Head-up Display Market Size by Component (Video generators, Projectors/Projection Units, Display units, Software, and Other), Type (Conventional head-up display and Augmented Reality (AR)-based head-up display), Application (Aviation and Automotive), Regions, Segmentation, and Projection till 2029

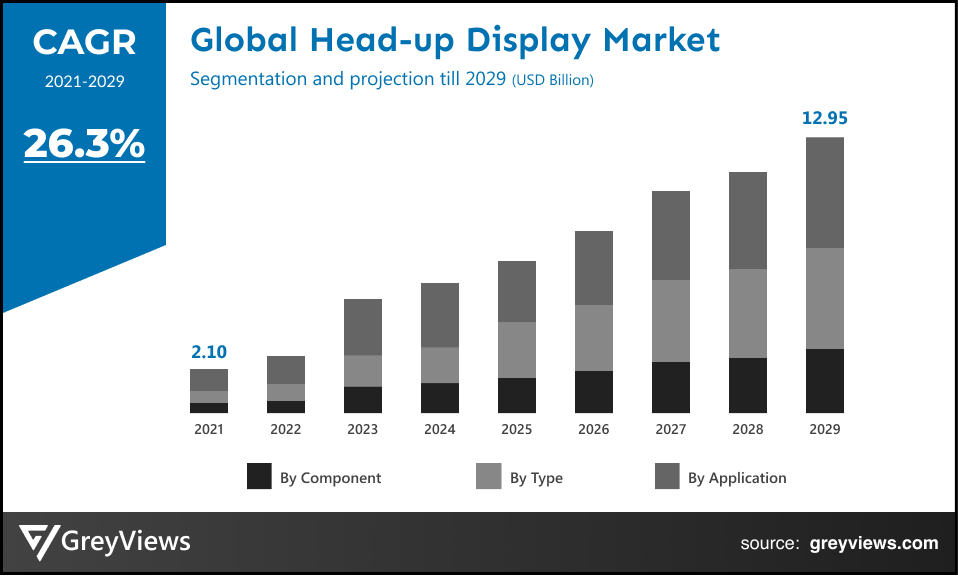

CAGR: 26.3%Current Market Size: USD 2.10 BillionFastest Growing Region: APAC

Largest Market: EuropeProjection Time: 2022-2029Base Year: 2021

Global Head-Up Display- Market Overview

The global head-up display market is expected to grow from USD 2.10 billion in 2021 to USD 12.95 billion by 2029, at a CAGR of 26.3% during the Projection period 2022-2029. Growing production of aircraft and increased awareness about vehicle and passenger safety have primarily driven the growth of the global head-up display market.

Head-up display (HUD) appears in the pilot's or driver's line of sight to provide the information which is displayed on the windscreen or other transparent panel. These solutions were originally designed to enable pilots to have access to relevant information with no need to look down at their instrument panel, hence reducing the distraction. It provides pilots with flight data symbology on a transparent combiner glass while allowing them to observe the out-the-window view.

On the other hand, the HUD in-car enables drivers to get important information such as warning signals, speed, and indicator arrows for navigation with no need to look down to the secondary display or the instrument cluster. It improves safety by enhancing the interaction between the driver and the vehicle on the road. It is widely being installed in commercial vehicles as well as passenger cars to enable the driver to access information, such as warning signals, speed, and indicators for navigation.

Request Sample:- Head-Up Display Market

Market Dynamics:

Drivers:

- Increasing sales of automobiles

According to the data released by the Federation of Automobile Dealers Associations (FADA) in India, retail sales of vehicles increased by 7% in the financial year 2021-22 as compared with the previous year. In addition, increased purchasing power increased population, and the rising standard of living all over the globe has driven sales of automobiles. This growth in sales of automobiles is fueling demand for head-up display which is a transparent display mounted on to the dashboard of the cars. In addition, several automobile manufacturers are offering head-up displays according to the driver's choice of the car's operational parameters in a format that's easy to read and see.

- Demand for connected vehicles

The growing tech-savvy population around the globe has led to an upsurge in demand for advanced connected features in vehicles. These vehicles use a multitude of sensors, such as radar, ultrasonic sensors, cameras, LIDAR, and vehicle motion sensors to safely transport goods and passengers. For instance, according to McKinsey’s 2020 consumer survey on autonomous driving, connectivity, electrification, and shared mobility (ACES), by 2030, about 95% of new vehicles sold globally will be connected. Head-up displays are the prominent component of connected vehicles; hence, demand for connected vehicles fuels the growth of the global market.

Restraints:

- Space restrictions in automotive cockpits

The automotive cockpits are continuing to evolve as more advanced technologies enter the interior in preparation for modern vehicles. However, the head-up display has large space requirements in the automotive cockpit. Therefore, considerable efforts are being made to re-design automotive cockpits due to significant space occupied by head-up displays. Hence, space restrictions in automotive cockpits may hamper the growth of the market to some extent.

Opportunities:

- The emergence of AR-based head-up displays

The augmented reality (AR) head-up displays (HUD) is helping to make driving even more safe and more comfortable. In the increasingly complex world, the emergence of AR-HUD has enabled autonomous driving mode by providing the reassurance to the driver that the vehicle is in control, is aware of its surroundings, and is able to take appropriate actions whenever needed. On the other hand, the market players are introducing new AR-HUD products, creating lucrative growth opportunities for the market. For instance, Huawei launched AR HUD technology for cars which is an AR-based system empowering a heads-up display that turns a car’s front windshield into a smart screen.

Challenges

- High cost of HUDs

HUDs are yet to be widely accepted and are still in the developing stage. It is mostly being used in luxury vehicles such as BMW and Mercedes-Benz due to its high price. In addition, these systems require a high cost of production; hence, less number of manufacturers are entering the market. HUDs costs about $1,000 for automotive OEMs. Hence, the high cost of HUDs is expected to pose considerable challenges to market growth.

Segmentation Analysis:

The global head-up display market has been segmented based on components, types, applications, and regions.

By Component

The component offering segment includes video generators, projectors/projection units, display units, software, and others. The video generators segment led the head-up display market with a market share of around 30.1% in 2021. Video generator is used for displaying video as well as real-time developments both outside the vehicle and in the vehicle. The growth of this segment is mainly driven by the need for real-time situation projection along with the high-quality picture and video images in HUDs. In addition, the ongoing technological advancements in HUD technology is projected to fuel demand for video generators in automotive HUDs.

By Type

The type segment includes a conventional head-up display and an augmented reality (AR)-based head-up display. The conventional head-up display segment led the head-up display market with a market share of around 67.21% in 2021. This is attributed to the increased penetration of conventional head-up display technology in the automotive sector. In addition, these displays are being equipped with satellite navigation technology to allow the adjustment of the brightness level of displays during the daytime and night, as well as display the images in different colors. Such advancements in the conventional head-up display are further projected to boost the growth of this segment.

By Application

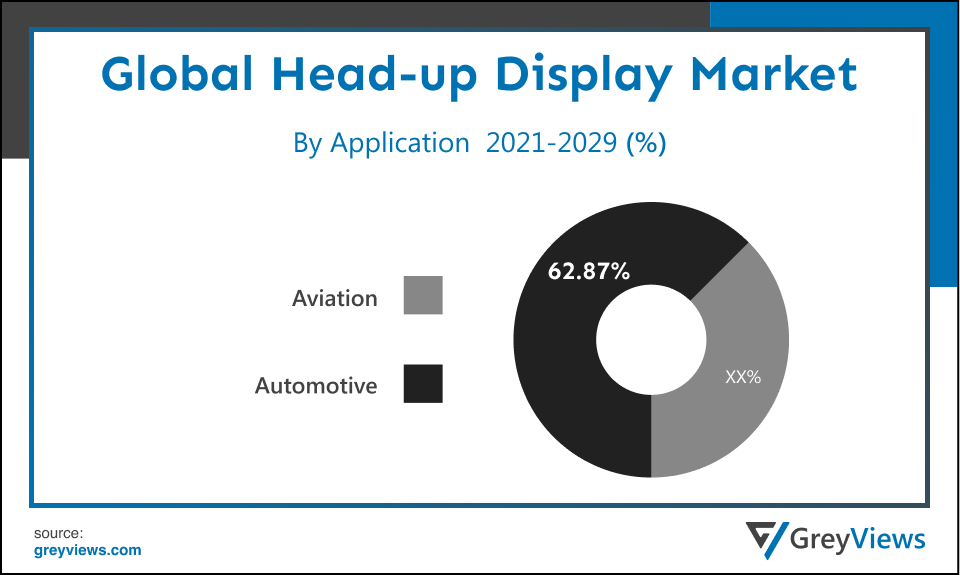

The application segment includes aviation and automotive. The automotive segment led the head-up display market with a market share of around 62.87% in 2021. Ongoing advancements in automotive design have primarily created a demand for head-up displays to reduce driver fatigue in managing vehicle information. These displays don’t require the driver to take their eyes off the road; hence, the ability to project information to a driver along with improved safety has driven the growth of this segment. In addition, the automotive industry players are creating innovative Head-Up Displays for vehicles, further boosting the growth of this segment. For instance, in June 2021, Hyundai created cluster less HUD, the new and innovative Head-Up Display (HUD) that will be integrated into the range of vehicles by Hyundai.

By Regional Analysis:

The regions analyzed for the head-up display market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. The Europe region dominated the head-up display market and held the 35.03% share of the market revenue in 2021.

- The Europe region witnessed a significant The growth of this region is mainly driven by the fact that Europe is considered the leading premium/luxury car-manufacturing region. For instance, the leading high-end car OEMs include Audi AG, BMW AG, Mercedes-Benz, Ferrari s.p.a, Bentley Motors Ltd., Skoda Auto, Maserati, and Bugatti Automobiles S.A.S, which are headquartered in Europe. In addition, the region has a significant presence of aircraft manufacturers such as BAE Systems, Dassault, and Airbus. The aforementioned factors contribute to the growth of Europe's head-up display market.

- Asia-Pacific is expected to witness the highest growth rate during the Projection period. A number of factors, such as growing investments in the defense and aviation sector and the increased sales of semi-autonomous vehicles in the region, have driven the growth of the Asia-Pacific head-up display market. In addition, the region is seeing massive growth in the automotive sector, creating lucrative growth opportunities for the market.

Global Head-up display Market- Country Analysis:

- Germany

Germany is one of the leading nations in the mechanical engineering, manufacturing, automotive, and electrical industries. In addition, the country is Europe's major automotive market, with over 25% of all passenger cars manufactured and about 20% of all new car registrations. Hence, demand for head-up display solutions in Germany drives the market's growth.Germany head-up display market size was valued at USD 0.17 billion in 2021, at a CAGR of 25.67% from 2022 to 2029.

- China

China head-up display market size was valued at USD 0.14 billion in 2021 and is expected to reach USD 0.77 billion by 2029, at a CAGR of 24.4% from 2022 to 2029. Rising disposable income in China has favored the demand for semi-autonomous vehicles. In addition, the military and aviation sector in the country is seeing considerable investment. For instance, according to estimates presented to the National People's Congress, the country will spend $229.47 billion on defense in 2022. The aforementioned factors are fueling the growth of the China head-up display market.

Moreover, China is the world’s largest light vehicle manufacturer. In addition, the country has seen a growing demand for luxury electric cars in recent years as it is a vastly populous nation and attracts significant investments from worldwide carmakers. This factor has further contributed to the growth of the China head-up display market.

- India

India head-up display market size was valued at USD 0.09 billion in 2021 and is expected to reach USD 0.59 billion by 2029, at a CAGR of 26.4% from 2022 to 2029. India is one of the strongest growing economies in Asia. In addition, the automotive industry in this country is worth more than $100 billion and contributes 8% of the country's total export, and accounts for 2.3% of the GDP of the country. Growth of the automotive sector has primarily driven demand for head-up displays.

Key Industry Players Analysis:

To increase their market position in the global head-up display business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- BAE Systems

- Continental AG

- Denso Corporation

- Elbit Systems Ltd.

- Nippon Seiki Co., Ltd.

- Panasonic Corporation

- Rockwell Collins

- STMicroelectronics

- Texas Instruments Incorporated

- Visteon Corporation

Latest Development:

In February 2022, Continental AG has developed a head-up display (HUD) for trams. This display solution is aimed at making intra-urban traffic safer and ensure that tram drivers focus their full attention on the road.

In February 2021, Hindustan Aeronautics Ltd (HAL) entered into an agreement with Elbit Systems Electro Optics Elop Ltd., Israel, for supply of Digital Overhead Head Up Display Systems (DOHS). On the other hand, in January 2021, Panasonic Automotive Systems of America (Panasonic Automotive) introduced a new Augmented Reality (AR) HUD.

Report Metrics

| Report Attribute | Details |

| Market size available for years | 2021-2029 |

| Base year considered | 2021 |

| CAGR (%) | 26.3% |

| Market Size | 2.10 billion in 2021 |

| Forecast period | 2022-2029 |

| Forecast unit | Value (USD) |

| Segments covered | Component, type, and application, and Regions |

| Report Scope | Revenue forecast, competitive landscape, company ranking, growth factors, and trends |

Companies covered | BAE Systems, Continental AG, Denso Corporation, Elbit Systems Ltd., Nippon Seiki Co., Ltd., Panasonic Corporation, Rockwell Collins, STMicroelectronics, Texas Instruments Incorporated, and Visteon Corporation among others |

| By Component |

|

By Type |

|

| By Application |

|

Regional scope |

|

Scope of the Report

Global Head-up Display Market by Component:

- Video Generators

- Projectors/Projection Units

- Display Units

- Software

- Others

Global Head-up Display Market by Type:

- Conventional head-up display

- Augmented Reality (AR)-based head-up display

Global Head-up Display Market by Application:

- Aviation

- Automotive

Global Head-up Display Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the Current Market Size of Global head-up display market?

The current market size of global head-up display market is USD 2.10 billion in 2021

What will be the market size of global head-up display market in 2029?

The Market size of global head-up display will be USD 12.95 billion by 2029, at a CAGR of 26.3%

Which Segment hold the large share in Head-Up Display Market?

The conventional head-up display segment led the head-up display market with a market share of around 67.21% in 2021

What is the Market size of China Head-Up Display Market?

China head-up display market size was valued at USD 0.14 billion in 2021 and is expected to reach USD 0.77 billion by 2029, at a CAGR of 24.4% from 2022 to 2029

What are the technological factors in Head-Up Display Market?

The augmented reality (AR) head-up displays (HUD) is helping to make driving even safer and more comfortable. In the increasingly complex world, the emergence of AR-HUD has enabled autonomous driving mode by providing the reassurance to the driver that the vehicle is in control, is aware of its surroundings, and is able to take appropriate actions whenever needed. On the other hand, the market players are introducing new AR-HUD products, creating lucrative growth opportunities for the market. For instance, Huawei launched AR HUD technology for cars which is an AR-based system empowering a heads-up display that turns a car�s front windshield into a smart screen.

What are the Economic factor of Head-Up Display Market?

HUDs are yet to be widely accepted and are still in the developing stage. It is mostly being used in luxury vehicles such as BMW and Mercedes-Benz due to its high price. In addition, these systems require a high cost of production; hence, a smaller number of manufacturers are entering the market. HUDs costs about $1,000 for automotive OEMs. Hence, the high cost of HUDs is expected to pose considerable challenges to market growth. The automotive industry in India is worth more than $100 billion and contributes 8% of the country's total export, and accounts for 2.3% of the GDP of the country. The growth of the automotive sector has primarily driven demand for head-up displays.

What are the legal factor of Head-up Display Market?

Hindustan Aeronautics Ltd (HAL) entered into an agreement with Elbit Systems Electro-Optics Elop Ltd., Israel, for the supply of Digital Overhead Head-Up Display Systems (DOHS). On the other hand, in January 2021, Panasonic Automotive Systems of America (Panasonic Automotive) introduced a new Augmented Reality (AR) HUD. Continental AG has developed a head-up display (HUD) for trams. This display solution is aimed at making intra-urban traffic safer and ensuring that tram drivers focus their full attention on the road

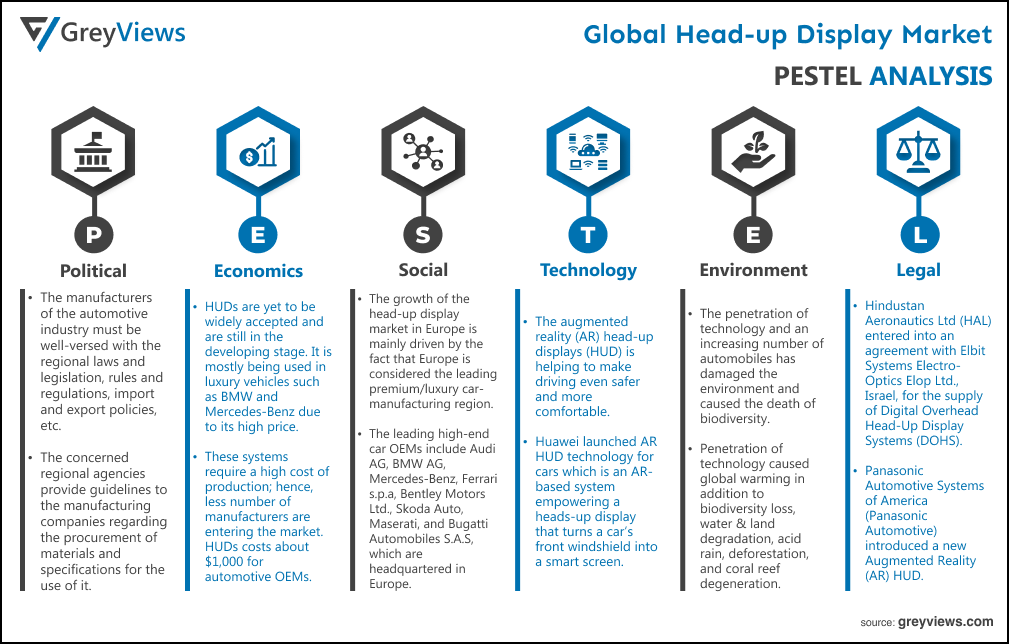

Political Factors- The manufacturers of the automotive industry must be well-versed with the regional laws and legislation, rules and regulations, import and export policies, etc. The concerned regional agencies provide guidelines to the manufacturing companies regarding the procurement of materials and specifications for the use of it. Not abiding by the rules and regulations is a punishable offense.

Economic Factors- HUDs are yet to be widely accepted and are still in the developing stage. It is mostly being used in luxury vehicles such as BMW and Mercedes-Benz due to its high price. In addition, these systems require a high cost of production; hence, a smaller number of manufacturers are entering the market. HUDs costs about $1,000 for automotive OEMs. Hence, the high cost of HUDs is expected to pose considerable challenges to market growth. The automotive industry in India is worth more than $100 billion and contributes 8% of the country's total export, and accounts for 2.3% of the GDP of the country. The growth of the automotive sector has primarily driven demand for head-up displays.

Social Factor- The growth of the head-up display market in Europe is mainly driven by the fact that Europe is considered the leading premium/luxury car-manufacturing region. For instance, the leading high-end car OEMs include Audi AG, BMW AG, Mercedes-Benz, Ferrari s.p.a, Bentley Motors Ltd., Skoda Auto, Maserati, and Bugatti Automobiles S.A.S, which are headquartered in Europe. In addition, the region has a significant presence of aircraft manufacturers such as BAE Systems, Dassault, and Airbus. The aforementioned factors contribute to the growth of Europe's head-up display market.

Technological Factors- The augmented reality (AR) head-up displays (HUD) is helping to make driving even safer and more comfortable. In the increasingly complex world, the emergence of AR-HUD has enabled autonomous driving mode by providing the reassurance to the driver that the vehicle is in control, is aware of its surroundings, and is able to take appropriate actions whenever needed. On the other hand, the market players are introducing new AR-HUD products, creating lucrative growth opportunities for the market. For instance, Huawei launched AR HUD technology for cars which is an AR-based system empowering a heads-up display that turns a car’s front windshield into a smart screen.

Environmental Factors- According to various studies, the penetration of technology and an increasing number of automobiles has damaged the environment and caused the death of biodiversity. Penetration of technology caused global warming in addition to biodiversity loss, water & land degradation, acid rain, deforestation, and coral reef degeneration. Hence, the aforementioned environmental concerns triggered by the automotive industry may pose significant challenges to market growth.

Legal Factors- Hindustan Aeronautics Ltd (HAL) entered into an agreement with Elbit Systems Electro-Optics Elop Ltd., Israel, for the supply of Digital Overhead Head-Up Display Systems (DOHS). On the other hand, in January 2021, Panasonic Automotive Systems of America (Panasonic Automotive) introduced a new Augmented Reality (AR) HUD. Continental AG has developed a head-up display (HUD) for trams. This display solution is aimed at making intra-urban traffic safer and ensuring that tram drivers focus their full attention on the road.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Component

- Market Attractiveness Analysis By Type

- Market Attractiveness Analysis By Application

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Increasing sales of automobiles

- Demand for connected vehicles

- Restrains

- Space restrictions in automotive cockpits

- Opportunities

- Emergence of AR-based head-up displays

- Challenges

- High cost of HUDs

- Global Head-up Display Market Analysis and Projection, By Component

- Segment Overview

- Video Generators

- Projectors/Projection Units

- Display Units

- Software

- Others

- Global Head-up display Market Analysis and Projection, By Type

- Segment Overview

- Conventional head-up display

- Augmented Reality (AR)-based head-up display

- Global Head-up display Market Analysis and Projection, By Application

- Segment Overview

- Aviation

- Automotive

- Global Head-up display Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Head-up Display Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Head-up Display Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Component Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- BAE Systems

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- Continental AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- Denso Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- Elbit Systems Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- Nippon Seiki Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- Panasonic Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- Rockwell Collins

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- STMicroelectronics

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- Texas Instruments Incorporated

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- Visteon Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- BAE Systems

List of Table

- Global Head-up display Market, By Component, 2021–2029(USD Billion)

- Global Video generators Market, By Region, 2021–2029(USD Billion)

- Global Projectors/Projection Units Market, By Region, 2021–2029(USD Billion)

- Global Display Units Market, By Region, 2021–2029(USD Billion)

- Global Software Market, By Region, 2021–2029(USD Billion)

- Global Others Market, By Region, 2021–2029(USD Billion)

- Global Head-up display Market, By Type, 2021–2029(USD Billion)

- Global Conventional head-up display Head-up display Market, By Region, 2021–2029(USD Billion)

- Global Augmented Reality (AR)-based head-up display Head-up display Market, By Region, 2021–2029(USD Billion)

- Global Head-up display Market, By Application, 2021–2029(USD Billion)

- Global Aviation Head-up display Market, By Region, 2021–2029(USD Billion)

- Global Automotive Application Head-up display Market, By Region, 2021–2029(USD Billion)

- Global Head-up display Market, By Region, 2021–2029(USD Billion)

- Global Head-up display Market, By North America, 2021–2029(USD Billion)

- North America Head-up display Market, By Component, 2021–2029(USD Billion)

- North America Head-up display Market, By Type, 2021–2029(USD Billion)

- North America Head-up display Market, By Application, 2021–2029(USD Billion)

- US Head-up display Market, By Component, 2021–2029(USD Billion)

- US Head-up display Market, By Type, 2021–2029(USD Billion)

- US Head-up display Market, By Application, 2021–2029(USD Billion)

- Canada Head-up display Market, By Component, 2021–2029(USD Billion)

- Canada Head-up display Market, By Type, 2021–2029(USD Billion)

- Canada Head-up display Market, By Application, 2021–2029(USD Billion)

- Mexico Head-up display Market, By Component, 2021–2029(USD Billion)

- Mexico Head-up display Market, By Type, 2021–2029(USD Billion)

- Mexico Head-up display Market, By Application, 2021–2029(USD Billion)

- Europe Head-up display Market, By Component, 2021–2029(USD Billion)

- Europe Head-up display Market, By Type, 2021–2029(USD Billion)

- Europe Head-up display Market, By Application, 2021–2029(USD Billion)

- Germany Head-up display Market, By Component, 2021–2029(USD Billion)

- Germany Head-up display Market, By Type, 2021–2029(USD Billion)

- Germany Head-up display Market, By Application, 2021–2029(USD Billion)

- France Head-up display Market, By Component, 2021–2029(USD Billion)

- France Head-up display Market, By Type, 2021–2029(USD Billion)

- France Head-up display Market, By Application, 2021–2029(USD Billion)

- UK Head-up display Market, By Component, 2021–2029(USD Billion)

- UK Head-up display Market, By Type, 2021–2029(USD Billion)

- UK Head-up display Market, By Application, 2021–2029(USD Billion)

- Italy Head-up display Market, By Component, 2021–2029(USD Billion)

- Italy Head-up display Market, By Type, 2021–2029(USD Billion)

- Italy Head-up display Market, By Application, 2021–2029(USD Billion)

- Spain Head-up display Market, By Component, 2021–2029(USD Billion)

- Spain Head-up display Market, By Type, 2021–2029(USD Billion)

- Spain Head-up display Market, By Application, 2021–2029(USD Billion)

- Asia Pacific Head-up display Market, By Component, 2021–2029(USD Billion)

- Asia Pacific Head-up display Market, By Type, 2021–2029(USD Billion)

- Asia Pacific Head-up display Market, By Application, 2021–2029(USD Billion)

- Japan Head-up display Market, By Component, 2021–2029(USD Billion)

- Japan Head-up display Market, By Type, 2021–2029(USD Billion)

- Japan Head-up display Market, By Application, 2021–2029(USD Billion)

- China Head-up display Market, By Component, 2021–2029(USD Billion)

- China Head-up display Market, By Type, 2021–2029(USD Billion)

- China Head-up display Market, By Application, 2021–2029(USD Billion)

- India Head-up display Market, By Component, 2021–2029(USD Billion)

- India Head-up display Market, By Type, 2021–2029(USD Billion)

- India Head-up display Market, By Application, 2021–2029(USD Billion)

- South America Head-up display Market, By Component, 2021–2029(USD Billion)

- South America Head-up display Market, By Type, 2021–2029(USD Billion)

- South America Head-up display Market, By Application, 2021–2029(USD Billion)

- Brazil Head-up display Market, By Component, 2021–2029(USD Billion)

- Brazil Head-up display Market, By Type, 2021–2029(USD Billion)

- Brazil Head-up display Market, By Application, 2021–2029(USD Billion)

- Middle East and Africa Head-up display Market, By Component, 2021–2029(USD Billion)

- Middle East and Africa Head-up display Market, By Type, 2021–2029(USD Billion)

- Middle East and Africa Head-up display Market, By Application, 2021–2029(USD Billion)

- UAE Head-up display Market, By Component, 2021–2029(USD Billion)

- UAE Head-up display Market, By Type, 2021–2029(USD Billion)

- UAE Head-up display Market, By Application, 2021–2029(USD Billion)

- South Africa Head-up display Market, By Component, 2021–2029(USD Billion)

- South Africa Head-up display Market, By Type, 2021–2029(USD Billion)

- South Africa Head-up display Market, By Application, 2021–2029(USD Billion)

List of Figures

- Global Head-up display Market Segmentation

- Head-up display Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Head-up display Market Attractiveness Analysis By Component

- Global Head-up display Market Attractiveness Analysis By Type

- Global Head-up display Market Attractiveness Analysis By Application

- Global Head-up display Market Attractiveness Analysis By Region

- Global Head-up display Market: Dynamics

- Global Head-up display Market Share By Component(2021 & 2029)

- Global Head-up display Market Share By Type(2021 & 2029)

- Global Head-up display Market Share By Application(2021 & 2029)

- Global Head-up display Market Share by Regions (2021 & 2029)

- Global Head-up display Market Share by Company (2020)