Mooring Buoy Market Size by Product Type (Plastic Buoy and Steel Buoy), End-User (Oil & Gas, Marine and Defense, Aquaculture, and Others), Regions, Segmentation, and Projection till 2029

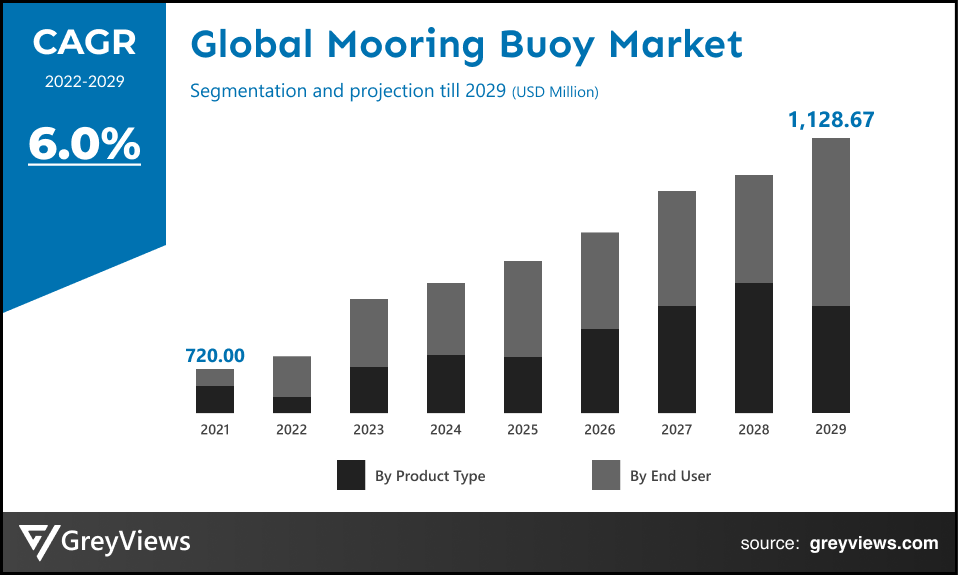

CAGR: 6.0%Current Market Size: USD 720.00 MillionFastest Growing Region: APAC

Largest Market: EuropeProjection Time: 2022-2029Base Year: 2021

Global Mooring Buoy - Market Overview

The global mooring buoy market is expected to grow from USD 720.00 million in 2021 to USD 1,128.67 million by 2029, at a CAGR of 6.0% during the Projection period 2022-2029. This growth is mainly driven by growing international trade & global economy coupled with the upsurge in the popularity of water sports as a recreational activity among millennials.

A mooring buoy is a type of structure that floats in water to moor vessels such as cruise ships, cargo ships, fishing boats, or private ships while in shallow or deep water. The main aim of this structure is to warn, guide, or notify mariners, to spot the presence of submerged objects that could be hazardous or to moor vessels in lieu of anchoring. These structures are designed in a way that there is a heavyweight located at the bottom of the sea. This heavyweight is used as an anchor to hold the buoy floating in the water.

The utilization of mooring buoys has helped the maritime industry accomplish objectives such as protected marine life and surety that the ships are properly moored. The traditional anchors are inclined to unearth and uproot coral that lies underneath the surface of the water; however, ships are using mooring buoys to protect coral reefs. The usage of mooring buoys has helped ships to eliminate the catastrophic effects on marine ecology that would have been caused due to digging.

Request Sample:- Global Mooring Buoy Market

Market Dynamics:

Drivers:

- Growing international trade & global economy

The global economy and international trade growth is significantly driven by maritime transport. For instance, according to the Maritime Transport 2021 by United Nations Conference on Trade and Development (UNCTAD), more than 80% of the volume of international trade in goods is carried by sea, and this share is considerably higher for most of the developing countries around the globe. Hence, there is a surge in shipments around the various regions, along with the growing trade through the sea route. This has led to the concerns associated with security and safe navigation through waterways, creating demand for a mooring buoy.

- Upsurge in popularity of water sports as a recreational activity among millennial

In the past several years, watersports, such as stand-up paddleboarding, kayaking, recreational sailing, and open water swimming, have seen significant growth in popularity. This is mainly attributed to the emerging need among millennials to improve their mental health. This increase in the popularity of watersports has created a demand for safety products and floatation devices, fueling the growth of the global mooring buoy market.

Restraints:

- Rising penetration of renewable energy

The rising adoption of renewable energy sources such as solar energy for power generation causes reduced demand for oil & gas. This may hamper exploration activities of oil and gas in the deep ocean, leading to the reduced usage of mooring buoys and hampering the global market. In addition, several governments are planning to increase renewable energy power generation. For instance, the government of the UK aimed to generate about 50% of its electricity from renewable energy sources. In addition, Germany is expected to account for about 65% of its energy to be generated by renewable sources.

Opportunities:

- Growing investment in seaports

Seaport investment has become a prominent agenda in modern seaport economics to plan the seaport funding, developments, and access. For instance, the Chinese government has dedicated an estimated $153 billion to constructing new port facilities and upgrading existing seaports from 2012 to 2019. In addition, the country is rapidly expanding its influence in the Indian Ocean Region through massive investment in ports. Such investments are expected to create lucrative growth opportunities for the global mooring buoy market.

Challenges

- Impact of COVID-19 on the global maritime industry

The pandemic caused the maritime and shipping industry to face the worst circumstances due to a considerable decline in global trade activities. For instance, according to the UNCTAD’s Review of Maritime Transport 2021 report published in November 2021, maritime trade contracted by 3.8% in 2020. Such scenarios posed by the COVID-19 pandemic have challenged the mooring buoy market players.

Segmentation Analysis:

The global Mooring Buoy market has been segmented based on product type, end-user, and regions.

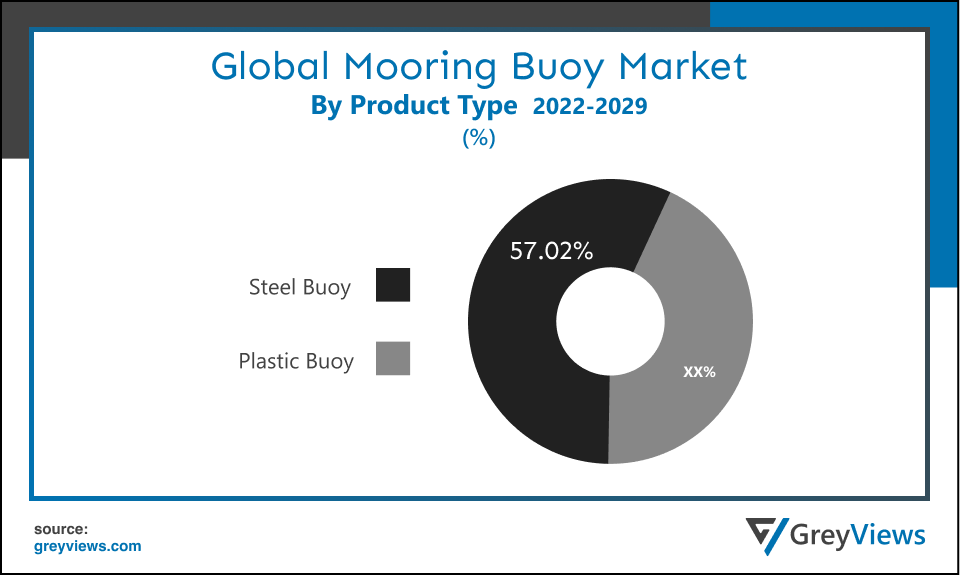

By Product Type

The product type segment includes plastic buoys and steel buoys. The steel buoy segment led the Mooring Buoy market with a market share of around 57.02% in 2021. Steel mooring buoys were traditionally preferred as they provide durable and safe mooring operations and ensure efficient space usage. In addition, such buoys offer solidity and rigidity, which is essential for withstanding harsh offshore conditions. The factors mentioned above have primarily driven the growth of the segment.

By End User

The end-user segment includes oil & gas, marine and defense, aquaculture, and others. The oil & gas segment led the mooring buoy market with a market share of around 59.10% in 2021. Increased exploration activities are being carried out at shallow and deep underwater depths, which has mainly driven demand for mooring buoys in the oil and gas sector. In addition, several marine oil and gas (O&G) exploration companies reinvent themselves by transforming business models and enhancing their oil & gas production. This creates opportunities for growth of the mooring buoy market in the oil & gas sector.

Global Mooring Buoy Market- By Regional Analysis

The regions analyzed for the mooring buoy market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Asia-Pacific region dominated the Mooring Buoy market and held the 43.05% share of the market revenue in 2021.

- Asia-Pacific region witnessed a major share due to the aquaculture, offshore wind power, and oil & gas sector growth across the countries, including India, China, Vietnam, and South Korea. In addition, Asia dominates the global maritime trade sector due to the growing e-commerce sector and huge investments in seaports by China and India. Also, most Asian countries are active in seafaring, shipbuilding, and ship recycling. All of the factors mentioned above have driven the growth of the Asia-Pacific mooring buoy market.

- Europe is expected to witness a considerable growth rate during the Projection period. About 90% of the European Union’s (EU) external freight trade is in seaborne. In addition, according to the European Commission, more than 400 million passengers embark and disembark at European ports every year. Also, the EU shipping industry contributes about $153.01 billion to the EU’s annual GDP. Such significance of the shipping industry in the region is opportunistic for the growth of the mooring buoy market.

Global Mooring Buoy Market- Country Analysis:

- Germany

Germany Mooring Buoy's market size was valued at USD 79.20 million in 2021 and is expected to reach USD 125.10 million by 2029, at a CAGR of 6.1%from 2022 to 2029.

Germany is one of the largest seafaring countries in the world. In addition, the country is actively involved in international trade deals. For instance, in September 2021, COSCO Shipping Ports Ltd. announced a strategic partnership with Hamburger Hafen und Logistik AG (HHLA), a German container terminal operator, to augment the throughput at the Port of Hamburg as well as to expand trade between Germany and China. Such investments in support of international trade are opportunistic for market growth.

- China

China Mooring Buoy's market size was valued at USD 158.40 million in 2021 and is expected to reach USD 239.07 million by 2029, at a CAGR of 5.5% from 2022 to 2029. In 2019, marine industries in China contributed about 9% of its gross domestic product (GDP) in 2020. Also, according to the State Oceanic Administration in China, emerging marine industries, including advanced manufacturing and coastal tourism, grew by over 11% annually from 2016 to 2020. The significance of marine industries is the primary factor contributing to China's mooring buoy market growth. In addition, supportive policies to attract and incorporate competitive technological advances into the marine industry have boosted the market's growth. For instance, under China’s 14th five-year plan and 2035 vision, the country has outlined goals to expand its ocean economy and develop an enhanced marine infrastructure in the upcoming years. This plan is opportunistic for the growth of the china mooring buoy market.

- India

India Mooring Buoy's market size was valued at USD 57.60 million in 2021 and is expected to reach USD 92.36 million by 2029, at a CAGR of 6.3% from 2022 to 2029. India is one of the strongest growing economies in Asia. The maritime transport sector in this country handles about 95% of its international trade by volume. In addition, the development of its maritime sector has become one of the top priorities for the government of India. Moreover, the country is surrounded by the Indian Ocean Region (IOR), which supports about 80% of the global maritime oil trade. All of the factors mentioned above boost the growth of India's mooring buoy market.

Key Industry Players Analysis:

To increase their market position in the global Mooring Buoy business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Trelleborg Marine and Infrastructure

- Sealite

- KinderCare

- Mobilis SA

- Floatex Srl

- Walsh Marine Products

- Norfloat International Ltd.

- Anchor Marine

- Tidal Marine

- IRM Offshore and Marine Engineers Pvt. Ltd.

Latest Development:

- In February 2022, Trelleborg’s marine & infrastructure operation completed the installation of its rope-free automated mooring system at the Port of Tallinn. This system is expected to enhance the day-to-day efficiency and productivity of mooring operations, enabling port-wide decarbonization and prioritizing crew safety.

- In November 2020, JGH Marine, the company specializing in building and supplying vessels, was awarded a contract for installing and supplying four mooring buoys for the Mauritius Ports Authority.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

6.0% |

|

Market Size |

720.00 million in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Product Type, End User, and regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Trelleborg Marine and Infrastructure, Sealite, FenderCare, Mobilis SA, Floatex Srl, Walsh Marine Products, Norfloat International Ltd., Anchor Marine, Tidal Marine, IRM Offshore and Marine Engineers Pvt. Ltd. among others |

|

By Product Type |

|

|

By End User

|

|

|

Regional scope |

|

Scope of the Report

Global Mooring Buoy Market by Product Type:

- Plastic Buoy

- Steel Buoy

Global Mooring Buoy Market by End User:

- Oil & Gas

- Marine and Defence

- Aquaculture

- Others

Global Mooring Buoy Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

How Big Is Global Mooring Buoy Market?

Global mooring buoy market was USD 720.00 million in 2021 and will grow to USD 1,128.67 million by 2029, at a CAGR of 6.0%

Who are the end user of Mooring Buoy?

The end-user segment includes oil & gas, marine and defense, aquaculture, and others. The oil & gas segment led the mooring buoy market with a market share of around 59.10% in 2021. Increased exploration activities are being carried out at shallow and deep underwater depths, which has mainly driven demand for mooring buoys in the oil and gas sector. In addition, several marine oil and gas (O&G) exploration companies reinvent themselves by transforming business models and enhancing their oil & gas production. This creates opportunities for growth of the mooring buoy market in the oil & gas sector

Which Region dominate the Global Mooring Buoy Market?

Asia-Pacific region dominated the Mooring Buoy market and held the 43.05% share of the market revenue in 2021

What are the Opportunities in Mooring Buoy Market?

Seaport investment has become a prominent agenda in modern seaport economics to plan the seaport funding, developments, and access. For instance, the Chinese government has dedicated an estimated $153 billion to constructing new port facilities and upgrading existing seaports from 2012 to 2019. In addition, the country is rapidly expanding its influence in the Indian Ocean Region through massive investment in ports. Such investments are expected to create lucrative growth opportunities for the global mooring buoy market.

What are the technological factors in Mooring Buoy Market?

In 2019, marine industries in China contributed about 9% of its gross domestic product (GDP) in 2020. Also, according to the State Oceanic Administration in China, emerging marine industries, including advanced manufacturing and coastal tourism, grew by over 11% annually from 2016 to 2020. The significance of marine industries is the primary factor contributing to China's mooring buoy market growth. In addition, supportive policies to attract and incorporate competitive technological advances into the marine industry have boosted the market's growth. For instance, under China’s 14th five-year plan and 2035 vision, the country has outlined goals to expand its ocean economy and develop an enhanced marine infrastructure in the upcoming years. This plan is opportunistic for the growth of the China mooring buoy market

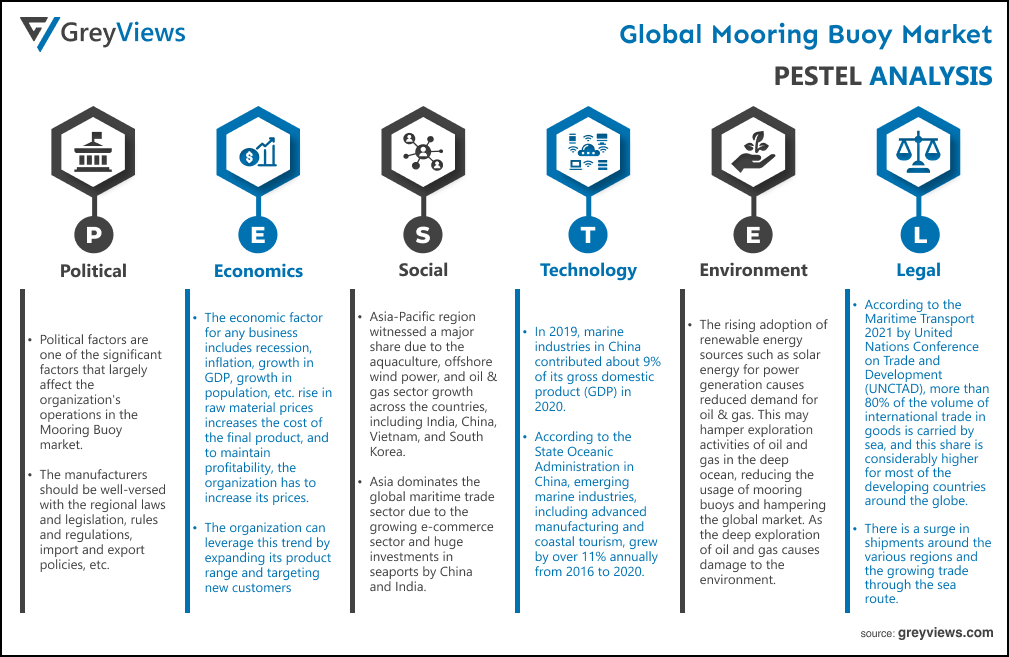

Political Factors- Political factors are one of the significant factors that largely affect the organization's operations in the Mooring Buoy market. The manufacturers should be well-versed with the regional laws and legislation, rules and regulations, import and export policies, etc. The concerned regional agencies provide guidelines to the manufacturing companies regarding the procurement of materials and specifications for its use. For instance, several governments are planning to increase renewable energy power generation.

Economical Factors- The economic factor for any business includes recession, inflation, growth in GDP, population growth, etc. rise in raw material prices increases the cost of the final product, and to maintain profitability, the organization has to increase its prices. The organization can leverage this trend by expanding its product range and targeting new customers. For instance, Seaport investment has become a prominent agenda in modern seaport economics to plan the seaport funding, developments, and access. For instance, the Chinese government has dedicated an estimated $153 billion to constructing new port facilities and upgrading existing seaports from 2012 to 2019. In addition, the country is rapidly expanding its influence in the Indian Ocean Region through massive investment in ports. Such investments are expected to create lucrative growth opportunities for the global mooring buoy market.

Social Factor- Asia-Pacific region witnessed a major share due to the aquaculture, offshore wind power, and oil & gas sector growth across the countries, including India, China, Vietnam, and South Korea. In addition, Asia dominates the global maritime trade sector due to the growing e-commerce sector and huge investments in seaports by China and India. Also, most Asian countries are active in seafaring, shipbuilding, and ship recycling. All of the factors mentioned above have driven the growth of the Asia-Pacific mooring buoy market.

Technological Factors- In 2019, marine industries in China contributed about 9% of its gross domestic product (GDP) in 2020. Also, according to the State Oceanic Administration in China, emerging marine industries, including advanced manufacturing and coastal tourism, grew by over 11% annually from 2016 to 2020. The significance of marine industries is the primary factor contributing to China's mooring buoy market growth. In addition, supportive policies to attract and incorporate competitive technological advances into the marine industry have boosted the market's growth. For instance, under China’s 14th five-year plan and 2035 vision, the country has outlined goals to expand its ocean economy and develop an enhanced marine infrastructure in the upcoming years. This plan is opportunistic for the growth of the china mooring buoy market.

Environmental Factors- The rising adoption of renewable energy sources such as solar energy for power generation causes reduced demand for oil & gas. This may hamper exploration activities of oil and gas in the deep ocean, reducing the usage of mooring buoys and hampering the global market. As the deep exploration of oil and gas causes damage to the environment. In addition, several governments are planning to increase renewable energy power generation. For instance, Germany is expected to account for about 65% of its energy generated by renewable sources.

Legal Factors- The global economy and international trade growth are significantly driven by maritime transport. For instance, according to the Maritime Transport 2021 by United Nations Conference on Trade and Development (UNCTAD), more than 80% of the volume of international trade in goods is carried by sea, and this share is considerably higher for most of the developing countries around the globe. Hence, there is a surge in shipments around the various regions and the growing trade through the sea route. This has led to the concerns associated with security and safe navigation through waterways, creating demand for a mooring buoy.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Product Type

- Market Attractiveness Analysis By End User

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Growing international trade & global economy

- Upsurge in popularity of water sports as a recreational activity among millennial

- Restrains

- Rising penetration of renewable energy

- Opportunities

- Growing investment in sea ports

- Challenges

- Impact of COVID-19 on the global maritime industry

- Global Mooring Buoy Market Analysis and Projection, By Product Type

- Segment Overview

- Plastic Buoy

- Steel Buoy

- Global Mooring Buoy Market Analysis and Projection, By End User

- Segment Overview

- Oil & Gas

- Marine and Defence

- Aquaculture

- Others

- Global Mooring Buoy Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Mooring Buoy Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Mooring Buoy Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Product Type Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Trelleborg Marine and Infrastructure

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Sealite

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- FenderCare

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Mobilis SA

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Floatex Srl

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Walsh Marine Products

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Norfloat International Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Anchor Marine

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Tidal Marine

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- IRM Offshore and Marine Engineers Pvt. Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Trelleborg Marine and Infrastructure

List of Table

- Global Mooring Buoy Market, By Product Type, 2021–2029(USD Million)

- Global Plastic Buoy Mooring Buoy Market, By Region, 2021–2029(USD Million)

- Global Steel Buoy Mooring Buoy Market, By Region, 2021–2029(USD Million)

- Global Mooring Buoy Market, By End User, 2021–2029(USD Million)

- Global Oil & Gas Mooring Buoy Market, By Region, 2021–2029(USD Million)

- Global Marine and Defence Mooring Buoy Market, By Region, 2021–2029(USD Million)

- Global Aquaculture Mooring Buoy Market, By Region, 2021–2029(USD Million)

- Global Others Mooring Buoy Market, By Region, 2021–2029(USD Million)

- Global Mooring Buoy Market, By Region, 2021–2029(USD Million)

- Global Mooring Buoy Market, By North America, 2021–2029(USD Million)

- North America Mooring Buoy Market, By Product Type, 2021–2029(USD Million)

- North America Mooring Buoy Market, By End User, 2021–2029(USD Million)

- USA Mooring Buoy Market, By Product Type, 2021–2029(USD Million)

- USA Mooring Buoy Market, By End User, 2021–2029(USD Million)

- Canada Mooring Buoy Market, By Product Type, 2021–2029(USD Million)

- Canada Mooring Buoy Market, By End User, 2021–2029(USD Million)

- Mexico Mooring Buoy Market, By Product Type, 2021–2029(USD Million)

- Mexico Mooring Buoy Market, By End User, 2021–2029(USD Million)

- Europe Mooring Buoy Market, By Product Type, 2021–2029(USD Million)

- Europe Mooring Buoy Market, By End User, 2021–2029(USD Million)

- Germany Mooring Buoy Market, By Product Type, 2021–2029(USD Million)

- Germany Mooring Buoy Market, By End User, 2021–2029(USD Million)

- France Mooring Buoy Market, By Product Type, 2021–2029(USD Million)

- France Mooring Buoy Market, By End User, 2021–2029(USD Million)

- UK Mooring Buoy Market, By Product Type, 2021–2029(USD Million)

- UK Mooring Buoy Market, By End User, 2021–2029(USD Million)

- Italy Mooring Buoy Market, By Product Type, 2021–2029(USD Million)

- Italy Mooring Buoy Market, By End User, 2021–2029(USD Million)

- Spain Mooring Buoy Market, By Product Type, 2021–2029(USD Million)

- Spain Mooring Buoy Market, By End User, 2021–2029(USD Million)

- Asia Pacific Mooring Buoy Market, By Product Type, 2021–2029(USD Million)

- Asia Pacific Mooring Buoy Market, By End User, 2021–2029(USD Million)

- Japan Mooring Buoy Market, By Product Type, 2021–2029(USD Million)

- Japan Mooring Buoy Market, By End User, 2021–2029(USD Million)

- China Mooring Buoy Market, By Product Type, 2021–2029(USD Million)

- China Mooring Buoy Market, By End User, 2021–2029(USD Million)

- India Mooring Buoy Market, By Product Type, 2021–2029(USD Million)

- India Mooring Buoy Market, By End User, 2021–2029(USD Million)

- South America Mooring Buoy Market, By Product Type, 2021–2029(USD Million)

- South America Mooring Buoy Market, By End User, 2021–2029(USD Million)

- Brazil Mooring Buoy Market, By Product Type, 2021–2029(USD Million)

- Brazil Mooring Buoy Market, By End User, 2021–2029(USD Million)

- Middle East and Africa Mooring Buoy Market, By Product Type, 2021–2029(USD Million)

- Middle East and Africa Mooring Buoy Market, By End User, 2021–2029(USD Million)

- UAE Mooring Buoy Market, By Product Type, 2021–2029(USD Million)

- UAE Mooring Buoy Market, By End User, 2021–2029(USD Million)

- South Africa Mooring Buoy Market, By Product Type, 2021–2029(USD Million)

- South Africa Mooring Buoy Market, By End User, 2021–2029(USD Million)

List of Figures

- Global Mooring Buoy Market Segmentation

- Mooring Buoy Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Mooring Buoy Market Attractiveness Analysis By Product Type

- Global Mooring Buoy Market Attractiveness Analysis By End User

- Global Mooring Buoy Market Attractiveness Analysis By Region

- Global Mooring Buoy Market: Dynamics

- Global Mooring Buoy Market Share By Product Type(2021 & 2029)

- Global Mooring Buoy Market Share By End User(2021 & 2029)

- Global Mooring Buoy Market Share by Regions (2021 & 2029)

- Global Mooring Buoy Market Share by Company (2020)