Industrial Coatings Market Size By Type (High Solids, Solvent, Powder, and Water), By Resin (Polyurethane, Fluoropolymers, Polyester, Acrylic, Alkyd, Epoxy, and Others), and By End-user (Automotive OEM, General Industrial, Construction, Marine, Aerospace, Wood, Packaging, and Others), Regions, Segmentation, and Projection till 2029

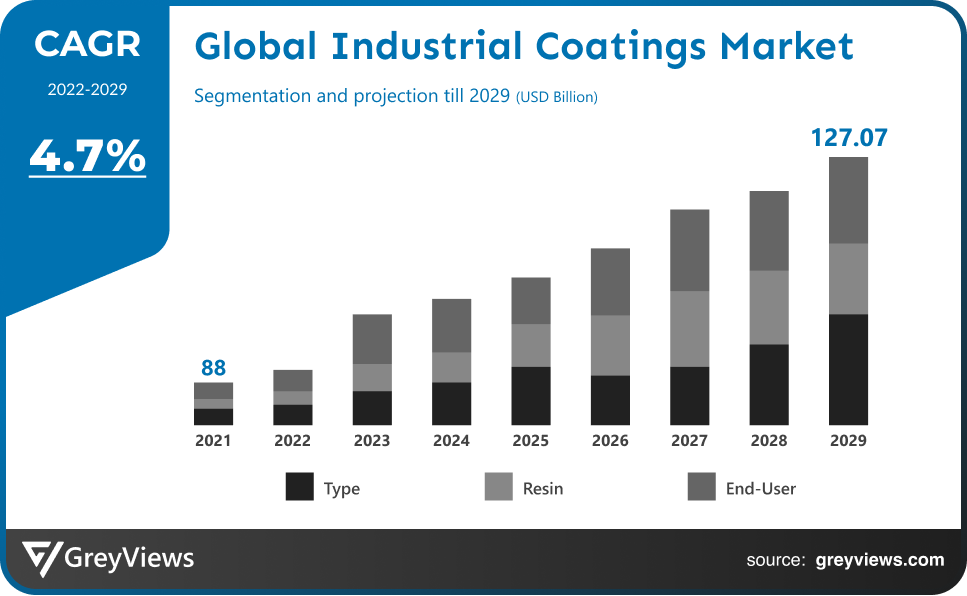

CAGR: 4.7%Current Market Size: USD 88 BillionFastest Growing Region: Europe

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Industrial Coatings Market- Market Overview:

The Global Industrial Coatings market is expected to grow from USD 88 billion in 2021 to USD 127.07 billion by 2029, at a CAGR of 4.7% during the Projection period 2022-2029. The growth of this market is mainly driven by increasing development in construction projects that are demanding efficient coating for concrete or steel.

Polymer materials are used in the production of industrial coatings to provide chemical protection, abrasion resistance, non-stick functionality, and corrosion resistance. The product's polymers offer excellent resistance to acids, bases, and chemical solvents. Superior aesthetics, durability, and environmental compliance are also provided by these coatings. These solutions are put over a primer, then sealed off. The substance is mostly utilised to prevent steel or concrete from rusting. These coatings, which increase materials' fire or water resistance, are available in powder, water-based, and electrocoating (or E-coating) varieties. Industrial coatings are utilised in a wide range of items, including building materials, automobiles, boats, transportation equipment, outdoor buildings and equipment, sporting goods, and agricultural and construction equipment. Since acrylic materials offer a high gloss and great corrosion resistance, they are frequently employed in automotive and architectural applications. On steel items, many zinc-based coatings are used. High corrosion resistance is provided by the polymeric and galvanic barrier that zinc offers. Epoxy provides outstanding corrosion, abrasion, and weathering characteristics. Additionally, resistant to extremely high temperatures are these solutions. The most popular type of resin in the industrial coatings market is acrylic. The principal designed metal derivative used in acrylic resin to improve the performance of industrial coatings. The simplicity of application, physical characteristics, and affordability of acrylic industrial coatings are its key advantages. Additionally, due to their quick drying capabilities, industrial coatings with an acrylic base offer outstanding physical qualities. They provide good moisture protection, a longer pot life than typical, and resistance to fungal. Numerous homes are choosing acrylic coating since it is ecologically benign as roof coatings become more and more popular.

Sample Request: - Global Industrial Coatings Market

Market Dynamics:

Drivers:

- Growing trends of automotive refinish coatings

In the world of auto refinishing, the introduction of driverless and electric vehicles is creating waves. Body shops are experiencing an increase in the complexity and cost of repairs as OEMs utilise ADAS (advanced driver-assistance systems) more often. This is due to the enormous effort needed to maintain and calibrate these systems in accordance with OEM requirements. New repair coatings are also required to handle light-weight multi-substrate cars while guaranteeing radar and LIDAR safety systems are not damaged by the push to lower total CO2 emission of vehicles through weight reduction and the usage of in-body sensors.

Restraints:

- Fluctuations in Raw Material Prices

The price of crude oil has been significantly influenced by the current pricing conflict between Saudi Arabia and Russia as well as the ongoing hostility between the United States and China. This battle was beneficial to many emerging nations, but it resulted in high pricing for large manufacturers and highly industrialised nations. The price of resins has been affected by the volatility in crude oil prices, which may lead to a rise in the cost of industrial coatings in the near future.

Opportunities:

- Tremendous advancements in the shipbuilding industry across APAC

China, South Korea, and Japan are leading the Chinese Association of Shipbuilding Industry (CASI), Asia Pacific, which has achieved significant strides in the shipbuilding sector. According to the study, China took the top spot globally, with new orders making up more over 33% of the world's shipbuilding market. Because of the extensive shipbuilding activity taking place in China, Japan, South Korea, the Philippines, and Taiwan, Asia Pacific will account for a large portion of the sector. For instance, in Europe, the demand for marine coatings continues to be strongest in the maritime hubs of Greece, Germany, and Norway. There is also a significant market in APAC, particularly in Japan, China, and Singapore. The need for marine coatings is rising globally due to the increasing demand for import and export via waterways.

Challenges:

- COVID-19 Impact

For industrial coatings, customer shutdowns, record declines in consumer spending, and a lack of capital expenditures are all trends that are negatively affecting the markets as a result of COVID-19 palindrome. The automotive and transportation markets have been significantly impacted within the broad spectrum of industrial segments.

Segmentation Analysis:

The global Industrial Coatings market has been segmented based on Type, Resin, End-user and Regions.

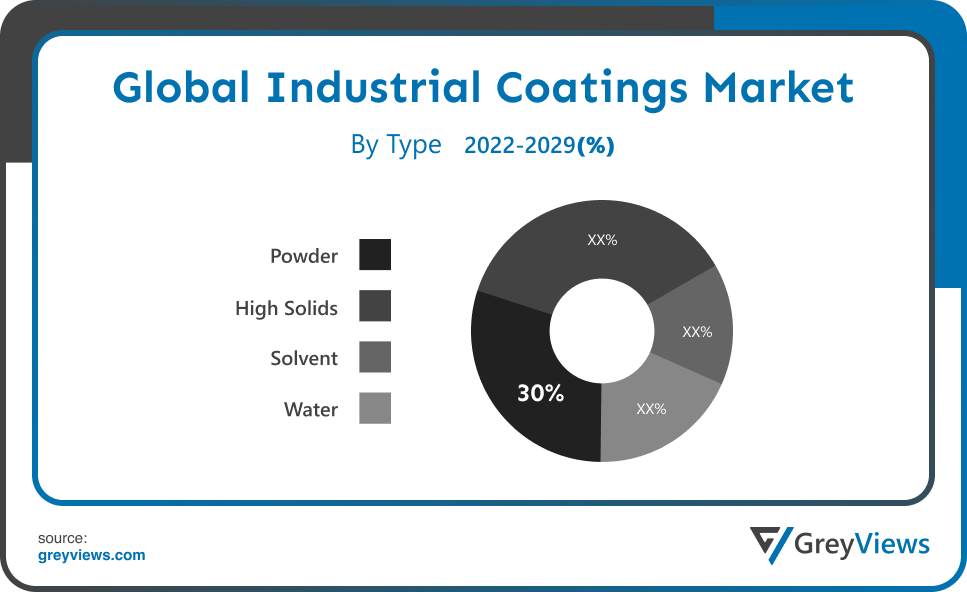

By Type

The type segment includes High Solids, Solvent, Powder, and Water. The Powder segment led the largest share of the Industrial Coatings market with a market share of around 30% in 2021. Finely ground pigment and resin particles are electrostatically charged and sprayed onto electrically grounded components as part of the dry finishing process known as powder coating. Powder-based industrial coatings deliver minimal VOC emission, enhanced performance, and cost efficiency for applications that need the greatest levels of abrasion resistance and hardness. These are the primary factors that, over the course of the Projection period, will fuel the expansion of the powder type segment in the worldwide market.

By Resin

The Resin segment includes Polyurethane, Fluoropolymers, Polyester, Acrylic, Alkyd, Epoxy, and Others. The Acrylic segment led the Industrial Coatings market with a market share of around 52% in 2021. Acrylic coatings are widely recognised and used in a variety of applications, including on structural steel, pipelines, tools for construction, industrial sites, heavy casting, consumer goods, and automobiles. Fire resistance, abrasion resistance, UV light resistance, vapour permeability, gloss retention, and high weathering resistance are among the qualities that are driving suppliers to invest and a variety of end-users to employ it for the final product coating. Additionally, these coatings are utilised in numerous formulations, including waterborne, solvent-borne, and powder-based divisions. These are the main advantages that will fuel the segment's expansion in the worldwide market over the course of the projection.

By End-user

The end user segment includes Automotive OEM, General Industrial, Construction, Marine, Aerospace, Wood, Packaging, and Others. The OEM segment led the Industrial Coatings market with a market share of around 28.08% in 2021. Original equipment manufacturer, or OEM, is a crucial component of the automobile sector. Coatings are advantageous for automotive equipment since they are of high calibre and durability. Automobile OEM Coatings have excellent mechanical properties that shield them against chemicals, the climate, and scratches. The surface area of an automobile's body is increased by coatings used on internal components. These are the main advantages that fuel the expansion of the Automotive OEM market sector globally over the course of the projected timeframe.

Global Industrial Coatings Market- Sales Analysis

The sale of Industrial Coatings types expanded at a CAGR of 2.2% from 2015 to 2021.

Industrial coatings shield concrete or metal against algae development, corrosion, abrasion, and gear wear. Industrial coatings are primarily used to provide the surface they are applied to aesthetic appeal. Industrial coating's environmental friendliness is one of its key features. Demand for environmentally friendly Industrial Coatings Market is rising as a result of strict rules for decreasing VOC emissions in coating resins and minimising pollution coating processes.

The Industrial Coatings Market is expanding due to improvements in materials like solvent-free powder coating. Due to improvements in coating performance, industrial items are often provided with a multi-year corrosion warranty. Additionally, industrial coatings provide advantages, including high flexibility, crack-bridging, waterproofing, and resistance to chemicals and dirt.

Industrial coatings are also utilised to shield walls, roofs, and floors from wind, snow, and torrential rain. Additionally, the expansion of Industrial Coatings is being driven by an increase in industrial applications in the automotive, aerospace, wood, and marine sectors. Additionally, modern latex-based paints are replaced with industrial coatings since they provide substrates an appealing look.

Thus, owing to the aforementioned factors, the global Industrial Coatings Market is expected to grow at a CAGR of 4.7% during the Projection period from 2022 to 2029.

By Regional Analysis:

The regions analysed for the Industrial Coatings market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Asia Pacific region dominated the Industrial Coatings market and held a 39% share of the market revenue in 2021.

- The Asia Pacific region witnessed a major share. During the projected period, the market is anticipated to be driven by rapid industrialization and rising product demand from the automotive and vehicle refinish industries in nations like India, Japan, and South Korea. Large-scale opportunities for the use of industrial coatings in various end-use sectors, including the marine, automotive, vehicle refinish, and general industry, are anticipated as a result of factors like the less stringent laws regarding VOC emissions in the Asia Pacific compared to Europe and North America and the simple availability of raw materials.

- Europe is anticipated to experience significant growth during the predicted period. During the anticipated period, the regional market is anticipated to be driven by the rising product demand from several end-use industries. However, the region's stringent VOC emission restrictions, which are a result of growing environmental concerns, are expected to have an influence on the market for solvent-based industrial coatings.

Global Industrial Coatings Market- Country Analysis:

- Germany

Germany Industrial Coatings market size was valued at USD 4.11 billion in 2021 and is expected to reach USD 10.17 billion by 2029, at a CAGR of 12% from 2022 to 2029. Paint production businesses are quite few in number. There are approximately 200 firms operating in Germany. Germany's robust, export-driven economy is well-known. Naturally, this also applies to the coatings sector. The amount of coatings that the nation exports exceeds what it imports by a factor of two. The value discrepancies are even more pronounced because the nation exclusively imports inexpensive low-quality goods while mostly exports high-class coatings.

- China

China’s Industrial Coatings’ market size was valued at USD 3.77 billion in 2021 and is expected to reach USD 8.68 billion by 2029, at a CAGR of 11% from 2022 to 2029. High growth in the maritime transportation industry and the rise of the Chinese navy are two major drivers. Their booster biocides and self-polishing resins, which include biocides like cuprous oxide, aid in preventing biofouling organisms. Overall, the marine coatings industry is anticipated to be dominated by anti-fouling coatings. due to the large volume of foul resistant coatings needed for seagoing boats.

- India

India's Industrial Coatings market size was valued at USD 3.08 billion in 2021 and is expected to reach USD 6.13 billion by 2029, at a CAGR of 9% from 2022 to 2029. The expansion of the automobile sector and the growth of industrial paints are directly correlated positively because of the substantial contribution of automotive coating to the industrial coatings segment in India.

Key Industry Players Analysis:

To increase their market position in the global Industrial Coatings business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, type developments, collaborations, partnerships, joint ventures, etc.

- PPG Industries, Inc

- Akzo Nobel N.V

- The Sherwin-Williams Company

- Axalta Coating Systems, LLC

- Jotun

- BASF SE

- Henkel AG & Company, KGaA

- Nippon Paint Holdings Co., Ltd

- Hempel A/S

- Beckers Group

Latest Development:

- In July 2022, IGL Coatings produced an Eco coat Armor that may be used to maintain and prolong the life of diverse surfaces. A robust and resilient coating with great flexibility, impact resistance, and chemical resistance is called Eco coat Armor. The coating gives defence against corrosive substances, solvents, and severe conditions.

- In December 2021, Imron Industrial Ultra 2.8 VOC Topcoat was introduced by Axalta for use with ACE applications (agricultural, construction, and earthmoving equipment). These coatings provide a quicker cure, lower VOC emissions, and better weather resistance.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

4.7% |

|

Market Size |

88 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Type, By Resin, By End-user and By Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

PPG Industries, Inc, Akzo Nobel N.V, The Sherwin-Williams Company, Axalta Coating Systems, LLC, Jotun, BASF SE, Henkel AG & Company, KGaA, Nippon Paint Holdings Co., Ltd, Hempel A/S, and Beckers Group. |

|

By Type |

|

|

By Resin |

|

|

By End-user |

|

|

Regional scope |

|

Scope of the Report

Global Industrial Coatings Market by Type:

- High Solids

- Solvent

- Powder

- Water

Global Industrial Coatings Market by Resin:

- Polyurethane

- Fluoropolymers

- Polyester

- Acrylic

- Alkyd

- Epoxy

- Others

Global Industrial Coatings Market By End-user:

- Automotive OEM

- General Industrial

- Construction

- Marine

- Aerospace

- Wood

- Packaging

- Others

Global Industrial Coatings Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is value of Industrial Coatings market in 2021?

Industrial coatings market was valued at 88 billion.

What is the major driving factor of the Industrial Coatings market?

Tremendous advancements in the shipbuilding industry across APAC drives the market’s growth.

Who are the key players in global Industrial Coatings market?

Global Industrial Coatings key market players are Abbott Laboratories, Thermo Fisher Scientific Inc., Bio Rad Laboratories Inc., Roche Holding AG, GE Healthcare, Illumina, Inc., Siemens AG, Bristol-Myers Squibb, Toshiba Medical Systems Corporation, Koninklijke Philips N.V., and Agilent Technologies Inc.

How is the North American Industrial Coatings market projected to grow?

The North American Industrial Coatings market was projected to gain a global market share of 39% in 2021.

What will be the growth rate of the global Industrial Coatings market during the Projection period?

The global Industrial Coatings market is expected to grow with a 4.7% CAGR during the Projection period.

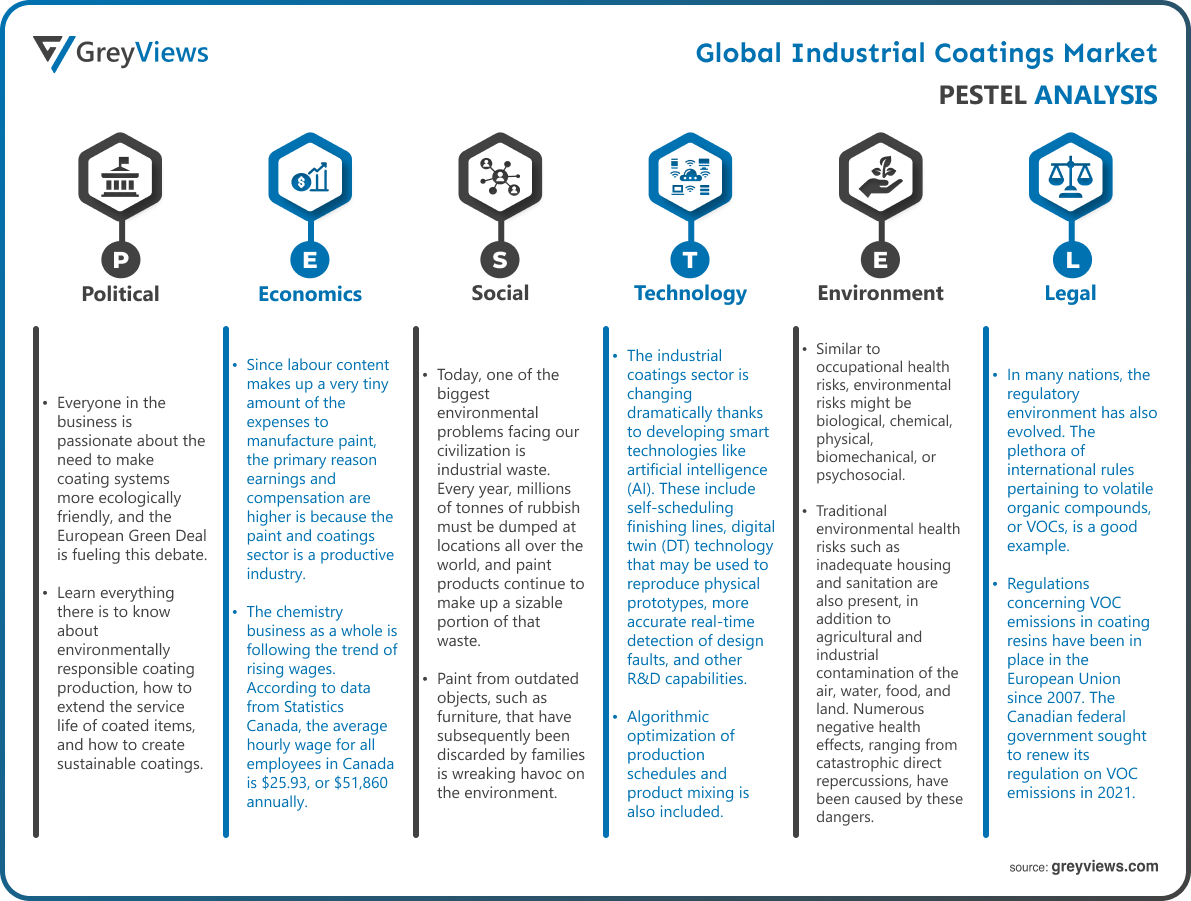

Political Factors- Everyone in the business is passionate about the need to make coating systems more ecologically friendly, and the European Green Deal is fueling this debate. Learn everything there is to know about environmentally responsible coating production, how to extend the service life of coated items, and how to create sustainable coatings. The EC Tech Report provides an overview of the many different methodologies being used. We will go deeply into the European Green Deal, its tenets, purpose, and effects on the coatings sector. We will also examine the new raw materials being produced to replace or reduce the content of goods in the SVHC group and discover several methods for formulating sustainable paint.

Economical Factors- Since labour content makes up a very tiny amount of the expenses to manufacture paint, the primary reason earnings and compensation are higher is because the paint and coatings sector is a productive industry. The chemistry business as a whole is following the trend of rising wages. According to data from Statistics Canada, the average hourly wage for all employees in Canada is $25.93, or $51,860 annually. The average compensation in the chemical sector is 39% greater than the national average for all Canadian industries. Given that the paint and coatings sector is a subset of the chemical sector, it is not unexpected that pay for coatings companies are higher.

Social Factor- Today, one of the biggest environmental problems facing our civilization is industrial waste. Every year, millions of tonnes of rubbish must be dumped at locations all over the world, and paint products continue to make up a sizable portion of that waste. Paint from outdated objects, such as furniture, that have subsequently been discarded by families is wreaking havoc on the environment. Older paint paints, which include materials like lead, may seep into water supplies, potentially polluting water sources and having an effect on people all over the world. These are only a few of the numerous ways that conventional paints now have an adverse effect on our local ecology.

Technological Factors- The industrial coatings sector is changing dramatically thanks to developing smart technologies like artificial intelligence (AI). These include self-scheduling finishing lines, digital twin (DT) technology that may be used to reproduce physical prototypes, more accurate real-time detection of design faults, and other R&D capabilities. Algorithmic optimization of production schedules and product mixing is also included. Sensors and other smart devices can perform titrations, other tests, and material additions automatically and in real time, making labour-intensive lab samples redundant. A formerly conservative maintenance business has fully adopted AI beyond inspections and quality control. The Industrial Internet of Things (IIoT) is being fully utilised by maintenance departments, allowing data-driven maintenance systems to detect emergent defects more accurately and even react immediately. Fewer asset failures, longer asset lifespans, fewer shutdowns, and, subsequently, significant cost savings are some of the outcomes.

Environmental Factors- Similar to occupational health risks, environmental risks might be biological, chemical, physical, biomechanical, or psychosocial. Traditional environmental health risks such as inadequate housing and sanitation are also present, in addition to agricultural and industrial contamination of the air, water, food, and land. Numerous negative health effects, ranging from catastrophic direct repercussions, have been caused by these dangers. Health has benefited greatly from development, and industrialization in particular, as well as from increased societal and personal wealth, substantially improved transportation and enhanced health and education services. Without a doubt, compared to centuries or even decades ago, people are living longer and healthier globally. The industrialization has, however, had negative health effects on the population as a whole as well as on the workers. Exposure to dangers and toxic substances has directly contributed to these impacts, while environmental degradation on a local and global scale has also played a role.

Legal Factors- In many nations, the regulatory environment has also evolved. The plethora of international rules pertaining to volatile organic compounds, or VOCs, is a good example. Regulations concerning VOC emissions in coating resins have been in place in the European Union since 2007. The Canadian federal government sought to renew its regulation on VOC emissions in 2021. All coatings that may emit VOCs are produced under these laws, which surely has an impact on innovation, research, and development (R&D). The sector continues to struggle with chemicals as demand from various regulatory bodies increases. For instance, a new, strict regulation set by the National Science Foundation (NSF), which goes into effect in 2023, would cover the permitted amounts of Xylol and other solvents for potable water storage tank linings in the United States.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Type

- 3.2. Market Attractiveness Analysis By Resin

- 3.3. Market Attractiveness Analysis By End-user

- 3.4. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Growing trends of automotive refinish coatings

- 3. Restraints

- 3.1. Fluctuations in Raw Material Prices

- 4. Opportunities

- 4.1. Tremendous advancements in the shipbuilding industry across APAC

- 5. Challenges

- 5.1. COVID-19 Impact

- Global Industrial Coatings Market Analysis and Projection, By Type

- 1. Segment Overview

- 2. High Solids

- 3. Solvent

- 4. Powder

- 5. Water

- Global Industrial Coatings Market Analysis and Projection, By Resin

- 1. Segment Overview

- 2. Polyurethane

- 3. Fluoropolymers

- 4. Polyester

- 5. Acrylic

- 6. Alkyd

- 7. Epoxy

- 8. Others

- Global Industrial Coatings Market Analysis and Projection, By End-user

- 1. Segment Overview

- 2. Automotive OEM

- 3. General Industrial

- 4. Construction

- 5. Marine

- 6. Aerospace

- 7. Wood

- 8. Packaging

- 9. Others

- Global Industrial Coatings Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Industrial Coatings Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Industrial Coatings Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- PPG Industries, Inc

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Akzo Nobel N.V

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- The Sherwin-Williams Company

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Axalta Coating Systems, LLC

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Jotun

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- BASF SE

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Henkel AG & Company, KGaA

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Nippon Paint Holdings Co., Ltd

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Hempel A/S

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Beckers Group

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- PPG Industries, Inc

List of Table

- Global Industrial Coatings Market, By Type, 2021–2029 (USD Billion)

- Global High Solids, Industrial Coatings Market, By Region, 2021–2029 (USD Billion)

- Global Solvent, Industrial Coatings Market, By Region, 2021–2029 (USD Billion)

- Global Powder, Industrial Coatings Market, By Region, 2021–2029 (USD Billion)

- Global Water, Industrial Coatings Market, By Region, 2021–2029 (USD Billion)

- Global Industrial Coatings Market, By Resin, 2021–2029 (USD Billion)

- Global Polyurethane, Industrial Coatings Market, By Region, 2021–2029 (USD Billion)

- Global Fluoropolymers, Industrial Coatings Market, By Region, 2021–2029 (USD Billion)

- Global Polyester, Industrial Coatings Market, By Region, 2021–2029 (USD Billion)

- Global Acrylic, Industrial Coatings Market, By Region, 2021–2029 (USD Billion)

- Global Alkyd, Industrial Coatings Market, By Region, 2021–2029 (USD Billion)

- Global Epoxy, Industrial Coatings Market, By Region, 2021–2029 (USD Billion)

- Global Others, Industrial Coatings Market, By Region, 2021–2029 (USD Billion)

- Global Industrial Coatings Market, By End-user, 2021–2029 (USD Billion)

- Global Automotive OEM, Industrial Coatings Market, By Region, 2021–2029 (USD Billion)

- Global General Industrial, Industrial Coatings Market, By Region, 2021–2029 (USD Billion)

- Global Construction, Industrial Coatings Market, By Region, 2021–2029 (USD Billion)

- Global Marine, Industrial Coatings Market, By Region, 2021–2029 (USD Billion)

- Global Aerospace, Industrial Coatings Market, By Region, 2021–2029 (USD Billion)

- Global Wood, Industrial Coatings Market, By Region, 2021–2029 (USD Billion)

- Global Packaging, Industrial Coatings Market, By Region, 2021–2029 (USD Billion)

- Global Others, Industrial Coatings Market, By Region, 2021–2029 (USD Billion)

- Global Industrial Coatings Market, By Region, 2021–2029 (USD Billion)

- North America Industrial Coatings Market, By Type, 2021–2029 (USD Billion)

- North America Industrial Coatings Market, By Resin, 2021–2029 (USD Billion)

- North America Industrial Coatings Market, By End-user, 2021–2029 (USD Billion)

- USA Industrial Coatings Market, By Type, 2021–2029 (USD Billion)

- USA Industrial Coatings Market, By Resin, 2021–2029 (USD Billion)

- USA Industrial Coatings Market, By End-user, 2021–2029 (USD Billion)

- Canada Industrial Coatings Market, By Type, 2021–2029 (USD Billion)

- Canada Industrial Coatings Market, By Resin, 2021–2029 (USD Billion)

- Canada Industrial Coatings Market, By End-user, 2021–2029 (USD Billion)

- Mexico Industrial Coatings Market, By Type, 2021–2029 (USD Billion)

- Mexico Industrial Coatings Market, By Resin, 2021–2029 (USD Billion)

- Mexico Industrial Coatings Market, By End-user, 2021–2029 (USD Billion)

- Europe Industrial Coatings Market, By Type, 2021–2029 (USD Billion)

- Europe Industrial Coatings Market, By Resin, 2021–2029 (USD Billion)

- Europe Industrial Coatings Market, By End-user, 2021–2029 (USD Billion)

- Germany Industrial Coatings Market, By Type, 2021–2029 (USD Billion)

- Germany Industrial Coatings Market, By Resin, 2021–2029 (USD Billion)

- Germany Industrial Coatings Market, By End-user, 2021–2029 (USD Billion)

- France Industrial Coatings Market, By Type, 2021–2029 (USD Billion)

- France Industrial Coatings Market, By Resin, 2021–2029 (USD Billion)

- France Industrial Coatings Market, By End-user, 2021–2029 (USD Billion)

- UK Industrial Coatings Market, By Type, 2021–2029 (USD Billion)

- UK Industrial Coatings Market, By Resin, 2021–2029 (USD Billion)

- UK Industrial Coatings Market, By End-user, 2021–2029 (USD Billion)

- Italy Industrial Coatings Market, By Type, 2021–2029 (USD Billion)

- Italy Industrial Coatings Market, By Resin, 2021–2029 (USD Billion)

- Italy Industrial Coatings Market, By End-user, 2021–2029 (USD Billion)

- Spain Industrial Coatings Market, By Type, 2021–2029 (USD Billion)

- Spain Industrial Coatings Market, By Resin, 2021–2029 (USD Billion)

- Spain Industrial Coatings Market, By End-user, 2021–2029 (USD Billion)

- Asia Pacific Industrial Coatings Market, By Type, 2021–2029 (USD Billion)

- Asia Pacific Industrial Coatings Market, By Resin, 2021–2029 (USD Billion)

- Asia Pacific Industrial Coatings Market, By End-user, 2021–2029 (USD Billion)

- Japan Industrial Coatings Market, By Type, 2021–2029 (USD Billion)

- Japan Industrial Coatings Market, By Resin, 2021–2029 (USD Billion)

- Japan Industrial Coatings Market, By End-user, 2021–2029 (USD Billion)

- China Industrial Coatings Market, By Type, 2021–2029 (USD Billion)

- China Industrial Coatings Market, By Resin, 2021–2029 (USD Billion)

- China Industrial Coatings Market, By End-user, 2021–2029 (USD Billion)

- India Industrial Coatings Market, By Type, 2021–2029 (USD Billion)

- India Industrial Coatings Market, By Resin, 2021–2029 (USD Billion)

- India Industrial Coatings Market, By End-user, 2021–2029 (USD Billion)

- South America Industrial Coatings Market, By Type, 2021–2029 (USD Billion)

- South America Industrial Coatings Market, By Resin, 2021–2029 (USD Billion)

- South America Industrial Coatings Market, By End-user, 2021–2029 (USD Billion)

- Brazil Industrial Coatings Market, By Type, 2021–2029 (USD Billion)

- Brazil Industrial Coatings Market, By Resin, 2021–2029 (USD Billion)

- Brazil Industrial Coatings Market, By End-user, 2021–2029 (USD Billion)

- Middle East and Africa Industrial Coatings Market, By Type, 2021–2029 (USD Billion)

- Middle East and Africa Industrial Coatings Market, By Resin, 2021–2029 (USD Billion)

- Middle East and Africa Industrial Coatings Market, By End-user, 2021–2029 (USD Billion)

- UAE Industrial Coatings Market, By Type, 2021–2029 (USD Billion)

- UAE Industrial Coatings Market, By Resin, 2021–2029 (USD Billion)

- UAE Industrial Coatings Market, By End-user, 2021–2029 (USD Billion)

- South Africa Industrial Coatings Market, By Type, 2021–2029 (USD Billion)

- South Africa Industrial Coatings Market, By Resin, 2021–2029 (USD Billion)

- South Africa Industrial Coatings Market, By End-user, 2021–2029 (USD Billion)

List of Figures

- Global Industrial Coatings Market Segmentation

- Industrial Coatings Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Industrial Coatings Market Attractiveness Analysis By Type

- Global Industrial Coatings Market Attractiveness Analysis By Resin

- Global Industrial Coatings Market Attractiveness Analysis By End-user

- Global Industrial Coatings Market Attractiveness Analysis By Region

- Global Industrial Coatings Market: Dynamics

- Global Industrial Coatings Market Share By Type (2021 & 2029)

- Global Industrial Coatings Market Share By Resin (2021 & 2029)

- Global Industrial Coatings Market Share By End-user (2021 & 2029)

- Global Industrial Coatings Market Share by Regions (2021 & 2029)

- Global Industrial Coatings Market Share by Company (2020)