Acrylic Polymer Market Size by Type (Water-borne and Solvent-borne), Application (Laundry & Detergent, Dish Washing, Industrial & Institutional, Hard Surface Cleaning, and Others), Regions, Segmentation, and Projection till 2029

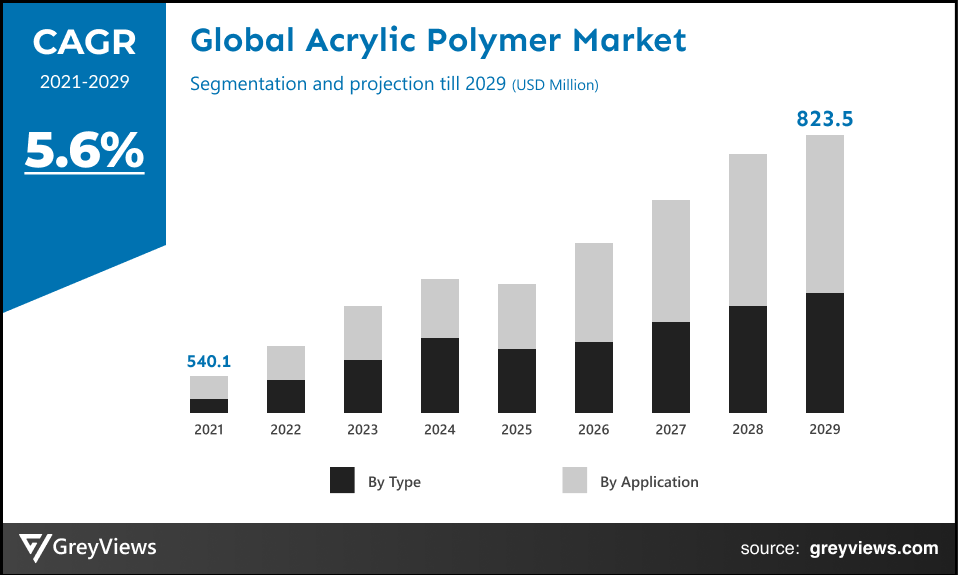

CAGR: 5.6%Current Market Size: 540.1 millionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Acrylic Polymer- Market Overview

The global acrylic polymer market is expected to grow from USD 540.1 million in 2021 to USD 823.5 million by 2029, at a CAGR of 5.6% during the Projection period 2022-2029. This growth is mainly driven by a significant rise in demand for acrylic polymer from applications such as dishwashing, laundry and detergent, hard surface cleaning, and industrial and institutional.

Acrylics or acrylic polymers are the types of polymers made by the connection of smaller units known as acrylates. Chemists across the globe select suitable hard and soft monomers to build acrylic polymers with specific attributes for different types of end-use applications. The pure acrylic polymers can form polyacrylic acid or crosslinked polyacrylic acid compounds, which are being used in the manufacture of detergents, hygienic products, and wastewater treatment & water purification.

On the other hand, acrylic polymer offers an important advantage as an ingredient in latex paint. Such paints provide better resistance to cracking and blistering, last for decades without yellowing while exposed to UV light, and are considered waterproof. Further, these polymers are generally being used in pressure-sensitive adhesives (PSAs) that are designed either for removable or permanent applications.

Request Sample:- Global Acrylic Polymer Market

Market Dynamics:

Drivers:

- Growing demand for acrylic polymers from the laundry detergent industry

Polymers had been used in detergent applications for the past 4 decades due to benefits such as anti-soil redeposition, anti-encrustation (Fabric whiteness maintenance), and a replacement for sodium tripolyphosphate (STPP), stain and soil removal, and dispersion and removal of insoluble fillers. The primary function of acrylic polymers is to act as builders and anti-soil re-deposition agents. Therefore, such polymers have substituted conventionally utilized phosphate builders in a detergent formulation that are harmful in nature and hazardous to the environment. In addition, acrylic polymers provide good fabric softening and dispersion properties, due to which, they are commonly used in laundry detergent. The aforementioned reasons have created the demand for acrylic polymers from the laundry detergent industry; thus, boosting the growth of the global market.

- Increasing application of acrylic polymers in institutional & industrial cleaning

Acrylic polymers are very effective in terms of cleaning applications such as hard surface cleaning, institutional & industrial cleaning, and other cleaning applications. Hence, the need for washing in manufacturing, retail, healthcare, and hospitality has driven the growth of the global market. In addition, industrial cleaning of hazardous areas is necessary for industrial facilities such as factories, power plants, warehouses, and other types of industrial facilities to achieve a pristine workplace for both customers and employees. Hence, the need for industrial cleaning drives the demand for acrylic polymers.

Restraints:

- Fluctuations in raw material prices

The raw material prices are growing due to supply shortages and rising feedstock & energy costs. Also, the volatility in crude oil prices has led to fluctuations in raw material prices in the global acrylic polymer market. For instance, due to a considerable shortage of feedstock chemicals such as Propylene, the prices of Acrylic Acid had seen growth in a consistent manner from $1490/MT to $1610/MT from January to March 2021. Such fluctuations in raw material prices are projected to hamper the growth of the market to some extent.

Opportunities:

- The rise in demand for environmentally sustainable formulations

The acrylic polymer is highly recyclable and durable. Its durability is attributed to its resistance to degradation by UV, unlike other plastics. In addition, it is highly weather-resistant and can withstand an extensive range of temperatures. However, environmental sustainability has become a major goal of the industrial sector in past few years; hence, the manufacturing sector across the globe is moving towards the usage of green, bio-based, or less toxic products. For instance, several developed countries have banned phosphate-based detergents fueling the demand for alternatives. On the other hand, acrylic polymer appears to be a great alternative to phosphate binders. Hence, the rise in demand for environmentally sustainable formulations is expected to create lucrative growth opportunities for the market.

Challenges

- Strict government regulations

Different regulations set by environmental and government authorities monitor the usage of acrylic polymers in industrial cleaning sectors owing to their VOC content. On the other hand, regulations such as DIN EN 16516, EU Construction Products Regulation (CPR), U.S. EPA, REACH, and similar others, regulate the production as well as the sale of acrylic polymers in European countries and the U.S. Such regulation poses significant challenges to the global acrylic polymers market players.

Segmentation Analysis:

The global acrylic polymer market has been segmented based on ingredient type, application, and regions.

By Type

The type segment includes water-borne and solvent-borne. The water-borne segment led the acrylic polymer market with a market share of around 57.6% in 2021. The growth of this segment is mainly driven by increasing demand for sustainable products, the high solubility of water-borne acrylic polymer, and dispersion in cleaning products. In addition, water-based acrylic polymers are easy to work with and environmentally friendly. Such polymers are widely being used in different industrial applications including industrial coatings, high-gloss varnishes, and printing inks.

By Application

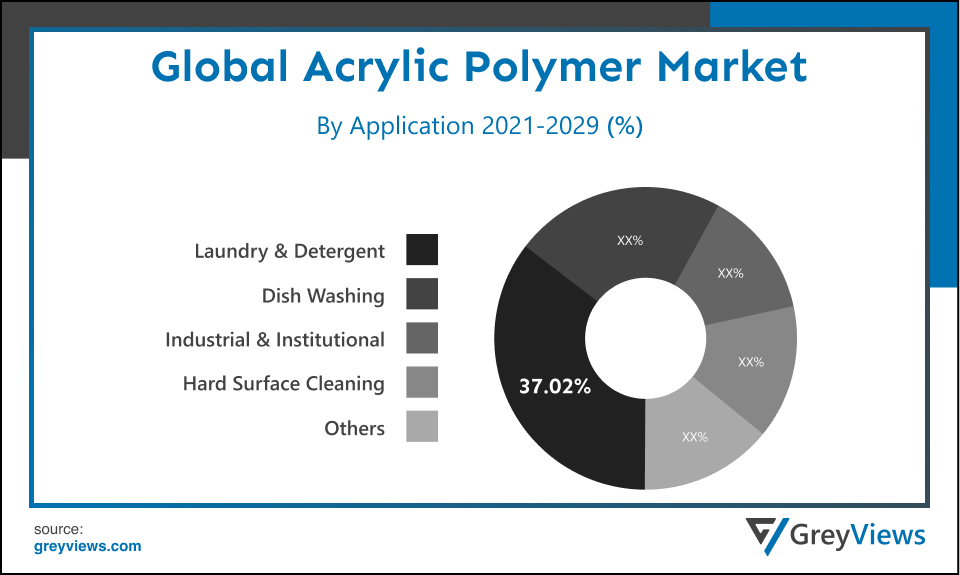

The application segment includes laundry & detergent, dishwashing, industrial & institutional, hard surface cleaning, and others. The laundry & detergent segment led the acrylic polymer market with a market share of around 36.11% in 2021. The demand for laundry detergent is growing due to several factors such as increasing per-capita income, increasing population, and growing usage of washing machines across the globe. This demand for laundry detergent subsequently fuels the growth of the acrylic polymer market in cleaning applications.

By Regional Analysis

The regions analyzed for the acrylic polymer market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. The North American region dominated the acrylic polymer market and held the 37.02% share of the market revenue in 2021.

- North America region witnessed a major share. The growth of this region is mainly driven by rising demand for sustainable laundry & detergents and other cleaning products due to strict regulations. In addition, the product innovations in the polymer industry in this region are fueling the growth of the market. For instance, Mallard Creek Polymers, a privately held specialty chemical company in the S. launched Rovene 6120, an all-acrylic emulsion polymer for highly durable elastomeric roof coatings.

- Asia-Pacific is expected to witness the highest growth rate during the Projection period. The rise in demand for superabsorbent polymers along with the wide-ranging acceptance of acrylic-based products across emerging economies in this region drives the growth of the acrylic polymer market. On the other hand, in May 2021, BASF, a German multinational chemical company started up a new acrylic dispersions production line in Pasir Gudang, Malaysia, doubling its capacity. Such business expansions in the region are opportunistic for the growth of the market.

Global Acrylic Polymer Market- Country Analysis:

- Germany

Germany acrylic polymer market size was valued at USD 91.8 million in 2021 and is expected to reach USD 138.9 million by 2029, at a CAGR of 5.5% from 2022 to 2029. This country is one of the leading nations in the mechanical engineering, manufacturing, automotive, and electrical industries. However, the rise in imports of acrylic polymer in this country is primarily driving the growth of the market. For instance, according to the IndexBox, an Ai-driven market intelligence platform in 2019, Germany accounted for imports of 495 thousand tonnes of acrylic polymer.

- China

China's acrylic polymer market size was valued at USD 108.02 million in 2021 and is expected to reach USD 161.0 million by 2029, at a CAGR of 5.3% from 2022 to 2029. Growing exports of acrylic polymer from China primarily fuel the growth of the market in the country. For instance, according to the United Nations COMTRADE database on international trade, China's exports of acrylic polymers in primary forms to India accounted for $136.39 Million during the year 2020.

- India

India's acrylic polymer market size was valued at USD 59.41 million in 2021 and is expected to reach USD 91.3 million by 2029, at a CAGR of 5.7% from 2022 to 2029. India is one of the strongest growing economies in Asia. The government in this country is focused on reviving the economy and are taking initiatives to promote the small and medium scale polymer processing industry. On the other hand, according to the study by Mintel India in April 2021, about 40% of Indians use powders and 19% of Indians use liquid detergents for machine washing laundry. This huge demand for detergents is further boosting the growth of the acrylic polymer market.

Key Industry Players Analysis:

To increase their market position in the global acrylic polymer business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Dow Inc.

- BASF SE

- Toagosei Co., Ltd.

- Sumitomo Seika Chemicals Co., Ltd.

- Arkema

- Nippon Shokubai Co. Ltd.

- Ashland Global Holdings, Inc.

- Plaskolite

- Lucite International

- Gellner Industrial

- others

Latest Development:

- In February 2021, Dow Inc., the leading material science company launched ACUSOL Prime 1 polymer, the Dow’s first multifunctional, Biodegradable dispersant. This is the game-changing dispersant that achieves multi-functionality as well as high performance while improved sustainability.

- In February 2020, Clariant, the supplier of sustainable ingredients and solutions for the Industrial and home care cleaning industry launched Bio-based TexCare SRN 260 Life. This product is the new polymer for laundry detergents with the best-in-class fiber protection against dirt, along with outstanding sustainability benefits.

Report Metrics

|

Report Attribute |

Details |

|

Market size available for years |

2021-2029 |

|

Base year considered |

2021 |

|

CAGR (%) |

5.6% |

|

Market Size |

540.1 million in 2021 |

|

Forecast period |

2022-2029 |

|

Forecast unit |

Value (USD) |

|

Segments covered |

Type and application, and Regions |

|

Report Scope |

Revenue forecast, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Dow Inc., BASF SE, Toagosei Co., Ltd., Sumitomo Seika Chemicals Co., Ltd., Arkema, Nippon Shokubai Co. Ltd., Ashland Global Holdings, Inc., Plaskolite, Lucite International, and Gellner Industrial among others |

|

By Type |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Acrylic Polymer Market by Type:

- Water-Borne

- Solvent-Borne

Global Acrylic Polymer Market by Application:

- Laundry & Detergent

- Dish Washing

- Industrial & Institutional

- Hard Surface Cleaning

- Others

Global Acrylic Polymer Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What are the Application of Acrylic Polymer?

The application segment includes laundry & detergent, dishwashing, industrial & institutional, hard surface cleaning, and others. The laundry & detergent segment led the acrylic polymer market with a market share of around 36.11% in 2021. The demand for laundry detergent is growing due to several factors such as increasing per-capita income, increasing population, and growing usage of washing machines across the globe. This demand for laundry detergent subsequently fuels the growth of the acrylic polymer market in cleaning applications

Which Region dominate the Acrylic Polymer Market?

North American region dominated the acrylic polymer market and held the 37.02% share of the market revenue in 2021

Which Country in APAC hold the large market Share of Acrylic Polymer Market?

China's acrylic polymer market size was valued at USD 108.02 million in 2021 and is expected to reach USD 161.0 million by 2029, at a CAGR of 5.3% from 2022 to 2029. Growing exports of acrylic polymer from China primarily fuel the growth of the market in the country. For instance, according to the United Nations COMTRADE database on international trade, China's exports of acrylic polymers in primary forms to India accounted for $136.39 Million during the year 2020

Who is the winner of Acrylic Polymer Market?

Dow Inc

What are the Drivers for Acrylic Polymer Market?

"Growing demand for acrylic polymers from the laundry detergent industry" Polymers had been used in detergent applications for the past 4 decades due to benefits such as anti-soil redeposition, anti-encrustation (Fabric whiteness maintenance), and a replacement for sodium tripolyphosphate (STPP), stain and soil removal, and dispersion and removal of insoluble fillers. The primary function of acrylic polymers is to act as builders and anti-soil re-deposition agents. Therefore, such polymers have substituted conventionally utilized phosphate builders in a detergent formulation that are harmful in nature and hazardous to the environment. In addition, acrylic polymers provide good fabric softening and dispersion properties, due to which, they are commonly used in laundry detergent. The aforementioned reasons have created the demand for acrylic polymers from the laundry detergent industry; thus, boosting the growth of the global market

How much Global Acrylic Polymer Market was valued in 2021?

Global acrylic polymer market was valued USD 540.1 million in 2021

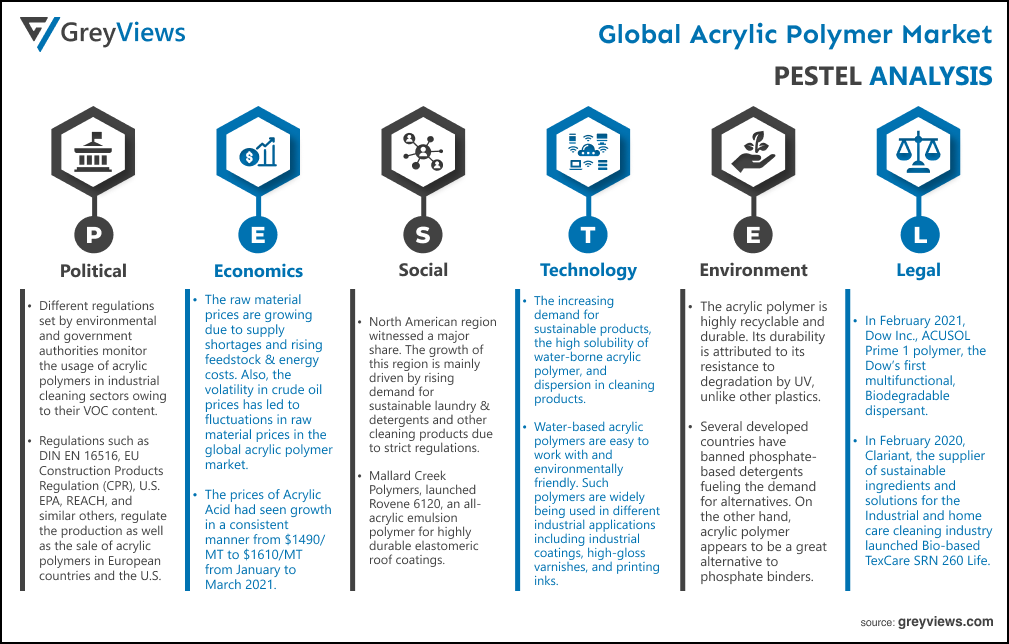

Political Factors- Different regulations set by environmental and government authorities monitor the usage of acrylic polymers in industrial cleaning sectors owing to their VOC content. On the other hand, regulations such as DIN EN 16516, EU Construction Products Regulation (CPR), U.S. EPA, REACH, and similar others, regulate the production as well as the sale of acrylic polymers in European countries and the U.S. Such regulation poses significant challenges to the global acrylic polymers market players.

Economic Factors- The raw material prices are growing due to supply shortages and rising feedstock & energy costs. Also, the volatility in crude oil prices has led to fluctuations in raw material prices in the global acrylic polymer market. For instance, due to a considerable shortage of feedstock chemicals such as Propylene, the prices of Acrylic Acid had seen growth in a consistent manner from $1490/MT to $1610/MT from January to March 2021. Such fluctuations in raw material prices are projected to hamper the growth of the market to some extent.

Social Factor- North American region witnessed a major share. The growth of this region is mainly driven by rising demand for sustainable laundry & detergents and other cleaning products due to strict regulations. In addition, the product innovations in the polymer industry in this region are fueling the growth of the market. For instance, Mallard Creek Polymers, a privately held specialty chemical company in the U.S. launched Rovene 6120, an all-acrylic emulsion polymer for highly durable elastomeric roof coatings. On the other hand, in May 2021, BASF, a German multinational chemical company started up a new acrylic dispersions production line in Pasir Gudang, Malaysia, doubling its capacity. Such business expansions in the region are opportunistic for the growth of the market.

Technological Factors- The increasing demand for sustainable products, the high solubility of water-borne acrylic polymer, and dispersion in cleaning products. In addition, water-based acrylic polymers are easy to work with and environmentally friendly. Such polymers are widely being used in different industrial applications including industrial coatings, high-gloss varnishes, and printing inks. For instance, in May 2021, BASF, a German multinational chemical company started up a new acrylic dispersions production line in Pasir Gudang, Malaysia, doubling its capacity.

Environmental Factors- The acrylic polymer is highly recyclable and durable. Its durability is attributed to its resistance to degradation by UV, unlike other plastics. In addition, it is highly weather-resistant and can withstand an extensive range of temperatures. However, environmental sustainability has become a major goal of the industrial sector in past few years; hence, the manufacturing sector across the globe is moving towards the usage of green, bio-based, or less toxic products. For instance, several developed countries have banned phosphate-based detergents fueling the demand for alternatives. On the other hand, acrylic polymer appears to be a great alternative to phosphate binders. Hence, the rise in demand for environmentally sustainable formulations is expected to create lucrative growth opportunities for the market.

Legal Factors- In February 2021, Dow Inc., the leading material science company launched ACUSOL Prime 1 polymer, the Dow’s first multifunctional, Biodegradable dispersant. This is the game-changing dispersant that achieves multi-functionality as well as high performance while improved sustainability. In February 2020, Clariant, the supplier of sustainable ingredients and solutions for the Industrial and home care cleaning industry launched Bio-based TexCare SRN 260 Life. This product is the new polymer for laundry detergents with the best in class fiber protection against dirt, along with outstanding sustainability benefits.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Type

- Market Attractiveness Analysis By Application

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Growing demand for acrylic polymers from laundry detergent industry

- Increasing application of acrylic polymers in institutional & industrial cleaning

- Restrains

- Fluctuations in raw material prices

- Opportunities

- Rise in demand for environmentally sustainable formulations

- Challenges

- Strict government regulations

- Global Acrylic Polymer Market Analysis and Projection, By Type

- Segment Overview

- Water-borne

- Solvent-borne

- Global Acrylic Polymer Market Analysis and Projection, By Application

- Segment Overview

- Laundry & Detergent

- Dish Washing

- Industrial & Institutional

- Hard Surface Cleaning

- Others

- Global Acrylic Polymer Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- S.

- Canada

- Mexico

- Europe

- Germany

- France

- K.

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Acrylic Polymer Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Acrylic Polymer Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Type Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Dow Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- BASF SE

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Toagosei Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Sumitomo Seika Chemicals Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Arkema

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Nippon Shokubai Co. Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Ashland Global Holdings, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Plaskolite

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Lucite International

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Solvay S.A.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Dow Inc.

List of Table

- Global Acrylic Polymer Market, By Type, 2021–2029(USD Million)

- Global Water-borne Market, By Region, 2021–2029(USD Million)

- Global Solvent-borne Market, By Region, 2021–2029(USD Million)

- Global Acrylic Polymer Market, By Application, 2021–2029(USD Million)

- Global Laundry & Detergent Acrylic Polymer Market, By Region, 2021–2029(USD Million)

- Global Dish Washing Application Acrylic Polymer Market, By Region, 2021–2029(USD Million)

- Global Industrial & Institutional Acrylic Polymer Market, By Region, 2021–2029(USD Million)

- Global Hard Surface Cleaning Acrylic Polymer Market, By Region, 2021–2029(USD Million)

- Global Others Acrylic Polymer Market, By Region, 2021–2029(USD Million)

- Global Acrylic Polymer Market, By Region, 2021–2029(USD Million)

- Global Acrylic Polymer Market, By North America, 2021–2029(USD Million)

- North America Acrylic Polymer Market, By Type, 2021–2029(USD Million)

- North America Acrylic Polymer Market, By Application, 2021–2029(USD Million)

- USA Acrylic Polymer Market, By Type, 2021–2029(USD Million)

- USA Acrylic Polymer Market, By Application, 2021–2029(USD Million)

- Canada Acrylic Polymer Market, By Type, 2021–2029(USD Million)

- Canada Acrylic Polymer Market, By Application, 2021–2029(USD Million)

- Mexico Acrylic Polymer Market, By Type, 2021–2029(USD Million)

- Mexico Acrylic Polymer Market, By Application, 2021–2029(USD Million)

- Europe Acrylic Polymer Market, By Type, 2021–2029(USD Million)

- Europe Acrylic Polymer Market, By Application, 2021–2029(USD Million)

- Germany Acrylic Polymer Market, By Type, 2021–2029(USD Million)

- Germany Acrylic Polymer Market, By Application, 2021–2029(USD Million)

- France Acrylic Polymer Market, By Type, 2021–2029(USD Million)

- France Acrylic Polymer Market, By Application, 2021–2029(USD Million)

- UK Acrylic Polymer Market, By Type, 2021–2029(USD Million)

- UK Acrylic Polymer Market, By Application, 2021–2029(USD Million)

- Italy Acrylic Polymer Market, By Type, 2021–2029(USD Million)

- Italy Acrylic Polymer Market, By Application, 2021–2029(USD Million)

- Spain Acrylic Polymer Market, By Type, 2021–2029(USD Million)

- Spain Acrylic Polymer Market, By Application, 2021–2029(USD Million)

- Asia Pacific Acrylic Polymer Market, By Type, 2021–2029(USD Million)

- Asia Pacific Acrylic Polymer Market, By Application, 2021–2029(USD Million)

- Japan Acrylic Polymer Market, By Type, 2021–2029(USD Million)

- Japan Acrylic Polymer Market, By Application, 2021–2029(USD Million)

- China Acrylic Polymer Market, By Type, 2021–2029(USD Million)

- China Acrylic Polymer Market, By Application, 2021–2029(USD Million)

- India Acrylic Polymer Market, By Type, 2021–2029(USD Million)

- India Acrylic Polymer Market, By Application, 2021–2029(USD Million)

- South America Acrylic Polymer Market, By Type, 2021–2029(USD Million)

- South America Acrylic Polymer Market, By Application, 2021–2029(USD Million)

- Brazil Acrylic Polymer Market, By Type, 2021–2029(USD Million)

- Brazil Acrylic Polymer Market, By Application, 2021–2029(USD Million)

- Middle East and Africa Acrylic Polymer Market, By Type, 2021–2029(USD Million)

- Middle East and Africa Acrylic Polymer Market, By Application, 2021–2029(USD Million)

- UAE Acrylic Polymer Market, By Type, 2021–2029(USD Million)

- UAE Acrylic Polymer Market, By Application, 2021–2029(USD Million)

- South Africa Acrylic Polymer Market, By Type, 2021–2029(USD Million)

- South Africa Acrylic Polymer Market, By Application, 2021–2029(USD Million)

List of Figures

- Global Acrylic Polymer Market Segmentation

- Acrylic Polymer Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Acrylic Polymer Market Attractiveness Analysis By Type

- Global Acrylic Polymer Market Attractiveness Analysis By Application

- Global Acrylic Polymer Market Attractiveness Analysis By Region

- Global Acrylic Polymer Market: Dynamics

- Global Acrylic Polymer Market Share By Type(2021 & 2029)

- Global Acrylic Polymer Market Share By Application(2021 & 2029)

- Global Acrylic Polymer Market Share by Regions (2021 & 2029)

- Global Acrylic Polymer Market Share by Company (2020)