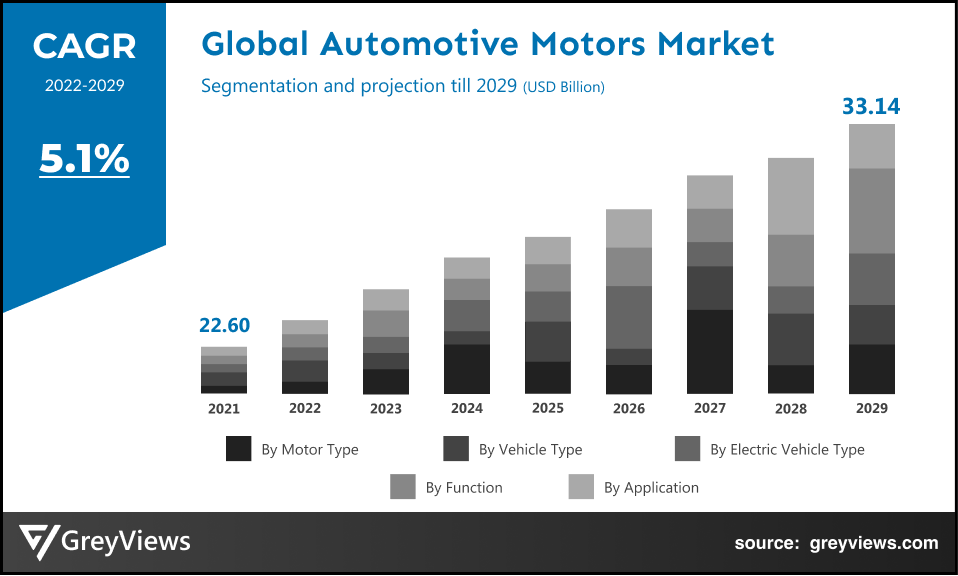

Automotive Motors Market Size by Motor Type (Brushed Motors, Brushless Motors, and Stepper Motors), Vehicle Type (Passenger Car, Light Commercial Vehicle, and Heavy Commercial Vehicle), Electric Vehicle Type (Hybrid Electric Vehicle (HEV), Plug-In Hybrid Electric Vehicle (PHEV), Battery Electric Vehicle (BEV), and Fuel Cell Electric Vehicle (FCEV)), Function (Performance Motors, Comfort Motors, and Safety Motors), Application (Alternator, ETC, Electric parking brake, Sunroof motor, Fuel pump motor, ECM, Wiper motor, Engine cooling fan, HVAC, VVT, EGR, Starter motor, Anti-lock brake system, EPS, PLG, and Others), Regions, Segmentation, and Projection till 2029

CAGR: 5.1%Current Market Size: USD 22.60 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Automotive Motors- Market Overview

The global Automotive Motors market is expected to grow from USD 22.60 billion in 2021 to USD 33.14 billion by 2029, at a CAGR of 5.1% during the Projection period 2022-2029. This growth of the automotive motors market is significantly driven by an upsurge in demand for low emission commuting of ICE vehicles and increasing spending on comfort and safety features in automotive.

An electric motor is an electrical machine that helps in the conversion of electrical energy into mechanical energy. Such motors have become an essential part of a vehicle to smoothly perform operations involving continuous rotational motion. The electric motors used in automobiles should have characteristics such as high-power density, high starting torque, and enhanced efficiency. Also, there are increasing applications of speed or torque-controlled motors in automotive due to the need for improved fuel economy along with the demand for vehicles with more convenience and comfort.

The applications of the automotive motor include power steering motors, power window motors, battery cooling fans, engine cooling fans, seat cooling fans, wiper systems, and others. Furthermore, various types of application-specific motors are used in automotive. For instance, brushless DC (BLDC) motors are mainly preferred for automotive applications which demand long-term continuous duty cycles.

Request Sample: - Automotive Motors Market

Market Dynamics:

Drivers:

- Upsurge in demand for convenience and safety in vehicles

In present times, the continuous developments in technology have enabled the rising focus of automobile manufacturers on the implementation of automotive motors for different systems in the vehicle. These systems include a power steering system, anti-lock braking system, and climate control system among others. In addition, the automotive motor is a prominent part of ABS, ESC, and AEB systems. Furthermore, convenience and safety features are not only limited to premium vehicles but are also being provided in entry-level and mid-level vehicles. Hence, demand for convenience and safety features in vehicles has driven the growth of the global automotive motor market.

- Ongoing product development trends in the global automotive motors industry

Automotive motors directly convert electric power into movement which makes them significantly efficient as compared with conventional cars. Moreover, electric motors convert more than 85% of electrical energy into motion or mechanical energy as compared with less than 40% for gas combustion. Hence, there is significant demand for efficient automotive motors, which has led to the product development trend. For instance, in March 2022, Johnson Electric, a provider of motors, actuators, and motion subsystems launched the ECI-043 brushless DC motor platform. This launch is aimed at providing enhanced reliability along with best-in-class performance.

On the other hand, some regional and country-level players are also investing heavily to expand their product portfolio and enhance their sales. For instance, in February 2022, Valeo, Renault, and Valeo Siemens eAutomotive signed a memorandum of understanding (MoU) for the co-development, design, and manufacture of a new-generation automotive electric motor.

Restraints:

- Increased weight of the vehicle due to automotive motor

The rising number of automotive manufacturers are investing in the incorporation of motors; however, the in-wheel motor technology leads to increased unsprung weight, which can hamper ride comfort. In electric motors, both the copper and iron losses are reduced by increasing the amount of copper and iron; however, this increases package size and the weight of the motor. This factor may hamper the growth of the market to some extent during the Projection period.

Opportunities:

- Demand for automotive motors in EV

In an EV, the electricity is stored in rechargeable batteries to power an electric motor for turning the wheels. Such vehicles are integrating different types of electric motors. For instance, Tesla used AC induction motors in its Model S; however, permanent-magnet DC motors have been used in its Model 3. The popularity of such electric vehicles equipped with highly efficient electric motors is a prominent trend in the global market. This is attributed to the emergence of a number of government incentives that encourage electric vehicle sales to safeguard the environment from carbon emissions. For instance, the governments are pushing the deployment of EV charging stations by offering capital subsidies along with the faster adoption and manufacturing of EVs. Hence, demand for automotive motors in EVs is expected to create lucrative growth opportunities for the market.

Challenges

- High costs associated with automobiles with advanced features

Vehicle manufacturers are continuing to invest in technologies such as electric vehicles, autonomous vehicles, and mobility services. Autonomous cars require high-tech infrastructure and hugely expensive lidar & radar systems. These high costs associated with such automobiles posed considerable challenges to the global automotive motors market.

Segmentation Analysis:

The global Automotive Motors market has been segmented based on motor type, vehicle type, electric vehicle type, function, vehicle drive type, application, and regions.

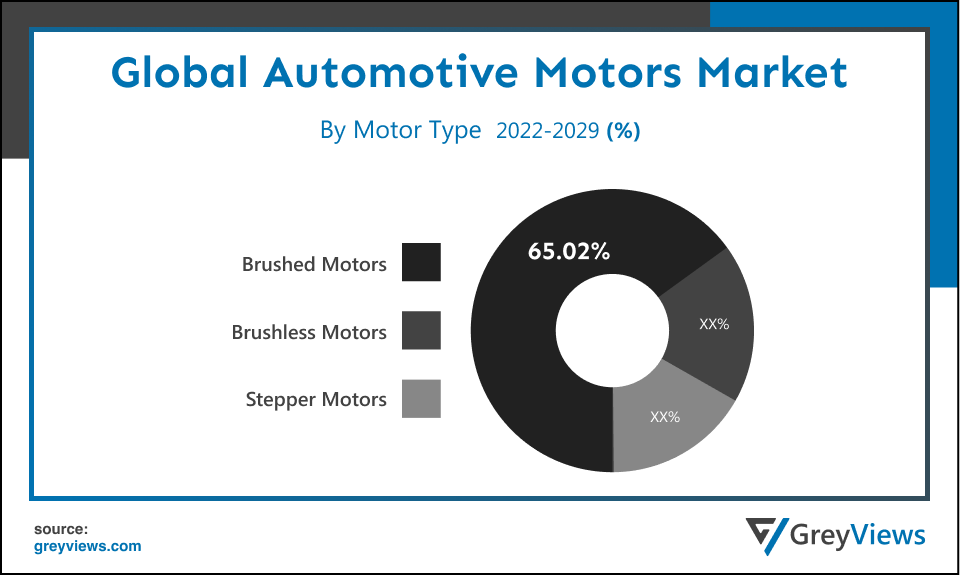

By Motor Type

The motor type segment includes brushed motors, brushless motors, and stepper motors. The brushed motors segment led the automotive motors market with a market share of around 65.02% in 2021. This is attributed to the significant use of brushed motors in various applications such as power seats and windshield wipers. In addition, it offers benefits such as low overall construction costs, simple and inexpensive controller, can often be rebuilt to extend its life and is ideal for extreme operating environments. Such features are further boosting the growth of this segment.

By Vehicle Type

The vehicle type segment includes passenger cars, light commercial vehicles, and heavy commercial vehicles. The passenger cars segment led the automotive motors market with a market share of around 56.1% in 2021. This is attributed to the fact that passenger cars are the most common mode of transportation in advanced countries. In addition, such vehicles are seeing huge demand from developing countries due to growing per capita income. Moreover, there is rising demand for fuel-efficient passenger vehicles. Such factors contribute to the growth of the global market.

By Electric Vehicle Type

The propulsion segment includes Hybrid Electric Vehicle (HEV), Plug-In Hybrid Electric Vehicle (PHEV), Battery Electric Vehicle (BEV), and Fuel Cell Electric Vehicle (FCEV)). The HEV segment led the automotive motors market with a market share of around 30.17% in 2021. HEVs are equipped with IC engines along with one or more electric motors. The growth of this segment is mainly driven by the rising need for high fuel economy along with low emissions as compared with conventional vehicles.

By Regional Analysis:

The regions analyzed for the Automotive Motors market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. The North American region dominated the Automotive Motors market and held a 42.1% share of the market revenue in 2021.

- The North American region has registered the highest value for the year 2021. The growth of this region is mainly driven by the easy availability of convenient financing options along with the significant emphasis by the governments on ensuring in-house automotive production. In addition, the region is seeing several developments in autonomous vehicle This factor is opportunistic for the growth of the automotive motors market.

- Asia-Pacific is expected to witness the highest growth rate during the Projection period. This region is home to OEMs such as Honda Motor Co., Ltd., Toyota Industries Corporation, Hyundai Motor Company, and Nissan Motor Corporation. Also, there is significant production and sales of electric motors in China and Japan. Such factors have driven the growth of the Asia-Pacific automotive motors market. In addition, rising investments by global battery manufacturers to expand their battery plant facilities in Asia-Pacific are anticipated to create lucrative growth opportunities for the market in the electric vehicle segment.

Global Automotive Motors Market- Country Analysis:

- Germany

Germany's automotive motors market size was valued at USD 2.49 billion in 2021 and is expected to reach USD 3.58 billion by 2029, at a CAGR of 4.9% from 2022 to 2029.

Germany is one of the leading nations in the mechanical engineering, manufacturing, automotive, and electrical industries. However, the huge investment in electric mobility in this country has boosted the growth of the automotive motors market. For instance, according to the German Association of the Automotive Industry statement in 2019, the car industry in this country was expected to invest about $68 billion in electric cars and automated driving by 2022.

Furthermore, according to the Capgemini “COVID -19 and the automotive consumer” study in 2020, interest in car ownership amongst under 35-year-olds is on the rise in the country. This trend of car ownership is creating demand for automotive motors.

- China

China Automotive Motors' market size was valued at USD 4.07 billion in 2021 and is expected to reach USD 5.82 billion by 2029, at a CAGR of 4.8% from 2022 to 2029.

China is the world’s largest light-vehicle manufacturer. It is the major producer and consumer of electric motors with over 28% of the volume share in the global market in 2021. The growth of the market in this country is mainly driven by increased EV sales. For instance, according to the China Association of Automobile Manufacturers (CAAM), electric vehicle (EV) sales in China account for more than 50% of new EV sales.

Furthermore, the country has seen a growing demand for luxury electric cars in recent years as it is a vastly populous nation and attracts significant investments from worldwide carmakers.

- India

India's automotive motors market size was valued at USD 1.13 billion in 2021 and is expected to reach USD 1.68 billion by 2029, at a CAGR of 5.3% from 2022 to 2029.

India is one of the strongest growing economies in Asia. The huge demand for passenger vehicles in this country is the major factor contributing to the growth of the automotive motor market. For instance, passenger vehicle sales in the country have crossed the 3-million-unit mark in the financial year 2022, a 12% year-on-year uptick as compared with the 2021 figures.

In addition, the emerging popularity of electric vehicles in this country is expected to create lucrative growth opportunities for the automotive motors market.

Key Industry Players Analysis:

To increase their market position in the global Automotive Motors business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Robert Bosch GmbH

- Denso

- BorgWarner

- ZF Group

- Continental AG

- Mitsubishi Electric Corporation

- Johnson Electric Holdings Ltd.

- Nidec Corporation

- MITSUBA Corporation

- BorgWarner Inc.

Latest Development:

- In April 2022, BorgWarner Inc. acquired Santroll Automotive Components, the manufacturer of hairpin and concentrated-winding technology eMotors. This acquisition is projected to enhance BorgWarner’s portfolio of in-light vehicle e-motors while enabling increased speed to market.

- In January 2022, ZF Group, the German auto component company introduced a new commercial vehicle (CV) solution, division. This business expansion strategy of ZF Commercial Vehicle Solutions (ZF CVS) is aimed at strengthening the commercial vehicle portfolio of the company.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

5.1% |

|

Market Size |

22.60 Billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Motor Type, Vehicle Type, Electric Vehicle Type, Function, Vehicle Drive Type, Application, and Regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Robert Bosch GmbH, Denso, BorgWarner, ZF Group, Continental AG, Mitsubishi Electric Corporation, Johnson Electric Holdings Ltd., Nidec Corporation, MITSUBA Corporation, and BorgWarner Inc. among others |

|

By Motor Type |

|

|

By Vehicle Type |

|

|

By Electric Vehicle Type |

|

|

By Function |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Automotive Motors Market by Motor Type:

- Brushed Motors

- Brushless Motors

- Stepper Motors

Global Automotive Motors Market by Vehicle Type:

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Global Automotive Motors Market by Electric Vehicle Type:

- Hybrid Electric Vehicle (HEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicle (FCEV)

Global Automotive Motors Market by Function:

- Performance Motors

- Comfort Motors

- Safety Motors

Global Automotive Motors Market by Application:

- Alternator

- ETC

- Electric parking brake

- Sun roof motor

- Fuel pump motor

- ECM

- Wiper motor

- Engine cooling fan

- HVAC

- VVT

- EGR

- Starter motor

- Anti-lock brake system

- EPS

- PLG

- Others

Global Automotive Motors Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market size of the Automotive Motors market?

Global Automotive Motors market is expected to grow from USD 22.60 billion in 2021 to USD 33.14 billion by 2029, at a CAGR of 5.1% during the Projection period 2022-2029.

Which regions dominate the Automotive Motors market?

North American region dominated the Automotive Motors market and held a 42.1% share of the market revenue in 2021

What is happening in Asia pacific Automotive Motors Market?

Asia-Pacific is expected to witness the highest growth rate during the Projection period. This region is home to OEMs such as Honda Motor Co., Ltd., Toyota Industries Corporation, Hyundai Motor Company, and Nissan Motor Corporation. Also, there is significant production and sales of electric motors in China and Japan. Such factors have driven the growth of the Asia-Pacific automotive motors market

How in Electric Vehicle Automotive Motor work?

In an EV, the electricity is stored in rechargeable batteries to power an electric motor for turning the wheels. Such vehicles are integrating different types of electric motors. For instance, Tesla used AC induction motors in its Model S; however, permanent-magnet DC motors have been used in its Model 3. The popularity of such electric vehicles equipped with highly efficient electric motors is a prominent trend in the global market

Which are the leading market players active in the Automotive Motors market?

Leading market players active in the global automotive motors market are Robert Bosch GmbH, Denso, BorgWarner, ZF Group, Continental AG, Mitsubishi Electric Corporation, Johnson Electric Holdings Ltd., Nidec Corporation, MITSUBA Corporation, and BorgWarner Inc. among others.

What are the opportunities in Automotive Motors market?

In an EV, the electricity is stored in rechargeable batteries to power an electric motor for turning the wheels. Such vehicles are integrating different types of electric motors. For instance, Tesla used AC induction motors in its Model S; however, permanent-magnet DC motors have been used in its Model 3. The popularity of such electric vehicles equipped with highly efficient electric motors is a prominent trend in the global market. This is attributed to the emergence of a number of government incentives that encourage electric vehicle sales to safeguard the environment from carbon emissions. For instance, the governments are pushing the deployment of EV charging stations by offering capital subsidies along with the faster adoption and manufacturing of EVs. Hence, demand for automotive motors in EVs is expected to create lucrative growth opportunities for the market.

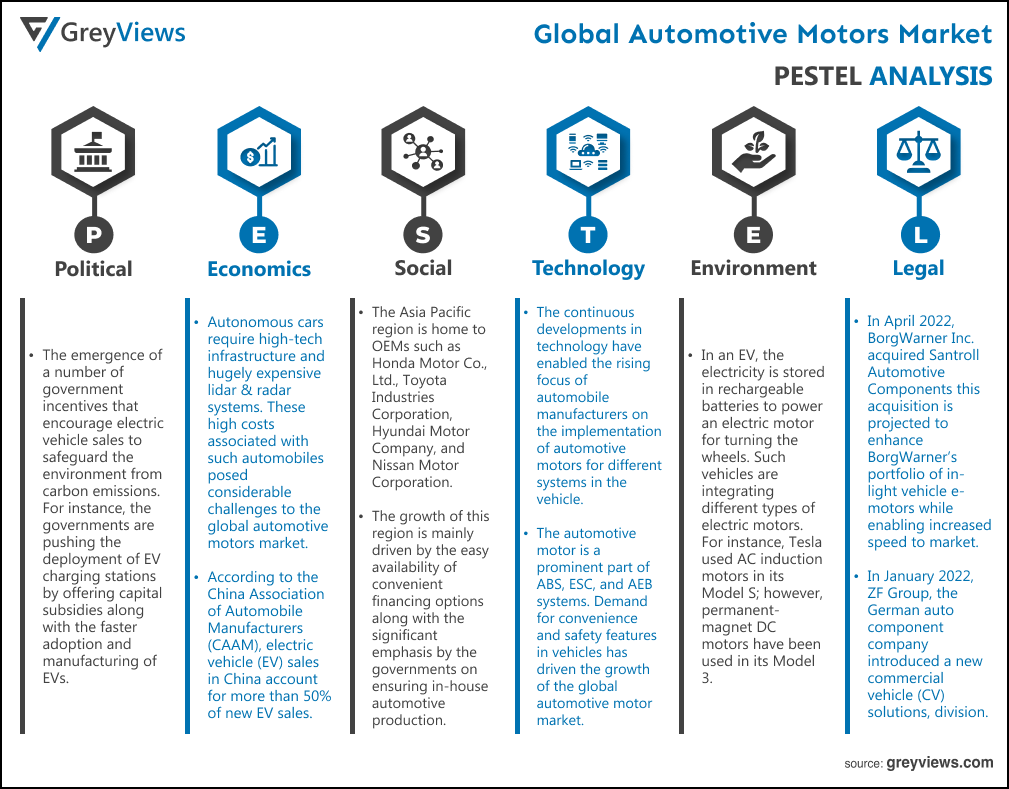

Political Factors- The emergence of a number of government incentives that encourage electric vehicle sales to safeguard the environment from carbon emissions. For instance, the governments are pushing the deployment of EV charging stations by offering capital subsidies along with the faster adoption and manufacturing of EVs.

Economical Factors- Vehicle manufacturers are continuing to invest in technologies such as electric vehicles, autonomous vehicles, and mobility services. Autonomous cars require high-tech infrastructure and hugely expensive lidar & radar systems. These high costs associated with such automobiles posed considerable challenges to the global automotive motors market. For instance, according to the China Association of Automobile Manufacturers (CAAM), electric vehicle (EV) sales in China account for more than 50% of new EV sales. Furthermore, the country has seen a growing demand for luxury electric cars in recent years as it is a vastly populous nation and attracts significant investments from worldwide carmakers.

Social Factor- The growth of this region is mainly driven by the easy availability of convenient financing options along with the significant emphasis by the governments on ensuring in-house automotive production. In addition, the region is seeing several developments in autonomous vehicle development. The Asia Pacific region is home to OEMs such as Honda Motor Co., Ltd., Toyota Industries Corporation, Hyundai Motor Company, and Nissan Motor Corporation. Also, there is significant production and sales of electric motors in China and Japan.

Technological Factors- the continuous developments in technology have enabled the rising focus of automobile manufacturers on the implementation of automotive motors for different systems in the vehicle. These systems include a power steering system, anti-lock braking system, and climate control system among others. In addition, the automotive motor is a prominent part of ABS, ESC, and AEB systems. Furthermore, convenience and safety features are not only limited to premium vehicles but are also being provided in entry-level and mid-level vehicles. Hence, demand for convenience and safety features in vehicles has driven the growth of the global automotive motor market.

Environmental Factors- In an EV, the electricity is stored in rechargeable batteries to power an electric motor for turning the wheels. Such vehicles are integrating different types of electric motors. For instance, Tesla used AC induction motors in its Model S; however, permanent-magnet DC motors have been used in its Model 3. The popularity of such electric vehicles equipped with highly efficient electric motors is a prominent trend in the global market.

Legal Factors- In April 2022, BorgWarner Inc. acquired Santroll Automotive Components, the manufacturer of hairpin and concentrated-winding technology eMotors. This acquisition is projected to enhance BorgWarner’s portfolio of in-light vehicle e-motors while enabling increased speed to market. In January 2022, ZF Group, the German auto component company introduced a new commercial vehicle (CV) solutions, division. This business expansion strategy of ZF Commercial Vehicle Solutions (ZF CVS) is aimed at strengthening the commercial vehicle portfolio of the company.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Motor Type

- Market Attractiveness Analysis By Vehicle Type

- Market Attractiveness Analysis By Electric Vehicle Type

- Market Attractiveness Analysis By Function

- Market Attractiveness Analysis By Application

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Upsurge in demand for convenience and safety in vehicles

- Ongoing product development trend in global automotive motors industry

- Restrains

- Increased weight of the vehicle due to automotive motor

- Opportunities

- Demand for automotive motors in EV

- Challenges

- High costs associated with the automobiles with advanced features

- Global Automotive Motors Market Analysis and Projection, By Motor Type

- Segment Overview

- Brushed Motors

- Brushless Motors

- Stepper Motors

- Global Automotive Motors Market Analysis and Projection, By Vehicle Type

- Segment Overview

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Global Automotive Motors Market Analysis and Projection, By Electric Vehicle Type

- Segment Overview

- Hybrid Electric Vehicle (HEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicle (FCEV)

- Global Automotive Motors Market Analysis and Projection, By Function

- Segment Overview

- Performance Motors

- Comfort Motors

- Safety Motors

- Global Automotive Motors Market Analysis and Projection, By Application

- Segment Overview

- Alternator

- ETC

- Electric parking break

- Sun roof motor

- Fuel pump motor

- ECM

- Wiper motor

- Engine cooling fan

- HVAC

- VVT

- EGR

- Starter motor

- Anti-lock brake system

- EPS

- PLG

- Others

- Global Automotive Motors Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Automotive Motors Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Automotive Motors Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Motor Type Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Robert Bosch GmbH

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Motor Type Portfolio

- Recent Developments

- SWOT Analysis

- Denso

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Motor Type Portfolio

- Recent Developments

- SWOT Analysis

- BorgWarner

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Motor Type Portfolio

- Recent Developments

- SWOT Analysis

- ZF Group

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Motor Type Portfolio

- Recent Developments

- SWOT Analysis

- Continental AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Motor Type Portfolio

- Recent Developments

- SWOT Analysis

- Mitsubishi Electric Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Motor Type Portfolio

- Recent Developments

- SWOT Analysis

- Johnson Electric Holdings Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Motor Type Portfolio

- Recent Developments

- SWOT Analysis

- Nidec Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Motor Type Portfolio

- Recent Developments

- SWOT Analysis

- MITSUBA Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Motor Type Portfolio

- Recent Developments

- SWOT Analysis

- BorgWarner Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Motor Type Portfolio

- Recent Developments

- SWOT Analysis

- Robert Bosch GmbH

List of Table

- Global Automotive Motors Market, By Motor Type, 2021–2029(USD Billion)

- Global Brushed Motors Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global Brushless Motors Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global Stepper Motors Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global Automotive Motors Market, By Vehicle Type, 2021–2029(USD Billion)

- Global Passenger Cars Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global Light Commercial Vehicle Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global Heavy Commercial Vehicle Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global Automotive Motors Market, By Electric Vehicle Type, 2021–2029(USD Billion)

- Global Hybrid Electric Vehicle (HEV) Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global Plug-In Hybrid Electric Vehicle (PHEV) Electric Vehicle Type Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global Battery Electric Vehicle (BEV) Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global Fuel Cell Electric Vehicle (FCEV) Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global Automotive Motors Market, By Function, 2021–2029(USD Billion)

- Global Performance Motors Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global Comfort Motors Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global Safety Motors Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global Automotive Motors Market, By Application, 2021–2029(USD Billion)

- Global Alternator Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global ETC Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global Electric parking break Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global Sun roof motor Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global Fuel pump motor Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global ECM Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global Wiper motor Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global Engine cooling fan Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global HVAC Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global VVT Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global EGR Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global Starter motor Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global Anti-lock brake system Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global EPS Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global PLG Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global Others Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global Automotive Motors Market, By Region, 2021–2029(USD Billion)

- Global Automotive Motors Market, By North America, 2021–2029(USD Billion)

- North America Automotive Motors Market, By Motor Type, 2021–2029(USD Billion)

- North America Automotive Motors Market, By Vehicle Type, 2021–2029(USD Billion)

- North America Automotive Motors Market, By Electric Vehicle Type, 2021–2029(USD Billion)

- North America Automotive Motors Market, By Function, 2021–2029(USD Billion)

- North America Automotive Motors Market, By Application, 2021–2029(USD Billion)

- USA Automotive Motors Market, By Motor Type, 2021–2029(USD Billion)

- USA Automotive Motors Market, By Vehicle Type, 2021–2029(USD Billion)

- USA Automotive Motors Market, By Electric Vehicle Type, 2021–2029(USD Billion)

- USA Automotive Motors Market, By Function, 2021–2029(USD Billion)

- USA Automotive Motors Market, By Application, 2021–2029(USD Billion)

- Canada Automotive Motors Market, By Motor Type, 2021–2029(USD Billion)

- Canada Automotive Motors Market, By Vehicle Type, 2021–2029(USD Billion)

- Canada Automotive Motors Market, By Electric Vehicle Type, 2021–2029(USD Billion)

- Canada Automotive Motors Market, By Function, 2021–2029(USD Billion)

- Canada Automotive Motors Market, By Application, 2021–2029(USD Billion)

- Mexico Automotive Motors Market, By Motor Type, 2021–2029(USD Billion)

- Mexico Automotive Motors Market, By Vehicle Type, 2021–2029(USD Billion)

- Mexico Automotive Motors Market, By Electric Vehicle Type, 2021–2029(USD Billion)

- Mexico Automotive Motors Market, By Function, 2021–2029(USD Billion)

- Mexico Automotive Motors Market, By Application, 2021–2029(USD Billion)

- Europe Automotive Motors Market, By Motor Type, 2021–2029(USD Billion)

- Europe Automotive Motors Market, By Vehicle Type, 2021–2029(USD Billion)

- Europe Automotive Motors Market, By Electric Vehicle Type, 2021–2029(USD Billion)

- Europe Automotive Motors Market, By Function, 2021–2029(USD Billion)

- Europe Automotive Motors Market, By Application, 2021–2029(USD Billion)

- Germany Automotive Motors Market, By Motor Type, 2021–2029(USD Billion)

- Germany Automotive Motors Market, By Vehicle Type, 2021–2029(USD Billion)

- Germany Automotive Motors Market, By Electric Vehicle Type, 2021–2029(USD Billion)

- Germany Automotive Motors Market, By Function, 2021–2029(USD Billion)

- Germany Automotive Motors Market, By Application, 2021–2029(USD Billion)

- France Automotive Motors Market, By Motor Type, 2021–2029(USD Billion)

- France Automotive Motors Market, By Vehicle Type, 2021–2029(USD Billion)

- France Automotive Motors Market, By Electric Vehicle Type, 2021–2029(USD Billion)

- France Automotive Motors Market, By Function, 2021–2029(USD Billion)

- France Automotive Motors Market, By Application, 2021–2029(USD Billion)

- UK Automotive Motors Market, By Motor Type, 2021–2029(USD Billion)

- UK Automotive Motors Market, By Vehicle Type, 2021–2029(USD Billion)

- UK Automotive Motors Market, By Electric Vehicle Type, 2021–2029(USD Billion)

- UK Automotive Motors Market, By Function, 2021–2029(USD Billion)

- UK Automotive Motors Market, By Application, 2021–2029(USD Billion)

- Italy Automotive Motors Market, By Motor Type, 2021–2029(USD Billion)

- Italy Automotive Motors Market, By Vehicle Type, 2021–2029(USD Billion)

- Italy Automotive Motors Market, By Electric Vehicle Type, 2021–2029(USD Billion)

- Italy Automotive Motors Market, By Function, 2021–2029(USD Billion)

- Italy Automotive Motors Market, By Application, 2021–2029(USD Billion)

- Spain Automotive Motors Market, By Motor Type, 2021–2029(USD Billion)

- Spain Automotive Motors Market, By Vehicle Type, 2021–2029(USD Billion)

- Spain Automotive Motors Market, By Electric Vehicle Type, 2021–2029(USD Billion)

- Spain Automotive Motors Market, By Function, 2021–2029(USD Billion)

- Spain Automotive Motors Market, By Application, 2021–2029(USD Billion)

- Spain Automotive Motors Market, By EV Charging Point Type, 2021–2029(USD Billion)

- Spain Automotive Motors Market, By Propulsion, 2021–2029(USD Billion)

- Asia Pacific Automotive Motors Market, By Motor Type, 2021–2029(USD Billion)

- Asia Pacific Automotive Motors Market, By Vehicle Type, 2021–2029(USD Billion)

- Asia Pacific Automotive Motors Market, By Electric Vehicle Type, 2021–2029(USD Billion)

- Asia Pacific Automotive Motors Market, By Function, 2021–2029(USD Billion)

- Asia Pacific Automotive Motors Market, By Application, 2021–2029(USD Billion)

- Japan Automotive Motors Market, By Motor Type, 2021–2029(USD Billion)

- Japan Automotive Motors Market, By Vehicle Type, 2021–2029(USD Billion)

- Japan Automotive Motors Market, By Electric Vehicle Type, 2021–2029(USD Billion)

- Japan Automotive Motors Market, By Function, 2021–2029(USD Billion)

- Japan Automotive Motors Market, By Application, 2021–2029(USD Billion)

- China Automotive Motors Market, By Motor Type, 2021–2029(USD Billion)

- China Automotive Motors Market, By Vehicle Type, 2021–2029(USD Billion)

- China Automotive Motors Market, By Electric Vehicle Type, 2021–2029(USD Billion)

- China Automotive Motors Market, By Function, 2021–2029(USD Billion)

- China Automotive Motors Market, By Application, 2021–2029(USD Billion)

- India Automotive Motors Market, By Motor Type, 2021–2029(USD Billion)

- India Automotive Motors Market, By Vehicle Type, 2021–2029(USD Billion)

- India Automotive Motors Market, By Electric Vehicle Type, 2021–2029(USD Billion)

- India Automotive Motors Market, By Function, 2021–2029(USD Billion)

- India Automotive Motors Market, By Application, 2021–2029(USD Billion)

- South America Automotive Motors Market, By Motor Type, 2021–2029(USD Billion)

- South America Automotive Motors Market, By Vehicle Type, 2021–2029(USD Billion)

- South America Automotive Motors Market, By Electric Vehicle Type, 2021–2029(USD Billion)

- South America Automotive Motors Market, By Function, 2021–2029(USD Billion)

- South America Automotive Motors Market, By Application, 2021–2029(USD Billion)

- Brazil Automotive Motors Market, By Motor Type, 2021–2029(USD Billion)

- Brazil Automotive Motors Market, By Vehicle Type, 2021–2029(USD Billion)

- Brazil Automotive Motors Market, By Electric Vehicle Type, 2021–2029(USD Billion)

- Brazil Automotive Motors Market, By Function, 2021–2029(USD Billion)

- Brazil Automotive Motors Market, By Application, 2021–2029(USD Billion)

- Middle East and Africa Automotive Motors Market, By Motor Type, 2021–2029(USD Billion)

- Middle East and Africa Automotive Motors Market, By Vehicle Type, 2021–2029(USD Billion)

- Middle East and Africa Automotive Motors Market, By Electric Vehicle Type, 2021–2029(USD Billion)

- Middle East and Africa Automotive Motors Market, By Function, 2021–2029(USD Billion)

- Middle East and Africa Automotive Motors Market, By Application, 2021–2029(USD Billion)

- UAE Automotive Motors Market, By Motor Type, 2021–2029(USD Billion)

- UAE Automotive Motors Market, By Vehicle Type, 2021–2029(USD Billion)

- UAE Automotive Motors Market, By Electric Vehicle Type, 2021–2029(USD Billion)

- UAE Automotive Motors Market, By Function, 2021–2029(USD Billion)

- UAE Automotive Motors Market, By Application, 2021–2029(USD Billion)

- South Africa Automotive Motors Market, By Motor Type, 2021–2029(USD Billion)

- South Africa Automotive Motors Market, By Vehicle Type, 2021–2029(USD Billion)

- South Africa Automotive Motors Market, By Electric Vehicle Type, 2021–2029(USD Billion)

- South Africa Automotive Motors Market, By Function, 2021–2029(USD Billion)

- South Africa Automotive Motors Market, By Application, 2021–2029(USD Billion)

List of Figures

- Global Automotive Motors Market Segmentation

- Automotive Motors Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Automotive Motors Market Attractiveness Analysis By Motor Type

- Global Automotive Motors Market Attractiveness Analysis By Vehicle Type

- Global Automotive Motors Market Attractiveness Analysis By Electric Vehicle Type

- Global Automotive Motors Market Attractiveness Analysis By Function

- Global Automotive Motors Market Attractiveness Analysis By Application

- Global Automotive Motors Market Attractiveness Analysis By Region

- Global Automotive Motors Market: Dynamics

- Global Automotive Motors Market Share By Motor Type(2021 & 2029)

- Global Automotive Motors Market Share By Vehicle Type(2021 & 2029)

- Global Automotive Motors Market Share By Electric Vehicle Type(2021 & 2029)

- Global Automotive Motors Market Share By Function(2021 & 2029)

- Global Automotive Motors Market Share By Application (2021 & 2029)

- Global Automotive Motors Market Share by Regions (2021 & 2029)

- Global Automotive Motors Market Share by Company (2020)