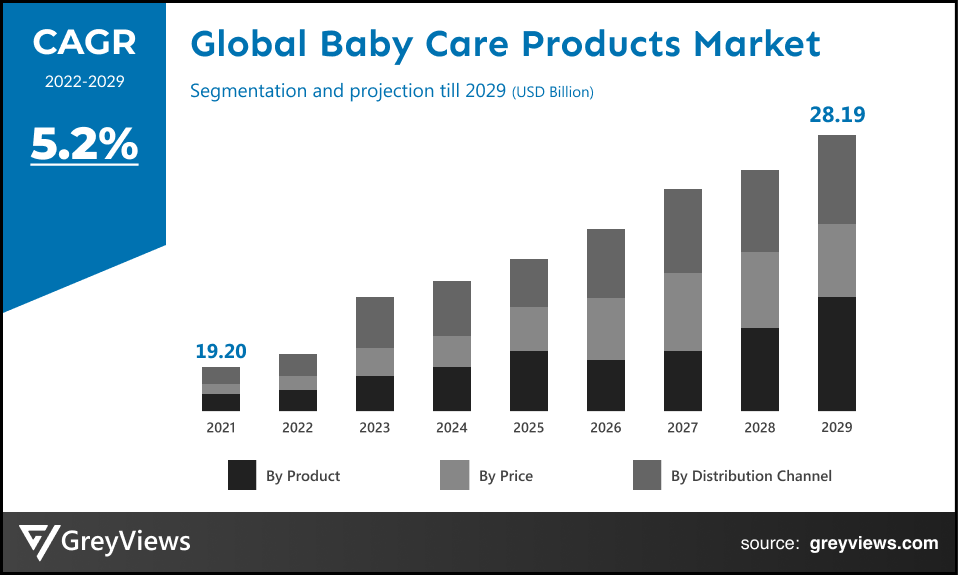

Baby Care Products Market Size by Product (Baby Skin Care, Baby Toiletries/Hair Care, Baby Food, and Baby Safety & Convenience), Price (Low, Medium, and High), and Distribution Channel (Hypermarket & Supermarket, Pharmacy & Drugstores, Specialty Store, Online, and Others), Regions, Segmentation, and Projection till 2029

CAGR: 5.2%Current Market Size: USD 19.20 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Baby Care Products Market- Market Overview:

The global Baby Care Products market is expected to grow from USD 19.20 billion in 2021 to USD 28.19 billion by 2029, at a CAGR of 5.2% during the Projection period 2022-2029. An increase in demand for fortified baby food, owing to parents' increasing knowledge of the importance of meeting their kids' nutritional needs, has primarily driven the growth of the global market.

A range of baby care products comprises baby shampoos, baby powders, baby powders, baby Wash & baby oils, and baby creams, among others. Such products are mainly intended to be used on infants and babies till the age of three years. Most baby care products are commonly made of hydrating and mild ingredients, including shea butter, aloe vera, almond oil, milk cream, jojoba oil, and butter. Such ingredients help in moisturizing and softening the skin of the baby.

Moreover, the outer skin layer of a baby is comparatively 30% thinner than that of adults. Hence, there is a significant increase in the popularity of organic baby care products. Such products are a good source of healthy nutrients that helps in the consistent development of skin.

Request Sample: - Global Baby Care Products Market

Market Dynamics:

Drivers:

- The rise in demand for fortified baby food

There has been a significant increase in the demand for fortified baby food, owing to parents' growing knowledge of the importance of meeting their kids' nutritional needs. An increase in demand for organic baby food products, in particular, is driving the market's growth. For instance, Nestle SA launched new products responding to the demand for fortified baby food in India with goods, such as Nestle Cerelac Fortified Baby Cereal with milk multi grain & fruits. Iron, zinc, and vitamins are among the minerals added to infant food during the fortification process. The most frequent dietary shortfall among children is iron insufficiency. As a result, fortified infant food items that are high in iron and folic acid are being introduced into the baby care products market for the baby's physical and mental development.

- Rising penetration of online shopping

Online retail platform is the major driver for baby care products. Presently, numerous retailers are associating with or have their own web-based retail stores where consumers can gain information about the organization and their products. There is an increase in the number of online shoppers, owing to the availability of varied product options and price comparison on online shopping sites.

This is useful for retailers due to zero expenditure on physical outlets or stores. One of the major reasons behind consumers preferring online shopping online is that consumers can read reviews provided by other users and compare various stores, products, and the price of different sellers. According to the World Bank, as of 2018, approximately 88.5% of the population in North America are internet users, followed by Europe and Central Asia, accounting for around 72.9% of the population internet users. In addition, access to the internet and online baby care products have provided consumers a platform where they can easily compare assorted products and prices and shop comfortably. Some of the popular online retailers in the baby care products market are Amazon.com, Walmart.com, and others.

Restraints:

- Lack of awareness about baby care products

Lack of awareness about baby care products among consumers operates as a major hurdle for expanding the baby care business. Many people live in rural areas globally, with inadequate internet access and fewer opportunities for advertisements to reach them. People who are not familiar with the ingredients or the applicability of the products are also hesitant to trust these baby care brands, fearing that they would harm their newborn children.

Rather than purchasing baby care products, they prefer to use natural homemade food, soap, and talcum powder, which restrain the baby care product market growth. Many baby care product manufacturers have shifted to organic and natural products. Still, some brands continue with chemical-containing products, which also makes some parents believe that no product is safe in the market. Parents globally are becoming more careful when it comes to buying baby products, whether it is baby food, baby cosmetics, hygiene, or baby safety and convenience. The rise in awareness of several health risks caused by synthetic baby products and toiletries, such as fungal and bacterial infections, acts as a restraint for the market growth.

Opportunities:

- Upsurge in demand for organic and natural baby products

The inclination of parents to organic and natural products is the major trend nowadays. Extravagant advertisements or giant names no longer appeal to educated parents. They are vigorously watching for innocuous ingredients in the product. Parents are attracted to natural baby-care recipes as they are harmless. In addition, internet penetration has made information accessible to consumers, which helps them make buying decisions.

Moreover, consumers are more inclined to purchase natural and organic items for their newborns to avoid artificial perfumes and chemicals found in many baby care products. Manufacturers in the baby care products market are concentrating on product innovation and quality, which will drive the growth of the market for baby care products in grow upcoming years.

Challenges

- Adverse effects of chemical products on babies

The market's expansion is limited as the usage of some chemicals can be detrimental to babies. Competition from local competitors is another significant challenge for the main international players in the global baby care products market. Due to the high cost of manufacturing infant products, local businesses produce low-priced, low-quality goods, hurting the entire industry's demand.

Furthermore, when it comes to baby care products, parents' first concern is safety. Baby's skin is considerably more delicate than an adult's. Thus, it is more susceptible to allergies, infections, chemical exposure, and so on. They may be more susceptible to infections and rashes due to these factors. Chemicals are included in baby creams, oils, wipes, and other similar goods. These difficulties prevent parents from acquiring baby care products since they become unsuitable for their skin. As parents are becoming more aware of the health of their babies, they are avoiding the usage of products with high amounts of chemicals. This factor is projected to pose significant challenges to the market players.

Segmentation Analysis:

The global Baby Care Products market has been segmented based on product, price, distribution channel, and regions.

By Product

The product segment includes baby skin care, baby toiletries/hair care, baby food, and baby safety & convenience. The baby toiletries/hair care segment led the Baby Care Products market with a market share of around 45.31% in 2021. A growing number of parents and a rise in birth rates are driving up demand for baby items, particularly hair care products. Because there are more newborns everywhere every day, it is important to use shampoos made specifically for babies to care for hair properly. Consumers' rising knowledge of numerous healthcare issues, such as skin allergies, has prompted businesses to concentrate on introducing new natural or organic brands with fewer chemicals that may be used by babies as well. Such factors have boosted the growth of this segment.

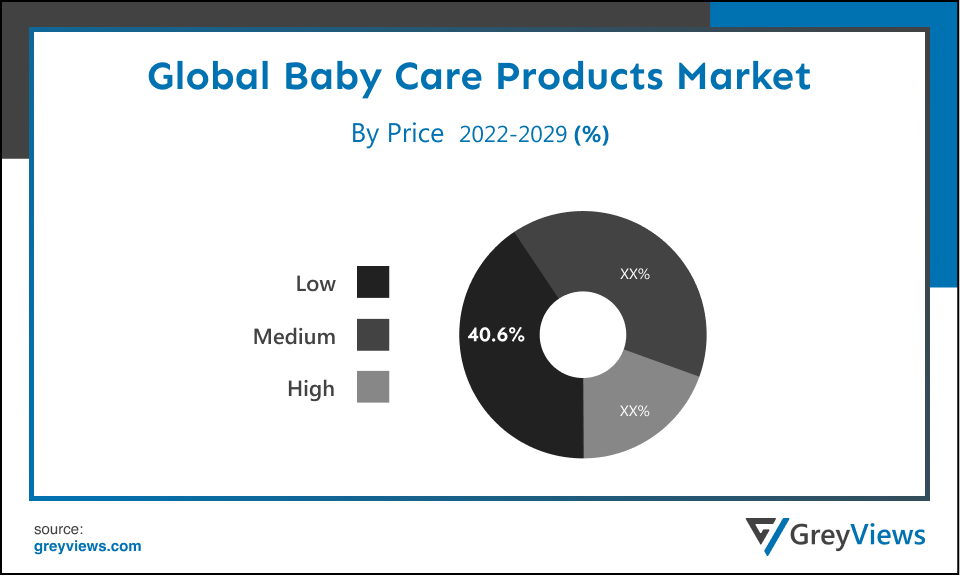

By Price

The price segment includes low, medium, and high. The low segment led the Baby Care Products market with a market share of around 40.6% in 2021. The baby care products from the low segment are expected to have a great growth opportunity, mainly in developing economies such as China, India, and Brazil. These developing nations are characterized by growing health consciousness, rapid urbanization, growing health awareness, and a rise in disposable income. Moreover, the trend of consuming natural products at low prices is expected further to boost the growth of the baby care products market.

By Distribution Channel

The distribution channel segment includes hypermarket & supermarket, pharmacy & drugstores, specialty stores, online, and others. The hypermarket & supermarket segment led the Baby Care Products market with a market share of around 46.98% in 2021. Supermarket/hypermarket is gaining popularity due to the availability of a broad range of consumer goods and food & beverages under a single roof, in addition to ample parking space and convenient operation timings. Consumers prefer to buy products that are on sale. Moreover, products are arranged nearby, which aids buyers in easy comparison among similar products, thereby helping consumers to decide which product to buy. In addition, an increase in urbanization, a rise in working-class population, and competitive pricing boost the popularity of supermarkets/hypermarkets.

By Regional Analysis:

The regions analyzed for the Baby Care Products market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. The Asia-Pacific region dominated the Baby Care Products market and held the 40.22% share of the market revenue in 2021.

- The Asia-Pacific region witnessed a major share. According to Worldometer estimates, Asia alone has 4.6 billion inhabitants or around 56.7% of the global population. The baby care products market is anticipated to increase significantly in this area, which is home to the two most populous nations globally, China and India, due to the favorable demographic trends. In addition to a significant increase in population, this region has also seen a significant rise in literacy rates, which is anticipated to be a major factor in the public's growing awareness of the importance of providing good healthcare for children and, as a result, is expected to boost the market shortly.

- North America is expected to witness a considerable growth rate during the Projection period. The need for baby care products has increased due to infants' greater sensitivity to other products, which is one of the main factors driving the expansion of the North American baby care products market. As young parents are more aware of the products given to their babies, they choose to select higher-quality baby care products, regardless of the product's price. The competition is also more among the manufacturers, contributing to the market's expansion.

Global Baby Care Products Market- Country Analysis:

- Germany

Germany's Baby Care Products market size was valued at USD 1.73 billion in 2021 and is expected to reach USD 2.52 billion by 2029, at a CAGR of 5.1% from 2022 to 2029. In the Europe region, Germany is one of the leading shareholders in the Baby Care Products market. In addition, the huge spending power of the population in this country has been a major contributor to market growth.

Moreover, the upsurge in daycare facilities in the country and government subsidies for enabling admissions of children in daycare facilities will further boost demand for baby care products in the country. On the other hand, the demand for baby care products, especially natural and organic baby care products, is rising due to consumers' growing awareness of the importance of baby care. This is one of the main drivers of Germany's baby care products market's growth.

- China

China's Baby Care Products market size was valued at USD 3.84 billion in 2021 and is expected to reach USD 5.52 billion by 2029, at a CAGR of 4.9% from 2022 to 2029. The factors such as the aging population, increasing consumer income, and government initiatives have driven the growth of the China Baby Care Products market. In addition, there are more than 300 million mobile internet users in the country who have children with age under 12 years. This has caused a significant demand for e-commerce sales of baby care products in the country.

On the other hand, in February 2021, Babycare, the Chinese baby care brand raised about $108.4 million in a series B round led by CDH Investments. This trend of baby care investments in the country is opportunistic for the growth of the market.

- India

India's Baby Care Products market size was valued at USD 0.96 billion in 2021 and is expected to reach USD 1.46 billion by 2029, at a CAGR of 5.6% from 2022 to 2029. India is one of the highest growing economies in Asia. Increasing population, rising middle-class population, ongoing upsurge in awareness about baby’s wellbeing, and changing lifestyle in the country are mainly driving the growth of the baby care products market.

Furthermore, the country is seeing huge demand for natural ingredients-based baby care products. Due to this, more market players are launching natural ingredients-based baby care products in the country. For instance, in June 2022, Sanosan, a German premium baby care brand, launched Baby Care Soap in India. This baby care soap comprises natural ingredients with the active substances hydrolyzed milk protein as well as organic olive oil. This trend of natural ingredients-based baby care products in the country is opportunistic for the growth of the market.

Key Industry Players Analysis:

To increase their market position in the global Baby Care Products business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Johnson & Johnson

- Procter & Gamble (P&G)

- Kimberly-Clark (KCWW)

- Honasa Consumer Pvt. Ltd.

- The Himalaya Drug Company

- Citta World

- Sebapharma GmbH & Co. KG

- Beiersdorf

- California Baby

- Unilever

Latest Development:

- In July 2022, Johnson & Johnson (J&J) launched Vivvi & Bloom, a new baby care brand. This brand is certified by the Environmental Working Group (EWG).

- In June 2021, Procter & Gamble, an American multinational consumer goods corporation, launched Pampers’ research facility at the P&G Singapore Innovation Center (SgIC). This facility has expanded its R&D capabilities associated with the BabyCare portfolio.

Scope of the Report

Global Baby Care Products Market by Product:

- Baby Skin Care

- Baby Toiletries/Hair Care

- Baby Food

- Baby Safety & Convenience

Global Baby Care Products Market by Price:

- Low

- Medium

- High

Global Baby Care Products Market by Distribution Channel:

- Hypermarket & Supermarket

- Pharmacy & Drugstores

- Specialty Store

- Online

- Others

Global Baby Care Products Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the Total Value of Global Baby Care Products market?

The Total value of Global Baby Care Products market is USD 19.20 billion in 2021 and it is expected to reach USD 28.19 billion by 2029, at a CAGR of 5.2% from 2022 to 2029.

Which Region Dominate the Global Baby Care Product Market?

Asia-Pacific region dominated the Baby Care Products market and held the 40.22% share of the market revenue in 2021

What are the top 5 exporter countries of Baby Care Products?

U.S., South Korea, China, France, and India

What are the upcoming trends in Global Baby Care Product Market?

Introduction of new baby care products, rising establishments of daycare centers, and rising population is projected to influence market growth in upcoming years.

What are the Restraints for Baby Care Products market?

Lack of awareness about baby care products among consumers operates as a major hurdle for expanding the baby care business. Many people live in rural areas globally, with inadequate internet access and fewer opportunities for advertisements to reach them.

Which are the leading market players active in the Baby Care Products market?

Leading market players active in the global Baby Care Products market are Johnson & Johnson, Procter & Gamble (P&G), Kimberly-Clark (KCWW), Honasa Consumer Pvt. Ltd., The Himalaya Drug Company, Citta World, Sebapharma GmbH & Co. KG, Beiersdorf, California Baby, and Unilever among others.

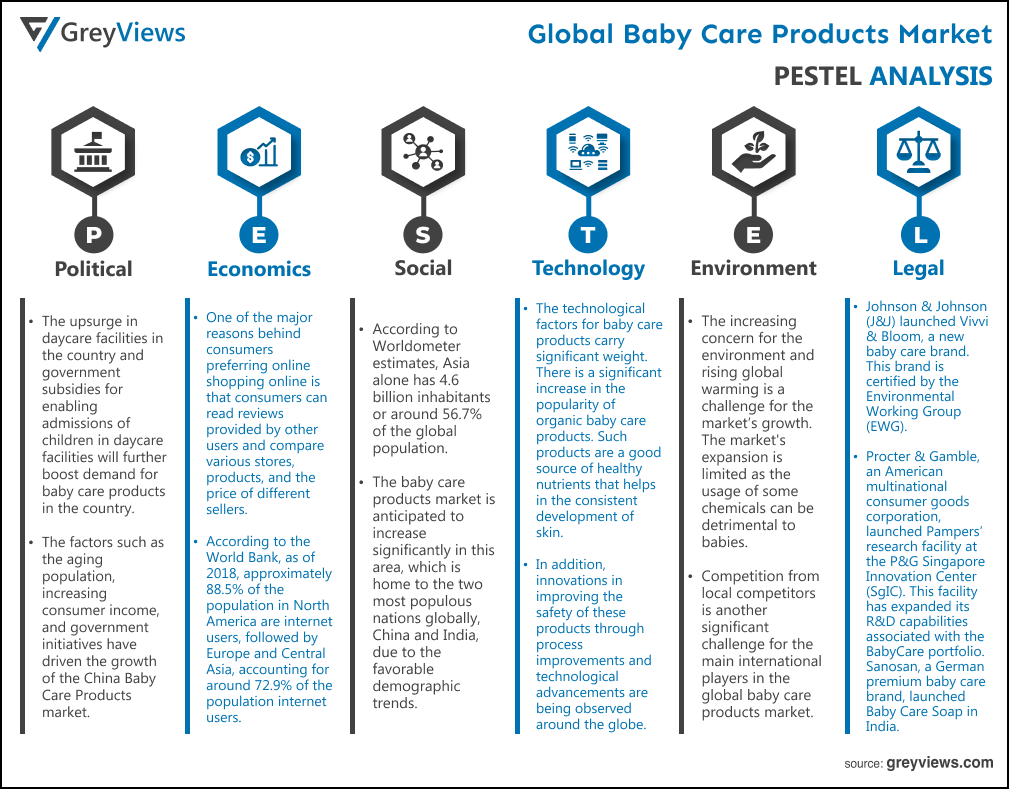

Political Factors- The upsurge in daycare facilities in the country and government subsidies for enabling admissions of children in daycare facilities will further boost demand for baby care products in the country. On the other hand, the demand for baby care products, especially natural and organic baby care products, is rising due to consumers' growing awareness of the importance of baby care. The factors such as the aging population, increasing consumer income, and government initiatives have driven the growth of the China Baby Care Products market. In addition, there are more than 300 million mobile internet users in the country who have children with age under 12 years.

Economical Factors- One of the major reasons behind consumers preferring online shopping online is that consumers can read reviews provided by other users and compare various stores, products, and the price of different sellers. According to the World Bank, as of 2018, approximately 88.5% of the population in North America are internet users, followed by Europe and Central Asia, accounting for around 72.9% of the population internet users. In addition, access to the internet and online baby care products have provided consumers a platform where they can easily compare assorted products and prices and shop comfortably. Some of the popular online retailers in the baby care products market are Amazon.com, Walmart.com, and others.

Social Factor- According to Worldometer estimates, Asia alone has 4.6 billion inhabitants or around 56.7% of the global population. The baby care products market is anticipated to increase significantly in this area, which is home to the two most populous nations globally, China and India, due to the favorable demographic trends. In addition to a significant increase in population, this region has also seen a significant rise in literacy rates, which is anticipated to be a major factor in the public's growing awareness of the importance of providing good healthcare for children and, as a result, is expected to boost the market shortly.

Technological Factors- The technological factors for baby care products carry significant weight. There is a significant increase in the popularity of organic baby care products. Such products are a good source of healthy nutrients that helps in the consistent development of skin. In addition, innovations in improving the safety of these products through process improvements and technological advancements are being observed around the globe. Furthermore, product innovations play an important role in the global baby care products industry. Also, extensive research and development (R&D) activities have further facilitated the launch of innovative products in the market.

Environmental Factors- The increasing concern for the environment and rising global warming is a challenge for the market’s growth. The market's expansion is limited as the usage of some chemicals can be detrimental to babies. Competition from local competitors is another significant challenge for the main international players in the global baby care products market. Due to the high cost of manufacturing infant products, local businesses produce low-priced, low-quality goods, hurting the entire industry's demand.

Legal Factors- Johnson & Johnson (J&J) launched Vivvi & Bloom, a new baby care brand. This brand is certified by the Environmental Working Group (EWG). Procter & Gamble, an American multinational consumer goods corporation, launched Pampers’ research facility at the P&G Singapore Innovation Center (SgIC). This facility has expanded its R&D capabilities associated with the BabyCare portfolio. Sanosan, a German premium baby care brand, launched Baby Care Soap in India. This baby care soap comprises natural ingredients with the active substances of hydrolyzed milk protein and organic olive oil. This trend of natural ingredients-based baby care products in the country is opportunistic for the market's growth.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Product

- Market Attractiveness Analysis By Price

- Market Attractiveness Analysis By Distribution Channel

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Rise in demand for fortified baby food

- Increased penetration of online shopping

- Restrains

- Lack of awareness about baby care products

- Opportunities

- Upsurge in demand for organic and natural baby products

- Challenges

- Adverse effects of chemical products on babies

- Global Baby Care Products Market Analysis and Projection, By Product

- Segment Overview

- Baby Skin Care

- Baby Toiletries/Hair Care

- Baby Food

- Baby Safety & Convenience

- Global Baby Care Products Market Analysis and Projection, By Price

- Segment Overview

- Low

- Medium

- High

- Global Baby Care Products Market Analysis and Projection, By Distribution Channel

- Segment Overview

- Hypermarket & Supermarket

- Pharmacy & Drugstores

- Specialty Store

- Online

- Others

- Global Baby Care Products Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Baby Care Products Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Baby Care Products Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Product Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Johnson & Johnson

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Procter & Gamble

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Kimberly-Clark

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Honasa Consumer Pvt. Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- The Himalaya Drug Company

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Citta World

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Sebapharma GmbH & Co. KG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Beiersdorf

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- California Baby

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Unilever

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Johnson & Johnson

List of Table

- Global Baby Care Products Market, By Product, 2021–2029(USD Billion)

- Global Baby Skin Care Baby Care Products Market, By Region, 2021–2029(USD Billion)

- Global Baby Toiletries/Hair Care Baby Care Products Market, By Region, 2021–2029(USD Billion)

- Global Baby Food Baby Care Products Market, By Region, 2021–2029(USD Billion)

- Global Baby Safety & Convenience Baby Care Products Market, By Region, 2021–2029(USD Billion)

- Global Baby Care Products Market, By Price, 2021–2029(USD Billion)

- Global Low Baby Care Products Market, By Region, 2021–2029(USD Billion)

- Global Medium Baby Care Products Market, By Region, 2021–2029(USD Billion)

- Global High Baby Care Products Market, By Region, 2021–2029(USD Billion)

- Global Baby Care Products Market, By Distribution Channel, 2021–2029(USD Billion)

- Global Hypermarket & Supermarket Baby Care Products Market, By Region, 2021–2029(USD Billion)

- Global Pharmacy & Drugstores Baby Care Products Market, By Region, 2021–2029(USD Billion)

- Global Specialty Store Baby Care Products Market, By Region, 2021–2029(USD Billion)

- Global Online Facilities Baby Care Products Market, By Region, 2021–2029(USD Billion)

- Global Other Facilities Baby Care Products Market, By Region, 2021–2029(USD Billion)

- Global Baby Care Products Market, By Region, 2021–2029(USD Billion)

- Global Baby Care Products Market, By North America, 2021–2029(USD Billion)

- North America Baby Care Products Market, By Product, 2021–2029(USD Billion)

- North America Baby Care Products Market, By Price, 2021–2029(USD Billion)

- North America Baby Care Products Market, By Distribution Channel, 2021–2029(USD Billion)

- USA Baby Care Products Market, By Product, 2021–2029(USD Billion)

- USA Baby Care Products Market, By Price, 2021–2029(USD Billion)

- USA Baby Care Products Market, By Distribution Channel, 2021–2029(USD Billion)

- Canada Baby Care Products Market, By Product, 2021–2029(USD Billion)

- Canada Baby Care Products Market, By Price, 2021–2029(USD Billion)

- Canada Baby Care Products Market, By Distribution Channel, 2021–2029(USD Billion)

- Mexico Baby Care Products Market, By Product, 2021–2029(USD Billion)

- Mexico Baby Care Products Market, By Price, 2021–2029(USD Billion)

- Mexico Baby Care Products Market, By Distribution Channel, 2021–2029(USD Billion)

- Europe Baby Care Products Market, By Product, 2021–2029(USD Billion)

- Europe Baby Care Products Market, By Price, 2021–2029(USD Billion)

- Europe Baby Care Products Market, By Distribution Channel, 2021–2029(USD Billion)

- Germany Baby Care Products Market, By Product, 2021–2029(USD Billion)

- Germany Baby Care Products Market, By Price, 2021–2029(USD Billion)

- Germany Baby Care Products Market, By Distribution Channel, 2021–2029(USD Billion)

- France Baby Care Products Market, By Product, 2021–2029(USD Billion)

- France Baby Care Products Market, By Price, 2021–2029(USD Billion)

- France Baby Care Products Market, By Distribution Channel, 2021–2029(USD Billion)

- UK Baby Care Products Market, By Product, 2021–2029(USD Billion)

- UK Baby Care Products Market, By Price, 2021–2029(USD Billion)

- UK Baby Care Products Market, By Distribution Channel, 2021–2029(USD Billion)

- Italy Baby Care Products Market, By Product, 2021–2029(USD Billion)

- Italy Baby Care Products Market, By Price, 2021–2029(USD Billion)

- Italy Baby Care Products Market, By Distribution Channel, 2021–2029(USD Billion)

- Spain Baby Care Products Market, By Product, 2021–2029(USD Billion)

- Spain Baby Care Products Market, By Price, 2021–2029(USD Billion)

- Spain Baby Care Products Market, By Distribution Channel, 2021–2029(USD Billion)

- Asia Pacific Baby Care Products Market, By Product, 2021–2029(USD Billion)

- Asia Pacific Baby Care Products Market, By Price, 2021–2029(USD Billion)

- Asia Pacific Baby Care Products Market, By Distribution Channel, 2021–2029(USD Billion)

- Japan Baby Care Products Market, By Product, 2021–2029(USD Billion)

- Japan Baby Care Products Market, By Price, 2021–2029(USD Billion)

- Japan Baby Care Products Market, By Distribution Channel, 2021–2029(USD Billion)

- China Baby Care Products Market, By Product, 2021–2029(USD Billion)

- China Baby Care Products Market, By Price, 2021–2029(USD Billion)

- China Baby Care Products Market, By Distribution Channel, 2021–2029(USD Billion)

- India Baby Care Products Market, By Product, 2021–2029(USD Billion)

- India Baby Care Products Market, By Price, 2021–2029(USD Billion)

- India Baby Care Products Market, By Distribution Channel, 2021–2029(USD Billion)

- South America Baby Care Products Market, By Product, 2021–2029(USD Billion)

- South America Baby Care Products Market, By Price, 2021–2029(USD Billion)

- South America Baby Care Products Market, By Distribution Channel, 2021–2029(USD Billion)

- Brazil Baby Care Products Market, By Product, 2021–2029(USD Billion)

- Brazil Baby Care Products Market, By Price, 2021–2029(USD Billion)

- Brazil Baby Care Products Market, By Distribution Channel, 2021–2029(USD Billion)

- Middle East and Africa Baby Care Products Market, By Product, 2021–2029(USD Billion)

- Middle East and Africa Baby Care Products Market, By Price, 2021–2029(USD Billion)

- Middle East and Africa Baby Care Products Market, By Distribution Channel, 2021–2029(USD Billion)

- UAE Baby Care Products Market, By Product, 2021–2029(USD Billion)

- UAE Baby Care Products Market, By Price, 2021–2029(USD Billion)

- UAE Baby Care Products Market, By Distribution Channel, 2021–2029(USD Billion)

- South Africa Baby Care Products Market, By Product, 2021–2029(USD Billion)

- South Africa Baby Care Products Market, By Price, 2021–2029(USD Billion)

- South Africa Baby Care Products Market, By Distribution Channel, 2021–2029(USD Billion)

List of Figures

- Global Baby Care Products Market Segmentation

- Baby Care Products Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Baby Care Products Market Attractiveness Analysis By Product

- Global Baby Care Products Market Attractiveness Analysis By Price

- Global Baby Care Products Market Attractiveness Analysis By Distribution Channel

- Global Baby Care Products Market Attractiveness Analysis By Region

- Global Baby Care Products Market: Dynamics

- Global Baby Care Products Market Share By Product(2021 & 2029)

- Global Baby Care Products Market Share By Price(2021 & 2029)

- Global Baby Care Products Market Share By Distribution Channel(2021 & 2029)

- Global Baby Care Products Market Share by Regions (2021 & 2029)

- Global Baby Care Products Market Share by Company (2020)