Gloves Market Size By Material (Polyethylene, Natural Rubber, Neoprene, Vinyl and Nitrile), By Product (Powder-Free and Powdered), By Type (Protective Gloves and Disposable Gloves), By End-User (Food & Beverage, Medical & Healthcare, Automotive, Electronics, Construction and Others), Regions, Segmentation, and Projection till 2029

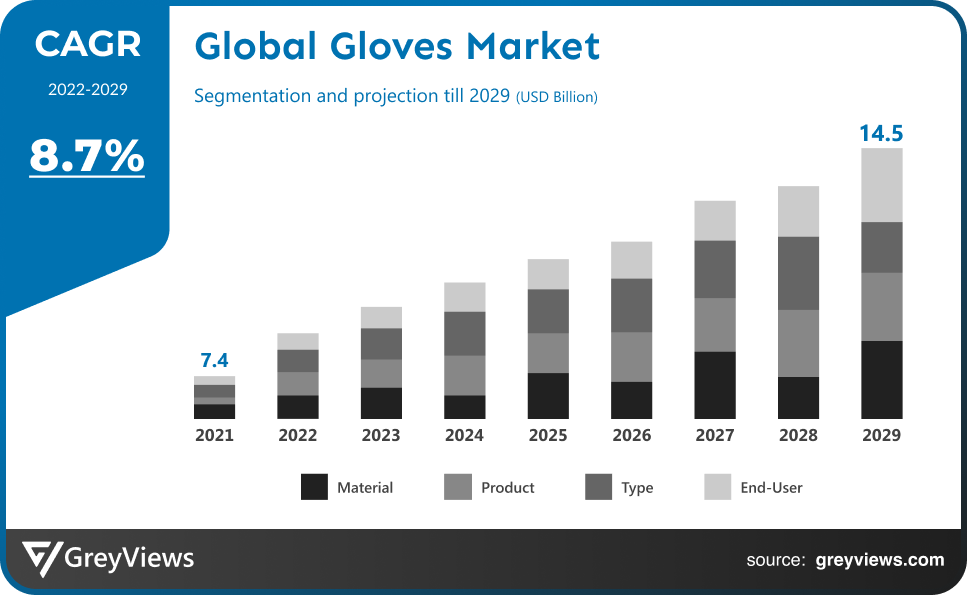

CAGR: 8.7%Current Market Size: USD 7.4 BillionFastest Growing Region: APAC

Largest Market: EuropeProjection Time: 2022-2029Base Year: 2021

Global Gloves Market- Market Overview:

The Global Gloves market is expected to grow from USD 7.4 billion in 2021 to USD 14.5 billion by 2029, at a CAGR of 8.7% during the Projection period 2022-2029. The growth of this market is mainly driven by rising demand for gloves in the healthcare sector to prevent cross-contamination and to maintain hygienic conditions.

Gloves are hand coverings that have separate sections for fingers and thumbs. The objective behind wearing gloves is to protect the hands from any kind of biological, physical and chemical hazard. Gloves protect the hands by creating a barrier between the outer environment and hand skin. Two types of gloves are most commonly used by various end user i.e., protective gloves and disposable gloves. Protective gloves are mainly used in the automotive, construction sectors etc. The healthcare sector is also expected to expand in response to rising healthcare expenditures, which is expected to drive disposable glove demand. It is anticipated that major companies in the market will expand their research & development activities as the awareness of raw materials rises regarding their importance to providing high heat resistance, comfort, elasticity, and lightweight properties increases. Gloves are expected to be driven by safety regulations over the Projection period due to the prevalence of rashes, hand cuts, skin diseases, and bloodborne pathogens in various industries, such as healthcare, mining, construction, etc., where gloves are required for the prevention of these risks. Gloves demand over the Projection period is also expected to increase due to growing concerns about employee safety and initiatives intended to reduce injury rates in manufacturing facilities.

Sample Request: - Global Gloves Market

Market Dynamics:

Drivers:

- Availability of different types of gloves

Several types of gloves are available today that offers protection against different types of hazards and the multi-functionality of these gloves makes them useful in a wide range of applications. Depending upon the type of work or industry variety of gloves are available in market such as disposable gloves, which are most commonly used in the healthcare, food & beverages, and laboratories sectors and protective gloves, which are mainly used in the construction, electronics, automotive sectors etc. because they can tolerate high thermal temperature, resist abrasion and durable.

Restraints:

- Arising skin-related issues

Gloves are one of the most common safety gear used in various industries but on the other hand gloves do have some disadvantages which are hampering the growth of the gloves market. There is a possibility that cornstarch powder used in latex gloves may cause allergies or sensitivities. Latex gloves are most commonly used in the healthcare sector. There is a higher risk that workers in the healthcare sector will suffer serious allergic reactions to latex, about 1 in 10 healthcare workers will be affected by latex allergies.

Opportunities:

- Increased demand for gloves during the COVID-19 pandemic

The sudden outbreak of COVID-19 globally positively impacts the gloves market as the demand for gloves especially disposable gloves increases in the healthcare sector. During the pandemic demand for gloves increases along with PPE kits and disposable face masks, as gloves provides protection against the coronavirus because it helps the healthcare workers to avoid coming in direct contact with the patients. Gloves offer protection to our hands by creating a barrier between the outer environment and hand. Moreover, in the medical industry, disposable gloves are in high demand for use in hospitals, vets, and dental offices to maintain a safe and hygienic environment throughout the diagnosis and treatment procedures. Post-COVID-19 people become more aware about the benefits of gloves in various sectors.

Challenges:

- Advanced automation and technology

Various operations will limit the demand for personal protective equipment, including industrial gloves because robots have takeover the manufacturing process in so many industries as a result of which the manpower is limited in some areas of the manufacturing industry. The increasing demand for high-tech machineries and robots in the place of humans are affecting the growth of gloves market as the demand for gloves is reduced due to high-tech machineries in the end user industries. Continuous technical development in the manufacturing sectors is one of the major challenges which is hampering the growth of the glove market.

Segmentation Analysis:

The global gloves market has been segmented based on material, product, end user and regions.

By Material

The material segment includes polyethylene, natural rubber, neoprene, vinyl and nitrile. The nitrile segment led the largest share of the gloves market with a market share of around 30.3% in 2021. Due to their latex-free nature, nitrile gloves are preferred among people with latex allergies since the potential for allergic reactions is reduced. However, market players are focusing on developing innovative nitrile gloves that are more affordable and operable. The rising demand for nitrile gloves from various end users propels the growth of the gloves market in the Projection period.

By Product

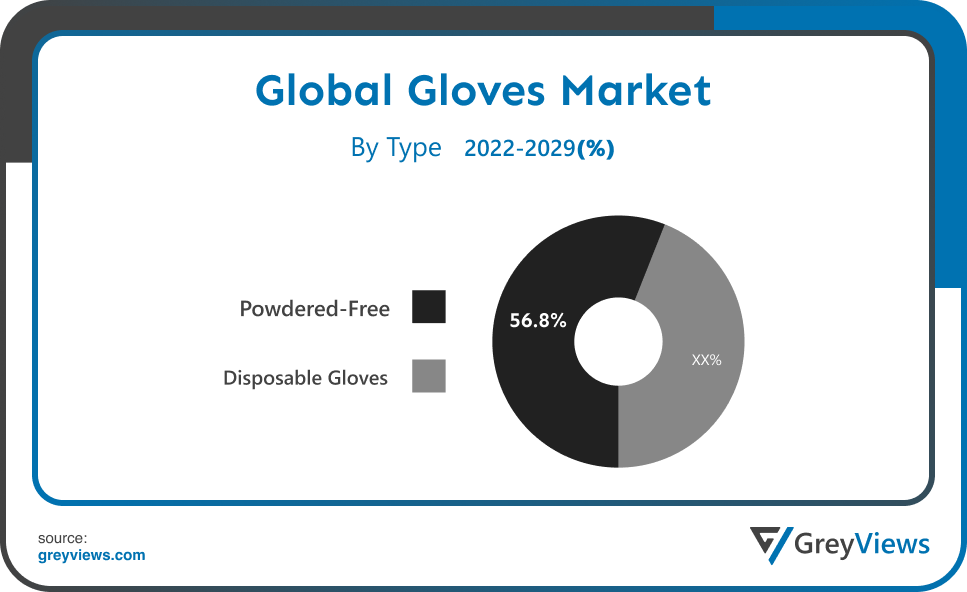

The product segment includes powder-free and powdered. The powder-free segment led the gloves market with a market share of around 56.8% in 2021. Several governments are expected to establish stricter regulations concerning powdered gloves in the coming years, which is expected to positively impact the powder-free gloves market growth. It is projected that powder-free gloves will continue to be popular across several industries, including chemical, medical, and the food processing industry.

By Type

The type segment includes protective gloves and disposable gloves. The powdered-free segment led the gloves market with a market share of around 56.8% in 2021. Several governments are expected to establish stricter regulations concerning powdered gloves in the coming years, which is expected to positively impact the powder-free gloves market growth. It is projected that powder-free gloves will continue to be popular across several industries, including chemical, medical, and the food processing industry.

By End-User

The end user segment includes food & beverage, medical & healthcare, automotive, electronics, construction and others. The medical & healthcare segment led the gloves market with a market share of around 23.8% in 2021. The demand for gloves used by healthcare professionals around the world to limit contact with infected patients and for examinations and testing driving the gloves market. Also, they offer protection against blood-borne pathogens, germ transmission on the job, and other environmental contaminants associated with blood-borne pathogens.

Global Gloves Market- Sales Analysis.

The sale of gloves market expanded at a CAGR of 8.5% from 2015 to 2021.

Workers' safety and security at work are expected to fuel industry expansion over the Projection period due to stringent laws and significant costs associated with workplace hazards. The ongoing COVID-19 epidemic and the expanding public awareness of healthcare-associated diseases are projected to drive the market growth for disposable gloves, particularly in the healthcare sector. Several causes, including rising investments in the public and private sectors, rising population, a large influx of migrants, and an increasing senior population, are expected to contribute to the substantial growth of the healthcare industry in major developing economies. Additionally, it is anticipated that rising healthcare costs would accelerate the expansion of the healthcare industry, which will in turn increase demand for disposable gloves.

The United States advanced healthcare infrastructure, patients' increased disposable income levels, and a sizable elderly population are some of the key factors driving the disposable glove market. In addition, the COVID-19 pandemic's spread throughout the nation has increased the demand for disposable gloves, particularly in the healthcare industry. One of the main causes of health problems among workers has been exposed to dangerous chemicals while working in certain industries. Bloodborne infections, hand wounds, skin disorders, rashes, and amputation are some of the frequent concerns encountered in various industries, including healthcare, medicine, and mining. The primary drivers projected to drive the market throughout the Projection period are probably safety regulations.

Thus, owing to the aforementioned factors, the global Gloves Market is expected to grow at a CAGR of 8.7% during the Projection period from 2022 to 2029.

By Regional Analysis:

The regions analyzed for the gloves market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Europe region dominated the gloves market and held the 38.2% share of the market revenue in 2021.

- The Europe region witnessed a major share. The increase in health awareness and income have led to a greater adoption of disposable gloves in the region, contributing to the growth of the market as a whole. While performing surgeries and undergoing medical diagnosis, disposable medical gloves are the best method of protecting against infections

- Asia Pacific is anticipated to experience significant growth during the predicted period. There are a number of applications where natural rubber disposable gloves provide superior performance and protection, including healthcare, food processing, sanitation, pharmaceuticals, and automotive sectors. A positive impact on the industry growth is also expected to be provided by improved hygiene standards across healthcare settings in developing countries, along with rapid industrialization.

Global Gloves Market- Country Analysis:

- Germany

Germany's gloves market size was valued at USD 6.5 billion in 2021 and is expected to reach USD 12.9 billion by 2029, at a CAGR of 8.9% from 2022 to 2029. As the country suffers from one of the highest cancer rates in the world, medical tests and procedures will be in high demand, impacting sales of personal protective equipment, including medical gloves.

- China

China gloves market size was valued at USD 6.6 billion in 2021 and is expected to reach USD 13.0 billion by 2029, at a CAGR of 9.1% from 2022 to 2029. One of the biggest buyers of international LPG is China. The increase in measures by the top authorities to offer incentives, start-up subsidies, and distribution licenses to encourage increased consumption and usage of LPG fuels, particularly in the transportation sector, would speed up market expansion throughout the projection period.

- India

India's gloves market size was valued at USD 5.8 billion in 2021 and is expected to reach USD 9.7 billion by 2029, at a CAGR of 8.95% from 2022 to 2029. A growing number of end users and the increase in safety and hygiene concerns are driving India's gloves market. Indian disposable glove manufacturers are expected to gain lucrative opportunities in the healthcare and food industries shortly as the healthcare sector and food industry grow.

Key Industry Players Analysis:

To increase their market position in the global gloves business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Midas Safety

- 3M

- Lakeland Inc.,

- MCR Safety

- Honeywell International Inc.,

- ANSELL LTD.,

- DELTA PLUS

- Kossan Rubber Industries Bhd

- Superior Glove

- Kimberly-Clark Worldwide, Inc.,

- Cardinal Health

- VIP GLOVE SDN BHD

- Hartlega Holding

- Shamrock Manufacturing Co. Inc.,

- Semperit AG Holding

Latest Development:

- In September 2021, In Ohio, American Nitrile opened a facility to manufacture latex-free nitrile gloves for government, healthcare, and industrial applications.

- In March 2019, there is a new nitrile exam glove provided by Ansell called MICROFLEX MidKnight XTRA that offers the added benefit of covering the wrist and forearm.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

8.7% |

|

Market Size |

7.4 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Material, By Product, By Type, By End-User and By Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Midas Safety, 3M, Lakeland Inc., MCR Safety, Honeywell International Inc., ANSELL LTD., DELTA PLUS, Kossan Rubber Industries Bhd, Superior Glove, Kimberly-Clark Worldwide, Inc., Cardinal Health, VIP GLOVE SDN BHD, Hartlega Holding, Shamrock Manufacturing Co. Inc., and Semperit AG Holding. |

|

By Material |

|

|

By Product |

|

|

By Type |

|

|

By End-User |

|

|

Regional scope |

|

Scope of the Report

Global Gloves Market by Material:

- Polyethylene

- Natural Rubber

- Neoprene

- Vinyl

- Nitrile

Global Gloves Market by Product

- Powder-Free

- Powdered

Global Gloves Market by Type:

- Protective Gloves

- Disposable Gloves

Global Gloves Market By End-User:

- Food & Beverage

- Medical & Healthcare

- Automotive

- Electronics

- Construction

- Others

Global Gloves Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the expected market size of the Gloves market in 2029?

Global Gloves market is expected to reach USD 14.5 billion by 2029, at a CAGR of 8.7% from 2022 to 2029.

What is the CAGR of the Gloves market?

The Gloves market is projected to have a CAGR of 8.7%.

What is the application segment of the Gloves market?

On the basis of product, the Gloves market is segmented into animal Powder-Free and Powdered.

What is the breakup of the global Gloves market based on material?

Based on raw material, the global Gloves market has been segmented into Polyethylene, Natural Rubber, Neoprene, Vinyl and Nitrile.

Which are the leading market players active in the Gloves market?

Leading market players active in the global Gloves market are Midas Safety, 3M, Lakeland Inc., MCR Safety, Honeywell International Inc., ANSELL LTD., DELTA PLUS, Kossan Rubber Industries Bhd, Superior Glove, Kimberly-Clark Worldwide, Inc., Cardinal Health among others.

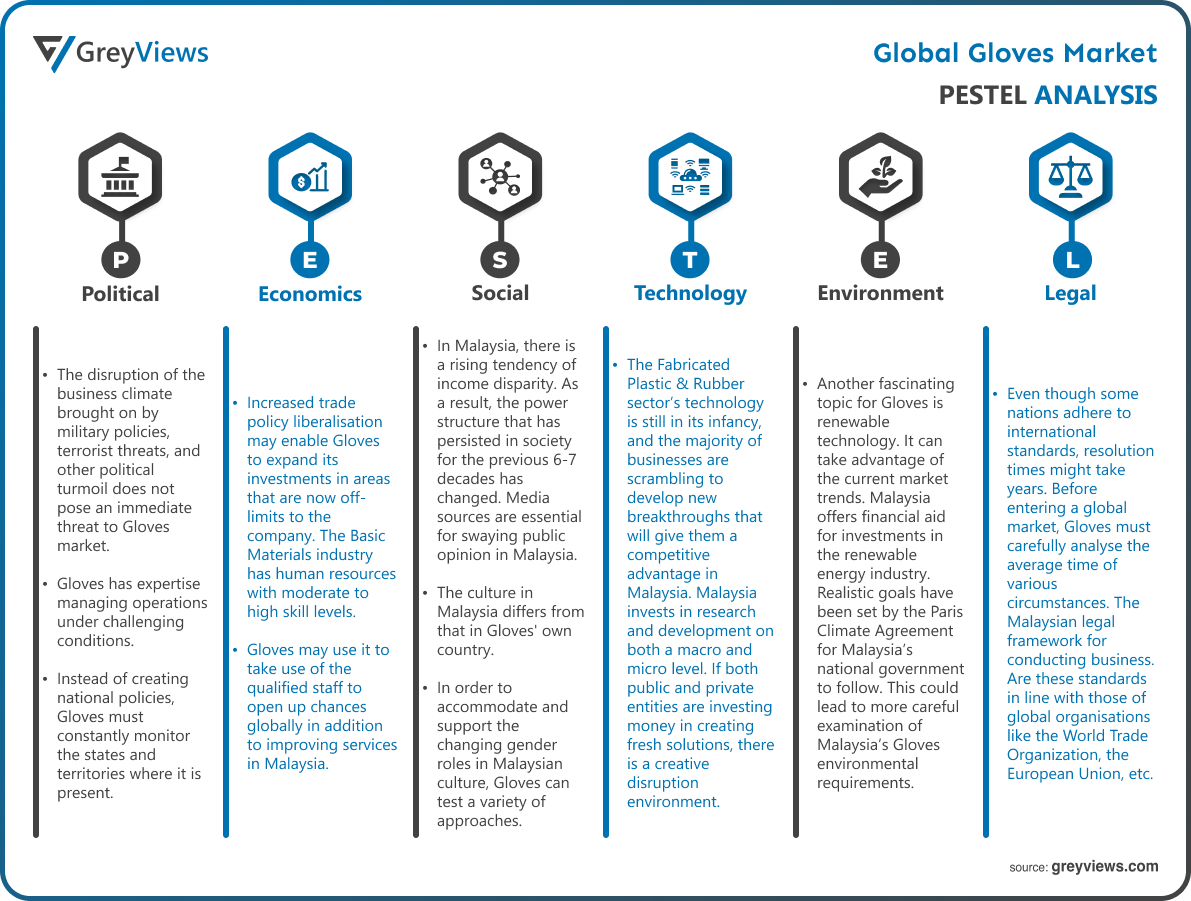

Political Factors- The disruption of the business climate brought on by military policies, terrorist threats, and other political turmoil does not pose an immediate threat to Gloves market. Gloves has expertise managing operations under challenging conditions. Other players including non-governmental organisations, pressure & protest groups, and activist movements are crucial to policymaking. In order to more effectively support both business aims and community goals. Gloves should work closely with these groups. In contrast to most other nations, the local governments are vital to the creation of laws and policies. Instead of creating national policies, Gloves must constantly monitor the states and territories where it is present.

Economical Factors- Increased trade policy liberalisation may enable Gloves to expand its investments in areas that are now off-limits to the company. The Basic Materials industry has human resources with moderate to high skill levels. Gloves may use it to take use of the qualified staff to open up chances globally in addition to improving services in Malaysia. Government intervention in the Fabricated Plastic & Rubber industry, a subsector of Basic Materials, may have an effect on Malaysia’s Gloves industry.

Social Factor- In Malaysia, there is a rising tendency of income disparity. As a result, the power structure that has persisted in society for the previous 6-7 decades has changed. Media sources are essential for swaying public opinion in Malaysia. In Malaysia, both conventional and social media are expanding quickly. This trend can help Gloves sell and position its goods more effectively. The culture in Malaysia differs from that in Gloves' own country. To better service the clients in Malaysia, it should work to assemble a local workforce that is familiar with the cultural norms and attitudes. In Malaysia, gender roles are changing. In order to accommodate and support the changing gender roles in Malaysian culture, Gloves can test a variety of approaches.

Technological Factors- The Fabricated Plastic & Rubber sector’s technology is still in its infancy, and the majority of businesses are scrambling to develop new breakthroughs that will give them a competitive advantage in Malaysia. Malaysia invests in research and development on both a macro and micro level. If both public and private entities are investing money in creating fresh solutions, there is a creative disruption environment. The life cycle of a product has been reduced, and suppliers may now create new goods more quickly. This has put pressure on Gloves’ marketing department to promote a variety of products in order to satisfy the suppliers. It has increased the Gloves’ operating expenses.

Environmental Factors- Another fascinating topic for Gloves is renewable technology. It can take advantage of the current market trends. Malaysia offers financial aid for investments in the renewable energy industry. Realistic goals have been set by the Paris Climate Agreement for Malaysia’s national government to follow. This could lead to more careful examination of Malaysia’s Gloves environmental requirements. Customer awareness has also elevated environmental concerns to the forefront of Gloves’ marketing approach. Customers anticipate Gloves to uphold and surpass regulatory requirements in order to play a responsible role in the community. The expense of running the Gloves is further increased by frequent inspection by environmental officials.

Legal Factors- Even though some nations adhere to international standards, resolution times might take years. Before entering a global market, Gloves must carefully analyse the average time of various circumstances. The Malaysian legal framework for conducting business. Are these standards in line with those of global organisations like the World Trade Organization, the European Union, etc. The severity of environmental regulations in Malaysia and what Gloves must do to comply. Malaysian standards for health and safety, what Gloves must do to comply, and how much it will cost to comply.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Material

- 3.2. Market Attractiveness Analysis By Product

- 3.3. Market Attractiveness Analysis By Type

- 3.4. Market Attractiveness Analysis By End-User

- 3.5. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Availability of different types of gloves

- 3. Restraints

- 3.1. Arising skin-related issues

- 4. Opportunities

- 4.1. Increased demand for gloves during the COVID-19 pandemic

- 5. Challenges

- 5.1. Advanced automation and technology

- Global Gloves Market Analysis and Projection, By Material

- 1. Segment Overview

- 2. Polyethylene

- 3. Natural Rubber

- 4. Neoprene

- 5. Vinyl

- 6. Nitrile

- Global Gloves Market Analysis and Projection, By Product

- 1. Segment Overview

- 2. Powder-Free

- 3. Powdered

- Global Gloves Market Analysis and Projection, By Type

- 1. Segment Overview

- 2. Protective Gloves

- 3. Disposable Gloves

- Global Gloves Market Analysis and Projection, By End-User

- 1. Segment Overview

- 2. Food & Beverage

- 3. Medical & Healthcare

- 4. Automotive

- 5. Electronics

- 6. Construction

- 7. Others

- Global Gloves Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- South America

- 5.1. Brazil

- Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Gloves Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Gloves Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Midas Safety

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- 3M

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Lakeland Inc.,

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- MCR Safety

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Honeywell International Inc.,

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- ANSELL LTD.,

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- DELTA PLUS

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Kossan Rubber Industries Bhd

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Superior Glove

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Kimberly-Clark Worldwide, Inc.,

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Cardinal Health

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- VIP GLOVE SDN BHD

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Hartlega Holding

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Shamrock Manufacturing Co. Inc.,

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Semperit AG Holding

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Midas Safety

List of Table

- Global Gloves Market, By Material, 2021–2029 (USD Billion)

- Global Polyethylene, Gloves Market, By Region, 2021–2029 (USD Billion)

- Global Natural Rubber, Gloves Market, By Region, 2021–2029 (USD Billion)

- Global Neoprene, Gloves Market, By Region, 2021–2029 (USD Billion)

- Global Vinyl, Gloves Market, By Region, 2021–2029 (USD Billion)

- Global Nitrile, Gloves Market, By Region, 2021–2029 (USD Billion)

- Global Gloves Market, By Product, 2021–2029 (USD Billion)

- Global Powder-Free, Gloves Market, By Region, 2021–2029 (USD Billion)

- Global Powdered, Gloves Market, By Region, 2021–2029 (USD Billion)

- Global Gloves Market, By Type, 2021–2029 (USD Billion)

- Global Protective Gloves, Gloves Market, By Region, 2021–2029 (USD Billion)

- Global Disposable Gloves, Gloves Market, By Region, 2021–2029 (USD Billion)

- Global Gloves Market, By End-User, 2021–2029 (USD Billion)

- Global Food & Beverage, Gloves Market, By Region, 2021–2029 (USD Billion)

- Global Medical & Healthcare, Gloves Market, By Region, 2021–2029 (USD Billion)

- Global Automotive, Gloves Market, By Region, 2021–2029 (USD Billion)

- Global Electronics, Gloves Market, By Region, 2021–2029 (USD Billion)

- Global Construction, Gloves Market, By Region, 2021–2029 (USD Billion)

- Global Others, Gloves Market, By Region, 2021–2029 (USD Billion)

- Global Gloves Market, By Region, 2021–2029 (USD Billion)

- North America Gloves Market, By Material, 2021–2029 (USD Billion)

- North America Gloves Market, By Product, 2021–2029 (USD Billion)

- North America Gloves Market, By Type, 2021–2029 (USD Billion)

- North America Gloves Market, By End-User, 2021–2029 (USD Billion)

- USA Gloves Market, By Material, 2021–2029 (USD Billion)

- USA Gloves Market, By Product, 2021–2029 (USD Billion)

- USA Gloves Market, By Type, 2021–2029 (USD Billion)

- USA Gloves Market, By End-User, 2021–2029 (USD Billion)

- Canada Gloves Market, By Material, 2021–2029 (USD Billion)

- Canada Gloves Market, By Product, 2021–2029 (USD Billion)

- Canada Gloves Market, By Type, 2021–2029 (USD Billion)

- Canada Gloves Market, By End-User, 2021–2029 (USD Billion)

- Mexico Gloves Market, By Material, 2021–2029 (USD Billion)

- Mexico Gloves Market, By Product, 2021–2029 (USD Billion)

- Mexico Gloves Market, By Type, 2021–2029 (USD Billion)

- Mexico Gloves Market, By End-User, 2021–2029 (USD Billion)

- Europe Gloves Market, By Material, 2021–2029 (USD Billion)

- Europe Gloves Market, By Product, 2021–2029 (USD Billion)

- Europe Gloves Market, By Type, 2021–2029 (USD Billion)

- Europe Gloves Market, By End-User, 2021–2029 (USD Billion)

- Germany Gloves Market, By Material, 2021–2029 (USD Billion)

- Germany Gloves Market, By Product, 2021–2029 (USD Billion)

- Germany Gloves Market, By Type, 2021–2029 (USD Billion)

- Germany Gloves Market, By End-User, 2021–2029 (USD Billion)

- France Gloves Market, By Material, 2021–2029 (USD Billion)

- France Gloves Market, By Product, 2021–2029 (USD Billion)

- France Gloves Market, By Type, 2021–2029 (USD Billion)

- France Gloves Market, By End-User, 2021–2029 (USD Billion)

- UK Gloves Market, By Material, 2021–2029 (USD Billion)

- UK Gloves Market, By Product, 2021–2029 (USD Billion)

- UK Gloves Market, By Type, 2021–2029 (USD Billion)

- UK Gloves Market, By End-User, 2021–2029 (USD Billion)

- Italy Gloves Market, By Material, 2021–2029 (USD Billion)

- Italy Gloves Market, By Product, 2021–2029 (USD Billion)

- Italy Gloves Market, By Type, 2021–2029 (USD Billion)

- Italy Gloves Market, By End-User, 2021–2029 (USD Billion)

- Spain Gloves Market, By Material, 2021–2029 (USD Billion)

- Spain Gloves Market, By Product, 2021–2029 (USD Billion)

- Spain Gloves Market, By Type, 2021–2029 (USD Billion)

- Spain Gloves Market, By End-User, 2021–2029 (USD Billion)

- Asia Pacific Gloves Market, By Material, 2021–2029 (USD Billion)

- Asia Pacific Gloves Market, By Product, 2021–2029 (USD Billion)

- Asia Pacific Gloves Market, By Type, 2021–2029 (USD Billion)

- Asia Pacific Gloves Market, By End-User, 2021–2029 (USD Billion)

- Japan Gloves Market, By Material, 2021–2029 (USD Billion)

- Japan Gloves Market, By Product, 2021–2029 (USD Billion)

- Japan Gloves Market, By Type, 2021–2029 (USD Billion)

- Japan Gloves Market, By End-User, 2021–2029 (USD Billion)

- China Gloves Market, By Material, 2021–2029 (USD Billion)

- China Gloves Market, By Product, 2021–2029 (USD Billion)

- China Gloves Market, By Type, 2021–2029 (USD Billion)

- China Gloves Market, By End-User, 2021–2029 (USD Billion)

- India Gloves Market, By Material, 2021–2029 (USD Billion)

- India Gloves Market, By Product, 2021–2029 (USD Billion)

- India Gloves Market, By Type, 2021–2029 (USD Billion)

- India Gloves Market, By End-User, 2021–2029 (USD Billion)

- South America Gloves Market, By Material, 2021–2029 (USD Billion)

- South America Gloves Market, By Product, 2021–2029 (USD Billion)

- South America Gloves Market, By Type, 2021–2029 (USD Billion)

- South America Gloves Market, By End-User, 2021–2029 (USD Billion)

- Brazil Gloves Market, By Material, 2021–2029 (USD Billion)

- Brazil Gloves Market, By Product, 2021–2029 (USD Billion)

- Brazil Gloves Market, By Type, 2021–2029 (USD Billion)

- Brazil Gloves Market, By End-User, 2021–2029 (USD Billion)

- Middle East and Africa Gloves Market, By Material, 2021–2029 (USD Billion)

- Middle East and Africa Gloves Market, By Product, 2021–2029 (USD Billion)

- Middle East and Africa Gloves Market, By Type, 2021–2029 (USD Billion)

- Middle East and Africa Gloves Market, By End-User, 2021–2029 (USD Billion)

- UAE Gloves Market, By Material, 2021–2029 (USD Billion)

- UAE Gloves Market, By Product, 2021–2029 (USD Billion)

- UAE Gloves Market, By Type, 2021–2029 (USD Billion)

- UAE Gloves Market, By End-User, 2021–2029 (USD Billion)

- South Africa Gloves Market, By Material, 2021–2029 (USD Billion)

- South Africa Gloves Market, By Product, 2021–2029 (USD Billion)

- South Africa Gloves Market, By Type, 2021–2029 (USD Billion)

- South Africa Gloves Market, By End-User, 2021–2029 (USD Billion)

List of Figures

- Global Gloves Market Segmentation

- Gloves Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Gloves Market Attractiveness Analysis By Material

- Global Gloves Market Attractiveness Analysis By Product

- Global Gloves Market Attractiveness Analysis By Type

- Global Gloves Market Attractiveness Analysis By End-User

- Global Gloves Market Attractiveness Analysis By Region

- Global Gloves Market: Dynamics

- Global Gloves Market Share By Material (2021 & 2029)

- Global Gloves Market Share By Product (2021 & 2029)

- Global Gloves Market Share By Type (2021 & 2029)

- Global Gloves Market Share By End-User (2021 & 2029)

- Global Gloves Market Share by Regions (2021 & 2029)

- Global Gloves Market Share by Company (2020)