Biodegradable Paper and Plastic Packaging Market Size By Type (Cellulose Based Plastic, Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), and Starch Based Plastic), By Material Type (Paper and Plastic), By End-user (Catering Service Wares, Personal and Home Care, Food and Beverage, and Healthcare), Regions, Segmentation, and Projection till 2029

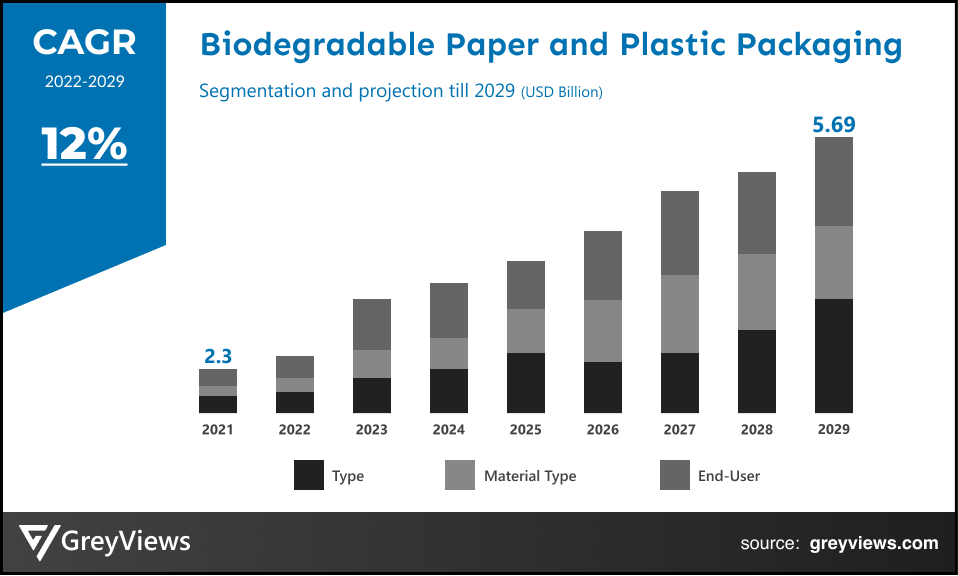

CAGR: 12%Current Market Size: USD 2.3 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Biodegradable Paper and Plastic Packaging Market- Market Overview:

The Global Biodegradable Paper and Plastic Packaging market is expected to grow from USD 2.3 billion in 2021 to USD 5.69 billion by 2029, at a CAGR of 12% during the Projection period 2022-2029. The growth of this market is mainly driven owing to the increasing adoption of sustainable packaging alternatives.

One of the major industries in the world is packaging. The natural and quickly biodegradable package protection approach is called biodegradable packaging. Since plastic enables logistics organisations to carry their goods and materials over long distances and in any environmental state, biodegradable plastic and paper packaging are widely employed in the packing of goods and materials carried from one place to another. Because it is safe for both the environment and human health, biodegradable paper and plastic packaging material is increasingly preferred by logistic end users in the wake of sustainable development. In order to keep packaged items secure and safe, biodegradable paper and plastic packaging helps protect products from moisture, dust, and other environmental factors. Due to their wide range of qualities, including biodegradability, recyclability, adaptability, widespread availability, lightweight, and most crucially the "sustainability" element, biodegradable plastic and paper are widely used for packaging across many industries. Significant environmental and food safety concerns are motivating the development of biodegradable packaging options as a partial replacement for plastics derived from petrochemicals, which is enhancing the market outlook.

Sample Request: - Global Biodegradable Paper and Plastic Packaging Market

Market Dynamics:

Drivers:

- Increasing preference for biodegradable packaging solutions

Manufacturers are concentrating more on product packaging in addition to food services production to draw in more customers. To cut down on the costs of logistics and recycling, food service producers are seeking sustainable packaging materials. The demand for biodegradable paper and plastic packaging that maintains the product's freshness and aroma over time has increased.

- Growth in research and development spending will pave the path for advancements

The increase in funds being devoted for the growth and development of innovative and automated packing equipment/machinery is a result of the increasing number of strategic market alliances. Additionally, an increase in the amount of money spent on research and development would pave the door for breakthroughs involving these packaging options.

Restraints:

- Raw Material Prices

Future market trends are hampered by the variable cost of raw materials used in biodegradable paper and plastic packaging. For numerous businesses, the price of raw materials continues to be the main source of worry. To remain competitive and provide sustainable margins in light of the significant price volatility of raw materials, it becomes a genuine problem for food firms.

- Increased regulations to eventually limit the extent of growth

Market expansion would be hampered by the increasing enforcement of strict environmental rules placed on the industry about the packaging waste produced. Additionally, the market's potential for expansion will be limited by strict controls on product approvals. More restrictions put in place by the government on the use of plastic as a packaging material would also be a hindrance.

Opportunities:

- Expansion of end user

The materials and packaging industries have enormous growth potential as a result of the global economic expansion. Cost-effective product packaging is provided by biodegradable paper and plastic packaging solutions. The packaging industry's emphasis on contemporary technologies is closely correlated with rising demand for such packaging solutions. Globalization and growing urbanization are the main drivers of market value growth. Other factors influencing market expansion include the booming creation of flexible packaging solutions, expanding technological developments in packaging equipment and technology to support a wide range of products, and increased e-commerce industry proliferation. Additionally, during the projection period, profitable potential for market participants are expanded by developments in manufacturing technology. The market's future expansion will also be aided by growing consumer awareness of the advantages of flexible lid stock packaging solutions, such as their affordability and extended product shelf lives.

Challenges

- High Prices owing to packaging

The price of the product rises as the packaging becomes more inventive, which is a deterrent for the market for biodegradable paper and plastic packaging. As the healthcare and food industry develops continuously, product packaging also advances, necessitating increased resources, technology, research, and other variables to satisfy consumer demand. All of these variables have a direct impact on the price or output of the product, which is likely to have an impact on the market throughout the Projection time.

Segmentation Analysis:

The global biodegradable paper and plastic packaging market has been segmented based on type, material type, end-user, and regions.

By Type

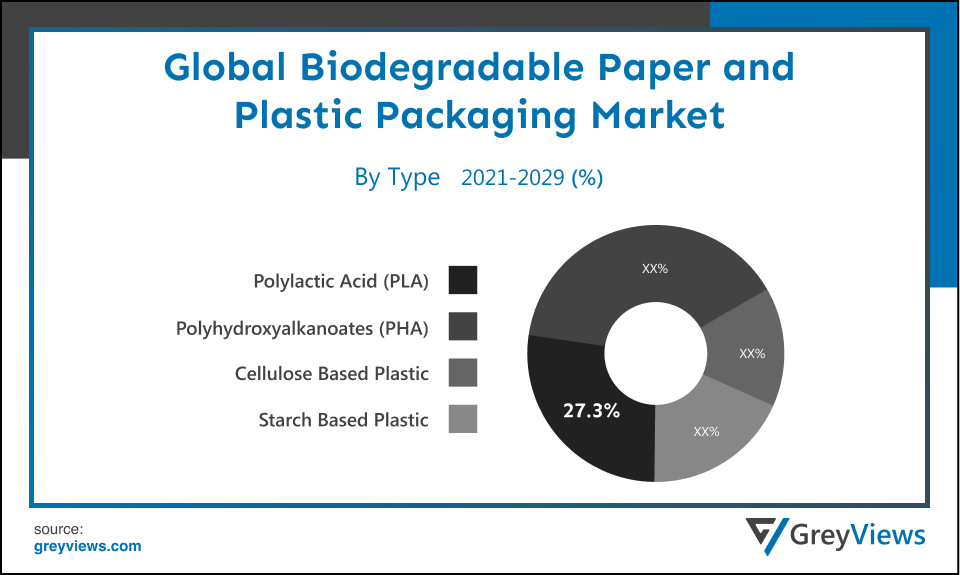

The type segment is cellulose based plastic, polylactic acid (PLA), polyhydroxyalkanoates (PHA), and starch based plastic. The polylactic acid (PLA) segment led the largest share of the biodegradable paper and plastic packaging market with a market share of around 27.3% in 2021. PLA is a remarkably transparent polymer that is simple to recycle. Thermoformed applications for the packaging of dairy products, ready-to-eat food packaging, clear blister packaging, and drink cups for cold beverages are widely utilised with this material.

By Material Type

The material type includes paper and plastic. The paper segment led the biodegradable paper and plastic packaging market with a market share of around 63.08% in 2021. Paper and paperboard are the most common and traditional types of environmentally friendly packing materials. The segment's growth will be aided by consumers' growing preference for paper-based packaging, which is thought to be better for the environment because of features like easy recycling, decomposition, and home compostability.

By End-User

The end-user includes catering service wares, personal and home care, food and beverage, and healthcare. The food and beverage segment led the biodegradable paper and plastic packaging market with a market share of around 24.08% in 2021. The global need for biodegradable paper and plastic packaging for food and beverages may be the cause of the growth. For instance, the North American beverage market is anticipated to grow by 4.5% between 2018 and 2028, with the United States leading the beverage packaging sector, according to PMMI (The Association for Packaging and Processing). Additionally, according to recent findings from the Packaging Federation of the United Kingdom, the demand for packaging from various industries, including the region's food & beverage industry, is on the rise. As a result, the UK packaging manufacturing industry is expected to reach annual sales of GBP 11 billion (US$ 15.2 billion) in 2020.

Global Biodegradable Paper and Plastic Packaging Market- By Regional Analysis:

The regions analyzed for the biodegradable paper and plastic packaging market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Asia Pacific region dominated the Biodegradable Paper and Plastic Packaging market and held the 32% share of the market revenue in 2021.

- Asia Pacific region witnessed a major share. The increased disposable income of the upper- and middle-class population might be attributed to this growth. The market is also expected to be driven by rising demand for packaged food by the working class as they prefer ready-to-eat food. Additionally, quick urbanisation and a rise in customer desire for lifestyle goods are key market drivers in the Asia Pacific biodegradable paper and plastic packaging industry. Additionally, fast food, coffee, tea, and other foods and beverages are popular in countries like India, China, Japan, and others, driving up demand for biodegradable paper and plastic packaging and advancing the industry.

- North America is anticipated to experience significant growth during the predicted period. As the dairy industry is one of the important sectors for food packaging producers in the U.S., it is anticipated that the market for biodegradable paper and plastic packaging will be driven by the country. Furthermore, during the course of the projection period, makers of packaging products in the nation should benefit greatly from the rising popularity of plant-based dairy products.

Global Biodegradable Paper and Plastic Packaging Market- Country Analysis:

- Germany

Germany's biodegradable paper and plastic packaging market size was valued at USD 0.106 billion in 2021 and is expected to reach USD 0.19 billion by 2029, at a CAGR of 8% from 2022 to 2029.

The market in the country is being driven by the ongoing rise in consumer demand for frozen, processed, and semi-processed food items with higher nutritional values. This demand is encouraging food packaging manufacturers to increase their production capacity of packaging products for diversified product categories. Moreover, developments in healthcare sector boost the demand for biodegradable paper and plastic packaging.

- China

China Biodegradable Paper and Plastic Packaging’s market size was valued at USD 0.28 billion in 2021 and is expected to reach USD 0.57 billion by 2029, at a CAGR of 9.8% from 2022 to 2029. The market is being driven by increased disposable incomes, particularly in urban areas. Additionally, China's enormous pool of affordable and competent employees allows the nation to sell its goods on the worldwide market at extremely competitive prices, which increases regional product demand.

- India

India's Biodegradable Paper and Plastic Packaging market size was valued at USD 0.20 billion in 2021 and is expected to reach USD 0.40 billion by 2029, at a CAGR of 9.3% from 2022 to 2029. As lifestyles change and the country's food distribution systems grow more dependent on online food applications, the trends in food packaging are changing quickly. The popularity of the typical fast food meal and an expanding global population are pushing the biodegradable paper and plastic packaging market.

Key Industry Players Analysis:

To increase their market position in the global Biodegradable Paper and Plastic Packaging business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Riverside Paper Co. Inc.

- Clearwater Paper Corporation

- Smurfit Kappa

- BASF SE

- Ultra Green Sustainable Packaging

- Kruger Inc.

- Stora Enso

- Mondi Group

- Plastic Suppliers Inc.

- Eurocell S.r.l

- Tetra Pak International SA

- International Paper Company

- Amcor PLC

- Klabin SA

Latest Development:

In June 2022, The new compostable and biodegradable six-pack packaging for Corona, the popular international beer brand, was introduced in India. The recently introduced product is as robust as standard packaging and is created from a fully renewable material like barley straw.

In December 2021, Kolon Industries and SK Geo Centric worked together to release a PBAT made of environmentally friendly, biodegradable plastic (Polybutylene Adipate Terephthalate). PBAT is a biodegradable plastic that breaks down quickly in nature as a result of chemical reactions including heat, oxygen, light, and enzymes. Excellent printability and wo0rkability make them perfect for usage in a variety of packaging applications.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

12% |

|

Market Size |

2.3 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Type, By Material Type, By End-User, and Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Riverside Paper Co. Inc., Clearwater Paper Corporation, Smurfit Kappa, BASF SE, Ultra Green Sustainable Packaging, Kruger Inc., Stora Enso, Mondi Group, Plastic Suppliers Inc., Eurocell S.r.l, Tetra Pak International SA, International Paper Company, Amcor PLC, Klabin SA, among others |

|

By Type |

|

|

By Material Type |

|

|

By End-User |

|

|

Regional scope |

|

Scope of the Report

Global Biodegradable Paper and Plastic Packaging Market by Type:

- Cellulose Based Plastic

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Starch Based Plastic

Global Biodegradable Paper and Plastic Packaging Market by Material Type:

- Paper

- Plastic

Global Biodegradable Paper and Plastic Packaging Market by End-User:

- Catering Service Wares

- Personal and Home Care

- Food and Beverage

- Healthcare

Global Biodegradable Paper and Plastic Packaging Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market size of the Biodegradable Paper and Plastic Packaging market?

Global Biodegradable Paper and Plastic Packaging market size was USD 2.3 billion in 2021.

What will be the growth rate of Biodegradable Paper and Plastic Packaging market by projected year?

Biodegradable Paper and Plastic Packaging market will grow at the rate CAGR of 12% from 2022 to 2029.

Which regions have been studied for the regional analysis of the global Biodegradable Paper and Plastic Packaging market?

The regions analyzed for the Biodegradable Paper and Plastic Packaging market include North America, Europe, South America, Asia Pacific, and the Middle East and Africa.

Which are the leading market players active in the Biodegradable Paper and Plastic Packaging market?

Leading market players active in the global biodegradable paper and plastic packaging market are Riverside Paper Co. Inc., Clearwater Paper Corporation, Smurfit Kappa, BASF SE, Ultra Green Sustainable Packaging, Kruger Inc., Stora Enso, Mondi Group, Plastic Suppliers Inc., Eurocell S.r.l, Tetra Pak International SA, International Paper Company, Amcor PLC, Klabin SA

What is the key driver of the biodegradable paper and plastic packaging market?

Increasing preference for biodegradable packaging solutions is primarily driving the growth of the biodegradable paper and plastic packaging market.

What are the threats that are projected to hamper the biodegradable paper and plastic packaging market?

High cost of raw material and lack of technology are projected to influence the market in the upcoming years.

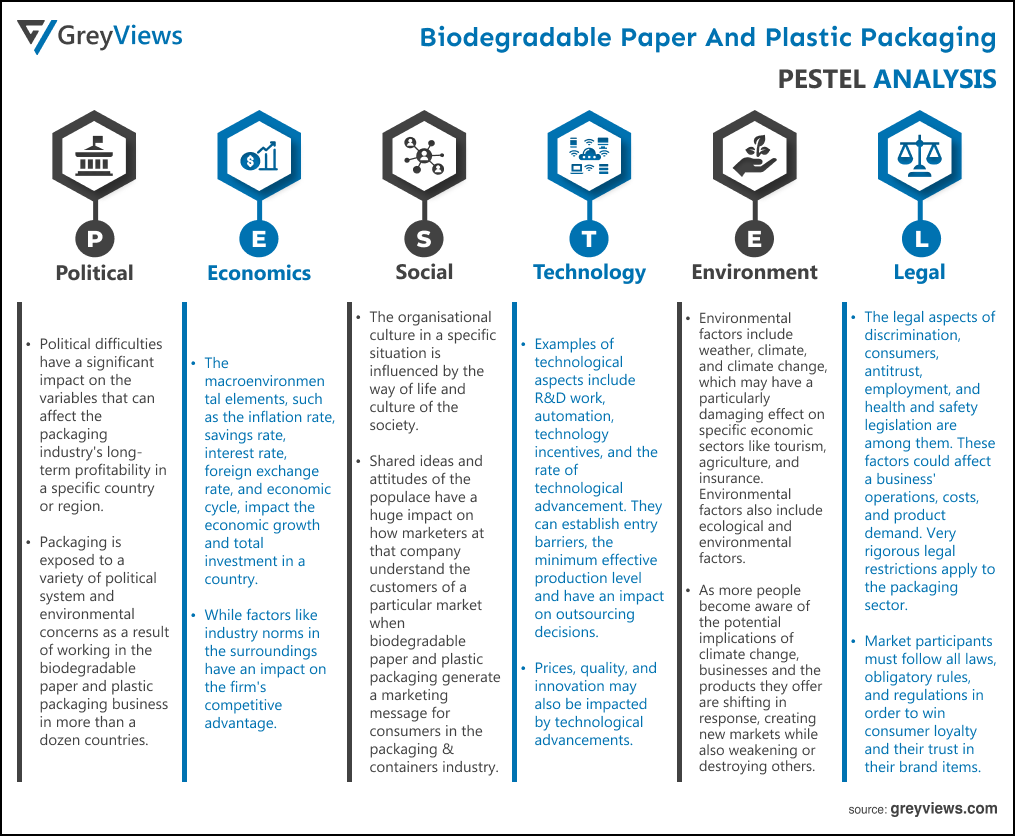

Political Factors- Political difficulties have a significant impact on the variables that can affect the packaging industry's long-term profitability in a specific country or region. Packaging is exposed to a variety of political system and environmental concerns as a result of working in the biodegradable paper and plastic packaging business in more than a dozen countries. To prosper in such a dynamic industry as packaging and containers across several countries, systemic risks of the political environment must be diversified. Political stability and the value of biodegradable packaging made of plastic and paper for the nation's economy. The market's expansion is also impacted by trade restrictions and taxes on consumer goods and biodegradable paper and plastic packaging.

Economical Factors- The macroenvironmental elements, such as the inflation rate, savings rate, interest rate, foreign exchange rate, and economic cycle, impact the economic growth and total investment in a country. While factors like industry norms in the surroundings have an impact on the firm's competitive advantage. By combining industry- and country-level economic data like the growth rate of the Packaging & Containers industry, consumer spending, etc., biodegradable paper and plastic packaging may Projection not only the growth trajectory of the packaging sector but also that of the organisation. Exchange rates affect the availability and cost of imported goods as well as their pricing in an economy.

Social Factor- The organisational culture in a specific situation is influenced by the way of life and culture of the society. Shared ideas and attitudes of the populace have a huge impact on how marketers at that company understand the customers of a particular market when biodegradable paper and plastic packaging generate a marketing message for consumers in the packaging & containers industry. The growth of the market for biodegradable paper and plastic packaging is also influenced by education level and standards. Social variables also consider age distribution, career attitudes, health consciousness, and safety emphasis in addition to cultural characteristics. Social trends impact a company's operations and the demand for its products. An ageing population, for instance, can indicate a smaller and less willing workforce (thus increasing the cost of labour). In addition, businesses may alter their management tactics to reflect these social trends (such as recruiting older workers).

Technological Factors- Examples of technological aspects include R&D work, automation, technology incentives, and the rate of technological advancement. They can establish entry barriers, the minimum effective production level and have an impact on outsourcing decisions. Prices, quality, and innovation may also be impacted by technological advancements. A business should evaluate the technological state of the sector and the speed of technological disruption. Rapid technological disruption may provide a firm little time to adapt and be successful, but slow technological disruption will give more time.

Environmental Factors- Environmental factors include weather, climate, and climate change, which may have a particularly damaging effect on specific economic sectors like tourism, agriculture, and insurance. Environmental factors also include ecological and environmental factors. Additionally, as more people become aware of the potential implications of climate change, businesses and the products they offer are shifting in response, creating new markets while also weakening or destroying others. Climate change, greenhouse gas emissions, and rising pollution are efficiently addressed by major market actors. It should place more of an emphasis on waste management, recycling, renewable energy sources, and naturally decomposing food-safe paper and plastic packaging. It should also be aware of how its resources and waste are being used up, as this could negatively affect its brand reputation and consumer loyalty.

Legal Factors- The legal aspects of discrimination, consumers, antitrust, employment, and health and safety legislation are among them. These factors could affect a business' operations, costs, and product demand. Very rigorous legal restrictions apply to the packaging sector. Market participants must follow all laws, obligatory rules, and regulations in order to win consumer loyalty and their trust in their brand items. Today, regulations governing consumer protection, data privacy, intellectual property rights (IPR), health and safety, and employees and the workplace are required to be obeyed in almost every country. Therefore, it becomes vital for this business to behave itself in a legitimate and ethical manner in order to avert any legal actions or penalties or punishments from a court of law. FSSAI is in charge of keeping an eye on standards, safety, and adulteration of food products, same like in India. The legislation mandates that all food establishments abide by this rule.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Type

- 3.2. Market Attractiveness Analysis By Material Type

- 3.3. Market Attractiveness Analysis By End-User

- 3.4. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Increasing preference for biodegradable packaging solutions

- 3. Restraints

- 3.1. Raw Material Prices

- 4. Opportunities

- 4.1. Expansion of end users

- 5. Challenges

- 5.1. High Prices owing to packaging

- Global Biodegradable Paper and Plastic Packaging Market Analysis and Projection, By Type

- 1. Segment Overview

- 2. Cellulose Based Plastic

- 3. Polylactic Acid (PLA)

- 4. Polyhydroxyalkanoates (PHA)

- 5. Starch Based Plastic

- Global Biodegradable Paper and Plastic Packaging Market Analysis and Projection, By Material Type

- 1. Segment Overview

- 2. Paper

- 3. Plastic

- Global Biodegradable Paper and Plastic Packaging Market Analysis and Projection, By End-User

- 1. Segment Overview

- 2. Catering Service Wares

- 3. Personal and Home Care

- 4. Food and Beverage

- 5. Healthcare

- Global Biodegradable Paper and Plastic Packaging Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Biodegradable Paper and Plastic Packaging Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Biodegradable Paper and Plastic Packaging Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Amcor Ltd

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Riverside Paper Co. Inc.

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Clearwater Paper Corporation

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Smurfit Kappa

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- BASF SE

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Ultra Green Sustainable Packaging

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Kruger Inc.

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Mondi Group

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Plastic Suppliers Inc.

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Eurocell S.r.l

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Amcor Ltd

List of Table

- Global Biodegradable Paper and Plastic Packaging Market, By Type, 2021–2029(USD Billion)

- Global Cellulose Based Plastic, Biodegradable Paper and Plastic Packaging Market, By Region, 2021–2029(USD Billion)

- Global Polylactic Acid (PLA), Biodegradable Paper and Plastic Packaging Market, By Region, 2021–2029(USD Billion)

- Global Polyhydroxyalkanoates (PHA), Biodegradable Paper and Plastic Packaging Market, By Region, 2021–2029(USD Billion)

- Global Starch Based Plastic, Biodegradable Paper and Plastic Packaging Market, By Region, 2021–2029(USD Billion)

- Global Biodegradable Paper and Plastic Packaging Market, By Material Type, 2021–2029(USD Billion)

- Global Paper, Biodegradable Paper and Plastic Packaging Market, By Region, 2021–2029(USD Billion)

- Global Plastic, Biodegradable Paper and Plastic Packaging Market, By Region, 2021–2029(USD Billion)

- Global Biodegradable Paper and Plastic Packaging Market, By End-User, 2021–2029(USD Billion)

- Global Catering Service Wares, Biodegradable Paper and Plastic Packaging Market, By Region, 2021–2029(USD Billion)

- Global Personal and Home Care, Biodegradable Paper and Plastic Packaging Market, By Region, 2021–2029(USD Billion)

- Global Food and Beverage, Biodegradable Paper and Plastic Packaging Market, By Region, 2021–2029(USD Billion)

- Global Healthcare, Biodegradable Paper and Plastic Packaging Market, By Region, 2021–2029(USD Billion)

- Global Biodegradable Paper and Plastic Packaging Market, By Region, 2021–2029(USD Billion)

- North America Biodegradable Paper and Plastic Packaging Market, By Type, 2021–2029(USD Billion)

- North America Biodegradable Paper and Plastic Packaging Market, By Material Type, 2021–2029(USD Billion)

- North America Biodegradable Paper and Plastic Packaging Market, By End-User, 2021–2029(USD Billion)

- USA Biodegradable Paper and Plastic Packaging Market, By Type, 2021–2029(USD Billion)

- USA Biodegradable Paper and Plastic Packaging Market, By Material Type, 2021–2029(USD Billion)

- USA Biodegradable Paper and Plastic Packaging Market, By End-User, 2021–2029(USD Billion)

- Canada Biodegradable Paper and Plastic Packaging Market, By Type, 2021–2029(USD Billion)

- Canada Biodegradable Paper and Plastic Packaging Market, By Material Type, 2021–2029(USD Billion)

- Canada Biodegradable Paper and Plastic Packaging Market, By End-User, 2021–2029(USD Billion)

- Mexico Biodegradable Paper and Plastic Packaging Market, By Type, 2021–2029(USD Billion)

- Mexico Biodegradable Paper and Plastic Packaging Market, By Material Type, 2021–2029(USD Billion)

- Mexico Biodegradable Paper and Plastic Packaging Market, By End-User, 2021–2029(USD Billion)

- Europe Biodegradable Paper and Plastic Packaging Market, By Type, 2021–2029(USD Billion)

- Europe Biodegradable Paper and Plastic Packaging Market, By Material Type, 2021–2029(USD Billion)

- Europe Biodegradable Paper and Plastic Packaging Market, By End-User, 2021–2029(USD Billion)

- Germany Biodegradable Paper and Plastic Packaging Market, By Type, 2021–2029(USD Billion)

- Germany Biodegradable Paper and Plastic Packaging Market, By Material Type, 2021–2029(USD Billion)

- Germany Biodegradable Paper and Plastic Packaging Market, By End-User, 2021–2029(USD Billion)

- France Biodegradable Paper and Plastic Packaging Market, By Type, 2021–2029(USD Billion)

- France Biodegradable Paper and Plastic Packaging Market, By Material Type, 2021–2029(USD Billion)

- France Biodegradable Paper and Plastic Packaging Market, By End-User, 2021–2029(USD Billion)

- UK Biodegradable Paper and Plastic Packaging Market, By Type, 2021–2029(USD Billion)

- UK Biodegradable Paper and Plastic Packaging Market, By Material Type, 2021–2029(USD Billion)

- UK Biodegradable Paper and Plastic Packaging Market, By End-User, 2021–2029(USD Billion)

- Italy Biodegradable Paper and Plastic Packaging Market, By Type, 2021–2029(USD Billion)

- Italy Biodegradable Paper and Plastic Packaging Market, By Material Type, 2021–2029(USD Billion)

- Italy Biodegradable Paper and Plastic Packaging Market, By End-User, 2021–2029(USD Billion)

- Spain Biodegradable Paper and Plastic Packaging Market, By Type, 2021–2029(USD Billion)

- Spain Biodegradable Paper and Plastic Packaging Market, By Material Type, 2021–2029(USD Billion)

- Spain Biodegradable Paper and Plastic Packaging Market, By End-User, 2021–2029(USD Billion)

- Asia Pacific Biodegradable Paper and Plastic Packaging Market, By Type, 2021–2029(USD Billion)

- Asia Pacific Biodegradable Paper and Plastic Packaging Market, By Material Type, 2021–2029(USD Billion)

- Asia Pacific Biodegradable Paper and Plastic Packaging Market, By End-User, 2021–2029(USD Billion)

- Japan Biodegradable Paper and Plastic Packaging Market, By Type, 2021–2029(USD Billion)

- Japan Biodegradable Paper and Plastic Packaging Market, By Material Type, 2021–2029(USD Billion)

- Japan Biodegradable Paper and Plastic Packaging Market, By End-User, 2021–2029(USD Billion)

- China Biodegradable Paper and Plastic Packaging Market, By Type, 2021–2029(USD Billion)

- China Biodegradable Paper and Plastic Packaging Market, By Material Type, 2021–2029(USD Billion)

- China Biodegradable Paper and Plastic Packaging Market, By End-User, 2021–2029(USD Billion)

- India Biodegradable Paper and Plastic Packaging Market, By Type, 2021–2029(USD Billion)

- India Biodegradable Paper and Plastic Packaging Market, By Material Type, 2021–2029(USD Billion)

- India Biodegradable Paper and Plastic Packaging Market, By End-User, 2021–2029(USD Billion)

- South America Biodegradable Paper and Plastic Packaging Market, By Type, 2021–2029(USD Billion)

- South America Biodegradable Paper and Plastic Packaging Market, By Material Type, 2021–2029(USD Billion)

- South America Biodegradable Paper and Plastic Packaging Market, By End-User, 2021–2029(USD Billion)

- Brazil Biodegradable Paper and Plastic Packaging Market, By Type, 2021–2029(USD Billion)

- Brazil Biodegradable Paper and Plastic Packaging Market, By Material Type, 2021–2029(USD Billion)

- Brazil Biodegradable Paper and Plastic Packaging Market, By End-User, 2021–2029(USD Billion)

- Middle East and Africa Biodegradable Paper and Plastic Packaging Market, By Type, 2021–2029(USD Billion)

- Middle East and Africa Biodegradable Paper and Plastic Packaging Market, By Material Type, 2021–2029(USD Billion)

- Middle East and Africa Biodegradable Paper and Plastic Packaging Market, By End-User, 2021–2029(USD Billion)

- UAE Biodegradable Paper and Plastic Packaging Market, By Type, 2021–2029(USD Billion)

- UAE Biodegradable Paper and Plastic Packaging Market, By Material Type, 2021–2029(USD Billion)

- UAE Biodegradable Paper and Plastic Packaging Market, By End-User, 2021–2029(USD Billion)

- South Africa Biodegradable Paper and Plastic Packaging Market, By Type, 2021–2029(USD Billion)

- South Africa Biodegradable Paper and Plastic Packaging Market, By Material Type, 2021–2029(USD Billion)

- South Africa Biodegradable Paper and Plastic Packaging Market, By End-User, 2021–2029(USD Billion)

List of Figures

- Global Biodegradable Paper and Plastic Packaging Market Segmentation

- Biodegradable Paper and Plastic Packaging Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Biodegradable Paper and Plastic Packaging Market Attractiveness Analysis By Type

- Global Biodegradable Paper and Plastic Packaging Market Attractiveness Analysis By Material Type

- Global Biodegradable Paper and Plastic Packaging Market Attractiveness Analysis By End-User

- Global Biodegradable Paper and Plastic Packaging Market Attractiveness Analysis By Region

- Global Biodegradable Paper and Plastic Packaging Market: Dynamics

- Global Biodegradable Paper and Plastic Packaging Market Share By Type (2021 & 2029)

- Global Biodegradable Paper and Plastic Packaging Market Share By Material Type (2021 & 2029)

- Global Biodegradable Paper and Plastic Packaging Market Share By End-User (2021 & 2029)

- Global Biodegradable Paper and Plastic Packaging Market Share by Regions (2021 & 2029)

- Global Biodegradable Paper and Plastic Packaging Market Share by Company (2020)