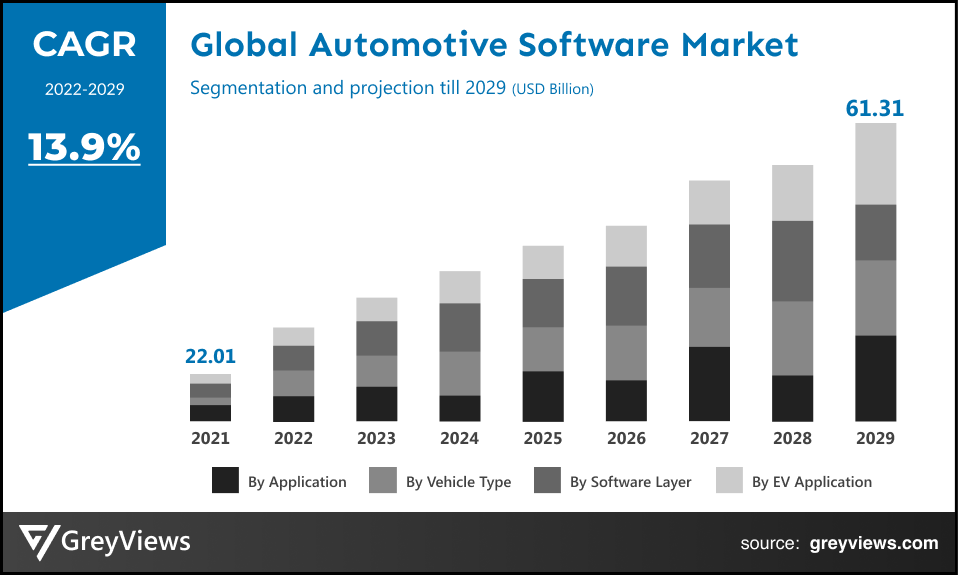

Automotive Software Market by Application (ADAS and Safety Systems, Body Control and Comfort Systems, Powertrain Systems, Infotainment Systems, Communication Systems, and Telematics Systems), Vehicle Type (Passenger Car, LCV, and HCV), Software Layer (Operating System, Middleware, and Application Software), EV Application (Charging Management, Battery Management, and V2G), Regions, Segmentation, and Projection till 2029

CAGR: 13.9%Current Market Size: 22.01 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Automotive Software- Market Overview

The global Automotive Software market is expected to grow from USD 22.01 billion in 2021 to USD 61.31 billion by 2029, at a CAGR of 13.9% during the Projection period 2022-2029. This growth of the market is driven by the increased adoption of AI in the automotive industry and the growing number of connected cars.

The mobility industry has witnessed technological advancements with software applications and Artificial Intelligence (AI) integration. These automotive software solutions comprise wide-ranging tools for performing computer-based in-vehicle operations. It interacts with hardware components, controls functions, and augments the experience of operating a motor vehicle. Also, it helps implement the car's functionality that runs on the essential processors, sensors, and memory. This software includes telematics, infotainment, body control & comfort, powertrain, communication, and advanced driver assistance systems (ADAS) software. Such software solutions are transforming car capabilities, creating development challenges for various automotive players.

On the other hand, modern automotive software provides improved customer satisfaction, additional hardware connectivity, reliability and flexibility, increased safety, enhanced control systems, infotainment, and many other car features.

Request Sample: - Automotive Software Market

Market Dynamics:

Drivers:

- Increased adoption of AI in the automotive industry

Artificial intelligence (AI) is rapidly being implemented across automotive manufacturing, including design, production, supply chain, and post-production. In addition, it is rapidly being integrated with driver assistance and risk assessment systems. Owing to such functionality, OEMs plan to develop their automotive software solutions. For instance, in January 2022, Toyota announced its plans to build its automotive software solutions for its vehicles by 2025 to compete with German rivals, Daimler AG and Volkswagen AG. Hence, the need for AI and deep learning-based solutions to enable the OEMs to enhance efficiencies significantly and make faster data-driven decisions have boosted the growth of the automotive software market.

- Upsurge in the adoption of ADAS features in vehicles.

Advanced driver assistance systems (ADAS) have been considered the essential component across the evolution of in-vehicle technology. These systems mainly focus on collision avoidance technologies and driver aids, such as night vision, adaptive cruise control, and driver alertness. Such features boost the adoption of ADAS to avoid accidents altogether or reduce the risk of injuries during a crash. This has led to the demand for ADAS software solutions that collect and validate data from sensors to detect the vehicle’s surroundings and enable immediate actions. In addition, the ADAS industry players are actively innovating their offerings with enhanced software. For instance, in January 2020, Hella, the German automotive part supplier, and Oculii, the US start-up, collaborated to develop high-performance, scalable radar software for ADAS. Therefore, an upsurge in adopting ADAS features in vehicles has driven the global automotive software market.

Restraints:

- Lack of connected infrastructure

Rugged, high-speed, and agile in-vehicle data networks are essential in achieving connected, seamless, feature-rich automotive software solutions. However, the emergence of 5G wireless data has the potential to meet the demand created by intelligent and autonomous driving by allowing faster data rates along with the secured vehicle-to-infrastructure (V2X) and vehicle-to-vehicle (V2V) connectivity. However, 5G and high-speed wireless connectivity require high-priced infrastructure. Hence, the lack of connected infrastructure due to the need for high investment is the prominent factor affecting the growth of the global automotive software market.

Opportunities:

- Extensive investments in software development for vehicles

There is a huge trend in software-driven automotive R&D due to the proliferation of in-vehicle infotainment (IVI), advanced driver assistance systems (ADAS), and information systems. Thus, OEMs are planning to step up and enhance their software capabilities over the next few years. For instance, in December 2021, The Volkswagen Group introduced its strategy for the coming decade with an investment of about $100.5 billion in future technology. Out of this investment, around $30.51 billion is projected to be spent on software development associated with automotive. Such investment in software development in the automotive industry is opportunistic for the growth of the global market.

Challenges

- Risk of cyber security related to the connected vehicles

Cyber security risk is the probability of loss or exposure resulting from a data breach or cyber-attack on software systems. The increased number of connected vehicles on the roads has created software vulnerabilities that have become accessible to malicious hackers using cellular networks and Wi-Fi. Cyber attackers can also target data generated, collected, stored, and shared by vehicles. Hence, the cyber security risk has posed significant challenges to the global automotive software industry players.

Segmentation Analysis:

The global automotive software market has been segmented based on application, vehicle type, software layer, EV application, EV Gear Type, and regions.

By Application

The application segment includes ADAS and safety systems, body control and comfort systems, powertrain systems, infotainment systems, communication systems, and telematics systems. The ADAS and safety systems segment led the automotive software market with a market share of around 28.05% in 2021. This is attributed to the need for software applications in ADAS and safety systems to avoid accidents or reduce the risk of injuries during a crash. These systems comprise various lucrative functions such as automatic emergency braking, surround view, parking assist, pedestrian detection, gaze detection, and driver drowsiness detection, among others. In addition, the ongoing software development trend in the ADAS and safety systems sector has further boosted the growth of this segment. For instance, in September 2020, Algolux, a provider of perception software solutions for safety-critical applications, launched the next generation of its Eos Embedded Perception Software for ADAS and autonomous vehicles applications.

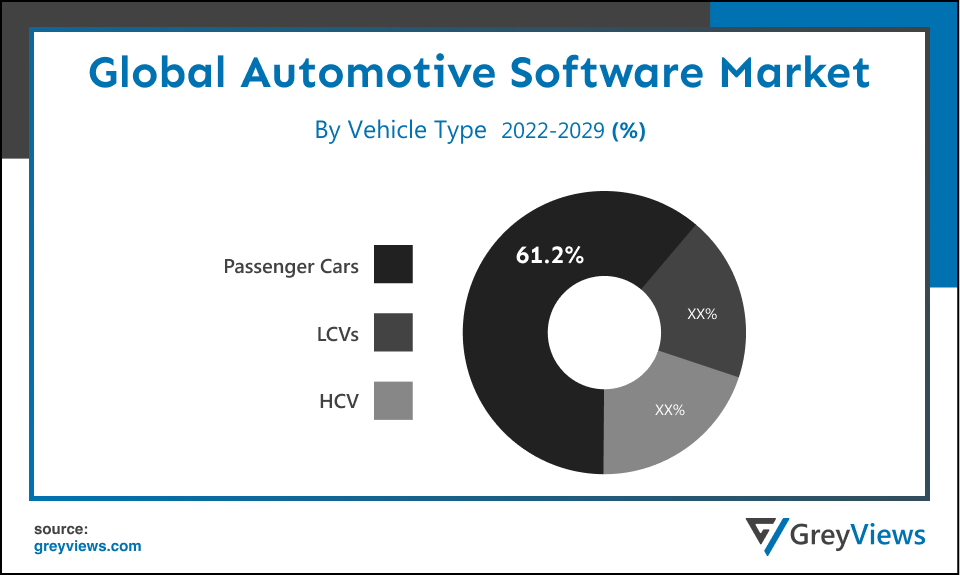

By Vehicle Type

The vehicle type segment includes passenger cars, LCVs, and HCV. The passenger car segment led the Automotive Software market with a market share of around 61.2% in 2021. This growth is mainly driven by the fact that software services have a higher penetration in passenger cars than commercial vehicles. In addition, there is enormous demand for advanced applications such as ADAS and connected vehicles in developed countries. Moreover, the rise of vehicle-to-infrastructure (V2I) and vehicle-to-vehicle (V2V) communications along with the emergence of semi- and fully autonomous passenger cars, has further created lucrative growth opportunities for the automotive software market.

By Software Layer

The software layer segment includes an operating system, middleware, and application software. The application software segment led the automotive software market with a market share of around 52.7% in 2021. The rising demand for innovative safety features in self-driving and automated vehicles has boosted the demand for application software. In addition, several automotive software providers and OEMs are integrating artificial intelligence and deep learning technologies to increase vehicle comfort, efficiency, and protection. For instance, in September 2021, Maruti Suzuki India Limited launched an AI-based 24x7 virtual car assistant app for NEXA, a premium car channel from Maruti Suzuki. This integration of AI with automotive application software is projected to be opportunistic for the growth of the global market.

By Regional Analysis:

The regions analyzed for the Automotive Software market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. The Asia-Pacific region dominated the Automotive Software market and held a 40.1% share of the market revenue in 2021.

- The Asia-Pacific region has registered the highest value for 2021. Growth of this region is mainly driven by factors such as the rising production of passenger vehicles in China and India, demands for connected vehicles, and cheap raw materials. This factor has further created growth opportunities for the automotive software market.

- North America is expected to witness a considerable growth rate during the Projection period. An upsurge in demand for autonomous vehicles, along with the easy availability of convenient financing options by the governments to ensure in-house automotive production, has driven the market's growth. In addition, the region is seeing advancements in automated transportation technology and the growing number of government initiatives pertaining to autonomous vehicles, creating growth opportunities for the market.

Global Automotive Software Market- Country Analysis:

- Germany

Germany's Automotive Software market size was valued at USD 2.42 billion in 2021 and is expected to reach USD 6.65 billion by 2029, at a CAGR of 13.7% from 2022 to 2029. Germany is one of the leading nations in the mechanical engineering, manufacturing, automotive, and electrical industries. In addition, the government in this country is actively focusing on introducing new supportive regulations for operating autonomous motor vehicles in Germany. This is the primary factor contributing to the demand for automotive software in the country.

In addition, according to Germany Trade & Invest, the economic development agency of the Federal Republic of Germany, this country is the leading automotive market in Europe, accounting for about 25% of all passenger cars manufactured in the region. This huge market for passenger vehicles is opportunistic for the market's growth.

- China

China's Automotive Software market was valued at USD 3.74 billion in 2021 and is expected to reach USD 10.06 billion by 2029, at a CAGR of 13.4% from 2022 to 2029. China is the world’s largest light-vehicle manufacturer. In addition, this country is a leading automotive producer, consumer, and exporter. For instance, the country continues to be the largest vehicle market by manufacturing output and annual sales, with domestic production anticipated to reach 35 million vehicles by 2025.

On the other hand, countries such as the U.S., EU, Japan, and South Korea are heavily investing in electric vehicles and autonomous vehicles technology. These investments are projected to create lucrative growth opportunities for the automotive software market. For instance, in 2021, the country saw more than $8.5 billion investments in robotaxi startups, smart electric car manufacturers, and self-driving truck developers.

- India

India's automotive software market size was valued at USD 1.10 billion in 2021 and is expected to reach USD 3.11 billion by 2029, at a CAGR of 14.1% from 2022 to 2029. India is one of the strongest growing economies in Asia. In addition, the emerging popularity of ADAS and connected vehicles in this country is expected to create lucrative growth opportunities for the market. On the other hand, the OEMs in the automotive industry in this country are actively integrating software applications in their vehicles. For instance, in February 2022, Mahindra & Mahindra Ltd. collaborated with BlackBerry to integrate its QNX Neutrino Realtime Operating System (RTOS) and QNX Hypervisor solutions with a Cockpit Domain Controller (CDC) of the next-generation XUV700 SUV.

Key Industry Players Analysis:

To increase their market position in the global Automotive Software business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Robert Bosch

- NVIDIA

- NXP

- BlackBerry

- Elektrobit

- Renesas Electronics

- Airbiquity

- Wind River Systems

- Green Hills Software

- Microsoft Corporation

Latest Development:

- In April 2022, Airbiquity launched DATAmatic, a suite of edge data management solutions. This software solution addresses the rising demand for services and tools to enable automakers to monetize and manage connected vehicle data.

- In February 2021, Microsoft Corp., the American tech company, partnered with Robert Bosch GmbH, the German automotive supply giant, to develop a vehicle software platform. This software platform is expected to not deliver an enhanced experience to its user and provide the drivers with quick access to advanced functions as well as digital services over the lifetime of their vehicles.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

13.9% |

|

Market Size |

22.01 Billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Application, Vehicle type, Software layer, EV application, and regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Robert Bosch, NVIDIA, NXP, BlackBerry, Elektrobit, Renesas Electronics, Airbiquity, Wind River Systems, Green Hills Software, and Microsoft Corporation among others |

|

By Application |

|

|

By Vehicle Type |

|

|

By Software Layer |

|

|

By EV Application |

|

|

Regional scope |

|

Scope of the Report

Global Automotive Software Market by Application:

- ADAS and Safety Systems

- Body Control and Comfort Systems

- Powertrain Systems

- Infotainment Systems

- Communication Systems

- Telematics Systems

Global Automotive Software Market by Vehicle Type:

- Passenger Car

- LCV

- HCV

Global Automotive Software Market by Software Layer:

- Operating System

- Middleware

- Application Software

Global Automotive Software Market by EV Application:

- BEV

- PHEV

- FCEV

Global Automotive Software Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is growth rate of Global Automotive Software market?

Global Automotive Software market will grow at rate of CAGR of 13.9% during the Projection period 2022-2029 and it will reach to USD 61.31 billion by 2029

What was the market size of the Automotive Software market?

The global Automotive Software market was USD 22.01 billion in 2021

Which are the leading market players active in the Automotive Software market?

Leading market players active in the global Automotive Software market are Robert Bosch, NVIDIA, NXP, BlackBerry, Elektrobit, Renesas Electronics, Airbiquity, Wind River Systems, Green Hills Software, and Microsoft Corporation among others.

What are the segments considered for Automotive Software market?

global Automotive Software market has been segmented based on application, vehicle type, software layer, EV application, and regions.

What is the key driver of the Automotive Software market?

Increased adoption of AI in the automotive industry and growing number of connected cars is primarily driving the growth of the Automotive Software market.

What are the technological factor in Automotive Software Market?

Artificial intelligence (AI) is rapidly being implemented across automotive manufacturing, including design, production, supply chain, and post-production. In addition, it is rapidly being integrated with driver assistance and risk assessment systems. Owing to such functionality, OEMs plan to develop their automotive software solutions. For instance, in January 2022, Toyota announced its plans to build its automotive software solutions for its vehicles by 2025 to compete with German rivals, Daimler AG and Volkswagen AG. Hence, the need for AI and deep learning-based solutions to enable the OEMs to enhance efficiencies significantly and make faster data-driven decisions have boosted the growth of the automotive software market.

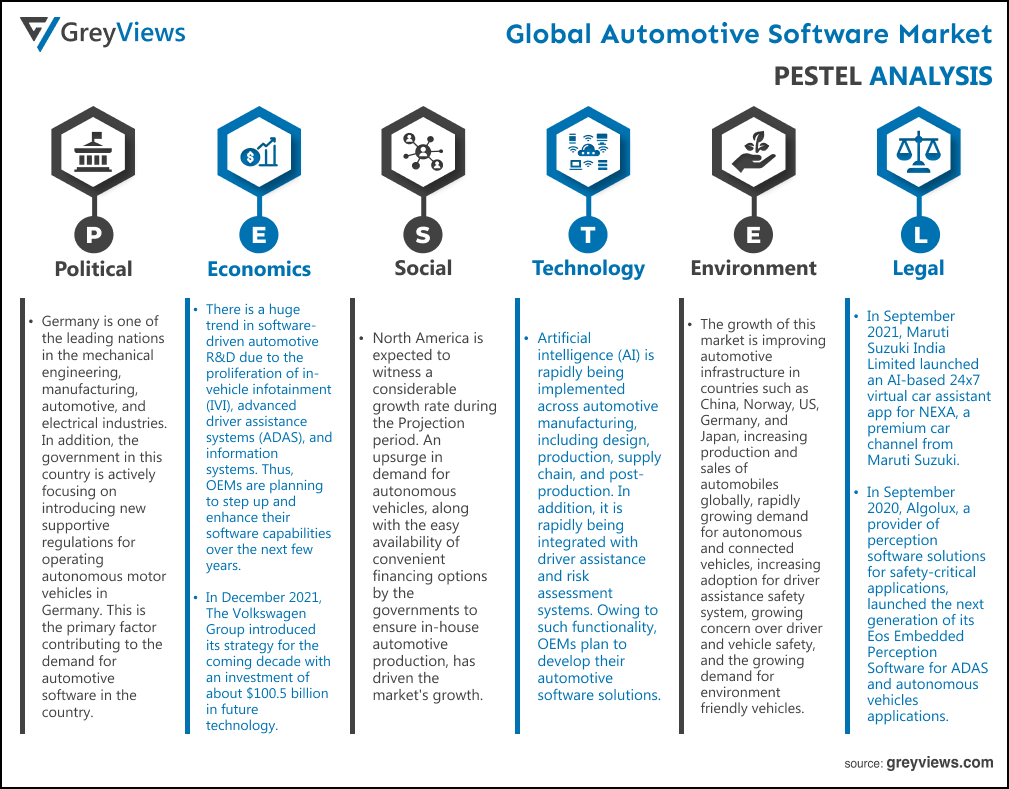

Political Factors- Germany is one of the leading nations in the mechanical engineering, manufacturing, automotive, and electrical industries. In addition, the government in this country is actively focusing on introducing new supportive regulations for operating autonomous motor vehicles in Germany. This is the primary factor contributing to the demand for automotive software in the country. In addition, according to Germany Trade & Invest, the economic development agency of the Federal Republic of Germany, this country is the leading automotive market in Europe, accounting for about 25% of all passenger cars manufactured in the region. This huge market for passenger vehicles is opportunistic for the market's growth.

Economical Factors- There is a huge trend in software-driven automotive R&D due to the proliferation of in-vehicle infotainment (IVI), advanced driver assistance systems (ADAS), and information systems. Thus, OEMs are planning to step up and enhance their software capabilities over the next few years. For instance, in December 2021, The Volkswagen Group introduced its strategy for the coming decade with an investment of about $100.5 billion in future technology. Out of this investment, around $30.51 billion is projected to be spent on software development associated with automotive. Such investment in software development in the automotive industry is opportunistic for the growth of the global market.

Social Factor- North America is expected to witness a considerable growth rate during the Projection period. An upsurge in demand for autonomous vehicles, along with the easy availability of convenient financing options by the governments to ensure in-house automotive production, has driven the market's growth. In addition, the region is seeing advancements in automated transportation technology and the growing number of government initiatives pertaining to autonomous vehicles, creating growth opportunities for the market.

Technological Factors- Artificial intelligence (AI) is rapidly being implemented across automotive manufacturing, including design, production, supply chain, and post-production. In addition, it is rapidly being integrated with driver assistance and risk assessment systems. Owing to such functionality, OEMs plan to develop their automotive software solutions. For instance, in January 2022, Toyota announced its plans to build its automotive software solutions for its vehicles by 2025 to compete with German rivals, Daimler AG and Volkswagen AG. Hence, the need for AI and deep learning-based solutions to enable the OEMs to enhance efficiencies significantly and make faster data-driven decisions have boosted the growth of the automotive software market.

Environmental Factors- The growth of this market is improving automotive infrastructure in countries such as China, Norway, US, Germany, and Japan, increasing production and sales of automobiles globally, rapidly growing demand for autonomous and connected vehicles, increasing adoption for driver assistance safety system, growing concern over driver and vehicle safety, and the growing demand for environment friendly vehicles. To succeed in this rapidly changing environment, companies should minimize complexity by reducing the effort required to develop and maintain software.

Legal Factors- For instance, in September 2021, Maruti Suzuki India Limited launched an AI-based 24x7 virtual car assistant app for NEXA, a premium car channel from Maruti Suzuki. This integration of AI with automotive application software is projected to be opportunistic for the growth of the global market. For instance, in September 2020, Algolux, a provider of perception software solutions for safety-critical applications, launched the next generation of its Eos Embedded Perception Software for ADAS and autonomous vehicles applications. In February 2022, Mahindra & Mahindra Ltd. collaborated with BlackBerry to integrate its QNX Neutrino Realtime Operating System (RTOS) and QNX Hypervisor solutions with a Cockpit Domain Controller (CDC) of the next-generation XUV700 SUV.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Application

- Market Attractiveness Analysis By Vehicle Type

- Market Attractiveness Analysis By Software Layer

- Market Attractiveness Analysis By EV Application

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Increased adoption of AI in the automotive industry

- Upsurge in adoption of ADAS features in vehicles

- Restrains

- Lack of connected infrastructure

- Opportunities

- Extensive investments in software development for vehicles

- Challenges

- Risk of cyber security related to the connected vehicles

- Global Automotive Software Market Analysis and Projection, By Application

- Segment Overview

- ADAS and Safety Systems

- Body Control and Comfort Systems

- Powertrain Systems

- Infotainment Systems

- Communication Systems

- Telematics Systems

- Global Automotive Software Market Analysis and Projection, By Vehicle Type

- Segment Overview

- Passenger Car

- LCV

- HCV

- Global Automotive Software Market Analysis and Projection, By Software Layer

- Segment Overview

- Operating System

- Middleware

- Application Software

- Global Automotive Software Market Analysis and Projection, By EV Application

- Segment Overview

- Charging Management

- Battery Management

- V2G

- Global Automotive Software Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Automotive Software Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Automotive Software Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Application Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Robert Bosch

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Application Portfolio

- Recent Developments

- SWOT Analysis

- NVIDIA

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Application Portfolio

- Recent Developments

- SWOT Analysis

- Microsoft Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Application Portfolio

- Recent Developments

- SWOT Analysis

- NXP

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Application Portfolio

- Recent Developments

- SWOT Analysis

- BlackBerry

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Application Portfolio

- Recent Developments

- SWOT Analysis

- Elektrobit

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Application Portfolio

- Recent Developments

- SWOT Analysis

- Renesas Electronics

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Application Portfolio

- Recent Developments

- SWOT Analysis

- Airbiquity

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Application Portfolio

- Recent Developments

- SWOT Analysis

- Wind River Systems

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Application Portfolio

- Recent Developments

- SWOT Analysis

- Green Hills Software

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Application Portfolio

- Recent Developments

- SWOT Analysis

- Robert Bosch

List of Table

- Global Automotive Software Market, By Application, 2021–2029(USD Billion)

- Global ADAS and Safety Systems Automotive Software Market, By Region, 2021–2029(USD Billion)

- Global Body Control and Comfort Systems Automotive Software Market, By Region, 2021–2029(USD Billion)

- Global Powertrain Systems Automotive Software Market, By Region, 2021–2029(USD Billion)

- Global Infotainment Systems Automotive Software Market, By Region, 2021–2029(USD Billion)

- Global Communication Systems Automotive Software Market, By Region, 2021–2029(USD Billion)

- Global Telematics Systems Automotive Software Market, By Region, 2021–2029(USD Billion)

- Global Automotive Software Market, By Vehicle Type, 2021–2029(USD Billion)

- Global Passenger Car Automotive Software Market, By Region, 2021–2029(USD Billion)

- Global LCV Automotive Software Market, By Region, 2021–2029(USD Billion)

- Global HCV Automotive Software Market, By Region, 2021–2029(USD Billion)

- Global Automotive Software Market, By Software Layer, 2021–2029(USD Billion)

- Global Operating System Automotive Software Market, By Region, 2021–2029(USD Billion)

- Global Middleware Software Layer Automotive Software Market, By Region, 2021–2029(USD Billion)

- Global Application Software Layer Automotive Software Market, By Region, 2021–2029(USD Billion)

- Global Automotive Software Market, By EV Application, 2021–2029(USD Billion)

- Global Charging Management Automotive Software Market, By Region, 2021–2029(USD Billion)

- Global Battery Management Automotive Software Market, By Region, 2021–2029(USD Billion)

- Global V2G Automotive Software Market, By Region, 2021–2029(USD Billion)

- Global Automotive Software Market, By Region, 2021–2029(USD Billion)

- Global Automotive Software Market, By North America, 2021–2029(USD Billion)

- North America Automotive Software Market, By Application, 2021–2029(USD Billion)

- North America Automotive Software Market, By Vehicle Type, 2021–2029(USD Billion)

- North America Automotive Software Market, By Software Layer, 2021–2029(USD Billion)

- North America Automotive Software Market, By EV Application, 2021–2029(USD Billion)

- USA Automotive Software Market, By Application, 2021–2029(USD Billion)

- USA Automotive Software Market, By Vehicle Type, 2021–2029(USD Billion)

- USA Automotive Software Market, By Software Layer, 2021–2029(USD Billion)

- USA Automotive Software Market, By EV Application, 2021–2029(USD Billion)

- Canada Automotive Software Market, By Application, 2021–2029(USD Billion)

- Canada Automotive Software Market, By Vehicle Type, 2021–2029(USD Billion)

- Canada Automotive Software Market, By Software Layer, 2021–2029(USD Billion)

- Canada Automotive Software Market, By EV Application, 2021–2029(USD Billion)

- Mexico Automotive Software Market, By Application, 2021–2029(USD Billion)

- Mexico Automotive Software Market, By Vehicle Type, 2021–2029(USD Billion)

- Mexico Automotive Software Market, By Software Layer, 2021–2029(USD Billion)

- Mexico Automotive Software Market, By EV Application, 2021–2029(USD Billion)

- Europe Automotive Software Market, By Application, 2021–2029(USD Billion)

- Europe Automotive Software Market, By Vehicle Type, 2021–2029(USD Billion)

- Europe Automotive Software Market, By Software Layer, 2021–2029(USD Billion)

- Europe Automotive Software Market, By EV Application, 2021–2029(USD Billion)

- Germany Automotive Software Market, By Application, 2021–2029(USD Billion)

- Germany Automotive Software Market, By Vehicle Type, 2021–2029(USD Billion)

- Germany Automotive Software Market, By Software Layer, 2021–2029(USD Billion)

- Germany Automotive Software Market, By EV Application, 2021–2029(USD Billion)

- France Automotive Software Market, By Application, 2021–2029(USD Billion)

- France Automotive Software Market, By Vehicle Type, 2021–2029(USD Billion)

- France Automotive Software Market, By Software Layer, 2021–2029(USD Billion)

- France Automotive Software Market, By EV Application, 2021–2029(USD Billion)

- UK Automotive Software Market, By Application, 2021–2029(USD Billion)

- UK Automotive Software Market, By Vehicle Type, 2021–2029(USD Billion)

- UK Automotive Software Market, By Software Layer, 2021–2029(USD Billion)

- UK Automotive Software Market, By EV Application, 2021–2029(USD Billion)

- Italy Automotive Software Market, By Application, 2021–2029(USD Billion)

- Italy Automotive Software Market, By Vehicle Type, 2021–2029(USD Billion)

- Italy Automotive Software Market, By Software Layer, 2021–2029(USD Billion)

- Italy Automotive Software Market, By EV Application, 2021–2029(USD Billion)

- Spain Automotive Software Market, By Application, 2021–2029(USD Billion)

- Spain Automotive Software Market, By Vehicle Type, 2021–2029(USD Billion)

- Spain Automotive Software Market, By Software Layer, 2021–2029(USD Billion)

- Spain Automotive Software Market, By EV Application, 2021–2029(USD Billion)

- Asia Pacific Automotive Software Market, By Application, 2021–2029(USD Billion)

- Asia Pacific Automotive Software Market, By Vehicle Type, 2021–2029(USD Billion)

- Asia Pacific Automotive Software Market, By Software Layer, 2021–2029(USD Billion)

- Asia Pacific Automotive Software Market, By EV Application, 2021–2029(USD Billion)

- Japan Automotive Software Market, By Application, 2021–2029(USD Billion)

- Japan Automotive Software Market, By Vehicle Type, 2021–2029(USD Billion)

- Japan Automotive Software Market, By Software Layer, 2021–2029(USD Billion)

- Japan Automotive Software Market, By EV Application, 2021–2029(USD Billion)

- China Automotive Software Market, By Application, 2021–2029(USD Billion)

- China Automotive Software Market, By Vehicle Type, 2021–2029(USD Billion)

- China Automotive Software Market, By Software Layer, 2021–2029(USD Billion)

- China Automotive Software Market, By EV Application, 2021–2029(USD Billion)

- India Automotive Software Market, By Application, 2021–2029(USD Billion)

- India Automotive Software Market, By Vehicle Type, 2021–2029(USD Billion)

- India Automotive Software Market, By Software Layer, 2021–2029(USD Billion)

- India Automotive Software Market, By EV Application, 2021–2029(USD Billion)

- South America Automotive Software Market, By Application, 2021–2029(USD Billion)

- South America Automotive Software Market, By Vehicle Type, 2021–2029(USD Billion)

- South America Automotive Software Market, By Software Layer, 2021–2029(USD Billion)

- South America Automotive Software Market, By EV Application, 2021–2029(USD Billion)

- Brazil Automotive Software Market, By Application, 2021–2029(USD Billion)

- Brazil Automotive Software Market, By Vehicle Type, 2021–2029(USD Billion)

- Brazil Automotive Software Market, By Software Layer, 2021–2029(USD Billion)

- Brazil Automotive Software Market, By EV Application, 2021–2029(USD Billion)

- Middle East and Africa Automotive Software Market, By Application, 2021–2029(USD Billion)

- Middle East and Africa Automotive Software Market, By Vehicle Type, 2021–2029(USD Billion)

- Middle East and Africa Automotive Software Market, By Software Layer, 2021–2029(USD Billion)

- Middle East and Africa Automotive Software Market, By EV Application, 2021–2029(USD Billion)

- UAE Automotive Software Market, By Application, 2021–2029(USD Billion)

- UAE Automotive Software Market, By Vehicle Type, 2021–2029(USD Billion)

- UAE Automotive Software Market, By Software Layer, 2021–2029(USD Billion)

- UAE Automotive Software Market, By EV Application, 2021–2029(USD Billion)

- South Africa Automotive Software Market, By Application, 2021–2029(USD Billion)

- South Africa Automotive Software Market, By Vehicle Type, 2021–2029(USD Billion)

- South Africa Automotive Software Market, By Software Layer, 2021–2029(USD Billion)

- South Africa Automotive Software Market, By EV Application, 2021–2029(USD Billion)

List of Figures

- Global Automotive Software Market Segmentation

- Automotive Software Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Automotive Software Market Attractiveness Analysis By Application

- Global Automotive Software Market Attractiveness Analysis By Vehicle Type

- Global Automotive Software Market Attractiveness Analysis By Software Layer

- Global Automotive Software Market Attractiveness Analysis By EV Application

- Global Automotive Software Market Attractiveness Analysis By Region

- Global Automotive Software Market: Dynamics

- Global Automotive Software Market Share By Application (2021 & 2028)

- Global Automotive Software Market Share By Vehicle Type (2021 & 2028)

- Global Automotive Software Market Share By Software Layer (2021 & 2028)

- Global Automotive Software Market Share By EV Application (2021 & 2028)

- Global Automotive Software Market Share by Regions (2021 & 2028)

- Global Automotive Software Market Share by Company (2020)