Automotive Door Guards Market Size By Material Type (Acrylonitrile Butadiene Styrene, Polypropylene, Polyoxymethylene, Thermoplastic Elastomer, and Others), By Interior Application (Dashboard, Door panel and Others), By Exterior Application (Bumpers, Door & window seals and Others), By Vehicle Type (ICE Passenger Vehicle, ICE Commercial Vehicle, Battery Electric Vehicle, Hybrid Electric Vehicle, and Plug-in Hybrid Electric Vehicle), By End-user (Original Equipment Manufacturers and Aftermarket), and Regions, Segmentation, and Projection till 2030

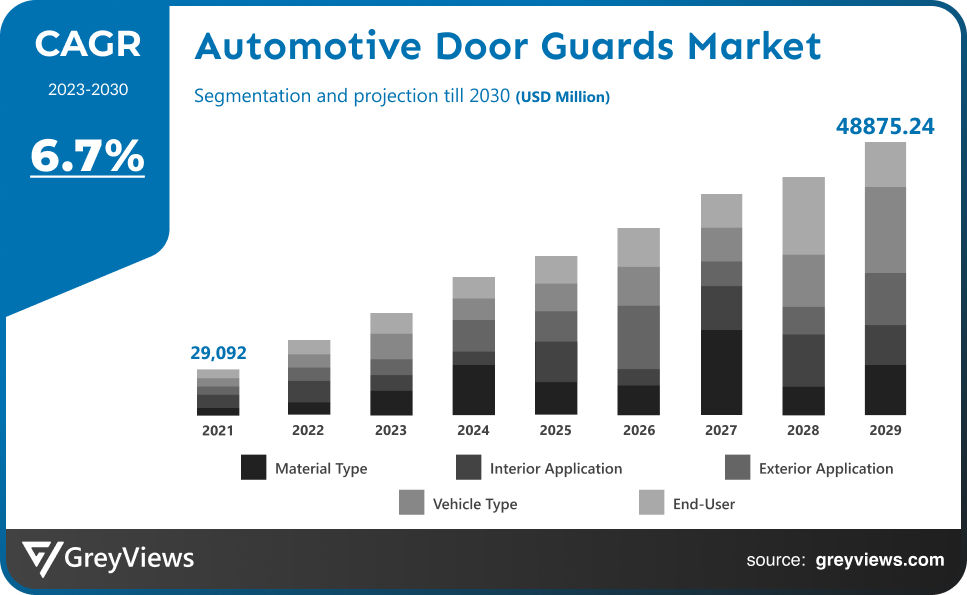

CAGR: 6.7%Current Market Size: USD 29,092 MillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2023-2030Base Year: 2022

Global Automotive Door Guards Market- Market Overview:

The Global Automotive Door Guards market is expected to grow from USD 29,092 million in 2022 to USD 48875.24 million by 2030, at a CAGR of 6.7% during the Projection period 2023-2030. The growth of this market is mainly driven by the worldwide increase in vehicle demand.

The structural part of a car that is meant to safeguard the occupants in collisions and accidents is called an automotive side guard door beam. The necessity for a safety device, which was mostly met by the automobile side guard door beams, was created by the rising number of collisions and accidents that occurred from the lateral side of the cars. The primary purpose of an automobile's side guard door beams is to deflect the impact of a collision in the event of an accident, minimising harm to the occupants. Due to the installation of vehicle side guard door beams, it has been observed in actual accident situations all over the world that passengers did survive collisions. The market offers a variety of forms, designs, and materials for automotive side guard door beams. Automotive side guard door beams are typically made of steel, aluminium, or high-strength plastic. These raw materials have high manufacturing qualities like ductility and malleability, high corrosion resistance, good strength, and durability. They can also be manufactured into a variety of shapes and sizes to meet the needs of the automobiles. Automotive side guard door beams are being designed and produced by manufacturers, and this is thought to be one of the key aspects propelling the market for these products globally.

Sample Request: - Global Automotive Door Guards Market

Market Dynamics:

Drivers:

- The Demand for Comfort & Luxury in Cars and the Increased Car production

Oral hygiene quickly deteriorates, and the frequency of dental issues rises as a result of bad eating habits, changing lifestyles, and increased use of aerated beverages and high-sugar foods. The American Dental Hygienists' Association estimates that about 80% of Americans will have at least one cavity by the time they are 17 years old. This shows a rise in dental treatments being performed and a need for more dental supplies and tools. More than 40% of individuals’ report having had mouth discomfort in the last year (2020), and more than 80% of people will have experienced at least one cavity by the age of 34, according to the Centres for Disease Control and Prevention (CDC). Each year, the US spends around $124 million on dental-related expenses.

Restraints:

- Expensive Replacement Cost

Dental bridges increase the risk of the bone surrounding the missing tooth or teeth deteriorating, which might impair the bone structure. This considerably increases the likelihood of dental plaque building up around the teeth, increasing the risk of tooth decay and related gum illnesses. The International Journal of Dentistry reports that gum diseases (32.3% of the population), cavities/tooth decay (38.4% of the population), and prostheses (3.6% of the population) are the most prevalent causes of tooth loss. In the US, tooth loss is a big issue. The American College of Prosthodontists estimates that as many as 36 million Americans are missing all of their teeth as of 2019 and that at least 120 million are missing one or more.

Opportunities:

- The Demand for Lightweight Components

Automotive Door Guards are rarely used in underdeveloped regions of the world and even in certain industrialised nations like the UK due to their expensive cost. However, the acceptability of Automotive Door Guards is anticipated to increase quickly due to the expansion of clinics in these areas and the accessibility of high-quality dental care at affordable prices. Due to the increased emphasis on aesthetic dentistry, the dental implant markets in the UK and France are also anticipated to expand.

Challenges:

- Spend more for hardware

If automobiles offered premium features, consumers would have to spend more for hardware, software, and other components, which would eventually restrict the market's growth. Such cars are also difficult to maintain and require expert workers because to their many components and sensors. Complex architectural systems have shorter useful lifetimes. As a result, it is projected that high replacement prices would restrict the growth of the global market for automobile trims.

Segmentation Analysis:

The global Automotive Door Guards market has been segmented based on Material Type, Interior Application, Exterior Application, Vehicle Type, End-user and Regions.

By Material Type

The Material Type segment includes Acrylonitrile Butadiene Styrene, Polypropylene, Polyoxymethylene, Thermoplastic Elastomer, and Others. The Polypropylene segment led the largest share of the Automotive Door Guards market with a market share of around 30% in 2022. Polypropylene is a versatile plastic material that may be modified for a variety of uses. The ability to produce a wide range of automotive components with it, as well as its exceptional resistance to corrosion and its capacity to function as an insulator, among many other qualities, have all helped the market grow.

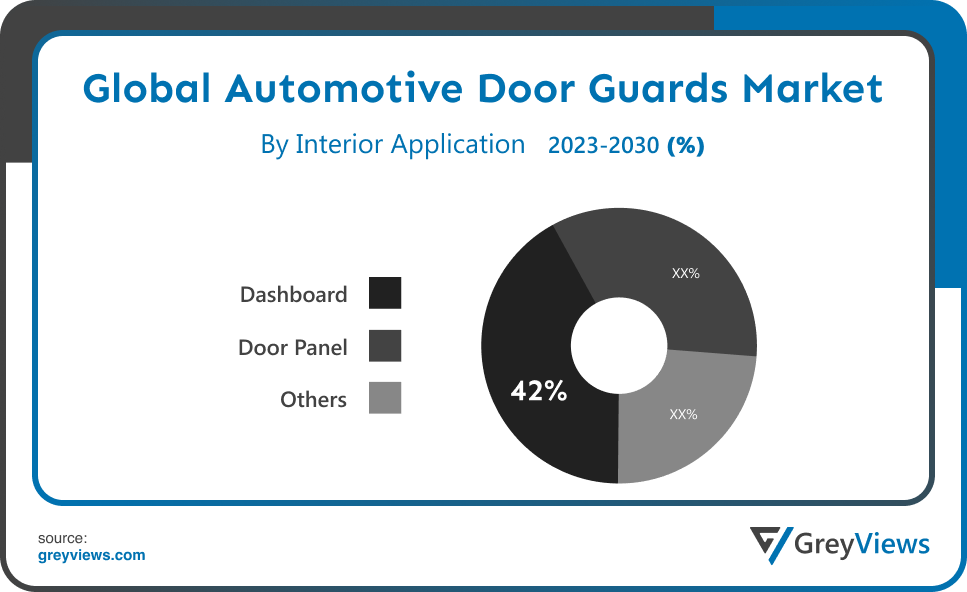

By Interior Application

The Interior Application segment includes Dashboard, Door panel and Others. The Dashboard segment led the Automotive Door Guards market with a market share of around 42% in 2022. The dashboards of cars are equipped to perform a number of tasks, including displaying the car's metres. Additionally, they are used to outfit dash cams and other components, aiding in the segment's expansion on the world market.

By Exterior Application

The Exterior Application segment includes Bumpers, Door & window seals and Others. The Bumpers segment led the Automotive Door Guards market with a market share of around 30% in 2022. Bumpers cover the hood, trunk, grill, gasoline, exhaust, and cooling systems of the automobile. They protect the car from injury by acting as shock absorbers since they are constructed of steel, aluminium, rubber, or plastic. These qualities enable the manufacturers to make sturdy bumpers, boosting the market's growth.

By Vehicle Type

The Vehicle Type segment includes ICE Passenger Vehicle, ICE Commercial Vehicle, Battery Electric Vehicle, Hybrid Electric Vehicle, and Plug-in Hybrid Electric Vehicle. The ICE Passenger Vehicle segment led the Automotive Door Guards market with a market share of around 25% in 2022. The ICE passenger car category includes all types of vehicles, including compact cars, hatchbacks, sedans, luxury sedans, and others, that use internal combustion engines and are used to carry people. The growth of the passenger car industry is facilitated by various automakers' development of electric vehicles. To support the segment's expansion, Ford, General Motors, and other businesses have made a number of investments and advancements.

By End-user

The End-user segment includes Original Equipment Manufacturers and Aftermarket. The OEMs segment led the Automotive Door Guards market with a market share of around 58% in 2022. OEMs are becoming increasingly significant in the automotive trims market as a result of the increased usage of functional components in automobiles. The rise of the worldwide market has also been spurred by the development of technology, which has enabled customers to choose effective car parts.

Global Automotive Door Guards Market- Sales Analysis

The sale of Automotive Door Guards types expanded at a CAGR of 4.2% from 2015 to 2022.

Additionally, rising consumer spending power, economic growth, and rising industrialization with the growth of the automobile industry have all contributed to an increase in the demand for and sale of luxury, commercial, and passenger vehicles, which is ultimately driving the expansion of the automotive door guards market.

The market for Automotive Door Guards has risen in popularity, but there have been some roadblocks. As a result, the Automotive Door Guards market is pushing these limits by providing various advantages over traditional dental procedures, such as competitive cost. Future market trends are anticipated to be altered by new Automotive Door Guards that are more sophisticated and created with the utmost care and effectiveness.

Similar to how industries like e-commerce, import-export, and the food industry are growing due to the industrialization and urbanisation of developing countries, these businesses need heavy and light commercial vehicles as a transportation solution, which will increase vehicle sales.

The market for automotive door guards is expected to expand at a faster rate in the future as a result of these overall sales, installations of door guards for existing vehicles and subsequent replacement from the aftermarket, and primarily growing preference for safety features in all types of vehicles.

Thus, owing to the aforementioned factors, the global Automotive Door Guards Market is expected to grow at a CAGR of 6.7% during the Projection period from 2022 to 2030.

By Regional Analysis:

The regions analysed for the Automotive Door Guards market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North American region dominated the Automotive Door Guards market and held a 39% share of the market revenue in 2022.

- The North America region witnessed a major share. This region has high standards of living, opulent lives, and large amounts of disposable wealth. As a result, vehicle side guard door beams that are lightweight and of outstanding quality have become more popular in the aforementioned locations. Additionally, in industrialised countries like the U.S., Germany, Japan, etc., a high quality of living and rising disposable money have made it possible for people to utilise cars that are both safe and have decent interior aesthetics. In the near future, it is anticipated that the rapidly expanding market for automobile safety components will serve as a stimulus for the expansion of the total vehicle side guard door beams industry.

- Asia Pacific is anticipated to experience significant growth during the predicted period. In the near future, emerging markets like China and India, in particular, will be crucial to the expansion of the vehicle side guard door beams industry. They will make a significant contribution to the worldwide automotive side guard door beams market in nations like China and India, which are the largest manufacturers in the world and have record-breaking annual vehicle sales.

Global Automotive Door Guards Market- Country Analysis:

- Germany

Germany’s Automotive Door Guards market size was valued at USD 1701.88 million in 2022 and is expected to reach USD 5206.08 million by 2030, at a CAGR of 15% from 2022 to 2030. To create and launch suitable vehicle trims, businesses like the Draxlmaier Group have operations all throughout Germany. This promotes the growth of the international market in Germany. The increased product selection that companies provide aids in the development of global automotive trims in Germany.

- China

China’s Automotive Door Guards’ market size was valued at USD 1928.79 million in 2022 and is expected to reach USD 6772.85 million by 2030, at a CAGR of 17% from 2022 to 2030. China is a significant market for the automobile industry. India is a good place for door trims because of the country's rising middle class income and population, which will drive future car sales and manufacturing there. India is a market for automobiles that is developing quickly.

- India

India's Automotive Door Guards market size was valued at USD 2155.71 million in 2022 and is expected to reach USD 8668.94 million by 2030, at a CAGR of 19% from 2022 to 2030. India surpassed Germany to become the fourth-largest auto market in terms of sales. The Government of India is also concentrating on the growth of the domestic manufacturing and R&D industries in the nation under the "Make in India" programme, demonstrating the potential future for automotive door trim in the nation.

Key Industry Players Analysis:

To increase their market position in the global Automotive Door Guards business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, type developments, collaborations, partnerships, joint ventures, etc.

- KIRCHHOFF Group

- H-ONE

- GNS America

- Benteler International AG

- KVA STAINLESS

- Shiloh Industries

- Gestamp

- IFB Industries

- Sango

- TOYOTA

Latest Development:

- In January 2022, Dura Automotive Systems Inc. formally opened a brand-new, cutting-edge manufacturing facility in Muscle Shoals, Alabama. The latest part of an expanding family of international locations is the location of Dura's first North American investment in lightweight constructions. The top site is built to accommodate the accelerated manufacturing of high-end electric automobiles anticipated during the following ten years.

- In October 2020, The new Muscle Shoals factory represents DURA's most recent investment in the electrification of vehicle technologies.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2022-2030 |

|

Base year |

2022 |

|

CAGR (%) |

6.7% |

|

Market Size |

29,092 million in 2022 |

|

Projection period |

2023-2030 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Material Type, By Interior Application, By Exterior Application, By Vehicle Type, By End-user, and By Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

KIRCHHOFF Group, H-ONE, GNS America, Benteler International AG, KVA STAINLESS, Shiloh Industries, Gestamp, IFB Industries, Sango, and TOYOTA. |

|

By Material Type |

|

|

By Interior Application |

|

|

By Exterior Application |

|

|

By Vehicle Type |

|

|

By End-user |

|

|

Regional scope |

|

Scope of the Report

Global Automotive Door Guards Market by Material Type:

- Acrylonitrile Butadiene Styrene

- Polypropylene

- Polyoxymethylene

- Thermoplastic Elastomer

- Others

Global Automotive Door Guards Market by Interior Application:

- Dashboard

- Door panel

- Others

Global Automotive Door Guards Market by Exterior Application:

- Bumpers

- Door & window seals

- Others

Global Automotive Door Guards Market by Vehicle Type:

- ICE Passenger Vehicle

- ICE Commercial Vehicle

- Battery Electric Vehicle

- Hybrid Electric Vehicle

- Plug-in Hybrid Electric Vehicle

Global Automotive Door Guards Market by End-user:

- Original Equipment Manufacturers

- Aftermarket

Global Automotive Door Guards Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- K.

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the current market size of Automotive Door Guards Market?

Global Automotive Door Guards market current size is USD 29,092 million in 2022

What will be the growth rate of the global Automotive Door Guards market during the Projection period?

The global Automotive Door Guards market is expected to grow with a 6.7% CAGR during the Projection period.

How is the North American Automotive Door Guards market projected to grow?

The North American Automotive Door Guards market was projected to gain a global market share of 39% in 2022.

What are the Vehicle type segments in the Automotive Door Guards market?

The Vehicle type segment includes ICE Passenger Vehicle, ICE Commercial Vehicle, Battery Electric Vehicle, Hybrid Electric Vehicle, and Plug-in Hybrid Electric Vehicle.

Who are the key players in global Automotive Door Guards market?

KIRCHHOFF Group, H-ONE, GNS America, Benteler International AG, KVA STAINLESS, Shiloh Industries, Gestamp, IFB Industries, Sango, TOYOTA and Others

What is the major driving factor of the Automotive Door Guards market?

The growth of this market is mainly driven by a worldwide increase in vehicle demand.

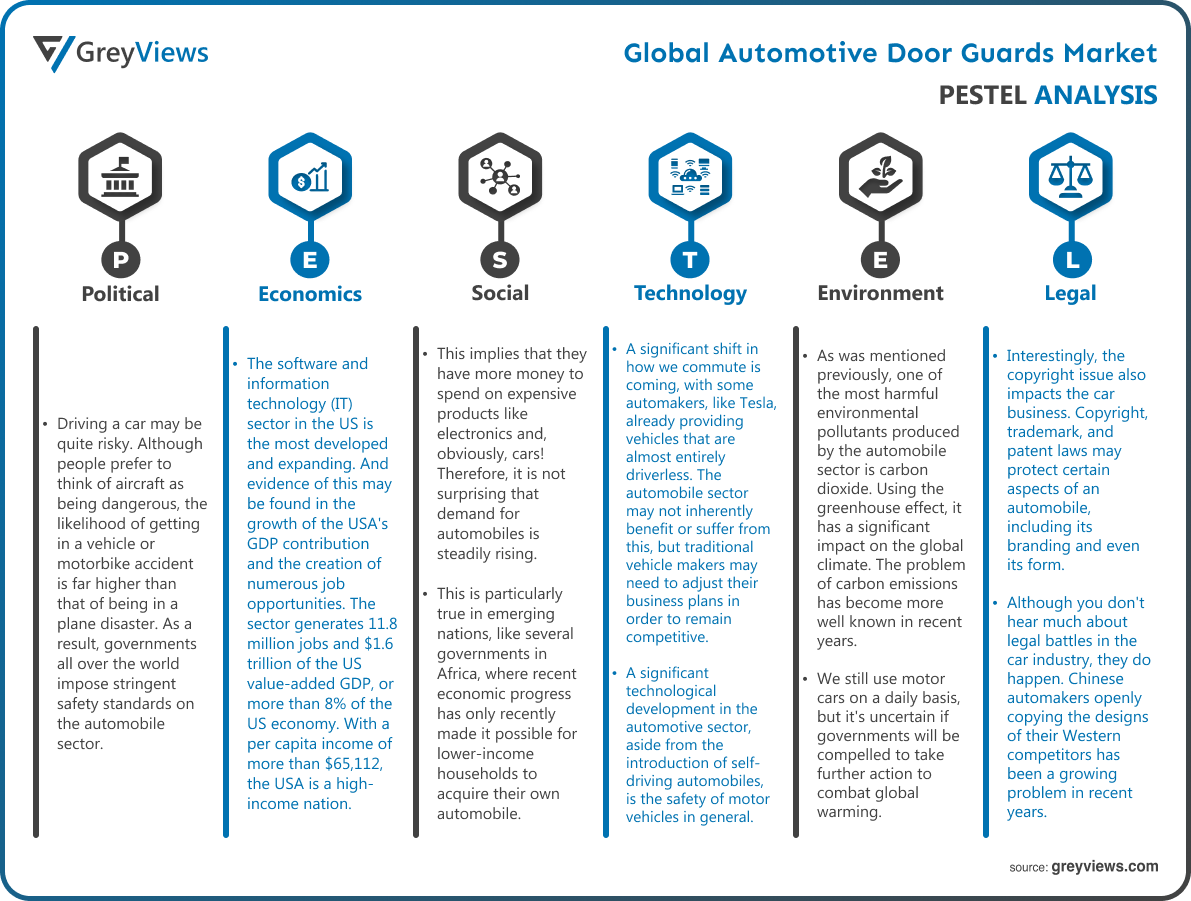

Political Factors- Driving a car may be quite risky. Although people prefer to think of aircraft as being dangerous, the likelihood of getting in a vehicle or motorbike accident is far higher than that of being in a plane disaster. As a result, governments all over the world impose stringent safety standards on the automobile sector. These laws not only set down particular standards for the construction of motor vehicles, such as seatbelts to guarantee passenger safety, but they also have an impact on those who operate them. This makes it more challenging to start a new company in the automotive industry, assisting established brands in keeping their market share.

Economical Factors- The software and information technology (IT) sector in the US is the most developed and expanding. And evidence of this may be found in the growth of the USA's GDP contribution and the creation of numerous job opportunities. The sector generates 11.8 million jobs and $1.6 trillion of the US value-added GDP, or more than 8% of the US economy. With a per capita income of more than $65,112, the USA is a high-income nation. The American economy is capitalist, or you might say market-based. The global economy exposes the US economy to more external shocks. A slowdown in the economies of Europe or Asia has a greater impact on the US economy. For instance, the Indian IT industry depends heavily on foreign clients, particularly the USA, for more than 70% of its revenue; therefore, changes in the exchange rate can have a significant impact on the performance of the IT industry as well as other sectors. The USA's inflation rate in 2019 was 2.3%, which is 0.4% higher than the inflation rate in 2018, which was 1.9%. The majority of the physical and human resources needed for the information and technology sector are readily available because the USA is a developed country. Infrastructure refers to all of the hardware and networking tools required to maintain an IT operation. The majority of empirical investigations have come to the conclusion that greater use of information and technology can boost GDP, productivity, and employment.

Social Factor- Globally speaking, people are making an increasing amount of money each year. This implies that they have more money to spend on expensive products like electronics and, obviously, cars! Therefore, it is not surprising that demand for automobiles is steadily rising. This is particularly true in emerging nations, like several governments in Africa, where recent economic progress has only recently made it possible for lower-income households to acquire their own automobile. In the end, more automobiles will be sold as a result of the rising demand for motor vehicles, boosting profits for those working in the sector.

Technological Factors- The development of self-driving technology is without a doubt the most significant technological change to affect the car industry. A significant shift in how we commute is coming, with some automakers, like Tesla, already providing vehicles that are almost entirely driverless. The automobile sector may not inherently benefit or suffer from this, but traditional vehicle makers may need to adjust their business plans in order to remain competitive.A significant technological development in the automotive sector, aside from the introduction of self-driving automobiles, is the safety of motor vehicles in general. Wearing seat belts wasn't made mandatory until the 1980s, and lower-end automakers didn't start installing airbags in all of their vehicles until the early 2000s. Industry-wide standards are rising, and the underlying technology is as well. Recently, automakers have started equipping their vehicles with emergency brake assist systems, greatly reducing the possibility of frontal collisions.

Environmental Factors- As was mentioned previously, one of the most harmful environmental pollutants produced by the automobile sector is carbon dioxide. Using the greenhouse effect, it has a significant impact on the global climate. The problem of carbon emissions has become more well known in recent years. We still use motor cars on a daily basis, but it's uncertain if governments will be compelled to take further action to combat global warming. This may mean outlawing the use or manufacturing of all motor vehicles or at the very least shifting to electric ones.

Legal Factors- Interestingly, the copyright issue also impacts the car business. Copyright, trademark, and patent laws may protect certain aspects of an automobile, including its branding and even its form. Although you don't hear much about legal battles in the car industry, they do happen. Chinese automakers openly copying the designs of their Western competitors has been a growing problem in recent years. For instance, there has been significant contention over some suspiciously identical Rolls Royce Phantom replicas made by the Chinese company Geely. Although the overall impact of this copying on the sector is dangerous.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Material Type

- 3.2. Market Attractiveness Analysis By Interior Application

- 3.3. Market Attractiveness Analysis By Exterior Application

- 3.4. Market Attractiveness Analysis By Vehicle Type

- 3.5. Market Attractiveness Analysis By End-user

- 3.6. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. The Demand for Comfort & Luxury in Cars and the Increased Car production

- 3. Restraints

- 3.1. Expensive Replacement Cost

- 4. Opportunities

- 4.1. The Demand for Lightweight Components

- 5. Challenges

- 5.1. Spend more for hardware

- Global Automotive Door Guards Market Analysis and Projection, By Material Type

- 1. Segment Overview

- 2. Acrylonitrile Butadiene Styrene

- 3. Polypropylene

- 4. Polyoxymethylene

- 5. Thermoplastic Elastomer

- 6. Others

- Global Automotive Door Guards Market Analysis and Projection, By Interior Application

- 1. Segment Overview

- 2. Dashboard

- 3. Door panel

- 4. Others

- Global Automotive Door Guards Market Analysis and Projection, By Exterior Application

- 1. Segment Overview

- 2. Bumpers

- 3. Door & window seals

- 4. Others

- Global Automotive Door Guards Market Analysis and Projection, By Vehicle Type

- 1. Segment Overview

- 2. ICE Passenger Vehicle

- 3. ICE Commercial Vehicle

- 4. Battery Electric Vehicle

- 5. Hybrid Electric Vehicle

- 6. Plug-in Hybrid Electric Vehicle

- Global Automotive Door Guards Market Analysis and Projection, By End-user

- Segment Overview

- Original Equipment Manufacturers

- Aftermarket

- Global Automotive Door Guards Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- South America

- 5.1. Brazil

- Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Automotive Door Guards Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Automotive Door Guards Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- KIRCHHOFF Group

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- H-ONE

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- GNS America

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Benteler International AG

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- KVA STAINLESS

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Shiloh Industries

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Gestamp

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- IFB Industries

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Sango

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- TOYOTA

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- KIRCHHOFF Group

List of Table

- Global Automotive Door Guards Market, By Material Type, 2022–2030 (USD Million)

- Global Acrylonitrile Butadiene Styrene, Automotive Door Guards Market, By Region, 2022–2030 (USD Million)

- Global Polypropylene, Automotive Door Guards Market, By Region, 2022–2030 (USD Million)

- Global Polyoxymethylene, Automotive Door Guards Market, By Region, 2022–2030 (USD Million)

- Global Thermoplastic Elastomer, Automotive Door Guards Market, By Region, 2022–2030 (USD Million)

- Global Others, Automotive Door Guards Market, By Region, 2022–2030 (USD Million)

- Global Automotive Door Guards Market, By Interior Application, 2022–2030 (USD Million)

- Global Dashboard, Automotive Door Guards Market, By Region, 2022–2030 (USD Million)

- Global Door panel, Automotive Door Guards Market, By Region, 2022–2030 (USD Million)

- Global Others, Automotive Door Guards Market, By Region, 2022–2030 (USD Million)

- Global Automotive Door Guards Market, By Exterior Application, 2022–2030 (USD Million)

- Global Bumpers, Automotive Door Guards Market, By Region, 2022–2030 (USD Million)

- Global Door & window seals, Automotive Door Guards Market, By Region, 2022–2030 (USD Million)

- Global Others, Automotive Door Guards Market, By Region, 2022–2030 (USD Million)

- Global Automotive Door Guards Market, By Vehicle Type, 2022–2030 (USD Million)

- Global ICE Passenger Vehicle, Automotive Door Guards Market, By Region, 2022–2030 (USD Million)

- Global ICE Commercial Vehicle, Automotive Door Guards Market, By Region, 2022–2030 (USD Million)

- Global Battery Electric Vehicle, Automotive Door Guards Market, By Region, 2022–2030 (USD Million)

- Global Hybrid Electric Vehicle, Automotive Door Guards Market, By Region, 2022–2030 (USD Million)

- Global Plug-in Hybrid Electric Vehicle, Automotive Door Guards Market, By Region, 2022–2030 (USD Million)

- Global Automotive Door Guards Market, By End-user, 2022–2030 (USD Million)

- Global Original Equipment Manufacturers, Automotive Door Guards Market, By Region, 2022–2030 (USD Million)

- Global Aftermarket, Automotive Door Guards Market, By Region, 2022–2030 (USD Million)

- Global Automotive Door Guards Market, By Region, 2022–2030 (USD Million)

- North America Automotive Door Guards Market, By Material Type, 2022–2030 (USD Million)

- North America Automotive Door Guards Market, By Interior Application, 2022–2030 (USD Million)

- North America Automotive Door Guards Market, By Exterior Application, 2022–2030 (USD Million)

- North America Automotive Door Guards Market, By Vehicle Type, 2022–2030 (USD Million)

- North America Automotive Door Guards Market, By End-user, 2022–2030 (USD Million)

- USA Automotive Door Guards Market, By Material Type, 2022–2030 (USD Million)

- USA Automotive Door Guards Market, By Interior Application, 2022–2030 (USD Million)

- USA Automotive Door Guards Market, By Exterior Application, 2022–2030 (USD Million)

- USA Automotive Door Guards Market, By Vehicle Type, 2022–2030 (USD Million)

- USA Automotive Door Guards Market, By End-user, 2022–2030 (USD Million)

- Canada Automotive Door Guards Market, By Material Type, 2022–2030 (USD Million)

- Canada Automotive Door Guards Market, By Interior Application, 2022–2030 (USD Million)

- Canada Automotive Door Guards Market, By Exterior Application, 2022–2030 (USD Million)

- Canada Automotive Door Guards Market, By Vehicle Type, 2022–2030 (USD Million)

- Canada Automotive Door Guards Market, By End-user, 2022–2030 (USD Million)

- Mexico Automotive Door Guards Market, By Material Type, 2022–2030 (USD Million)

- Mexico Automotive Door Guards Market, By Interior Application, 2022–2030 (USD Million)

- Mexico Automotive Door Guards Market, By Exterior Application, 2022–2030 (USD Million)

- Mexico Automotive Door Guards Market, By Vehicle Type, 2022–2030 (USD Million)

- Mexico Automotive Door Guards Market, By End-user, 2022–2030 (USD Million)

- Europe Automotive Door Guards Market, By Material Type, 2022–2030 (USD Million)

- Europe Automotive Door Guards Market, By Interior Application, 2022–2030 (USD Million)

- Europe Automotive Door Guards Market, By Exterior Application, 2022–2030 (USD Million)

- Europe Automotive Door Guards Market, By Vehicle Type, 2022–2030 (USD Million)

- Europe Automotive Door Guards Market, By End-user, 2022–2030 (USD Million)

- Germany Automotive Door Guards Market, By Material Type, 2022–2030 (USD Million)

- Germany Automotive Door Guards Market, By Interior Application, 2022–2030 (USD Million)

- Germany Automotive Door Guards Market, By Exterior Application, 2022–2030 (USD Million)

- Germany Automotive Door Guards Market, By Vehicle Type, 2022–2030 (USD Million)

- Germany Automotive Door Guards Market, By End-user, 2022–2030 (USD Million)

- France Automotive Door Guards Market, By Material Type, 2022–2030 (USD Million)

- France Automotive Door Guards Market, By Interior Application, 2022–2030 (USD Million)

- France Automotive Door Guards Market, By Exterior Application, 2022–2030 (USD Million)

- France Automotive Door Guards Market, By Vehicle Type, 2022–2030 (USD Million)

- France Automotive Door Guards Market, By End-user, 2022–2030 (USD Million)

- UK Automotive Door Guards Market, By Material Type, 2022–2030 (USD Million)

- UK Automotive Door Guards Market, By Interior Application, 2022–2030 (USD Million)

- UK Automotive Door Guards Market, By Exterior Application, 2022–2030 (USD Million)

- UK Automotive Door Guards Market, By Vehicle Type, 2022–2030 (USD Million)

- UK Automotive Door Guards Market, By End-user, 2022–2030 (USD Million)

- Italy Automotive Door Guards Market, By Material Type, 2022–2030 (USD Million)

- Italy Automotive Door Guards Market, By Interior Application, 2022–2030 (USD Million)

- Italy Automotive Door Guards Market, By Exterior Application, 2022–2030 (USD Million)

- Italy Automotive Door Guards Market, By Vehicle Type, 2022–2030 (USD Million)

- Italy Automotive Door Guards Market, By End-user, 2022–2030 (USD Million)

- Spain Automotive Door Guards Market, By Material Type, 2022–2030 (USD Million)

- Spain Automotive Door Guards Market, By Interior Application, 2022–2030 (USD Million)

- Spain Automotive Door Guards Market, By Exterior Application, 2022–2030 (USD Million)

- Spain Automotive Door Guards Market, By Vehicle Type, 2022–2030 (USD Million)

- Spain Automotive Door Guards Market, By End-user, 2022–2030 (USD Million)

- Asia Pacific Automotive Door Guards Market, By Material Type, 2022–2030 (USD Million)

- Asia Pacific Automotive Door Guards Market, By Interior Application, 2022–2030 (USD Million)

- Asia Pacific Automotive Door Guards Market, By Exterior Application, 2022–2030 (USD Million)

- Asia Pacific Automotive Door Guards Market, By Vehicle Type, 2022–2030 (USD Million)

- Asia Pacific Automotive Door Guards Market, By End-user, 2022–2030 (USD Million)

- Japan Automotive Door Guards Market, By Material Type, 2022–2030 (USD Million)

- Japan Automotive Door Guards Market, By Interior Application, 2022–2030 (USD Million)

- Japan Automotive Door Guards Market, By Exterior Application, 2022–2030 (USD Million)

- Japan Automotive Door Guards Market, By Vehicle Type, 2022–2030 (USD Million)

- Japan Automotive Door Guards Market, By End-user, 2022–2030 (USD Million)

- China Automotive Door Guards Market, By Material Type, 2022–2030 (USD Million)

- China Automotive Door Guards Market, By Interior Application, 2022–2030 (USD Million)

- China Automotive Door Guards Market, By Exterior Application, 2022–2030 (USD Million)

- China Automotive Door Guards Market, By Vehicle Type, 2022–2030 (USD Million)

- China Automotive Door Guards Market, By End-user, 2022–2030 (USD Million)

- India Automotive Door Guards Market, By Material Type, 2022–2030 (USD Million)

- India Automotive Door Guards Market, By Interior Application, 2022–2030 (USD Million)

- India Automotive Door Guards Market, By Exterior Application, 2022–2030 (USD Million)

- India Automotive Door Guards Market, By Vehicle Type, 2022–2030 (USD Million)

- India Automotive Door Guards Market, By End-user, 2022–2030 (USD Million)

- South America Automotive Door Guards Market, By Material Type, 2022–2030 (USD Million)

- South America Automotive Door Guards Market, By Interior Application, 2022–2030 (USD Million)

- South America Automotive Door Guards Market, By Exterior Application, 2022–2030 (USD Million)

- South America Automotive Door Guards Market, By Vehicle Type, 2022–2030 (USD Million)

- South America Automotive Door Guards Market, By End-user, 2022–2030 (USD Million)

- Brazil Automotive Door Guards Market, By Material Type, 2022–2030 (USD Million)

- Brazil Automotive Door Guards Market, By Interior Application, 2022–2030 (USD Million)

- Brazil Automotive Door Guards Market, By Exterior Application, 2022–2030 (USD Million)

- Brazil Automotive Door Guards Market, By Vehicle Type, 2022–2030 (USD Million)

- Brazil Automotive Door Guards Market, By End-user, 2022–2030 (USD Million)

- Middle East and Africa Automotive Door Guards Market, By Material Type, 2022–2030 (USD Million)

- Middle East and Africa Automotive Door Guards Market, By Interior Application, 2022–2030 (USD Million)

- Middle East and Africa Automotive Door Guards Market, By Exterior Application, 2022–2030 (USD Million)

- Middle East and Africa Automotive Door Guards Market, By Vehicle Type, 2022–2030 (USD Million)

- Middle East and Africa Automotive Door Guards Market, By End-user, 2022–2030 (USD Million)

- UAE Automotive Door Guards Market, By Material Type, 2022–2030 (USD Million)

- UAE Automotive Door Guards Market, By Interior Application, 2022–2030 (USD Million)

- UAE Automotive Door Guards Market, By Exterior Application, 2022–2030 (USD Million)

- UAE Automotive Door Guards Market, By Vehicle Type, 2022–2030 (USD Million)

- UAE Automotive Door Guards Market, By End-user, 2022–2030 (USD Million)

- South Africa Automotive Door Guards Market, By Material Type, 2022–2030 (USD Million)

- South Africa Automotive Door Guards Market, By Interior Application, 2022–2030 (USD Million)

- South Africa Automotive Door Guards Market, By Exterior Application, 2022–2030 (USD Million)

- South Africa Automotive Door Guards Market, By Vehicle Type, 2022–2030 (USD Million)

- South Africa Automotive Door Guards Market, By End-user, 2022–2030 (USD Million)

List of Figures

- Global Automotive Door Guards Market Segmentation

- Automotive Door Guards Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Automotive Door Guards Market Attractiveness Analysis By Material Type

- Global Automotive Door Guards Market Attractiveness Analysis By Interior Application

- Global Automotive Door Guards Market Attractiveness Analysis By Exterior Application

- Global Automotive Door Guards Market Attractiveness Analysis By Vehicle Type

- Global Automotive Door Guards Market Attractiveness Analysis By End-user

- Global Automotive Door Guards Market Attractiveness Analysis By Region

- Global Automotive Door Guards Market: Dynamics

- Global Automotive Door Guards Market Share By Material Type (2022 & 2030)

- Global Automotive Door Guards Market Share By Interior Application (2022 & 2030)

- Global Automotive Door Guards Market Share By Exterior Application (2022 & 2030)

- Global Automotive Door Guards Market Share By Vehicle Type (2022 & 2030)

- Global Automotive Door Guards Market Share By End-user (2022 & 2030)

- Global Automotive Door Guards Market Share by Regions (2022 & 2030)

- Global Automotive Door Guards Market Share by Company (2020)