Acrylic Acid Market Size By Product Type (Glacial Acrylic Acid, Acrylate Esters, Superabsorbent Polymers and Others), By Application (Textiles, Water Treatment, Surfactants & Surface Coatings, Personal Care Products and Others), Regions, Segmentation, and Projection till 2029

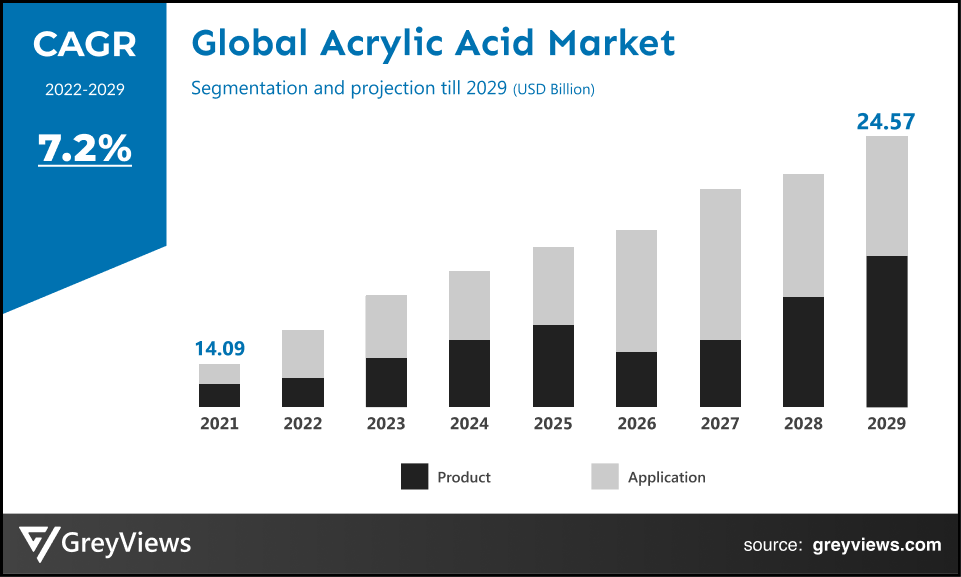

CAGR: 7.2%Current Market Size: USD 14.09 BillionFastest Growing Region: Europe

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Acrylic Acid Market- Market Overview:

The Global Acrylic Acid market is expected to grow from USD 14.09 billion in 2021 to USD 24.57 billion by 2029, at a CAGR of 7.2% during the Projection period 2022-2029. The growth of this market is mainly driven owing to the increasing demand for superabsorbent polymers in the manufacturing of personal care products.

Acrylic acid is a very versatile and valuable industrial chemical, as it is used as an intermediate in the production of a wide range of products. It is a corrosive, flammable, and colourless liquid. It is miscible with water, alcohol, chloroform, acetone, etc. Acrylic acid can form polyacrylic acid by reacting with itself because acrylic acid is highly reactive in nature. In addition, methacrylate-based polymers are widely used in lighting fixtures, electronic displays, and automotive rear lights, which has led to noticeable growth in the acrylic acid market. A large share of the acrylic acid market is dedicated to feminine hygiene products, including sanitary napkins, menstrual cups, tampons etc. As interior decoration trends grow, many developers and consumers prefer emulsion paints due to their better finishes, weather resistance, and dirt resistance which is contributing a large share in the growth of the acrylic acid market. The COVID-19 outbreak had a negative impact on the acrylic acid market due shortage of manpower, disrupted the supply chain and instability in the availability of raw materials. Post-COVID-19 as the restrictions ended the market started growing at a normal pace. Moreover, chemical manufacturing industries are continuously reforming their production processes and implementing several innovative strategies to make the production process safe and eco-friendly.

Sample Request: - Global Acrylic Acid Market

Market Dynamics:

Drivers:

- Rising demand for bio-based acrylics and coatings

Bio-based acrylics and coatings are in great demand due to their outstanding properties such as durability, ease to clean, easy adhesion etc. In addition, several R&D initiatives for new products are driving revenue growth in the chemical industry by shifting their focus to clean sustainable technologies in order to manufacture eco-friendly products. Moreover, the increasing R&D investment in advanced technology and techniques from major companies to produce bio acrylic acid from renewable resources, including sugar and glycerol, could offer lucrative opportunities for global growth.

Restraints:

- Strict regulations on restricting the use of acrylic acid

To reduce carbon emissions, government regulations and tighter rules are limiting the commercialization of acrylic acid in all countries. Moreover, if acrylic acid comes in contact with the eyes, it can cause severe and irreversible damage. It is severely irritating and corrosive to the skin and the respiratory tract due to which the government has imposed strict regulations on the use of acrylic acid which is also hampering the growth of the acrylic acid market.

Opportunities:

- Rising demand for water treatment polymers

The rising demand for water treatment polymers is driving the acrylic polymer market. Rapid industrialization and urbanization are one of the leading causes behind the generation of wastewater which needs to be treated before discharging in the environment in order to reduce the toxicity and microbial load of the water. Moreover, as a result of government regulations, manufacturers have to treat the effluent before releasing it into seas and oceans, which in turn increases the need for polyacrylamide, which indirectly benefits acrylic acid manufacturers.

Challenges:

- Availability of substitutes in the market

The major challenge, the acrylic acid market is facing is the availability of substitutes in the market which are hampering the growth of the market. It has been observed that the production of acrylic acid is more than its demand. Since alternative resins and absorbent agents are readily available on the market, the acrylic acid compound's demand in industries such as paint & coatings, automotive, construction, and plastic additives is low which has negatively impacted the growth of the market.

Segmentation Analysis:

The global acrylic acid market has been segmented based on product type, application, and region.

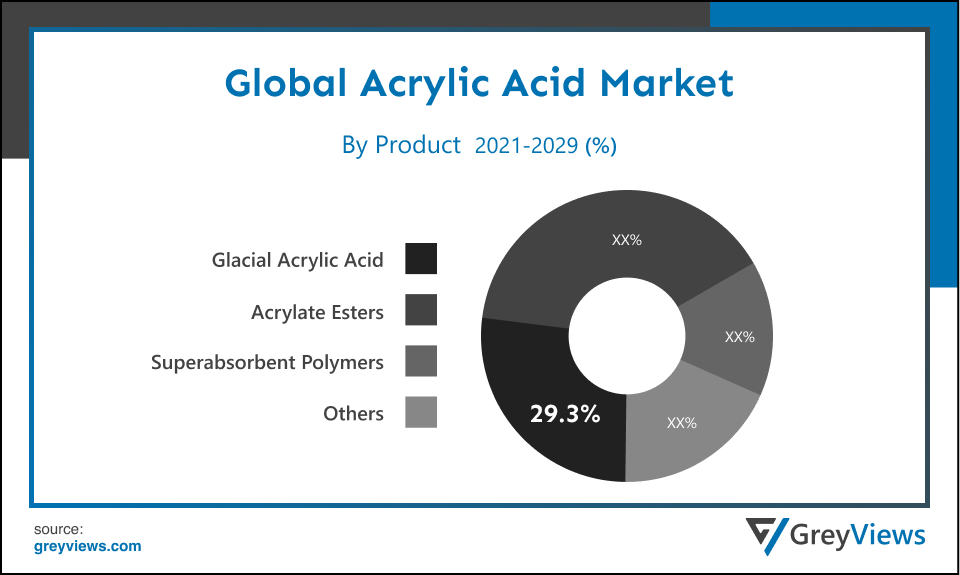

By Type

The type segment includes glacial acrylic acid, acrylate esters, superabsorbent polymers and others. The acrylate esters segment led the largest share of the acrylic acid market with a market share of around 29.3% in 2021. Polymers containing acrylates have several desirable properties including clarity, colour stability, heat resistance, and excellent weatherability, leading to higher product demand in the coatings and adhesives industries. A number of companies have been concentrating on the utilization of acrylate esters for various end-use applications, including automotive which will drive the growth of the acrylic acid market

By Application

The application segment includes textiles, water treatment, surfactants & surface coatings, personal care products and others. The personal care segment led the largest share of the acrylic acid market with a market share of around 26.14% in 2021. Due to the growing demand for superabsorbent polymers in personal care products such as adult incontinence products, sanitary napkins and diapers, there is expected to be an increase in demand for superabsorbent polymers which will boost the growth of the acrylic acid market.

Global Acrylic Acid Market- Sales Analysis.

The sale of acrylic acid product type and application expanded at a CAGR of 5% from 2015 to 2021.

Bio-acrylic acid is a result of increased regulatory pressure on businesses. Several large manufacturers, including BASF, Dow Chemicals, Cargill, and Novozyme, have invested in creating a bio-based product with comparable costs to those of its conventional counterpart. In May 2015, the price of acrylic acid in Europe increased primarily due to outages. However, it is anticipated that overall demand will remain steady and close to 2014 levels.

Bio-acrylic acid is a result of increased regulatory pressure on businesses. Several large manufacturers, including BASF, Dow Chemicals, Cargill, and Novozyme, have invested in the creation of a bio-based product with costs that are comparable to those of its conventional equivalent. In May 2015, the price of acrylic acid in Europe increased, mostly as a result of outages. However, it is anticipated that total demand would remain steady and remain similar to 2014 levels.

Thus, owing to the aforementioned factors, the global Acrylic Acid Market is expected to grow at a CAGR of 7.2% during the Projection period from 2022 to 2029.

By Regional Analysis:

The regions analyzed for the gloves market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Asia Pacific region dominated the acrylic acid market and held a 39.28% share of the market revenue in 2021.

- The Asia Pacific region witnessed a major share. Asia Pacific is expected to dominate the acrylic acid market in the coming years, growing at a robust growth rate as a result of the high demand for acrylic acid in numerous industries in emerging economies such as China, Japan, and India. Moreover, the region's large infant population causes a need for personal care and hygiene products and increasing individual and hygiene care expenditures will boost the growth of the acrylic acid market in the region.

- Europe is anticipated to experience significant growth during the predicted period. Rising demand for environment-friendly alternatives and water treatment polymers in the region due to increased industrialization and urbanization will propel the growth of the acrylic acid market in the Projection period.

Global Smart Farming Market- Country Analysis:

- Germany

Germany's acrylic acid market size was valued at USD 1.66 billion in 2021 and is expected to reach USD 2.91 billion by 2029, at a CAGR of 7.3% from 2022 to 2029. Research and development activities, along with increased investment by emerging and innovative players, have brought about a paradigm shift in the market's technology will boost the growth of the acrylic acid market in the country.

- China

China’s acrylic acid market size was valued at USD 1.65 billion in 2021 and is expected to reach USD 2.9 billion by 2029, at a CAGR of 7.7% from 2022 to 2029. Acrylic Acid demand in China has grown rapidly in the past decade because the Chinese economy maintains a high-speed growth rate resulting from a sustained increase in industrial output, imports and exports, consumer consumption, and capital expenditures over the last two decades.

- India

India's acrylic acid market size was valued at USD 1.21 billion in 2021 and is expected to reach USD 2.15 billion by 2029, at a CAGR of 7.5% from 2022 to 2029. The use of acrylic acid in polyacrylates, coatings and adhesives, and in rheology controllers and dispersants, the demand for acrylic acid would also increase. Moreover, the rising demand for superabsorbent polymers in the manufacturing of diapers will also contribute a large share in the growth of the market in the country.

Key Industry Players Analysis:

To increase their market position in the global acrylic acid business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- SIBUR

- LG Chem Ltd.

- Arkema S.A.

- Mitsubishi Chemical Holdings Corporation

- Formosa Corporation

- The Lubrizol Corporation

- Myriant Corporation

- Shell Chemicals

- Exxon Mobil Corporation

- Nippon Shokubai Co. Ltd.

- Mitsui Chemicals Inc.,

- BP plc

- Ashland

- Lucite International

- Sumitomo Chemicals Co. Ltd.

- BASF SE

Latest Development:

- In April 2022, as part of the plan, Wanhua will spend USD 3.6 billion on the construction of a chemical complex in China by 2024 which will also produce propylene oxide, acrylic acid, polyether polyols, and other chemicals.

- In September 2020, A new unit of acrylic acid purification has been planned by LG Chem as it plans to increase its capacity of high-purity acrylic acid to 160,000 tons a year at its complex in Yeosu, South Korea.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

7.2% |

|

Market Size |

14.09 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Product Type, By Application and By Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

SIBUR, LG Chem Ltd., Arkema S.A., Mitsubishi Chemical Holdings Corporation, Formosa Corporation, The Lubrizol Corporation, Myriant Corporation, Shell Chemicals, Exxon Mobil Corporation, Nippon Shokubai Co. Ltd., Mitsui Chemicals Inc., BP plc, Ashland, Lucite International, Sumitomo Chemicals Co. Ltd., and BASF SE. |

|

By Product Type |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Acrylic Acid Market by Product Type:

- Glacial Acrylic Acid

- Acrylate Esters

- Superabsorbent Polymers

- Others

Global Acrylic Acid Market by Application:

- Textiles

- Water Treatment

- Surfactants & Surface Coatings

- Personal Care Products

- Others

Global Acrylic Acid Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the expected market size of the acrylic acid Market in 2029?

Global acrylic acid Market is expected to reach USD 24.57 billion by 2029, at a CAGR of 7.2% from 2022 to 2029.

What is the CAGR of the acrylic acid Market?

The acrylic acid Market is projected to have a CAGR of 7.2%.

What is the Product Type segment of the acrylic acid Market?

On the basis of Product Type, the acrylic acid market is segmented into Glacial Acrylic Acid, Acrylate Esters, Superabsorbent Polymers and Others.

Which are the leading market players active in the acrylic acid Market?

Leading market players active in the acrylic acid Market are SIBUR, LG Chem Ltd., , Arkema S.A., Mitsubishi Chemical Holdings Corporation, Formosa Corporation, The Lubrizol Corporation, Myriant Corporation, Shell Chemicals, Exxon Mobil Corporation among others.

Political Factors- The factors that can affect acrylic acids' long-term profitability in a particular nation or market are heavily influenced by political issues such as wars, competitive political scenarios, Risk of military invasion etc. Acrylic acid engages in major diversified business in several nations, exposing it to various political systems and environmental concerns. Diversifying the systemic risks of the political environment is necessary to succeed in an industry like food, manufacturing, automotive, pharmaceutical, etc., which is dynamic and spread across many nations.

Economical Factors- The aggregate demand and investment in an economy are determined by the macroenvironmental factors, such as the inflation rate, savings rate, interest rate, foreign exchange rate, and economic cycle. While microenvironmental elements like industry norms have an impact on the firm's competitive edge. Acrylic acid can Projection the growth trajectory of not only different sectors but also that of the organisation by using country-level economic factors like growth rate and inflation and industry-level economic indicators like industry growth rate, consumer spending, etc.

Social Factors- The manner of life and culture of the society affect the organisational culture in a given environment. When developing a marketing strategy for customers in acrylic acids, different cultures and demographics of the society should be kept in mind. Acrylic acid marketers must consider the populace's shared values and attitudes before making the product available to the public.

Technological Factors- Numerous industries are being rapidly disrupted by technology. The chemical industry is a wonderful example to demonstrate this idea. The industry has been changing quickly over the past five years, not even allowing established firms to adapt. Technology companies like artificial intelligence and the Internet of Things are driving the automation of the chemical sector.. These technologies are widely used to increase the sale of acrylic acids. A company should analyse the industry's technological state as well as how quickly it is being disrupted by technology. Slow technological disruption will allow more time, whereas rapid disruption may give a firm little time to adapt and be profitable.

Environmental Factors- Different markets have various norms or environmental requirements, which might affect an organization's profitability. States frequently have differing liability and environmental regulations even within the same nation. For instance, in the United States, Florida and Texas have differing liability provisions in the event of accidents or environmental catastrophes. Similarly, many European nations offer substantial tax incentives to businesses engaged in the renewable energy industry. The firm should thoroughly assess the environmental criteria necessary to operate in those areas before entering or opening a new business in an existing market.

Legal Factors- Many nations' institutions and legal systems are not strong enough to safeguard an organization's intellectual property rights. Before entering such markets, a company should carefully consider its options because doing so could result in the theft of its secret competitive advantage. Different countries and regions have different laws and regulations for the use of acrylic acid and its sale of them. The different agencies of the countries monitor it.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Product Type

- 3.2. Market Attractiveness Analysis By Application

- 3.3. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Rising demand for bio-based acrylics and coatings

- 3. Restraints

- 3.1. Strict regulations on restricting the use of acrylic acid

- 4. Opportunities

- 4.1. Rising demand for water treatment polymers

- 5. Challenges

- 5.1. Availability of substitutes in the market

- Global Acrylic Acid Market Analysis and Projection, By Product Type

- 1. Segment Overview

- 2. Glacial Acrylic Acid

- 3. Acrylate Esters

- 4. Superabsorbent Polymers

- 5. Others

- Global Acrylic Acid Market Analysis and Projection, By Application

- 1. Segment Overview

- 2. Textiles

- 3. Water Treatment

- 4. Surfactants & Surface Coatings

- 5. Personal Care Products

- 6. Others

- Global Acrylic Acid Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Acrylic Acid Market-Competitive Landscape

- 1. Overview

- 2. Market Share of Key Players in the Acrylic Acid Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- 3. Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- SIBUR

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- LG Chem Ltd.

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Arkema S.A.

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Mitsubishi Chemical Holdings Corporation

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Formosa Corporation

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- The Lubrizol Corporation

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Myriant Corporation

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Shell Chemicals

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Exxon Mobil Corporation

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Nippon Shokubai Co. Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Mitsui Chemicals Inc.,

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- BP plc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Ashland

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Lucite International

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Sumitomo Chemicals Co. Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- BASF SE

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- SIBUR

List of Table

- Global Acrylic Acid Market, By Product Type, 2021–2029 (USD Billion)

- Global Glacial Acrylic Acid, Acrylic Acid Market, By Region, 2021–2029 (USD Billion)

- Global Acrylate Esters, Acrylic Acid Market, By Region, 2021–2029 (USD Billion)

- Global Superabsorbent Polymers, Acrylic Acid Market, By Region, 2021–2029 (USD Billion)

- Global Others, Acrylic Acid Market, By Region, 2021–2029 (USD Billion)

- Global Acrylic Acid Market, By Application, 2021–2029 (USD Billion)

- Global Textiles, Acrylic Acid Market, By Region, 2021–2029 (USD Billion)

- Global Water Treatment, Acrylic Acid Market, By Region, 2021–2029 (USD Billion)

- Global Surfactants & Surface Coatings, Acrylic Acid Market, By Region, 2021–2029 (USD Billion)

- Global Personal Care Products, Acrylic Acid Market, By Region, 2021–2029 (USD Billion)

- Global Others, Acrylic Acid Market, By Region, 2021–2029 (USD Billion)

- Global Acrylic Acid Market, By Region, 2021–2029 (USD Billion)

- North America Acrylic Acid Market, By Product Type, 2021–2029 (USD Billion)

- North America Acrylic Acid Market, By Application, 2021–2029 (USD Billion)

- USA Acrylic Acid Market, By Product Type, 2021–2029 (USD Billion)

- USA Acrylic Acid Market, By Application, 2021–2029 (USD Billion)

- Canada Acrylic Acid Market, By Product Type, 2021–2029 (USD Billion)

- Canada Acrylic Acid Market, By Application, 2021–2029 (USD Billion)

- Mexico Acrylic Acid Market, By Product Type, 2021–2029 (USD Billion)

- Mexico Acrylic Acid Market, By Application, 2021–2029 (USD Billion)

- Europe Acrylic Acid Market, By Product Type, 2021–2029 (USD Billion)

- Europe Acrylic Acid Market, By Application, 2021–2029 (USD Billion)

- Germany Acrylic Acid Market, By Product Type, 2021–2029 (USD Billion)

- Germany Acrylic Acid Market, By Application, 2021–2029 (USD Billion)

- France Acrylic Acid Market, By Product Type, 2021–2029 (USD Billion)

- France Acrylic Acid Market, By Application, 2021–2029 (USD Billion)

- UK Acrylic Acid Market, By Product Type, 2021–2029 (USD Billion)

- UK Acrylic Acid Market, By Application, 2021–2029 (USD Billion)

- Italy Acrylic Acid Market, By Product Type, 2021–2029 (USD Billion)

- Italy Acrylic Acid Market, By Application, 2021–2029 (USD Billion)

- Spain Acrylic Acid Market, By Product Type, 2021–2029 (USD Billion)

- Spain Acrylic Acid Market, By Application, 2021–2029 (USD Billion)

- Asia Pacific Acrylic Acid Market, By Product Type, 2021–2029 (USD Billion)

- Asia Pacific Acrylic Acid Market, By Application, 2021–2029 (USD Billion)

- Japan Acrylic Acid Market, By Product Type, 2021–2029 (USD Billion)

- Japan Acrylic Acid Market, By Application, 2021–2029 (USD Billion)

- China Acrylic Acid Market, By Product Type, 2021–2029 (USD Billion)

- China Acrylic Acid Market, By Application, 2021–2029 (USD Billion)

- India Acrylic Acid Market, By Product Type, 2021–2029 (USD Billion)

- India Acrylic Acid Market, By Application, 2021–2029 (USD Billion)

- South America Acrylic Acid Market, By Product Type, 2021–2029 (USD Billion)

- South America Acrylic Acid Market, By Application, 2021–2029 (USD Billion)

- Brazil Acrylic Acid Market, By Product Type, 2021–2029 (USD Billion)

- Brazil Acrylic Acid Market, By Application, 2021–2029 (USD Billion)

- Middle East and Africa Acrylic Acid Market, By Product Type, 2021–2029 (USD Billion)

- Middle East and Africa Acrylic Acid Market, By Application, 2021–2029 (USD Billion)

- UAE Acrylic Acid Market, By Product Type, 2021–2029 (USD Billion)

- UAE Acrylic Acid Market, By Application, 2021–2029 (USD Billion)

- South Africa Acrylic Acid Market, By Product Type, 2021–2029 (USD Billion)

- South Africa Acrylic Acid Market, By Application, 2021–2029 (USD Billion)

List of Figures

- Global Acrylic Acid Market Segmentation

- Acrylic Acid Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Acrylic Acid Market Attractiveness Analysis By Product Type

- Global Acrylic Acid Market Attractiveness Analysis By Application

- Global Acrylic Acid Market Attractiveness Analysis By Region

- Global Acrylic Acid Market: Dynamics

- Global Acrylic Acid Market Share By Product Type (2021 & 2029)

- Global Acrylic Acid Market Share By Application (2021 & 2029)

- Global Acrylic Acid Market Share by Regions (2021 & 2029)

- Global Acrylic Acid Market Share by Company (2020)