Defibrillator Market Size by Type (Implantable Cardioverter Defibrillators, Transvenous Implantable Cardioverter Defibrillators, Subcutaneous Implantable Cardioverter Defibrillators, External Defibrillators, Manual & Semi-Automated External Defibrillators, Fully Automated External Defibrillators, and Wearable Cardioverter Defibrillators), Patients type (Adult and Pediatrics), End Users (Hospitals, Clinics and Cardiac Centers, Pre-hospital Care Settings, Public Access Markets, Home Care Settings, Alternate Care Facilities, and Others), Regions, Segmentation, and Projection till 2029

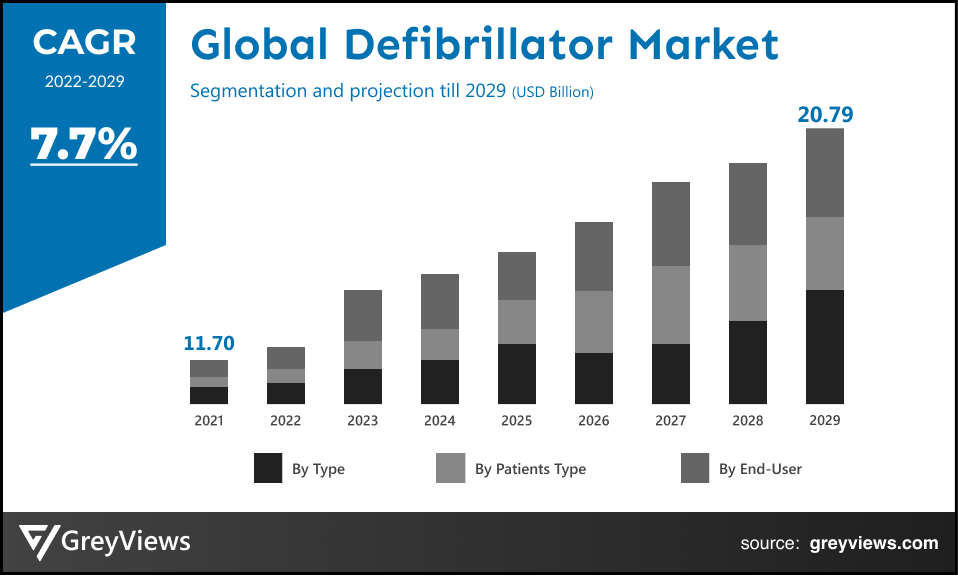

CAGR: 7.7%Current Market Size: USD 11.70 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Defibrillator Market- Market Overview:

The global defibrillator market is expected to grow from USD 11.70 billion in 2021 to USD 20.79 billion by 2029, at a CAGR of 7.7% % during the Projection period 2022-2029. The increasing prevalence of sudden cardiac arrest and supportive initiatives by governments has driven the growth of the global market.

A defibrillator is a device used for defibrillation; a procedure used for the treatment of life-threatening conditions that involve an impact on the rhythm of the heart. These conditions include ventricular fibrillation, cardiac arrhythmia, and pulseless ventricular tachycardia. A defibrillator delivers a therapeutic shock to the heart to ensure depolarization of the heart muscles and restore normal conduction of the heart’s electrical impulses. Major types of defibrillators include external defibrillators, implanted defibrillators, and transvenous defibrillators.

Moreover, different types of defibrillators are used in different ways. For instance, automated external defibrillators (AEDs) are lightweight and portable devices mainly found in public spaces to save the lives of people suffering cardiac arrest.

Request Sample: - Global Defibrillator Market

Market Dynamics:

Drivers:

- Increased prevalence of target diseases

Defibrillators have become a prominent device for preventing and correcting an arrhythmia that causes an uneven heartbeat that is too fast or too slow. There is a significant prevalence of arrhythmia among the global population. For instance, according to Scripps Health, a nonprofit health care system based in San Diego, California, about one in 18 people, or 5% of the U.S. population, has an arrhythmia. In addition, recent studies suggested that one in four adults across the U.S. over the age of 40 might develop an irregular heartbeat. This prevalence of target diseases associated with irregular heartbeat fuels demands for defibrillators that send an electric shock or pulse to the heart to restore a normal heartbeat.

- The proliferation of public-access defibrillators

Public access defibrillation (PAD) programs and policies around the globe are making automated external defibrillators (AEDs) available for public and/or private places. This equipment is used to save the lives of people who experience cardiac arrest in their respective places. The growing numbers of AEDs are being implemented to support timely defibrillation provision during cardiac arrest. This public access AEDs are found in airports, hospitals, schools, government buildings, community centers, and other public locations. For intance, according to Readiness Systems, LLC, there are more than 3.2 million AEDs are found in public settings across the U.S. This proliferation of public-access defibrillators is boosting the growth of the global market.

Restraints:

- Issues associated with automated and implantable external defibrillators

Possible risks associated with implantable cardioverter-defibrillators (ICDs) are infection at the implant site; swelling, bleeding, or bruising, bleeding around the heart, which can be life-threatening; and blood leaking through the heart valve where the ICD lead is placed. On the other hand, battery failure has been one of the most common problems related to automated external defibrillators (AEDs). Such issues associated with automated and implantable external defibrillators may hamper the growth of the global market to some extent.

Opportunities:

- Rising development of S-ICDs as well as MRI-compatible ICDs & CRT-Ds

The S-ICD System is the subcutaneous implantable defibrillator that offers protection from sudden cardiac arrest (SCA), leaving the vasculature and heart untouched. Boston Scientific Corporation, a biomedical/biotechnology engineering firm, developed S-ICD to provide an electrical shock to stop dangerously fast heart rhythms.

Furthermore, in July 2020, Abbott, American multinational health care and medical devices company, received FDA approval for its next-generation Gallant implantable cardioverter-defibrillator (ICD) and cardiac resynchronization therapy defibrillator (CRT-D) devices. The development of such innovative defibrillator products is expected to create lucrative growth opportunities for the market.

Challenges

- Lack of awareness regarding sudden cardiac arrest (SCA)

The incidence of SCA among populations has increased in the past few years due to sedentary lifestyles, increasing consumption of alcohol, and diabetes in both developed and developing countries. However, developing nations have comparatively less awareness of sudden cardiac arrest. Also, according to the Philips Foundation and the International Federation of Red Cross and Red Crescent Societies (IFRC), only a few people in the general public in developing countries are aware of SCA risks. While most of them do not know how to save the life of someone in need. This factor is projected to be a major challenge in the global defibrillator market.

Segmentation Analysis:

The global defibrillator market has been segmented based on type, patient type, end users, and regions.

By Type

The type segment includes implantable cardioverter defibrillators, transvenous implantable cardioverter defibrillators, subcutaneous implantable cardioverter defibrillators, external defibrillators, manual & semi-automated external defibrillators, fully automated external defibrillators, and wearable cardioverter defibrillators. The implantable cardioverter defibrillators (ICDs) segment led the Defibrillator market with a market share of around 52.03% in 2021. ICDs are small battery-powered devices that are placed in the chest to stop or detect irregular heartbeats. The demand for ICDs is mainly driven by the ongoing development of technically advanced defibrillators and the increased prevalence of cardiovascular diseases. For instance, according to Boston Scientific, the ICDs had been implanted in over 100,000 patients nationwide in the U.S. as of December 2021. In addition, as per the company, ICDs are significantly effective in delivering an electric shock to the heart after detecting sudden cardiac arrest.

By Patients type

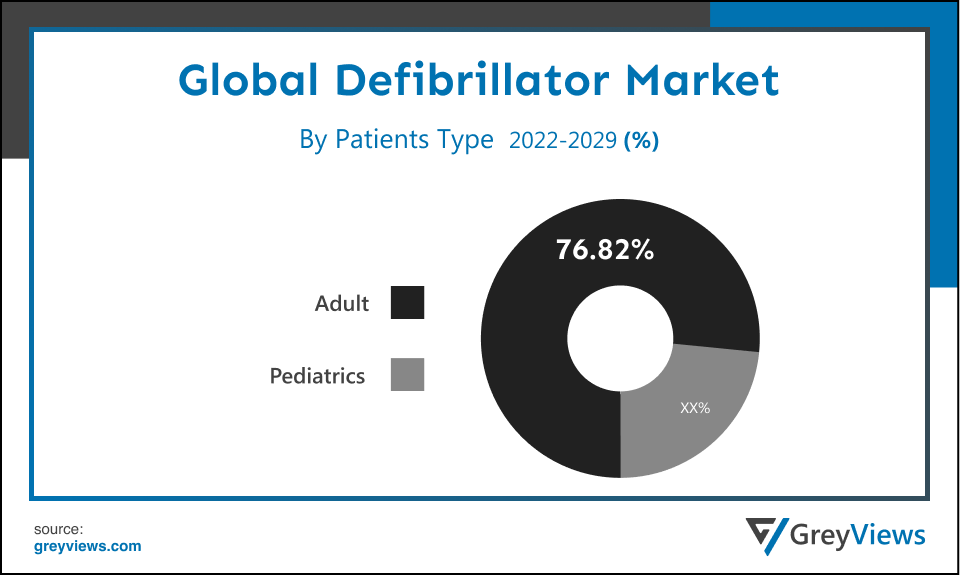

The patient type segment includes adults and pediatrics. The adult segment led the defibrillator market with a market share of around 76.82% in 2021. This is attributed to the fact that heart diseases are more often associated with adults than children or teens. For instance, adults aged 65 and older are more likely to suffer from cardiovascular disease due to blood vessels, heart, or both problems.

By End Users

The end users segment includes hospitals, clinics and cardiac centers, pre-hospital care settings, public access markets, home care settings, alternate care facilities, and others. The hospitals segment led the defibrillator market with a market share of around 68.1% in 2021. The increased number of cardiac patients received in hospitals and an upsurge in surgeries performed across hospital settings has mainly driven the growth of this segment. Moreover, there is an upsurge in the use of defibrillators in hospitals to provide more effective treatments and better patient safety with the help of better control of complications during Cardiopulmonary Resuscitation (CPR).

By Regional Analysis:

The regions analyzed for the Defibrillator market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. The north American region dominated the Defibrillator market and held a 36.22% share of the market revenue in 2021.

- North America region witnessed a major share. The market growth in this region is mainly driven by factors such as favorable regulations and technically innovative healthcare facilities across the U.S. and Canada. In addition, this region is home to key market leaders such as Boston Scientific Corporation, Abbott, and Stryker Corporation. These players are actively developing technically advanced products to manage and treat heart failure and heart rhythm disorders.

- Asia-Pacific is expected to witness a considerable growth rate during the Projection period. Several factors, such as the prevalence of cardiac diseases, rapid growth in the geriatric population, and rising investments in healthcare infrastructure, have driven the growth of the Asia-Pacific defibrillator market.

Global Defibrillator Market- Country Analysis:

- Germany

Germany's Defibrillator market size was valued at USD 1.29 billion in 2021 and is expected to reach USD 2.24 billion by 2029, at a CAGR of 7.4% from 2022 to 2029.

In Europe, Germany is one of the leading shareholders in the defibrillator market. In addition, the huge healthcare spending by the government in this country has been a major contributor to market growth. For instance, according to the Federal Statistical Office (Destatis), 67.9 billion euros of health spending in the country was only financed from government transfers and subsidies. Also, the country spent 12.5% of its GDP on healthcare in 2020.

- China

China's defibrillator market size was valued at USD 2.22 billion in 2021 and is expected to reach USD 3.78 billion by 2029, at a CAGR of 7.1% from 2022 to 2029. The factors such as the aging population, increasing consumer income, and government initiatives have primarily driven the growth of the China defibrillator market. In addition, the first-tier cities, as well as several coastal provinces in the country, are taking action to install automated external defibrillators (AEDs).

Furthermore, according to its action plan published in 2019, China planned to disseminate AEDs across all schools, public institutes, airports, government offices, shopping malls, and cinemas around the country. Such initiatives by the Chinese government are opportunistic for market growth.

- India

India's defibrillator market size was valued at USD 0.59 billion in 2021 and is expected to reach USD 1.07 billion by 2029, at a CAGR of 8.1% from 2022 to 2029. India is one of the strongest growing economies in Asia. Several public health schemes introduced by the government, the emergence of the COVID-19 pandemic, and rising heart disease prevalence rates in India are the major factors contributing to the defibrillator market. For instance, according to the Global Burden of Disease, the most comprehensive global observational epidemiological study, about a quarter (24.8%) of all deaths in India are caused by cardiovascular diseases (CVDs).

Key Industry Players Analysis:

To increase their market position in the global defibrillator business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Medtronic

- Abbott

- Boston Scientific Corporation

- BIOTRONIK SE & Co. KG

- MicroPort Scientific Corporation

- Koninklijke Philips N.V.

- Stryker

- ZOLL Medical Corporation (Asahi Kasei)

- Nihon Kohden Corporation

- Schiller AG

Latest Development:

- In September 2021, Medtronic plc, the medical technology provider, introduced a pilot program with Mpirik, the cardiac intelligence platform, to address disparities in care related to the prevention of sudden cardiac arrest (SCA).

- In July 2021, MicroPort Cardiac Rhythm Management Limited, the subsidiary of MicroPort Scientific Corporation, announced a 150 Million Series C investment. The MicroPort and Hillhouse Capital Group will co-lead this Series C investment.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

7.7% |

|

Market Size |

11.70 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Type, Patients type, End Users, and Regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Medtronic, Abbott, Boston Scientific Corporation, BIOTRONIK SE & Co. KG, MicroPort Scientific Corporation, Koninklijke Philips N.V., Stryker, ZOLL Medical Corporation (Asahi Kasei), Nihon Kohden Corporation, and Schiller AG among others |

|

By Type |

|

|

By Material Type |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Defibrillator Market by Type:

- Implantable Cardioverter Defibrillators

- Transvenous Implantable Cardioverter Defibrillators

- Subcutaneous Implantable Cardioverter Defibrillators

- External Defibrillators

- Manual & Semi-Automated External Defibrillators

- Fully Automated External Defibrillators

- Wearable Cardioverter Defibrillators

Global Defibrillator Market by Patients Type:

- Adult

- Pediatrics

Global Defibrillator Market by End Users:

- Hospitals

- Clinics and Cardiac Centers

- Pre-hospital Care Settings

- Public Access Markets

- Home Care Settings

- Alternate Care Facilities

- Others

Global Defibrillator Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What was the market size of the Defibrillator market in 2021?

The market size of Defibrillator market in 2021 is USD 11.70 billion in 2021

What is the current growth rate of Defibrillator market?

Global defibrillator market growth rate is CAGR of 7.7% from 2022 to 2029 and it will reach to market value of USD 20.79 billion by 2029.

Which are the leading market players active in the Defibrillator market?

Leading market players active in the global Defibrillator market are Medtronic, Abbott, Boston Scientific Corporation, BIOTRONIK SE & Co. KG, MicroPort Scientific Corporation, Koninklijke Philips N.V., Stryker, ZOLL Medical Corporation (Asahi Kasei), Nihon Kohden Corporation, and Schiller AG among others.

What are the upcoming trends to influence the Defibrillator market?

Emerging development of S-ICDs and MRI-compatible ICDs & CRT-Ds and demand for defibrillators in emerging markets is projected to influence market growth in upcoming years.

Which segment is most significant segment in end-user of Defibrillator?

The hospital's segment led the Defibrillator market with a market share of around 68.1% in 2021

What is the key driver of the Defibrillator market?

Increasing prevalence of sudden cardiac arrest and supportive initiatives by governments is primarily driving the growth of the Defibrillator market.

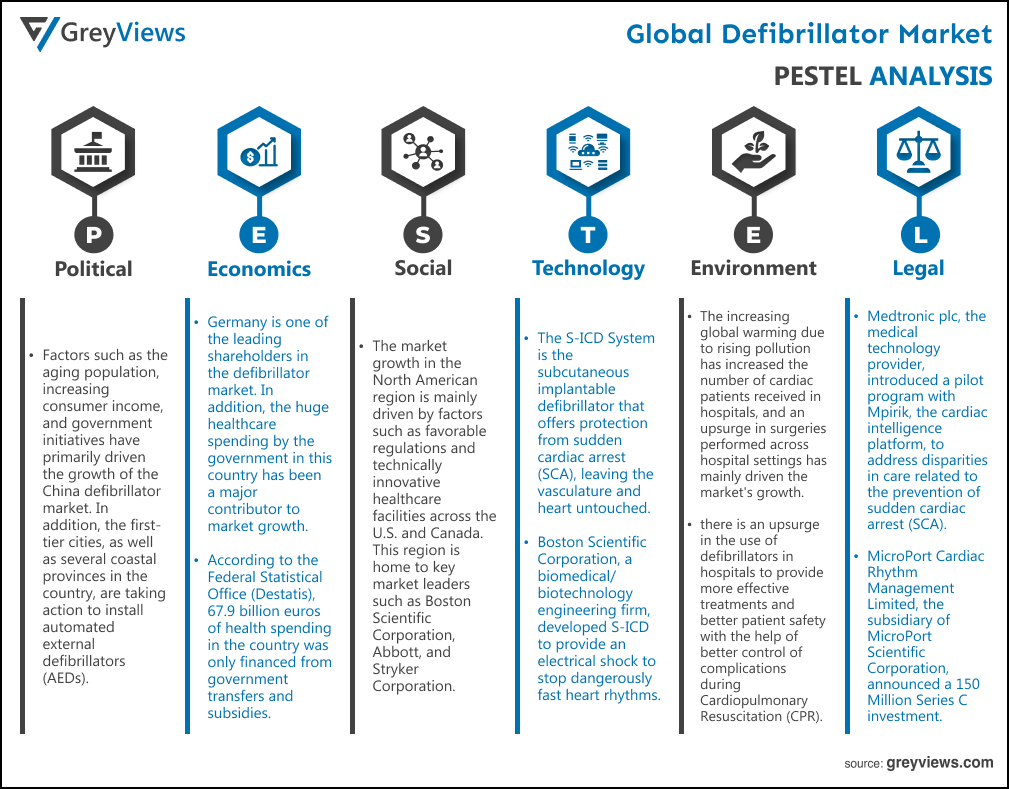

Political Factors- factors such as the aging population, increasing consumer income, and government initiatives have primarily driven the growth of the China defibrillator market. In addition, the first-tier cities, as well as several coastal provinces in the country, are taking action to install automated external defibrillators (AEDs). Furthermore, according to its action plan published in 2019, China planned to disseminate AEDs across all schools, public institutes, airports, government offices, shopping malls, and cinemas around the country. Such initiatives by the Chinese government are opportunistic for market growth. Several public health schemes introduced by the government, the emergence of the COVID-19 pandemic, and rising heart disease prevalence rates in India are the major factors contributing to the defibrillator market.

Economical Factors- Germany is one of the leading shareholders in the defibrillator market. In addition, the huge healthcare spending by the government in this country has been a major contributor to market growth. For instance, according to the Federal Statistical Office (Destatis), 67.9 billion euros of health spending in the country was only financed from government transfers and subsidies. Also, the country spent 12.5% of its GDP on healthcare in 2020.

Social Factor- The market growth in the North American region is mainly driven by factors such as favorable regulations and technically innovative healthcare facilities across the U.S. and Canada. In addition, this region is home to key market leaders such as Boston Scientific Corporation, Abbott, and Stryker Corporation. These players actively develop technically advanced products to manage and treat heart failure and heart rhythm disorders.

Technological Factors- The S-ICD System is the subcutaneous implantable defibrillator that offers protection from sudden cardiac arrest (SCA), leaving the vasculature and heart untouched. Boston Scientific Corporation, a biomedical/biotechnology engineering firm, developed S-ICD to provide an electrical shock to stop dangerously fast heart rhythms. Furthermore, in July 2020, Abbott, American multinational health care and medical devices company, received FDA approval for its next-generation Gallant implantable cardioverter-defibrillator (ICD) and cardiac resynchronization therapy defibrillator (CRT-D) devices. The development of such innovative defibrillator products is expected to create lucrative growth opportunities for the market.

Environmental Factors- The increasing global warming due to rising pollution has increased the number of cardiac patients received in hospitals, and an upsurge in surgeries performed across hospital settings has mainly driven the market's growth. Moreover, there is an upsurge in the use of defibrillators in hospitals to provide more effective treatments and better patient safety with the help of better control of complications during Cardiopulmonary Resuscitation (CPR).

Legal Factors- Medtronic plc, the medical technology provider, introduced a pilot program with Mpirik, the cardiac intelligence platform, to address disparities in care related to the prevention of sudden cardiac arrest (SCA). MicroPort Cardiac Rhythm Management Limited, the subsidiary of MicroPort Scientific Corporation, announced a 150 Million Series C investment. The MicroPort and Hillhouse Capital Group will co-lead this Series C investment.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Type

- Market Attractiveness Analysis By Patients Type

- Market Attractiveness Analysis By End Users

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Increased prevalence of target diseases

- Proliferation of public-access defibrillators

- Restrains

- Issues associated with automated and implantable external defibrillators

- Opportunities

- Rising development of S-ICDs as well as MRI-compatible ICDs & CRT-Ds

- Challenges

- Lack of awareness regarding sudden cardiac arrest (SCA)

- Global Defibrillator Market Analysis and Projection, By Type

- Segment Overview

- Implantable Cardioverter Defibrillators

- Transvenous Implantable Cardioverter Defibrillators

- Subcutaneous Implantable Cardioverter Defibrillators

- External Defibrillators

- Manual & Semi-Automated External Defibrillators

- Fully Automated External Defibrillators

- Wearable Cardioverter Defibrillators

- Global Defibrillator Market Analysis and Projection, By Patients Type

- Segment Overview

- Adult

- Pediatrics

- Global Defibrillator Market Analysis and Projection, By End Users

- Segment Overview

- Hospitals

- Clinics and Cardiac Centers

- Pre-hospital Care Settings

- Public Access Markets

- Home Care Settings

- Alternate Care Facilities

- Others

- Global Defibrillator Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Defibrillator Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Defibrillator Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Type Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Medtronic

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Abbott

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Boston Scientific Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- BIOTRONIK SE & Co. KG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- MicroPort Scientific Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Koninklijke Philips N.V.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Stryker

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- ZOLL Medical Corporation (Asahi Kasei)

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Nihon Kohden Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Schiller AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Medtronic

List of Table

- Global Defibrillator Market, By Type, 2021–2029(USD Billion)

- Global Implantable Cardioverter Defibrillators Defibrillator Market, By Region, 2021–2029(USD Billion)

- Global Transvenous Implantable Cardioverter Defibrillators Defibrillator Market, By Region, 2021–2029(USD Billion)

- Global Subcutaneous Implantable Cardioverter Defibrillators Defibrillator Market, By Region, 2021–2029(USD Billion)

- Global External Defibrillators Defibrillators Defibrillator Market, By Region, 2021–2029(USD Billion)

- Global Manual & Semi-Automated External Defibrillators Defibrillators Defibrillator Market, By Region, 2021–2029(USD Billion)

- Global Fully Automated External Defibrillators Defibrillators Defibrillator Market, By Region, 2021–2029(USD Billion)

- Global Wearable Cardioverter Defibrillators Defibrillators Defibrillator Market, By Region, 2021–2029(USD Billion)

- Global Defibrillator Market, By Patients Type, 2021–2029(USD Billion)

- Global Adult Defibrillator Market, By Region, 2021–2029(USD Billion)

- Global Pediatrics Defibrillator Market, By Region, 2021–2029(USD Billion)

- Global Defibrillator Market, By End Users, 2021–2029(USD Billion)

- Global Hospitals Defibrillator Market, By Region, 2021–2029(USD Billion)

- Global Clinics and Cardiac Centers Defibrillator Market, By Region, 2021–2029(USD Billion)

- Global Pre-hospital Care Settings Defibrillator Market, By Region, 2021–2029(USD Billion)

- Global Public Access Markets Defibrillator Market, By Region, 2021–2029(USD Billion)

- Global Home Care Settings Defibrillator Market, By Region, 2021–2029(USD Billion)

- Global Alternate Care Facilities Defibrillator Market, By Region, 2021–2029(USD Billion)

- Global Others Defibrillator Market, By Region, 2021–2029(USD Billion)

- Global Defibrillator Market, By Region, 2021–2029(USD Billion)

- Global Defibrillator Market, By North America, 2021–2029(USD Billion)

- North America Defibrillator Market, By Type, 2021–2029(USD Billion)

- North America Defibrillator Market, By Patients Type, 2021–2029(USD Billion)

- North America Defibrillator Market, By End Users, 2021–2029(USD Billion)

- USA Defibrillator Market, By Type, 2021–2029(USD Billion)

- USA Defibrillator Market, By Patients Type, 2021–2029(USD Billion)

- USA Defibrillator Market, By End Users, 2021–2029(USD Billion)

- Canada Defibrillator Market, By Type, 2021–2029(USD Billion)

- Canada Defibrillator Market, By Patients Type, 2021–2029(USD Billion)

- Canada Defibrillator Market, By End Users, 2021–2029(USD Billion)

- Mexico Defibrillator Market, By Type, 2021–2029(USD Billion)

- Mexico Defibrillator Market, By Patients Type, 2021–2029(USD Billion)

- Mexico Defibrillator Market, By End Users, 2021–2029(USD Billion)

- Europe Defibrillator Market, By Type, 2021–2029(USD Billion)

- Europe Defibrillator Market, By Patients Type, 2021–2029(USD Billion)

- Europe Defibrillator Market, By End Users, 2021–2029(USD Billion)

- Germany Defibrillator Market, By Type, 2021–2029(USD Billion)

- Germany Defibrillator Market, By Patients Type, 2021–2029(USD Billion)

- Germany Defibrillator Market, By End Users, 2021–2029(USD Billion)

- France Defibrillator Market, By Type, 2021–2029(USD Billion)

- France Defibrillator Market, By Patients Type, 2021–2029(USD Billion)

- France Defibrillator Market, By End Users, 2021–2029(USD Billion)

- UK Defibrillator Market, By Type, 2021–2029(USD Billion)

- UK Defibrillator Market, By Patients Type, 2021–2029(USD Billion)

- UK Defibrillator Market, By End Users, 2021–2029(USD Billion)

- Italy Defibrillator Market, By Type, 2021–2029(USD Billion)

- Italy Defibrillator Market, By Patients Type, 2021–2029(USD Billion)

- Italy Defibrillator Market, By End Users, 2021–2029(USD Billion)

- Spain Defibrillator Market, By Type, 2021–2029(USD Billion)

- Spain Defibrillator Market, By Patients Type, 2021–2029(USD Billion)

- Spain Defibrillator Market, By End Users, 2021–2029(USD Billion)

- Asia Pacific Defibrillator Market, By Type, 2021–2029(USD Billion)

- Asia Pacific Defibrillator Market, By Patients Type, 2021–2029(USD Billion)

- Asia Pacific Defibrillator Market, By End Users, 2021–2029(USD Billion)

- Japan Defibrillator Market, By Type, 2021–2029(USD Billion)

- Japan Defibrillator Market, By Patients Type, 2021–2029(USD Billion)

- Japan Defibrillator Market, By End Users, 2021–2029(USD Billion)

- China Defibrillator Market, By Type, 2021–2029(USD Billion)

- China Defibrillator Market, By Patients Type, 2021–2029(USD Billion)

- China Defibrillator Market, By End Users, 2021–2029(USD Billion)

- India Defibrillator Market, By Type, 2021–2029(USD Billion)

- India Defibrillator Market, By Patients Type, 2021–2029(USD Billion)

- India Defibrillator Market, By End Users, 2021–2029(USD Billion)

- South America Defibrillator Market, By Type, 2021–2029(USD Billion)

- South America Defibrillator Market, By Patients Type, 2021–2029(USD Billion)

- South America Defibrillator Market, By End Users, 2021–2029(USD Billion)

- Brazil Defibrillator Market, By Type, 2021–2029(USD Billion)

- Brazil Defibrillator Market, By Patients Type, 2021–2029(USD Billion)

- Brazil Defibrillator Market, By End Users, 2021–2029(USD Billion)

- Middle East and Africa Defibrillator Market, By Type, 2021–2029(USD Billion)

- Middle East and Africa Defibrillator Market, By Patients Type, 2021–2029(USD Billion)

- Middle East and Africa Defibrillator Market, By End Users, 2021–2029(USD Billion)

- UAE Defibrillator Market, By Type, 2021–2029(USD Billion)

- UAE Defibrillator Market, By Patients Type, 2021–2029(USD Billion)

- UAE Defibrillator Market, By End Users, 2021–2029(USD Billion)

- South Africa Defibrillator Market, By Type, 2021–2029(USD Billion)

- South Africa Defibrillator Market, By Patients Type, 2021–2029(USD Billion)

- South Africa Defibrillator Market, By End Users, 2021–2029(USD Billion)

List of Figures

- Global Defibrillator Market Segmentation

- Defibrillator Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Defibrillator Market Attractiveness Analysis By Type

- Global Defibrillator Market Attractiveness Analysis By Patients Type

- Global Defibrillator Market Attractiveness Analysis By End Users

- Global Defibrillator Market Attractiveness Analysis By Region

- Global Defibrillator Market: Dynamics

- Global Defibrillator Market Share By Type(2021 & 2029)

- Global Defibrillator Market Share By Patients Type(2021 & 2029)

- Global Defibrillator Market Share By End Users(2021 & 2029)

- Global Defibrillator Market Share by Regions (2021 & 2029)

- Global Defibrillator Market Share by Company (2020)