicle Type, 2023–2030 (USD Billion)

- Italy Automotive Cybersecurity Market, By Security, 2023–2030 (USD Billion)

- Italy Automotive Cybersecurity Market, By Application, 2023–2030 (USD Billion)

- Spain Automotive Cybersecurity Market, By Vehicle Type, 2023–2030 (USD Billion)

- Spain Automotive Cybersecurity Market, By Security, 2023–2030 (USD Billion)

- Spain Automotive Cybersecurity Market, By Application, 2023–2030 (USD Billion)

- Asia Pacific Automotive Cybersecurity Market, By Vehicle Type, 2023–2030 (USD Billion)

- Asia Pacific Automotive Cybersecurity Market, By Security, 2023–2030 (USD Billion)

- Asia Pacific Automotive Cybersecurity Market, By Application, 2023–2030 (USD Billion)

- Japan Automotive Cybersecurity Market, By Vehicle Type, 2023–2030 (USD Billion)

- Japan Automotive Cybersecurity Market, By Security, 2023–2030 (USD Billion)

- Japan Automotive Cybersecurity Market, By Application, 2023–2030 (USD Billion)

- China Automotive Cybersecurity Market, By Vehicle Type, 2023–2030 (USD Billion)

- China Automotive Cybersecurity Market, By Security, 2023–2030 (USD Billion)

- China Automotive Cybersecurity Market, By Application, 2023–2030 (USD Billion)

- India Automotive Cybersecurity Market, By Vehicle Type, 2023–2030 (USD Billion)

- India Automotive Cybersecurity Market, By Security, 2023–2030 (USD Billion)

- India Automotive Cybersecurity Market, By Application, 2023–2030 (USD Billion)

- South America Automotive Cybersecurity Market, By Vehicle Type, 2023–2030 (USD Billion)

- South America Automotive Cybersecurity Market, By Security, 2023–2030 (USD Billion)

- South America Automotive Cybersecurity Market, By Application, 2023–2030 (USD Billion)

- Brazil Automotive Cybersecurity Market, By Vehicle Type, 2023–2030 (USD Billion)

- Brazil Automotive Cybersecurity Market, By Security, 2023–2030 (USD Billion)

- Brazil Automotive Cybersecurity Market, By Application, 2023–2030 (USD Billion)

- Middle East and Africa Automotive Cybersecurity Market, By Vehicle Type, 2023–2030 (USD Billion)

- Middle East and Africa Automotive Cybersecurity Market, By Security, 2023–2030 (USD Billion)

- Middle East and Africa Automotive Cybersecurity Market, By Application, 2023–2030 (USD Billion)

- UAE Automotive Cybersecurity Market, By Vehicle Type, 2023–2030 (USD Billion)

- UAE Automotive Cybersecurity Market, By Security, 2023–2030 (USD Billion)

- UAE Automotive Cybersecurity Market, By Application, 2023–2030 (USD Billion)

- South Africa Automotive Cybersecurity Market, By Vehicle Type, 2023–2030 (USD Billion)

- South Africa Automotive Cybersecurity Market, By Security, 2023–2030 (USD Billion)

- South Africa Automotive Cybersecurity Market, By Application, 2023–2030 (USD Billion)

List of Figures

- Global Automotive Cybersecurity Market Segmentation

- Automotive Cybersecurity Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Automotive Cybersecurity Market Attractiveness Analysis By Vehicle Type

- Global Automotive Cybersecurity Market Attractiveness Analysis By Security

- Global Automotive Cybersecurity Market Attractiveness Analysis By Application

- Global Automotive Cybersecurity Market Attractiveness Analysis By Region

- Global Automotive Cybersecurity Market: Dynamics

- Global Automotive Cybersecurity Market Share By Vehicle Type (2023 & 2030)

- Global Automotive Cybersecurity Market Share By Security (2023 & 2030)

- Global Automotive Cybersecurity Market Share By Application (2023 & 2030)

- Global Automotive Cybersecurity Market Share by Regions (2023 & 2030)

- Global Automotive Cybersecurity Market Share by Company (2021)