Aluminium Composite Panels Market Size By Product (Polyester, PVDF, Laminating Coating, Oxide Films, and Others), By Vehicle Type (Light Commercial Vehicles and Passenger Cars), By Application (Automotive, Railways, Construction, Advertisement Board, and Others), Regions, Segmentation, and Projection till 2030

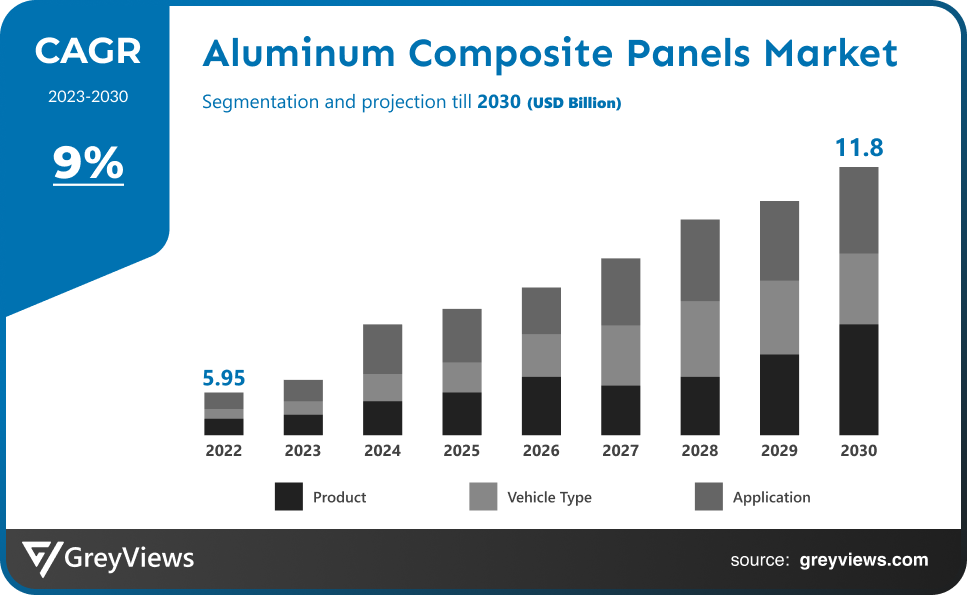

CAGR: 9%Current Market Size: USD 5.95 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2023-2030Base Year: 2022

Global Aluminium Composite Panels Market- Market Overview:

The global aluminium composite panels market is expected to grow from USD 5.95 billion in 2022 to USD 11.8 billion by 2030, at a CAGR of 9% during the Projection period 2023-2030. growth of the aluminium composite panels market is mainly driven by the increasing demand in commercial and residential sectors.

A lightweight external cladding material used to create modern facades on buildings, ceilings, and signage boards is known as an aluminium composite panel (ACP). It is created by bonding two thin coil-coated aluminium sheets to a core made of another material. ACP offers improved ease of installation, and resistance to chemicals, moisture, corrosion, and ultraviolet (UV) radiation as compared to conventional cladding materials, such as tiles, wood, and unplasticized polyvinyl chloride (uPVC). In addition, they may be digitally printed, are incredibly flexible and adaptable, need little upkeep, and come in a wide range of colours and patterns. One of the main elements fostering a favourable view for the business is the advertising sector's rapid expansion. Clear, enticing, and illuminating advertisements are frequently displayed using ACPs for outdoor advertising in public locations and on transit vehicles. Additionally, the market is growing due to the rising demand for strong and lightweight materials for commercial and residential projects. They are also widely used for tunnel ceiling reinforcement and high-rise building insulation. Accordingly, ACPs with polyvinylidene difluoride (PVDF) coating are used to shield the exposed area of the structure from harsh weather, which helps to preserve the colour and gloss for a longer period. An additional aspect driving expansion is the growing use of ACPs in automobiles for improved looks. The panels' strong acoustic insulation and compression resistance make them excellent noise dampers and aesthetic padding. It is projected that additional variables, such as rising green building construction across numerous areas, will fuel the market.

Sample Request: - Global Aluminium Composite Panels Market

Market Dynamics:

Drivers:

- Increase Demand

Over the Projection period, the market is expected to grow as more lightweight aluminium composite panels are used for insulation in the building sector. These composite panels offer benefits that are essential for building construction, such as reduced thickness, increased insulation, and enhanced sealing. ACPs also provides outstanding flexibility, high load performance, durability, and air and water barrier, all of which are likely to have a beneficial effect on market growth over the course of the Projection period. By 2025, light-duty vehicles must meet Corporate Average Fuel Efficiency (CAFE) criteria of 54.5 mpg, according to rules laid forth by the US government. Thus, it is anticipated that the federal proposal to raise CAFE regulations will act as a significant catalyst for the use of lightweight materials, such as aluminium composites, in automobiles, ultimately propelling the market.

Restraints:

- High Prices

The price of aluminium composite panels as a whole is impacted even though the availability and cost of basic components like polyethene, aluminium metal, and other coating ingredients are uncertain. aluminium composite panel raw materials and manufacturing costs are both high when compared to other building materials. The price of raw materials has increased as a result of changing crude oil prices and changing exchange rates. Building facilities for production smelting, refining, and metal recovery requires a substantial initial financial outlay. This factor is thus restricting the expansion of the market for aluminium composite panels. India's market may be constrained by increasing ACP costs as a result of rising raw material prices there.

Opportunities:

- Several Benefits

Increased demand from end-use industries, the rising popularity of anti-toxic and antibacterial panels, protection from UV light, wind, humidity, heavy rain, and harmful bacteria and microbes, as well as a decrease in sound transmission, are all factors that have an impact on the market. Furthermore, the aluminium composite panels market is positively impacted by urbanization, industrialization, increased construction activity, lifestyle changes, rising disposable income, and product innovation. Additionally, profitable opportunities are expanded for market participants during the Projection period through technological innovations and advancements. One of the key reasons propelling the aluminium composite panels market is the expansion of the building sector globally. Increased adoption of these panels due to their benefits, including lower thickness, higher insulation, and superior sealing, which play crucial roles in building structures, as well as rising demand for lightweight aluminium composite panels for insulation in the construction industry, both contribute to the market's rapid expansion.

Challenges:

- Rise in Prices of Raw Material

In September 2021, several Indian companies announced a 7–10% price increase on several composite panel types, citing rising expenses for raw materials like aluminium coil, PE granules, polymer films, and shipping fees. Additionally, despite price hikes, Indian businesses are having trouble obtaining enough raw materials to meet demand. The primary raw material for ACPs, which are extensively used in the facade and signs industries, is Aluminium coil. ACP manufacturing businesses have been severely impacted by a significant increase in pricing and insufficient supply, despite the number of ACP producers in India in recent years due to increased demand in various sectors.

Segmentation Analysis:

The global aluminium composite panels market has been segmented based on thickness, type, application and region.

By Product

The product segment is polyester, PVDF, laminating coating, oxide films, and others. The PVDF segment led the largest share of the aluminium composite panels market with a market share of around 30% in 2022. Due to a variety of applications, such as lightweight buildings, fast trains, and billboards. Additionally, the market expansion is anticipated to profit from their properties, such as durability, corrosion resistance, and wear resistance. Due to qualities like exceptional rigidity, surface flatness, smoothness, and thermal and acoustical insulation, they are also among the most widely utilised goods. Future growth is predicted to be significant due to simple manufacturing and processing advantages.

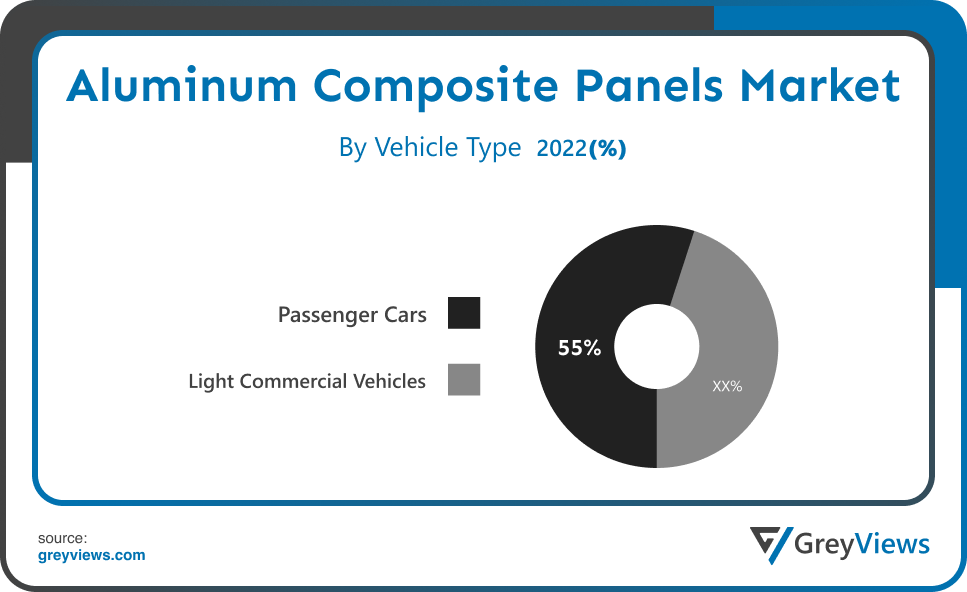

By Vehicle Type

The vehicle type segment is a light commercial vehicles and passenger cars. The passenger cars segment led the largest share of the aluminium composite panels market with a market share of around 55% in 2022. Better comfort in premium cars is made possible by the product's thermal and acoustic insulation, which increases demand in this market. When ACPs are used in high-performance cars, the vehicle's overall weight is reduced, which raises its fuel efficiency. Additionally, the product's flexibility and smooth surface facilitate the creation of bespoke cars with greater aesthetics and performance. The device is one of the safest, greenest, and most affordable ways to improve performance, lower emissions, and increase fuel economy, and it is increasingly being used in commercial vehicles. Due to consumers' increased preference for ACPs over steel, the Light Commercial Vehicle (LCV) market is anticipated to develop at the second-fastest rate.

By Application

The application segment is automotive, railways, construction, advertisement board, and others. The construction segment led the largest share of the aluminium composite panels market with a market share of around 46% in 2022. Additionally, the product's eco-friendly features are anticipated to boost demand for it in green buildings, spurring market expansion. Benefits provided by the product, such as thermal and acoustic insulation and corrosion resistance, are also anticipated to fuel their demand in the contemporary construction business. The segment growth product is also projected to be boosted over the coming few years by increasing product use in decorative and cladding applications to meet transitional building and energy standards. Increased spending on advertising boards is a result of the rapidly growing global advertising, marketing, and mass media industries. ACPs are frequently utilised for these boards since they are exposed to harsh environmental factors such as pollution, temperature changes, and severe humidity.

Global Aluminium Composite Panels Market - Sales Analysis.

The sale of the aluminium composite panels market expanded at a CAGR of 7% from 2016 to 2022.

Aluminium Composite Panels (ACP) are flat panels constructed from two sheets of an alloy based on aluminium and joined together with core material to create a composite. Different levels of panel layers are covered with protective films, and the front side is typically coated with polyvinylidene fluoride (PVDF). Environmentally friendly materials like aluminium composite panels are frequently utilised in the building industry for cladding and insulation in commercial structures including airports, restaurants, and homes. They are also widely employed in the advertising sector as cheaper and lighter alternatives to heavier substrate solutions. For market participants, the recent prohibition on the import of polyethene (PE) core in nations like the United States and Germany poses a danger.

Better core material solutions that adhere to changes in building and fire regulations have been created as a consequence of industry research efforts to produce cladding goods and create new technologies. Important manufacturers are expanding the colour and finish options available in their product lines and growing their stocks to support the rising construction activity. Aluminium composite panels are high-performance materials because they are lightweight, efficient, flexible, and durable as well as corrosion, water, and fire resistant. The demand for interior and exterior cladding businesses is soaring, which can be attributed to growing awareness of sustainable materials and expansion in the real estate industry.

Thus, owing to the aforementioned factors, the global aluminium composite panels market is expected to grow at a CAGR of 9% during the Projection period from 2023 to 2030.

By Regional Analysis:

The regions analyzed for the aluminium composite panels market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Asia Pacific region dominated the aluminium composite panels market and held a 39% share of the market revenue in 2022.

- The Asia Pacific region witnessed a major share. The rapidly expanding construction sector is expected to positively affect the regional market, particularly in rising markets like China, India, Indonesia, and Vietnam. One of the main reasons influencing the region's growth is the expanding population in conjunction with government initiatives encouraging basic utilities and high demand for inexpensive homes. The industry is expected to grow as a result of the region's growing number of green buildings.

- North America is anticipated to experience significant growth during the Projection period. The expansion of North America is being aided by an increase in governmental programmes and initiatives to foster better infrastructure. In addition, the increase is anticipated to be boosted by the increasing usage of panels in cladding and ornamental applications to meet evolving architectural and energy standards. Increased manufacturing of hybrid and electric cars in North America will also bode well for the market's expansion.

Global Aluminium Composite Panels Market- Country Analysis:

- Germany

Germany's aluminium composite panels market size was valued at USD 0.53 billion in 2022 and is expected to reach USD 0.66 billion by 2030, at a CAGR of 2.9% from 2023 to 2030. Due to the rise in the usage of panels for aesthetic and cladding purposes in green buildings and the region's shifting building and energy requirements.

- China

China’s aluminium composite panels market size was valued at USD 0.92 billion in 2022 and is expected to reach USD 1.25 billion by 2030, at a CAGR of 4.0% from 2023 to 2030. Due to the usage of ACPs in interior decorating for aesthetic appeal, large-scale investments in hotels by the tourism departments of ASEAN countries offer attractive potential for the market's growth. The ongoing economic prosperity of China depends heavily on the building industry. According to the National Bureau of Statistics, the value of building output accounted for 25.7% of China's GDP in 2021, up from 11.0% in 2020. China's Five-Year Plan, which was released in January 2022, projects that the construction industry will rise by 6% in 2022. Over 30% of a new building in the nation may consist of prefabricated elements, which are either fully or partially built and brought to construction sites for assembly.

- India

India's aluminium composite panels market size was valued at USD 0.83 billion in 2022 and is expected to reach USD 1.10 billion by 2030, at a CAGR of 3.6% from 2023 to 2030. To stimulate economic growth, the Indian government places a heavy emphasis on infrastructure development. By 2030, the country's real estate market is anticipated to be worth USD 1 trillion, and by 2025, it would have contributed 13% of the GDP. Along with strategic government initiatives, rising investments in the residential and commercial sectors are anticipated to boost India's construction industry, which is anticipated to fuel the country's aluminium composite panel (ACP) market.

Key Industry Players Analysis:

To increase their market position in the global aluminium composite panels market business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Jyi Shyang Industrial

- Alstrong

- Yaret Industrial Group

- Changshu Kaidi Decoration Material

- Alumax Industrial

- Mitsubishi Chemical Corporation

- Shanghai Huayuan New Composite Materials

- Arconic

- 3A Composites

- Alubond U.S.A.

Latest Development:

- On December 2020, Alubond created the Fire-Retardant A1 Aluminium Composite Panels, a perfect environmentally friendly substitute for façade cladding materials because they are completely non-combustible and don't produce any smoke in the case of a fire.

- In June 2020, To address the rising market need for building and construction services, Archicom, a Singapore-based manufacturer of aluminium composite materials, introduced aluminium composite panel products in Africa.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2022-2030 |

|

Base year |

2022 |

|

CAGR (%) |

9% |

|

Market Size |

5.95 billion in 2022 |

|

Projection period |

2023-2030 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Product, By Vehicle Type, By Application, and By Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Jyi Shyang Industrial, Alstrong, Yaret Industrial Group, Changshu Kaidi Decoration Material, Alumax Industrial, Mitsubishi Chemical Corporation, Shanghai Huayuan New Composite Materials, Arconic, 3A Composites, and Alubond U.S.A. |

|

By Product |

|

|

By Vehicle Type |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Aluminium Composite Panels Market By Product:

- Polyester

- PVDF

- Laminating Coating

- Oxide Films

- Others

Global Aluminium Composite Panels Market By Vehicle Type:

- Light Commercial Vehicles

- Passenger Cars

Global Aluminium Composite Panels Market By Application:

- Automotive

- Railways

- Construction

- Advertisement Board

- Others

Global Aluminium Composite Panels Market By Region:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions

What will be the expected market size of the aluminium composite panels market in 2030?

Global aluminium composite panels market is expected to reach USD 11.8 billion by 2030.

Which are the leading market players active in the aluminium composite panels market?

Leading market players active in the global aluminium composite panels market are Jyi Shyang Industrial, Alstrong, Mitsubishi Chemical Corporation, Arconic, Yaret Industrial Group, Alubond U.S.A., 3A Composites, Alumax Industrial, Changshu Kaidi Decoration Material, Guangzhou Xinghe Aluminium Composite Panel, Shanghai Huayuan New Composite Materials, Jyi Shyang Industrial. , EURO PANELS PRODUCTS PVT LTD among other

What is the CAGR of the aluminium composite panels market?

The aluminium composite panels market is projected to have a CAGR of 9%.

What are the key factors for the growth of the aluminium composite panels market?

Over the Projection period, the market is expected to grow as more lightweight aluminium composite panels are used for insulation in the building sector. These composite panels offer benefits that are essential for building construction, such as reduced thickness, increased insulation, and enhanced sealing. ACPs also provides outstanding flexibility, high load performance, durability, and air and water barrier, all of which are likely to have a beneficial effect on market growth over the course of the Projection period.

What is the global aluminium composite panels market breakup based on the application?

Based on the application, the global aluminium composite panels market has been segmented into automotive, railways, construction, advertisement board, and others.

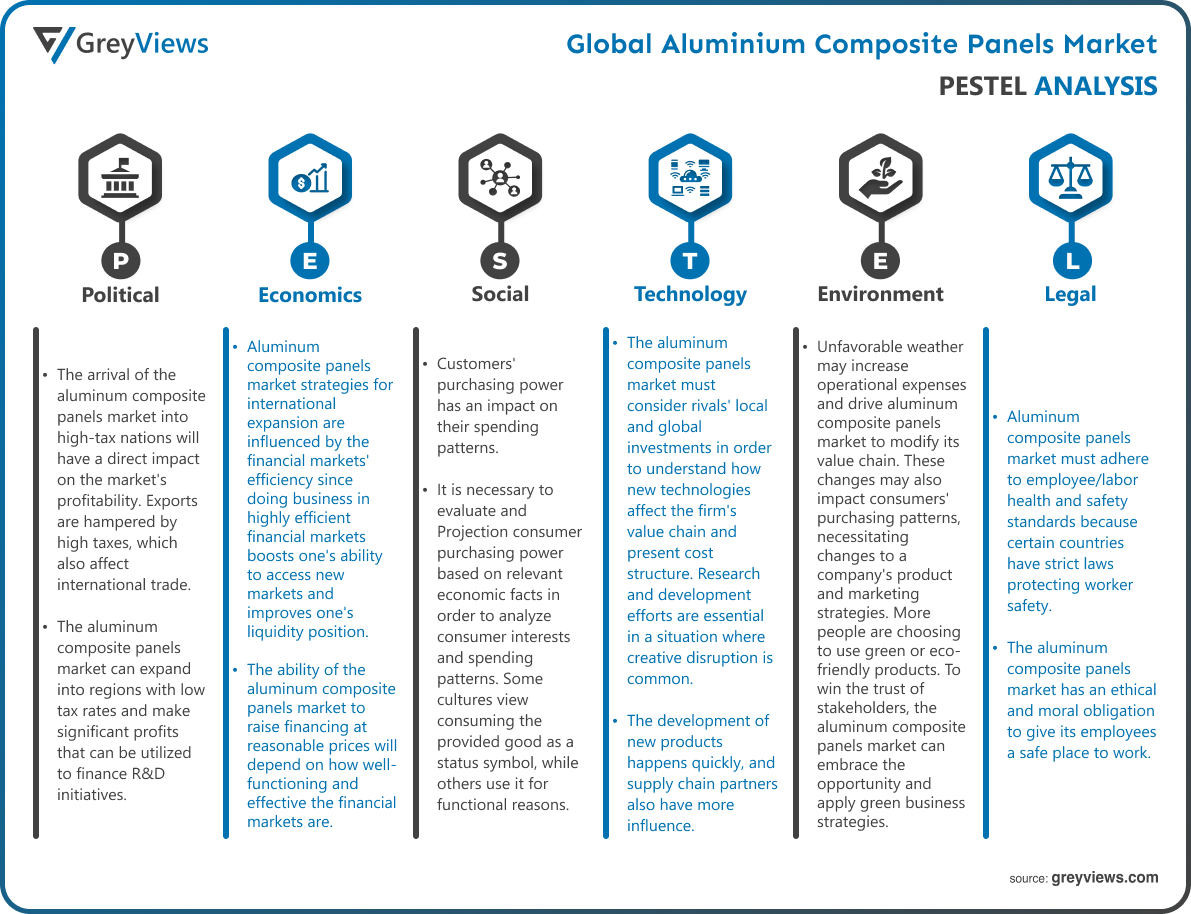

Political Factors- The arrival of the aluminum composite panels market into high-tax nations will have a direct impact on the market's profitability. Exports are hampered by high taxes, which also affect international trade. The aluminum composite panels market can expand into regions with low tax rates and make significant profits that can be utilized to finance R&D initiatives. The organization may also look into the tax laws that are pertinent to the business in order to understand the priorities and interests of the host government in rising industries. High trade barriers might exacerbate the current economic situation by harming exports and relationships with international trading partners. Furthermore, if the government of the country under scrutiny does not take seriously its obligation to protect the intellectual property rights of commercial enterprises.

Economic Factors- aluminum composite panels market strategies for international expansion are influenced by the financial markets' efficiency since doing business in highly efficient financial markets boosts one's ability to access new markets and improves one's liquidity position. The ability of the aluminum composite panels market to raise financing at reasonable prices will depend on how well-functioning and effective the financial markets are. The business operations of the aluminum composite panels market are impacted by the current economic structure. A structure with the perfect or monopolistic competition will not have the same economic or regulatory environment as one with an oligopolistic or monopolistic structure.

Social factors- Customers' purchasing power has an impact on their spending patterns. It is necessary to evaluate and Projection consumer purchasing power based on relevant economic facts in order to analyze consumer interests and spending patterns. Some cultures view consuming the provided good as a status symbol, while others use it for functional reasons. The aluminum composite panels market should make an effort to understand the societal trends and consumer behavior factors that influence customer behavior. In order to understand the amount of customer ethnocentrism and take into account the country of origin effect, the aluminum composite panels market should also try to understand how local consumers in the area see imported items.

Technological Factors- The aluminum composite panels market must consider rivals' local and global investments in order to understand how new technologies affect the firm's value chain and present cost structure. Research and development efforts are essential in a situation where creative disruption is common. In order to maximize profits and reinvest those earnings in disruptive technologies in the future, the aluminum composite panels market should make investments in innovative technologies now. The use of new technologies has shortened the time needed to produce new items. Today, the development of new products happens quickly, and supply chain partners also have more influence.

Environmental Factors- The efficiency with which enterprises run can be impacted by weather and climatic fluctuations. For instance, unfavorable weather may increase operational expenses and drive aluminum composite panels market to modify its value chain. These changes may also impact consumers' purchasing patterns, necessitating changes to a company's product and marketing strategies. More people are choosing to use green or eco-friendly products. To win the trust of stakeholders, the aluminum composite panels market can embrace the opportunity and apply green business strategies. Due to regulatory organizations' emphasis on assuring compatibility with environmental requirements, priorities for product innovation are changing. Environmental friendliness must be prioritized over conventional value propositions in the aluminum composite panels market's marketing plan.

Legal Factors- aluminum composite panels market must adhere to employee/labor health and safety standards because certain countries have strict laws protecting worker safety. The aluminum composite panels market has an ethical and moral obligation to give its employees a safe place to work. In a similar vein, anti-discrimination laws (such as equal employment opportunity laws) also need to be carefully taken into account when creating human resource practices, as discriminatory lawsuits against employers harm the organization's reputation and affect its ability to attract and retain talent.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Product

- 3.2. Market Attractiveness Analysis By Vehicle Type

- 3.3. Market Attractiveness Analysis By Application

- 3.4. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Increase Demand

- 3. Restraints

- 3.1. High Prices

- 4. Opportunities

- 4.1. Several Benefits

- 5. Challenges

- 5.1. Rise in Prices of Raw Material

- Global Aluminium Composite Panels Market Analysis and Projection, By Product

- 1. Segment Overview

- 2. Polyester

- 3. PVDF

- 4. Laminating Coating

- 5. Oxide Films

- 6. Others

- Global Aluminium Composite Panels Market Analysis and Projection, By Vehicle Type

- 1. Segment Overview

- 2. Light Commercial Vehicles

- 3. Passenger Cars

- Global Aluminium Composite Panels Market Analysis and Projection, By Application

- 1. Segment Overview

- 2. Automotive

- 3. Railways

- 4. Construction

- 5. Advertisement Board

- 6. Others

- Global Aluminium Composite Panels Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Aluminium Composite Panels Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Aluminium Composite Panels Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Jyi Shyang Industrial

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Alstrong

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Yaret Industrial Group

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Changshu Kaidi Decoration Material

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Alumax Industrial

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Mitsubishi Chemical Corporation

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Shanghai Huayuan New Composite Materials

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Arconic

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- 3A Composites

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Alubond U.S.A.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Jyi Shyang Industrial

List of Table

- Global Aluminium Composite Panels Market, By Product, 2023–2030 (USD Billion)

- Global Polyester, Aluminium Composite Panels Market, By Region, 2023–2030 (USD Billion)

- Global PVDF, Aluminium Composite Panels Market, By Region, 2023–2030 (USD Billion)

- Global Laminating Coating, Aluminium Composite Panels Market, By Region, 2023–2030 (USD Billion)

- Global Oxide Films, Aluminium Composite Panels Market, By Region, 2023–2030 (USD Billion)

- Global Others, Aluminium Composite Panels Market, By Region, 2023–2030 (USD Billion)

- Global Aluminium Composite Panels Market, By Vehicle Type, 2023–2030 (USD Billion)

- Global Light Commercial Vehicles, Aluminium Composite Panels Market, By Region, 2023–2030 (USD Billion)

- Global Passenger Cars, Aluminium Composite Panels Market, By Region, 2023–2030 (USD Billion)

- Global Aluminium Composite Panels Market, By Application, 2023–2030 (USD Billion)

- Global Automotive, Aluminium Composite Panels Market, By Region, 2023–2030 (USD Billion)

- Global Railways, Aluminium Composite Panels Market, By Region, 2023–2030 (USD Billion)

- Global Construction, Aluminium Composite Panels Market, By Region, 2023–2030 (USD Billion)

- Global Advertisement Board, Aluminium Composite Panels Market, By Region, 2023–2030 (USD Billion)

- Global Others, Aluminium Composite Panels Market, By Region, 2023–2030 (USD Billion)

- Global Aluminium Composite Panels Market, By Region, 2023–2030 (USD Billion)

- North America Aluminium Composite Panels Market, By Product, 2023–2030 (USD Billion)

- North America Aluminium Composite Panels Market, By Vehicle Type, 2023–2030 (USD Billion)

- North America Aluminium Composite Panels Market, By Application, 2023–2030 (USD Billion)

- USA Aluminium Composite Panels Market, By Product, 2023–2030 (USD Billion)

- USA Aluminium Composite Panels Market, By Vehicle Type, 2023–2030 (USD Billion)

- USA Aluminium Composite Panels Market, By Application, 2023–2030 (USD Billion)

- Canada Aluminium Composite Panels Market, By Product, 2023–2030 (USD Billion)

- Canada Aluminium Composite Panels Market, By Vehicle Type, 2023–2030 (USD Billion)

- Canada Aluminium Composite Panels Market, By Application, 2023–2030 (USD Billion)

- Mexico Aluminium Composite Panels Market, By Product, 2023–2030 (USD Billion)

- Mexico Aluminium Composite Panels Market, By Vehicle Type, 2023–2030 (USD Billion)

- Mexico Aluminium Composite Panels Market, By Application, 2023–2030 (USD Billion)

- Europe Aluminium Composite Panels Market, By Product, 2023–2030 (USD Billion)

- Europe Aluminium Composite Panels Market, By Vehicle Type, 2023–2030 (USD Billion)

- Europe Aluminium Composite Panels Market, By Application, 2023–2030 (USD Billion)

- Germany Aluminium Composite Panels Market, By Product, 2023–2030 (USD Billion)

- Germany Aluminium Composite Panels Market, By Vehicle Type, 2023–2030 (USD Billion)

- Germany Aluminium Composite Panels Market, By Application, 2023–2030 (USD Billion)

- France Aluminium Composite Panels Market, By Product, 2023–2030 (USD Billion)

- France Aluminium Composite Panels Market, By Vehicle Type, 2023–2030 (USD Billion)

- France Aluminium Composite Panels Market, By Application, 2023–2030 (USD Billion)

- UK Aluminium Composite Panels Market, By Product, 2023–2030 (USD Billion)

- UK Aluminium Composite Panels Market, By Vehicle Type, 2023–2030 (USD Billion)

- UK Aluminium Composite Panels Market, By Application, 2023–2030 (USD Billion)

- Italy Aluminium Composite Panels Market, By Product, 2023–2030 (USD Billion)

- Italy Aluminium Composite Panels Market, By Vehicle Type, 2023–2030 (USD Billion)

- Italy Aluminium Composite Panels Market, By Application, 2023–2030 (USD Billion)

- Spain Aluminium Composite Panels Market, By Product, 2023–2030 (USD Billion)

- Spain Aluminium Composite Panels Market, By Vehicle Type, 2023–2030 (USD Billion)

- Spain Aluminium Composite Panels Market, By Application, 2023–2030 (USD Billion)

- Asia Pacific Aluminium Composite Panels Market, By Product, 2023–2030 (USD Billion)

- Asia Pacific Aluminium Composite Panels Market, By Vehicle Type, 2023–2030 (USD Billion)

- Asia Pacific Aluminium Composite Panels Market, By Application, 2023–2030 (USD Billion)

- Japan Aluminium Composite Panels Market, By Product, 2023–2030 (USD Billion)

- Japan Aluminium Composite Panels Market, By Vehicle Type, 2023–2030 (USD Billion)

- Japan Aluminium Composite Panels Market, By Application, 2023–2030 (USD Billion)

- China Aluminium Composite Panels Market, By Product, 2023–2030 (USD Billion)

- China Aluminium Composite Panels Market, By Vehicle Type, 2023–2030 (USD Billion)

- China Aluminium Composite Panels Market, By Application, 2023–2030 (USD Billion)

- India Aluminium Composite Panels Market, By Product, 2023–2030 (USD Billion)

- India Aluminium Composite Panels Market, By Vehicle Type, 2023–2030 (USD Billion)

- India Aluminium Composite Panels Market, By Application, 2023–2030 (USD Billion)

- South America Aluminium Composite Panels Market, By Product, 2023–2030 (USD Billion)

- South America Aluminium Composite Panels Market, By Vehicle Type, 2023–2030 (USD Billion)

- South America Aluminium Composite Panels Market, By Application, 2023–2030 (USD Billion)

- Brazil Aluminium Composite Panels Market, By Product, 2023–2030 (USD Billion)

- Brazil Aluminium Composite Panels Market, By Vehicle Type, 2023–2030 (USD Billion)

- Brazil Aluminium Composite Panels Market, By Application, 2023–2030 (USD Billion)

- Middle East and Africa Aluminium Composite Panels Market, By Product, 2023–2030 (USD Billion)

- Middle East and Africa Aluminium Composite Panels Market, By Vehicle Type, 2023–2030 (USD Billion)

- Middle East and Africa Aluminium Composite Panels Market, By Application, 2023–2030 (USD Billion)

- UAE Aluminium Composite Panels Market, By Product, 2023–2030 (USD Billion)

- UAE Aluminium Composite Panels Market, By Vehicle Type, 2023–2030 (USD Billion)

- UAE Aluminium Composite Panels Market, By Application, 2023–2030 (USD Billion)

- South Africa Aluminium Composite Panels Market, By Product, 2023–2030 (USD Billion)

- South Africa Aluminium Composite Panels Market, By Vehicle Type, 2023–2030 (USD Billion)

- South Africa Aluminium Composite Panels Market, By Application, 2023–2030 (USD Billion)

List of Figures

- Global Aluminium Composite Panels Market Segmentation

- Aluminium Composite Panels Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Aluminium Composite Panels Market Attractiveness Analysis By Product

- Global Aluminium Composite Panels Market Attractiveness Analysis By Vehicle Type

- Global Aluminium Composite Panels Market Attractiveness Analysis By Application

- Global Aluminium Composite Panels Market Attractiveness Analysis By Region

- Global Aluminium Composite Panels Market: Dynamics

- Global Aluminium Composite Panels Market Share By Product (2023 & 2030)

- Global Aluminium Composite Panels Market Share By Vehicle Type (2023 & 2030)

- Global Aluminium Composite Panels Market Share By Application (2023 & 2030)

- Global Aluminium Composite Panels Market Share by Regions (2023 & 2030)

- Global Aluminium Composite Panels Market Share by Company (2021)