Ambulatory Surgical Centre Market Size Center By Type (Multispecialty Centers and Single Specialty Centers), By Application (Ophthalmology, Gastroenterology, Pain/Neurology, Orthopedics, and Others), Regions, Segmentation, and Projection till 2030

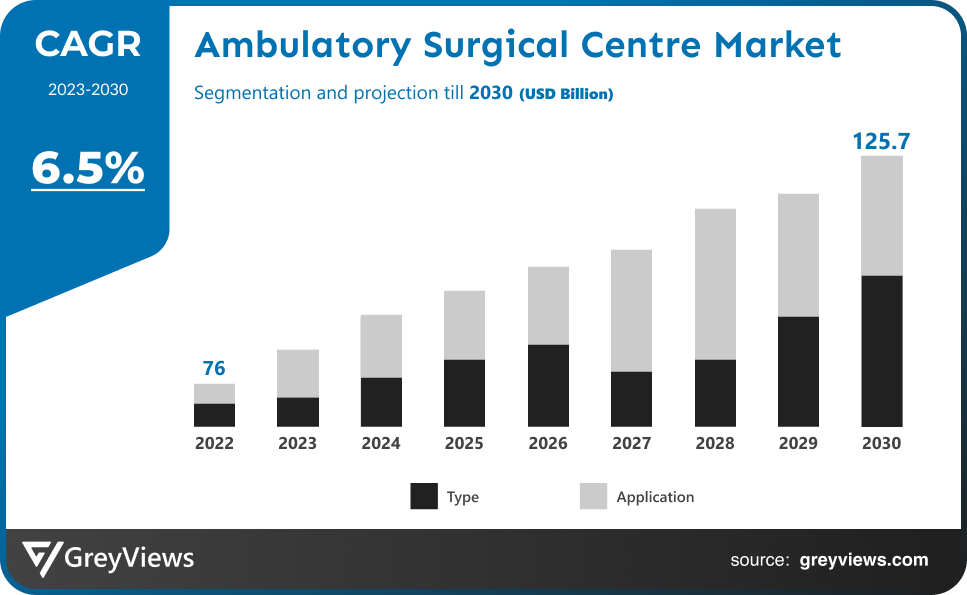

CAGR: 6.5%Current Market Size: USD 76 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2023-2030Base Year: 2022

Global Ambulatory Surgical Centre Market- Market Overview:

The global ambulatory surgical center market is expected to grow from USD 76 billion in 2022 to USD 125.7 billion by 2030, at a CAGR of 6.5% during the Projection period 2023-2030. The growth of the ambulatory surgical center market is mainly driven by the increase in the incidence of chronic diseases and a rise in geriatric population.

The rise of chronic diseases, the rise in surgical demand, and the trend toward ambulatory surgery facilities are all driving the market expansion under study. Additionally, the main market players' strategic moves and the introduction of new products will further fuel market expansion. Over time, the market expansion is anticipated to be boosted by the increased prevalence rate of neurogenerative illnesses like Parkinson's disease, Alzheimer's disease, etc. According to Parkinson's News Today 2021, an estimated seven to ten million people worldwide have the disease, and about 60,000 Americans have been given a diagnosis. This has increased demand for a quick and accurate diagnosis of the disease, which has resulted in a significant increase in the market. Additionally, the profitable market expansion will result from strategic initiatives including product launches, mergers and acquisitions, collaborations, and others. For instance, HST Pathways introduced "HST One," a premium membership program for ambulatory surgery centers (ASCs), in January 2021. The end user of this membership program will have the option to choose popular items that are packaged together as part of their subscription, with the option to add on additional services as necessary. The beginning of providing personalized services at ambulatory surgery facilities will draw more patients and propel the market to major expansion.

Sample Request: - Global Ambulatory Surgical Centre Market

Market Dynamics:

Drivers:

- Increase Demand

Over the Projection period, an increase in cataract operations is anticipated to fuel market expansion for ambulatory surgery centers worldwide. One of the first procedures to be transferred to an outpatient setting was ophthalmic surgery as a result of a change in Medicare coverage rules that prohibited paying for overnight stays for cataract patients. The prevalence of any cataract ranged from 6.71% in people aged 45–49 years to 73.01% in elderly males aged 85–89 years, according to a study titled "The national and subnational prevalence of cataract and cataract blindness in China: a systematic review and meta-analysis" that was published in the Journal of Global Health in June 2018. For instance, the World Health Organization reports that 9.6 million deaths and 18.1 million new instances of cancer were linked.

Restraints:

- Low Physician-to-Patient Ratio

The global ambulatory surgery center market is anticipated to develop, but a low physician-to-patient ratio is predicted to impede that expansion. For instance, the preliminary findings of the Competition Commission of South Africa's health market inquiry, which was published in July 2018, indicated that between 2010 and 2014, the estimated annual average of doctors per 1,000 patients in the private sector was 1.75. Additionally, it is anticipated that the elimination of out-of-network reimbursement may impede market expansion. This is a result of payors pressuring doctors and patients to refer patients to and schedule appointments with in-network providers.

Opportunities:

- Rise in Investment

For market participants, the use of joint venture techniques in the establishment of new ASCs is anticipated to present attractive growth prospects. ASCs' declining revenues in the current climate call for joint ventures because they might lower the initial investment costs and mitigate some of the financial risks that could result from them. Key players must also evaluate obstacles to moving cases from hospitals to ASCs. This can assist in addressing ASCs' inability to reach the volume threshold necessary to generate income.

Challenges:

- High Hospitalization Cost

High hospital expenditures have also resulted in fewer patients being admitted to hospitals, while the frequency of outpatient visits has increased. The total number of outpatient admissions climbed from 624 million in 2008 to 675 million in 2012, according to the American Hospital Association, while the number of inpatient admissions fell from 35.76 million to 34.40 million over the same time period.

Segmentation Analysis:

The global ambulatory surgical center market has been segmented based on type, application, and region.

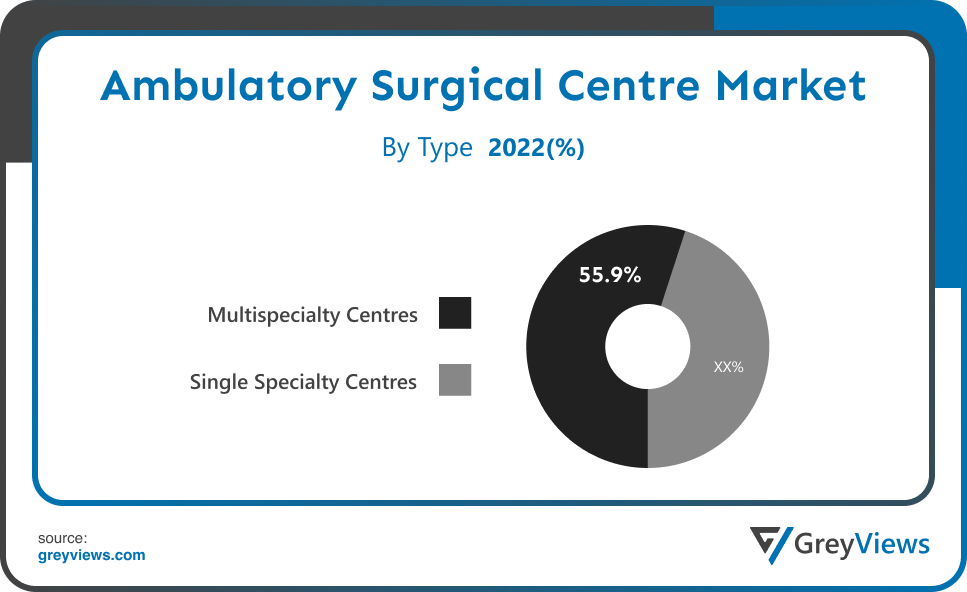

By Type

The type segment is a Multispecialty Centers and Single Specialty Centers. The multispeciality center's segment led the largest share of the ambulatory surgical center market with a market share of around 55.9% in 2022. In multispeciality centers, several facilities are provided under one roof and because of this people don't have to rush in the time of emergency, directly rising the demand for the multispeciality center.

By Application

The application segment is Ophthalmology, Gastroenterology, Pain/Neurology, Orthopedics, and Others. The orthopedics segment led the largest share of the ambulatory surgical center market with a market share of around 43.4% in 2022. Orthopedic surgery is performed on the musculoskeletal systems of the body, which comprise the bones, joints, and surrounding soft tissues, as a result of certain diseases, disorders, trauma, accidents, or circumstances. In recent years, there has been an increase in the number of knee and hip replacement operations, which has positively benefited the segment's growth in the electrosurgical equipment market. For instance, according to the Canadian Institute of Health Information's June 2021 report, 63,496 hip replacements, and 75,073 knee replacements were carried out nationwide in the years 2019–2020. Additionally, the nation's knee and hip replacement surgeries have increased on average by around 5% in recent years.

Global Ambulatory Surgical Centre Market - Sales Analysis.

The sale of the ambulatory surgical center market expanded at a CAGR of 4.3% from 2016 to 2022.

In November 2021, Sarah Bush Lincoln Health System (SBLHS) and United Surgical Partners International (USPI) affiliate Effingham Ambulatory Surgery Center (ASC) inaugurated a brand-new entire collaborative program under a joint venture agreement. The patient will receive individualized support through this program from the time surgery is scheduled until they have recovered from the procedure. Such activities by market participants will aid in raising the standard of care provided, hence promoting market expansion. Additionally, the entry of new market participants shows that there is enormous room for future market expansion.

For instance, Stryker started an ASC-focused business in July 2020 with the intention of providing ASCs with specialized solutions to help them accomplish their objectives. This would increase Stryker's product line, enabling it to offer greater services at ambulatory surgery centers, which will further extend the market under study. As a result of the aforementioned factors, it is anticipated that the investigated market would experience considerable growth throughout the Projection period. However, it is anticipated that during the Projection period, the market expansion will be hampered by the significant investments and time needed for product development.

Thus, owing to the aforementioned factors, the global ambulatory surgical center market is expected to grow at a CAGR of 6.5% during the Projection period from 2023 to 2030.

By Regional Analysis:

The regions analyzed for the ambulatory surgical center market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America region dominated the ambulatory surgical center market and held a 40% share of the market revenue in 2022.

- The North America region witnessed a major share. Increasing government support for primary care services and rising outpatient coverage are two important elements driving this market's expansion. The demand for ambulatory and primary care services is projected to increase as a result of strategic initiatives taken by important market participants in North America, such as mergers and acquisitions and collaborations to offer technologically enhanced operations and treatments. For instance, in March 2015, United Surgical Partners International and Tenet Healthcare partnered to grow their network of ambulatory care facilities. The alliance included 20 imaging centers, 265 short-day surgery facilities, and 4,000 physician staff members.

- Asia-Pacific is anticipated to experience significant growth during the Projection period. In Asia Pacific, ASCs are still a relatively new idea. However, the expansion of outpatient facilities has been brought about by rising healthcare expenditures as a result of an increase in chronic illness prevalence, an aging population, high healthcare spending, and an increase in hospital readmissions. As a result, the area is anticipated to experience the fastest growth in the years to come. The countries that have contributed most to the expansion of the regional market include Japan, China, India, Singapore, Australia, and New Zealand.

Global Ambulatory Surgical Centre Market- Country Analysis:

- Germany

Germany's ambulatory surgical center market size was valued at USD 4.59 billion in 2022 and is expected to reach USD 7.72 billion by 2030, at a CAGR of 5.6% from 2023 to 2030. Due to rising strategic activities by important market participants, rising product releases, rising demand for procedures, and rising prevalence of chronic disorders in the region. Some of the factors driving the market expansion include rising demand for minimally invasive surgeries (MIS), technological advancements in surgical devices and equipment, and surgeons' authority over the selection of such equipment.

- China

China’s ambulatory surgical center market size was valued at USD 5.03 billion in 2022 and is expected to reach USD 8.39 billion by 2030, at a CAGR of 6.9% from 2023 to 2030. Some of the reasons influencing the growth of the ASC market include the rise in demand for minimally invasive procedures, technological advancements in surgical instruments and equipment, and surgeons' control over the selection of such equipment. Numerous activities are carried out by the government of China to raise public knowledge about minimally invasive procedures.

- India

India's ambulatory surgical center market size was valued at USD 5.90 billion in 2022 and is expected to reach USD 8.17 billion by 2030, at a CAGR of 6.4% from 2023 to 2030. For a variety of illnesses like cataract, cancer, and acute kidney ailments, among others, India lacks adequate medical facilities. In India, 0.2 million people required dialysis each year as of 2016, however there were only 0.4 dialysis facilities per million residents. Surgical, medical, and radiation oncology departments do not all offer full cancer care services on the same site in 95% of medical institutions in India. Thus, there is room to build more daycare facilities to address the nation's growing need for healthcare services.

Key Industry Players Analysis:

To increase their market position in the global ambulatory surgical center market business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Community Health Systems, Inc.

- Healthway Medical Group

- Envision Healthcare Corporation

- Tenet Healthcare Corporation

- Terveystalo

- Quorum Health Corporation

- MEDNAX Services, Inc.

- TeamHealth

- Surgery Partners

- UnitedHealth Group

Latest Development:

- In February 2022, The ambulatory robotic joint replacement program for total robotic knee, robotic anterior total hip, and robotic partial knee replacements were introduced by South Shore Surgery Center on Long Island.

- In January 2022, ValueHealth LLC, one of the top Ambulatory Centers of Excellence (ACE) in the country, partnered with Penn State Health. Penn State Health is now a partial owner of the Surgery Center of Lancaster.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2022-2030 |

|

Base year |

2022 |

|

CAGR (%) |

6.5% |

|

Market Size |

76 billion in 2022 |

|

Projection period |

2023-2030 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Type, By Application, and By Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Community Health Systems, Inc., Healthway Medical Group, Envision Healthcare Corporation, Tenet Healthcare Corporation, Terveystalo, Quorum Health Corporation, MEDNAX Services, Inc., TeamHealth, Surgery Partners, and UnitedHealth Group. |

|

By Type |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Ambulatory Surgical Centre Market By Type:

- Multispecialty Centers

- Single Specialty Centers

Global Ambulatory Surgical Centre Market By Application:

- Ophthalmology

- Gastroenterology

- Pain/Neurology

- Orthopedics

- Others

Global Ambulatory Surgical Centre Market By Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the expected market size of the ambulatory surgical center market in 2030?

Global ambulatory surgical center market is expected to reach USD 125.7 billion by 2030.

What is the CAGR of the ambulatory surgical center market?

The ambulatory surgical center market is projected to have a CAGR of 6.5%.

What is the type segment of the ambulatory surgical center market?

Based on the type, the ambulatory surgical center market is segmented into Multispecialty Centers and Single Specialty Centers.

What are the key factors for the growth of the ambulatory surgical center market?

Over the Projection period, an increase in cataract operations is anticipated to fuel market expansion for ambulatory surgery centers worldwide. One of the first procedures to be transferred to an outpatient setting was ophthalmic surgery as a result of a change in Medicare coverage rules that prohibited paying for overnight stays for cataract patients. The prevalence of any cataract ranged from 6.71% in people aged 45–49 years to 73.01% in elderly males aged 85–89 years, according to a study titled "The national and subnational prevalence of cataract and cataract blindness in China: a systematic review and meta-analysis" that was published in the Journal of Global Health in June 2018. For instance, the World Health Organization reports that 9.6 million deaths and 18.1 million new instances of cancer were linked.

Which are the leading market players active in the ambulatory surgical center market?

Leading market players active in the global ambulatory surgical center market are Community Health Systems, Inc.;Terveystalo; Envision Healthcare Corporation; Tenet Healthcare Corporation; TeamHealth; Quorum Health Corporation; MEDNAX Services, Inc.; UnitedHealth Group; Surgery Partners; and Healthway Medical Group among other.

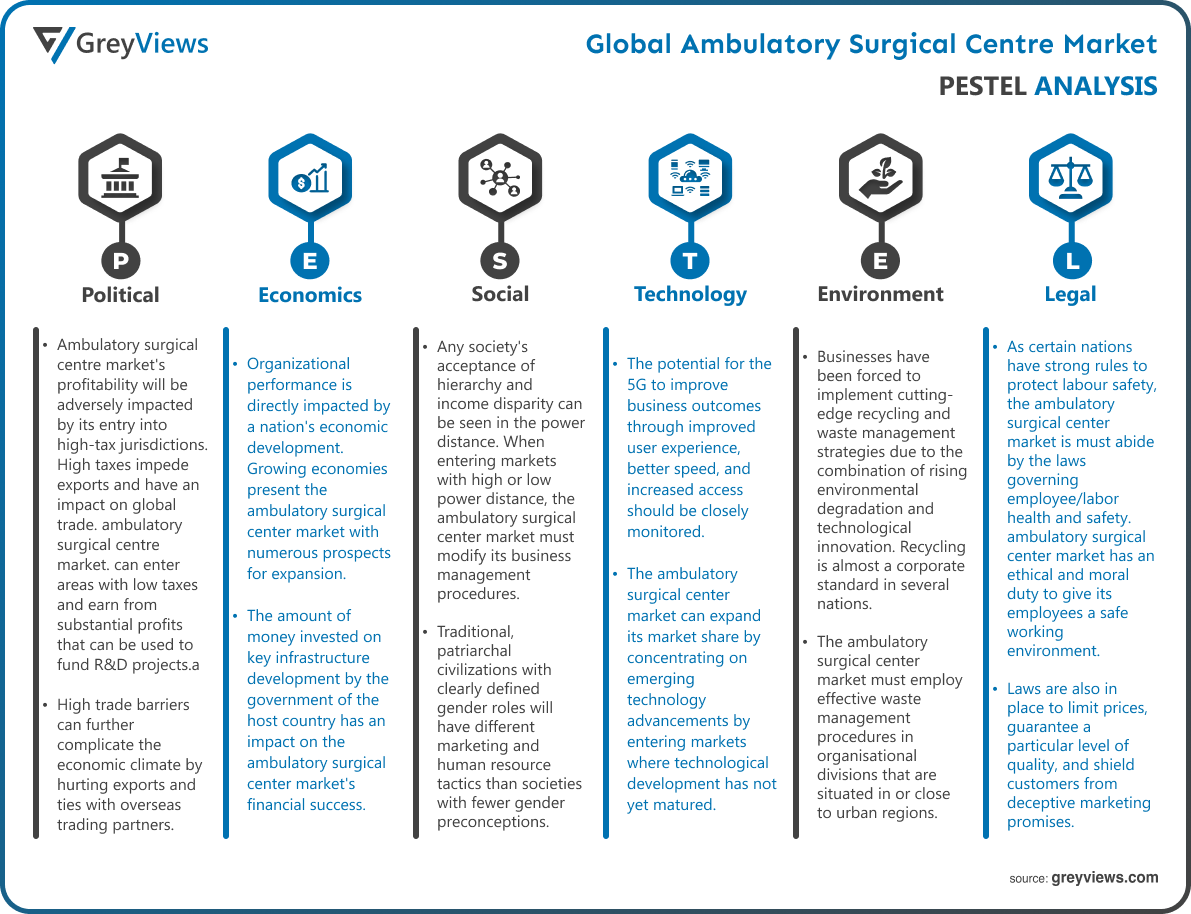

Political Factors- ambulatory surgical centre market's profitability will be adversely impacted by its entry into high-tax jurisdictions. High taxes impede exports and have an impact on global trade. ambulatory surgical centre market. can enter areas with low taxes and earn from substantial profits that can be used to fund R&D projects. To understand the priorities and interest of the host government in emerging industries, the organisation may also investigate the taxation rules that are relevant to the industry. High trade barriers can further complicate the economic climate by hurting exports and ties with overseas trading partners.

Economic Factors- Organizational performance is directly impacted by a nation's economic development. Growing economies present the ambulatory surgical centre market with numerous prospects for expansion. In a similar vein, it's critical to comprehend the stage of the industrial lifecycle. Due to market saturation, entering mature sectors might be more difficult than entering businesses in the growth stage. Furthermore, the amount of money invested on key infrastructure development by the government of the host country has an impact on the ambulatory surgical centre market's financial success. The business climate is made easier by a well-developed infrastructure, which also boosts the gold industry's growth potential in the respective nation.

Social factors- Any society's acceptance of hierarchy and income disparity can be seen in the power distance. When entering markets with high or low power distance, the ambulatory surgical centre market must modify its business management procedures. The power structure is changing as a result of the rising inequality in many nations, which has significant ramifications for global markets like the ambulatory surgical centre market. the ambulatory surgical centre market must research the conventionally accepted gender norms in order to adjust its marketing and communication strategies. Traditional, patriarchal civilizations with clearly defined gender roles will have different marketing and human resource tactics than societies with fewer gender preconceptions.

Technological Factors- To keep ahead of the competition, the ambulatory surgical centre market needs carefully analyse the ongoing technical developments. The potential for the 5G to improve business outcomes through improved user experience, better speed, and increased access should be closely monitored. Such technological advancements have the power to fundamentally alter a sector and rewrite the guidelines for market participants' success. Additionally, it's crucial to take into account the technology's state of development and maturity in the relevant industry. the ambulatory surgical centre market can expand its market share by concentrating on emerging technology advancements by entering markets where technological development has not yet matured.

Environmental Factors- Businesses have been forced to implement cutting-edge recycling and waste management strategies due to the combination of rising environmental degradation and technological innovation. Recycling is almost a corporate standard in several nations. Furthermore, the ambulatory surgical centre market must employ effective waste management procedures in organisational divisions that are situated in or close to urban regions. Many nations have established stringent regulations to safeguard their metropolitan regions through efficient garbage management. Some nations provide financial aid to encourage the use of renewable energy sources. To ensure long-term sustainability, the ambulatory surgical centre market. can profit from it and make investments in renewable technologies. Due to improved brand perception, this investment will also result in higher stakeholder satisfaction and a larger consumer base.

Legal Factors- As certain nations have strong rules to protect labour safety, the ambulatory surgical centre market is must abide by the laws governing employee/labor health and safety. ambulatory surgical centre market has an ethical and moral duty to give its employees a safe working environment. In a similar vein, anti-discrimination laws (such as equal employment opportunity laws) also need to be carefully considered when developing human resource practises as discriminatory lawsuits against employers harm the organisational image and affect organisations' capacity to attract and retain talent. The privacy and security concerns of consumers have made data protection a crucial issue. To safeguard consumer data, the ambulatory surgical centre market must research data protection laws. Laws are also in place to limit prices, guarantee a particular level of quality, and shield customers from deceptive marketing promises.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Type

- 3.2. Market Attractiveness Analysis By Application

- 3.3. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Increase Demand

- 3. Restraints

- 3.1. Low Physician-to-Patient Ratio

- 4. Opportunities

- 4.1. Rise in Investment

- 5. Challenges

- 5.1. High Hospitalization Cost

- Global Ambulatory Surgical Centre Market Analysis and Projection, By Type

- 1. Segment Overview

- 2. Multispecialty Centers

- 3. Single Specialty Centers

- Global Ambulatory Surgical Centre Market Analysis and Projection, By Application

- 1. Segment Overview

- 2. Ophthalmology

- 3. Gastroenterology

- 4. Pain/Neurology

- 5. Orthopedics

- 6. Others

- Global Ambulatory Surgical Centre Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Ambulatory Surgical Centre Market-Competitive Landscape

- 1. Overview

- 2. Market Share of Key Players in the Ambulatory Surgical Centre Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- 3. Competitive Situations and Trends

- 3.1. Technology Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Community Health Systems, Inc.

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Technology Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Healthway Medical Group

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Technology Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Envision Healthcare Corporation

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Technology Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Tenet Healthcare Corporation

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Technology Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Terveystalo

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Technology Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Quorum Health Corporation

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Technology Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- MEDNAX Services, Inc.

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Technology Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- TeamHealth

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Technology Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Surgery Partners

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Technology Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- UnitedHealth Group

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technology Portfolio

- Recent Developments

- SWOT Analysis

- Community Health Systems, Inc.

List of Table

- Global Ambulatory Surgical Centre Market, By Type, 2023–2030 (USD Billion)

- Global Multispecialty Centers, Ambulatory Surgical Centre Market, By Region, 2023–2030 (USD Billion)

- Global Single Specialty Centers, Ambulatory Surgical Centre Market, By Region, 2023–2030 (USD Billion)

- Global Ambulatory Surgical Centre Market, By Application 2023–2030 (USD Billion)

- Global Ophthalmology, Ambulatory Surgical Centre Market, By Region, 2023–2030 (USD Billion)

- Global Gastroenterology, Ambulatory Surgical Centre Market, By Region, 2023–2030 (USD Billion)

- Global Pain/Neurology, Ambulatory Surgical Centre Market, By Region, 2023–2030 (USD Billion)

- Global Orthopedics, Ambulatory Surgical Centre Market, By Region, 2023–2030 (USD Billion)

- Global Others, Ambulatory Surgical Centre Market, By Region, 2023–2030 (USD Billion)

- Global Ambulatory Surgical Centre Market, By Region, 2023–2030 (USD Billion)

- North America Ambulatory Surgical Centre Market, By Type, 2023–2030 (USD Billion)

- North America Ambulatory Surgical Centre Market, By Application 2023–2030 (USD Billion)

- USA Ambulatory Surgical Centre Market, By Type, 2023–2030 (USD Billion)

- USA Ambulatory Surgical Centre Market, By Application 2023–2030 (USD Billion)

- Canada Ambulatory Surgical Centre Market, By Type, 2023–2030 (USD Billion)

- Canada Ambulatory Surgical Centre Market, By Application 2023–2030 (USD Billion)

- Mexico Ambulatory Surgical Centre Market, By Type, 2023–2030 (USD Billion)

- Mexico Ambulatory Surgical Centre Market, By Application 2023–2030 (USD Billion)

- Europe Ambulatory Surgical Centre Market, By Type, 2023–2030 (USD Billion)

- Europe Ambulatory Surgical Centre Market, By Application 2023–2030 (USD Billion)

- Germany Ambulatory Surgical Centre Market, By Type, 2023–2030 (USD Billion)

- Germany Ambulatory Surgical Centre Market, By Application 2023–2030 (USD Billion)

- France Ambulatory Surgical Centre Market, By Type, 2023–2030 (USD Billion)

- France Ambulatory Surgical Centre Market, By Application 2023–2030 (USD Billion)

- UK Ambulatory Surgical Centre Market, By Type, 2023–2030 (USD Billion)

- UK Ambulatory Surgical Centre Market, By Application 2023–2030 (USD Billion)

- Italy Ambulatory Surgical Centre Market, By Type, 2023–2030 (USD Billion)

- Italy Ambulatory Surgical Centre Market, By Application 2023–2030 (USD Billion)

- Spain Ambulatory Surgical Centre Market, By Type, 2023–2030 (USD Billion)

- Spain Ambulatory Surgical Centre Market, By Application 2023–2030 (USD Billion)

- Asia Pacific Ambulatory Surgical Centre Market, By Type, 2023–2030 (USD Billion)

- Asia Pacific Ambulatory Surgical Centre Market, By Application 2023–2030 (USD Billion)

- Japan Ambulatory Surgical Centre Market, By Type, 2023–2030 (USD Billion)

- Japan Ambulatory Surgical Centre Market, By Application 2023–2030 (USD Billion)

- China Ambulatory Surgical Centre Market, By Type, 2023–2030 (USD Billion)

- China Ambulatory Surgical Centre Market, By Application 2023–2030 (USD Billion)

- India Ambulatory Surgical Centre Market, By Type, 2023–2030 (USD Billion)

- India Ambulatory Surgical Centre Market, By Application 2023–2030 (USD Billion)

- South America Ambulatory Surgical Centre Market, By Type, 2023–2030 (USD Billion)

- South America Ambulatory Surgical Centre Market, By Application 2023–2030 (USD Billion)

- Brazil Ambulatory Surgical Centre Market, By Type, 2023–2030 (USD Billion)

- Brazil Ambulatory Surgical Centre Market, By Application 2023–2030 (USD Billion)

- Middle East and Africa Ambulatory Surgical Centre Market, By Type, 2023–2030 (USD Billion)

- Middle East and Africa Ambulatory Surgical Centre Market, By Application 2023–2030 (USD Billion)

- UAE Ambulatory Surgical Centre Market, By Type, 2023–2030 (USD Billion)

- UAE Ambulatory Surgical Centre Market, By Application 2023–2030 (USD Billion)

- South Africa Ambulatory Surgical Centre Market, By Type, 2023–2030 (USD Billion)

- South Africa Ambulatory Surgical Centre Market, By Application 2023–2030 (USD Billion)

List of Figures

- Global Ambulatory Surgical Centre Market Segmentation

- Ambulatory Surgical Centre Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Ambulatory Surgical Centre Market Attractiveness Analysis By Type

- Global Ambulatory Surgical Centre Market Attractiveness Analysis By Application

- Global Ambulatory Surgical Centre Market Attractiveness Analysis By Region

- Global Ambulatory Surgical Centre Market: Dynamics

- Global Ambulatory Surgical Centre Market Share By Type (2023 & 2030)

- Global Ambulatory Surgical Centre Market Share By Application (2023 & 2030)

- Global Ambulatory Surgical Centre Market Share by Regions (2023 & 2030)

- Global Ambulatory Surgical Centre Market Share by Company (2021)