Automated Hospital Bed Market Size By Type (Semi-Automatic and Fully Automatic), By Technology (Basic Automated and Smart Automated), By Treatment Type (Critical care, Long-Term Care, and Acute Care), By Usage (Intensive Care Delivery, Pressure Relief, General Purpose, Bariatric, Pediatric, Psychiatric Care, and Others), By End-User (Ambulatory Surgery Centers, Rehabilitation Centers, Hospitals, and Others) Regions, Segmentation, and Projection till 2029

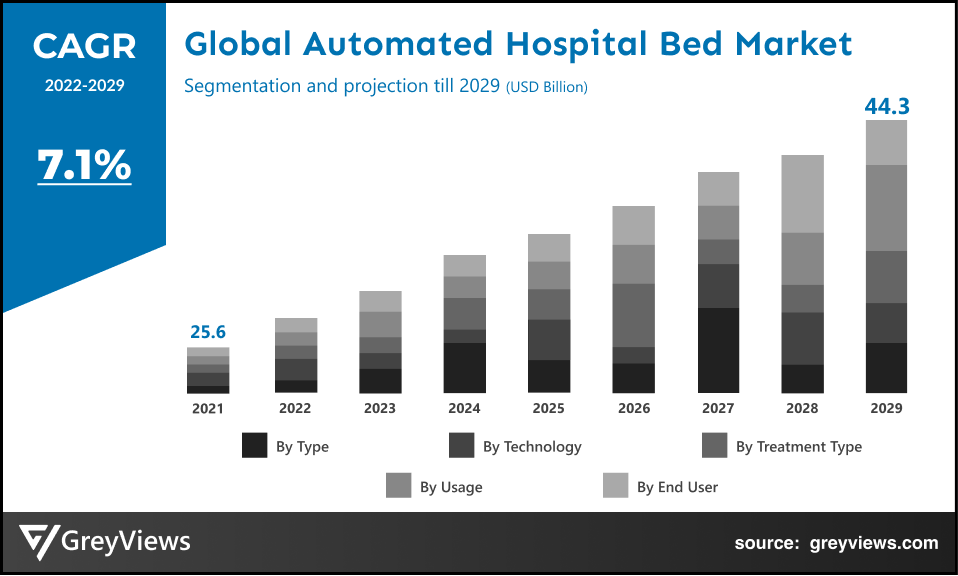

CAGR: 7.1%Current Market Size: USD 25.6 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Automated Hospital Bed Market- Market Overview:

The Global Automated Hospital Bed market is expected to grow from USD 25.6 billion in 2021 to USD 44.3 billion by 2029, at a CAGR of 7.1% during the Projection period 2022-2029. The growth of this market is mainly driven owing to the growing preference of consumers for high-quality and specialized coffee products

As patients need to rest, hospital beds are the most crucial piece of medical equipment. When patients are hospitalized, beds are an essential item they require, and they must be constructed to be as comfortable as possible while also shielding them from harm. Patients are kept comfortable during extended hospital stays thanks to automated hospital beds. Hospital beds with automated functionality are advantageous for patients with difficulty getting in and out of bed. Automated beds are used in surgical facilities, hospitals, and clinics alike. By using an automatic hospital bed, people unable to change positions or perform simple tasks on their own might regain their independence and confidence. An automatic hospital bed allows people who must spend a lot of time in bed to take charge of their motions and improve their comfort. Most electrical profiling beds allow for the automatic adjustment of bed height, simplifying and streamlining treatment. Even some beds can tilt. The function is known as Trendelenburg and is managed by a handset. Depending on the circumstance, an individual or a carer can use this remote control. The mattress platform's modular design can identify an autonomous hospital bed. This enables the user to change the device's height and tilt. Some beds' backrests can be raised to help the patient sit up. Some have a knee break or adjustable footrest to help elevate the legs. These beds offer support for the head, neck, back, knees, and hips. They are adaptable and clever. Depending on the user's specific needs, the bed may change to meet or even exceed those expectations regarding posture, comfort, and activity. An autonomous hospital bed has numerous advantages. Patients with chronic medical conditions and mobility problems can manage daily tasks more easily.

Sample Request: - Global Automated Hospital Bed Market

Market Dynamics:

Drivers:

- The rise in the prevalence of chronic diseases

The demand for automated hospital beds is increasing owing to the increasing prevalence of chronic diseases such as Cancer, diabetes, functional gastrointestinal disorder, eczema, arthritis, asthma, cancer, and chronic obstructive pulmonary disease. The rise of accidents happening every day worldwide is another reason for boosting the demand for automated hospital beds.

- The rapid development and Government investments in the healthcare industry

The market for automated hospital beds is growing along with the healthcare industry, particularly in emerging nations. The market value of automated hospital beds is also rising as a result of technological developments and increased R&D spending. Additionally, the federal government's increased financing to promote the use of these automated beds has a further impact on the market. Additionally, the market for automated hospital beds is positively impacted by the rise in healthcare spending, improvements in the healthcare infrastructure, and strong demand for extended care delivery.

Restraints:

- The initial cost of setup

The initial cost of automated hospital beds will control how quickly the business expands. Additionally, keeping automated hospital beds is fairly expensive. The market for automated hospital beds will grow more slowly due to public hospitals' limited resources and area capacity. The deployment of autonomous hospital beds in underdeveloped and developing regions is constrained due to the high initial cost, which is projected to impede the market's expansion.

Opportunities:

- Increasing geriatric population

The increasing number of elderly people worldwide is a factor that is probably fueling the market's expansion. The global Automated Hospital Beds Market will expand as a result of the expanding geriatric population, as older individuals require more procedures as become more susceptible to various ailments.

Challenges

- Penetration in underdeveloped regions

In many countries, the healthcare system is still underdeveloped, and the government in those countries would likely spend money on basic healthcare needs rather than advanced technologies. This factor may impede the market growth.

Segmentation Analysis:

The global automated hospital bed market has been segmented based on type, technology, treatment type, usage, end-user, and regions.

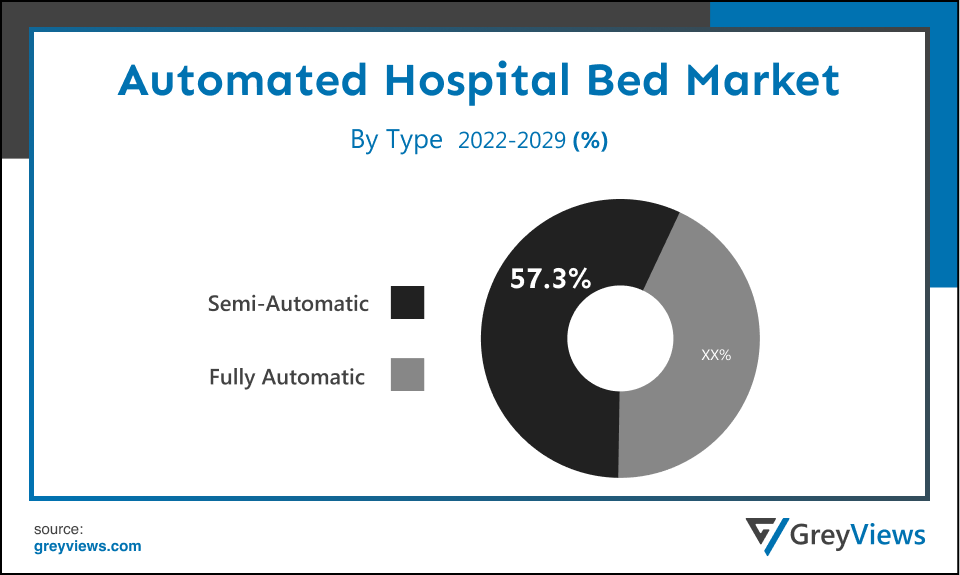

By Type

The type segment is semi-automatic and fully automatic. The semi-automatic segment led the largest share of the automated hospital bed market with a market share of around 57.3% in 2021. The growth can be attributed to its advantages, which include being less expensive than fully mechanical hospital beds, having manual height adjustment features, and having electronic head and foot sections. While in intensive care units, fully automatic hospital beds are typically preferred.

By Technology

The technology includes basic automated and smart automated. The smart automated segment led the automated hospital bed market with a market share of around 52.08% in 2021. Patient care, aid, and monitoring are just a few of the answers offered by smart, automated hospital beds. The market for smart Automated Hospital Beds will experience tremendous demand due to the growing need from hospitals to replace their outdated equipment with new, technologically sophisticated technology.

By Treatment Type

The treatment type segment includes critical care, long-term care, and acute care. The critical care automated hospital bed segment led the automated hospital bed market with a market share of around 42.08% in 2021. Critical care is the term used to describe the specialist treatment provided to patients whose ailments are life-threatening and necessitate extensive attention and ongoing observation. The prevalence of chronic diseases is rising globally, which increases demand in this market.

By Usage

The usage segment includes intensive care delivery, pressure relief, general purpose, bariatric, pediatric, psychiatric care, and others. The general purpose automated hospital bed segment led the automated hospital bed market with a market share of around 22.08% in 2021. The general ward has more patients than the other wards, which explains why. In addition, a rising requirement for hospitals to treat people with minor injuries or illnesses is anticipated to fuel the market sector's future growth.

By End-User

The end-user segment includes ambulatory surgery centers, rehabilitation centers, hospitals, and others. The hospital automated hospital bed segment led the automated hospital bed market with a market share of around 22.08% in 2021. The market is expected to grow rapidly due to rising healthcare infrastructure spending and demand for smart hospital beds in medical institutions. Furthermore, hospitals have ample space and infrastructure to accommodate hospital beds which propels the market’s growth.

By Regional Analysis:

The regions analyzed for the automated hospital bed market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North American region dominated the automated hospital bed market and held the 35.1% share of the market revenue in 2021.

- North America region witnessed a major share. Developed nations like the US, Canada, and Mexico are the main causes of the region's high share. Growing elderly populations, who are more susceptible to age-related illnesses, rising frequency and incidence of chronic diseases, and the region's high per capita health expenditures are all expected to boost the market in North America throughout the Projection period.

- The Asia Pacific is anticipated to experience significant growth during the predicted period. This can be ascribed to a growth in the number of people with chronic illnesses, as well as to new product availability and development in Asia, as well as to greater use of these devices in the region.

Global Automated Hospital Bed Market- Country Analysis:

- Germany

Germany's automated hospital bed market size was valued at USD 0.98 billion in 2021 and is expected to reach USD 1.59 billion by 2029, at a CAGR of 6.3% from 2022 to 2029.

Because the pharmaceutical and medical industries are so prevalent, there is a growing demand for automated hospital beds. Additionally, market-friendly government policies are fueling expansion in this region.

- China

China automated hospital beds’ market size was valued at USD 2.4 billion in 2021 and is expected to reach USD 4.2 billion by 2029, at a CAGR of 7.4% from 2022 to 2029. Increased discretionary incomes, particularly in metropolitan areas, are driving the market. Furthermore, China has money available and is constantly searching the world for business opportunities. According to McKinsey, healthcare funds raised over $40 billion of capital in 2017, with over $10 billion going toward funding agreements. The trend slowed down in 2018, but Chinese funders are still backing US-based biotech in an increasingly prominent way (e.g., Grail, VielaBio) and are beginning to focus on Europe, where many biotechs could profit from access to new funding sources.

- India

India's automated hospital bed market size was valued at USD 1.9 billion in 2021 and is expected to reach USD 3.2 billion by 2029, at a CAGR of 6.9% from 2022 to 2029. Because of the expanding population, rising consumer spending, and improvements in the healthcare industry, the region is expected to experience major growth in product demand. According to the Economic Survey of 2022, India's public healthcare spending increased from 1.8% of GDP in 2020–2021 to 2.1% in 2021–2022. These elements support the nation's demand for automated hospital beds.

Key Industry Players Analysis:

To increase their market position in the global automated hospital bed business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Malvestio SpA

- Paramount Bed Co Ltd

- Linet spol. s.r.o

- Stiegelmeyer GmbH & Co KG

- Arjo Huntleigh

- Gendron Inc.

- Hill-Rom Holdings

- Invacare Corporation

- sr.o.

- Medline Industries, Inc.

- Paramount Bed Holdings Co. Ltd.

- Stryker

Latest Development:

- In October 2021, the LINET Group will introduce a new generation of Multicare X beds to the world market as part of the prestigious International Symposium on Intensive Care and Emergency Medicine (ISICEM). The OptiCare X active integrated mattress and the Multicare X intensive care bed were revealed to be the company's ground-breaking flagship products.

- In December 2021, Hillrom was successfully acquired by Baxter International Inc., a global leader in medical technology. The merger unites two leading medical technology firms to transform healthcare and enhance patient care globally.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

6.9% |

|

Market Size |

178.8 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Product type, distribution channel, end-user, and Regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Adidas AG, Amer Sports, Callaway Golf Co., Sumitomo Rubber Industries Limited, Nike, Inc., Puma SE, Mizuno Corporation, Sports Direct International PLC, Under Armour, Yonex Co., Ltd. among others |

|

By Product Type |

|

|

By Distribution Channel |

|

|

By End-User |

|

|

Regional scope |

|

Scope of the Report

Global Automated Hospital Bed Market by Type:

- Semi-Automatic

- Fully Automatic

Global Automated Hospital Bed Market by Technology Type:

- Basic Automated

- Smart Automated

Global Automated Hospital Bed Market by Treatment Type:

- Critical care

- Long-Term Care

- Acute Care

Global Automated Hospital Bed Market by Usage:

- Intensive Care Delivery

- Pressure Relief

- General Purpose

- Bariatric

- Pediatric

- Psychiatric Care

- Others

Global Automated Hospital Bed Market by End-User:

- Ambulatory Surgery Centers

- Rehabilitation Centers

- Hospitals

- Others

Global Automated Hospital Bed Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What was the market size of the Automated Hospital Bed market?

Global automated hospital bed market size was USD 25.6 billion in 2021.

What will be the market size of Automated Hospital Bed market in 2029?

Global Automated Hospital Bed market cap will rise to USD 44.3 billion in 2029 and it will grow with CAGR of 7.1% from 2022 to 2029.

What are the top 5 exporter countries of Automated Hospital Bed?

United States, Germany, United Kingdom, China, and France.

What is the most significant end-user of Automated Hospital Bed?

Hospitals segment witnessed a significant share in the Automated Hospital Bed market with a market share of around 22.08% in 2021

What are the challenges of the Automated Hospital Bed market?

High cost of initial purchasing of automated hospital beds is primarily driving the growth of the automated hospital bed market.

Which are the leading market players active in the Automated Hospital Bed market?

Leading market players active in the global automated hospital bed market are Malvestio SpA, Paramount Bed Co Ltd, Linet spol. s.r.o, Stiegelmeyer GmbH & Co KG, Arjo Huntleigh, Gendron Inc., Hill-Rom Holdings, Invacare Corporation, Linetspol. Sr.o., Medline Industries, Inc., Paramount Bed Holdings Co. Ltd., and Stryker, among others.

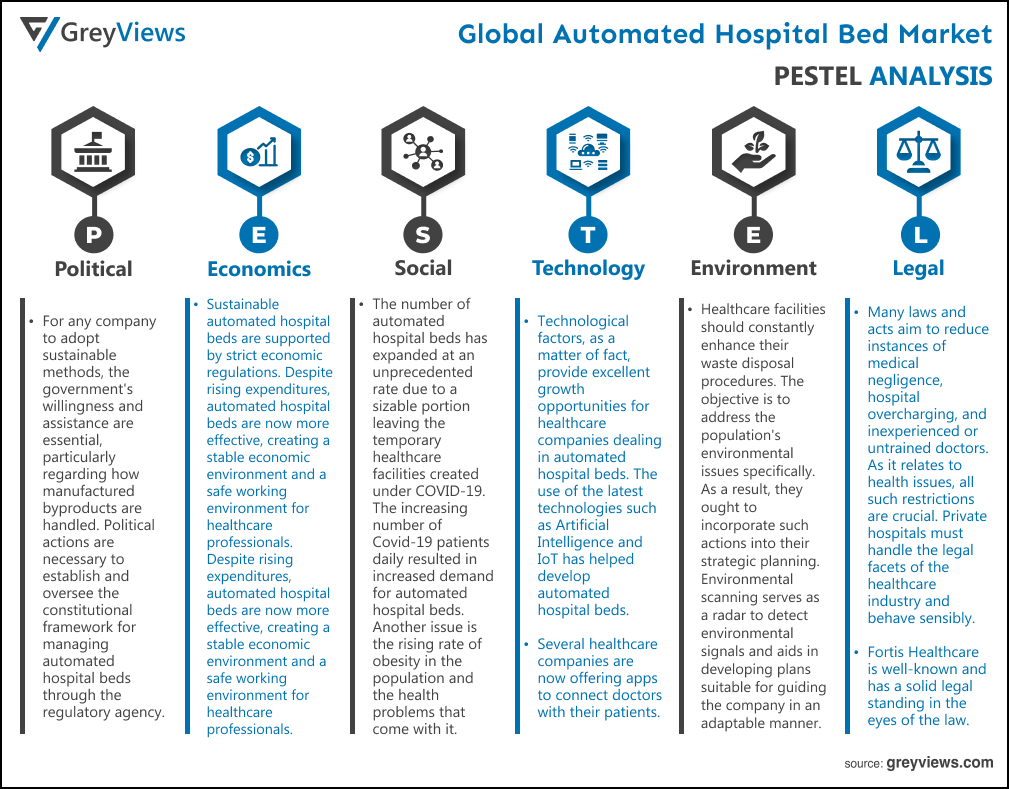

Political Factors- For any company to adopt sustainable methods, the government's willingness and assistance are essential, particularly regarding how manufactured byproducts are handled. Political actions are necessary to establish and oversee the constitutional framework for managing automated hospital beds through the regulatory agency. Additionally, the government should encourage research and development (R&D) initiatives in automated hospital beds. Additionally, financial assistance in the form of tax breaks, price concessions, the creation of SEZs (special economic zones), etc. should be given to the manufacturers. The healthcare sector may be impacted by political considerations such as shifting tax laws, employment restrictions, consumer protection laws, and insurance obligations.

Economical Factors- Sustainable automated hospital beds are supported by strict economic regulations. Despite rising expenditures, automated hospital beds are now more effective, creating a stable economic environment and a safe working environment for healthcare professionals. Despite rising expenditures, automated hospital beds are now more effective, creating a stable economic environment and a safe working environment for healthcare professionals. Hence, to combat the epidemic, the government should take action by implementing investment plans for the creation of sustainable automated hospital beds. Many investors in the health sector may lose money when interest rates rise. Similar to this, rising unemployment or declining customer purchasing power would indicate that they would not use the goods or services provided by healthcare manufacturers.

Social Factor- The number of automated hospital beds has expanded at an unprecedented rate due to a sizable portion leaving the temporary healthcare facilities created under COVID-19. The increasing number of Covid-19 patients daily resulted in increased demand for automated hospital beds. Another issue is the rising rate of obesity in the population and the health problems that come with it. Nowadays, people are more likely to consume fewer processed chemicals or artificial sugars. Given how little any population's culture changes, this can also be used as a long-term marketing approach. It is crucial for healthcare service providers to become closer to their clients without going over legal bounds.

Technological Factors- Technological factors, as a matter of fact, provide excellent growth opportunities for healthcare companies dealing in automated hospital beds. The use of the latest technologies such as Artificial Intelligence and IoT has helped develop automated hospital beds. Developments in computer applications can allow patients to receive treatment or care faster than before, and apart from this, they can also book beds in hospitals as per their needs through the apps. Several healthcare companies are now offering apps to connect doctors with their patients. Moreover, several healthcare institutions also allow making a live chat or email to doctors for querying about their illness. Moreover, increasing market players are getting involved in healthcare distribution and healthcare technology solutions.

Environmental Factors- Healthcare facilities should constantly enhance their waste disposal procedures. The objective is to address the population's environmental issues specifically. As a result, they ought to incorporate such actions into their strategic planning. Environmental scanning serves as a radar to detect environmental signals and aids in developing plans suitable for guiding the company in an adaptable manner. Consequently, it is an effective strategic procedure to follow environmental guidelines in this complex and uncertain healthcare system. To reduce uncertainty, environmental scanning predicts and understands organizational aspects internally and externally, as well as how they are related. The elements outside an organization's typical boundaries that impact management decisions are referred to as the external environment, including the micro and macro environments.

Legal Factors- Many laws and acts aim to reduce instances of medical negligence, hospital overcharging, and inexperienced or untrained doctors. As it relates to health issues, all such restrictions are crucial. Private hospitals must handle the legal facets of the healthcare industry and behave sensibly. Fortis Healthcare is well-known and has a solid legal standing in the eyes of the law. A new generation of Multicare X beds will be introduced to the world market by the LINET Group as part of the prestigious International Symposium on Intensive Care and Emergency Medicine (ISICEM). The OptiCare X active integrated mattress and the Multicare X intensive care bed were revealed to be the company's ground-breaking flagship products.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Type

- Market Attractiveness Analysis By Technology

- Market Attractiveness Analysis By Treatment Type

- Market Attractiveness Analysis By Usage

- Market Attractiveness Analysis By End-User

- Market Attractiveness Analysis By Region

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- The rise in the prevalence of chronic diseases

- The rapid development and Government investments in the healthcare industry

- Restraints

- The initial cost of setup

- Opportunities

- Increasing geriatric population

- Challenges

- Penetration in underdeveloped regions

- Global Automated Hospital Beds Market Analysis and Projection, By Type

- Segment Overview

- Semi-Automatic

- Fully Automatic

- Global Automated Hospital Beds Market Analysis and Projection, By Technology

- Segment Overview

- Basic Automated

- Smart Automated

- Global Automated Hospital Beds Market Analysis and Projection, By Treatment Type

- Segment Overview

- Critical care

- Long-Term Care

- Acute Care

- Global Automated Hospital Beds Market Analysis and Projection, By Usage

- Segment Overview

- Intensive Care Delivery

- Pressure Relief

- General Purpose

- Bariatric

- Pediatric

- Psychiatric Care

- Others

- Global Automated Hospital Beds Market Analysis and Projection, By End-User

- Segment Overview

- Ambulatory Surgery Centers

- Rehabilitation Centers

- Hospitals

- Others

- Global Automated Hospital Beds Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Automated Hospital Beds Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Automated Hospital Beds Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Product Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Malvestio SpA

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Paramount Bed Co Ltd

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Linet spol. s.r.o

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Stiegelmeyer GmbH & Co KG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Arjo Huntleigh

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Gendron Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Hill-Rom Holdings

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Invacare Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Linetspol sr.o.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Medline Industries, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Paramount Bed Holdings Co. Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Stryker

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Malvestio SpA

List of Table

- Global Automated Hospital Beds Market, By Type, 2021–2029(USD Billion)

- Global Semi-Automatic Automated Hospital Beds Market, By Region, 2021–2029(USD Billion)

- Global Fully-Automatic Automated Hospital Beds Market, By Region, 2021–2029(USD Billion)

- Global Automated Hospital Beds Market, By Technology, 2021–2029(USD Billion)

- Global Basic Automated Automated Hospital Beds Market, By Region, 2021–2029(USD Billion)

- Global Smart Automated Automated Hospital Beds Market, By Region, 2021–2029(USD Billion)

- Global Automated Hospital Beds Market, By Treatment Type, 2021–2029(USD Billion)

- Global Critical care Automated Hospital Beds Market, By Region, 2021–2029(USD Billion)

- Global Long-Term Care Automated Hospital Beds Market, By Region, 2021–2029(USD Billion)

- Global Acute Care Automated Hospital Beds Market, By Region, 2021–2029(USD Billion)

- Global Automated Hospital Beds Market, By Usage, 2021–2029(USD Billion)

- Global Intensive Care Delivery Automated Hospital Beds Market, By Region, 2021–2029(USD Billion)

- Global Pressure Relief Automated Hospital Beds Market, By Region, 2021–2029(USD Billion)

- Global General Purpose Automated Hospital Beds Market, By Region, 2021–2029(USD Billion)

- Global Bariatric Automated Hospital Beds Market, By Region, 2021–2029(USD Billion)

- Global Pediatric Automated Hospital Beds Market, By Region, 2021–2029(USD Billion)

- Global Psychiatric Care Automated Hospital Beds Market, By Region, 2021–2029(USD Billion)

- Global Other Automated Hospital Beds Market, By Region, 2021–2029(USD Billion)

- Global Automated Hospital Beds Market, By End-User, 2021–2029(USD Billion)

- Global Ambulatory Surgery Centers Automated Hospital Beds Market, By Region, 2021–2029(USD Billion)

- Global Rehabilitation Centers Automated Hospital Beds Market, By Region, 2021–2029(USD Billion)

- Global Hospitals Automated Hospital Beds Market, By Region, 2021–2029(USD Billion)

- Global Other Automated Hospital Beds Market, By Region, 2021–2029(USD Billion)

- Global Automated Hospital Beds Market, By Region, 2021–2029(USD Billion)

- North America Automated Hospital Beds Market, By Type, 2021–2029(USD Billion)

- North America Automated Hospital Beds Market, By Technology, 2021–2029(USD Billion)

- North America Automated Hospital Beds Market, By Treatment Type, 2021–2029(USD Billion)

- North America Automated Hospital Beds Market, By Usage, 2021–2029(USD Billion)

- North America Automated Hospital Beds Market, By End-User, 2021–2029(USD Billion)

- USA Automated Hospital Beds Market, By Type, 2021–2029(USD Billion)

- USA Automated Hospital Beds Market, By Technology, 2021–2029(USD Billion)

- USA Automated Hospital Beds Market, By Treatment Type, 2021–2029(USD Billion)

- USA Automated Hospital Beds Market, By Usage, 2021–2029(USD Billion)

- USA Automated Hospital Beds Market, By End-User, 2021–2029(USD Billion)

- Canada Automated Hospital Beds Market, By Type, 2021–2029(USD Billion)

- Canada Automated Hospital Beds Market, By Technology, 2021–2029(USD Billion)

- Canada Automated Hospital Beds Market, By Treatment Type, 2021–2029(USD Billion)

- Canada Automated Hospital Beds Market, By Usage, 2021–2029(USD Billion)

- Canada Automated Hospital Beds Market, By End-User, 2021–2029(USD Billion)

- Mexico Automated Hospital Beds Market, By Type, 2021–2029(USD Billion)

- Mexico Automated Hospital Beds Market, By Technology, 2021–2029(USD Billion)

- Mexico Automated Hospital Beds Market, By Treatment Type, 2021–2029(USD Billion)

- Mexico Automated Hospital Beds Market, By Usage, 2021–2029(USD Billion)

- Mexico Automated Hospital Beds Market, By End-User, 2021–2029(USD Billion)

- Europe Automated Hospital Beds Market, By Type, 2021–2029(USD Billion)

- Europe Automated Hospital Beds Market, By Technology, 2021–2029(USD Billion)

- Europe Automated Hospital Beds Market, By Treatment Type, 2021–2029(USD Billion)

- Europe Automated Hospital Beds Market, By Usage, 2021–2029(USD Billion)

- Europe Automated Hospital Beds Market, By End-User, 2021–2029(USD Billion)

- Germany Automated Hospital Beds Market, By Type, 2021–2029(USD Billion)

- Germany Automated Hospital Beds Market, By Technology, 2021–2029(USD Billion)

- Germany Automated Hospital Beds Market, By Treatment Type, 2021–2029(USD Billion)

- Germany Automated Hospital Beds Market, By Usage, 2021–2029(USD Billion)

- Germany Automated Hospital Beds Market, By End-User, 2021–2029(USD Billion)

- France Automated Hospital Beds Market, By Type, 2021–2029(USD Billion)

- France Automated Hospital Beds Market, By Technology, 2021–2029(USD Billion)

- France Automated Hospital Beds Market, By Treatment Type, 2021–2029(USD Billion)

- France Automated Hospital Beds Market, By Usage, 2021–2029(USD Billion)

- France Automated Hospital Beds Market, By End-User, 2021–2029(USD Billion)

- UK Automated Hospital Beds Market, By Type, 2021–2029(USD Billion)

- UK Automated Hospital Beds Market, By Technology, 2021–2029(USD Billion)

- UK Automated Hospital Beds Market, By Treatment Type, 2021–2029(USD Billion)

- UK Automated Hospital Beds Market, By Usage, 2021–2029(USD Billion)

- UK Automated Hospital Beds Market, By End-User, 2021–2029(USD Billion)

- Italy Automated Hospital Beds Market, By Type, 2021–2029(USD Billion)

- Italy Automated Hospital Beds Market, By Technology, 2021–2029(USD Billion)

- Italy Automated Hospital Beds Market, By Treatment Type, 2021–2029(USD Billion)

- Italy Automated Hospital Beds Market, By Usage, 2021–2029(USD Billion)

- Italy Automated Hospital Beds Market, By End-User, 2021–2029(USD Billion)

- Spain Automated Hospital Beds Market, By Type, 2021–2029(USD Billion)

- Spain Automated Hospital Beds Market, By Technology, 2021–2029(USD Billion)

- Spain Automated Hospital Beds Market, By Treatment Type, 2021–2029(USD Billion)

- Spain Automated Hospital Beds Market, By Usage, 2021–2029(USD Billion)

- Spain Automated Hospital Beds Market, By End-User, 2021–2029(USD Billion)

- Asia Pacific Automated Hospital Beds Market, By Type, 2021–2029(USD Billion)

- Asia Pacific Automated Hospital Beds Market, By Technology, 2021–2029(USD Billion)

- Ashi Pacific Automated Hospital Beds Market, By Treatment Type, 2021–2029(USD Billion)

- Ashi Pacific Automated Hospital Beds Market, By Usage, 2021–2029(USD Billion)

- Ashi Pacific Automated Hospital Beds Market, By End-User, 2021–2029(USD Billion)

- Japan Automated Hospital Beds Market, By Type, 2021–2029(USD Billion)

- Japan Automated Hospital Beds Market, By Technology, 2021–2029(USD Billion)

- Japan Automated Hospital Beds Market, By Treatment Type, 2021–2029(USD Billion)

- Japan Automated Hospital Beds Market, By Usage, 2021–2029(USD Billion)

- Japan Automated Hospital Beds Market, By End-User, 2021–2029(USD Billion)

- China Automated Hospital Beds Market, By Type, 2021–2029(USD Billion)

- China Automated Hospital Beds Market, By Technology, 2021–2029(USD Billion)

- China Automated Hospital Beds Market, By Treatment Type, 2021–2029(USD Billion)

- China Automated Hospital Beds Market, By Usage, 2021–2029(USD Billion)

- China Automated Hospital Beds Market, By End-User, 2021–2029(USD Billion)

- India Automated Hospital Beds Market, By Type, 2021–2029(USD Billion)

- India Automated Hospital Beds Market, By Technology, 2021–2029(USD Billion)

- India Mexico Automated Hospital Beds Market, By Treatment Type, 2021–2029(USD Billion)

- India Automated Hospital Beds Market, By Usage, 2021–2029(USD Billion)

- India Automated Hospital Beds Market, By End-User, 2021–2029(USD Billion)

- South America Automated Hospital Beds Market, By Type, 2021–2029(USD Billion)

- South America Automated Hospital Beds Market, By Technology, 2021–2029(USD Billion)

- South America Automated Hospital Beds Market, By Treatment Type, 2021–2029(USD Billion)

- South America Automated Hospital Beds Market, By Usage, 2021–2029(USD Billion)

- South America Automated Hospital Beds Market, By End-User, 2021–2029(USD Billion)

- Brazil Automated Hospital Beds Market, By Type, 2021–2029(USD Billion)

- Brazil Automated Hospital Beds Market, By Technology, 2021–2029(USD Billion)

- Brazil Mexico Automated Hospital Beds Market, By Treatment Type, 2021–2029(USD Billion)

- Brazil Mexico Automated Hospital Beds Market, By Usage, 2021–2029(USD Billion)

- Brazil Mexico Automated Hospital Beds Market, By End-User, 2021–2029(USD Billion)

- Middle East and Africa Automated Hospital Beds Market, By Type, 2021–2029(USD Billion)

- Middle East and Africa Automated Hospital Beds Market, By Technology, 2021–2029(USD Billion)

- Middle East Automated Hospital Beds Market, By Treatment Type, 2021–2029(USD Billion)

- Middle East Automated Hospital Beds Market, By Usage, 2021–2029(USD Billion)

- Middle East Automated Hospital Beds Market, By End-User, 2021–2029(USD Billion)

- UAE Automated Hospital Beds Market, By Type, 2021–2029(USD Billion)

- UAE Automated Hospital Beds Market, By Technology, 2021–2029(USD Billion)

- UAE Mexico Automated Hospital Beds Market, By Treatment Type, 2021–2029(USD Billion)

- UAE Mexico Automated Hospital Beds Market, By Usage, 2021–2029(USD Billion)

- UAE Mexico Automated Hospital Beds Market, By End-User, 2021–2029(USD Billion)

- South Africa Automated Hospital Beds Market, By Type, 2021–2029(USD Billion)

- South Africa Automated Hospital Beds Market, By Technology, 2021–2029(USD Billion)

- South Africa Automated Hospital Beds Market, By Treatment Type, 2021–2029(USD Billion)

- South Africa Automated Hospital Beds Market, By Usage, 2021–2029(USD Billion)

- South Africa Automated Hospital Beds Market, By End-User, 2021–2029(USD Billion)

List of Figures

- Global Automated Hospital Beds Market Segmentation

- Automated Hospital Beds Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Automated Hospital Beds Market Attractiveness Analysis By Type

- Global Automated Hospital Beds Market Attractiveness Analysis By Technology

- Global Automated Hospital Beds Market Attractiveness Analysis By Treatment Type

- Global Automated Hospital Beds Market Attractiveness Analysis By Usage

- Global Automated Hospital Beds Market Attractiveness Analysis By End-User

- Global Automated Hospital Beds Market Attractiveness Analysis By Region

- Global Automated Hospital Beds Market: Dynamics

- Global Automated Hospital Beds Market Share By Type (2021 & 2029)

- Global Automated Hospital Beds Market Share By Technology (2021 & 2029)

- Global Automated Hospital Beds Market Share By Treatment Type (2021 & 2029)

- Global Automated Hospital Beds Market Share By Usage (2021 & 2029)

- Global Automated Hospital Beds Market Share By End-User (2021 & 2029)

- Global Automated Hospital Beds Market Share by Regions (2021 & 2029)

- Global Automated Hospital Beds Market Share by Company (2020)