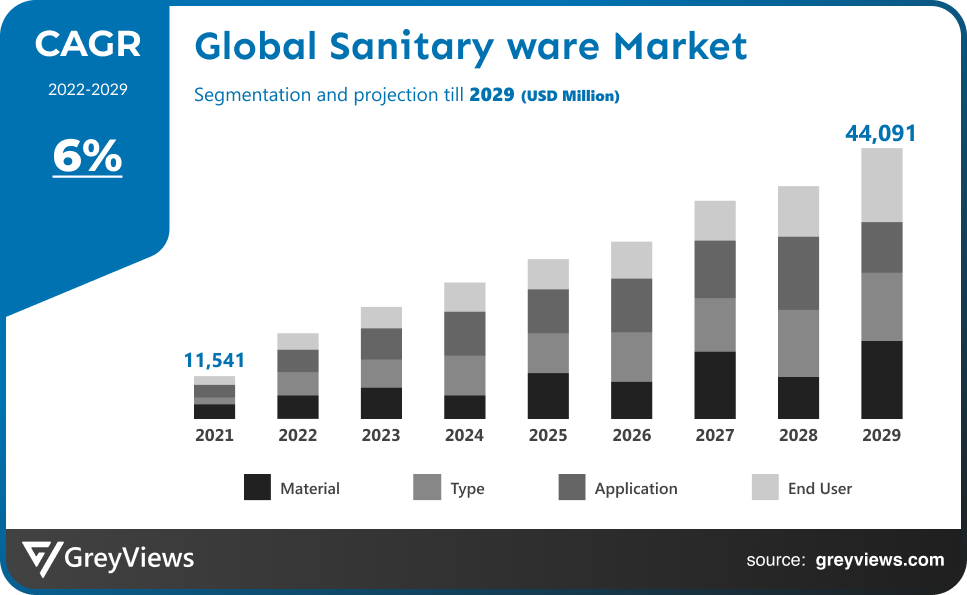

Sanitary Ware Market Size By Material (Ceramic, Plastic, and Other), By Type (Water Closet, Wash Basins, Pedestals, Cisterns, and Other), By Application (Kitchen and Bathroom), By End User (Residential and Commercial), Regions, Segmentation, and Projection till 2029

CAGR: 6%Current Market Size: USD 11,541 MillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Sanitary ware Market- Market Overview:

The Global Sanitary Ware Market is expected to grow from 11,541 Million in 2021 to USD 44,091 million by 2029, at a CAGR of 6% during the Projection period 2022-2029. The growth of this market is mainly driven owing to the expanding residential, commercial, and infrastructural projects.

Cisterns, bathroom sinks, wash basins, and pedestals are all examples of sanitary ware. Porcelain was traditionally used to create these goods. Ceramics include porcelain. However, these days, sanitary goods are produced utilising a variety of materials, including plastic, metal, glass, and others. Ceramic sanitary wares can support heavy loads, are highly resistant to chemical attacks, and are profitable. The value of residential construction has increased as a result of the real estate industry's recent rapid rise. The need for hygienic goods rises as the number of homes rises, which fuels the market's expansion for sanitary wares. Increased household expenditure is another important aspect that is anticipated to propel the market for sanitary ware. Due to improvements in toilet seats forms, designs, and specifications throughout the Projection period, the"toilet seats" type segment is the one that is developing at the fastest rate. Furthermore, one of the main drivers that will propel the global expansion is the rising awareness of the advantages of better sanitary ware products for cleanliness and health.

Sample Request: - Global Sanitary ware Market

Market Dynamics:

Drivers:

- Growing Trends

The growth of the sanitary ware market is anticipated to be fueled by the expansion of infrastructure and the increasing acceptance of smart homes around the world during the Projection period. Additionally, residential building interior design modifications are raising the demand for sanitary supplies. Because homemakers replace outdated sanitary ware with more modern products that offer better looks or functionality, residential replacement and remodelling are the main sources of interest for the sanitary ware market.

Restraints:

- Fluctuation in Housing Demand

The primary factor anticipated to impede the demand for sanitary ware in the market and hinder the expansion of the sanitary ware market in the Projection period of 2022–2029 is the volatility in the housing demand.

Opportunities:

- Surging Product Innovations

To effectively maintain current customers and draw in new ones, the leading industry players are constantly releasing new and innovative items. Product design, quality, and other cutting-edge developments are key factors in luring customers to sanitary ware items. As a result, new product introductions spur market expansion, resulting in lucrative prospects for the sanitary ware industry in the coming years. The market for sanitary ware will also be driven by an increase in the number of public and private sector promotional campaigns aimed at raising consumer awareness of the use of sanitary wares and the rising investment made by both sectors in their respective projects.

Challenges:

- Adverse Effect on the Environment

Mineral extraction's wide variety of unfavourable environmental effects presents a significant barrier to the expansion of the sanitary ware market. Menstrual products made of plastic generate a lot of garbage, which has grown irksome over time. Menstrual waste, particularly pad waste, that is not properly disposed of ends up in open areas, water bodies, or even flushed down toilets, where it clogs drains.

Segmentation Analysis:

The global Sanitary Ware market has been segmented based on material, type, end-user, application and regions.

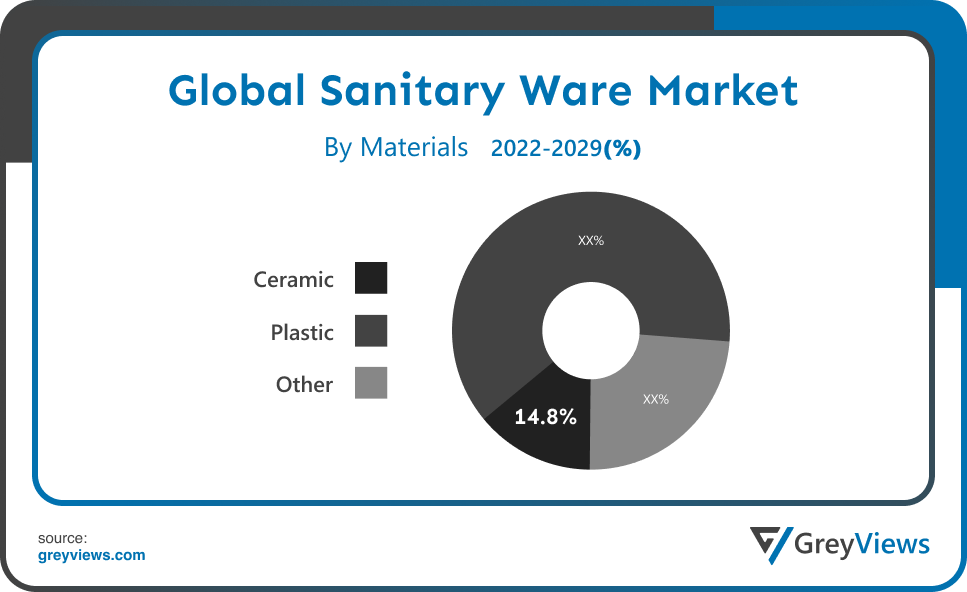

By Materials

The materials segment is Ceramic, Plastic, and Other. The ceramic segment led the largest share of the Sanitary Ware Market with a market share of around 14,800% in 2021. The demand for sanitaryware goods is growing as consumers become more aware of and adopt safe sanitation habits. The majority of clients have been choosing ceramic for their sanitaryware due to the glossy look it offers as well as other qualities like resistance to stains, heat, and easy cleaning. They are more ideal for both residential and commercial uses because they are readily available, affordable, and easily blend in with the surroundings. They also add more elegance. Because of these characteristics, it is expected that ceramic sanitaryware items would continue to rule the market throughout the Projection period.

By End User

The end user segment includes Residential and Commercial. The residential segment led the Sanitary Ware Market with a market share of around 18,500% in 2021. In general, urban regions have a higher need for ceramic sanitary ware than rural areas do. Rising residential construction activity in emerging economies like China and India is the main driver of this segment's growth. Further broadening the reach of the residential segment in the near future will be supportive measures by nations like China and India targeted at enhancing cleanliness.

Global Sanitary Ware Market- Sales Analysis.

The sale of Sanitary Ware type, applications, end users, materials expanded at a CAGR of 4% from 2015 to 2021.

Because of their affordability and exceptional resistance to chemicals and scratches, ceramic materials are becoming more and more popular in the building business. This trend is predicted to continue favourably. Additionally, it is anticipated that changing attitudes about cleanliness and hygiene would encourage consumer expenditure on the use of opulent goods with aesthetic appeal in the near future. Various programs are being launched by the government and corporate entities to raise public awareness of the need for appropriate sanitary goods. For instance, the Indian government declared in July 2018 that it would invest USD 20 million to build over 111 million toilets nationwide. It is anticipated that increasing living standards, particularly in metropolitan regions of growing economies like China, India, and Bangladesh, will encourage the usage of sanitary facilities.

In addition, it is anticipated that over the coming few years, the range of ceramic-based advanced materials will increase as a result of the expansion of the hotel business due to a bright outlook for the tourism industry in nations like China, Japan, and Australia. Growing infrastructure spending in developing nations like China and India is anticipated to have a significant impact on the expansion of the ceramic sanitary ware market.

Thus, owing to the aforementioned factors, the global Sanitary Ware Market is expected to grow at a CAGR of 6% during the Projection period from 2022 to 2029.

By Regional Analysis:

The regions analyzed for the Sanitary Ware Market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Asia-Pacific region dominated the Sanitary Ware Market and held a 39% share of the market revenue in 2021.

- The Asia-Pacific region witnessed a major share. The largest exporter of sanitary products globally, Asia-Pacific saw its percentage of global exports rise from 58% to 62.8% in 2019, thanks to shipments from China, India, and Vietnam. With the shifting circumstances in the region, the market returned to the growth track in production and exports in 2021 after being significantly impacted by COVID-19 throughout 2020. With 1.75 million tonnes in 2019, up from 768,000 tonnes in 2009 and a 14% increase over 2018, China maintained its lead in the standings and established a new record. China alone contributed for 60.6% of global exports and 79% of those from Asia.

- North America is anticipated to experience significant growth during the Projection period. The industry is anticipated to benefit from rising consumer awareness of upscale feminine hygiene products with aesthetic appeal in key regions including the United States and Canada. In the upcoming years, it is anticipated that the glossy finish and the availability of items in a variety of color options in the aforementioned nations will further entice purchasers.

Global Sanitary Ware Market- Country Analysis:

- Germany

Germany's Sanitary Ware Market size was valued at USD 144 million in 2021 and is expected to reach USD 387 million by 2029, at a CAGR of 4% from 2022 to 2029.

Due to significant investments made in R&D projects to produce improved product quality in nations Germany, this region is predicted to experience significant growth in the sanitary ware market. Leading companies might consider establishing R&D facilities in these nations in the future, which could support market expansion in the area.

- China

China’s Sanitary Ware Market size was valued at USD 2,520 million in 2021 and is expected to reach USD 4,890 million by 2029, at a CAGR of 5.6% from 2022 to 2029. Increased demand for various sanitary ware items like washbasins and toilets is anticipated to be the main development driver for the industry in the region.

- India

India's Sanitary Ware Market size was valued at USD 2,295 million in 2021 and is expected to reach USD 4,500 million by 2029, at a CAGR of 5.1% from 2022 to 2029. India continued to be the third-largest exporter of sanitaryware products in the year before Mexico, with a 9% growth over 2018 to 199,000 tons. It is anticipated that this trend will persist during the Projection period as well, increasing market revenue.

Key Industry Players Analysis:

To increase their market position in the global sanitary ware business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- LIXIL Corporation (Japan)

- Zurn Industries LLC. (U.S.)

- Masco Corporation (U.S.)

- Bella Group (U.S.)

- Kohler Co. (U.S.)

- Jaquar (India)

- VITRA INTERNATIONAL AG. (Switzerland)

- Kerovit (India)

- CERA Sanitaryware Limited. (India)

- Wenzhou Liangsha Sanitary Ware Co., Ltd. (China)

- BRIZO KITCHEN & BATH COMPANY (India)

- Oras Ltd. (Finland)

- TOTO LTD. (India)

- Roca Sanitario, S.A (Spain)

- Boch AG (Germany)

Latest Development:

- In October 2020, Kohler announced the beginning of Safe Water For All, a project to increase public awareness of water issues while tackling urgent problems with water access, quality, and conservation.

- In June 2020, Kohler bought Kohler Signature Store. The 300 Albemarle Street location of the Kohler Signature Store, which opened in May 2015, is in Baltimore, Maryland, in the United States.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

6% |

|

Market Size |

11,541 Million in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Material, By Type, By Application, By End-User, and By Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

LIXIL Corporation, Zurn Industries LLC., Masco Corporation, Bella Group, Kohler Co., Jaquar, VITRA INTERNATIONAL AG., Kerovit, CERA Sanitaryware Limited., Wenzhou Liangsha Sanitary Ware Co., Ltd., BRIZO KITCHEN & BATH COMPANY, Oras Ltd., TOTO LTD., Roca Sanitario, S.A, Boch AG. |

|

By Material |

|

|

By Type |

|

|

By Application |

|

|

By End-User |

|

|

Regional scope |

|

Scope of the Report

Global Sanitary Ware Market By Materials:

- Ceramic

- Plastic

- Other

Global Sanitary Ware Market By Type:

- Water Closet

- Wash Basins

- Pedestals

- Cisterns

- Other

Global Sanitary Ware Market By Application:

- Kitchen

- Bathroom

Global Sanitary Ware Market By End User:

- Residential

- Commercial

Global Sanitary Ware Market By Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the expected market size of the Sanitary Ware Market in 2029?

Global Sanitary Ware Market is expected to reach USD 44,091 million by 2029, at a CAGR of 6% from 2022 to 2029.

What is the CAGR of the Sanitary Ware Market?

The Sanitary Ware Market is projected to have a CAGR of 6%.

What is the application segment of the Sanitary Ware Market?

On the basis of application, the amino acids market is segmented into the kitchen and bathroom.

What are the key factors for the growth of the Sanitary Ware Market?

Because of their affordability and exceptional resistance to chemicals and scratches, ceramic materials are becoming increasingly popular in the construction industry. This trend is predicted to continue favourably.

Which are the leading market players active in the Sanitary Ware market?

Leading market players active in the global Sanitary Ware Market are Grohe AG; SOMANY CERAMICS Limited; RAK Ceramics; Duravit AG; Villeroy & Boch; Johnson Tiles Geberit Group; Toto Inc.; Hansgrohe; Kohler; Ideal Standard International S.A.; and HSIL. among others.

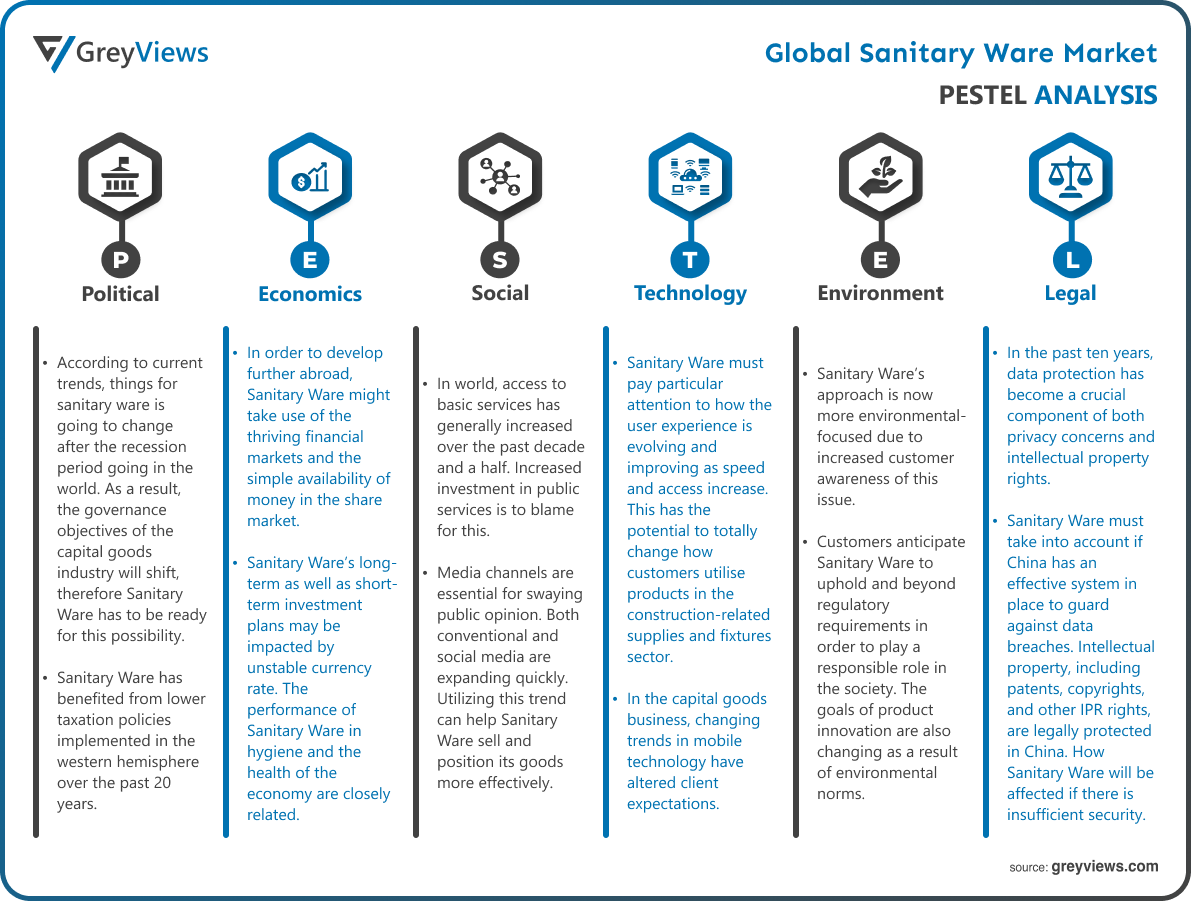

Political Factors- According to current trends, things for sanitary ware is going to change after the recession period going in the world. As a result, the governance objectives of the capital goods industry will shift, therefore Sanitary Ware has to be ready for this possibility. Sanitary Ware has benefited from lower taxation policies implemented in the western hemisphere over the past 20 years. High earnings and rising investment on research and development are the outcomes. Changes in taxes policy may result from growing inequality. In order to reduce the carbon footprint of the capital goods industry, local governments are also looking at taxing schemes that are unique to construction supplies and fixtures.

Economical Factors- In order to develop further abroad, Sanitary Ware might take use of the thriving financial markets and the simple availability of money in the share market. Sanitary Ware’s long-term as well as short-term investment plans may be impacted by unstable currency rate. The performance of Sanitary Ware in hygiene and the health of the economy are closely related. Growing globalisation and the use of local resources to serve international markets have been the cornerstones of the past two decades of growth.

Social Factor- In world, access to basic services has generally increased over the past decade and a half. Increased investment in public services is to blame for this. Media channels are essential for swaying public opinion. Both conventional and social media are expanding quickly. Utilizing this trend can help Sanitary Ware sell and position its goods more effectively. China has a high level of education, particularly in the Sanitary Ware industry, which might increase its demand in China. In China, the general perception of migration is unfavourable. This may hinder Sanitary Ware’s capacity to hire executives and managers from abroad to run its activities in the nation.

Technological Factors- Sanitary Ware must pay particular attention to how the user experience is evolving and improving as speed and access increase. This has the potential to totally change how customers utilise products in the construction-related supplies and fixtures sector. In the capital goods business, changing trends in mobile technology have altered client expectations. In order to be competitive, Sanitary Ware must not only fulfil and manage these expectations, but also innovate. As more stakeholders in the Capital Goods sector, including outside parties, have access to information, technological innovation is quickly altering the supply chain.

Environmental Factors- Sanitary Ware’s approach is now more environmental-focused due to increased customer awareness of this issue. Customers anticipate Sanitary Ware to uphold and beyond regulatory requirements in order to play a responsible role in the society. The goals of product innovation are also changing as a result of environmental norms. Many times, environmental regulations and expectations are taken into consideration while designing products rather than traditional value propositions. The expense of running the Sanitary Ware is further increased by routine inspection by environmental officials. Extreme weather also raises operational costs for Sanitary Ware, which must invest in a more adaptable supply chain.

Legal Factors- In the past ten years, data protection has become a crucial component of both privacy concerns and intellectual property rights. Sanitary Ware must take into account if China has an effective system in place to guard against data breaches. Intellectual property, including patents, copyrights, and other IPR rights, are legally protected in China. How Sanitary Ware will be affected if there is insufficient security. The severity of China’s environmental standards and what Sanitary Ware must do to comply. Even though some nations adhere to international standards, resolution times sometimes take years. Before entering a global market, Sanitary Ware must carefully analyse the average time of certain circumstance.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Material

- 3.2. Market Attractiveness Analysis By Type

- 3.3. Market Attractiveness Analysis By Application

- 3.4. Market Attractiveness Analysis By End-User

- 3.5. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Growing Trends

- 3. Restraints

- 3.1. Fluactuation Housing Demand

- 4. Opportunities

- 4.1. Surging Product Innovations

- 5. Challenges

- 5.1. Adverse Effect on the Environment

- Global Sanitary Ware Market Analysis and Projection, By Material

- 1. Segment Overview

- 2. Ceramic

- 3. Plastic

- 4. Other

- Global Sanitary Ware Market Analysis and Projection, By Type

- 1. Segment Overview

- 2. Water Closet

- 3. Wash Basins

- 4. Pedestals

- 5. Cisterns

- 6. Other

- Global Sanitary Ware Market Analysis and Projection, By Application

- 1. Segment Overview

- 2. Kitchen

- 3. Bathroom

- Global Sanitary Ware Market Analysis and Projection, By End-User

- 1. Segment Overview

- 2. Residential

- 3. Commercial

- Global Sanitary Ware Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- South America

- 5.1. Brazil

- Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Sanitary Ware Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Sanitary Ware Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- LIXIL Corporation

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Zurn Industries LLC.

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Masco Corporation

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Bella Group

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Kohler Co.

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Jaquar

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- VITRA INTERNATIONAL AG.

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Kerovit

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- CERA Sanitaryware Limited.

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Wenzhou Liangsha Sanitary Ware Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- LIXIL Corporation

List of Table

- Global Sanitary Ware Market, By Material, 2021–2029 (USD Million)

- Global Ceramic, Sanitary Ware Market, By Region, 2021–2029 (USD Million)

- Global Plastic, Sanitary Ware Market, By Region, 2021–2029 (USD Million)

- Global Other, Sanitary Ware Market, By Region, 2021–2029 (USD Million)

- Global Sanitary Ware Market, By Type, 2021–2029 (USD Million)

- Global Water Closet, Sanitary Ware Market, By Region, 2021–2029 (USD Million)

- Global Wash Basins, Sanitary Ware Market, By Region, 2021–2029 (USD Million)

- Global Pedestals, Sanitary Ware Market, By Region, 2021–2029 (USD Million)

- Global Cisterns, Sanitary Ware Market, By Region, 2021–2029 (USD Million)

- Global Other, Sanitary Ware Market, By Region, 2021–2029 (USD Million)

- Global Sanitary Ware Market, By Application, 2021–2029 (USD Million)

- Global Kitchen, Sanitary Ware Market, By Region, 2021–2029 (USD Million)

- Global Bathroom, Sanitary Ware Market, By Region, 2021–2029 (USD Million)

- Global Sanitary Ware Market, By End-User, 2021–2029 (USD Million)

- Global Residential, Sanitary Ware Market, By Region, 2021–2029 (USD Million)

- Global Commercial, Sanitary Ware Market, By Region, 2021–2029 (USD Million)

- Global Sanitary Ware Market, By Region, 2021–2029 (USD Million)

- North America Sanitary Ware Market, By Material, 2021–2029 (USD Million)

- North America Sanitary Ware Market, By Type, 2021–2029 (USD Million)

- North America Sanitary Ware Market, By Application, 2021–2029 (USD Million)

- North America Sanitary Ware Market, By End-User, 2021–2029 (USD Million)

- USA Sanitary Ware Market, By Material, 2021–2029 (USD Million)

- USA Sanitary Ware Market, By Type, 2021–2029 (USD Million)

- USA Sanitary Ware Market, By Application, 2021–2029 (USD Million)

- USA Sanitary Ware Market, By End-User, 2021–2029 (USD Million)

- Canada Sanitary Ware Market, By Material, 2021–2029 (USD Million)

- Canada Sanitary Ware Market, By Type, 2021–2029 (USD Million)

- Canada Sanitary Ware Market, By Application, 2021–2029 (USD Million)

- Canada Sanitary Ware Market, By End-User, 2021–2029 (USD Million)

- Mexico Sanitary Ware Market, By Material, 2021–2029 (USD Million)

- Mexico Sanitary Ware Market, By Type, 2021–2029 (USD Million)

- Mexico Sanitary Ware Market, By Application, 2021–2029 (USD Million)

- Mexico Sanitary Ware Market, By End-User, 2021–2029 (USD Million)

- Europe Sanitary Ware Market, By Material, 2021–2029 (USD Million)

- Europe Sanitary Ware Market, By Type, 2021–2029 (USD Million)

- Europe Sanitary Ware Market, By Application, 2021–2029 (USD Million)

- Europe Sanitary Ware Market, By End-User, 2021–2029 (USD Million)

- Germany Sanitary Ware Market, By Material, 2021–2029 (USD Million)

- Germany Sanitary Ware Market, By Type, 2021–2029 (USD Million)

- Germany Sanitary Ware Market, By Application, 2021–2029 (USD Million)

- Germany Sanitary Ware Market, By End-User, 2021–2029 (USD Million)

- France Sanitary Ware Market, By Material, 2021–2029 (USD Million)

- France Sanitary Ware Market, By Type, 2021–2029 (USD Million)

- France Sanitary Ware Market, By Application, 2021–2029 (USD Million)

- France Sanitary Ware Market, By End-User, 2021–2029 (USD Million)

- UK Sanitary Ware Market, By Material, 2021–2029 (USD Million)

- UK Sanitary Ware Market, By Type, 2021–2029 (USD Million)

- UK Sanitary Ware Market, By Application, 2021–2029 (USD Million)

- UK Sanitary Ware Market, By End-User, 2021–2029 (USD Million)

- Italy Sanitary Ware Market, By Material, 2021–2029 (USD Million)

- Italy Sanitary Ware Market, By Type, 2021–2029 (USD Million)

- Italy Sanitary Ware Market, By Application, 2021–2029 (USD Million)

- Italy Sanitary Ware Market, By End-User, 2021–2029 (USD Million)

- Spain Sanitary Ware Market, By Material, 2021–2029 (USD Million)

- Spain Sanitary Ware Market, By Type, 2021–2029 (USD Million)

- Spain Sanitary Ware Market, By Application, 2021–2029 (USD Million)

- Spain Sanitary Ware Market, By End-User, 2021–2029 (USD Million)

- Asia Pacific Sanitary Ware Market, By Material, 2021–2029 (USD Million)

- Asia Pacific Sanitary Ware Market, By Type, 2021–2029 (USD Million)

- Asia Pacific Sanitary Ware Market, By Application, 2021–2029 (USD Million)

- Asia Pacific Sanitary Ware Market, By End-User, 2021–2029 (USD Million)

- Japan Sanitary Ware Market, By Material, 2021–2029 (USD Million)

- Japan Sanitary Ware Market, By Type, 2021–2029 (USD Million)

- Japan Sanitary Ware Market, By Application, 2021–2029 (USD Million)

- Japan Sanitary Ware Market, By End-User, 2021–2029 (USD Million)

- China Sanitary Ware Market, By Material, 2021–2029 (USD Million)

- China Sanitary Ware Market, By Type, 2021–2029 (USD Million)

- China Sanitary Ware Market, By Application, 2021–2029 (USD Million)

- China Sanitary Ware Market, By End-User, 2021–2029 (USD Million)

- India Sanitary Ware Market, By Material, 2021–2029 (USD Million)

- India Sanitary Ware Market, By Type, 2021–2029 (USD Million)

- India Sanitary Ware Market, By Application, 2021–2029 (USD Million)

- India Sanitary Ware Market, By End-User, 2021–2029 (USD Million)

- South America Sanitary Ware Market, By Material, 2021–2029 (USD Million)

- South America Sanitary Ware Market, By Type, 2021–2029 (USD Million)

- South America Sanitary Ware Market, By Application, 2021–2029 (USD Million)

- South America Sanitary Ware Market, By End-User, 2021–2029 (USD Million)

- Brazil Sanitary Ware Market, By Material, 2021–2029 (USD Million)

- Brazil Sanitary Ware Market, By Type, 2021–2029 (USD Million)

- Brazil Sanitary Ware Market, By Application, 2021–2029 (USD Million)

- Brazil Sanitary Ware Market, By End-User, 2021–2029 (USD Million)

- Middle East and Africa Sanitary Ware Market, By Material, 2021–2029 (USD Million)

- Middle East and Africa Sanitary Ware Market, By Type, 2021–2029 (USD Million)

- Middle East and Africa Sanitary Ware Market, By Application, 2021–2029 (USD Million)

- Middle East and Africa Sanitary Ware Market, By End-User, 2021–2029 (USD Million)

- UAE Sanitary Ware Market, By Material, 2021–2029 (USD Million)

- UAE Sanitary Ware Market, By Type, 2021–2029 (USD Million)

- UAE Sanitary Ware Market, By Application, 2021–2029 (USD Million)

- UAE Sanitary Ware Market, By End-User, 2021–2029 (USD Million)

- South Africa Sanitary Ware Market, By Material, 2021–2029 (USD Million)

- South Africa Sanitary Ware Market, By Type, 2021–2029 (USD Million)

- South Africa Sanitary Ware Market, By Application, 2021–2029 (USD Million)

- South Africa Sanitary Ware Market, By End-User, 2021–2029 (USD Million)

List of Figures

- Global Sanitary Ware Market Segmentation

- Sanitary Ware Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Sanitary Ware Market Attractiveness Analysis By Material

- Global Sanitary Ware Market Attractiveness Analysis By Type

- Global Sanitary Ware Market Attractiveness Analysis By Application

- Global Sanitary Ware Market Attractiveness Analysis By End-User

- Global Sanitary Ware Market Attractiveness Analysis By Region

- Global Sanitary Ware Market: Dynamics

- Global Sanitary Ware Market Share By Material (2021 & 2029)

- Global Sanitary Ware Market Share By Type (2021 & 2029)

- Global Sanitary Ware Market Share By Application (2021 & 2029)

- Global Sanitary Ware Market Share By End-User (2021 & 2029)

- Global Sanitary Ware Market Share by Regions (2021 & 2029)

- Global Sanitary Ware Market Share by Company (2020)