Construction Chemicals Market Size By Type (Concrete Admixture, Construction Adhesive, Construction Sealant, and Flame Retardant), By Application (Residential, Infrastructure, Industrial, and Repair Structures), Regions, Segmentation, and Projection till 2029

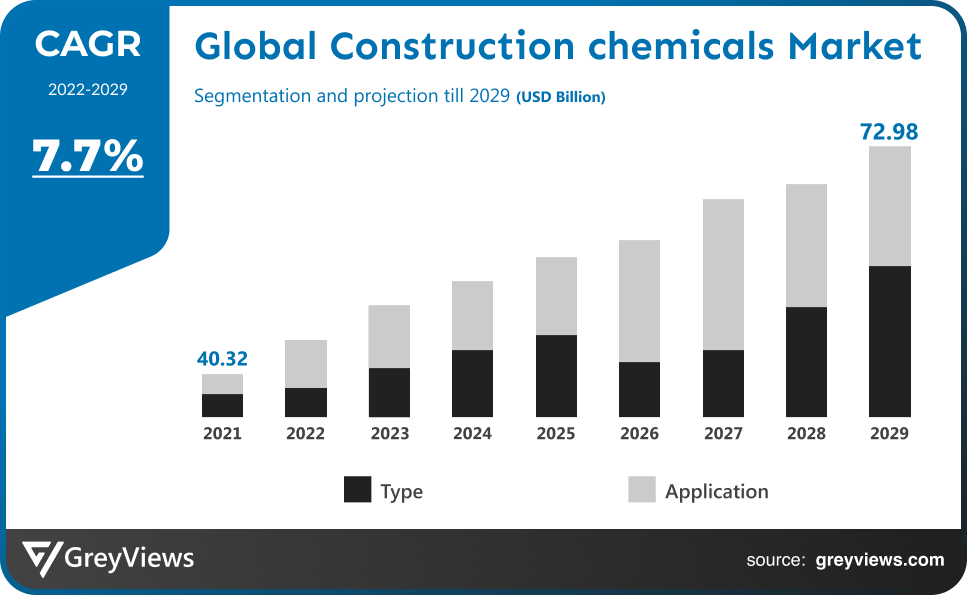

CAGR: 7.7%Current Market Size: USD 40.32 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Construction chemicals Market- Market Overview:

The Global Construction chemicals market is expected to grow from USD 40.32 billion in 2021 to USD 72.98 billion by 2029, at a CAGR of 7.7% during the Projection period 2022-2029. The crucial component of the rise in the market revenue of the construction chemicals market, as well as the most recent technological advancements due to rising building and construction, and other infrastructure activities, which will foster market growth, is the increased implementation of growing infrastructural developments and rising demand.

Construction chemicals are chemical substances that are used with cement, concrete, or other building materials during construction to hold them all together. The project will be more sustainable and the building materials will be of higher quality. Chemical compounds called construction chemicals are utilized in building projects. They are primarily employed to speed up the procedure and provide the buildings greater sustainability and strength. Construction chemicals are used in various building materials to improve workability, performance, provide functionality, and maintain the fundamental or bespoke aspects of a structure during construction. The most important component of every chemical enterprise is these compounds. The environments of the whole construction sector have changed as a result of construction chemicals. Their use has increased building material quality, and as a result, they are widely employed in construction projects to provide sustainability. Chemicals known as construction chemicals are added to cement, concrete, or other building materials during construction to help keep everything together. The project will be more environmentally friendly, and better-quality building materials will be used. Construction projects make use of chemical substances known as construction chemicals. They are mostly used to expedite the process and provide the buildings more durability and strength. Construction chemicals are added to a variety of building materials to enhance their usability and performance, give functionality, and protect a structure's essential or unique features while it is being built. These chemicals are the most crucial part of any chemical business. Construction chemicals have altered the settings throughout the whole construction industry.

Sample Request: - Global Construction chemicals Market

Market Dynamics:

Drivers:

- High Requirement

The need for premix admixtures before they are employed in construction is increasing, which is driving growth in the building chemicals sector. Additionally, the diminished infrastructure durability brought on by greater rainstorms and wetter winters has led to a rise in the demand for high-quality construction chemicals.

Restraints:

- Fluctuations in Prices and Rates

Airport security is ensured with full-body scanners, which create a digital, stripped image of each person boarding an aircraft. This makes sure that none of the passengers are in possession of any chemicals or dangerous goods. However, excessive X-ray exposure can exacerbate genetic illnesses, raise the risk of cardiovascular and cancer disorders, and result in foggy eye lenses. Some European countries forbid the use of X-ray detectors at airports, which is predicted to impede market revenue development. The global scarcity of radiologists is one of the major issues in healthcare. The absence of this skill set is a crucial factor in the rising issues in pulmonary healthcare. The market's projected revenue growth is being hampered by this.

Opportunities:

- High Investments and Eco-Friendly Chemicals

In addition, governments' increasing attention on eco-friendly chemicals and green construction requirements opens up lucrative potential for market participants over the projected period of 2022 to 2029. The significant expenditures made by well-established market players in eco-binders and silicate binder systems are also projected to contribute to the building chemicals industry's continued expansion.

Challenges:

- Outbreak of Covid-19

The market for building chemicals suffered as a result of the coronavirus outbreak. The market suffered a significant financial blow as a result of the major interruptions in different industrial and construction operations brought on by the numerous precautionary lockdowns implemented by governments to stop the spread of illness. All around the world, especially in major building hotspots like China, India, the United States, and European nations, construction activities ceased. For instance, it is anticipated that the construction industry would contract by around 3% in 2020 as a result of the coronavirus pandemic and slower economic development in South Korea.

Segmentation Analysis:

The global Construction chemicals market has been segmented based on Type, Application, and regions.

By Type

The Type segment includes Concrete Admixture, Construction Adhesive, Construction Sealant, and Flame Retardant. The Concrete segment led the largest share of the Construction chemicals market with a market share of around 30.3% in 2021. Concrete serves the fundamental needs of civil constructions, such as strength and longevity of the finished structure, and is a vital component of all types of building projects. Sand, aggregate, binder, water, and additives are all combined to make concrete. Concrete admixtures are synthetic chemicals or additives that are mixed in with the fresh or cured concrete to improve certain qualities, such as workability, durability, or early and final strength.

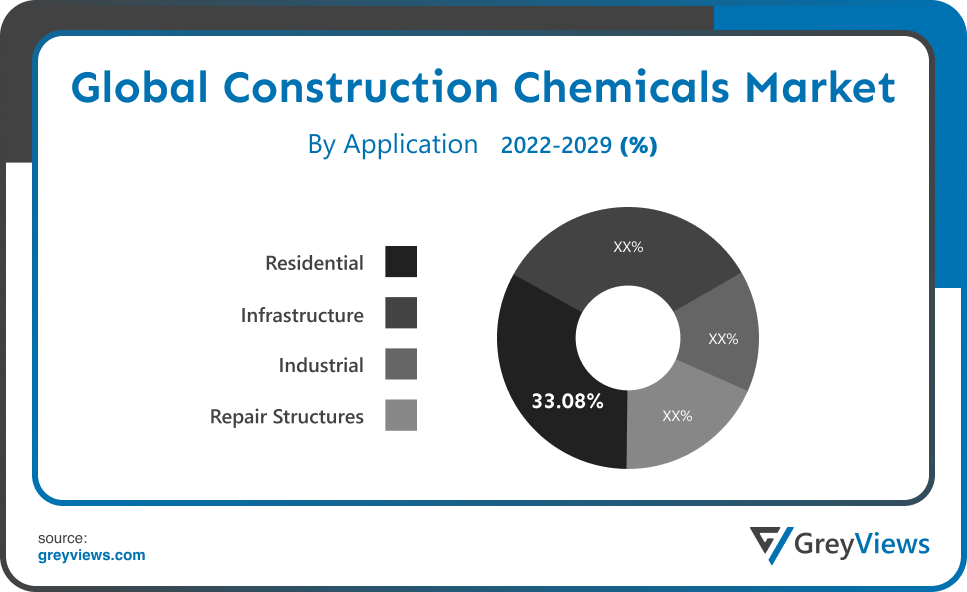

By Application

The Application segment includes Residential, Infrastructure, Industrial, and Repair Structures. The Residential segment led the Construction chemicals market with a market share of around 33.08% in 2021. Developers are building projects to meet the rising demand for villas, apartments, penthouses, and bungalows in gated communities with the greatest architecture and facilities. Due to the increased demand for homes and other residential structures in metropolitan areas, construction chemicals are frequently employed in residential construction.

Global Construction Chemicals Market- Sales Analysis.

The market value for Construction chemicals was approximately 17.2% of the overall USD 6.50 of the global medical Construction chemicals market in 2021.

The sale of synthetic biology products expanded at a CAGR of 7.62% from 2015 to 2021.

Concrete admixture is becoming increasingly necessary. Manufacturers have started to react to the rise in demand. For instance, BASF unveiled the Master X-Seed STE additive for the concrete industry in March 2019. The product was created especially for the Asia-Pacific region because it enhances concrete strength performance and development qualities. In addition, the Lone Star affiliate that bought the BASF construction chemicals company sold it to MBCC Group. MBCC Group has been decoupled from BASF Group for the past 18 months and is now a totally independent business. Thanks to this acquisition, the business is able to meet client demand for construction chemicals.

Industry developments have increased the popularity of super-plasticizers. Growing applications of high-strength concrete, particularly in public infrastructure projects, are driving up demand for construction chemicals. Comparable workability at lower water to cement ratios is made possible by superior molecular mass and water reduction of up to 40%. This supports the demand for these materials as well as its long-term applications.

Thus, owing to the aforementioned factors, the global Construction Chemicals Market is expected to grow at a CAGR of 7.7% during the Projection period from 2022 to 2032.

By Regional Analysis:

The regions analyzed for the Construction chemicals market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North America region dominated the Construction chemicals market and held the 39.1% share of the market revenue in 2021.

- The North America region witnessed a major share. The demand for construction chemicals in this area is expected to be driven by the region's rising economy and strong market fundamentals for commercial real estate developments. The public works and institutional infrastructure markets are also anticipated to benefit from a rise in state and federal investment, notably in the US and Canada. Furthermore, the development of the construction chemicals market in this region may be aided by the expanding population and upcoming projects that are planned for the building industry.

- Asia Pacific is anticipated to experience significant growth during the predicted period. Due to the rising demand for luxury residences, the expansion of building projects, and the optimal acceptance of product development in the construction sector, particularly in Asian nations like India, China, and Southeast Asia, the area has seen tremendous growth. Additionally, Asian nations like China and India are recognized global leaders in the rate of urbanization, which eventually drives demand for the construction chemicals market. Along with this, key firms are employing a variety of techniques to

Global Construction Chemicals Market- Country Analysis:

- Germany

Germany Construction chemicals market size was valued at USD 16.38 billion in 2021 and is expected to reach USD 24.29 billion by 2029, at a CAGR of 5.3% from 2022 to 2029.

Future Growth to be Driven by Increased Investment in Infrastructure Development and Rise in Demand for Real Estate" offers a thorough examination of the construction chemical market in Germany. Construction chemical use has emerged as a crucial element in the creation of huge infrastructure projects. They also improve the quality and longevity of the structure by providing cover and preventing foreign objects from getting to the surface or core.

- China

China Construction chemicals market size was valued at USD 29.78 billion in 2021 and is expected to reach USD 43.50 billion by 2029, at a CAGR of 5.1% from 2022 to 2029. The demand for construction chemicals is anticipated to increase throughout the Projection period as a result of rising investments and building activity in the nation. The region's economy has been steadily improving, which has improved customers' financial situations and increased demand for homes and other infrastructure projects in the nation.

- India

India's Construction chemicals market size was valued at USD 5.96 billion in 2021 and is expected to reach USD 9.32 billion by 2029, at a CAGR of 6.0% from 2022 to 2029. Government policies and programs like Make-in-India promote the establishment of various industrial facilities in India. Further encouraging construction chemical manufacturers in the region to push hard for the incorporation of sustainable and technologically cutting-edge materials in concrete admixtures, waterproofing, and industrial flooring are rising government and foreign investments in mega projects in the Asia Pacific. The demand for construction chemicals in the Asia Pacific area is expected to rise due to the increasing number of building chemicals utilized in numerous residential and non-residential sectors.

Key Industry Players Analysis:

To increase their market position in the global Construction chemicals business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- RPM International Inc.

- Ashland Inc.

- MAPEI

- Akzo Nobel NV

- Arkema SA

- Fosroc

- Pidilite Industries

- Covestro AG

- Henkel AG & Co. KGaA

- HB Fuller Company

- Lanxess AG

- The 3M Company

- Wacker Chemie AG

- Huntsman Corporation

Latest Development:

- In June 2021, RPM International Inc. disclosed that the Dudick Inc. company had been bought by its Carboline subsidiary. Dudick, an Ohio-based manufacturer of high-performance coatings, flooring systems, and tank linings, with annual net sales of around USD 10 million. Its headquarters are in Streetsboro. The transaction's terms weren't made public.

- In June 2022, Leading Egyptian manufacturer of roofing and waterproofing products Modern Waterproofing Group was purchased by Sika AG. Sika's progress in the Egyptian building sector has recently

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

7.7% |

|

Market Size |

40.32 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Type, By Application, and By Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

RPM International Inc., Ashland Inc., MAPEI, Akzo Nobel NV, Arkema SA, Fosroc, Pidilite Industries, Covestro AG, Henkel AG & Co. KgaA, HB Fuller Company, Lanxess AG, The 3M Company, Wacker Chemie AG, and Huntsman Corporation. |

|

By Type |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Construction Chemicals Market by Type:

- Concrete Admixture

- Construction Adhesive

- Construction Sealant

- Flame Retardant

Global Construction Chemicals Market by Application:

- Residential

- Infrastructure

- Industrial

- Repair Structures

Global Construction Chemicals Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the expected market size of the Construction chemicals market in 2029?

Global Construction chemicals market is expected to reach USD 72.98 billion by 2029, at a CAGR of 7.7% from 2022 to 2029.

Which is the Leading Region in the Construction Chemicals Market?

North America dominates the construction chemicals market during the Projection period.

Which is the leading segment in the Construction Chemicals Market based on Application?

Residential segment is leading in the construction chemicals market.

What is the Growth Outlook of the Construction Chemicals Market?

The construction chemicals market is estimated to record a CAGR of 7.7% during the Projection period.

Which are the leading market players active in the Construction chemicals market?

Leading market players active in the global Construction chemicals market are BW Group, Dorian LPG Ltd., EXMAR, Hyundai Heavy Industries Co., Ltd, Kawasaki Heavy Industries, Ltd, Mitsubishi Heavy Industries, Ltd., Namura Shipbuilding Co., Ltd., PT Pertamina (Persero), StealthGas Inc., The Great Eastern Shipping Co. Ltd., Teekay Corporation among others.

Political Factors- The licenses and paperwork that must be secured during the various stages of building are affected by political issues in the construction sector. Political variables take into account how much the government is likely to alter or have an impact on a certain sector of the economy or industry. For instance, a new tax or duty may cause the organization's revenue-generating structure to shift. These rules may be imposed on the specific industry by the government. All of these variables have to do with how and to what extent the government interferes with the economy or a particular sector.

Economical Factors- The main economic factor is how the economy runs and how it affects how the business operates. The way the business sets the pricing of its items may be impacted by a rise in the rate of economic inflation. The models used to predict supply and demand in the economy will also alter. Economic development, patterns of foreign exchange rates, inflation rates, etc. are the primary economic factors. The performance of a particular economy is determined by economic considerations. Economic growth, exchange rates, inflation rates, interest rates, consumer disposable income, and unemployment rates are among the variables.

Social Factor- All events that might have a social impact on the market and the community are examined by social factors. It is also important to take into account the benefits and drawbacks for the residents in the area where the project is being established or carried out. These include population dynamics, climate change, professional levels, social conventions, and cultural expectations, among others. These aspects determine or measure the determinants such as demographics, cultural trends, population analytic, etc. while taking into account the social context that is prevalent in the market. The demographic traits, norms, customs, and values of the community in which the organisation operates are represented by this aspect of the general environment.

Technological Factors- These are associated with technological advancements and changes that may have a positive or negative impact on how an industry operates and the market. This is also connected to the company's level of technological savvy. This factor, which is technology, considers all legal factors, including quotas, resources, exports, imports, employment, etc. Legal considerations include both internal and external aspects. There are some regulations that could potentially alter the company's external environment, and the company also has a variety of internal policies.

Environmental Factors- All that is influenced or determined by the immediate environment is most frequently referred to as an environmental factor. The environment in which business is conducted is typically taken into account by pestle environmental variables. The terms "weather," "climate," "global changes in climate," "ground conditions," "environmental offsets," etc. are all included in this. An industry-wide analysis, often known as a pest analysis or pestle analysis, can be of the building sector. The industry's various environmental concerns are represented by the letter "E." Only relatively recently have environmental factors gained prominence.

Legal Factors- These variables include more specific laws including discrimination laws, antitrust laws, employment laws, consumer protection laws, copyright and patent laws, and health and safety regulations, but there may be some overlap with the political issues. It is obvious that for businesses to conduct profitable and moral business, they must understand what is and is not legal. Since every nation has its own set of laws and regulations, this becomes particularly challenging for businesses that conduct international business. You should also be informed of any potential legislative changes and how they can affect your company in the future.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Type

- 3.2. Market Attractiveness Analysis By Application

- 3.3. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. High Requirement

- 3. Restraints

- 3.1. Fluctuations in Prices and Rates

- 4. Opportunities

- 4.1. High Investments and Eco-Friendly Chemicals

- 5. Challenges

- 5.1. Financial loss owing to external factors

- Global Construction chemicals Market Analysis and Projection, By Type

- 1. Segment Overview

- 2. Concrete Admixture

- 3. Construction Adhesive

- 4. Construction Sealant

- 5. Flame Retardant

- Global Construction chemicals Market Analysis and Projection, By Application

- 1. Segment Overview

- 2. Residential

- 3. Infrastructure

- 4. Industrial

- 5. Repair Structures

- Global Construction chemicals Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Construction chemicals Market-Competitive Landscape

- 1. Overview

- 2. Market Share of Key Players in the Construction chemicals Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- 3. Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- RPM International Inc.

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Ashland Inc.

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- MAPEI

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Akzo Nobel NV

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Arkema SA

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Fosroc

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Pidilite Industries

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Covestro AG

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Henkel AG & Co. KGaA

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- HB Fuller Company

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Lanxess AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- The 3M Company

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Wacker Chemie AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Huntsman Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- RPM International Inc.

List of Table

- Global Construction chemicals Market, By Type, 2021–2029 (USD Billion)

- Global Concrete Admixture, Construction chemicals Market, By Region, 2021–2029 (USD Billion)

- Global Construction Adhesive, Construction chemicals Market, By Region, 2021–2029 (USD Billion)

- Global Construction Sealant, Construction chemicals Market, By Region, 2021–2029 (USD Billion)

- Global Flame Retardant, Construction chemicals Market, By Region, 2021–2029 (USD Billion)

- Global Construction chemicals Market, By Application, 2021–2029 (USD Billion)

- Global Residential, Construction chemicals Market, By Region, 2021–2029 (USD Billion)

- Global Infrastructure, Construction chemicals Market, By Region, 2021–2029 (USD Billion)

- Global Industrial, Construction chemicals Market, By Region, 2021–2029 (USD Billion)

- Global Repair Structures, Construction chemicals Market, By Region, 2021–2029 (USD Billion)

- Global Construction chemicals Market, By Region, 2021–2029 (USD Billion)

- North America Construction Chemicals Market, By Type, 2021–2029 (USD Billion)

- North America Construction Chemicals Market, By Application, 2021–2029 (USD Billion)

- USA Construction chemicals Market, By Type, 2021–2029 (USD Billion)

- USA Construction chemicals Market, By Application, 2021–2029 (USD Billion)

- Canada Construction chemicals Market, By Type, 2021–2029 (USD Billion)

- Canada Construction chemicals Market, By Application, 2021–2029 (USD Billion)

- Mexico Construction chemicals Market, By Type, 2021–2029 (USD Billion)

- Mexico Construction chemicals Market, By Application, 2021–2029 (USD Billion)

- Europe Construction chemicals Market, By Type, 2021–2029 (USD Billion)

- Europe Construction chemicals Market, By Application, 2021–2029 (USD Billion)

- Germany Construction chemicals Market, By Type, 2021–2029 (USD Billion)

- Germany Construction chemicals Market, By Application, 2021–2029 (USD Billion)

- France Construction chemicals Market, By Type, 2021–2029 (USD Billion)

- France Construction chemicals Market, By Application, 2021–2029 (USD Billion)

- UK Construction chemicals Market, By Type, 2021–2029 (USD Billion)

- UK Construction chemicals Market, By Application, 2021–2029 (USD Billion)

- Italy Construction chemicals Market, By Type, 2021–2029 (USD Billion)

- Italy Construction chemicals Market, By Application, 2021–2029 (USD Billion)

- Spain Construction chemicals Market, By Type, 2021–2029 (USD Billion)

- Spain Construction chemicals Market, By Application, 2021–2029 (USD Billion)

- Asia Pacific Construction Chemicals Market, By Type, 2021–2029 (USD Billion)

- Asia Pacific Construction Chemicals Market, By Application, 2021–2029 (USD Billion)

- Japan Construction chemicals Market, By Type, 2021–2029 (USD Billion)

- Japan Construction chemicals Market, By Application, 2021–2029 (USD Billion)

- China Construction chemicals Market, By Type, 2021–2029 (USD Billion)

- China Construction chemicals Market, By Application, 2021–2029 (USD Billion)

- India Construction chemicals Market, By Type, 2021–2029 (USD Billion)

- India Construction chemicals Market, By Application, 2021–2029 (USD Billion)

- South America Construction Chemicals Market, By Type, 2021–2029 (USD Billion)

- South America Construction Chemicals Market, By Application, 2021–2029 (USD Billion)

- Brazil Construction chemicals Market, By Type, 2021–2029 (USD Billion)

- Brazil Construction chemicals Market, By Application, 2021–2029 (USD Billion)

- Middle East and Africa Construction chemicals Market, By Type, 2021–2029 (USD Billion)

- Middle East and Africa Construction chemicals Market, By Application, 2021–2029 (USD Billion)

- UAE Construction chemicals Market, By Type, 2021–2029 (USD Billion)

- UAE Construction chemicals Market, By Application, 2021–2029 (USD Billion)

- South Africa Construction Chemicals Market, By Type, 2021–2029 (USD Billion)

- South Africa Construction Chemicals Market, By Application, 2021–2029 (USD Billion)

List of Figures

- Global Construction chemicals Market Segmentation

- Construction chemicals Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Construction chemicals Market Attractiveness Analysis By Type

- Global Construction chemicals Market Attractiveness Analysis By Application

- Global Construction chemicals Market Attractiveness Analysis By Region

- Global Construction chemicals Market: Dynamics

- Global Construction chemicals Market Share By Type (2021 & 2029)

- Global Construction chemicals Market Share By Application (2021 & 2029)

- Global Construction chemicals Market Share by Regions (2021 & 2029)

- Global Construction chemicals Market Share by Company (2020)