Nucleic Acid Isolation & Purification Market Size by Product (Kits, Reagents, and Instruments), By Type, By Method (Column-based Isolation and Purification, Magnetic Bead-based Isolation and Purification, Reagent-based Isolation and Purification, and Other Isolation and Purification Methods), By Application, By End User Regions, Segmentation, and Projection till 2029

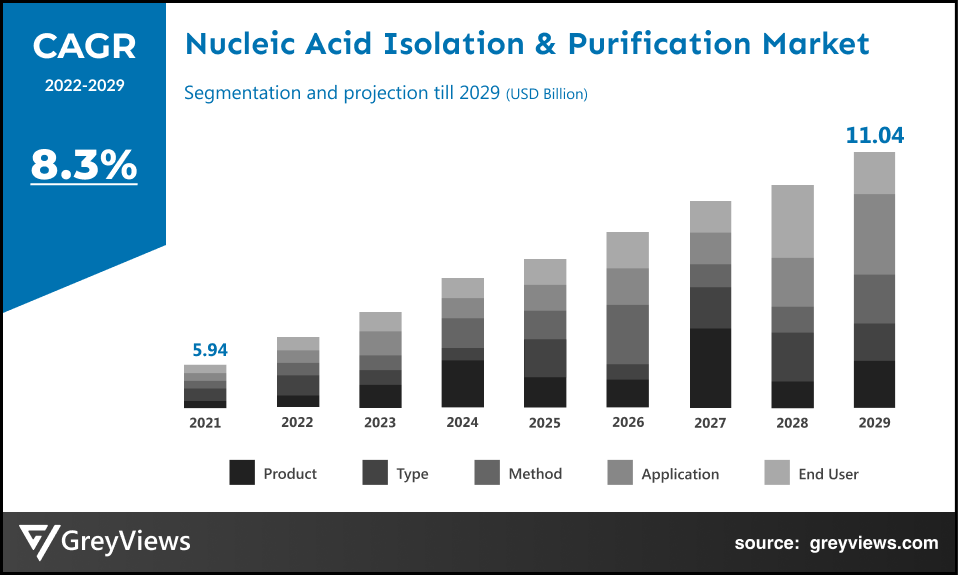

CAGR: 8.3%Current Market Size: USD 11.04 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Nucleic Acid Isolation & Purification Market- Market Overview:

The global nucleic acid isolation & purification market is expected to grow from USD 5.94 billion in 2021 to USD 11.04 billion by 2029, at a CAGR of 8.3% during the Projection period 2022-2029. Increasing research & development activities mainly drive the market's growth focused on precision medicine and biology.

In molecular biology, nucleic acid extraction (NAE) plays a significant role as it is an initial step for various downstream applications. This procedure has developed substantially over the past few decades. Nucleic Acid Isolation & Purification is part of the NAE procedure. The NAE is generally divided into four steps: cell disruption; removal of proteins, membrane lipids, and other nucleic acids; nucleic acid purification from bulk; and nucleic acid concentration.

Efficient isolation of enhanced quality nucleic acid in the sampled material is essential for downstream analyses such as sequencing, PCR, and molecular cloning. The factors, including ease of procedure, processing speed, recovery efficiency, and purity of an isolated product, have enabled innovation in nucleic acid isolation practices.

Request Sample: - Global Nucleic Acid Isolation & Purification Market

Market Dynamics:

Drivers:

- Increasing R&D activities in precision medicine and biology

Precision medicine involves researching and developing vaccines and medicines that offer superior outcomes for patients. This R&D deals with using technologies to acquire and validate population-wise data, including omics-based single-cell analysis and biomarker discovery. In addition, precision medicine requires a purification system that can purify rare nucleic acids such as cfDNA or miRNA from large volume liquid biopsy. Moreover, nucleic acid isolation and purification are initial steps in most molecular biology. Therefore, increasing R&D activities in the precision medicine and biology sector boosts the global market growth.

- Increasing automation in the field of nucleic acid isolation & purification

Automation has significantly increased speed and accuracy, along with minimizing human intervention in diagnostics and therapeutics. For instance, in the nucleic acid isolation & purification industry, automated nucleic acid purification has helped to increase throughput, accuracy, and reproducibility while processing samples with a higher grade of purity. Such automated processes are helping researchers from life science disciplines in research applications, including biomarker discovery, epidemiology, microbiomics, and cell-free diagnostics.

Restraints:

- High costs associated with automated instruments

The automated instruments and kits are comparatively more expensive than conventional methods of nucleic acid isolation & purification. The automated instruments enable key benefits such as simplifying isolation processes, augmented safety, high throughput, and reduced working times. However, the significantly higher price associated with such instrument’s hampers market growth to some extent. For instance, there is a need for an investment of about USD 8,000 to USD 160,000 to purchase automated nucleic acid isolation and purification instruments.

Opportunities:

- Rising demand for nucleic acid isolation & purification in molecular diagnostics

Nucleic acid isolation from whole blood and its purification is one of the most important steps in DNA/RNA-based diagnosis. Isolation of nucleic acids from whole blood is carried out by standard laboratory extraction procedure, which includes steps such as lysis of cell nucleus membranes with surfactants, denaturation of proteins by proteases, and purification of nucleic acids.

Moreover, the industry players are introducing innovative products in the molecular diagnostics sector, further creating lucrative growth opportunities for the market. For instance, in March 2021, Promega Corporation, one of the leaders in biochemistry and molecular biology, introduced Xpress Amp Direct Amplification Reagents to facilitate RNA extraction-free sample preparation.

Challenges

- Low market penetration in developing countries

In developing countries, there is low market penetration for purification procedures and automated nucleic acid isolation. In addition, some developing countries have limited resources for research and development in the field of nucleic acid isolation & purification. Also, there is limited spending in the healthcare sector in developing countries. For instance, in India, the budgetary allocation to the healthcare sector is low at 1.3% of GDP. Such factors pose challenges to the growth of the market.

Segmentation Analysis:

The global nucleic acid isolation & purification market has been segmented based on product, type, method, application, end-user, and region.

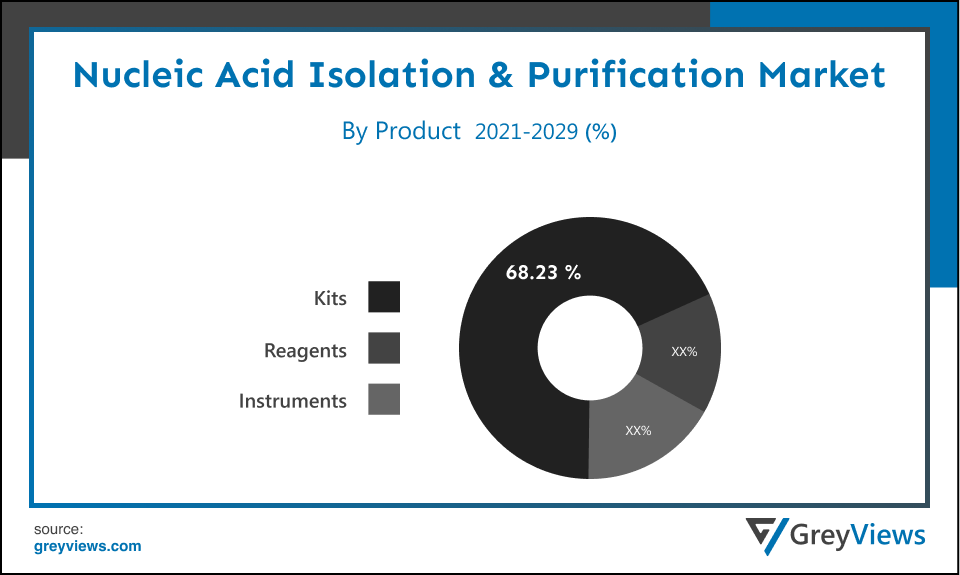

By Product

The product segment includes kits, reagents, and instruments. The kits segment led the Nucleic acid isolation & purification market with a market share of around 68.23 in 2021. This is attributed to the extensive application of kits to prepare samples and libraries. In addition, easy usage and low cost associated with the kits drive the growth of this segment. On the other hand, the market players are actively introducing kits focused on R&D. For instance, in October 2020, Purigen Biosystems, Inc., a provider of next-generation technologies for extraction and purification of nucleic acids Ionic Cells to Pure DNA Low Input Kit, focused on usage by researchers working with limited biological samples. The emergence of such products further boosts the growth of this segment.

By Type

The type segment includes Plasmid DNA Isolation and Purification, Total RNA Isolation and Purification, Circulating Nucleic Acid Isolation and Purification, Genomic DNA Isolation and Purification, Messenger RNA Isolation and Purification, microRNA Isolation and Purification, PCR Cleanup, and Other Nucleic Acid Isolation and Purification Types. The Total RNA Isolation and Purification segment led the nucleic acid isolation & purification market with a market share of around 42.9% in 2021. The growth of this segment is mainly driven by an upsurge in the application of total RNA isolation and purification in COVID-19 diagnostics, along with the increasing usage of purified mRNA for building the cDNA library. Such libraries have different applications, including gene expression profiling, clinical diagnostics, and sequencing.

By End User

The end users segment includes hospitals & diagnostic centers, academic & government research institutes, pharmaceutical & biotechnology companies, contract research organizations, and other end users. The hospitals & diagnostic centers segment led the nucleic acid isolation & purification market with a market share of around 32.81% in 2021. Increased demand for accurate and early diagnosis of diseases has mainly driven the growth of this segment. In addition, ongoing research & development activities across hospitals & diagnostic centers, along with the usage of nucleic acid tests in molecular diagnostics, further fuel the growth of this segment.

By Regional Analysis:

The regions analyzed for the nucleic acid isolation & purification market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. North American region dominated the nucleic acid isolation & purification market and held the the35.94% share of the market revenue in 2021.

- The North American region has registered the highest value for the year 2021. The extensive presence of leading market players and their expansion strategies have mainly driven this region's growth. For instance, the S. is home to leading market players such as Thermo Fisher Scientific, Bio-Rad Laboratories, Agilent Technologies, Danaher Corporation, GE Healthcare, and Illumina, Inc., among others. In June 2021, Danaher Corporation announced the acquisition of Aldevron, a provider of critical nucleic acids and proteins. Through this acquisition, the company was expected to add plasmid DNA, protein production, and mRNA services to its life sciences portfolio. Such strategies adopted by market players are opportunistic for the market's growth.

- Asia-Pacific is expected to witness the highest growth rate during the Projection period. Ongoing research and development in the field of life sciences, supportive government initiatives, and increased patient population in the region have mainly driven the growth of the nucleic acid isolation & purification market.

Global Nucleic acid isolation & purification Market- Country Analysis:

- Germany

Germany's nucleic acid isolation & purification market size was valued at USD 0.59 billion in 2021 and is expected to reach USD 1.09 billion by 2029, at a CAGR of 8.1% from 2022 to 2029.

Germany is the largest economy in Europe. In addition, this country is the largest market for healthcare and life sciences products. This factor has mainly driven the growth of the German nucleic acid isolation & purification market. In addition, this country is seeing significant innovations in medical technology, medical biotechnology, pharmaceuticals, and digital health. This factor is expected to create lucrative growth opportunities for the market.

- China

China's nucleic acid isolation & purification market size was valued at USD 1.31 billion in 2021 and is expected to reach USD 2.37 billion by 2029, at a CAGR of 8.0% from 2022 to 2029. Over the past few years, China has experienced exceptional growth in the domestic Healthcare & Life Sciences (HLS) sector. In addition, this sector has a huge investment, innovation acceleration, and business expansion. For instance, according to various studies, in 2020, life science funds in China are estimated to raise about USD 42 billion, representing a fourfold increase in the past five years.

On the other hand, the market value of biopharma innovation players from China across the Nasdaq, Shanghai Stock Exchange Science and Technology Innovation Board (STAR), and Hong Kong Stock Exchange (HKEX) has surged from $3 billion in 2016 to over $380 billion in July 2021. This growth of the country's Life Sciences (HLS) sector is a major contributor to the China nucleic acid isolation & purification market.

- India

India's nucleic acid isolation & purification market size was valued at USD 0.30 billion in 2021 and is expected to reach USD 0.57 billion by 2029, at a CAGR of 8.8% from 2022 to 2029. Significant growth if the biotechnology sector, along with rising research & development spending in the biotechnology sector, is fueling the market's growth. For instance, according to the Confederation of Indian Industry (CII) report published in October 2021, the biotechnology industry in India contributed about 3% to the global industry in 2017, which is anticipated to grow to 19% by 2025.

Furthermore, in May 2021, 30M Genomics, the Indian start-up, developed AmpReady, a new technology for extracting DNA from biological samples in five seconds with no need for equipment. Such product innovations in the country are opportunistic for the growth of the nucleic acid isolation & purification market.

Key Industry Players Analysis:

To increase their market position in the global Nucleic acid isolation & purification business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

- Danaher

- Hoffmann-La Roche AG

- Merck KGaA

- Agilent Technologies

- Bio-Rad Laboratories, Inc.

- Takara Bio, Inc.

- Promega Corporation

- New England Biolabs

Latest Development:

- In March 2022, MP Biomedicals, the global manufacturer, exporter, and supplier of Life Science products, launched The MPure-32, the 3rd generation of automated nucleic acid purification and extraction.

- In July 2021, Cytiva and Pall, the subsidiaries of Danaher, planned to invest about $1.5 billion to expand their operation in 13 sites across the U.S., Europe, and Asia. This investment program mainly focuses on products used to make biological medicines.

Scope of the Report

Global Nucleic acid isolation & purification Market by Product:

- Kits

- Reagents

- Instruments

Global Nucleic acid isolation & purification Market by Type:

- Plasmid DNA Isolation and Purification

- Total RNA Isolation and Purification

- Circulating Nucleic Acid Isolation and Purification

- Genomic DNA Isolation and Purification

- Messenger RNA Isolation and Purification

- microRNA Isolation and Purification

- PCR Cleanup

- Other Nucleic Acid Isolation and Purification Types

Global Nucleic acid isolation & purification Market by Method:

- Column-based Isolation and Purification

- Magnetic Bead-based Isolation and Purification

- Reagent-based Isolation and Purification

- Other Isolation and Purification Methods

Global Nucleic acid isolation & purification Market by Application:

- Diagnostics

- Drug Discovery & Development

- Personalized Medicine

- Agriculture & Animal Research

- Other Applications

Global Nucleic acid isolation & purification Market by End User:

- Hospitals & Diagnostic Centers

- Academic & Government Research Institutes

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations

- Other End Users

Global Nucleic acid isolation & purification Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

Frequently Asked Questions

What is the value of Nucleic acid isolation & purification market?

Value of Global Nucleic acid isolation & purification market is USD 5.94 billion and it will grow at a CAGR of 9.3% from 2022 to 2029.

Which region is prominent in Nucleic acid isolation & purification market?

North American region dominated the nucleic acid isolation & purification market and held the the35.94% share of the market revenue in 2021.

Market players in the Nucleic acid isolation & purification market?

Leading market players active in the global Nucleic acid isolation & purification market are QIAGEN, Thermo Fisher Scientific, Inc., Illumina, Inc., Danaher, F. Hoffmann-La Roche AG, Merck KGaA, Agilent Technologies, Bio-Rad Laboratories, Inc., Takara Bio, Inc., Promega Corporation, and New England Biolabs among others.

What is the key driver of the Nucleic acid isolation & purification market?

Increasing research & development activities focused on precision medicine and biology is primarily driving the growth of the Nucleic acid isolation & purification market.

What are the Key trends in Nucleic Acid Isolation & Purification Market?

Higher scope of growth in developing countries and the ongoing trend of molecular diagnostics and personalized medicine is projected to influence the market in the upcoming years.

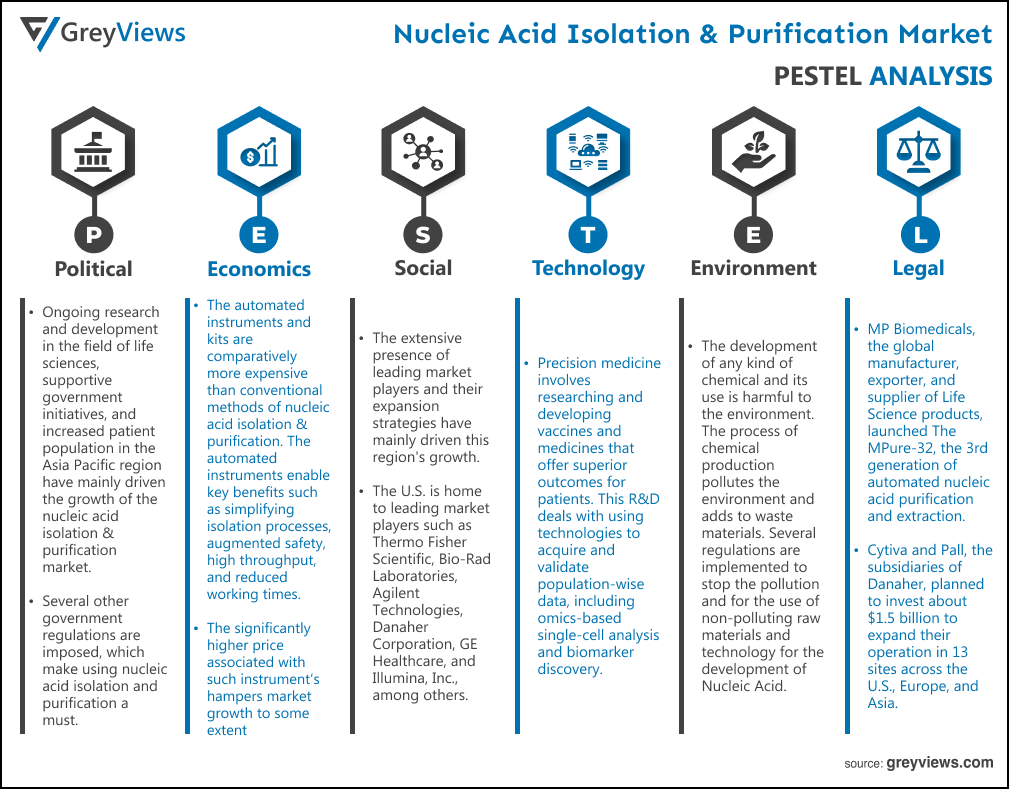

Political Factors- Ongoing research and development in the field of life sciences, supportive government initiatives, and increased patient population in the Asia Pacific region have mainly driven the growth of the nucleic acid isolation & purification market. Several other government regulations are imposed, which make using nucleic acid isolation and purification a must. The organizations operating in the country or region must abide by the strict governmental regulations and rules to operate the business in the region.

Economical Factors- The automated instruments and kits are comparatively more expensive than conventional methods of nucleic acid isolation & purification. The automated instruments enable key benefits such as simplifying isolation processes, augmented safety, high throughput, and reduced working times. However, the significantly higher price associated with such instrument’s hampers market growth to some extent. For instance, there is a need for an investment of about USD 8,000 to USD 160,000 to purchase automated nucleic acid isolation and purification instruments.

Social Factor- The extensive presence of leading market players and their expansion strategies have mainly driven this region's growth. For instance, the U.S. is home to leading market players such as Thermo Fisher Scientific, Bio-Rad Laboratories, Agilent Technologies, Danaher Corporation, GE Healthcare, and Illumina, Inc., among others. In June 2021, Danaher Corporation announced the acquisition of Aldevron, a provider of critical nucleic acids and proteins. Through this acquisition, the company was expected to add plasmid DNA, protein production, and mRNA services to its life sciences portfolio. Such strategies adopted by market players are opportunistic for the market's growth.

Technological Factors- Precision medicine involves researching and developing vaccines and medicines that offer superior outcomes for patients. This R&D deals with using technologies to acquire and validate population-wise data, including omics-based single-cell analysis and biomarker discovery. In addition, precision medicine requires a purification system that can purify rare nucleic acids such as cfDNA or miRNA from large volume liquid biopsy. Moreover, nucleic acid isolation and purification are initial steps in most molecular biology. Therefore, increasing R&D activities in the precision medicine and biology sector boosts the global market growth.

Environmental Factors- The development of any kind of chemical and its use is harmful to the environment. The process of chemical production pollutes the environment and adds to waste materials. Several regulations are implemented to stop the pollution and for the use of non-polluting raw materials and technology for the development of Nucleic Acid. Therefore, increasing R&D activities in the precision medicine and biology sector reduces chemical waste and pollution.

Legal Factors- MP Biomedicals, the global manufacturer, exporter, and supplier of Life Science products, launched The MPure-32, the 3rd generation of automated nucleic acid purification and extraction. Cytiva and Pall, the subsidiaries of Danaher, planned to invest about $1.5 billion to expand their operation in 13 sites across the U.S., Europe, and Asia. This investment program mainly focuses on products used to make biological medicines.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Product

- Market Attractiveness Analysis By Type

- Market Attractiveness Analysis By Method

- Market Attractiveness Analysis By Application

- Market Attractiveness Analysis By End User

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Increasing R&D activities in precision medicine and biology

- Increasing automation in the field of nucleic acid isolation & purification

- Restrains

- High costs associated with automated instruments

- Opportunities

- Rising demand for nucleic acid isolation & purification in molecular diagnostics

- Challenges

- Low market penetration in developing countries

- Global Nucleic Acid Isolation & Purification Market Analysis and Projection, By Product

- Segment Overview

- Kits

- Reagents

- Instruments

- Global Nucleic Acid Isolation & Purification Market Analysis and Projection, By Type

- Segment Overview

- Plasmid DNA Isolation and Purification

- Total RNA Isolation and Purification

- Circulating Nucleic Acid Isolation and Purification

- Genomic DNA Isolation and Purification

- Messenger RNA Isolation and Purification

- microRNA Isolation and Purification

- PCR Cleanup

- Other Nucleic Acid Isolation and Purification Types

- Global Nucleic Acid Isolation & Purification Market Analysis and Projection, By Method

- Segment Overview

- Column-based Isolation and Purification

- Magnetic Bead-based Isolation and Purification

- Reagent-based Isolation and Purification

- Other Isolation and Purification Methods

- Global Nucleic Acid Isolation & Purification Market Analysis and Projection, By Application

- Segment Overview

- Diagnostics

- Drug Discovery & Development

- Personalized Medicine

- Agriculture & Animal Research

- Other Applications

- Global Nucleic Acid Isolation & Purification Market Analysis and Projection, By End User

- Segment Overview

- Hospitals & Diagnostic Centers

- Academic & Government Research Institutes

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations

- Other End Users

- Global Nucleic Acid Isolation & Purification Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Nucleic Acid Isolation & Purification Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Nucleic Acid Isolation & Purification Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Product Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- QIAGEN

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Thermo Fisher Scientific, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Illumina, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Danaher

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Hoffmann-La Roche AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Merck KGaA

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Agilent Technologies

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Bio-Rad Laboratories, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Takara Bio, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- New England Biolabs

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- QIAGEN

List of Table

- Global Nucleic Acid Isolation & Purification Market, By Product, 2021–2029(USD Billion)

- Global Kits Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Reagents Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Instruments Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Nucleic Acid Isolation & Purification Market, By Type, 2021–2029(USD Billion)

- Global Plasmid DNA Isolation and Purification Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Total RNA Isolation and Purification Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Circulating Nucleic Acid Isolation and Purification Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Genomic DNA Isolation and Purification Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Messenger RNA Isolation and Purification Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global microRNA Isolation and Purification Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global PCR Cleanup Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Other Nucleic Acid Isolation and Purification Types Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Nucleic Acid Isolation & Purification Market, By Method, 2021–2029(USD Billion)

- Global Column-based Isolation and Purification Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Magnetic Bead-based Isolation and Purification Method Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Reagent-based Isolation and Purification Method Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Other Isolation and Purification Methods Method Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Nucleic Acid Isolation & Purification Market, By Application, 2021–2029(USD Billion)

- Global Diagnostics Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Drug Discovery & Development Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Personalized Medicine Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Agriculture & Animal Research Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Other Applications Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Nucleic Acid Isolation & Purification Market, By End User, 2021–2029(USD Billion)

- Global Hospitals & Diagnostic Centers Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Academic & Government Research Institutes Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Pharmaceutical & Biotechnology Companies Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Contract Research Organizations Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Other End Users Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Nucleic Acid Isolation & Purification Market, By Region, 2021–2029(USD Billion)

- Global Nucleic Acid Isolation & Purification Market, By North America, 2021–2029(USD Billion)

- North America Nucleic Acid Isolation & Purification Market, By Product, 2021–2029(USD Billion)

- North America Nucleic Acid Isolation & Purification Market, By Type, 2021–2029(USD Billion)

- North America Nucleic Acid Isolation & Purification Market, By Method, 2021–2029(USD Billion)

- North America Nucleic Acid Isolation & Purification Market, By Application, 2021–2029(USD Billion)

- North America Nucleic Acid Isolation & Purification Market, By End User, 2021–2029(USD Billion)

- USA Nucleic Acid Isolation & Purification Market, By Product, 2021–2029(USD Billion)

- USA Nucleic Acid Isolation & Purification Market, By Type, 2021–2029(USD Billion)

- USA Nucleic Acid Isolation & Purification Market, By Method, 2021–2029(USD Billion)

- USA Nucleic Acid Isolation & Purification Market, By Application, 2021–2029(USD Billion)

- USA Nucleic Acid Isolation & Purification Market, By End User, 2021–2029(USD Billion)

- Canada Nucleic Acid Isolation & Purification Market, By Product, 2021–2029(USD Billion)

- Canada Nucleic Acid Isolation & Purification Market, By Type, 2021–2029(USD Billion)

- Canada Nucleic Acid Isolation & Purification Market, By Method, 2021–2029(USD Billion)

- Canada Nucleic Acid Isolation & Purification Market, By Application, 2021–2029(USD Billion)

- Canada Nucleic Acid Isolation & Purification Market, By End User, 2021–2029(USD Billion)

- Mexico Nucleic Acid Isolation & Purification Market, By Product, 2021–2029(USD Billion)

- Mexico Nucleic Acid Isolation & Purification Market, By Type, 2021–2029(USD Billion)

- Mexico Nucleic Acid Isolation & Purification Market, By Method, 2021–2029(USD Billion)

- Mexico Nucleic Acid Isolation & Purification Market, By Application, 2021–2029(USD Billion)

- Mexico Nucleic Acid Isolation & Purification Market, By End User, 2021–2029(USD Billion)

- Europe Nucleic Acid Isolation & Purification Market, By Product, 2021–2029(USD Billion)

- Europe Nucleic Acid Isolation & Purification Market, By Type, 2021–2029(USD Billion)

- Europe Nucleic Acid Isolation & Purification Market, By Method, 2021–2029(USD Billion)

- Europe Nucleic Acid Isolation & Purification Market, By Application, 2021–2029(USD Billion)

- Europe Nucleic Acid Isolation & Purification Market, By End User, 2021–2029(USD Billion)

- Germany Nucleic Acid Isolation & Purification Market, By Product, 2021–2029(USD Billion)

- Germany Nucleic Acid Isolation & Purification Market, By Type, 2021–2029(USD Billion)

- Germany Nucleic Acid Isolation & Purification Market, By Method, 2021–2029(USD Billion)

- Germany Nucleic Acid Isolation & Purification Market, By Application, 2021–2029(USD Billion)

- Germany Nucleic Acid Isolation & Purification Market, By End User, 2021–2029(USD Billion)

- France Nucleic Acid Isolation & Purification Market, By Product, 2021–2029(USD Billion)

- France Nucleic Acid Isolation & Purification Market, By Type, 2021–2029(USD Billion)

- France Nucleic Acid Isolation & Purification Market, By Method, 2021–2029(USD Billion)

- France Nucleic Acid Isolation & Purification Market, By Application, 2021–2029(USD Billion)

- France Nucleic Acid Isolation & Purification Market, By End User, 2021–2029(USD Billion)

- UK Nucleic Acid Isolation & Purification Market, By Product, 2021–2029(USD Billion)

- UK Nucleic Acid Isolation & Purification Market, By Type, 2021–2029(USD Billion)

- UK Nucleic Acid Isolation & Purification Market, By Method, 2021–2029(USD Billion)

- UK Nucleic Acid Isolation & Purification Market, By Application, 2021–2029(USD Billion)

- UK Nucleic Acid Isolation & Purification Market, By End User, 2021–2029(USD Billion)

- Italy Nucleic Acid Isolation & Purification Market, By Product, 2021–2029(USD Billion)

- Italy Nucleic Acid Isolation & Purification Market, By Type, 2021–2029(USD Billion)

- Italy Nucleic Acid Isolation & Purification Market, By Method, 2021–2029(USD Billion)

- Italy Nucleic Acid Isolation & Purification Market, By Application, 2021–2029(USD Billion)

- Italy Nucleic Acid Isolation & Purification Market, By End User, 2021–2029(USD Billion)

- Spain Nucleic Acid Isolation & Purification Market, By Product, 2021–2029(USD Billion)

- Spain Nucleic Acid Isolation & Purification Market, By Type, 2021–2029(USD Billion)

- Spain Nucleic Acid Isolation & Purification Market, By Method, 2021–2029(USD Billion)

- Spain Nucleic Acid Isolation & Purification Market, By Application, 2021–2029(USD Billion)

- Spain Nucleic Acid Isolation & Purification Market, By End User, 2021–2029(USD Billion)

- Asia Pacific Nucleic Acid Isolation & Purification Market, By Product, 2021–2029(USD Billion)

- Asia Pacific Nucleic Acid Isolation & Purification Market, By Type, 2021–2029(USD Billion)

- Asia Pacific Nucleic Acid Isolation & Purification Market, By Method, 2021–2029(USD Billion)

- Asia Pacific Nucleic Acid Isolation & Purification Market, By Application, 2021–2029(USD Billion)

- Asia Pacific Nucleic Acid Isolation & Purification Market, By End User, 2021–2029(USD Billion)

- Japan Nucleic Acid Isolation & Purification Market, By Product, 2021–2029(USD Billion)

- Japan Nucleic Acid Isolation & Purification Market, By Type, 2021–2029(USD Billion)

- Japan Nucleic Acid Isolation & Purification Market, By Method, 2021–2029(USD Billion)

- Japan Nucleic Acid Isolation & Purification Market, By Application, 2021–2029(USD Billion)

- Japan Nucleic Acid Isolation & Purification Market, By End User, 2021–2029(USD Billion)

- China Nucleic Acid Isolation & Purification Market, By Product, 2021–2029(USD Billion)

- China Nucleic Acid Isolation & Purification Market, By Type, 2021–2029(USD Billion)

- China Nucleic Acid Isolation & Purification Market, By Method, 2021–2029(USD Billion)

- China Nucleic Acid Isolation & Purification Market, By Application, 2021–2029(USD Billion)

- China Nucleic Acid Isolation & Purification Market, By End User, 2021–2029(USD Billion)

- India Nucleic Acid Isolation & Purification Market, By Product, 2021–2029(USD Billion)

- India Nucleic Acid Isolation & Purification Market, By Type, 2021–2029(USD Billion)

- India Nucleic Acid Isolation & Purification Market, By Method, 2021–2029(USD Billion)

- India Nucleic Acid Isolation & Purification Market, By Application, 2021–2029(USD Billion)

- India Nucleic Acid Isolation & Purification Market, By End User, 2021–2029(USD Billion)

- South America Nucleic Acid Isolation & Purification Market, By Product, 2021–2029(USD Billion)

- South America Nucleic Acid Isolation & Purification Market, By Type, 2021–2029(USD Billion)

- South America Nucleic Acid Isolation & Purification Market, By Method, 2021–2029(USD Billion)

- South America Nucleic Acid Isolation & Purification Market, By Application, 2021–2029(USD Billion)

- South America Nucleic Acid Isolation & Purification Market, By End User, 2021–2029(USD Billion)

- Brazil Nucleic Acid Isolation & Purification Market, By Product, 2021–2029(USD Billion)

- Brazil Nucleic Acid Isolation & Purification Market, By Type, 2021–2029(USD Billion)

- Brazil Nucleic Acid Isolation & Purification Market, By Method, 2021–2029(USD Billion)

- Brazil Nucleic Acid Isolation & Purification Market, By Application, 2021–2029(USD Billion)

- Brazil Nucleic Acid Isolation & Purification Market, By End User, 2021–2029(USD Billion)

- Middle East and Africa Nucleic Acid Isolation & Purification Market, By Product, 2021–2029(USD Billion)

- Middle East and Africa Nucleic Acid Isolation & Purification Market, By Type, 2021–2029(USD Billion)

- Middle East and Africa Nucleic Acid Isolation & Purification Market, By Method, 2021–2029(USD Billion)

- Middle East and Africa Nucleic Acid Isolation & Purification Market, By Application, 2021–2029(USD Billion)

- Middle East and Africa Nucleic Acid Isolation & Purification Market, By End User, 2021–2029(USD Billion)

- UAE Nucleic Acid Isolation & Purification Market, By Product, 2021–2029(USD Billion)

- UAE Nucleic Acid Isolation & Purification Market, By Type, 2021–2029(USD Billion)

- UAE Nucleic Acid Isolation & Purification Market, By Method, 2021–2029(USD Billion)

- UAE Nucleic Acid Isolation & Purification Market, By Application, 2021–2029(USD Billion)

- UAE Nucleic Acid Isolation & Purification Market, By End User, 2021–2029(USD Billion)

- South Africa Nucleic Acid Isolation & Purification Market, By Product, 2021–2029(USD Billion)

- South Africa Nucleic Acid Isolation & Purification Market, By Type, 2021–2029(USD Billion)

- South Africa Nucleic Acid Isolation & Purification Market, By Method, 2021–2029(USD Billion)

- South Africa Nucleic Acid Isolation & Purification Market, By Application, 2021–2029(USD Billion)

- South Africa Nucleic Acid Isolation & Purification Market, By End User, 2021–2029(USD Billion)

List of Figures

- Global Nucleic Acid Isolation & Purification Market Segmentation

- Nucleic Acid Isolation & Purification Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Nucleic Acid Isolation & Purification Market Attractiveness Analysis By Product

- Global Nucleic Acid Isolation & Purification Market Attractiveness Analysis By Type

- Global Nucleic Acid Isolation & Purification Market Attractiveness Analysis By Method

- Global Nucleic Acid Isolation & Purification Market Attractiveness Analysis By Application

- Global Nucleic Acid Isolation & Purification Market Attractiveness Analysis By End User

- Global Nucleic Acid Isolation & Purification Market Attractiveness Analysis By Region

- Global Nucleic Acid Isolation & Purification Market: Dynamics

- Global Nucleic Acid Isolation & Purification Market Share By Product(2021 & 2029)

- Global Nucleic Acid Isolation & Purification Market Share By Type(2021 & 2029)

- Global Nucleic Acid Isolation & Purification Market Share By Method(2021 & 2029)

- Global Nucleic Acid Isolation & Purification Market Share By Application(2021 & 2029)

- Global Nucleic Acid Isolation & Purification Market Share By End User (2021 & 2029)

- Global Nucleic Acid Isolation & Purification Market Share by Regions (2021 & 2029)

- Global Nucleic Acid Isolation & Purification Market Share by Company (2020)