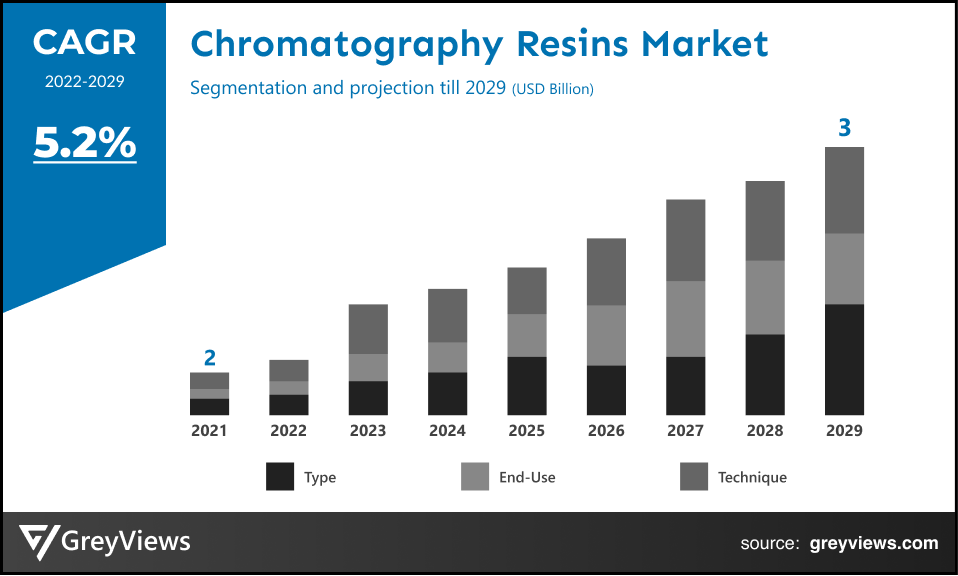

Chromatography Resins Market Size By Type (Natural Polymer, Synthetic Polymer), By End-use (Pharmaceutical, Biotechnology, and Food and Beverages), By Technique (Ion Exchange, Multimodal, Affinity, Hydrophobic Interaction, Size-exclusion, Others), Regions, Segmentation, and Projection till 2029

CAGR: 5.2%Current Market Size: USD 2 BillionFastest Growing Region: Europe

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Chromatography Resins Market- Market Overview:

The Global Chromatography Resins market is expected to grow from USD 2 billion in 2021 to USD 3 billion by 2029, at a CAGR of 5.2% during the Projection period 2022-2029. The growth of this market is mainly driven owing to the rising demand for chromatography resins in the pharmaceutical and food and beverages industries.

Biologists utilise chromatography to distinguish between organic and inorganic molecules so that they can be examined and studied. Chromatography is a useful physical technique for analysing liquids and mixtures. This is one of the most popular techniques for cleaning up biomolecules like peptides, proteins, and nucleic acids. Proteins and therapeutic antibodies are frequently purified using large-scale chromatography. The use of these chromatographic materials for a huge number of cycles has a significant economic benefit because the bulk of commercially available resins have expensive pricing. For example, two proteins that differ by a single charged amino acid can be separated using ion exchange chromatography. Cancer, dementia, diabetes, and rheumatoid arthritis are among the illnesses that are frequently treated with monoclonal antibody (mAb) therapy. Agarose-based chromatography resin can be advantageous for biopharmaceutical businesses seeking the maximum level of purity in mAb bioprocessing once the antibody has been produced. Antibody manufacturing may benefit from chromatography resin based on agarose. Chromatography is one of the most important bio-separation techniques used in the production of biosimilar antibodies. Throughout the projection period, it is anticipated that rising demand for biopharmaceuticals would enhance the use of chromatographic resins. Additionally, the target molecule can be captured using affinity resins through a particular biospecific interaction. Finding the right chromatography resins can reduce the number of stages required to achieve the desired purity and boost the yield of biotherapeutics.

Sample Request: - Global Chromatography Resins Market

Market Dynamics:

Drivers:

- Growing demand for therapeutic antibodies

Lower unit pricing are the outcome of biopharmaceutical companies developing effective downstream and upstream procedures in response to the rising demand for mAbs. An important stage in the purification of mAbs is chromatography. Due to their excellent specificity and the fact that current antibody medications have fewer side effects, the demand for monoclonal antibodies in treating cancer and other therapeutic drugs for Alzheimer's disease, autoimmune diseases, and inflammatory illnesses has increased significantly in recent decades. Therapeutic antibodies have emerged as the most popular novel therapy type in recent years. Over the past five years, antibodies have been the pharmaceutical industry's top-selling drugs. As novel drugs to treat cancer, autoimmune, metabolic, and viral disorders have been created, the market for therapeutic antibodies has expanded quickly. For instance, on May 4, 2022, the FDA approved fam-trastuzumab deruxtecan-nxki (Enhertu, Daiichi Sankyo, Inc.) for people with advanced HER2-positive breast cancer who have previously received an anti-HER2-based regimen in the metastatic, neoadjuvant, or adjuvant settings and have suffered a disease recurrence during or within six months after stopping treatment.

Restraints:

- Challenges in bio purification beyond aggregates

Significant challenges exist in the downstream processing of viral vectors used in gene therapy, including the limitations of the available separation and purification techniques. There are several techniques for purifying viral vectors, but they all have limitations; either they can't be scaled up to purify large quantities of vectors, or they involve many inefficient steps, making them expensive. There is a need for scalable, reliable, economical, and adaptable purification techniques to gene therapy products (i.e., to both viral and non-viral vectors). In the downstream processing of viral vectors, size is a limiting factor. Compared to isolated and purified therapeutic proteins, viral molecules are larger and heavier. In contrast to proteins, which typically range from 0.005 to 0.08 x 106 Da, viruses frequently reach 5 x 106 Da and some can be as large as 1,000 nm. Therefore, producers cannot expect the same outcomes when processing viral compounds using the same machinery as processing antibodies or other therapeutic proteins.

Opportunities:

- Growing demand for chromatography in drug development and omics research in bio purification beyond aggregates

The most adaptable separation method is chromatography, which is also widely accessible. Many closely similar molecules are generated early in the drug development process and must be isolated. It is crucial to identify them and test them for purity. For these purposes, chromatography techniques are frequently employed. As a result, the demand for the chromatographic resin is rising across several nations due to the expanding demand for high-quality medicines and the adoption of strict government measures.

Challenges

- Presence of alternative technologies to chromatography

Some well-known techniques available as alternatives to chromatography include precipitation, high-resolution ultra-filtration, crystallisation, high-pressure refolding, charged ultra-filtration membranes, protein crystallisation, capillary electrophoresis, two-phase aqueous extraction, three-phase partitioning, monoliths, and membrane chromatography. The benefits offered by alternative methods will probably pose a threat to the market for chromatography resin.

Segmentation Analysis:

The global chromatography resins market has been segmented based on type, end-use, technique, and regions.

By Type

The type segment is natural polymer, and synthetic polymer. The natural polymer segment led the largest share of the chromatography resins market with a market share of around 53% in 2021. This high percentage can be attributed to rising natural product consumption and the widespread use of size exclusion and paper chromatography in various industrial applications. Due to numerous major international pharmaceutical companies, the U.S. dominates the consumption of natural resin in North America. The primary factors influencing the market in North America are the growing pharmaceutical and biomedical industries due to the increase in healthcare spending and rising demand from the food and beverage industry. Furthermore, it is projected that government funding for research and development of more productive chromatographic resins would further fuel demand for natural products in North America across various applications and end-uses.

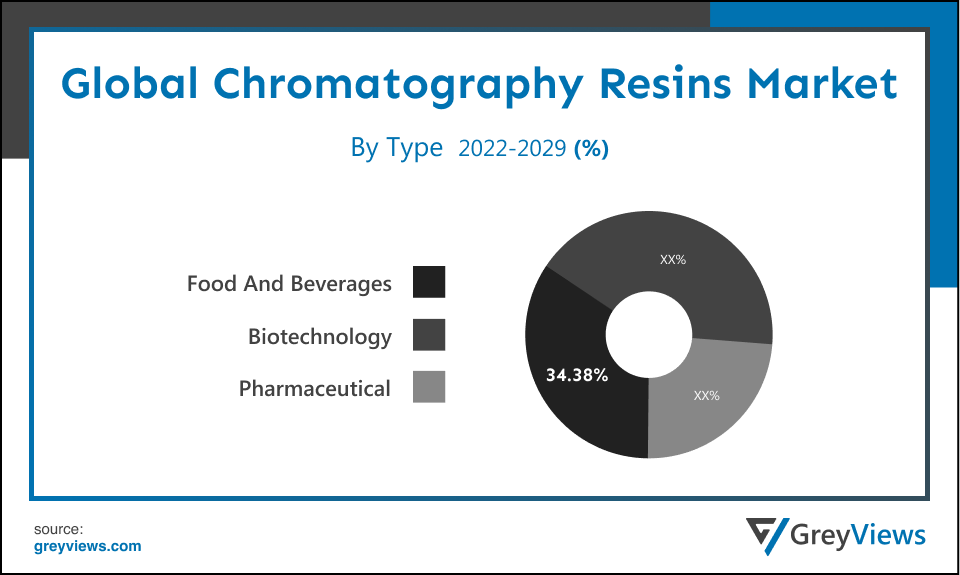

By End-Use

The end-use includes pharmaceutical, biotechnology, and food and beverages. The food and beverages segment led the chromatography resins market with a market share of around 34.38% in 2021. Ion exchange resin is one of the busiest and most creative industries in the food and fermentation industry. They are crucial to the expansion of the food industry. People's nutritional requirements increase as their living situations improve. Ion exchange resin has been crucial in the long-term trends of food safety, hygiene, and non-toxicity that people have been pursuing. As a result, resin usage in the food business will increase, and resin specifications will tighten up.

By Technique

The technique includes ion exchange, multimodal, affinity, hydrophobic interaction, size exclusion, and others. The affinity chromatography segment led the chromatography resins market with a market share of around 22.65% in 2021. Due to its extensive use in large-scale bioprocessing, affinity chromatography (AC) is the ideal approach for primary scope in the downstream processing of various biopharmaceuticals. By enabling the standardisation of process development and production processes as well as the utilisation of rigid continuous operations multiproduct manufacturing suites, adopting AC can lead to cost reductions.

By Regional Analysis:

The regions analyzed for the chromatography resins market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North America region dominated the chromatography resins market and held the 36% share of the market revenue in 2021.

- North America region saw significant growth. This high proportion is linked to the rising need for drug discovery techniques to combat diseases like Ebola, Zika, and others worldwide. The sector in North America is also anticipated to benefit from growing interest in using monoclonal antibodies in medicinal applications. With more than 91% of the market, the United States dominates the product market in North America. Due to its highly developed pharmaceutical industry, burgeoning end-use applications, highly qualified workforce, and expanding R&D endeavours to support cutting-edge product applications, the nation presents a leading opportunity for chromatography resin.

- During the Projection period, Europe is expected to grow significantly. There are many large manufacturers in Europe, including Merck. The demand for chromatography resin has significantly increased due to European Union efforts like the Innovative Medications Initiative (IMI), which aims to accelerate the discovery of better and safer medicines. Due to the enormous concentration of pharmaceutical companies research and development centres in Germany, the country is the largest consumer of chromatography resin in Europe. In addition to other economies worldwide, the region exports more drugs and related goods to its neighbours.

Global Chromatography Resins Market- Country Analysis:

- Germany

Germany's chromatography resins market size was valued at USD 0.25 billion in 2021 and is expected to reach USD 0.34 billion by 2029, at a CAGR of 4% from 2022 to 2029. The biggest market for chromatography resins in Europe is Germany. The growth of the German chromatography resins market is influenced by numerous pharmaceutical businesses and research facilities in these nations.

- China

China Chromatography Resins’s market size was valued at USD 0.21 billion in 2021 and is expected to reach USD 0.27 billion by 2029, at a CAGR of 3.5% from 2022 to 2029. At least 20 biosimilars are available in China. The first to receive approval was a rituximab biosimilar from Shanghai Henlius Biotech. China saw 11 more biosimilar approvals between 2019 and 2020 and two more in the first half of 2021.

- India

India's Chromatography Resins market size was valued at USD 0.15 billion in 2021 and is expected to reach USD 0.19 billion by 2029, at a CAGR of 3% from 2022 to 2029. The majority of the major pharmaceutical companies have research facilities in India, which is fueling the market's revenue growth. Furthermore, the region's market is fueled by advancements in the Indian pharmaceutical industry.

Key Industry Players Analysis:

To increase their market position in the global chromatography resins business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Bio-Rad Laboratories Inc.

- Purolite

- Danaher

- Avantor Inc

- Mitsubishi Chemical Holdings Corporation

- R. Grace & Co.

- Merck KGaA

- GE Healthcare

- Thermo Fisher Scientific

- Bio-Works Technologies

- WIPRO GE HEALTHCARE PVT LTD

Latest Development:

- In 13 March 2021, In South Korea and Singapore, Purolite announced the availability of its Praesto Protein A and Ion Exchange chromatography resins. Purolite will sell these products through an extended strategic relationship with PharmNXT Biotech, a solutions supplier for the pharmaceutical and life sciences industries.

- In 5 March 2021, The world's first industrial-scale Centrifugal Partition Chromatography (CPC) technology platform developer, RotaChrom Technologies, recently announced a cooperation with the cyclodextrin research, development, and production company, Cyclolab Cyclodextrin Research & Development Laboratory Ltd. This joint venture between Cyclolab and RotaChrom intends to create a purification process for Remdesivir, a commonly used COVID-19 therapy, that is more effective and affordable.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

5.2% |

|

Market Size |

2 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Type, By End-use, By Technique, and Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Bio-Rad Laboratories Inc., Purolite, Danaher, Avantor Inc, Mitsubishi Chemical Holdings Corporation, W.R. Grace & Co., Merck KGaA, GE Healthcare, Thermo Fisher Scientific, Bio-Works Technologies, WIPRO GE HEALTHCARE PVT LTD., among others |

|

By Type |

|

|

By End-Use |

|

|

By Technique |

|

|

Regional scope |

|

Scope of the Report

Global Chromatography Resins Market by Type:

- Natural Polymer

- Synthetic Polymer

Global Chromatography Resins Market by End-Use:

- Pharmaceutical

- Biotechnology

- Food and Beverages

Global Chromatography Resins Market by Technique:

- Ion Exchange

- Multimodal

- Affinity

- Hydrophobic Interaction

- Size-exclusion

- Others

Global Chromatography Resins Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the market size of the Chromatography Resins market?

Global Chromatography Resins market is expected to reach USD 3 billion by 2029, at a CAGR of 5.2% from 2022 to 2029.

Which region dominate the Chromatography Resins market?

North America region dominated the chromatography resins market and held the 36% share of the market revenue in 2021.

What are the trends influencing the Chromatography Resins Market?

Growing demand for chromatography in drug development and omics research around the globe are projected to influence the market in the upcoming years.

What is the key driver of the Chromatography Resins market?

Rising demand for chromatography resins in pharmaceutical, food, and beverages industries.

Which are the leading market players active in the Chromatography Resins market?

Leading market players active in the global chromatography resins market are Bio-Rad Laboratories Inc., Purolite, Danaher, Avantor Inc, Mitsubishi Chemical Holdings Corporation, W.R. Grace & Co., Merck KGaA, GE Healthcare, Thermo Fisher Scientific, Bio-Works Technologies, WIPRO GE HEALTHCARE PVT LTD.

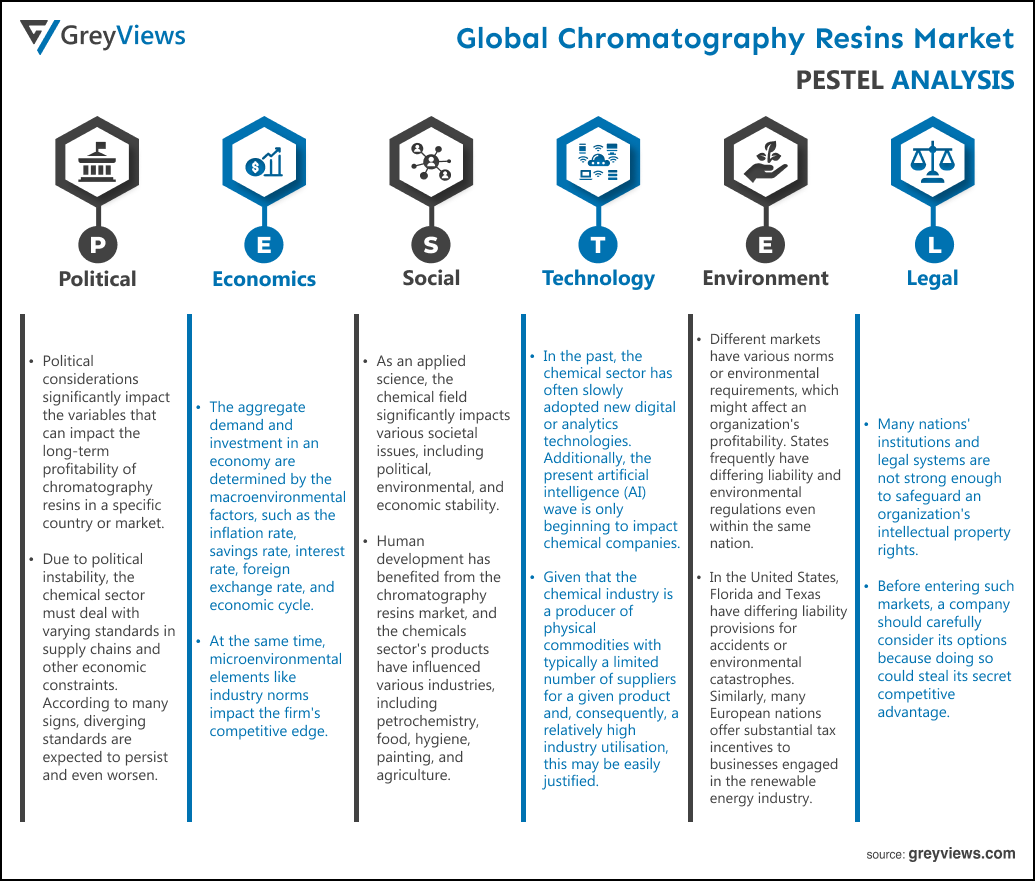

Political Factors- Political considerations significantly impact the variables that can impact the long-term profitability of chromatography resins in a specific country or market. Due to political instability, the chemical sector must deal with varying standards in supply chains and other economic constraints. According to many signs, diverging standards are expected to persist and even worsen. Fortunately, most chemicals are naturally regionally-specific rather than really global goods. However, intercontinental trade is important for many participants, particularly those with access to favourable feedstock or labour rates. In addition, many chemical businesses rely on clients who ship their products across continents.

Economical Factors- The aggregate demand and investment in an economy are determined by the macroenvironmental factors, such as the inflation rate, savings rate, interest rate, foreign exchange rate, and economic cycle. At the same time, microenvironmental elements like industry norms impact the firm's competitive edge. To predict the growth trajectory, the chromatography resins sector can use national economic factors like growth rate and inflation as well as industry-specific economic indicators like materials industry growth rate and consumer spending.

Social Factor- As an applied science, the chemical field significantly impacts various societal issues, including political, environmental, and economic stability. Human development has benefited from the chromatography resins market, and the chemicals sector's products have influenced various industries, including petrochemistry, food, hygiene, painting, and agriculture. The chemical industry is regarded as a problem-solver for society because it created crop-enhancing agricultural chemicals to guarantee a steady and viable food supply, contributed to the eradication of deadly diseases by developing life-saving pharmaceuticals and chemical pesticides, developed novel plastics and synthetic fibres for use in both industrial and consumer products, and produced chromatography resins that are used in numerous other industries.

Technological Factors- In the past, the chemical sector has often slowly adopted new digital or analytics technologies. Additionally, the present artificial intelligence (AI) wave is only beginning to impact chemical companies. Given that the chemical industry is a producer of physical commodities with typically a limited number of suppliers for a given product and, consequently, a relatively high industry utilisation, this may be easily justified. New digital strategies can still offer little but significant advantages (mostly around asset and commercial productivity).

Environmental Factors- Different markets have various norms or environmental requirements, which might affect an organization's profitability. States frequently have differing liability and environmental regulations even within the same nation. For instance, in the United States, Florida and Texas have differing liability provisions for accidents or environmental catastrophes. Similarly, many European nations offer substantial tax incentives to businesses engaged in the renewable energy industry. The strongly increasing intensity of economic human activity has resulted in several concerning ecological developments, such as climate change, water shortage, the reduction of biodiversity, and other challenges.

Legal Factors- Many nations' institutions and legal systems are not strong enough to safeguard an organization's intellectual property rights. Before entering such markets, a company should carefully consider its options because doing so could steal its secret competitive advantage. Laws governing discrimination, copyright, patents, intellectual property, consumer protection, e-commerce, employment, health and safety, and data protection are just a few of the legal aspects that affect chromatography resins.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Type

- 3.2. Market Attractiveness Analysis By End-Use

- 3.3. Market Attractiveness Analysis By Technique

- 3.4. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Growing demand for therapeutic antibodies

- 3. Restraints

- 3.1. Challenges in bio purification beyond aggregates

- 4. Opportunities

- 4.1. Growing demand for chromatography in drug development and omics research

- 5. Challenges

- 5.1. Presence of alternative technologies to chromatography

- Global Chromatography Resins Market Analysis and Projection, By Type

- 1. Segment Overview

- 2. Natural Polymer

- 3. Synthetic Polymer

- Global Chromatography Resins Market Analysis and Projection, By End-Use

- 1. Segment Overview

- 2. Pharmaceutical

- 3. Biotechnology

- 4. Food and Beverages

- Global Chromatography Resins Market Analysis and Projection, By Technique

- 1. Segment Overview

- 2. Ion Exchange

- 3. Multimodal

- 4. Affinity

- 5. Hydrophobic Interaction

- 6. Size-exclusion

- 7. Others

- Global Chromatography Resins Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Chromatography Resins Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Chromatography Resins Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Bio-Rad Laboratories Inc.

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Purolite

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Danaher

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Avantor Inc

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Mitsubishi Chemical Holdings Corporation

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- R. Grace & Co.

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Merck KGaA

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- GE Healthcare

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Thermo Fisher Scientific

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Bio-Works Technologies

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Bio-Rad Laboratories Inc.

List of Table

- Global Chromatography Resins Market, By Type, 2021–2029 (USD Billion)

- Global Natural Polymer, Chromatography Resins Market, By Region, 2021–2029 (USD Billion)

- Global Synthetic Polymer, Chromatography Resins Market, By Region, 2021–2029 (USD Billion)

- Global Chromatography Resins Market, By End-Use, 2021–2029 (USD Billion)

- Global Pharmaceutical, Chromatography Resins Market, By Region, 2021–2029 (USD Billion)

- Global Biotechnology, Chromatography Resins Market, By Region, 2021–2029 (USD Billion)

- Global Food and Beverages, Chromatography Resins Market, By Region, 2021–2029 (USD Billion)

- Global Chromatography Resins Market, By Technique, 2021–2029 (USD Billion)

- Global Ion Exchange, Chromatography Resins Market, By Region, 2021–2029 (USD Billion)

- Global Multimodal, Chromatography Resins Market, By Region, 2021–2029 (USD Billion)

- Global Affinity, Chromatography Resins Market, By Region, 2021–2029 (USD Billion)

- Global Hydrophobic Interaction, Chromatography Resins Market, By Region, 2021–2029 (USD Billion)

- Global Size-exclusion, Chromatography Resins Market, By Region, 2021–2029 (USD Billion)

- Global Others, Chromatography Resins Market, By Region, 2021–2029 (USD Billion)

- Global Chromatography Resins Market, By Region, 2021–2029 (USD Billion)

- North America Chromatography Resins Market, By Type, 2021–2029 (USD Billion)

- North America Chromatography Resins Market, By End-Use, 2021–2029 (USD Billion)

- North America Chromatography Resins Market, By Technique, 2021–2029 (USD Billion)

- USA Chromatography Resins Market, By Type, 2021–2029 (USD Billion)

- USA Chromatography Resins Market, By End-Use, 2021–2029 (USD Billion)

- USA Chromatography Resins Market, By Technique, 2021–2029 (USD Billion)

- Canada Chromatography Resins Market, By Type, 2021–2029 (USD Billion)

- Canada Chromatography Resins Market, By End-Use, 2021–2029 (USD Billion)

- Canada Chromatography Resins Market, By Technique, 2021–2029 (USD Billion)

- Mexico Chromatography Resins Market, By Type, 2021–2029 (USD Billion)

- Mexico Chromatography Resins Market, By End-Use, 2021–2029 (USD Billion)

- Mexico Chromatography Resins Market, By Technique, 2021–2029 (USD Billion)

- Europe Chromatography Resins Market, By Type, 2021–2029 (USD Billion)

- Europe Chromatography Resins Market, By End-Use, 2021–2029 (USD Billion)

- Europe Chromatography Resins Market, By Technique, 2021–2029 (USD Billion)

- Germany Chromatography Resins Market, By Type, 2021–2029 (USD Billion)

- Germany Chromatography Resins Market, By End-Use, 2021–2029 (USD Billion)

- Germany Chromatography Resins Market, By Technique, 2021–2029 (USD Billion)

- France Chromatography Resins Market, By Type, 2021–2029 (USD Billion)

- France Chromatography Resins Market, By End-Use, 2021–2029 (USD Billion)

- France Chromatography Resins Market, By Technique, 2021–2029 (USD Billion)

- UK Chromatography Resins Market, By Type, 2021–2029 (USD Billion)

- UK Chromatography Resins Market, By End-Use, 2021–2029 (USD Billion)

- UK Chromatography Resins Market, By Technique, 2021–2029 (USD Billion)

- Italy Chromatography Resins Market, By Type, 2021–2029 (USD Billion)

- Italy Chromatography Resins Market, By End-Use, 2021–2029 (USD Billion)

- Italy Chromatography Resins Market, By Technique, 2021–2029 (USD Billion)

- Spain Chromatography Resins Market, By Type, 2021–2029 (USD Billion)

- Spain Chromatography Resins Market, By End-Use, 2021–2029 (USD Billion)

- Spain Chromatography Resins Market, By Technique, 2021–2029 (USD Billion)

- Asia Pacific Chromatography Resins Market, By Type, 2021–2029 (USD Billion)

- Asia Pacific Chromatography Resins Market, By End-Use, 2021–2029 (USD Billion)

- Asia Pacific Chromatography Resins Market, By Technique, 2021–2029 (USD Billion)

- Japan Chromatography Resins Market, By Type, 2021–2029 (USD Billion)

- Japan Chromatography Resins Market, By End-Use, 2021–2029 (USD Billion)

- Japan Chromatography Resins Market, By Technique, 2021–2029 (USD Billion)

- China Chromatography Resins Market, By Type, 2021–2029 (USD Billion)

- China Chromatography Resins Market, By End-Use, 2021–2029 (USD Billion)

- China Chromatography Resins Market, By Technique, 2021–2029 (USD Billion)

- India Chromatography Resins Market, By Type, 2021–2029 (USD Billion)

- India Chromatography Resins Market, By End-Use, 2021–2029 (USD Billion)

- India Chromatography Resins Market, By Technique, 2021–2029 (USD Billion)

- South America Chromatography Resins Market, By Type, 2021–2029 (USD Billion)

- South America Chromatography Resins Market, By End-Use, 2021–2029 (USD Billion)

- South America Chromatography Resins Market, By Technique, 2021–2029 (USD Billion)

- Brazil Chromatography Resins Market, By Type, 2021–2029 (USD Billion)

- Brazil Chromatography Resins Market, By End-Use, 2021–2029 (USD Billion)

- Brazil Chromatography Resins Market, By Technique, 2021–2029 (USD Billion)

- Middle East and Africa Chromatography Resins Market, By Type, 2021–2029 (USD Billion)

- Middle East and Africa Chromatography Resins Market, By End-Use, 2021–2029 (USD Billion)

- Middle East and Africa Chromatography Resins Market, By Technique, 2021–2029 (USD Billion)

- UAE Chromatography Resins Market, By Type, 2021–2029 (USD Billion)

- UAE Chromatography Resins Market, By End-Use, 2021–2029 (USD Billion)

- UAE Chromatography Resins Market, By Technique, 2021–2029 (USD Billion)

- South Africa Chromatography Resins Market, By Type, 2021–2029 (USD Billion)

- South Africa Chromatography Resins Market, By End-Use, 2021–2029 (USD Billion)

- South Africa Chromatography Resins Market, By Technique, 2021–2029 (USD Billion)

List of Figures

- Global Chromatography Resins Market Segmentation

- Chromatography Resins Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Chromatography Resins Market Attractiveness Analysis By Type

- Global Chromatography Resins Market Attractiveness Analysis By End-Use

- Global Chromatography Resins Market Attractiveness Analysis By Technique

- Global Chromatography Resins Market Attractiveness Analysis By Region

- Global Chromatography Resins Market: Dynamics

- Global Chromatography Resins Market Share By Type (2021 & 2029)

- Global Chromatography Resins Market Share By End-Use (2021 & 2029)

- Global Chromatography Resins Market Share By Technique(2021 & 2029)

- Global Chromatography Resins Market Share by Regions (2021 & 2029)

- Global Chromatography Resins Market Share by Company (2020)