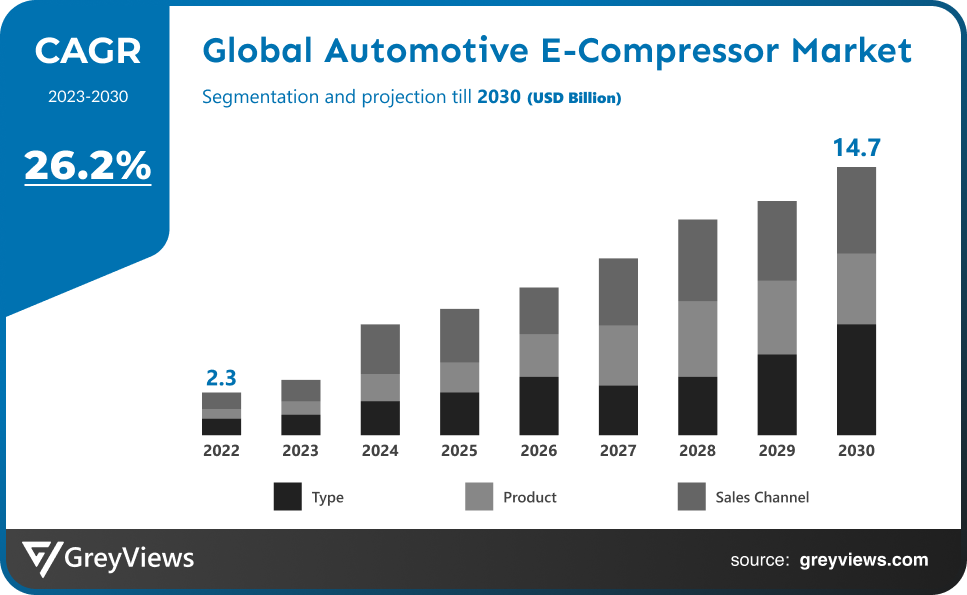

Automotive E-Compressor Market Size By Type (Electric Vehicles and Hybrid-Electric Vehicles), By Product (Swash, Scroll, Screw, Wobble and Others), By Sales Channel (OEM and Aftermarket), Regions, Segmentation, and Projection till 2030

CAGR: 26.2%Current Market Size: USD 2.3 BillionFastest Growing Region: Europe

Largest Market: APACProjection Time: 2023-2030Base Year: 2022

Global Automotive E-Compressor Market- Market Overview:

The global automotive e-compressor market is expected to grow from USD 2.3 billion in 2022 to USD 14.7 billion by 2030, at a CAGR of 26.2% during the Projection period 2023-2030. The growth of this market is mainly driven owing to the rising demand for electric vehicles and hybrid electric vehicles.

An automotive e-compressor is a tightly sealed compressor, which is equipped with its own motor, which transfers power to its motor through the compressor terminals. By preventing the leakage of refrigerant and transferring a large amount of energy from the battery to the air conditioning compressor, the compressor terminal is an important part of hybrid and electric vehicles. When the car battery in a non-electric vehicle is depleted, the alternator will recharge the battery, which powers the e-compressor. As well, an automotive e-compressor is more friendly because the AC system determines driving power based on the power supply voltage. Aside from the built-in drive and robust capability to adjust to load under strong cooling automatically, the automotive e-compressor also has other advantages. As a result of increasing consumer demand, automotive companies are developing technologically advanced compressors to improve quality, product life, and meet consumer expectations. In addition, the market is expected to be heavily influenced by the growth and popularity of HVAC systems, electric vehicles, and hybrid vehicles. E-compressors, which are equipped with a motor, are used in the automotive sector. In addition to improving fuel efficiency, the built-in motor can still operate even when the engine is off. The air conditioner can continue to operate comfortably even during idling stops.

Sample Request: - Global Automotive E-Compressor Market

Market Dynamics:

Drivers:

- Strict rules imposed by the government on vehicle emissions

Regulations on vehicle efficiency and emissions are a key driver of market growth, and emission models are legally required to regulate air pollutants released into the environment. A vehicle emission performance standard specifies the limits beyond which emissions control technology can operate. In addition, traditional belt-driven compressors increase the engine's workload, resulting in reduced efficiency and performance, which influences the market's growth.

Restraints:

- Reduced automotive production

In 2020, the automobile sector was affected by COVID-19 outbreaks in Wuhan, China, and its exponential spread worldwide. The automotive production in Q1 2020 was 17,860 million units, a 23.07% decline from Q1 2019. Also, the temporary shutdown of manufacturing facilities and disruptions in global supply chains have caused strong headwinds for automotive production in a number of countries.

Opportunities:

- Rising competition among the market players

An important factor driving the automotive e-compressor market is the lucrative presence of industry contributors globally. The recent improvement in e-vehicles and the use of air conditioners in these automobiles further boost the market's growth during the Projection period. Additionally, the increasing competition among industry players creates an opportunity for the market to grow.

Challenges:

- High maintenance and initial cost

As a result of the enormous initial and maintenance costs, the electric HVAC compressor market is stifled. Furthermore, the installation of electric HVAC compressors requires heavy-duty electrical wiring, which increases the cost of the whole system. In addition, electric compressor repairs & maintenance are complex tasks that require optimum levels of expertise, so they are more costly.

Segmentation Analysis:

The global automotive e-compressor market has been segmented based on type, security, application, and region.

By Type

The type segment includes electric vehicles and hybrid-electric vehicles. The hybrid electric vehicles segment led the largest share of the automotive e-compressor market with a market share of around 59.1% in 2022. Hybrid electric vehicles dominated the 2021 market because they offer a dual-fuel alternative. In addition, the segment is experiencing growth due to the type of advantages such as reduced operational and maintenance costs and less pollution. As a result of stringent fuel laws & tax incentives, electric vehicles are expected to dominate the market by 2030.

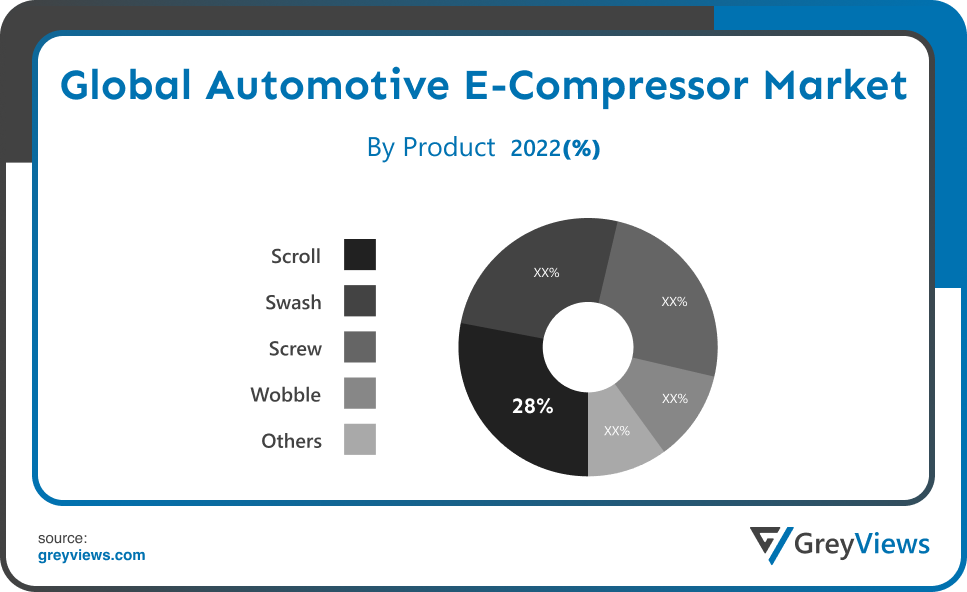

By Product

The product segment includes swash, scroll, screw, wobble and others. The scroll segment led the largest share of the automotive e-compressor market with a market share of around 28% in 2022. It is expected that the scroll e-compressor segment will have the largest share of the automotive e-compressor market during the Projection period. The growing demand for goods that improve acoustics and cool is driving the growth of this segment as automotive manufacturers focus on providing low-cost scroll e-compressors.

By Sales Channel

The sales channel segment includes aftermarket and OEM. The OEM segment led the largest share of the automotive e-compressor market with a market share of around 58.9% in 2022. Rising production of e-vehicles and hybrid vehicles led to the OEM sales channel segment dominating the market in 2021 with 55.13% of the market and $8.34 billion in market revenue.

Global Automotive E-Compressor Market- Sales Analysis.

The sale of automotive e-compressor expanded at a CAGR of 25.5% from 2016 to 2022.

An important driver of the global automotive e-compressor market is the growing adoption of electric vehicles and hybrid vehicles. As a result of fuel-saving benefits provided by automotive e-compressors, consumers will continue to prefer hybrid and electric vehicles, contributing to the market's growth during the Projection period.

In addition to the growing focus on lowering weight and concerns about reducing vehicle emissions, the automotive e-compressor market is driven by a growing demand for e-compressors. Additionally, automotive e-compressor manufacturers are developing compact components that allow for energy savings. Furthermore, the autonomous operation is the trend of market growth.

As government support for the automobile industry increases, market growth is accelerating. Among other factors driving the automotive E-compressor market growth are the increased adoption of hybrid and electric vehicles, the increase in research and development activities, and the increase in research and development activity.

Thus, owing to the aforementioned factors, the global automotive e-compressor market is expected to grow at a CAGR of 26.2% during the Projection period from 2023 to 2030.

By Regional Analysis:

The regions analyzed for the automotive e-compressor market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Asia Pacific region dominated the automotive e-compressor market and held a 38% share of the market revenue in 2022.

- The Asia Pacific region witnessed a major share. In recent years, ASEAN countries have been experiencing an increase in the sales of both passenger and commercial vehicles, which is expected to boost the Asia Pacific automotive e-compressor market over the Projection period. Due to rising passenger car demand, the region's automotive e-compressor market is expected to grow. An increase in the demand for hybrid powertrain systems in vehicles increased the manufacturing of new automobiles, and modifications and upgrades to existing vehicles are contributing to the region's growth.

- Europe is anticipated to experience significant growth during the predicted period. As a major producer of automobiles and vehicles, Europe has long been one. As a result of the presence of prominent automobile manufacturers, increasing R&D expenditures, and rising demand for electric vehicles, the market is growing rapidly. It is anticipated that Europe's automotive e-compressor market will grow as it has the presence of major OEMs and tier-1 suppliers with advanced research and development facilities.

Global Automotive E-Compressor Market - Country Analysis:

- Germany

Germany's automotive e-compressor market size was valued at USD 0.20 billion in 2022 and is expected to reach USD 1.29 billion by 2030, at a CAGR of 26.3% from 2023 to 2030.

According to market estimates, Germany will hold the largest share of the worldwide automotive e-compressor market. As the HEV sector in Germany is expanding rapidly, public-private investment initiatives will become more common in the future.

- China

China’s automotive e-compressor market size was valued at USD 0.22 billion in 2022 and is expected to reach USD 1.44 billion by 2030, at a CAGR of 26.5% from 2023 to 2030.

Competitiveness among industry players, favourable government policies that boost electric vehicles, and technological advancements propel the market growth during the Projection period. Market growth during the Projection period is also influenced by the increasing acceptance of environmentally friendly vehicles. Increasing efforts are being made to reduce the energy output and weight of traditional IC engine-driven compressors, driving growth.

- India

India's automotive e-compressor market size was valued at USD 0.17 billion in 2022 and is expected to reach USD 1.10 billion by 2030, at a CAGR of 26.4% from 2023 to 2030.

Growing demand for passenger cars will contribute to the automotive e-compressor market in this country, as well as an ever-increasing demand for hybrid powertrain systems in automobiles, increasing manufacturing of new cars, as well as upgrading and modifying existing cars.

Key Industry Players Analysis:

To increase their market position in the global automotive e-compressor market business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Hella

- WABCO

- Brose Fahrzeugteile GmbH & Co. Kg

- Robert Bosch GmbH

- Sanden Corporation

- Valeo S.A.

- Hanon Systems

- Calsonic Kansei Corporation

- Toyota Industries Corporation

- Mahle Behr GmbH

- Delphic Plc

Latest Development:

- In November 2021, A production site to assemble eco-friendly car parts in Korea was inaugurated by Hanon methods.

- In March 2021, With Toyota Industries partnering to test advanced autonomous tow tractors, All Nippon Airways Co., Ltd. will be introducing a new autonomous tow tractor that will have the capability of moving to higher locations, which will make operation between outdoor and indoor environments easier.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2022-2030 |

|

Base year |

2022 |

|

CAGR (%) |

26.2% |

|

Market Size |

2.3 billion in 2022 |

|

Projection period |

2023-2030 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Type, By Product, By Sales Channel, and By Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Hella, WABCO, Brose Fahrzeugteile GmbH & Co. Kg, Robert Bosch GmbH, Sanden Corporation, Valeo S.A., Hanon Systems, Calsonic Kansei Corporation, Toyota Industries Corporation, Mahle Behr GmbH, and Delphic Plc. |

|

By Type |

|

|

By Product |

|

|

By Sales Channel |

|

|

Regional scope |

|

Scope of the Report

Global Automotive E-Compressor Market by Type:

- Electric Vehicles

- Hybrid-Electric Vehicles

Global Automotive E-Compressor Market by Product:

- Swash

- Scroll

- Screw

- Wobble

- Others

Global Automotive E-Compressor Market by Sales Channel

- OEM

- Aftermarket

Global Automotive E-Compressor Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the expected market size of the automotive e-compressor market in 2030?

Global automotive e-compressor market is expected to reach USD 14.7 billion by 2030, at a CAGR of 26.2% from 2023 to 2030.

Which are the leading market players active in the automotive e-compressor market?

Leading players in the automotive e-compressor market are Hella, WABCO, Brose Fahrzeugteile GmbH & Co. Kg, Robert Bosch GmbH, Sanden Corporation, Valeo S.A., Hanon Systems, Calsonic Kansei Corporation, Toyota Industries Corporation, Mahle Behr GmbH, Delphic Plc among others.

What are the driving factors of the automotive e-compressor market?

Strict rules imposed by the government on vehicle emissions and rising competition among the market players.

Which region will witness more growth in the automotive e-compressor market?

Asia Pacific region will witness more growth in the automotive e-compressor market.

What is the type segment of the automotive e-compressor market?

Based on the type, the automotive e-compressor market is segmented into electric vehicles and hybrid-electric vehicles.

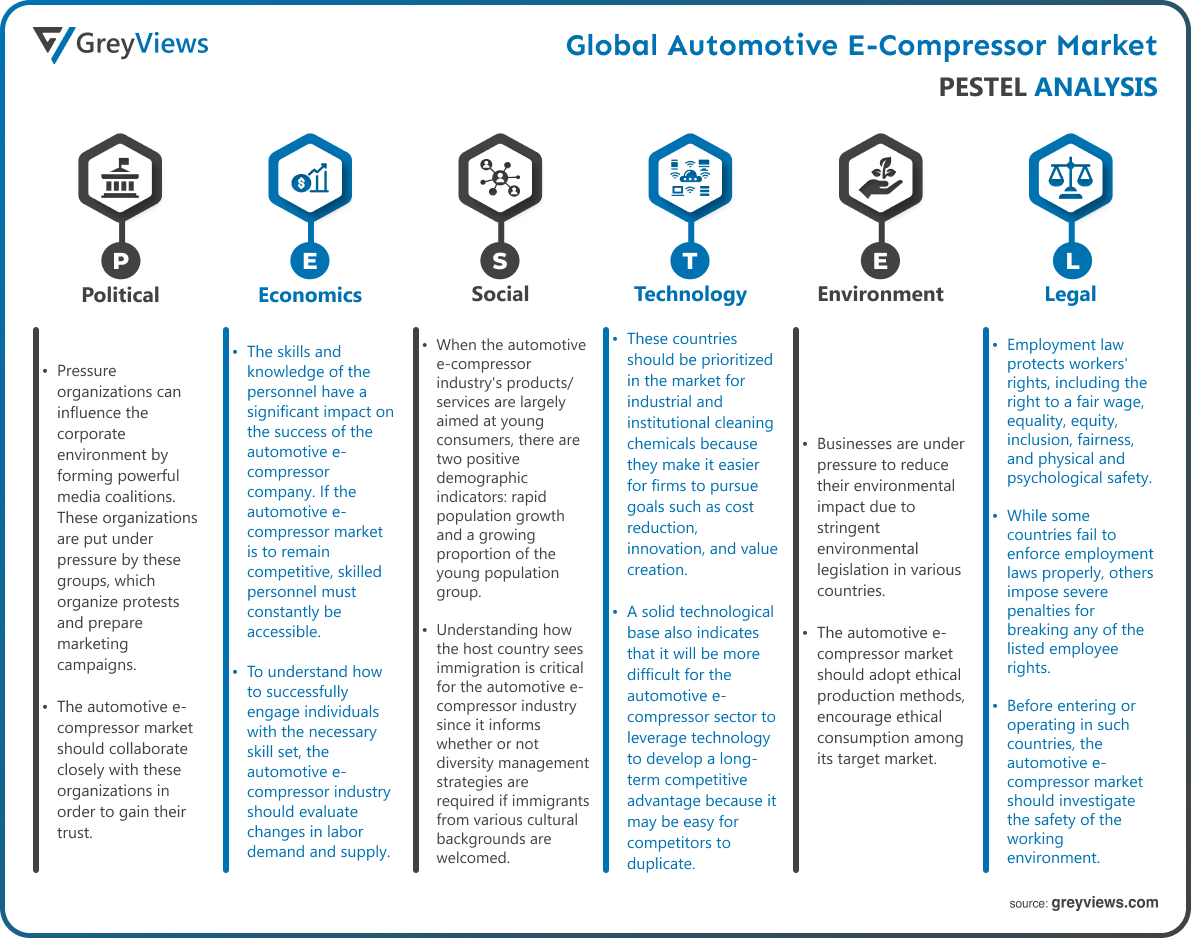

Political Factors- Pressure organizations can influence the corporate environment by forming powerful media coalitions. These organizations are put under pressure by these groups, which organize protests and prepare marketing campaigns. These pressure groups have the ability to influence government legislation, which can have an impact on the general business climate, so the automotive e-compressor market should keep a watch on them. The automotive e-compressor market should collaborate closely with these organizations in order to gain their trust. It should also invest in ethical and philanthropic projects in order to strengthen ties with the community.

Economic Factors- The skills and knowledge of the personnel have a significant impact on the success of the automotive e-compressor company. If the automotive e-compressor market is to remain competitive, skilled personnel must constantly be accessible. To understand how to successfully engage individuals with the necessary skill set, the automotive e-compressor industry should evaluate changes in labor demand and supply. As a result of a tight labor market and strong worker unions, the automotive e-compressor market firm may confront a number of challenges. It may, for example, exert pressure on the automotive e-compressor market to accept an exorbitant pay increase, or it could halt output by launching a strike.

Social Factors- When the automotive e-compressor industry's products/services are largely aimed at young consumers, there are two positive demographic indicators: rapid population growth and a growing proportion of the young population group. Understanding how the host country sees immigration is critical for the automotive e-compressor industry since it informs whether or not diversity management strategies are required if immigrants from various cultural backgrounds are welcomed. To encourage inclusiveness and diversity, the automotive e-compressor industry's marketing strategies should be revised. A positive outlook on migration also demonstrates how simple it is for enterprises in the automotive e-compressor sector to hire people from varied cultural backgrounds.

Technological Factors- These countries should be prioritized in the market for industrial and institutional cleaning chemicals because they make it easier for firms to pursue goals such as cost reduction, innovation, and value creation. A solid technological base also indicates that it will be more difficult for the automotive e-compressor sector to leverage technology to develop a long-term competitive advantage because it may be easy for competitors to duplicate. By making the right technology investments, the automotive e-compressor sector may increase customer satisfaction, increase operational efficiency, and distinguish itself as an innovative firm.

Environmental Factors- Businesses are under pressure to reduce their environmental impact due to stringent environmental legislation in various countries. In response, the automotive e-compressor market should adopt ethical production methods, encourage ethical consumption among its target market, work to improve its brand's sustainability reputation, and ensure full compliance with local and international environmental laws, or face harsh, reputation-damaging criticism from relevant stakeholders.

Legal Factors- Employment law protects workers' rights, including the right to a fair wage, equality, equity, inclusion, fairness, and physical and psychological safety. While some countries fail to enforce employment laws properly, others impose severe penalties for breaking any of the listed employee rights. Before entering or operating in such countries, the automotive e-compressor market should investigate the safety of the working environment. To prevent both direct and indirect discrimination, the proper mechanisms must be in place. Employer brand recognition in the automotive e-compressor business can be improved by adequate adherence to employment rules, which are required for attracting and retaining top talent in the market.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Type

- 3.2. Market Attractiveness Analysis By Product

- 3.3. Market Attractiveness Analysis By Sales Channel

- 3.4. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Strict rules imposed by the government on vehicle emissions

- 3. Restraints

- 3.1. Reduced automotive production

- 4. Opportunities

- 4.1. Rising competition among the market players

- 5. Challenges

- 5.1. High maintenance and initial cost

- Global Automotive E-Compressor Market Analysis and Projection, By Type

- 1. Segment Overview

- 2. Electric Vehicles

- 3. Hybrid-Electric Vehicles

- Global Automotive E-Compressor Market Analysis and Projection, By Product

- 1. Segment Overview

- 2. Swash

- 3. Scroll

- 4. Screw

- 5. Wobble

- 6. Others

- Global Automotive E-Compressor Market Analysis and Projection, By Sales Channel

- 1. Segment Overview

- 2. OEM

- 3. Aftermarket

- Global Automotive E-Compressor Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Automotive E-Compressor Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Automotive E-Compressor Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Technology Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Hella

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Technology Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- WABCO

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Technology Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Brose Fahrzeugteile GmbH & Co. Kg

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Technology Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Robert Bosch GmbH

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Technology Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Sanden Corporation

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Technology Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Valeo S.A.

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Technology Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Hanon Systems

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Technology Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Calsonic Kansei Corporation

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Technology Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Toyota Industries Corporation

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Technology Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Mahle Behr GmbH

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technology Portfolio

- Recent Developments

- SWOT Analysis

- Delphic Plc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technology Portfolio

- Recent Developments

- SWOT Analysis

- Hella

List of Table

- Global Automotive E-Compressor Market, By Type, 2023–2030 (USD Billion)

- Global Electric Vehicles, Automotive E-Compressor Market, By Region, 2023–2030 (USD Billion)

- Global Hybrid-Electric Vehicles, Automotive E-Compressor Market, By Region, 2023–2030 (USD Billion)

- Global Automotive E-Compressor Market, By Product, 2023–2030 (USD Billion)

- Global Swash, Automotive E-Compressor Market, By Region, 2023–2030 (USD Billion)

- Global Scroll, Automotive E-Compressor Market, By Region, 2023–2030 (USD Billion)

- Global Screw, Automotive E-Compressor Market, By Region, 2023–2030 (USD Billion)

- Global Wobble, Automotive E-Compressor Market, By Region, 2023–2030 (USD Billion)

- Global Others, Automotive E-Compressor Market, By Region, 2023–2030 (USD Billion)

- Global Automotive E-Compressor Market, By Sales Channel, 2023–2030 (USD Billion)

- Global OEM, Automotive E-Compressor Market, By Region, 2023–2030 (USD Billion)

- Global Aftermarket, Automotive E-Compressor Market, By Region, 2023–2030 (USD Billion)

- Global Automotive E-Compressor Market, By Region, 2023–2030 (USD Billion)

- North America Automotive E-Compressor Market, By Type, 2023–2030 (USD Billion)

- North America Automotive E-Compressor Market, By Product, 2023–2030 (USD Billion)

- North America Automotive E-Compressor Market, By Sales Channel, 2023–2030 (USD Billion)

- USA Automotive E-Compressor Market, By Type, 2023–2030 (USD Billion)

- USA Automotive E-Compressor Market, By Product, 2023–2030 (USD Billion)

- USA Automotive E-Compressor Market, By Sales Channel, 2023–2030 (USD Billion)

- Canada Automotive E-Compressor Market, By Type, 2023–2030 (USD Billion)

- Canada Automotive E-Compressor Market, By Product, 2023–2030 (USD Billion)

- Canada Automotive E-Compressor Market, By Sales Channel, 2023–2030 (USD Billion)

- Mexico Automotive E-Compressor Market, By Type, 2023–2030 (USD Billion)

- Mexico Automotive E-Compressor Market, By Product, 2023–2030 (USD Billion)

- Mexico Automotive E-Compressor Market, By Sales Channel, 2023–2030 (USD Billion)

- Europe Automotive E-Compressor Market, By Type, 2023–2030 (USD Billion)

- Europe Automotive E-Compressor Market, By Product, 2023–2030 (USD Billion)

- Europe Automotive E-Compressor Market, By Sales Channel, 2023–2030 (USD Billion)

- Germany Automotive E-Compressor Market, By Type, 2023–2030 (USD Billion)

- Germany Automotive E-Compressor Market, By Product, 2023–2030 (USD Billion)

- Germany Automotive E-Compressor Market, By Sales Channel, 2023–2030 (USD Billion)

- France Automotive E-Compressor Market, By Type, 2023–2030 (USD Billion)

- France Automotive E-Compressor Market, By Product, 2023–2030 (USD Billion)

- France Automotive E-Compressor Market, By Sales Channel, 2023–2030 (USD Billion)

- UK Automotive E-Compressor Market, By Type, 2023–2030 (USD Billion)

- UK Automotive E-Compressor Market, By Product, 2023–2030 (USD Billion)

- UK Automotive E-Compressor Market, By Sales Channel, 2023–2030 (USD Billion)

- Italy Automotive E-Compressor Market, By Type, 2023–2030 (USD Billion)

- Italy Automotive E-Compressor Market, By Product, 2023–2030 (USD Billion)

- Italy Automotive E-Compressor Market, By Sales Channel, 2023–2030 (USD Billion)

- Spain Automotive E-Compressor Market, By Type, 2023–2030 (USD Billion)

- Spain Automotive E-Compressor Market, By Product, 2023–2030 (USD Billion)

- Spain Automotive E-Compressor Market, By Sales Channel, 2023–2030 (USD Billion)

- Asia Pacific Automotive E-Compressor Market, By Type, 2023–2030 (USD Billion)

- Asia Pacific Automotive E-Compressor Market, By Product, 2023–2030 (USD Billion)

- Asia Pacific Automotive E-Compressor Market, By Sales Channel, 2023–2030 (USD Billion)

- Japan Automotive E-Compressor Market, By Type, 2023–2030 (USD Billion)

- Japan Automotive E-Compressor Market, By Product, 2023–2030 (USD Billion)

- Japan Automotive E-Compressor Market, By Sales Channel, 2023–2030 (USD Billion)

- China Automotive E-Compressor Market, By Type, 2023–2030 (USD Billion)

- China Automotive E-Compressor Market, By Product, 2023–2030 (USD Billion)

- China Automotive E-Compressor Market, By Sales Channel, 2023–2030 (USD Billion)

- India Automotive E-Compressor Market, By Type, 2023–2030 (USD Billion)

- India Automotive E-Compressor Market, By Product, 2023–2030 (USD Billion)

- India Automotive E-Compressor Market, By Sales Channel, 2023–2030 (USD Billion)

- South America Automotive E-Compressor Market, By Type, 2023–2030 (USD Billion)

- South America Automotive E-Compressor Market, By Product, 2023–2030 (USD Billion)

- South America Automotive E-Compressor Market, By Sales Channel, 2023–2030 (USD Billion)

- Brazil Automotive E-Compressor Market, By Type, 2023–2030 (USD Billion)

- Brazil Automotive E-Compressor Market, By Product, 2023–2030 (USD Billion)

- Brazil Automotive E-Compressor Market, By Sales Channel, 2023–2030 (USD Billion)

- Middle East and Africa Automotive E-Compressor Market, By Type, 2023–2030 (USD Billion)

- Middle East and Africa Automotive E-Compressor Market, By Product, 2023–2030 (USD Billion)

- Middle East and Africa Automotive E-Compressor Market, By Sales Channel, 2023–2030 (USD Billion)

- UAE Automotive E-Compressor Market, By Type, 2023–2030 (USD Billion)

- UAE Automotive E-Compressor Market, By Product, 2023–2030 (USD Billion)

- UAE Automotive E-Compressor Market, By Sales Channel, 2023–2030 (USD Billion)

- South Africa Automotive E-Compressor Market, By Type, 2023–2030 (USD Billion)

- South Africa Automotive E-Compressor Market, By Product, 2023–2030 (USD Billion)

- South Africa Automotive E-Compressor Market, By Sales Channel, 2023–2030 (USD Billion)

List of Figures

- Global Automotive E-Compressor Market Segmentation

- Automotive E-Compressor Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Automotive E-Compressor Market Attractiveness Analysis By Type

- Global Automotive E-Compressor Market Attractiveness Analysis By Product

- Global Automotive E-Compressor Market Attractiveness Analysis By Sales Channel

- Global Automotive E-Compressor Market Attractiveness Analysis By Region

- Global Automotive E-Compressor Market: Dynamics

- Global Automotive E-Compressor Market Share By Type (2023 & 2030)

- Global Automotive E-Compressor Market Share By Product (2023 & 2030)

- Global Automotive E-Compressor Market Share By Sales Channel (2023 & 2030)

- Global Automotive E-Compressor Market Share by Regions (2023 & 2030)

- Global Automotive E-Compressor Market Share by Company (2021)