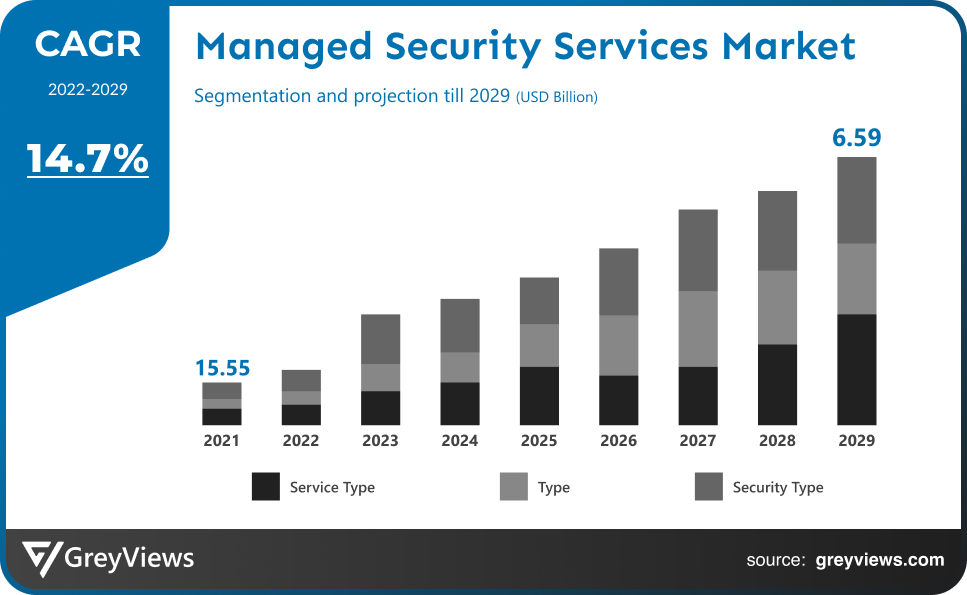

Managed Security Services Market Size By Service Type (BFSI, Managed IAM, MDR, Managed SIEM and Log Management), By Type (Fully Managed and Co-managed), and By Security Type (Network, Cloud, Endpoint and Application), Regions, Segmentation, and Projection till 2029

CAGR: 14.7%Current Market Size: USD 15.55 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Managed Security Services Market- Market Overview:

The Global Managed Security Services market is expected to grow from USD 15.55 billion in 2021 to USD 46.4 billion by 2029, at a CAGR of 14.7% during the forecast period 2022-2029. The growth of this market is mainly driven by increasing development in construction projects that demand efficient coating for concrete or steel.

Third-party providers provide proactive security measures through managed security services. These services are customised to meet an organization's needs and security demands. Continuous network (cloud-based or on-premises) and application monitoring, analysis, and evaluation are all included in managed security services. Constant improvements in the IT industry are causing security-related problems. To provide efficient managed security services for fast-advancing IT technologies, organisations are collaborating on research and development projects and forging partnerships. Organizations are having difficulty managing several sophisticated business networks and software programmes. As a result, they hire managed service providers to handle their IT needs. A sort of outsourcing called managed security service ensures that cyber defence measures are put in place and managed to protect a company's digital assets from ever evolving security threats. Security services including infrastructure development, data protection, security management, incident response management, regulatory compliance, and continuous monitoring are provided by managed security service providers. Due to a lack of internal security expertise or resources and a growing demand for continuous security management and monitoring outside of regular business hours, organisations use MSSPs. MSSPs keep an MSSP interface for ongoing reporting and communication to companies, allowing enterprises to concentrate on their core business activities with little disturbance from security measures.

Sample Request: - Global Managed Security Services Market

Market Dynamics:

Drivers:

- The rate of cybercrime is increasing

The prevalence of cybercrime is rising globally, which is driving up demand for managed security services. Businesses still utilise outdated data protection strategies in spite of the sophistication of attacks rising and the complexity of the IT network. The difficulty of guaranteeing data security has been further exacerbated by technology breakthroughs and practises such as bring your own device (BYOD), cellphones, social media, and cloud service usage.

Restraints:

- Lack of highly qualified IT workers

Throughout the projection period, it is expected that the shortage of highly skilled IT personnel and the low awareness of cyber-attacks among small and medium-sized businesses would impede the growth of the worldwide market. There may be several new business prospects as a result of the expanding adoption of blockchain-based security. Customers may utilise blockchain technology to track all business transactions in one location without fearing that their data would be misused or used for entertainment purposes. As a result, there is less reliance on other sources, and information may be accessed faster and more precisely.

Opportunities:

- Increasing emphasis on technology advances

Global business prospects might be enormous as a result of the growing acceptance of blockchain-based security. With the use of blockchain technology, consumers can monitor all company transactions in one location without worrying about information being compromised or being used for window dressing. This has reduced the dependence on any third party and increased the credibility and speed of access to the information. The managed security services industry has benefited from all these technological developments since these security measures are quite dependable.

Challenges:

- Security threats

For service providers, keeping the client-organization relationship strong is crucial. As a result, a relationship of trust is established between the two parties. The client must have complete faith in the organisation before sharing potentially fatal information with the service providers, and the latter must create a corporate culture that will allow industries to participate in the managed services market. A small number of non-compliance actions taken on the client's system also resulted in a security breach and a threat to the entire organisation.

Segmentation Analysis:

The global Managed Security Services market has been segmented based on Service Type, Type, Security Type and Regions.

By Service Type

The Service Type segment includes BFSI, Managed IAM, MDR, Managed SIEM and Log Management. The Powder segment led the largest share of the Managed Security Services market with a market share of around 30% in 2021. The BFSI is the repository for extremely sensitive data, including user names, passwords, and financial information about consumers. As a result, the vertical is heavily concentrated on safeguarding these resources and important data. Financial institutions are aware of the benefits of recent technological developments that may be used to enhance the customer experience and shield their clients from the repercussions of a security breach. Phishing and DDoS assaults, which try to steal login credentials and disrupt online transactions, have the most effects on the BFSI sector.

By Type

The Type segment includes Fully Managed and Co-managed. The Fully Managed segment led the Managed Security Services market with a market share of around 52% in 2021. Fully MSS offers various advantages over co-managed services, including managed workforce that can connect to a secure network and interact remotely, full remote and on-site support, and specialised and qualified knowledge to tackle security challenges. Hiring an MSSP is more cost-effective than spending money to train in-house IT specialists to address cybersecurity concerns and create a full-fledged IT security architecture. Among the well-known completely MSSPs are IBM (US), Cipher Security (US), Digital Guardian (US), SecureWorks (US), TCS (India), and Nettitude (US). Organizations are having trouble managing the security of remote workers in the wake of the COVID-19 epidemic.

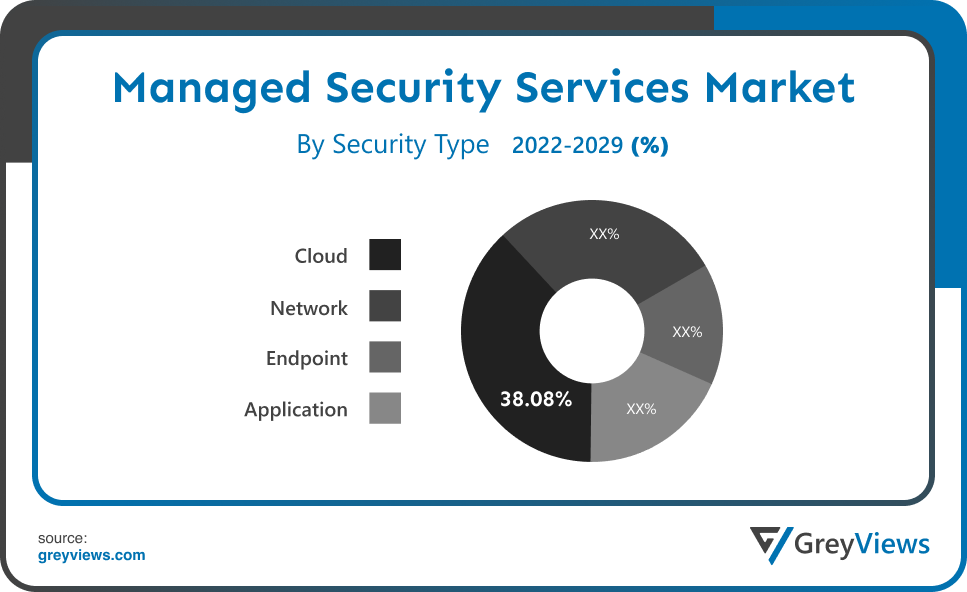

By Security Type

The Security Type segment includes Network, Cloud, Endpoint and Application. The Cloud segment led the Managed Security Services market with a market share of around 38.08% in 2021. Cloud security solutions offer whole ransomware, internal email, and file-sharing threat protection for the company cloud. Cloud security solutions are simple to integrate into current systems, corporate procedures, and operational groups. Various service models of software, platforms, and infrastructures are covered by cloud security, which covers both physical and virtual security. Risk analysis, application governance, DLP, IAM, encryption, malware detection and prevention, and SIEM are a few examples of different cloud application security solutions. These solutions guarantee security, compliance, and IT governance while controlling the use of sensitive data. As the amount of private data stored in the cloud rises, so does the demand for cloud security. Across the BFSI, healthcare, IT and telecom, retail, and government industries, cloud security is offered on public, private, and hybrid cloud networks.

Global Managed Security Services Market- Sales Analysis

The sale of Managed Security Services Service Types expanded at a CAGR of 10.2% from 2015 to 2021.

Industries are moving toward cloud technology because of its low cost, wide accessibility, pay-per-use business model, and enhanced performance. This includes cloud security managed services. This change has resulted in a number of security incident management problems.

Furthermore, current security solutions are typically inadequate and cannot be applied directly in cloud-based systems. Because of the growing reliance on connection between people and processes, security, resilience, and dependability of data and infrastructure are becoming more and more important.

Standards and services for connecting, managing, and securing various IoT devices are included in cloud infrastructure that is based on the Internet of Things. Smart grids for utilities, smart city infrastructure management, manufacturing, automotive, healthcare, and other end-use sectors are made possible by the Internet of Things (IoT). Due to their ability to manage resources, the use of cloud computing and IoT enables users to respond quickly and work more productively. Cloud-based solutions combine all user data into a single interface to provide a comprehensive view of the company's operations.

Thus, owing to the aforementioned factors, the global Managed Security Services Market is expected to grow at a CAGR of 14.7% during the Projection period from 2022 to 2029.

By Regional Analysis:

The regions analysed for the Managed Security Services market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Asia Pacific region dominated the Managed Security Services market and held a 39% share of the market revenue in 2021.

- The Asia Pacific region witnessed a major share. Owing to a shortage of internal security experts and the availability of few security technologies to safeguard data from cutting-edge cyber-attacks throughout the anticipated period. The complexity of the IT security infrastructure rises with the increased use of cutting-edge technologies like IoT, cloud computing, and operational technologies. The region's market for managed security services is expanding as a result of evolving cyber threats and existing security systems' incapacity to stop these sophisticated security threats.

- North America is anticipated to experience significant growth during the predicted period. Multiple MSSPs' accessibility and the region's early adoption of managed security services products are key drivers driving the industry. The COVID-19 pandemic has escalated cyberthreats in the area. The government, pharmaceutical, and healthcare industries are the most frequently targeted by cyber criminals. The University of California paid the NetWalker ransomware perpetrators a US$ 1.14 million ransom in June 2020. The School of Medicine's IT network was successfully penetrated by NetWalker, allowing access to data and encrypted systems.

Global Managed Security Services Market- Country Analysis:

- Germany

Germany Managed Security Services market size was valued at USD 0.51 billion in 2021 and is expected to reach USD 0.55 billion by 2029, at a CAGR of 11% from 2022 to 2029. Germany, a significant industrial country worldwide, will see IT-OT convergence as one of its growth patterns. The usage of MSS solutions that satisfy this demand is anticipated to increase due to the need to safeguard both IT and operational technology (OT) environments. Security issues related to the Internet of Things (IoT) are also anticipated to drive the sector.

- China

China’s Managed Security Services’ market size was valued at USD 0.84 billion in 2021 and is expected to reach USD 0.93 billion by 2029, at a CAGR of 14% from 2022 to 2029. In the last ten years, China's need for security and surveillance equipment has increased quickly. Both demand and output will increase during the following ten years. The Chinese economy continues to expand at a fast rate, which has been drive by long-term improvements in industrial output, import and export, consumer spending, and capital investment. In a recent research, China's economic trends, investment climate, industry development, supply and demand, industry capacity, industry structure, marketing channels, and important industry participants were examined.

- India

India's Managed Security Services market size was valued at USD 0.78 billion in 2021 and is expected to reach USD 0.86 billion by 2029, at a CAGR of 13% from 2022 to 2029. Organizations are under increasing pressure to take preventive action against possible dangers as cybercrimes occur more often and with greater regularity in India. The breaches at the nuclear power plant in India demonstrate that the security measures may not have been sufficient and that there is still a risk of an attack. Therefore, it is crucial to keep cybersecurity measures current and applicable.

Key Industry Players Analysis:

To increase their market position in the global Managed Security Services business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Alert Logic, Inc.

- SecureWorks, Inc.

- Trustwave Holdings, Inc.

- AT&T

- Broadcom Inc.

- NTT Security

- IBM Corporation

- Verizon Communications Inc.

- Atos SE

- Optiv Security, Inc.

- DXC Technology

- Wipro Limited

- Accenture

- Cipher

- BT Group plc

Latest Development:

- In May 2022, A cooperation between Palo Alto Networks and Deloitte was launched in order to offer managed security services to their shared clientele. Threat detection, 5G security, zero trust corporate enablement, and cloud security are all features of the Palo Alto-Deloitte managed security solution.

- In January 2021, A MSSP named Herjavec Group and Fishtech Group declared their intention to join, creating one of the biggest security solutions providers. Along with its six security operation centres, the new business will also provide MDR, professional services, and identity management system capabilities.

Report Metrics

| Report Attribute | Details |

| Study Period | 2021-2029 |

| Base year | 2021 |

| CAGR (%) | 14.7% |

| Market Size | 15.55 billion in 2021 |

| Projection period | 2022-2029 |

| Projection unit | Value (USD) |

| Segments covered | By Service Type, By Type, By Security Type, and By Region. |

| Report Scope | Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

Companies covered | Alert Logic, Inc., SecureWorks, Inc., Trustwave Holdings, Inc., AT&T, Broadcom Inc., NTT Security, IBM Corporation, Verizon Communications Inc., Atos SE, Optiv Security, Inc., DXC Technology, Wipro Limited, Accenture, Cipher, and BT Group plc. |

| By Service Type |

|

| By Type |

|

| By Security Type |

|

Regional scope |

|

Scope of the Report

Global Managed Security Services Market by Service Type:

- BFSI

- Managed IAM

- MDR

- Managed SIEM

- Log Management

Global Managed Security Services Market by Type:

- Fully Managed

- Co-managed

Global Managed Security Services Market by Security Type:

- Network

- Cloud

- Endpoint

- Application

Global Managed Security Services Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the growth rate of the Managed Security Services market during the Projection period?

The global Managed Security Services market is expected to grow with a 14.7% CAGR during the Projection period.

How is the North American Managed Security Services market projected to grow?

The North American Managed Security Services market was projected to gain a global market share of 39% in 2021.

What is the major driving factor of the Managed Security Services market?

Global Managed Security Services key market players are Abbott Laboratories, Thermo Fisher Scientific Inc., Bio Rad Laboratories Inc., Roche Holding AG, GE Healthcare, Illumina, Inc., Siemens AG, Bristol-Myers Squibb, Toshiba Medical Systems Corporation, Koninklijke Philips N.V., and Agilent Technologies Inc.

What was the market size of Managed Security Services market?

Global Managed Security Services market�s size in 2021 was USD 15.55 billion in 2021.

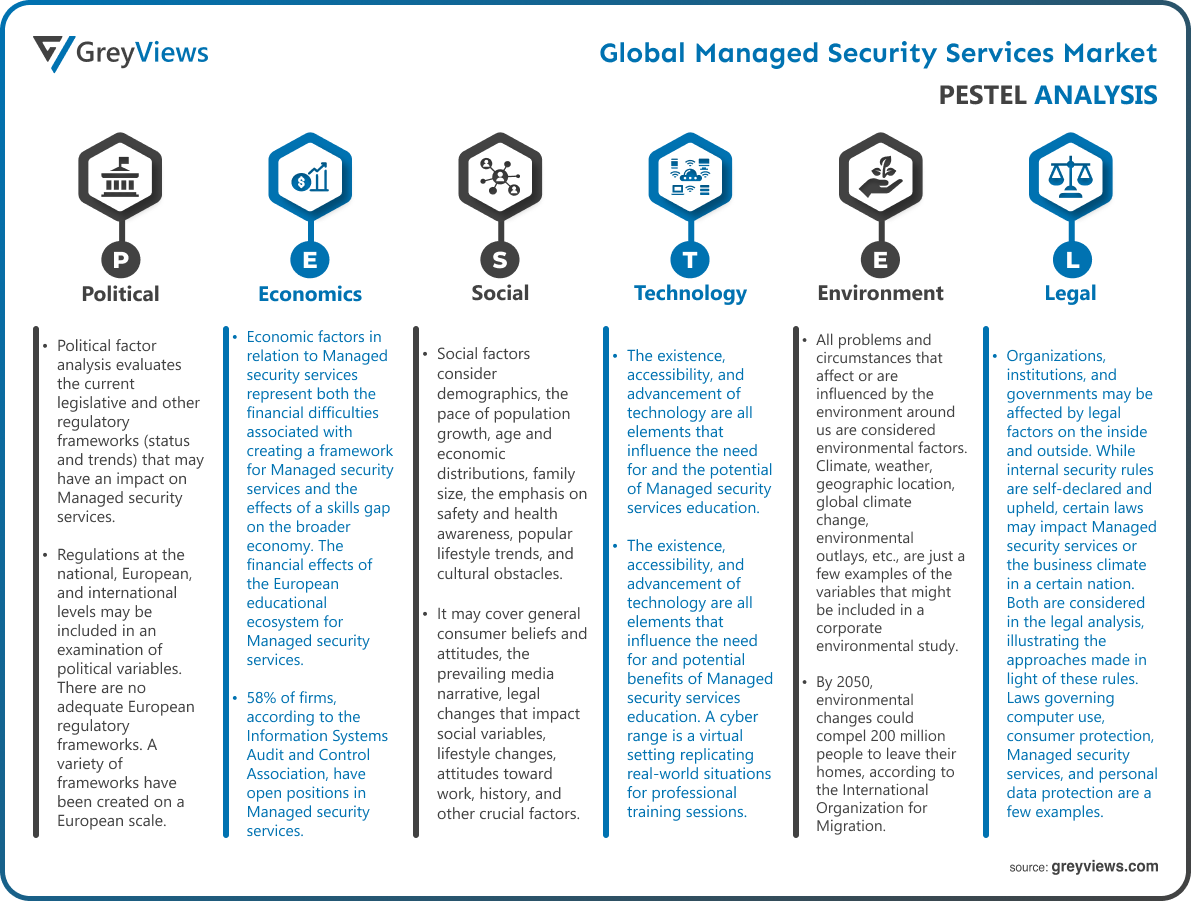

Political Factors- Political factor analysis evaluates the current legislative and other regulatory frameworks (status and trends) that may have an impact on Managed security services. Regulations at the national, European, and international levels may be included in an examination of political variables. There are no adequate European regulatory frameworks. A variety of frameworks have been created on a European scale. However, these frameworks fail to address Managed security services and training in sufficient detail, preventing the development of pertinent regulatory frameworks in this field. Deficiencies in skills and weaknesses in the training systems. To properly identify the abilities required in the labour market, Managed security services must draw in more students.

Economical Factors- Economic factors in relation to Managed security services represent both the financial difficulties associated with creating a framework for Managed security services and the effects of a skills gap on the broader economy. The financial effects of the European educational ecosystem for Managed security services. 58% of firms, according to the Information Systems Audit and Control Association, have open positions in Managed security services. The dearth of qualified specialists is among the main causes of this. Increased availability of degree programmes and training programmes across Europe could help close the skills gap.

Social Factor- Social factors consider demographics, the pace of population growth, age and economic distributions, family size, the emphasis on safety and health awareness, popular lifestyle trends, and cultural obstacles. Additionally, it may cover general consumer beliefs and attitudes, the prevailing media narrative, legal changes that impact social variables, lifestyle changes, attitudes toward work, history, and other crucial factors. Only a small percentage of women enrol in Managed security services programmes, and many of those students leave early. This can be attributed partly to a lack of role models' encouragement, continuing ideas that the industry is more suited to men, a lack of knowledge about what Managed security services professions require, and in some circumstances, how simple or difficult they find the subjects.

Technological Factors- The existence, accessibility, and advancement of technology are all elements that influence the need for and the potential of Managed security services education. The existence, accessibility, and advancement of technology are all elements that influence the need for and potential benefits of Managed security services education. A cyber range is a virtual setting replicating real-world situations for professional training sessions. These are crucial tools for teaching groups of security experts about ethical hacking and how to recognise and respond to threats. A revision of present security curricula would be necessary for light of a variety of upcoming technologies that have the potential to alter how computers, networks, and systems are operated. Examples include cyber-physical systems, machine learning, and quantum computing.

Environmental Factors- All problems and circumstances that affect or are influenced by the environment around us are considered environmental factors. Climate, weather, geographic location, global climate change, environmental outlays, etc., are just a few examples of the variables that might be included in a corporate environmental study. By 2050, environmental changes could compel 200 million people to leave their homes, according to the International Organization for Migration. This will also impact Managed security services and physical security in a modern, digital society. A larger pool of cyber-security experts will be required to supply answers and services.

Legal Factors- Organizations, institutions, and governments may be affected by legal factors on the inside and outside. While internal security rules are self-declared and upheld, certain laws may impact Managed security services or the business climate in a certain nation. Both are considered in the legal analysis, illustrating the approaches made in light of these rules. Laws governing computer use, consumer protection, Managed security services, and personal data protection are a few examples. We noticed certain aspects during our analysis. Only a small percentage of products, services, and procedures are certified for Managed security services. There are considerable differences in product coverage, degrees of assurances, fundamental criteria, and actual use across existing certification systems, which makes it difficult for the European Union to implement procedures for mutual recognition (EU).

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Service Type

- 3.2. Market Attractiveness Analysis By Type

- 3.3. Market Attractiveness Analysis By Security Type

- 3.4. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. The rate of cybercrime is increasing

- 3. Restraints

- 3.1. Lack of highly qualified IT workers

- 4. Opportunities

- 4.1. Increasing emphasis on technology advances

- 5. Challenges

- 5.1. Security threats

- Global Managed Security Services Market Analysis and Projection, By Service Type

- 1. Segment Overview

- 2. BFSI

- 3. Managed IAM

- 4. MDR

- 5. Managed SIEM

- 6. Log Management

- Global Managed Security Services Market Analysis and Projection, By Type

- 1. Segment Overview

- 2. Fully Managed

- 3. Co-managed

- Global Managed Security Services Market Analysis and Projection, By Security Type

- 1. Segment Overview

- 2. Network

- 3. Cloud

- 4. Endpoint

- 5. Application

- Global Managed Security Services Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Managed Security Services Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Managed Security Services Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Alert Logic, Inc.

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- SecureWorks, Inc.

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Trustwave Holdings, Inc.

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- AT&T

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Broadcom Inc.

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- NTT Security

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- IBM Corporation

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Verizon Communications Inc.

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Atos SE

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Optiv Security, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- DXC Technology

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Wipro Limited

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Accenture

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Cipher

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- BT Group plc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Alert Logic, Inc.

- List of Table

- Global Managed Security Services Market, By Service Type, 2021–2029 (USD Billion)

- Global BFSI, Managed Security Services Market, By Region, 2021–2029 (USD Billion)

- Global Managed IAM, Managed Security Services Market, By Region, 2021–2029 (USD Billion)

- Global MDR, Managed Security Services Market, By Region, 2021–2029 (USD Billion)

- Global Managed SIEM, Managed Security Services Market, By Region, 2021–2029 (USD Billion)

- Global Log Management, Managed Security Services Market, By Region, 2021–2029 (USD Billion)

- Global Managed Security Services Market, By Type, 2021–2029 (USD Billion)

- Global Fully Managed, Managed Security Services Market, By Region, 2021–2029 (USD Billion)

- Global Co-managed, Managed Security Services Market, By Region, 2021–2029 (USD Billion)

- Global Managed Security Services Market, By Security Type, 2021–2029 (USD Billion)

- Global Network, Managed Security Services Market, By Region, 2021–2029 (USD Billion)

- Global Cloud, Managed Security Services Market, By Region, 2021–2029 (USD Billion)

- Global Endpoint, Managed Security Services Market, By Region, 2021–2029 (USD Billion)

- Global Application, Managed Security Services Market, By Region, 2021–2029 (USD Billion)

- Global Managed Security Services Market, By Region, 2021–2029 (USD Billion)

- North America Managed Security Services Market, By Service Type, 2021–2029 (USD Billion)

- North America Managed Security Services Market, By Type, 2021–2029 (USD Billion)

- North America Managed Security Services Market, By Security Type, 2021–2029 (USD Billion)

- USA Managed Security Services Market, By Service Type, 2021–2029 (USD Billion)

- USA Managed Security Services Market, By Type, 2021–2029 (USD Billion)

- USA Managed Security Services Market, By Security Type, 2021–2029 (USD Billion)

- Canada Managed Security Services Market, By Service Type, 2021–2029 (USD Billion)

- Canada Managed Security Services Market, By Type, 2021–2029 (USD Billion)

- Canada Managed Security Services Market, By Security Type, 2021–2029 (USD Billion)

- Mexico Managed Security Services Market, By Service Type, 2021–2029 (USD Billion)

- Mexico Managed Security Services Market, By Type, 2021–2029 (USD Billion)

- Mexico Managed Security Services Market, By Security Type, 2021–2029 (USD Billion)

- Europe Managed Security Services Market, By Service Type, 2021–2029 (USD Billion)

- Europe Managed Security Services Market, By Type, 2021–2029 (USD Billion)

- Europe Managed Security Services Market, By Security Type, 2021–2029 (USD Billion)

- Germany Managed Security Services Market, By Service Type, 2021–2029 (USD Billion)

- Germany Managed Security Services Market, By Type, 2021–2029 (USD Billion)

- Germany Managed Security Services Market, By Security Type, 2021–2029 (USD Billion)

- France Managed Security Services Market, By Service Type, 2021–2029 (USD Billion)

- France Managed Security Services Market, By Type, 2021–2029 (USD Billion)

- France Managed Security Services Market, By Security Type, 2021–2029 (USD Billion)

- UK Managed Security Services Market, By Service Type, 2021–2029 (USD Billion)

- UK Managed Security Services Market, By Type, 2021–2029 (USD Billion)

- UK Managed Security Services Market, By Security Type, 2021–2029 (USD Billion)

- Italy Managed Security Services Market, By Service Type, 2021–2029 (USD Billion)

- Italy Managed Security Services Market, By Type, 2021–2029 (USD Billion)

- Italy Managed Security Services Market, By Security Type, 2021–2029 (USD Billion)

- Spain Managed Security Services Market, By Service Type, 2021–2029 (USD Billion)

- Spain Managed Security Services Market, By Type, 2021–2029 (USD Billion)

- Spain Managed Security Services Market, By Security Type, 2021–2029 (USD Billion)

- Asia Pacific Managed Security Services Market, By Service Type, 2021–2029 (USD Billion)

- Asia Pacific Managed Security Services Market, By Type, 2021–2029 (USD Billion)

- Asia Pacific Managed Security Services Market, By Security Type, 2021–2029 (USD Billion)

- Japan Managed Security Services Market, By Service Type, 2021–2029 (USD Billion)

- Japan Managed Security Services Market, By Type, 2021–2029 (USD Billion)

- Japan Managed Security Services Market, By Security Type, 2021–2029 (USD Billion)

- China Managed Security Services Market, By Service Type, 2021–2029 (USD Billion)

- China Managed Security Services Market, By Type, 2021–2029 (USD Billion)

- China Managed Security Services Market, By Security Type, 2021–2029 (USD Billion)

- India Managed Security Services Market, By Service Type, 2021–2029 (USD Billion)

- India Managed Security Services Market, By Type, 2021–2029 (USD Billion)

- India Managed Security Services Market, By Security Type, 2021–2029 (USD Billion)

- South America Managed Security Services Market, By Service Type, 2021–2029 (USD Billion)

- South America Managed Security Services Market, By Type, 2021–2029 (USD Billion)

- South America Managed Security Services Market, By Security Type, 2021–2029 (USD Billion)

- Brazil Managed Security Services Market, By Service Type, 2021–2029 (USD Billion)

- Brazil Managed Security Services Market, By Type, 2021–2029 (USD Billion)

- Brazil Managed Security Services Market, By Security Type, 2021–2029 (USD Billion)

- Middle East and Africa Managed Security Services Market, By Service Type, 2021–2029 (USD Billion)

- Middle East and Africa Managed Security Services Market, By Type, 2021–2029 (USD Billion)

- Middle East and Africa Managed Security Services Market, By Security Type, 2021–2029 (USD Billion)

- UAE Managed Security Services Market, By Service Type, 2021–2029 (USD Billion)

- UAE Managed Security Services Market, By Type, 2021–2029 (USD Billion)

- UAE Managed Security Services Market, By Security Type, 2021–2029 (USD Billion)

- South Africa Managed Security Services Market, By Service Type, 2021–2029 (USD Billion)

- South Africa Managed Security Services Market, By Type, 2021–2029 (USD Billion)

- South Africa Managed Security Services Market, By Security Type, 2021–2029 (USD Billion)

- List of Figures

- Global Managed Security Services Market Segmentation

- Managed Security Services Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Managed Security Services Market Attractiveness Analysis By Service Type

- Global Managed Security Services Market Attractiveness Analysis By Type

- Global Managed Security Services Market Attractiveness Analysis By Security Type

- Global Managed Security Services Market Attractiveness Analysis By Region

- Global Managed Security Services Market: Dynamics

- Global Managed Security Services Market Share By Service Type (2021 & 2029)

- Global Managed Security Services Market Share By Type (2021 & 2029)

- Global Managed Security Services Market Share By Security Type (2021 & 2029)

- Global Managed Security Services Market Share by Regions (2021 & 2029)

- Global Managed Security Services Market Share by Company (2020)