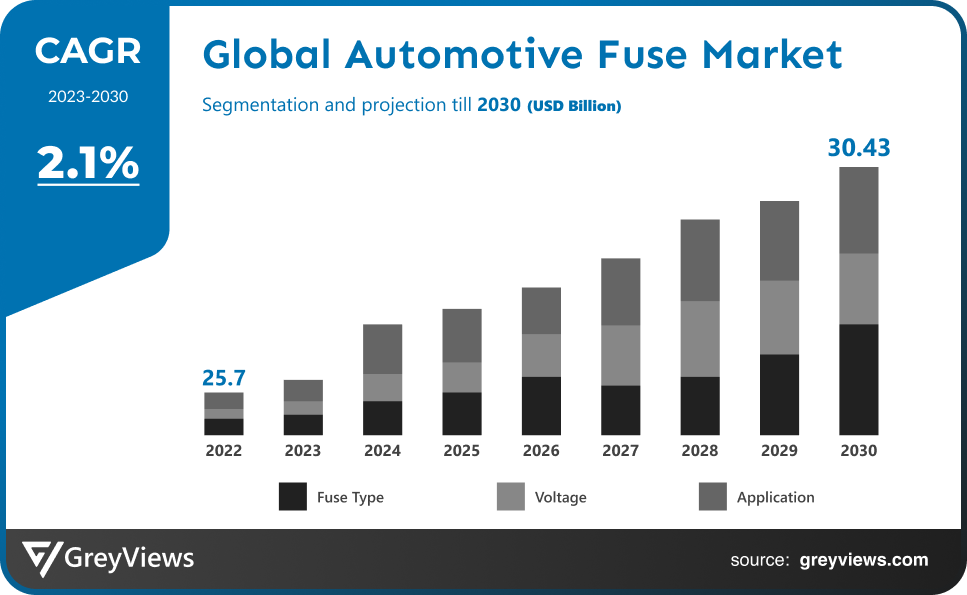

Automotive Fuse Market Size By Fuse Type (Glass Tube, Blade Fuse, Semiconductor, and Others), By Voltage (12V-24V, 24V-48V, 49V-150V and Others), By Application (PCU Fuse, Battery Fuse, Onboard Charger Fuse, Charge Inlet Fuse and Others), Regions, Segmentation, and Projection till 2030

CAGR: 2.1%Current Market Size: USD 25.7 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2023-2030Base Year: 2022

Global Automotive Fuse Market- Market Overview:

The global automotive fuse market is expected to grow from USD 25.7 billion in 2022 to USD 30.43 billion by 2030, at a CAGR of 2.1% during the Projection period 2023-2030. The growth of this market is mainly driven owing to the rising demand for electronic vehicles.

Automobile fuses protect electrical equipment and wiring in cars and trucks. Automotive fuses are typically rated for circuits with DC voltages over 24 volts but can be rated for 42 volts in some cases. Microeconomic factors such as the GDP's effect on commercial vehicle sales, rising urbanization, and developing infrastructure are fostering the growth of the automotive industry market. Increasing vehicle demand in nations like South Korea, India, etc., has led to the improvement of automotive part systems by automotive fuse manufacturers. As a result, global demand for automotive parts is increasing, fueling the global growth of the automotive fuse market. The development of advanced automotive fuses is also driven by technological developments that ensure soldering, the use of fully insulated clips, and the use of nickel-plated brass contacts for vibration and shock resistance, which is in turn boosting the automotive fuse market. The increasing use of high-power fuses is another factor driving the demand for effective automotive fuses globally. With the development of luxury and safety features in premium cars, the application of automotive fuse will be greater than in mid-segment or low-segment vehicles, which is expected to lead to an increase in demand for the automotive fuse.

Sample Request: - Global Automotive Fuse Market

Market Dynamics:

Drivers:

- Rising demand for premium vehicles

In response to increasing disposable income, families have changed their lifestyles, resulting in changes in their preferences in response. Sales of premium passenger vehicles across the globe are being positively impacted by factors such as increasing per capita incomes, and increasing competition between OEMs to provide improved features, boosting the market growth.

Restraints:

- Unorganized aftermarkets

The global automotive fuse market is facing challenges due to unorganized aftermarkets and connected smart junction boxes for autonomous vehicles. Moreover, fluctuating prices of raw materials are also hampering the market growth. The rising cost of metals used for the manufacturing of automotive fuse is impacting the market growth negatively.

Opportunities:

- Rising investment in electric infrastructure

Market growth will be positively impacted by investments in electric infrastructure, the electrification of the automotive sector and a growing focus on industrialization and urbanization. Moreover, a surge in the adoption rate of automotive electronics and advancements associated with existing substations and feeder line protection will create beneficial opportunities for the growth of the market.

Challenges:

- Lack of skilled professional

It is expected that the absence of skilled labour and technicians will be the most challenging factor for market growth. The increasing features in cars are adding pressure and load to the fuse box, which is likely to restrain the growth of the automotive fuse block during the Projectioned period.

Segmentation Analysis:

The global automotive fuse market has been segmented based on fuse type, voltage, application, and region.

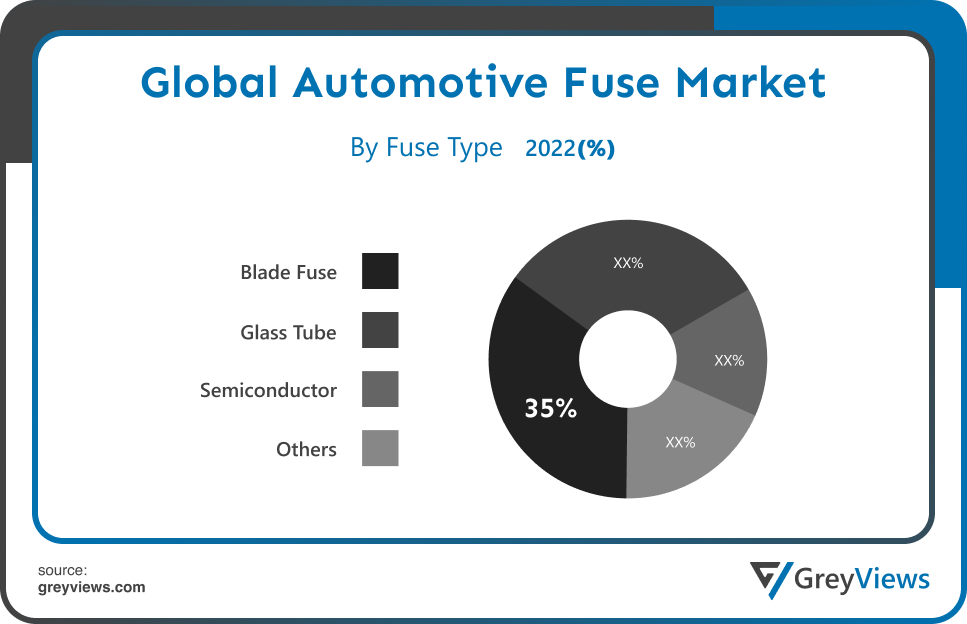

By Fuse Type

The fuse type segment includes glass tube, blade fuse, semiconductor, and others. The blade fuse segment led the largest share of the automotive fuse market with a market share of around 35% in 2022. A blade fuse is one of the most important elements of any vehicle's electrical system because it breaks the circuit when the current exceeds the desired value, preventing possible damage from equipment failures and short circuits. Moreover, it is commonly used for towed campers and marine applications with simple, low-voltage DC electrical systems, such as sailboats and motorboats.

By Voltage

The voltage segment includes 12V-24V, 24V-48V, 49V-150V and others. The 24V-48V segment led the largest share of the automotive fuse market with a market share of around 32% in 2022. The 24V-48V segment is expected to witness the highest CAGR during the Projection period, mainly due to the fact that it is characterized by low emissions and the high sales of ICE vehicles which are equipped with 12 and 24V systems.

By Application

The application segment includes PCU fuse, battery fuse, onboard charger fuse, charge inlet fuse and others. The charge inlet fuse segment led the largest share of the automotive fuse market with a market share of around 28.5% in 2022. During the Projection period, the charge inlet fuse segment will hold the largest market share. The factors driving the demand for this segment include the growing need for high-power electric vehicles in regions such as Asia Oceania and Europe.

Global Automotive Fuse Market- Sales Analysis.

The sale of automotive fuse expanded at a CAGR of 1.9% from 2016 to 2022.

All of the electrical components in a car are dependent on fuse units. The increase in demand for vehicles with advanced technological features is largely attributed to fuse units. Automobile manufacturers are ramping up the production of these vehicles in order to meet the increased consumer demand.

Due to the rapid development of novel technologies, the automotive industry will see a few structural changes in the near future. Robotic efficiency, accuracy, and consistency will be greatly improved by artificial intelligence and machine learning is boosting the market growth.

Electrification of vehicles is gaining traction, with governments all over the world switching from internal combustion and hybrid automobiles to electric vehicles. It is anticipated that this will create a multitude of opportunities for the future to reduce pollution and rely less on fossil fuels by improving the system.

Thus, owing to the aforementioned factors, the global automotive fuse market is expected to grow at a CAGR of 2.1% during the Projection period from 2023 to 2030.

By Regional Analysis:

The regions analyzed for the automotive fuse market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North American region dominated the automotive fuse market and held a 37.6% share of the market revenue in 2022.

- The North American region witnessed a major share. In the automotive fuse market, the US leads with the highest sales of passenger cars, LCVs, and HCVs in the region. As EV sales in North America are the highest, the US is the leading market for automotive fuse products for electric vehicles. In this region, a large customer base and high disposable incomes lead to an increase in automotive OEM production activities. Among the most popular vehicles in North America, the LCV and HCV indicate promising growth potential.

- Asia Pacific is anticipated to experience significant growth during the predicted period. As a result of rising demand from the Asia Pacific region, the global automotive fuse industry is experiencing significant growth. As a result of the increased demand for automobile comfort and protection, government safety regulations and laws, as well as high vehicle sales, the market in the region is witnessing rapid growth. Additionally, the availability of cheap labour in the region has boosted automotive fuse production, which in turn has driven the market to grow.

Global Automotive Fuse Market - Country Analysis:

- Germany

Germany's automotive fuse market size was valued at USD 1.8 billion in 2022 and is expected to reach USD 2.14 billion by 2030, at a CAGR of 2.2% from 2023 to 2030.

Electrification of vehicles is gaining traction, with governments all over the world switching from internal combustion and hybrid automobiles to electric vehicles. It is anticipated that this will create a multitude of opportunities for the future to reduce pollution and rely less on fossil fuels by improving the system.

- China

China’s automotive fuse market size was valued at USD 2 billion in 2022 and is expected to reach USD 2.4 billion by 2030, at a CAGR of 2.5% from 2023 to 2030.

A significant increase in electric vehicle sales, as well as the integration of fuses into operational models, are expected to boost automotive fuse demand during the Projection period. In recent years, several major automakers have announced plans to speed up the transition to a fully electric world by establishing new product lines and converting existing factories.

- India

India's automotive fuse market size was valued at USD 1.54 billion in 2022 and is expected to reach USD 1.86 billion by 2030, at a CAGR of 2.4% from 2023 to 2030.

Increasing automobile demand has led automotive part manufacturers in countries like India to develop improved systems. This, in turn, is driving demand for efficient automotive parts and, thus, a global market for automotive fuse products. Furthermore, advanced technology ensures successful soldering, fully insulated clips, and nickel-plated brass contacts resist vibration.

Key Industry Players Analysis:

To increase their market position in the global automotive fuse market business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Pacific Engineering Corporation

- Mersen Electrical Power

- Fuzetec Technology Co. Ltd.

- SIBA

- Lawson Fuses India Ltd.

- ABB

- DF Electric

- Okino

- Siemens

- Weber South Pacific

Latest Development:

- In October 2021, A definitive agreement has been signed between Littelfuse, Inc. and Carling Technologies, Inc., involving Littelfuse's acquisition of Carling for USD 315 million in cash. Carling is a leader in switching and circuit protection technology, as well as a major player in commercial vehicles, marine, and datacom/telecom infrastructure.

- In May 2021, Mersen, an international company operating in two key segments: Advanced Materials and Electrical Power, purchased Fusetech, one of the top fuse manufacturers on the market. With this acquisition, Mersen plans to ramp up fuse production and integrate a high-performance facility for the manufacture of its next products.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2022-2030 |

|

Base year |

2022 |

|

CAGR (%) |

2.1% |

|

Market Size |

25.7 billion in 2022 |

|

Projection period |

2023-2030 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Fuse Type, By Voltage, By Application, and By Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Pacific Engineering Corporation, Mersen Electrical Power, Fuzetec Technology Co. Ltd., SIBA, Lawson Fuses India Ltd., ABB, DF Electric, Okino, Siemens, and Weber South Pacific. |

|

By Fuse Type |

|

|

By Voltage |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Automotive Fuse Market by Fuse Type:

- Glass Tube

- Blade Fuse

- Semiconductor

- Others

Global Automotive Fuse Market by Application:

- 12V-24V

- 24V-48V

- 49V-150V

- Others

Global Automotive Fuse Market by Application:

- PCU Fuse

- Battery Fuse

- Onboard Charger Fuse

- Charge Inlet Fuse

- Others

Global Automotive Fuse Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the expected market size of the automotive fuse market in 2030?

Global automotive fuse market is expected to reach USD 30.43 billion by 2030, at a CAGR of 2.1% from 2023 to 2030.

What are the driving factors of the automotive fuse market?

Rising investment in electronic infrastructure and rising demand for premium vehicles.

Which region will witness more growth in the automotive fuse market?

North American region will witness more growth in the automotive fuse market.

What is the fuse type segment of the automotive fuse market?

Based on the fuse type, the automotive fuse market is segmented into glass tube, blade fuse, semiconductor, and others.

Which are the leading market players active in the automotive fuse market?

Leading players in the automotive fuse market are Pacific Engineering Corporation, Mersen Electrical Power, Fuzetec Technology Co. Ltd., SIBA, Lawson Fuses India Ltd., ABB, DF Electric, Okino, Siemens, Weber South Pacific among others.

Political Factors- Political stability is important for commercial organisations because it influences consumer and investor confidence, which has a significant impact on the economy. A high level of political unrest has a detrimental influence on consumer spending, company investment, and economic growth. There is currently political turbulence in the area where the automotive fuse industry is active due to both internal and external wars. If management is unable to recognise and control the current political unrest, the company may be unable to meet its growth targets and may be hesitant to spend more money.

Economic Factors- Capital accumulation and the creation of products and services are enabled by the efficiency of the financial market and general economic growth, which have a large positive association. In order to rapidly expand financial and human resources, the automobile fuse industry must select countries with particularly efficient financial needs. The market for automobile fuse treatments may be able to stay one step ahead of the competition by analysing the effectiveness of the financial market. Before deciding whether to go global, the automotive fuse market should assess the rates of economic growth in various nations. There are more possibilities for achieving long-term growth goals in countries experiencing high economic growth.

Social factors- Economic issues and consumer behaviours are inextricably linked. When people have more disposable income and are eager to spend it on goods and services that will improve their lifestyles, the automobile fuse industry will have great growth potential. This is owing to the ease with which new items and services may be introduced to these clients, as well as the higher chance of increasing sales. The automotive fuse sector must carefully analyse the consumption/spending behaviours and preferences of today's increasingly choosy consumers in order to alter its marketing mix strategies.

Technological Factors- The rate and progress of technological innovation may have an impact on the market and industry as a whole. The automobile fuse market will be able to comprehend the rate of new product production, the length of the product life cycle, and the specific features that consumers desire by evaluating the approaching trends in technological innovation. The automobile fuse industry can determine whether moving to e-commerce will be more profitable than opening a physical site by studying consumer emotions regarding cutting-edge, new digital technology. If competitors use automation technology to cut costs, especially if the general public is digitally informed, the automotive fuse market may be compelled to shift from manual to automated methods.

Environmental Factors- Businesses are under pressure to lessen their environmental impact as a result of stringent environmental legislation in many countries. Because failure to do so may result in harsh, reputation-damaging criticism from relevant stakeholders, the automotive fuse market should respond by adopting ethical manufacturing practises, promoting ethical consumption among its target market, working to improve its brand's sustainability reputation, and ensuring full compliance with local and international environmental laws. The automobile fuse market must make preparations in order to comply with rules and requirements in the Basic Materials industry.

Legal Factors- Workers' rights, such as the right to a fair wage, equality, equity, inclusion, justice, and physiological and psychological safety, are safeguarded by a plethora of laws known collectively as employment law. Others provide severe penalties for violating any of the aforementioned employee rights, while some countries fail to successfully enforce employment laws. The automotive fuse market should ensure the security of the working environment before entering or conducting business in these countries. To prevent both direct and indirect discrimination, the proper procedures must be in place.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Fuse Type

- 3.2. Market Attractiveness Analysis By Voltage

- 3.3. Market Attractiveness Analysis By Application

- 3.4. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Rising demand for premium vehicles

- 3. Restraints

- 3.1. Unorganized aftermarkets

- 4. Opportunities

- 4.1. Rising investment in electric infrastructure

- 5. Challenges

- 5.1. Lack of skilled professional

- Global Automotive Fuse Market Analysis and Projection, By Fuse Type

- 1. Segment Overview

- 2. Glass Tube

- 3. Blade Fuse

- 4. Semiconductor

- 5. Others

- Global Automotive Fuse Market Analysis and Projection, By Voltage

- 1. Segment Overview

- 2. 12V-24V

- 3. 24V-48V

- 4. 49V-150V

- 5. Others

- Global Automotive Fuse Market Analysis and Projection, By Application

- 1. Segment Overview

- 2. PCU Fuse

- 3. Battery Fuse

- 4. Onboard Charger Fuse

- 5. Charge Inlet Fuse

- 6. Others

- Global Automotive Fuse Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Automotive Fuse Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Automotive Fuse Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Technology Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Pacific Engineering Corporation

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Technology Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Mersen Electrical Power

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Technology Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Fuzetec Technology Co. Ltd.

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Technology Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- SIBA

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Technology Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Lawson Fuses India Ltd.

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Technology Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- ABB

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Technology Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- DF Electric

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Technology Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Okino

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Technology Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Siemens

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Technology Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Weber South Pacific

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technology Portfolio

- Recent Developments

- SWOT Analysis

- Pacific Engineering Corporation

List of Table

- Global Automotive Fuse Market, By Fuse Type, 2023–2030 (USD Billion)

- Global Glass Tube, Automotive Fuse Market, By Region, 2023–2030 (USD Billion)

- Global Blade Fuse, Automotive Fuse Market, By Region, 2023–2030 (USD Billion)

- Global Semiconductor, Automotive Fuse Market, By Region, 2023–2030 (USD Billion)

- Global Others, Automotive Fuse Market, By Region, 2023–2030 (USD Billion)

- Global Automotive Fuse Market, By Voltage, 2023–2030 (USD Billion)

- Global 12V-24V, Automotive Fuse Market, By Region, 2023–2030 (USD Billion)

- Global 24V-48V, Automotive Fuse Market, By Region, 2023–2030 (USD Billion)

- Global 49V-150V, Automotive Fuse Market, By Region, 2023–2030 (USD Billion)

- Global Others, Automotive Fuse Market, By Region, 2023–2030 (USD Billion)

- Global Automotive Fuse Market, By Application, 2023–2030 (USD Billion)

- Global PCU Fuse, Automotive Fuse Market, By Region, 2023–2030 (USD Billion)

- Global Battery Fuse, Automotive Fuse Market, By Region, 2023–2030 (USD Billion)

- Global Onboard Charger Fuse, Automotive Fuse Market, By Region, 2023–2030 (USD Billion)

- Global Charge Inlet Fuse, Automotive Fuse Market, By Region, 2023–2030 (USD Billion)

- Global Others, Automotive Fuse Market, By Region, 2023–2030 (USD Billion)

- Global Automotive Fuse Market, By Region, 2023–2030 (USD Billion)

- North America Automotive Fuse Market, By Fuse Type, 2023–2030 (USD Billion)

- North America Automotive Fuse Market, By Voltage, 2023–2030 (USD Billion)

- North America Automotive Fuse Market, By Application, 2023–2030 (USD Billion)

- USA Automotive Fuse Market, By Fuse Type, 2023–2030 (USD Billion)

- USA Automotive Fuse Market, By Voltage, 2023–2030 (USD Billion)

- USA Automotive Fuse Market, By Application, 2023–2030 (USD Billion)

- Canada Automotive Fuse Market, By Fuse Type, 2023–2030 (USD Billion)

- Canada Automotive Fuse Market, By Voltage, 2023–2030 (USD Billion)

- Canada Automotive Fuse Market, By Application, 2023–2030 (USD Billion)

- Mexico Automotive Fuse Market, By Fuse Type, 2023–2030 (USD Billion)

- Mexico Automotive Fuse Market, By Voltage, 2023–2030 (USD Billion)

- Mexico Automotive Fuse Market, By Application, 2023–2030 (USD Billion)

- Europe Automotive Fuse Market, By Fuse Type, 2023–2030 (USD Billion)

- Europe Automotive Fuse Market, By Voltage, 2023–2030 (USD Billion)

- Europe Automotive Fuse Market, By Application, 2023–2030 (USD Billion)

- Germany Automotive Fuse Market, By Fuse Type, 2023–2030 (USD Billion)

- Germany Automotive Fuse Market, By Voltage, 2023–2030 (USD Billion)

- Germany Automotive Fuse Market, By Application, 2023–2030 (USD Billion)

- France Automotive Fuse Market, By Fuse Type, 2023–2030 (USD Billion)

- France Automotive Fuse Market, By Voltage, 2023–2030 (USD Billion)

- France Automotive Fuse Market, By Application, 2023–2030 (USD Billion)

- UK Automotive Fuse Market, By Fuse Type, 2023–2030 (USD Billion)

- UK Automotive Fuse Market, By Voltage, 2023–2030 (USD Billion)

- UK Automotive Fuse Market, By Application, 2023–2030 (USD Billion)

- Italy Automotive Fuse Market, By Fuse Type, 2023–2030 (USD Billion)

- Italy Automotive Fuse Market, By Voltage, 2023–2030 (USD Billion)

- Italy Automotive Fuse Market, By Application, 2023–2030 (USD Billion)

- Spain Automotive Fuse Market, By Fuse Type, 2023–2030 (USD Billion)

- Spain Automotive Fuse Market, By Voltage, 2023–2030 (USD Billion)

- Spain Automotive Fuse Market, By Application, 2023–2030 (USD Billion)

- Asia Pacific Automotive Fuse Market, By Fuse Type, 2023–2030 (USD Billion)

- Asia Pacific Automotive Fuse Market, By Voltage, 2023–2030 (USD Billion)

- Asia Pacific Automotive Fuse Market, By Application, 2023–2030 (USD Billion)

- Japan Automotive Fuse Market, By Fuse Type, 2023–2030 (USD Billion)

- Japan Automotive Fuse Market, By Voltage, 2023–2030 (USD Billion)

- Japan Automotive Fuse Market, By Application, 2023–2030 (USD Billion)

- China Automotive Fuse Market, By Fuse Type, 2023–2030 (USD Billion)

- China Automotive Fuse Market, By Voltage, 2023–2030 (USD Billion)

- China Automotive Fuse Market, By Application, 2023–2030 (USD Billion)

- India Automotive Fuse Market, By Fuse Type, 2023–2030 (USD Billion)

- India Automotive Fuse Market, By Voltage, 2023–2030 (USD Billion)

- India Automotive Fuse Market, By Application, 2023–2030 (USD Billion)

- South America Automotive Fuse Market, By Fuse Type, 2023–2030 (USD Billion)

- South America Automotive Fuse Market, By Voltage, 2023–2030 (USD Billion)

- South America Automotive Fuse Market, By Application, 2023–2030 (USD Billion)

- Brazil Automotive Fuse Market, By Fuse Type, 2023–2030 (USD Billion)

- Brazil Automotive Fuse Market, By Voltage, 2023–2030 (USD Billion)

- Brazil Automotive Fuse Market, By Application, 2023–2030 (USD Billion)

- Middle East and Africa Automotive Fuse Market, By Fuse Type, 2023–2030 (USD Billion)

- Middle East and Africa Automotive Fuse Market, By Voltage, 2023–2030 (USD Billion)

- Middle East and Africa Automotive Fuse Market, By Application, 2023–2030 (USD Billion)

- UAE Automotive Fuse Market, By Fuse Type, 2023–2030 (USD Billion)

- UAE Automotive Fuse Market, By Voltage, 2023–2030 (USD Billion)

- UAE Automotive Fuse Market, By Application, 2023–2030 (USD Billion)

- South Africa Automotive Fuse Market, By Fuse Type, 2023–2030 (USD Billion)

- South Africa Automotive Fuse Market, By Voltage, 2023–2030 (USD Billion)

- South Africa Automotive Fuse Market, By Application, 2023–2030 (USD Billion)

List of Figures

- Global Automotive Fuse Market Segmentation

- Automotive Fuse Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Automotive Fuse Market Attractiveness Analysis By Fuse Type

- Global Automotive Fuse Market Attractiveness Analysis By Voltage

- Global Automotive Fuse Market Attractiveness Analysis By Application

- Global Automotive Fuse Market Attractiveness Analysis By Region

- Global Automotive Fuse Market: Dynamics

- Global Automotive Fuse Market Share By Fuse Type (2023 & 2030)

- Global Automotive Fuse Market Share By Voltage (2023 & 2030)

- Global Automotive Fuse Market Share By Application (2023 & 2030)

- Global Automotive Fuse Market Share by Regions (2023 & 2030)

- Global Automotive Fuse Market Share by Company (2021)