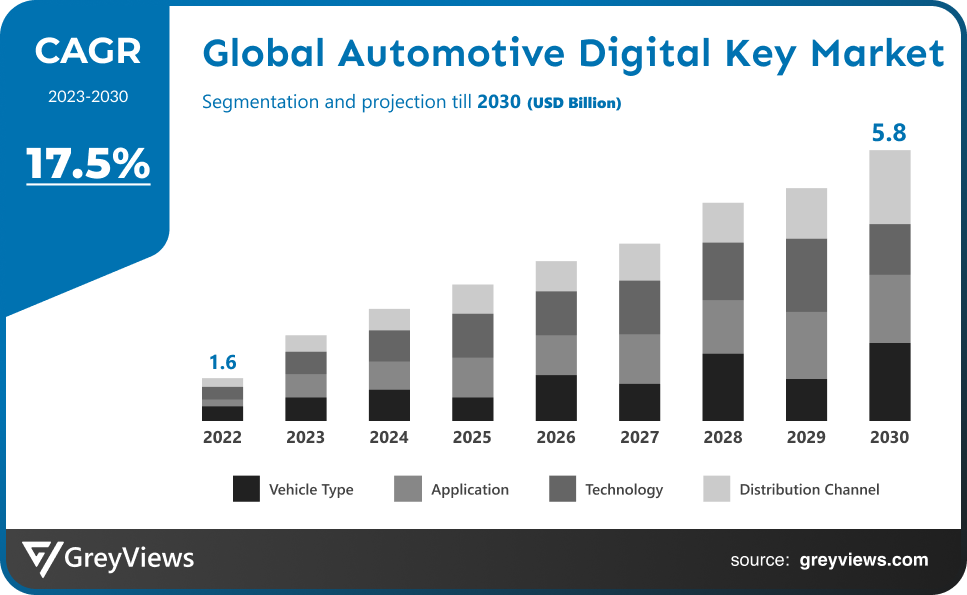

Automotive Digital Key Market Size By Vehicle Type (Passenger Vehicles and Commercial Vehicle), By Application (Multi-Function and Single Function), By Technology (Biometric, Wi-Fi, Near Field Communication, Remote Cloud Key Access, and Bluetooth), By Distribution Channel (Original Equipment Manufacturer and Aftersales), Regions, Segmentation, and Projection till 2030

CAGR: 17.5%Current Market Size: USD 1.6 BillionFastest Growing Region: APAC

Largest Market: APACProjection Time: 2023-2030Base Year: 2022

Global Automotive Digital Key Market- Market Overview:

The global automotive digital key market is expected to grow from USD 1.6 billion in 2022 to USD 5.8 billion by 2030, at a CAGR of 17.5% during the Projection period 2023-2030. The growth of this market is mainly driven owing to the rising technological advancements in the automotive sector.

An automotive digital key is also called a smart key. Digitalization and additional functionality are included in this type of key. It is equipped with microchips and sensors to automatically lock and unlock doors, start and stop the car automatically. Depending on the car model, the automotive key comes in standard equipment format. It is impossible to make copies of automotive digital keys, so consumers feel more secure. With automotive digital keys with advanced features, the consumer can operate various auto functions using just one device, which is convenient for them. In the next five years, automotive digital keys are expected to grow due to rising disposable income and advancements in automotive technology. Compared to traditional lock systems, automotive digital keys use a variety of software and systems which are susceptible to cyber-attacks. The growing digitization and automation of products and processes across industries has improved the efficiency & effectiveness of businesses. Automobile manufacturers are also looking for ways to improve brand reputation and retain customer loyalty in different areas of production, assembly, and aftersales service. In addition to the growing consumer demand for automotive digital keys, the automotive industry is becoming increasingly digitalized, which will help grow the global automotive digital key market. Nonetheless, automotive digital keys are more susceptible to cyber-attacks than conventional lock systems because they use various software and systems. Cyber-attacks raise consumer safety & security concerns, hampering the growth of the market.

Sample Request: - Global Automotive Digital Key Market

Market Dynamics:

Drivers:

- Increasing digitization

Developing economies like China & India are experiencing an increase in the demand for digitization and automation of devices as a result of increasing consumer disposable incomes. As consumers' per capita incomes increase, they expect more advanced features that ensure their safety and convenience. Additionally, the automotive digital key market benefits from government policies that promote the digitization of vehicles to reduce carbon emissions and improve fuel efficiency.

Restraints:

- Rising cyber-crimes

Several technologies and software are used in the operation of digital keys. The applications installed to facilitate their use are susceptible to cyber-attacks. As a result of the lack of prevention measures and awareness of the consequences of such cyber-attacks, users of digital keys may experience material damage. In spite of the safety assurance provided by digital keys, cyber-attacks have become more common and can hinder the market's expansion.

Opportunities:

- Technological advancements

Market players invest heavily in developing new digital key technologies to maintain their market share and gain a competitive advantage in the automotive digital key market as new players enter the market. Fuel tracking, speed control, monitoring in-vehicle information systems, and advanced driver assistance are some of the features of the latest product innovations, which improve consumer comfort and vehicle efficiency.

Challenges:

- Difficulty in insurance claim

Vehicles equipped with keyless entry systems and digital key systems have to meet additional insurance requirements. The insurance provider does not cover vehicles that have digital keys or keyless entry systems unless the driver also has household insurance, which hedges against the risk taken by the insurer. These factors are expected to negatively impact market growth during the Projection period.

Segmentation Analysis:

The global automotive digital key market has been segmented based on vehicle type, application, technology, distribution channel, and region.

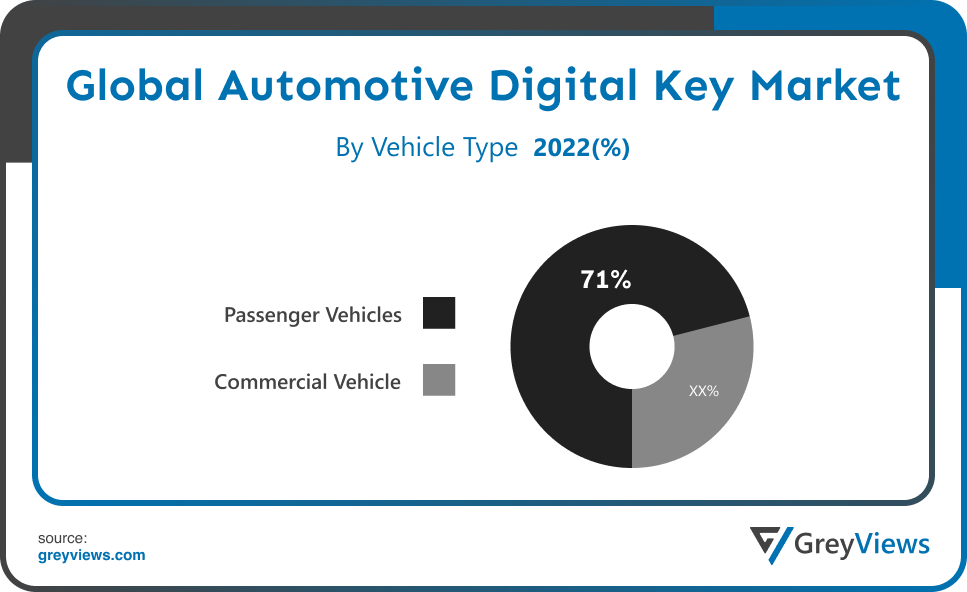

By Vehicle Type

The vehicle type segment includes passenger vehicles and commercial vehicle. The passenger vehicles segment led the largest share of the automotive digital key market with a market share of around 71% in 2022. A growing population with increased disposable income is attributed to the rising demand for passenger vehicles with digital features, which dominated the market in 2021. Consumer spending on luxury vehicles with automated systems has risen as a result of the desire to improve one's standard of living and social status, contributing to the growth of the automotive digital key market for passenger vehicles.

By Application

The application segment includes multi-function and single function. The multi-function segment led the largest share of the automotive digital key market with a market share of around 56.7% in 2022. With 50.1% of the market share in 2021, multi-function vehicles dominated the market. Growing demand for one-device-does-it-all features in developing economies contributed to the dominance of this segment.

By Technology

The technology segment includes biometric, Wi-Fi, near field communication, remote cloud key access, and bluetooth. The near field communication segment led the largest share of the automotive digital key market with a market share of around 31.3% in 2022. There is a strong likelihood that the near-field communication segment will grow at the fastest rate during the Projection period, since close-field communication systems have a competitive advantage over other technologies in terms of security features. Simple and easy installation will also contribute to the growth of this market.

By Distribution Channel

The distribution channel segment includes original equipment manufacturer and aftersales. The energy & power segment led the largest share of the automotive digital key market with a market share of around 59.3% in 2022. With around 55.3% of global revenue in 2021 coming from original equipment manufacturers, this segment dominated the market. This dominance can be attributed to the significant presence of this manufacturer, which is known for its manufacturing, installation, and operation of digital keys.

Global Automotive Digital Key Market- Sales Analysis.

The sale of automotive digital key expanded at a CAGR of 16.9% from 2016 to 2022.

In developing economies, a rise in disposable income and rising fuel prices will contribute to the growth of the market, resulting in an increase in demand for smart vehicles. Since smart vehicles are more fuel-efficient and thus reduce emissions, they will dominate the automotive market during the Projectioned period.

Despite the fragmentation of the Automotive Digital Key Market, vendors are focusing on multiple distribution channels in order to compete in it. To increase brand visibility, companies are utilizing mergers, expansions, acquisitions, partnerships, as well as new product development as strategic tactics.

As technology advances, new opportunities will emerge for market players as the features of digital keys are enhanced to include more functions for cars. Furthermore, the market can be challenged by the failure of automotive digital keys without proper connectivity or the presence of physical barriers between keys and cars.

Thus, owing to the aforementioned factors, the global hydrogen gas sensor market is expected to grow at a CAGR of 17.5% during the Projection period from 2023 to 2030.

By Regional Analysis:

The regions analyzed for the automotive digital key market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Asia Pacific region dominated the automotive digital key market and held a 40.5% share of the market revenue in 2022.

- The Asia Pacific region witnessed a major share. Approximately half of the global automotive digital key market is accounted for by Asia Pacific; Asia Pacific is home to many developed nations with advanced digital key research and development capabilities, so digital key solutions are likely to become increasingly popular throughout the region. As vehicles increasingly become digital, the automotive industry in this region is rapidly changing. Manufacturers are developing automotive digital keys in order to provide advanced features over conventional keys, such as enhanced driver safety features, connected automobiles, the Internet of Things, and keyless entry. A number of players in the automotive digital key market are also developing RFID-enabled key cards, smart key fobs, and wearable smart watches that are constantly being developed.

- Asia Pacific is anticipated to experience significant growth during the predicted period.

Global Automotive Digital Key Market - Country Analysis:

- Germany

Germany's automotive digital key market size was valued at USD 0.13 Billion in 2022 and is expected to reach USD 0.47 billion by 2030, at a CAGR of 17.6% from 2023 to 2030.

In the Projection period, Germany will grow due to the adoption of new policies by the government that encourage the production and consumption of digital passenger vehicles. Increased disposable income has led to an increase in demand for digital passenger cars.

- China

China’s automotive digital key market size was valued at USD 0.16 billion in 2022 and is expected to reach USD 0.59 billion by 2030, at a CAGR of 17.8% from 2023 to 2030.

Asia Pacific automotive digital key is dominated by China. A growing demand for vehicles in developing economies is being catered for by the economies' equally growing production capacity, thereby contributing to the growth of automotive digital keys. As the world's leading automobile manufacturer, China intends to reduce carbon emissions by improving fuel efficiency; the Chinese market is shifting to smart cars.

- India

India's automotive digital key market size was valued at USD 0.12 billion in 2022 and is expected to reach USD 0.44 billion by 2030, at a CAGR of 17.7% from 2023 to 2030.

India has excellent infrastructure, making it a perfect place for automobile manufacturing. During the Projection period, the country is expected to maintain its dominance in the global automotive digital key market due to favorable government policies for the manufacture of smart and digitized vehicles.

Key Industry Players Analysis:

To increase their market position in the global automotive digital key market business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- DENSO Corp.

- Robert Bosch GmbH

- Hyundai Motor Co.

- Tesla Inc.

- Ford Motor Co.

- General Motors Co.

- BMW AG

- RoboArt Inc.

- Valeo SA

- Samsung Electronics Co. Ltd.

- HELLA GmbH and Co. KG

- Daimler AG

- Continental AG

- Apple Inc.

- Volkswagen AG

- Volvo Car Corp.

- Toyota Motor Corp.

- Infineon Technologies AG

Latest Development:

- In March 2020, A new Duster model has been introduced by Renault with keyless entry, as well as a remote engine start feature that activates the air conditioning before entering the vehicle.

- In March 2020, An electronic key service based on digital keys has been tested by Tokai Rika Co., Ltd. and Kimura Unity Co., Ltd., together. Using a smartphone, the user can lock or unlock the doors using the digital key stored in a mobile application, which is sent to the smartphone. In this way, company vehicles can be used without key exchanges, which reduces the need for traditional keys to be used.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2022-2030 |

|

Base year |

2022 |

|

CAGR (%) |

17.5% |

|

Market Size |

1.6 billion in 2022 |

|

Projection period |

2023-2030 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Vehicle Type, By Application, By Technology, By Distribution Channel, and By Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

DENSO Corp., Robert Bosch GmbH, Hyundai Motor Co., Tesla Inc., Ford Motor Co., General Motors Co., BMW AG, RoboArt Inc., Valeo SA, Samsung Electronics Co. Ltd., HELLA GmbH and Co. KG, Daimler AG, Continental AG, Apple Inc., Volkswagen AG, Volvo Car Corp., Toyota Motor Corp., and Infineon Technologies AG. |

|

By Vehicle Type |

|

|

By Application |

|

|

By Technology |

|

|

By Distribution Channel |

|

|

Regional scope |

|

Scope of the Report

Global Automotive Digital Key Market by Vehicle Type:

- Passenger Vehicles

- Commercial Vehicle

Global Automotive Digital Key Market by Application:

- Multi-Function

- Single Function

Global Automotive Digital Key Market by Technology:

- Biometric

- Wi-Fi

- Near Field Communication

- Remote Cloud Key Access

- Bluetooth

Global Automotive Digital Key Market by Distribution Channel:

- Original Equipment Manufacturer

- Aftersales

Global Automotive Digital Key Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the expected market size of the automotive digital key market in 2030?

Global automotive digital key market is expected to reach USD 5.8 billion by 2030, at a CAGR of 17.5% from 2023 to 2030.

What are the driving factors of the automotive digital key market?

Increasing digitization and technological advancements.

Which region will witness more growth in the automotive digital key market?

Asia Pacific region will witness more growth in the automotive digital key market.

What are the segments covered in the automotive digital key market report?

The segments covered in the automotive digital key market are; vehicle type, application, technology, distribution channel, and region.

Which are the leading market players active in the automotive digital key market?

Leading players in the automotive digital key market are DENSO Corp., Robert Bosch GmbH, Hyundai Motor Co., Tesla Inc., Ford Motor Co., General Motors Co., BMW AG, RoboArt Inc., Valeo SA, Samsung Electronics Co. Ltd., HELLA GmbH and Co. KG, Daimler AG, Continental AG, Apple Inc., Volkswagen AG, Volvo Car Corp., Toyota Motor Corp., Infineon Technologies AG among others.

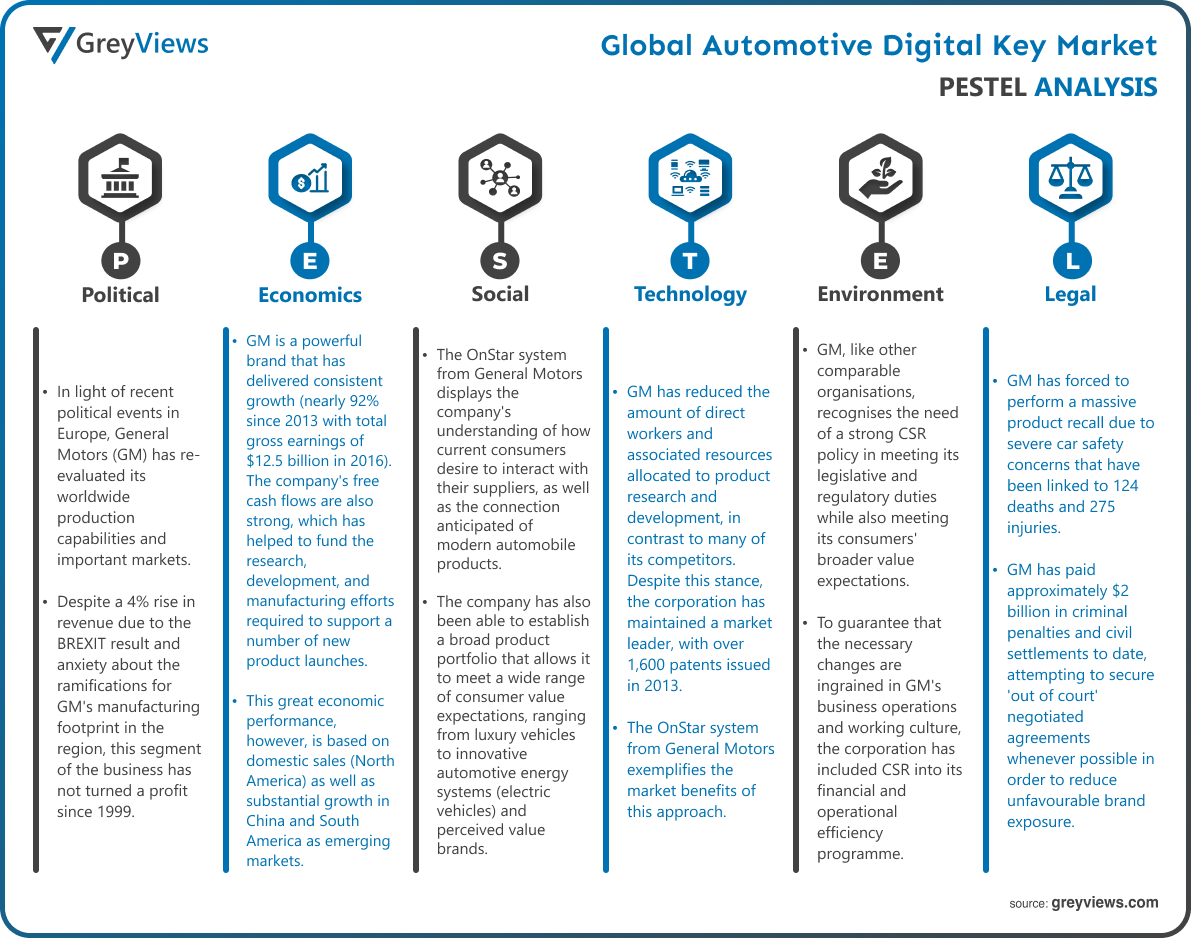

Political Factors- In light of recent political events in Europe, General Motors (GM) has re-evaluated its worldwide production capabilities and important markets. Despite a 4% rise in revenue due to the BREXIT result and anxiety about the ramifications for GM's manufacturing footprint in the region, this segment of the business has not turned a profit since 1999. As a result, there is a distinct emphasis on the home market (the United States), where political support and brand loyalties are believed to be strongest. The current US administration's more protectionist stance (showing the possibility of large tariffs on vehicle imports) appears to encourage this approach. As a result of these political upheavals, the external market emphasis has shifted to China and South America.

Economic Factors- GM is a powerful brand that has delivered consistent growth (nearly 92% since 2013 with total gross earnings of $12.5 billion in 2016). The company's free cash flows are also strong, which has helped to fund the research, development, and manufacturing efforts required to support a number of new product launches. Given the excellent capital returns (almost 29% in 2016), shareholder support is strong. This great economic performance, however, is based on domestic sales (North America) as well as substantial growth in China and South America as emerging markets. The European operations continued to lose money and were eventually sold to the PSA Group.

Social Factors- The OnStar system from General Motors displays the company's understanding of how current consumers desire to interact with their suppliers, as well as the connection anticipated of modern automobile products. The company has also been able to establish a broad product portfolio that allows it to meet a wide range of consumer value expectations, ranging from luxury vehicles to innovative automotive energy systems (electric vehicles) and perceived value brands. However, competitors have used its marketing to these separate customer groups as mixed (using the same channels to reach different social groupings). Due to the significant legislative and regulatory obligations surrounding automotive manufacturing, distribution, and operation, GM has implemented a proactive Corporate Social Responsibility (CSR) programme.

Technological Factors- GM has reduced the amount of direct workers and associated resources allocated to product research and development, in contrast to many of its competitors. Despite this stance, the corporation has maintained a market leader, with over 1,600 patents issued in 2013. This indicates a corporate recognition that modern product creation cannot be done in isolation, and that progress will come through more active, collaborative ways that use connected technology. The OnStar system from General Motors exemplifies the market benefits of this approach. This more collaborative approach (while still safeguarding corporate interests through strong patent protection) is also assisting in the exploration and development of new markets.

Environmental Factors- GM, like other comparable organisations, recognises the need of a strong CSR policy in meeting its legislative and regulatory duties while also meeting its consumers' broader value expectations. To guarantee that the necessary changes are ingrained in GM's business operations and working culture, the corporation has included CSR into its financial and operational efficiency programme. There are so defined targets for the usage of renewable energy, as well as a commitment to becoming entirely reliant on such sources by 2050. There are strong links between business-level initiatives and local community programmes, and re-use and recycling projects are employed to cut production costs and the company carbon footprint.

Legal Factors- GM has forced to perform a massive product recall due to severe car safety concerns that have been linked to 124 deaths and 275 injuries. Several criminal investigations and huge compensation claims were launched while the corporation sought to escape any legal duties (claiming that they would have been the duty of the prior corporate entity, which was declared bankrupt in 2009). GM has paid approximately $2 billion in criminal penalties and civil settlements to date, attempting to secure 'out of court' negotiated agreements whenever possible in order to reduce unfavourable brand exposure. It has since been revealed that the flaw was known to numerous GM employees, who have already been fired. Despite the magnitude of the problem, there appears to have been little influence on brand reputation.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis by Vehicle Type

- 3.2. Market Attractiveness Analysis by Application

- 3.3. Market Attractiveness Analysis by Technology

- 3.4. Market Attractiveness Analysis by Distribution Channel

- 3.5. Market Attractiveness Analysis by Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Increasing digitization

- 3. Restraints

- 3.1. Rising cyber-crimes

- 4. Opportunities

- 4.1. Technological advancements

- 5. Challenges

- 5.1. Difficulty in insurance claim

- Global Automotive Digital Key Market Analysis and Projection, By Vehicle Type

- 1. Segment Overview

- 2. Passenger Vehicles

- 3. Commercial Vehicle

- Global Automotive Digital Key Market Analysis and Projection, By Application

- 1. Segment Overview

- 2. Multi-Function

- 3. Single Function

- Global Automotive Digital Key Market Analysis and Projection, By Technology

- 1. Segment Overview

- 2. Biometric

- 3. Wi-Fi

- 4. Near Field Communication

- 5. Remote Cloud Key Access

- 6. Bluetooth

- Global Automotive Digital Key Market Analysis and Projection, By Distribution Channel

- 1. Segment Overview

- 2. Original Equipment Manufacturer

- 3. Aftersales

- Global Automotive Digital Key Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- South America

- 5.1. Brazil

- Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Automotive Digital Key Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Automotive Digital Key Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- DENSO Corp.

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Robert Bosch GmbH

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Hyundai Motor Co.

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Tesla Inc.

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Ford Motor Co.

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- General Motors Co.

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- BMW AG

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- RoboArt Inc.

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Valeo SA

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Samsung Electronics Co. Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- HELLA GmbH and Co. KG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Daimler AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Continental AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Apple Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Volkswagen AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Volvo Car Corp.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Toyota Motor Corp.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Infineon Technologies AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- DENSO Corp.

List of Table

- Global Automotive Digital Key Market, By Vehicle Type, 2023–2030 (USD Billion)

- Global Passenger Vehicles, Automotive Digital Key Market, By Region, 2023–2030 (USD Billion)

- Global Commercial Vehicle, Automotive Digital Key Market, By Region, 2023–2030 (USD Billion)

- Global Automotive Digital Key Market, By Application, 2023–2030 (USD Billion)

- Global Multi-Function, Automotive Digital Key Market, By Region, 2023–2030 (USD Billion)

- Global Single Function, Automotive Digital Key Market, By Region, 2023–2030 (USD Billion)

- Global Automotive Digital Key Market, By Technology, 2023–2030 (USD Billion)

- Global Biometric, Automotive Digital Key Market, By Region, 2023–2030 (USD Billion)

- Global Wi-Fi, Automotive Digital Key Market, By Region, 2023–2030 (USD Billion)

- Global Near Field Communication, Automotive Digital Key Market, By Region, 2023–2030 (USD Billion)

- Global Remote Cloud Key Access, Automotive Digital Key Market, By Region, 2023–2030 (USD Billion)

- Global Bluetooth, Automotive Digital Key Market, By Region, 2023–2030 (USD Billion)

- Global Automotive Digital Key Market, By Distribution Channel, 2023–2030 (USD Billion)

- Global Original Equipment Manufacturer, Automotive Digital Key Market, By Region, 2023–2030 (USD Billion)

- Global Aftersales, Automotive Digital Key Market, By Region, 2023–2030 (USD Billion)

- Global Automotive Digital Key Market, By Region, 2023–2030 (USD Billion)

- North America Automotive Digital Key Market, By Vehicle Type, 2023–2030 (USD Billion)

- North America Automotive Digital Key Market, By Application, 2023–2030 (USD Billion)

- North America Automotive Digital Key Market, By Technology, 2023–2030 (USD Billion)

- North America Automotive Digital Key Market, By Distribution Channel, 2023–2030 (USD Billion)

- USA Automotive Digital Key Market, By Vehicle Type, 2023–2030 (USD Billion)

- USA Automotive Digital Key Market, By Application, 2023–2030 (USD Billion)

- USA Automotive Digital Key Market, By Technology, 2023–2030 (USD Billion)

- USA Automotive Digital Key Market, By Distribution Channel, 2023–2030 (USD Billion)

- Canada Automotive Digital Key Market, By Vehicle Type, 2023–2030 (USD Billion)

- Canada Automotive Digital Key Market, By Application, 2023–2030 (USD Billion)

- Canada Automotive Digital Key Market, By Technology, 2023–2030 (USD Billion)

- Canada Automotive Digital Key Market, By Distribution Channel, 2023–2030 (USD Billion)

- Mexico Automotive Digital Key Market, By Vehicle Type, 2023–2030 (USD Billion)

- Mexico Automotive Digital Key Market, By Application, 2023–2030 (USD Billion)

- Mexico Automotive Digital Key Market, By Technology, 2023–2030 (USD Billion)

- Mexico Automotive Digital Key Market, By Distribution Channel, 2023–2030 (USD Billion)

- Europe Automotive Digital Key Market, By Vehicle Type, 2023–2030 (USD Billion)

- Europe Automotive Digital Key Market, By Application, 2023–2030 (USD Billion)

- Europe Automotive Digital Key Market, By Technology, 2023–2030 (USD Billion)

- Europe Automotive Digital Key Market, By Distribution Channel, 2023–2030 (USD Billion)

- Germany Automotive Digital Key Market, By Vehicle Type, 2023–2030 (USD Billion)

- Germany Automotive Digital Key Market, By Application, 2023–2030 (USD Billion)

- Germany Automotive Digital Key Market, By Technology, 2023–2030 (USD Billion)

- Germany Automotive Digital Key Market, By Distribution Channel, 2023–2030 (USD Billion)

- France Automotive Digital Key Market, By Vehicle Type, 2023–2030 (USD Billion)

- France Automotive Digital Key Market, By Application, 2023–2030 (USD Billion)

- France Automotive Digital Key Market, By Technology, 2023–2030 (USD Billion)

- France Automotive Digital Key Market, By Distribution Channel, 2023–2030 (USD Billion)

- UK Automotive Digital Key Market, By Vehicle Type, 2023–2030 (USD Billion)

- UK Automotive Digital Key Market, By Application, 2023–2030 (USD Billion)

- UK Automotive Digital Key Market, By Technology, 2023–2030 (USD Billion)

- UK Automotive Digital Key Market, By Distribution Channel, 2023–2030 (USD Billion)

- Italy Automotive Digital Key Market, By Vehicle Type, 2023–2030 (USD Billion)

- Italy Automotive Digital Key Market, By Application, 2023–2030 (USD Billion)

- Italy Automotive Digital Key Market, By Technology, 2023–2030 (USD Billion)

- Italy Automotive Digital Key Market, By Distribution Channel, 2023–2030 (USD Billion)

- Spain Automotive Digital Key Market, By Vehicle Type, 2023–2030 (USD Billion)

- Spain Automotive Digital Key Market, By Application, 2023–2030 (USD Billion)

- Spain Automotive Digital Key Market, By Technology, 2023–2030 (USD Billion)

- Spain Automotive Digital Key Market, By Distribution Channel, 2023–2030 (USD Billion)

- Asia Pacific Automotive Digital Key Market, By Vehicle Type, 2023–2030 (USD Billion)

- Asia Pacific Automotive Digital Key Market, By Application, 2023–2030 (USD Billion)

- Asia Pacific Automotive Digital Key Market, By Technology, 2023–2030 (USD Billion)

- Asia Pacific Automotive Digital Key Market, By Distribution Channel, 2023–2030 (USD Billion)

- Japan Automotive Digital Key Market, By Vehicle Type, 2023–2030 (USD Billion)

- Japan Automotive Digital Key Market, By Application, 2023–2030 (USD Billion)

- Japan Automotive Digital Key Market, By Technology, 2023–2030 (USD Billion)

- Japan Automotive Digital Key Market, By Distribution Channel, 2023–2030 (USD Billion)

- China Automotive Digital Key Market, By Vehicle Type, 2023–2030 (USD Billion)

- China Automotive Digital Key Market, By Application, 2023–2030 (USD Billion)

- China Automotive Digital Key Market, By Technology, 2023–2030 (USD Billion)

- China Automotive Digital Key Market, By Distribution Channel, 2023–2030 (USD Billion)

- India Automotive Digital Key Market, By Vehicle Type, 2023–2030 (USD Billion)

- India Automotive Digital Key Market, By Application, 2023–2030 (USD Billion)

- India Automotive Digital Key Market, By Technology, 2023–2030 (USD Billion)

- India Automotive Digital Key Market, By Distribution Channel, 2023–2030 (USD Billion)

- South America Automotive Digital Key Market, By Vehicle Type, 2023–2030 (USD Billion)

- South America Automotive Digital Key Market, By Application, 2023–2030 (USD Billion)

- South America Automotive Digital Key Market, By Technology, 2023–2030 (USD Billion)

- South America Automotive Digital Key Market, By Distribution Channel, 2023–2030 (USD Billion)

- Brazil Automotive Digital Key Market, By Vehicle Type, 2023–2030 (USD Billion)

- Brazil Automotive Digital Key Market, By Application, 2023–2030 (USD Billion)

- Brazil Automotive Digital Key Market, By Technology, 2023–2030 (USD Billion)

- Brazil Automotive Digital Key Market, By Distribution Channel, 2023–2030 (USD Billion)

- Middle East and Africa Automotive Digital Key Market, By Vehicle Type, 2023–2030 (USD Billion)

- Middle East and Africa Automotive Digital Key Market, By Application, 2023–2030 (USD Billion)

- Middle East and Africa Automotive Digital Key Market, By Technology, 2023–2030 (USD Billion)

- Middle East and Africa Automotive Digital Key Market, By Distribution Channel, 2023–2030 (USD Billion)

- UAE Automotive Digital Key Market, By Vehicle Type, 2023–2030 (USD Billion)

- UAE Automotive Digital Key Market, By Application, 2023–2030 (USD Billion)

- UAE Automotive Digital Key Market, By Technology, 2023–2030 (USD Billion)

- UAE Automotive Digital Key Market, By Distribution Channel, 2023–2030 (USD Billion)

- South Africa Automotive Digital Key Market, By Vehicle Type, 2023–2030 (USD Billion)

- South Africa Automotive Digital Key Market, By Application, 2023–2030 (USD Billion)

- South Africa Automotive Digital Key Market, By Technology, 2023–2030 (USD Billion)

- South Africa Automotive Digital Key Market, By Distribution Channel, 2023–2030 (USD Billion)

List of Figures

- Global Automotive Digital Key Market Segmentation

- Automotive Digital Key Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Automotive Digital Key Market Attractiveness Analysis by Vehicle Type

- Global Automotive Digital Key Market Attractiveness Analysis by Application

- Global Automotive Digital Key Market Attractiveness Analysis by Technology

- Global Automotive Digital Key Market Attractiveness Analysis by Distribution Channel

- Global Automotive Digital Key Market Attractiveness Analysis by Region

- Global Automotive Digital Key Market: Dynamics

- Global Automotive Digital Key Market Share by Vehicle Type (2023 & 2030)

- Global Automotive Digital Key Market Share by Application (2023 & 2030)

- Global Automotive Digital Key Market Share by Technology (2023 & 2030)

- Global Automotive Digital Key Market Share by Distribution Channel (2023 & 2030)

- Global Automotive Digital Key Market Share by Regions (2023 & 2030)

- Global Automotive Digital Key Market Share by Company (2021)