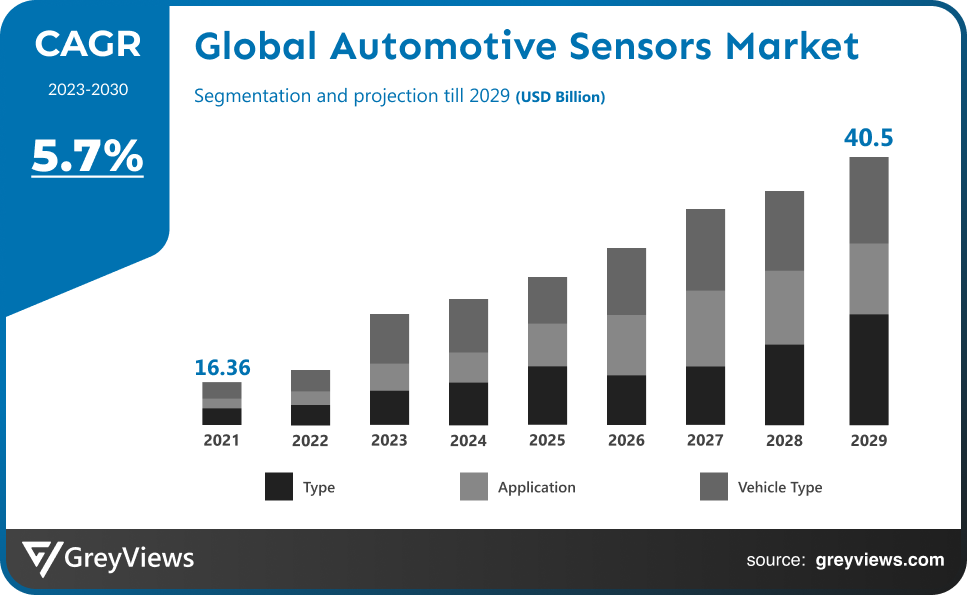

Automotive Sensors Market Size By Type (LED, Image Sensors, Position Sensors, Temperature Sensors, Pressure Sensors, MEMS and Others) By Application (Chassis, Safety & Security, Body Electronics, Powertrain, ADAS and Others) By Vehicle Type (LCV, HCV and Passenger Car), Regions, Segmentation, and Projection till 2029

CAGR: 5.7%Current Market Size: USD 16.36 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Automotive Sensors Market- Market Overview:

The Global Automotive Sensors market is expected to grow from USD 16.36 billion in 2021 to USD 40.5 billion by 2029, at a CAGR of 5.7% during the Projection period 2022-2029. The growth of this market is mainly driven owing to the increase in the trading of LPG across countries.

Automotive Sensors are a crucial part of a vehicle that are intended to detect, transmit, assess, record, and display information about the operation of the vehicle from both the interior and exterior surroundings. Currently, a variety of Sensors may be used in the design of modern automobiles. These are set up in the car's engine to detect and address any issues like repairs, service, etc. Automobile Sensors will test the vehicle's functionality. How many Sensors are currently being utilized in a car is unknown to the owner. There are a few of the biggest sensor companies in the globe that can provide consumers with cutting-edge solutions. Modern cars utilize Sensors to monitor changing circumstances inside and outside the vehicle and react accordingly. So that everyone within the car may move about effectively and safely, using the data from these Sensors, we can improve convenience, effectiveness, and safety. Intelligent Sensors, such as those used in automobiles, may be used to process and regulate temperature, oil pressure, pollution, coolant levels, and more. Although many different kinds of sensors are used in cars, understanding how they operate is crucial. The crankshaft of the car can be linked to the engine speed sensor. This sensor's primary function is to keep track of the crankshaft's rotational speed. in order to adjust fuel injection and engine timing. The car engine might abruptly stop in several ways. Thus, for drivers of cars, this sensor will stop that. The oxygen sensor, also known as an O2 sensor, is positioned in the exhaust stream, often after the catalytic converter and close to the exhaust manifold. It measures the amount of oxygen in the exhaust gases. To determine whether the engine is operating a rich fuel ratio or a low one, the information is compared to the oxygen level of ambient air. The engine computer uses this data to decide on fuel metering and emission controls.

Sample Request: - Global Automotive Sensors Market

Market Dynamics:

Drivers:

- Rising adoption of autonomous vehicles

One of the main causes of the need for car Sensors is autonomous driving. The majority of the automotive sensor industry is expanding along with the total automotive market. The main driver of the increased demand for automotive Sensors is the wide deployment of ADAS and AD systems. The majority of the market growth for automotive Sensors is due to the Sensors used in ADAS/AD systems, which include image Sensors, temperature Sensors, position Sensors, speed Sensors, and others.

Restraints:

- Underdeveloped aftermarket for automotive Sensors in emerging economies

Due to the undeveloped aftermarket for car Sensors, the business of automotive Sensors is dominated by OEMs. The aftermarket is crucial in fostering market expansion for a number of different industry sectors, including industrial Sensors and home automation devices. The main obstacle to the commercialization of automotive Sensors is that, in the case of automotive Sensors, the majority of technical parameters are provided by the car manufacturer or a tier 1 supplier. Similar to how the retrofit market is rather tiny for many modern Sensors like radar, lidar, and proximity Sensors due to their lesser penetration in cars. In North America and Europe's advanced economies, the aftermarket is only little established, while in the developing world.

Opportunities:

- Growing focus on electrification in the automotive industry

The strict government restrictions to reduce CO2 emissions and the huge demand for fuel-efficient automobiles have led to an increase in semiconductors in both conventional vehicles and EVs/HEVs. 2020 saw the introduction by the Chinese government of the new 6A emission standard, which assisted in lowering car emissions. There is a significant opportunity to reduce CO2 emissions from traditional internal combustion engines.

Challenges:

- Safety and security threats in autonomous vehicles

Autonomous vehicles have gained popularity recently. There have been several deadly accidents using Level 3 to Level 5 autonomous vehicles with little to no human involvement. Additionally, a paper from the Joint Research Centre (JRC) and the EU Agency for Cybersecurity (ENISA) found that autonomous cars pose significant cybersecurity concerns. According to the paper, autonomous cars are vulnerable to adversarial machine learning strategies like poisoning or evasion attempts. This threat model entails manipulating the face and pattern recognition software. Attackers using evasion techniques change the data that is provided into the systems in order to improve their own results. Similar to poisoning assaults, which tamper with the training procedure to make it malfunction in the attacker's favour. For example, Tesla self-driving cars were made to accelerate from 35 to 85.

Segmentation Analysis:

The global automotive sensors market has been segmented based on type, application, vehicle and region.

By Type

The type segment includes LED, image sensors, position sensors, temperature sensors, pressure sensors, MEMS and others. The position sensors segment led the largest share of the automotive sensors market with a market share of around 20.3% in 2021. The sector of the global automotive Sensors market that is expanding the fastest is position Sensors. They also include brake pedal position sensing, clutch pedal position sensing, manifold flap position sensing, accelerator pedal position sensing, seat and headrest position sensing, electric roof position sensing, windscreen wiper position sensing, sunroof position sensing, valve position sensing, gear shift position sensing, crash sensing, headlight position sensing, and seat position sensing. The factors are attributed to their various applications.

By Application

The application segment includes chassis, safety & security, body electronics, powertrain, ADAS and others. The powertrain segment led the automotive sensors market with a market share of around 23.08% in 2021. Over the anticipated term, the Powertrain's CAGR Value is the greatest. The causes are cited as being tight fuel economy and pollution standards implemented by several countries worldwide.

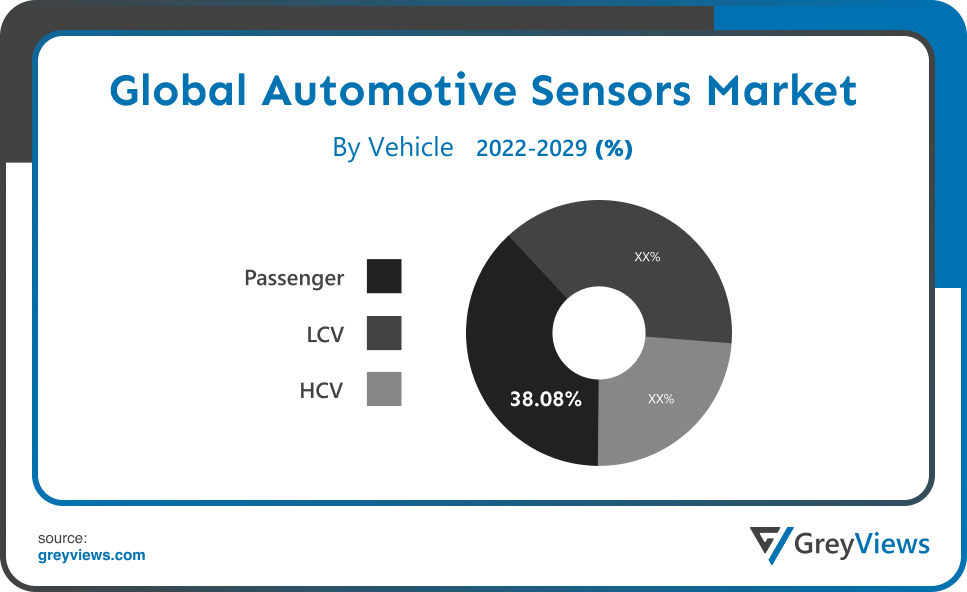

By Vehicle

The vehicle segment includes LCV, HCV and passenger car. The passenger segment led the automotive sensors market with a market share of around 38.08% in 2021. The predicted period's CAGR figure for passenger cars is the highest. Compared to Commercial Cars, these vehicles' Sensors increase vehicle performance, increase passenger safety, and lower emissions.

Global Automotive Sensors Market- Sales Analysis.

The sale of automotive sensors expanded at a CAGR of 4.9% from 2015 to 2021.

Sales of automotive Sensors will increase as automated emergency braking systems (AEBS) are included into commercial vehicles to improve driver and passenger comfort and safety. The market will benefit from the focus on enhancing overall vehicle performance. However, due to the high cost of Sensors, there has been a limited uptake of automotive Sensors in small and inexpensive automobiles, which may somewhat dim growth prospects throughout the evaluation period.

The development of the sensor sector will also contribute to the expansion overall. For instance, new linear magnetic position sensor ICs for automotive applications were introduced by Allegro MicroSystems Inc. in May 2021. According to the manufacturer, the A31315 sensor will exceed all demanding safety criteria while providing high measurement accuracy and exceptional performance to steering, braking, gearbox, and throttle systems.

Thus, owing to the aforementioned factors, the global Automotive Sensors Market is expected to grow at a CAGR of 5.7% during the Projection period from 2022 to 2029.

By Regional Analysis:

The regions analyzed for the Automotive Sensors market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Asia Pacific region dominated the Automotive Sensors market and held the 39.1% share of the market revenue in 2021.

- The Asia Pacific region witnessed a major share. The Asia Pacific market is characterized by growing middle-class discretionary income and cost advantages for OEMs such as affordable labor and cheap automobile production costs. However, a surge in the number of fatalities from auto accidents over the past several years has forced regulatory bodies to enact stricter safety and pollution standards. For example, the Ministry of Road Transport in India has approved the mandatory installation of seatbelt reminders, airbags, alert systems, reverse parking Sensors (RPS) for speeds over 80 km/h, and manual central locking system override in the event of an electronic system failure for all vehicles manufactured after July 1, 2019. RPS and airbags are also required for LCVs.

- North America is anticipated to experience significant growth during the predicted period. The market is expected to increase significantly in North America. The early acceptance of ADAS features and the increase in electric car sales are both attributable to North America's strong adoption of automotive Sensors.

Global Automotive Sensors Market- Country Analysis:

- Germany

Germany’s Automotive Sensors market size was valued at USD 1.01 billion in 2021 and is expected to reach USD 1.52 billion by 2029, at a CAGR of 5.3% from 2022 to 2029.

By detecting and calculating braking time, automatic emergency braking and other safety Sensors avoid car collisions, and as the number of accident-related fatalities in Germany rises, so will the use of automobile Sensors. Germany’s automotive sensor market will expand as a result of extensive research being done in the field of automotive Sensors toward miniaturization and capacity enhancement without sacrificing the basic functionalities of the vehicle.

- China

China Automotive Sensors’ market size was valued at USD 1.66 billion in 2021 and is expected to reach USD 2.47 billion by 2029, at a CAGR of 5.1% from 2022 to 2029.

The demand for automotive Sensors in China will increase due to the adoption of sophisticated temperature and position Sensors as a component of the battery safety system against mechanical shock and overheating. Sales of automotive Sensors in China will be fueled by government measures that support the use of alternative fuel cars to reduce carbon emissions. The aggressive execution of these regulations and growing consumer awareness of car safety will propel market expansion in China in the years to come.

- India

India's Automotive Sensors market size was valued at USD 1.27 billion in 2021 and is expected to reach USD 2.02 billion by 2029, at a CAGR of 6% from 2022 to 2029. The Indian Brand Equity Foundation (IBEF) reports that in March 2021, sales of passenger automobiles increased by 28.39% year over year. Leading automakers are concentrating on installing these Sensors in affordable automobiles due to expanding passenger car sales and rising demand for adaptive cruise control Sensors. This is good news for the expansion of the automotive sensor industry. In order to prevent this, autonomous emergency braking systems (AEBS) and other safety Sensors are becoming more and more necessary. The need for safety Sensors in automobiles in India will be fueled by an increase in the country's road accident-related death rate as well as the growing demand for fuel-efficient solutions for commercial vehicles.

Key Industry Players Analysis:

To increase their market position in the global Automotive Sensors business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- BW Group

- Dorian LPG Ltd.

- EXMAR

- Hyundai Heavy Industries Co., Ltd

- Kawasaki Heavy Industries, Ltd

- Mitsubishi Heavy Industries, Ltd.

- Namura Shipbuilding Co., Ltd.

- PT Pertamina (Persero)

- StealthGas Inc.

- The Great Eastern Shipping Co. Ltd.

- Teekay Corporation

Latest Development:

- In July 2021, A minority share in Feelit, an industry 4.0 firm situated in Tel Aviv, Israel, has been purchased by Continental AG. Feelit uses specialized hardware Sensors and algorithms to provide cutting-edge proactive maintenance solutions for a range of industrial machinery and equipment. The major objective of the firm is to develop structural sensing technology that is up to 50 times more sensitive than products on the market today.

- In October 2021, Infineon Technologies AG created the automobile current Sensors XENSIV TLE4972. The coreless current Sensors use the tried-and-true Hall technology from Infineon for accurate and consistent readings.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

5.7% |

|

Market Size |

16.36 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Type, By Application, By Vehicle Type and By Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

BW Group, Dorian LPG Ltd., EXMAR, Hyundai Heavy Industries Co., Ltd, Kawasaki Heavy Industries, Ltd, Mitsubishi Heavy Industries, Ltd., Namura Shipbuilding Co., Ltd., PT Pertamina (Persero), StealthGas Inc., The Great Eastern Shipping Co. Ltd., and Teekay Corporation. |

|

By Type |

|

|

By Application |

|

|

By Vehicle Type |

|

|

Regional scope |

|

Scope of the Report

Global Automotive Sensors Market by type:

- LED

- Image Sensors

- Position Sensors

- Temperature Sensors

- Pressure Sensors

- MEMS

- Others

Global Automotive Sensors Market by application:

- Chassis

- Safety & Security

- Body Electronics

- Powertrain

- ADAS

- Others

Global Automotive Sensors Market by vehicle:

- LCV

- HCV and

- Passenger Car

Global Automotive Sensors Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the expected market size of the Automotive Sensors market in 2029?

Global Automotive Sensors market is expected to reach USD 40.5 billion by 2029, at a CAGR of 5.7% from 2022 to 2029.

What is the driving factor of the automotive sensors market?

Rising adoption of autonomous vehicles is expected to drive the market’s growth.

What are the challenges affecting the market’s growth?

Safety and security threats in autonomous vehicles challenges the market’s growth.

Which are the leading market players active in the Automotive Sensors market?

Leading market players active in the global Automotive Sensors market are BW Group, Dorian LPG Ltd., EXMAR, Hyundai Heavy Industries Co., Ltd, Kawasaki Heavy Industries, Ltd, Mitsubishi Heavy Industries, Ltd., Namura Shipbuilding Co., Ltd., PT Pertamina (Persero), StealthGas Inc., The Great Eastern Shipping Co. Ltd., Teekay Corporation among others.

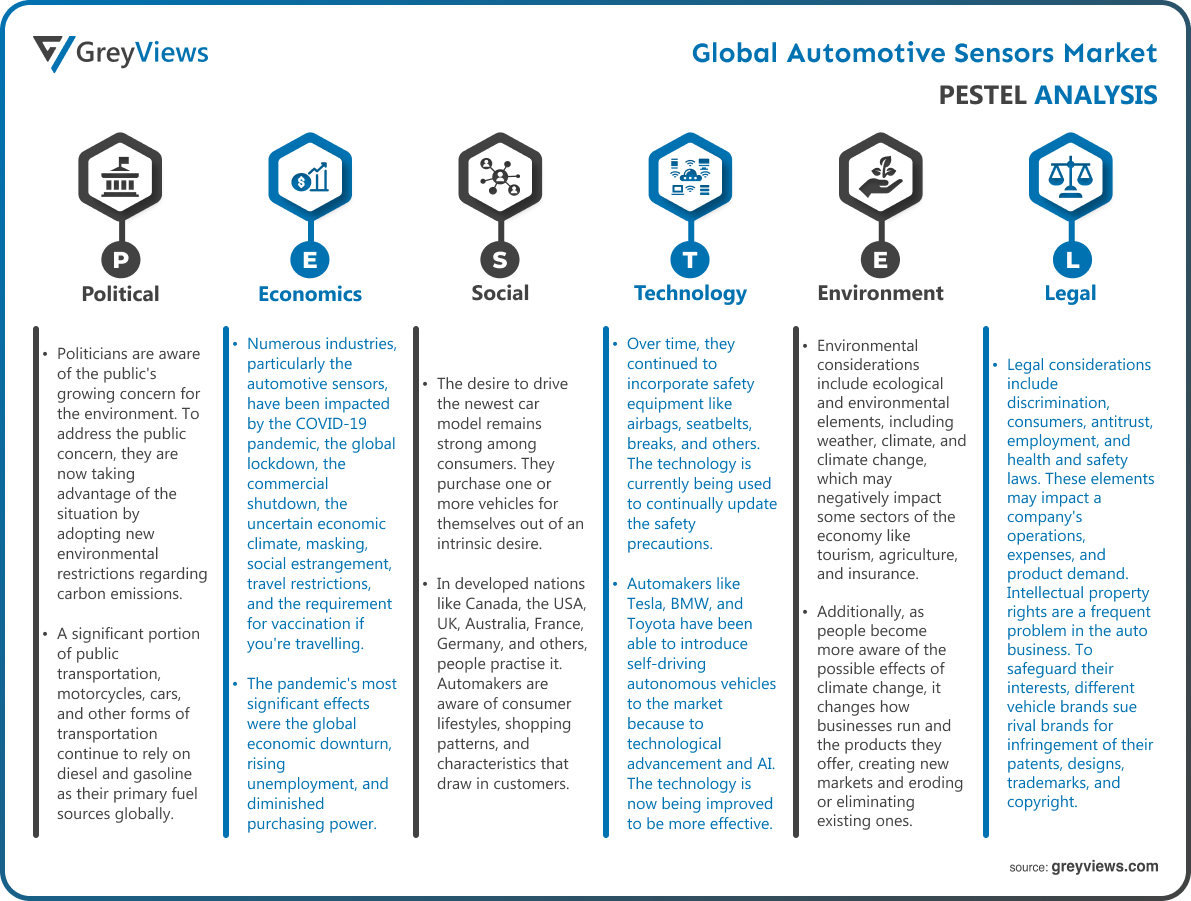

Political Factors- Politicians are aware of the public's growing concern for the environment. To address the public concern, they are now taking advantage of the situation by adopting new environmental restrictions regarding carbon emissions. However, a significant portion of public transportation, motorcycles, cars, and other forms of transportation continue to rely on diesel and gasoline as their primary fuel sources globally. When a vehicle burns and releases carbon into the atmosphere, they contribute to air pollution. Politicians and government officials are very interested in the figure of how much carbon is being released into the environment. Automotive businesses would have to go through environmental legal requirements after they implemented some environmental legislation.

Economical Factors- Numerous industries, particularly the automotive sensors, have been impacted by the COVID-19 pandemic, the global lockdown, the commercial shutdown, the uncertain economic climate, masking, social estrangement, travel restrictions, and the requirement for vaccination if you're travelling. The pandemic's most significant effects were the global economic downturn, rising unemployment, and diminished purchasing power. These economic factors made it harder for automakers to sell their products. The automotive sensors industry benefits from the market in growing nations like China, Malaysia, Indonesia, India, Brazil, Mexico, Singapore, and others in two ways. First, it lowers the cost of production by offering inexpensive labour. They also have a sizable consumer market with lots of room for expansion. To take advantage of both opportunities, international automotive sensors are moving their production and manufacturing facilities to Asia.

Social Factor- The desire to drive the newest car model remains strong among consumers. They purchase one or more vehicles for themselves out of an intrinsic desire. In developed nations like Canada, the USA, UK, Australia, France, Germany, and others, people practise it. Automakers are aware of consumer lifestyles, shopping patterns, and characteristics that draw in customers. They make appropriate customer targets. Most crucially, these factors have boosted the sector's expansion, market share, and earnings.

Technological Factors- The automotive sensors industry has been developing safety measures to make transportation secure and safe. Over time, they continued to incorporate safety equipment like airbags, seatbelts, breaks, and others. The technology is currently being used to continually update the safety precautions. Automakers like Tesla, BMW, and Toyota have been able to introduce self-driving autonomous vehicles to the market because to technological advancement and AI. The technology is now being improved to be more effective. such as additional battery timing, secure, self-sustaining, solar, and wind technologies. The mode of transportation would alter if these elements were included.

Environmental Factors- Environmental considerations include ecological and environmental elements, including weather, climate, and climate change, which may negatively impact some sectors of the economy like tourism, agriculture, and insurance. Additionally, as people become more aware of the possible effects of climate change, it changes how businesses run and the products they offer, creating new markets and eroding or eliminating existing ones. Air pollution and carbon emissions are two significant environmental problems caused by the automotive sensors industry. All of us are being impacted both directly and indirectly by them in terms of poor air quality, climate change, and global warming. Automotive sensors manufacturers are switching to electric vehicles as a result of environmental concerns.

Legal Factors- Legal considerations include discrimination, consumers, antitrust, employment, and health and safety laws. These elements may impact a company's operations, expenses, and product demand. Intellectual property rights are a frequent problem in the auto business. To safeguard their interests, different vehicle brands sue rival brands for infringement of their patents, designs, trademarks, and copyright. Government's goal is to increase the production capacity by 2030. The safety laws and guidelines apply to all businesses, not just automakers. Along with adhering to the law, drivers must fasten their seatbelts and drive within the posted speed limit. These laws and rules make it challenging for businesses to introduce new features while adhering to safety protocols.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Type

- 3.2. Market Attractiveness Analysis By Application

- 3.3. Market Attractiveness Analysis By Vehicle Type

- 3.4. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Rising adoption of autonomous vehicles

- 3. Restraints

- 3.1. The underdeveloped aftermarket for automotive Sensors in emerging economies

- 4. Opportunities

- 4.1. Growing focus on electrification in automotive industry

- 5. Challenges

- 5.1. Safety and security threats in autonomous vehicles

- Global Automotive Sensors Market Analysis and Projection, By Type

- 1. Segment Overview

- 2. LED

- 3. Image Sensors

- 4. Position Sensors

- 5. Temperature Sensors

- 6. Pressure Sensors

- 7. MEMS

- 8. Others

- Global Automotive Sensors Market Analysis and Projection, By Application

- 1. Segment Overview

- 2. Chassis

- 3. Safety & Security

- 4. Body Electronics

- 5. Powertrain

- 6. ADAS

- 7. Others

- Global Automotive Sensors Market Analysis and Projection, By Vehicle Type

- 1. Segment Overview

- 2. LCV

- 3. HCV and

- 4. Passenger Car

- Global Automotive Sensors Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Automotive Sensors Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Automotive Sensors Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- BW Group

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Dorian LPG Ltd.

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- EXMAR

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Hyundai Heavy Industries Co., Ltd

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Kawasaki Heavy Industries, Ltd

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Mitsubishi Heavy Industries, Ltd.

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Namura Shipbuilding Co., Ltd.

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- PT Pertamina (Persero)

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- StealthGas Inc.

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- The Great Eastern Shipping Co. Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Teekay Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- BW Group

List of Table

- Global Automotive Sensors Market, By Type, 2021–2029 (USD Billion)

- Global LED, Automotive Sensors Market, By Region, 2021–2029 (USD Billion)

- Global Image Sensors, Automotive Sensors Market, By Region, 2021–2029 (USD Billion)

- Global Position Sensors, Automotive Sensors Market, By Region, 2021–2029 (USD Billion)

- Global Temperature Sensors, Automotive Sensors Market, By Region, 2021–2029 (USD Billion)

- Global Pressure Sensors, Automotive Sensors Market, By Region, 2021–2029 (USD Billion)

- Global MEMS, Automotive Sensors Market, By Region, 2021–2029 (USD Billion)

- Global Others, Automotive Sensors Market, By Region, 2021–2029 (USD Billion)

- Global Automotive Sensors Market, By Application, 2021–2029 (USD Billion)

- Global Chassis, Automotive Sensors Market, By Region, 2021–2029 (USD Billion)

- Global Safety & Security, Automotive Sensors Market, By Region, 2021–2029 (USD Billion)

- Global Body Electronics, Automotive Sensors Market, By Region, 2021–2029 (USD Billion)

- Global Powertrain, Automotive Sensors Market, By Region, 2021–2029 (USD Billion)

- Global ADAS, Automotive Sensors Market, By Region, 2021–2029 (USD Billion)

- Global Others, Automotive Sensors Market, By Region, 2021–2029 (USD Billion)

- Global Automotive Sensors Market, By Vehicle Type, 2021–2029 (USD Billion)

- Global LCV, Automotive Sensors Market, By Region, 2021–2029 (USD Billion)

- Global HCV, Automotive Sensors Market, By Region, 2021–2029 (USD Billion)

- Global Passenger Car, Automotive Sensors Market, By Region, 2021–2029 (USD Billion)

- Global Automotive Sensors Market, By Region, 2021–2029 (USD Billion)

- North America Automotive Sensors Market, By Type, 2021–2029 (USD Billion)

- North America Automotive Sensors Market, By Application, 2021–2029 (USD Billion)

- North America Automotive Sensors Market, By Vehicle Type, 2021–2029 (USD Billion)

- USA Automotive Sensors Market, By Type, 2021–2029 (USD Billion)

- USA Automotive Sensors Market, By Application, 2021–2029 (USD Billion)

- USA Automotive Sensors Market, By Vehicle Type, 2021–2029 (USD Billion)

- Canada Automotive Sensors Market, By Type, 2021–2029 (USD Billion)

- Canada Automotive Sensors Market, By Application, 2021–2029 (USD Billion)

- Canada Automotive Sensors Market, By Vehicle Type, 2021–2029 (USD Billion)

- Mexico Automotive Sensors Market, By Type, 2021–2029 (USD Billion)

- Mexico Automotive Sensors Market, By Application, 2021–2029 (USD Billion)

- Mexico Automotive Sensors Market, By Vehicle Type, 2021–2029 (USD Billion)

- Europe Automotive Sensors Market, By Type, 2021–2029 (USD Billion)

- Europe Automotive Sensors Market, By Application, 2021–2029 (USD Billion)

- Europe Automotive Sensors Market, By Vehicle Type, 2021–2029 (USD Billion)

- Germany Automotive Sensors Market, By Type, 2021–2029 (USD Billion)

- Germany Automotive Sensors Market, By Application, 2021–2029 (USD Billion)

- Germany Automotive Sensors Market, By Vehicle Type, 2021–2029 (USD Billion)

- France Automotive Sensors Market, By Type, 2021–2029 (USD Billion)

- France Automotive Sensors Market, By Application, 2021–2029 (USD Billion)

- France Automotive Sensors Market, By Vehicle Type, 2021–2029 (USD Billion)

- UK Automotive Sensors Market, By Type, 2021–2029 (USD Billion)

- UK Automotive Sensors Market, By Application, 2021–2029 (USD Billion)

- UK Automotive Sensors Market, By Vehicle Type, 2021–2029 (USD Billion)

- Italy Automotive Sensors Market, By Type, 2021–2029 (USD Billion)

- Italy Automotive Sensors Market, By Application, 2021–2029 (USD Billion)

- Italy Automotive Sensors Market, By Vehicle Type, 2021–2029 (USD Billion)

- Spain Automotive Sensors Market, By Type, 2021–2029 (USD Billion)

- Spain Automotive Sensors Market, By Application, 2021–2029 (USD Billion)

- Spain Automotive Sensors Market, By Vehicle Type, 2021–2029 (USD Billion)

- Asia Pacific Automotive Sensors Market, By Type, 2021–2029 (USD Billion)

- Asia Pacific Automotive Sensors Market, By Application, 2021–2029 (USD Billion)

- Asia Pacific Automotive Sensors Market, By Vehicle Type, 2021–2029 (USD Billion)

- Japan Automotive Sensors Market, By Type, 2021–2029 (USD Billion)

- Japan Automotive Sensors Market, By Application, 2021–2029 (USD Billion)

- Japan Automotive Sensors Market, By Vehicle Type, 2021–2029 (USD Billion)

- China Automotive Sensors Market, By Type, 2021–2029 (USD Billion)

- China Automotive Sensors Market, By Application, 2021–2029 (USD Billion)

- China Automotive Sensors Market, By Vehicle Type, 2021–2029 (USD Billion)

- India Automotive Sensors Market, By Type, 2021–2029 (USD Billion)

- India Automotive Sensors Market, By Application, 2021–2029 (USD Billion)

- India Automotive Sensors Market, By Vehicle Type, 2021–2029 (USD Billion)

- South America Automotive Sensors Market, By Type, 2021–2029 (USD Billion)

- South America Automotive Sensors Market, By Application, 2021–2029 (USD Billion)

- South America Automotive Sensors Market, By Vehicle Type, 2021–2029 (USD Billion)

- Brazil Automotive Sensors Market, By Type, 2021–2029 (USD Billion)

- Brazil Automotive Sensors Market, By Application, 2021–2029 (USD Billion)

- Brazil Automotive Sensors Market, By Vehicle Type, 2021–2029 (USD Billion)

- Middle East and Africa Automotive Sensors Market, By Type, 2021–2029 (USD Billion)

- Middle East and Africa Automotive Sensors Market, By Application, 2021–2029 (USD Billion)

- Middle East and Africa Automotive Sensors Market, By Vehicle Type, 2021–2029 (USD Billion)

- UAE Automotive Sensors Market, By Type, 2021–2029 (USD Billion)

- UAE Automotive Sensors Market, By Application, 2021–2029 (USD Billion)

- UAE Automotive Sensors Market, By Vehicle Type, 2021–2029 (USD Billion)

- South Africa Automotive Sensors Market, By Type, 2021–2029 (USD Billion)

- South Africa Automotive Sensors Market, By Application, 2021–2029 (USD Billion)

- South Africa Automotive Sensors Market, By Vehicle Type, 2021–2029 (USD Billion)

List of Figures

- Global Automotive Sensors Market Segmentation

- Automotive Sensors Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Automotive Sensors Market Attractiveness Analysis By Type

- Global Automotive Sensors Market Attractiveness Analysis By Application

- Global Automotive Sensors Market Attractiveness Analysis By Vehicle Type

- Global Automotive Sensors Market Attractiveness Analysis By Region

- Global Automotive Sensors Market: Dynamics

- Global Automotive Sensors Market Share By Type (2021 & 2029)

- Global Automotive Sensors Market Share By Application (2021 & 2029)

- Global Automotive Sensors Market Share By Vehicle Type (2021 & 2029)

- Global Automotive Sensors Market Share by Regions (2021 & 2029)

- Global Automotive Sensors Market Share by Company (2020)