Agriculture Drones Market Size By Type (Fixed Wing, Rotary Wing, and Others), By Application (Crop Monitoring, Soil & Field Analysis, Planting & Seeding, Crop Spray, and Others), By Technology (Manual and Autonomous), Regions, Segmentation, and forecast till 2029

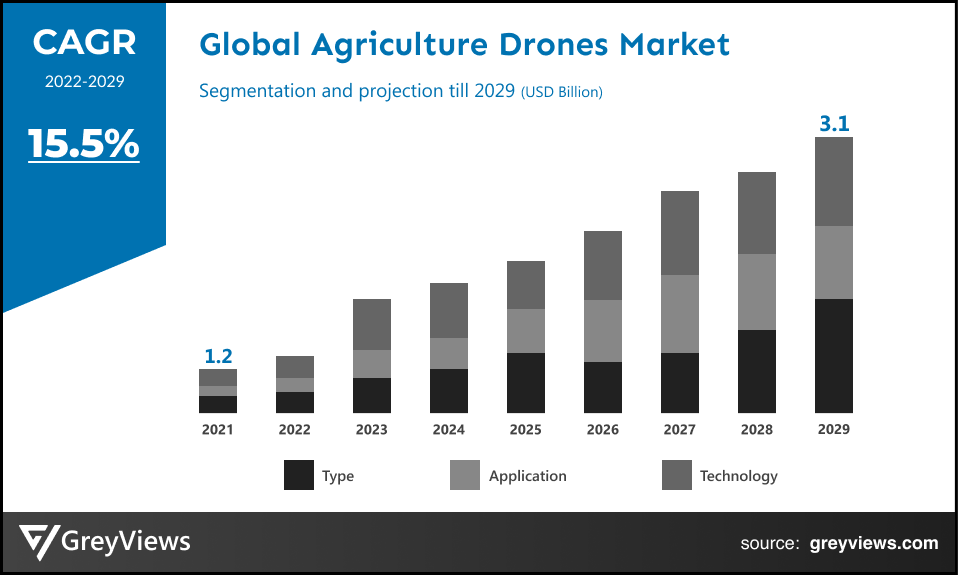

CAGR: 15.5%Current Market Size: USD 1.2 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Agriculture Drones Market- Market Overview:

The Global Agriculture Drones market is expected to grow from USD 1.2 billion in 2021 to USD 3.1 billion by 2029, at a CAGR of 15.5% during the forecast period 2022-2029. The pressure on the world's food supply brought on by population growth as well as an increase in venture capital funding for the development of agriculture Drones however are driving the market's growth.

Drones for agriculture are unmanned aircraft used to monitor crop development and increase crop yield in order to enhance agricultural operations. Digital photography capabilities of Drones offer a more thorough picture of the fields, increasing farm productivity. It makes it possible to deal with problems like irrigation, fungus infestations, and different types of soil. It's used to monitor farmers, livestock, and other things. Unmanned aerial vehicles, or Drones, are light aircraft that can carry up to 20 kg (50 lbs). Due of their size, a human body cannot board them (yet). Drones can be operated in two different ways: manually by a person via a wireless remote control, or autonomously by the vehicle itself, which follows a course determined by GPS or other sensors. In agricultural, Drones lessen pollution. The use of pesticides in the fields might vary. Drones in agriculture can help farmers decide where to evenly spray pesticides, as too much can result in a variety of health issues. The amount of chemical used by agricultural producers may be decreased if the Drones were outfitted with the tools required to scan the ground and uniformly spray the chemical.

Sample Request: - Global Agriculture Drones Market

Market Dynamics:

Drivers:

- Increase use of small Drones in Agriculture to drive demand

Precision agriculture and the use of technology like Drones are growing in popularity globally due to a growing population and the necessity for enough of food to meet rising market needs. Unexpected weather variations throughout the world are causing unprecedented degrees of difficulty in the agricultural sector, driving up need for cutting-edge technologies like agriculture Drones to boost crop productivity and business expertise. Additionally, the aerial view provided by drone agriculture can reveal a number of issues, including as soil variations, drainage issues, and fungal infections. These standards are used in agriculture to inspect crops and quickly spot problems, which will likely drive the expansion of the agriculture drone industry.

Restraints:

- High Costs Associated with UAVS to Limit Adoption

Smart technologies are being used by farmers to increase agricultural output in sparsely populated areas. Monitoring soil health, plant health, irrigation, and agricultural scouting are attractive prospects made possible by cutting-edge camera systems and software. Agriculture UAVs are high-tech aerial devices that can fly for hours over vast agricultural fields. These systems are equipped with a tone of pricey navigation and other autonomous systems, cutting-edge high-definition cameras, and other features, which raises the ultimate cost of the items. Therefore, the expansion of the market over the projection period is anticipated to be hampered by expensive product attributes.

The strict limitations imposed by many nations on the flying of unmanned aerial systems at specific heights are the second key problem for the sector. Additionally, the massive farmer populations' lack of knowledge is another issue limiting the demand in the market.

Opportunities:

- Technological Advancements in Agriculture Drones

Agriculture is using information and communication technology (ICTs) more and more to solve environmental issues. Farming communities need to be able to adapt and become resilient in the face of substantial problems brought on by climate change if they are to feed the world's growing population. In addition to providing a fantastic platform for addressing some of these issues, utilizing the growth and transformative power of ICTs can also help to expedite the fulfilment of the 2030 Sustainable Development Goals (SDGs). The productivity and efficiency of conventional agricultural practices will alter when cutting-edge technology is applied. Farmers that use sustainable farming methods could be able to speed up their production processes by using improved data analytics. An increase in auxiliary equipment expenditure would also help the market for agricultural Drones.

Challenges:

- Lack of knowledge to Farmers

Drone makers have a difficult time reaching out to potential customers since farmers lack the necessary skills. Additionally, individuals don't want to buy agriculture drones because they lack the expertise to use the tools (software applications) that evaluate and enhance efficiency, which restricts the market's expansion. Concerns about cyber security are another factor preventing market growth; if these issues are handled, the business may expand soon.

Segmentation Analysis:

The global Agriculture Drones market has been segmented based on type, application, technology and regions.

By type

The type segment includes Fixed Wing, Rotary Wing, and Others. The very large gas carrier segment led the largest share of the Agriculture Drones market with a market share of around 35.3% in 2021. Due to their strong structural advantages, rotary wing Drones are widely employed for a variety of farming applications. In order to transport big payloads, multi-rotor aircraft may take off and land vertically (VTOL) without requiring any extra airspace. Multi-rotor Drones can also fly for extended periods of time, which makes them ideal for precise spraying, aerial photography, and picture capture.

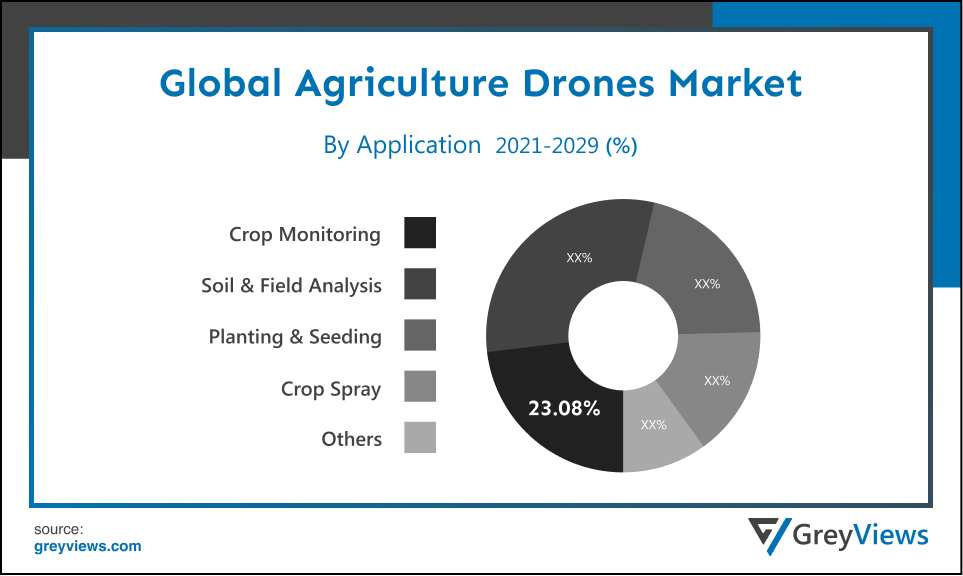

By application

The application segment includes Crop Monitoring, Soil & Field Analysis, Planting & Seeding, Crop Spray, and Others. The Crop Monitoring segment led the Agriculture Drones market with a market share of around 23.08% in 2021. Drones that monitor crops may quickly identify stressed regions, disease infestations, and actual plant counts while providing greater quality information about agricultural conditions than standard satellite approaches. Drones are estimated to be up to five times faster than traditional equipment in applying fertilizers and pesticides to fields up to 50 ha, and by concentrating exclusively on the areas that need treatment—as identified by crop monitoring—up to 60% of materials may be saved.

By technology

The technology segment includes Manual and Autonomous. The Autonomous segment led the Agriculture Drones market with a market share of around 53.08% in 2021. Drones with superior ground control systems that use automatic supervisory procedures to reduce the number of operators needed to manage the fleet are referred to as autonomous agriculture Drones. Many agricultural applications, including data-collection missions and drone mapping, are now carried out automatically. The sub-segment is also expected to have impressive growth in the next years because to advancements in autonomous technology like automated seeders and autonomous pollination Drones that can operate and assess crop health without the need for humans.

Global Agriculture Drones Market- Sales Analysis.

The sale of agriculture drones expanded at a CAGR of 7% from 2015 to 2021.

Agriculture is using information and communication technology (ICTs) more and more to address environmental issues. Farming communities need to be able to adapt and become resilient in the face of substantial problems brought on by climate change if they are to feed the world's growing population. In addition to providing a fantastic platform for addressing some of these issues, utilising the growth and transformative power of ICTs can also help to expedite the fulfilment of the 2030 Sustainable Development Goals (SDGs). The production and efficiency of conventional agricultural techniques will change when cutting-edge technology is applied. Farmers who use sustainable farming methods could be able to speed up their production processes by using improved data analytics. An increase in auxiliary equipment expenditure would also help the market for agricultural drones.

Drones are changing the culture and method of agriculture. Agriculture and the farm industry may increase crop productivity, make time-saving land management decisions, and boost long-term success by integrating drone technology. Drones may be used in agriculture for various tasks, including soil and field analysis, seeding, crop spraying and spot spraying, crop mapping and surveying, irrigation monitoring and management, and in-flight livestock monitoring. The market for Drones in agriculture will grow quickly throughout the projected period due to these varied applications.

Thus, owing to the aforementioned factors, the global Agriculture Drones Market is expected to grow at a CAGR of 15.5% during the forecast period from 2022 to 2032.

By Regional Analysis:

The regions analyzed for the Agriculture Drones market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Asia Pacific region dominated the Agriculture Drones market and held the 39.1% share of the market revenue in 2021.

- The primary drivers driving Asia Pacific region market expansion in the area are the rising use of improved technology in agribusiness and the expanding partnership between the public and private sectors to improve food. Furthermore, in nations like Japan and South Korea, where pesticide usage and civil aviation laws are well-established, agricultural drone use is regulated. Additionally, draught rules and aviation laws are in effect in China, Taiwan, Malaysia, India, and the Philippines. It is projected that these regional trends would promote the expansion of the agriculture drone industry.

- North America is anticipated to experience significant growth during the predicted period. Due to the strong inclination for technologically sophisticated machinery and drone systems to boost agricultural productivity, North America had a significant market share in 2019. By removing the need for a pilot's licence, the Department of Transportation (DOT) and the Federal Aviation Administration (FAA) have created favourable regulations to enable commercial and small unmanned aerial systems. Commercial agricultural firms operating huge farmlands across the nation have a sizable and loyal client base in the United States. The dominance of North America in the agriculture drone market share is caused by this as well as the existence of suitable manufacturing firms in the U.S. and Canada.

Global Agriculture Drones Market- Country Analysis:

- Germany

Germany Agriculture Drones market size was valued at USD 0.1 billion in 2021 and is expected to reach USD 0.24 billion by 2029, at a CAGR of 5.3% from 2022 to 2029.

When it comes to embracing new technologies, Germany has always maintained its lead. From 11 billion farmers in total in 1965 to fewer than 2 billion in 2020, the number of farmers in Japan has decreased. As a result, the government has set a target to adopt agriculture UAVs for more than half of the land area nationwide that is cultivated with wheat, soy, and rice by 2022.

- China

China Agriculture Drones’s market size was valued at USD 0.2 billion in 2021 and is expected to reach USD 0.4 billion by 2029, at a CAGR of 5.1% from 2022 to 2029. The top manufacturers in China, including XAG and DJI, account for over 80% of the domestic market. These manufacturers advanced their technologies, with XAG concentrating on agricultural Drones and DJI on camera Drones. These reasons contribute to the significant market development for agricultural Drones in China and the anticipated quick expansion.

- India

India's Agriculture Drones market size was valued at USD 0.05 billion in 2021 and is expected to reach USD 0.09 billion by 2029, at a CAGR of 6.0% from 2022 to 2029. In order to create Drones that spray fertilizer, the state governments of Karnataka, Haryana, Punjab, Tamil Nadu, and Madhya Pradesh are working with drone manufacturers, farmer producer associations, and state agriculture institutes. To assist farmers in becoming familiar with the usage of Drones, state governments and state colleges are working together.

Key Industry Players Analysis:

To increase their market position in the global Agriculture Drones business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- BW Group

- Dorian LPG Ltd

- EXMAR

- Hyundai Heavy Industries Co., Ltd

- Kawasaki Heavy Industries, Ltd

- Mitsubishi Heavy Industries, Ltd

- Namura Shipbuilding Co., Ltd

- PT Pertamina

- StealthGas Inc

- The Great Eastern Shipping Co. Ltd.

- Teekay Corporation

Latest Development:

- In April 2021, AgEagle Aerial Systems Inc. is a US-based drone technology company that has been operating for more than ten years. The business announced the purchase of Measure Global Inc., a leader in aerial intelligence products, for a combined price of around US$45 billion in stock and cash.

- In September 2019, The first fully integrated multispectral imaging drone for environmental management and precision agriculture, P4 Multispectral was introduced by DJI. P4 Multispectral integrates information from six different sensors to assess the health of crops, from single plants to entire fields, as well as to find weeds, insects, and different types of soil conditions.

Report Metrics

| Report Attribute | Details |

| Study Period | 2021-2029 |

| Base year | 2021 |

| CAGR (%) | 15.5% |

| Market Size | 1.2 billion in 2021 |

| Forecast period | 2022-2029 |

| Forecast unit | Value (USD) |

| Segments covered | By Type, By Application, By Technology and By Region. |

| Report Scope | Revenue forecast, competitive landscape, company ranking, growth factors, and trends |

Companies covered | BW Group, Dorian LPG Ltd, EXMAR, Hyundai Heavy Industries Co., Ltd, Kawasaki Heavy Industries, Ltd, Mitsubishi Heavy Industries, Ltd, Namura Shipbuilding Co., Ltd, PT Pertamina, StealthGas Inc, The Great Eastern Shipping Co. Ltd., and Teekay Corporation. |

| By Type |

|

| By Application |

|

| By Technology |

|

Regional scope |

|

Scope of the Report

Global Agriculture Drones Market by Type:

- Fixed Wing

- Rotary Wing

- Others

Global Agriculture Drones Market by Application:

- Crop Monitoring

- Soil & Field Analysis

- Planting & Seeding

- Crop Spray

- Others

Global Agriculture Drones Market by Technology:

- Manual

- Autonomous

Global Agriculture Drones Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the expected market size of the Agriculture Drones market in 2029?

Global Agriculture Drones market is expected to reach USD 3.1 billion by 2029, at a CAGR of 15.5% from 2022 to 2029.

Which are the driving factors of the agricultural drones market?

Growing use of sustainable farming is the primary driving factors of the agricultural drones market.

What is the share of market in dominating region?

The Asia Pacific region dominated the Agriculture Drones market and held the 39.1% share of the market revenue in 2021.

Which segment dominated the application type segment?

The Crop Monitoring segment is expected to witness the highest growth rate during the forecast period.

What was the CAGR of the global agriculture drone market during 2015-2021?

The of agriculture drones expanded at a CAGR of 7% from 2015 to 2021.

Which are the leading market players active in the Agriculture Drones market?

Leading market players active in the global Agriculture Drones market are BW Group, Dorian LPG Ltd., EXMAR, Hyundai Heavy Industries Co., Ltd, Kawasaki Heavy Industries, Ltd, Mitsubishi Heavy Industries, Ltd., Namura Shipbuilding Co., Ltd., PT Pertamina (Persero), StealthGas Inc., The Great Eastern Shipping Co. Ltd., Teekay Corporation among others.

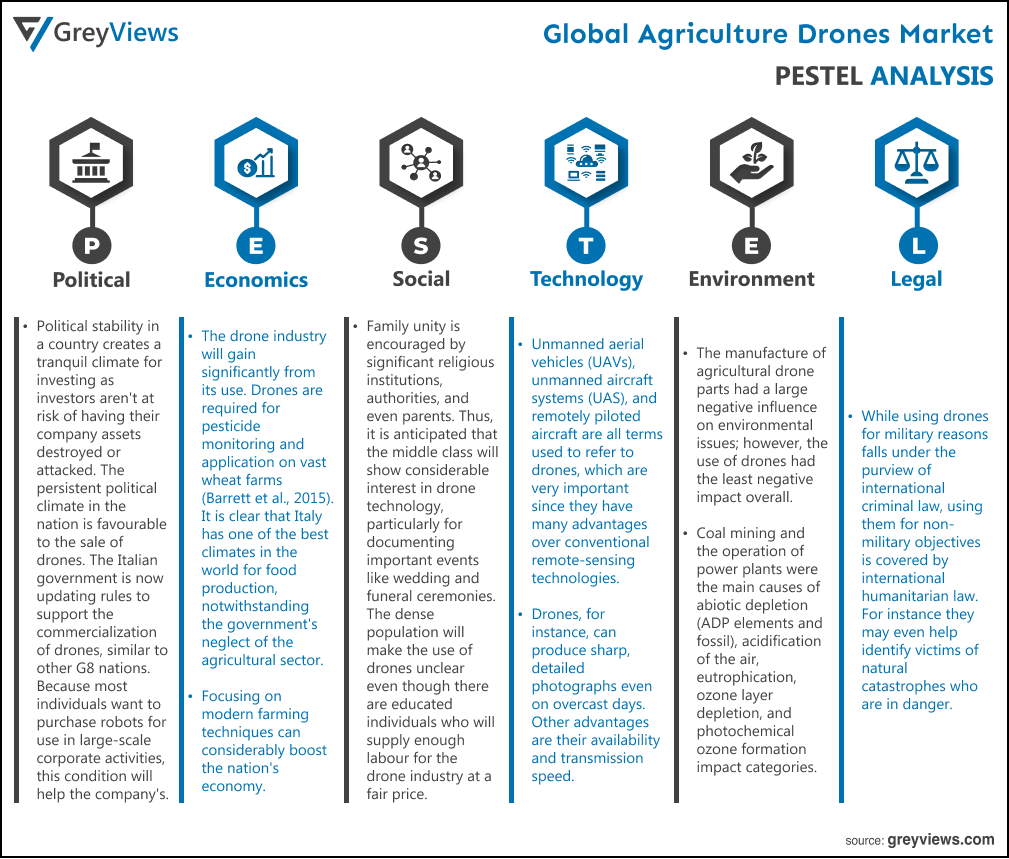

Political Analysis- Political stability in a country creates a tranquil climate for investing as investors aren't at risk of having their company assets destroyed or attacked. The persistent political climate in the nation is favourable to the sale of drones. The Italian government is now updating rules to support the commercialization of drones, similar to other G8 nations. Because most individuals want to purchase robots for use in large-scale corporate activities, this condition will help the company's. Drones can be used by small business owners to make sure their operations are efficient. Foreign investors are welcome in Italy thanks to the drone law. To prevent monopolistic users from exploiting their market and to make sure that consumers may purchase goods and services at reasonable prices, the government supports this practise. In Italy, the private sector currently controls around 60% of the UAV market, compared to the public sector's 40% share.

Economical Analysis- The drone industry will gain significantly from its use. Drones are required for pesticide monitoring and application on vast wheat farms (Barrett et al., 2015). It is clear that Italy has one of the best climates in the world for food production, notwithstanding the government's neglect of the agricultural sector. Focusing on modern farming techniques can considerably boost the nation's economy. As a result, the drone company will sell in Italy because the agricultural sector will also be helpful in securing the fields, particularly in identifying arsonists who want to destroy the plantations. The cameras on the drones can display photos at night.

Social Analysis- One of the most revered institutions in any society is the family. Family unity is encouraged by significant religious institutions, authorities, and even parents. Thus, it is anticipated that the middle class will show considerable interest in drone technology, particularly for documenting important events like wedding and funeral ceremonies. The dense population will make the use of drones unclear even though there are educated individuals who will supply enough labour for the drone industry at a fair price. This is because drones cannot take flight if there are 50 people within 50 metres of them. However, the country's economic situation and demands make it an ideal place to build a drone business empire. Because drones can be used in a variety of industries, the nation has a favourable business environment for them.

Technological Analysis- Unmanned aerial vehicles (UAVs), unmanned aircraft systems (UAS), and remotely piloted aircraft are all terms used to refer to drones, which are very important since they have many advantages over conventional remote-sensing technologies. Drones, for instance, can produce sharp, detailed photographs even on overcast days. Other advantages are their availability and transmission speed. Drones are much more affordable and simpler to set up and operate than aircraft. Drones can be used for precision irrigation, weed, pest, and disease management, as well as monitoring, estimating, and detection tasks based on their sensory data. In other words, based on environmental data, drones are able to spray water and insecticides in precise amounts.

Environmental Analysis- The manufacture of agricultural drone parts had a large negative influence on environmental issues; however, the use of drones had the least negative impact overall. Coal mining and the operation of power plants were the main causes of abiotic depletion (ADP elements and fossil), acidification of the air, eutrophication, ozone layer depletion, and photochemical ozone formation impact categories. However, the carbon fibres and the battery are the main causes of other impact categories, such as human toxicity, freshwater aquatic ecotoxicity, and terrestrial ecotoxicity.

Legal Analysis- While using drones for military reasons falls under the purview of international criminal law, using them for non-military objectives is covered by international humanitarian law. For instance, they may even help identify victims of natural catastrophes who are in danger. They can also be utilised for search and rescue missions, traffic and weather surveillance, firefighting, and dropping humanitarian pallets in areas that are largely unreachable due to poor transportation connectivity or other natural calamities. While to note that due to a lack of jurisprudential development in this area, there is now no explicit legislation governing the actions of drones. It becomes much more important when dealing with regulatory difficulties impacting the general public, national security, and preserving important natural, historical, and cultural areas.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Type

- 3.2. Market Attractiveness Analysis By Application

- 3.3. Market Attractiveness Analysis By Technology

- 3.4. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Increase use of small Drones in Agriculture to drive demand

- 3. Restraints

- 3.1. High Costs Associated with UAVS to Limit Adoption

- 4. Opportunities

- 4.1. Technological Advancements in Agriculture Drones

- 5. Challenges

- 5.1. Lack of knowledge to Farmers

- Global Agriculture Drones Market Analysis and Projection, By Type

- 1. Segment Overview

- 2. Fixed Wing

- 3. Rotary Wing

- 4. Others

- Global Agriculture Drones Market Analysis and Projection, By Application

- 1. Segment Overview

- 2.

- Global Agriculture Drones Market Analysis and Projection, By Technology

- 1. Segment Overview

- 2.

- Global Agriculture Drones Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Agriculture Drones Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Agriculture Drones Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- BW Group

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Dorian LPG Ltd.

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- EXMAR

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Hyundai Heavy Industries Co., Ltd

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Kawasaki Heavy Industries, Ltd

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Mitsubishi Heavy Industries, Ltd.

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Namura Shipbuilding Co., Ltd.

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- PT Pertamina (Persero)

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- StealthGas Inc.

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- The Great Eastern Shipping Co. Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Teekay Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- BW Group

List of Table

- Global Agriculture Drones Market, By Type, 2021–2029 (USD Billion)

- Global Fixed Wing, Agriculture Drones Market, By Region, 2021–2029 (USD Billion)

- Global Rotary Wing, Agriculture Drones Market, By Region, 2021–2029 (USD Billion)

- Global Others, Agriculture Drones Market, By Region, 2021–2029 (USD Billion)

- Global Agriculture Drones Market, By Application, 2021–2029 (USD Billion)

- Global Crop Monitoring, Agriculture Drones Market, By Region, 2021–2029 (USD Billion)

- Global Soil & Field Analysis, Agriculture Drones Market, By Region, 2021–2029 (USD Billion)

- Global Planting & Seeding, Agriculture Drones Market, By Region, 2021–2029 (USD Billion)

- Global Crop Spray, Agriculture Drones Market, By Region, 2021–2029 (USD Billion)

- Global Others, Agriculture Drones Market, By Region, 2021–2029 (USD Billion)

- Global Agriculture Drones Market, By Technology, 2021–2029 (USD Billion)

- Global Manual, Agriculture Drones Market, By Region, 2021–2029 (USD Billion)

- Global Autonomous, Agriculture Drones Market, By Region, 2021–2029 (USD Billion)

- Global Agriculture Drones Market, By Region, 2021–2029 (USD Billion)

- North America Agriculture Drones Market, By Type, 2021–2029 (USD Billion)

- North America Agriculture Drones Market, By Application, 2021–2029 (USD Billion)

- North America Agriculture Drones Market, By Technology, 2021–2029 (USD Billion)

- USA Agriculture Drones Market, By Type, 2021–2029 (USD Billion)

- USA Agriculture Drones Market, By Application, 2021–2029 (USD Billion)

- USA Agriculture Drones Market, By Technology, 2021–2029 (USD Billion)

- Canada Agriculture Drones Market, By Type, 2021–2029 (USD Billion)

- Canada Agriculture Drones Market, By Application, 2021–2029 (USD Billion)

- Canada Agriculture Drones Market, By Technology, 2021–2029 (USD Billion)

- Mexico Agriculture Drones Market, By Type, 2021–2029 (USD Billion)

- Mexico Agriculture Drones Market, By Application, 2021–2029 (USD Billion)

- Mexico Agriculture Drones Market, By Technology, 2021–2029 (USD Billion)

- Europe Agriculture Drones Market, By Type, 2021–2029 (USD Billion)

- Europe Agriculture Drones Market, By Application, 2021–2029 (USD Billion)

- Europe Agriculture Drones Market, By Technology, 2021–2029 (USD Billion)

- Germany Agriculture Drones Market, By Type, 2021–2029 (USD Billion)

- Germany Agriculture Drones Market, By Application, 2021–2029 (USD Billion)

- Germany Agriculture Drones Market, By Technology, 2021–2029 (USD Billion)

- France Agriculture Drones Market, By Type, 2021–2029 (USD Billion)

- France Agriculture Drones Market, By Application, 2021–2029 (USD Billion)

- France Agriculture Drones Market, By Technology, 2021–2029 (USD Billion)

- UK Agriculture Drones Market, By Type, 2021–2029 (USD Billion)

- UK Agriculture Drones Market, By Application, 2021–2029 (USD Billion)

- UK Agriculture Drones Market, By Technology, 2021–2029 (USD Billion)

- Italy Agriculture Drones Market, By Type, 2021–2029 (USD Billion)

- Italy Agriculture Drones Market, By Application, 2021–2029 (USD Billion)

- Italy Agriculture Drones Market, By Technology, 2021–2029 (USD Billion)

- Spain Agriculture Drones Market, By Type, 2021–2029 (USD Billion)

- Spain Agriculture Drones Market, By Application, 2021–2029 (USD Billion)

- Spain Agriculture Drones Market, By Technology, 2021–2029 (USD Billion)

- Asia Pacific Agriculture Drones Market, By Type, 2021–2029 (USD Billion)

- Asia Pacific Agriculture Drones Market, By Application, 2021–2029 (USD Billion)

- Asia Pacific Agriculture Drones Market, By Technology, 2021–2029 (USD Billion)

- Japan Agriculture Drones Market, By Type, 2021–2029 (USD Billion)

- Japan Agriculture Drones Market, By Application, 2021–2029 (USD Billion)

- Japan Agriculture Drones Market, By Technology, 2021–2029 (USD Billion)

- China Agriculture Drones Market, By Type, 2021–2029 (USD Billion)

- China Agriculture Drones Market, By Application, 2021–2029 (USD Billion)

- China Agriculture Drones Market, By Technology, 2021–2029 (USD Billion)

- India Agriculture Drones Market, By Type, 2021–2029 (USD Billion)

- India Agriculture Drones Market, By Application, 2021–2029 (USD Billion)

- India Agriculture Drones Market, By Technology, 2021–2029 (USD Billion)

- South America Agriculture Drones Market, By Type, 2021–2029 (USD Billion)

- South America Agriculture Drones Market, By Application, 2021–2029 (USD Billion)

- South America Agriculture Drones Market, By Technology, 2021–2029 (USD Billion)

- Brazil Agriculture Drones Market, By Type, 2021–2029 (USD Billion)

- Brazil Agriculture Drones Market, By Application, 2021–2029 (USD Billion)

- Brazil Agriculture Drones Market, By Technology, 2021–2029 (USD Billion)

- Middle East and Africa Agriculture Drones Market, By Type, 2021–2029 (USD Billion)

- Middle East and Africa Agriculture Drones Market, By Application, 2021–2029 (USD Billion)

- Middle East and Africa Agriculture Drones Market, By Technology, 2021–2029 (USD Billion)

- UAE Agriculture Drones Market, By Type, 2021–2029 (USD Billion)

- UAE Agriculture Drones Market, By Application, 2021–2029 (USD Billion)

- UAE Agriculture Drones Market, By Technology, 2021–2029 (USD Billion)

- South Africa Agriculture Drones Market, By Type, 2021–2029 (USD Billion)

- South Africa Agriculture Drones Market, By Application, 2021–2029 (USD Billion)

- South Africa Agriculture Drones Market, By Technology, 2021–2029 (USD Billion)

List of Figures

- Global Agriculture Drones Market Segmentation

- Agriculture Drones Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Agriculture Drones Market Attractiveness Analysis By Type

- Global Agriculture Drones Market Attractiveness Analysis By Application

- Global Agriculture Drones Market Attractiveness Analysis By Technology

- Global Agriculture Drones Market Attractiveness Analysis By Region

- Global Agriculture Drones Market: Dynamics

- Global Agriculture Drones Market Share By Type (2021 & 2029)

- Global Agriculture Drones Market Share By Application (2021 & 2029)

- Global Agriculture Drones Market Share By Technology (2021 & 2029)

- Global Agriculture Drones Market Share by Regions (2021 & 2029)

- Global Agriculture Drones Market Share by Company (2020)