Industrial Lubricants Market Size By Product Type (Compressor Oil, Hydraulic Fluid, Greases, Gear Oil, Refrigeration Oil, and Others), By End-Use (Automotive, Energy, Textiles, Hydraulic, Food Processing, and Others), and Regions, Segmentation, and Projection till 2029

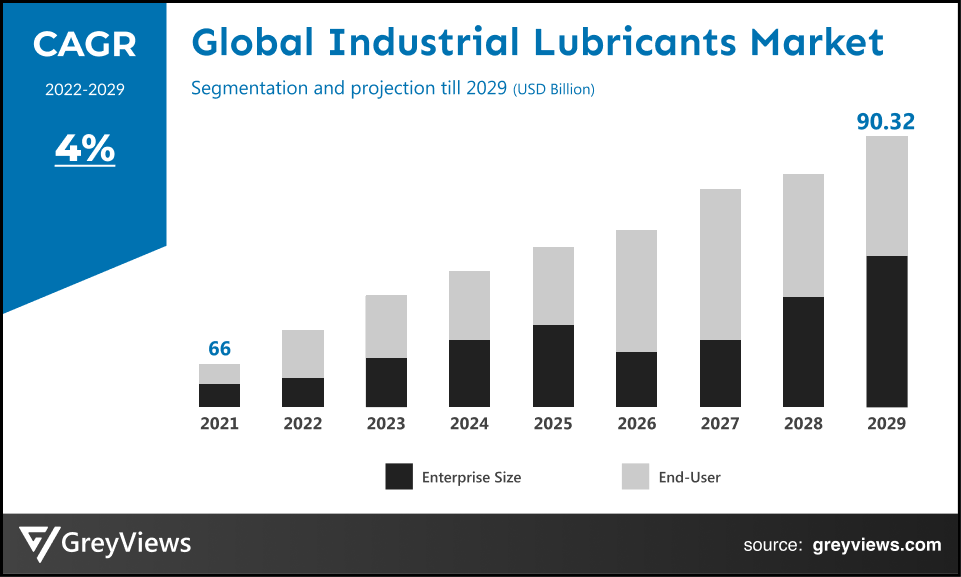

CAGR: 4%Current Market Size: USD 66 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Industrial Lubricants Market- Market Overview:

The Global Industrial Lubricants market is expected to grow from USD 66 billion in 2021 to USD 90.32 billion by 2029, at a CAGR of 4% during the Projection period 2022-2029. The growth of this market is mainly driven owing to the increasing development in automotive, energy, and more industry.

A chemical used on surfaces with relative motion between them is known as a lubricant. The lubricant lessens wear between the surfaces and friction. However, in addition to these main purposes, the lubricant may serve other purposes. Other functions include acting as a heat transfer agent, a sealing agent, a corrosion prevention agent, and a trapping and ejecting agent for impurities in mechanical systems. There are many different lubricants, with grease, liquid, and solid lubricants being the most popular. Oil is often provided in 55-gallon drums and 5-gallon pails, whereas grease is typically offered in 35-lb kegs. The shelf life of lubricants is often calculated using the additives in the lubricants. Environments that are dry, spotless, and less subject to temperature changes offer storage options that maximise shelf life. Drums should be stored on their sides and protected from the elements with tarps and shelters if they must be kept outside. When handling the drums, they can be rolled on their sides but not dropped. Drum handling jaws, which can completely enclose drum perimeters, should be employed on forklifts rather than blades, which are not the proper tool for grasping the drum sides. The goal is to administer the proper lubricant type in the right amount at the right time, whether the system is automatic or human.

Sample Request: - Global Industrial Lubricants Market

Market Dynamics:

Drivers:

- Rapid industrialization in BRICS nation

Brazil, Russia, India, China, and South Africa make up the BRICS countries. One of the world's largest rising economies is represented by these nations. The BRICS group seeks to advance collaboration, security, development, and peace. Due to substantial demand and consumption markets, these nations are likewise expanding rapidly. In addition, there are a number of factors that are predicted to contribute to an increase in demand for industrial lubricants in the upcoming years, including big and relatively young populations, significant expenditures in physical and digital infrastructure, affordable labour, and rising incomes.

Restraints:

- Threat to environment

Due to illegal dumping or inappropriate disposal, used industrial lubricants are regarded as a severe pollution issue because they contaminate groundwater, surface water, and soil. Without pre-treatment, it is impossible to immediately burn these old lubricants. Environmental limits apply to them since they could have poisonous and dangerous leftovers like metal and metalloid particles. The atmosphere may be exposed to these chlorinated substances. Instead of being disposed of as waste, used lubricant should be recycled. The quality of lubricants, which is measured in terms of the quantity of contamination by water, solids, or other fluids, is a major factor in determining their usefulness.

Opportunities:

- Growing use of industrial lubricants made from biomaterials

The environmental effects of greenhouse gas emissions are being made more widely known by various governments throughout the world. In order to decrease the negative effects of hazardous gases on the environment and human health, the government is also closely collaborating with environmental organisations and NGOs to establish strict emission laws. Manufacturers now have the chance to produce industrial lubricants that adhere to all emission laws while also being environmentally beneficial due to these regulations. Vegetable oil and synthetic esters are used to make bio-based industrial lubricants. The two continents that consume the most bio-based lubricants are North America and Europe.

Challenges

- Fluctuation in Crude Oil Prices

Crude oil is used to create mineral oil and synthetic base oil. Crude oil price changes pose a significant problem since they limit production and market use. The U.S. Energy Information Administration (EIA) estimates that the cost for a refiner to acquire a barrel of crude oil in May 2019 was US$ 55.83, US$ 20.04 in May 2020, US$ 42.64 in January 2021, and US$ 62.51 in October 2021. The production and cost of base oil are significantly impacted by the fluctuation in crude oil prices, which shifts the cost burden to the finished product. As a result, the industrial lubricants sector is experiencing a downturn and serious difficulties.

Segmentation Analysis:

The global industrial lubricants market has been segmented based on product type, end-use, and regions.

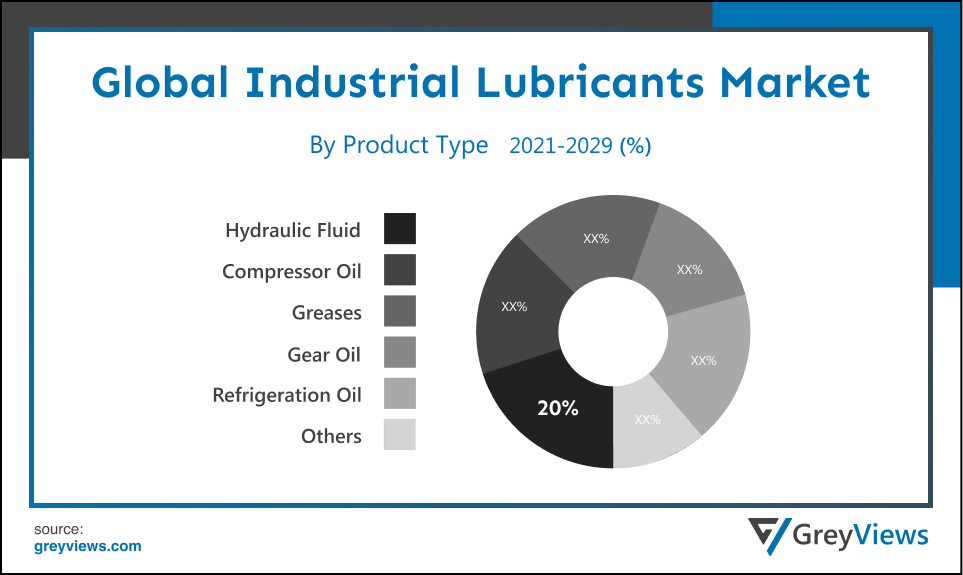

By Product Type

The product type segment is compressor oil, hydraulic fluid, greases, gear oil, refrigeration oil, and others. The hydraulic fluid segment led the largest share of the industrial lubricants market with a market share of around 20% in 2021. Loaders, cranes, excavators, and other types of construction machinery all extensively use hydraulic fluids. This is as a result of its better hydraulic system performance, superior performance, and increased mechanical stress endurance. The construction sector is experiencing a sharp increase in the demand for hydraulic fluids. Also, the market is being driven by an increase in infrastructure and development projects. The US Census Bureau reports that construction spending in the US decreased to US$1,730.5 billion in March 2022 from US$1,728 billion in February 2022. Additionally, the value of residential construction rose from US$1.64 million in November 2021 to US$1.72 million in February 2022. As a result, throughout the Projection period, there will be an increase in demand for industrial lubricants like hydraulic fluid for a variety of applications in the construction industry due to the booming construction industry.

By End-Use

The end-use includes metalworking, chemical manufacturing, automotive, energy, textiles, industrial gases, hydraulic, and food processing. The automotive segment led the industrial lubricants market with a market share of around 18% in 2021. In the automotive industry, industrial lubricants are used extensively in gearing, high-speed bearings, brake systems, engines, metalworking fluid, and other components. This is because lubricants provide superior qualities including binding, higher performance, and longer machinery work life. The market is being driven by the quickly expanding automotive production around the globe as a result of the increased demand for affordable and fuel-efficient vehicles and automotive technical advancements. The International Organization of Motor Vehicle Manufacturers (OICA) estimates that in 2021, automotive output will increase by 3% in China, 12% in Brazil, 30% in India, and 4% in the USA. The demand for lubricants such hydraulic fluids, engine oil, and other lubricants is increasing along with increased automotive vehicle manufacturing.

By Regional Analysis:

The regions analyzed for the industrial lubricants market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Asia Pacific region dominated the Industrial Lubricants market and held the 40% share of the market revenue in 2021.

- Asia Pacific region witnessed a major share. The strong demand across key industries has an impact on the region's robust expansion of industrial lubricants. Due to the superior qualities of industrial lubricants, such as improved performance, binding, protection against damage, and extended machinery life, the automotive industry accounts for the majority of demand. The market is driven by the increase of vehicle production in important APAC nations including China, Japan, India, and others. The Japan Automobile Manufacturers Association (JAMA) reports that from 344,875 units in December 2019 to 360,103 units in January 2020, the country's production of motor vehicles grew. Thus, the booming need for lubricants for construction, automobile production, and other uses in the Asia-Pacific area has an impact on the market for industrial lubricants.

- North Americais anticipated to experience significant growth during the ProjectionThe region's well-developed industrial sector is likely to be the main driver of market expansion. One of the key elements promoting the expansion of the business in the region is the rising demand for oilfield chemicals as a result of drilling and exploration activities. In addition, rising manufacturing in nations like Canada, the United States, and others is anticipated to support the expansion of the industrial lubricants industry. Additionally, over the course of the projection period, an increase in investment by a number of significant players active in US application sectors is anticipated to fuel demand for industrial lubricants.

Global Industrial Lubricants Market- Country Analysis:

- Germany

Germany's industrial lubricants market size was valued at USD 5.17 billion in 2021 and is expected to reach USD 6.39 billion by 2029, at a CAGR of 2.7% from 2022 to 2029.

The involvement of various multinational chemical producers around Germany is largely responsible for the rapid growth. Largely used in a variety of processes, including the fertilizer industry, rotatory and compressor units in manufacturing facilities, and more, these industrial lubricants help increase running cycles and improve the operation of machinery that is subjected to high stress.

- China

China Industrial Lubricants’s market size was valued at USD 7.39 billion in 2021 and is expected to reach USD 9.8 billion by 2029, at a CAGR of 3.7% 2022 to 2029. Due to the country's fast industrialization, urbanisation, population expansion, and strong growth in key end-use industries like textiles, chemicals, food processing, and automobiles, the market in China is expanding. The production and sales of automobiles in China were 26.08 million and 26.27 million, respectively, rising 3.4% and 3.8% year-over-year compared to the drop in the previous 3 years, according to the China Association of Automobile Manufacturers (CAAM).

- India

India's Industrial Lubricants market size was valued at USD 6.3 billion in 2021 and is expected to reach USD 11.9 billion by 2029, at a CAGR of 8.1% from 2022 to 2029. Demand for industrial lubricants is fueled by growth in India's auto industry. The domestic sales of passenger vehicles in India climbed from 2,711,457 units in 2020–21 to 3,069,499 units in 2021–22, according to the Society of Indian Automobile Manufacturers (SIAM). Additionally, the market is expected to rise as a result of the rising residential building and infrastructure development in the Asia-Pacific region. For instance, the Make in India campaign aims to raise US$965.5 million by 2040 for investments in India's infrastructure.

Key Industry Players Analysis:

To increase their market position in the global Industrial Lubricants business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- ExxonMobil Corporation

- PetroChina Company Limited

- Royal Dutch Shell

- Sinopec Limited

- Fuchs Petrolub AG

- Chevron Chemical Corporation

- Hindustan Petroleum Corporation Limited

- Repsol

- Idemitsu Kosan Co. Ltd.

- LUKOIL

Latest Development:

- In June 2021, By purchasing the lubricants division of Gleitmo Technik AB, the FUCHS expanded its specialist business. This acquisition would increase the company's customer base, product line, and market expansion.

- In November 2020, PT Pertamina and the MoU signed an agreement to collaborate on industrial lubricants products in Australia, expanding the overseas business range.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

4% |

|

Market Size |

66 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Product Type, By End-Use, and Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

ExxonMobil Corporation, PetroChina Company Limited, Royal Dutch Shell, Sinopec Limited, Fuchs Petrolub AG, Chevron Chemical Corporation, Hindustan Petroleum Corporation Limited, Repsol, Idemitsu Kosan Co. Ltd., LUKOIL, among others |

|

By Product Type |

|

|

By End-Use |

|

|

Regional scope |

|

Scope of the Report

Global Industrial Lubricants Market by Product Type

- Compressor Oil

- Hydraulic Fluid

- Greases

- Gear Oil

- Refrigeration Oil

- Others

Global Industrial Lubricants Market by By End-Use:

- Automotive

- Energy

- Textiles

- Hydraulic

- Food Processing

- Others

Global Industrial Lubricants Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What could be market size of the Industrial Lubricants market in 2029?

Global Industrial Lubricants market is expected to reach USD 90.32 billion by 2029, at a CAGR of 4% from 2022 to 2029.

Which is the fastest growing market for industrial lubricants market?

Asia Pacific is the fastest growing market for industrial lubricants market.

Which is the leading segment based on end-use in industrial lubricants market?

Automotive is a leading segment based on sales channel in industrial lubricants market.

Which are the leading market players active in the Industrial Lubricants market?

Leading market players active in the global industrial lubricants market are ExxonMobil Corporation, PetroChina Company Limited, Royal Dutch Shell, Sinopec Limited, Fuchs Petrolub AG, Chevron Chemical Corporation, Hindustan Petroleum Corporation Limited, Repsol, Idemitsu Kosan Co. Ltd., LUKOIL.

Political Factors- Political considerations significantly impact the variables that can impact the long-term profitability of industrial lubricants in a specific country or market. The chemical sector must deal with varying standards in supply chains and other economic constraints as a result of the rise in political instability. According to many signs, diverging standards are expected to persist and even worsen. Fortunately, most chemicals are naturally regionally-specific rather than really global goods. However, intercontinental trade is important for many participants, particularly those with access to favourable feedstock or labour rates. In addition, many chemical businesses rely on clients who ship their products across continents.

Economical Factors- The aggregate demand and investment in an economy are determined by the macroenvironmental factors, such as the inflation rate, savings rate, interest rate, foreign exchange rate, and economic cycle. At the same time, microenvironmental elements like industry norms have an impact on the firm's competitive edge. To predict the growth trajectory, the industrial lubricants sector can make use of national economic factors like growth rate and inflation as well as industry-specific economic indicators like materials industry growth rate and consumer spending.

Social Factor- As an applied science, the chemical field has a significant impact on a variety of societal issues, including political, environmental, and economic stability. Human development has benefited from the industrial lubricants market, and the chemicals sector's products have influenced a variety of industries, including petrochemistry, food, hygiene, painting, and agriculture. The chemical industry is regarded as a problem-solver for society because it created crop-enhancing agricultural chemicals to guarantee a steady and viable food supply, contributed to the eradication of deadly diseases by developing life-saving pharmaceuticals and chemical pesticides, developed novel plastics and synthetic fibres for use in both industrial and consumer products, and produced industrial lubricants that are used in numerous other industries.

Technological Factors- In the past, new digital or analytics technologies have often been slow to be adopted by the chemical sector. Additionally, the present artificial intelligence (AI) wave is only just beginning to impact chemical companies. Given that the chemical industry is a producer of physical commodities with typically a limited number of suppliers for a given product and, consequently, a relatively high industry utilisation, this may be easily justified. New digital strategies can still offer little but significant advantages (mostly around asset and commercial productivity).

Environmental Factors- Different markets have various norms or environmental requirements, which might have an effect on an organization's profitability there. States frequently have differing liability and environmental regulations even within the same nation. For instance, in the United States, Florida and Texas have differing liability provisions in the event of accidents or environmental catastrophes. Similar to this, many European nations offer substantial tax incentives to businesses engaged in the renewable energy industry. The strongly increasing intensity of economic human activity has resulted in a number of concerning ecological developments, such as climate change, water shortage, the reduction of biodiversity, and other challenges.

Legal Factors- Many nations' institutions and legal systems are not strong enough to safeguard an organization's intellectual property rights. Before entering such markets, a company should carefully consider its options because doing so could result in the theft of its secret competitive advantage. Laws governing discrimination, copyright, patents, intellectual property, consumer protection, e-commerce, employment, health and safety, and data protection are just a few of the legal aspects that affect Industrial lubricants.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Product Type

- 3.2. Market Attractiveness Analysis By End-Use

- 3.3. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Rapid industrialization in BRICS nation

- 3. Restraints

- 3.1. Threat to environment

- 4. Opportunities

- 4.1. Growing use of industrial lubricants made from biomaterials

- 5. Challenges

- 5.1. Fluctuation in Crude Oil Prices

- Global Industrial Lubricants Market Analysis and Projection, By Product Type

- 1. Segment Overview

- 2. Compressor Oil

- 3. Hydraulic Fluid

- 4. Greases

- 5. Gear Oil

- 6. Refrigeration Oil

- 7. Others

- Global Industrial Lubricants Market Analysis and Projection, By End-Use

- 1. Segment Overview

- 2. Automotive

- 3. Energy

- 4. Textiles

- 5. Hydraulic

- 6. Food Processing

- 7. Others

- Global Industrial Lubricants Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Industrial Lubricants Market-Competitive Landscape

- 1. Overview

- 2. Market Share of Key Players in the Industrial Lubricants Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- 3. Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- ExxonMobil Corporation

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- PetroChina Company Limited

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Royal Dutch Shell

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Sinopec Limited

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Fuchs Petrolub AG

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Chevron Chemical Corporation

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Hindustan Petroleum Corporation Limited

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Repsol

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Idemitsu Kosan Co. Ltd.

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- LUKOIL

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- ExxonMobil Corporation

List of Table

- Global Industrial Lubricants Market, By Product Type, 2021–2029 (USD Billion)

- Global Compressor Oil, Industrial Lubricants Market, By Region, 2021–2029 (USD Billion)

- Global Hydraulic Fluid, Industrial Lubricants Market, By Region, 2021–2029 (USD Billion)

- Global Greases, Industrial Lubricants Market, By Region, 2021–2029 (USD Billion)

- Global Gear Oil, Industrial Lubricants Market, By Region, 2021–2029 (USD Billion)

- Global Refrigeration Oil, Industrial Lubricants Market, By Region, 2021–2029 (USD Billion)

- Global Others, Industrial Lubricants Market, By Region, 2021–2029 (USD Billion)

- Global Industrial Lubricants Market, By End-Use, 2021–2029 (USD Billion)

- Global Automotive, Industrial Lubricants Market, By Region, 2021–2029 (USD Billion)

- Global Energy, Industrial Lubricants Market, By Region, 2021–2029 (USD Billion)

- Global Textiles, Industrial Lubricants Market, By Region, 2021–2029 (USD Billion)

- Global Hydraulic, Industrial Lubricants Market, By Region, 2021–2029 (USD Billion)

- Global Food Processing, Industrial Lubricants Market, By Region, 2021–2029 (USD Billion)

- Global Others, Industrial Lubricants Market, By Region, 2021–2029 (USD Billion)

- Global Industrial Lubricants Market, By Region, 2021–2029 (USD Billion)

- North America Industrial Lubricants Market, By Product Type, 2021–2029 (USD Billion)

- North America Industrial Lubricants Market, By End-Use, 2021–2029 (USD Billion)

- USA Industrial Lubricants Market, By Product Type, 2021–2029 (USD Billion)

- USA Industrial Lubricants Market, By End-Use, 2021–2029 (USD Billion)

- Canada Industrial Lubricants Market, By Product Type, 2021–2029 (USD Billion)

- Canada Industrial Lubricants Market, By End-Use, 2021–2029 (USD Billion)

- Mexico Industrial Lubricants Market, By Product Type, 2021–2029 (USD Billion)

- Mexico Industrial Lubricants Market, By End-Use, 2021–2029 (USD Billion)

- Europe Industrial Lubricants Market, By Product Type, 2021–2029 (USD Billion)

- Europe Industrial Lubricants Market, By End-Use, 2021–2029 (USD Billion)

- Germany Industrial Lubricants Market, By Product Type, 2021–2029 (USD Billion)

- Germany Industrial Lubricants Market, By End-Use, 2021–2029 (USD Billion)

- France Industrial Lubricants Market, By Product Type, 2021–2029 (USD Billion)

- France Industrial Lubricants Market, By End-Use, 2021–2029 (USD Billion)

- UK Industrial Lubricants Market, By Product Type, 2021–2029 (USD Billion)

- UK Industrial Lubricants Market, By End-Use, 2021–2029 (USD Billion)

- Italy Industrial Lubricants Market, By Product Type, 2021–2029 (USD Billion)

- Italy Industrial Lubricants Market, By End-Use, 2021–2029 (USD Billion)

- Spain Industrial Lubricants Market, By Product Type, 2021–2029 (USD Billion)

- Spain Industrial Lubricants Market, By End-Use, 2021–2029 (USD Billion)

- Asia Pacific Industrial Lubricants Market, By Product Type, 2021–2029 (USD Billion)

- Asia Pacific Industrial Lubricants Market, By End-Use, 2021–2029 (USD Billion)

- Japan Industrial Lubricants Market, By Product Type, 2021–2029 (USD Billion)

- Japan Industrial Lubricants Market, By End-Use, 2021–2029 (USD Billion)

- China Industrial Lubricants Market, By Product Type, 2021–2029 (USD Billion)

- China Industrial Lubricants Market, By End-Use, 2021–2029 (USD Billion)

- India Industrial Lubricants Market, By Product Type, 2021–2029 (USD Billion)

- India Industrial Lubricants Market, By End-Use, 2021–2029 (USD Billion)

- South America Industrial Lubricants Market, By Product Type, 2021–2029 (USD Billion)

- South America Industrial Lubricants Market, By End-Use, 2021–2029 (USD Billion)

- Brazil Industrial Lubricants Market, By Product Type, 2021–2029 (USD Billion)

- Brazil Industrial Lubricants Market, By End-Use, 2021–2029 (USD Billion)

- Middle East and Africa Industrial Lubricants Market, By Product Type, 2021–2029 (USD Billion)

- Middle East and Africa Industrial Lubricants Market, By End-Use, 2021–2029 (USD Billion)

- UAE Industrial Lubricants Market, By Product Type, 2021–2029 (USD Billion)

- UAE Industrial Lubricants Market, By End-Use, 2021–2029 (USD Billion)

- South Africa Industrial Lubricants Market, By Product Type, 2021–2029 (USD Billion)

- South Africa Industrial Lubricants Market, By End-Use, 2021–2029 (USD Billion)

List of Figures

- Global Industrial Lubricants Market Segmentation

- Industrial Lubricants Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Industrial Lubricants Market Attractiveness Analysis By Product Type

- Global Industrial Lubricants Market Attractiveness Analysis By End-Use

- Global Industrial Lubricants Market Attractiveness Analysis By Region

- Global Industrial Lubricants Market: Dynamics

- Global Industrial Lubricants Market Share By Product Type (2021 & 2029)

- Global Industrial Lubricants Market Share By End-Use (2021 & 2029)

- Global Industrial Lubricants Market Share by Regions (2021 & 2029)

- Global Industrial Lubricants Market Share by Company (2020)