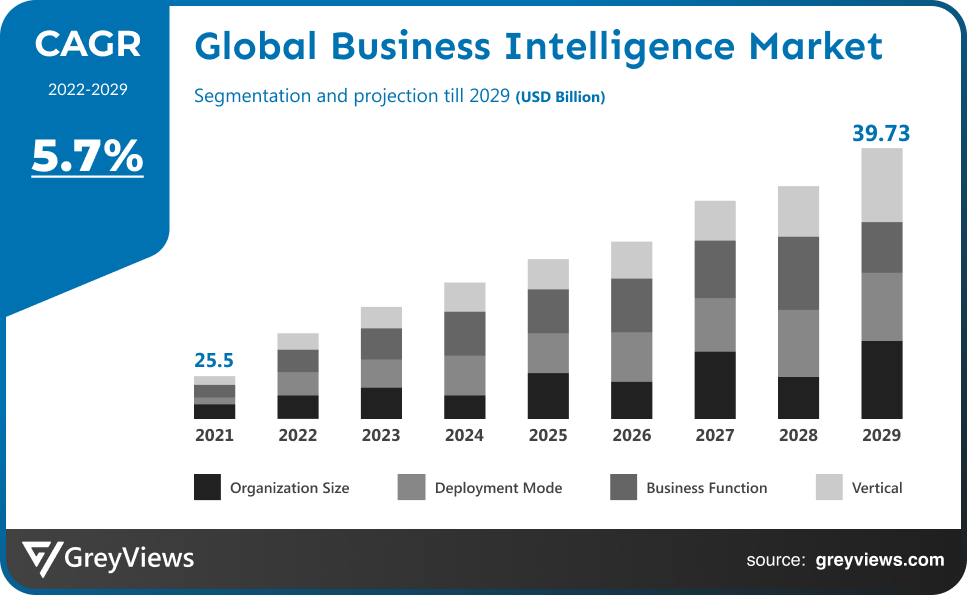

Business Intelligence Market Size By Organization Size (Large Enterprises and Small & Medium Sized Enterprises (SMEs)), By Deployment Mode (Cloud and On-Premises), By Business Function (Human Resource, Finance, Operations, and Sales & Marketing), By Vertical (Retail, Manufacturing, Government and Public Services, Media and Entertainment, Transportation and Logistics, BFSI, Telecom and IT, Healthcare and Life Sciences, Tourism and Hospitality, and Others), Regions, Segmentation, and Projection till 2029

CAGR: 5.7%Current Market Size: USD 25.5 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Business Intelligence Market- Market Overview:

The Global Business Intelligence market is expected to grow from USD 25.5 billion in 2021 to USD 39.73 billion by 2029, at a CAGR of 5.7% during the Projection period 2022-2029. The increasing need for real-time data analysis is one of the major factors propelling the growth of the business intelligence market.

Business intelligence (BI) is a technique for analysing data and providing employees, managers, and leaders with useful information so they can make better business decisions. As part of the BI process, businesses gather data from a variety of IT systems, prepare it for analysis, run queries on the data, and create data visualisations, BI presentations, and reports to present the analytical findings to corporate clients for tactical and strategic decision-making. The ultimate goal of business intelligence initiatives is to assist organisations in making better business decisions that will increase operational effectiveness, create revenue, and give them a competitive edge over their rivals. BI integrates analytics, data management, reporting, and a variety of data management and analysis approaches to achieve this goal. There is more to a business intelligence infrastructure than just BI software. Business intelligence data is often kept in an enterprise data warehouse or smaller data marts, which commonly have linkages to an enterprise data warehouse and include subsets of business information for certain departments and business units. Furthermore, data lakes built on Hadoop clusters or other big data platforms are widely utilized as warehouses or landing strips for BI and analytics data, particularly log files, sensor data, text, and other types of data. data that is either semi- or unstructured. BI solutions may assist both strategic and tactical decision-making processes since BI data can include both historical and real-time data that is collected as it is produced from source systems. To ensure that BI teams and business users are studying accurate and consistent data, raw data from various source systems must frequently be combined, aggregated, and cleansed using data integration and data quality management technologies before it can be used in business intelligence applications.

Sample Request: - Global Business Intelligence Market

Market Dynamics:

Drivers:

- Cloud computing and big data analytics are major contributors to the success of BI solutions

Data that is both organised and unstructured is stored on cloud services. Big data technologies examine enormous volumes of data to provide useful insights. Additionally, BI software adoption is being aided by advanced analytics capabilities like machine learning, artificial intelligence, IoT, and predictive analytics.

Restraints:

- BI solution costs hinder adoption for small and medium-scale enterprises

Costs associated with BI solutions prevent adoption by small and medium-sized businesses. Additionally, experts who can interpret vast volumes of data, such as data scientists and BI analysts, are somewhat hard to find. The problems of expensive infrastructure can be lessened through the development of self-service analytics and cloud computing.

Opportunities:

- Leveraging business intelligence and data visualizations during COVID-19

Similar to the 2008 financial crisis, businesses are focusing on operations, sales, income, and expenses during the COVID-19 crisis. High-level difficulties are being faced by businesses. The growing effects of COVID-19 are costing them money. Leaders must understand the factors that influence their income both locally and globally. Everywhere has a different local legislature. What may be pertinent for the US (and even for certain states) may not be pertinent for nations in Europe. Therefore, it's crucial to focus on customer behaviour and determine what information is essential for audiences. The necessity for all businesses to use their data to accelerate the decision-making process has increased as a result of COVID-19.

Challenges:

- Data integration

One such element that characterises the software's clients and users is integration. Professionals may access all the data in an integrated system thanks to end-to-end integration. However, business intelligence and analytics companies confront a significant issue with integration. Due to the significant benefits they offer, cloud-based business intelligence solutions are in great demand. However, cloud deployments come with a number of drawbacks, including security and data integration concerns with on-premises data. In this sector, it might be difficult to integrate different analytics software, business intelligence, Master Data Management (MDM), big data, and analytics tools.

Segmentation Analysis:

The global Business Intelligence market has been segmented based on Organization Size, Deployment Mode, Business Function, Vertical and regions.

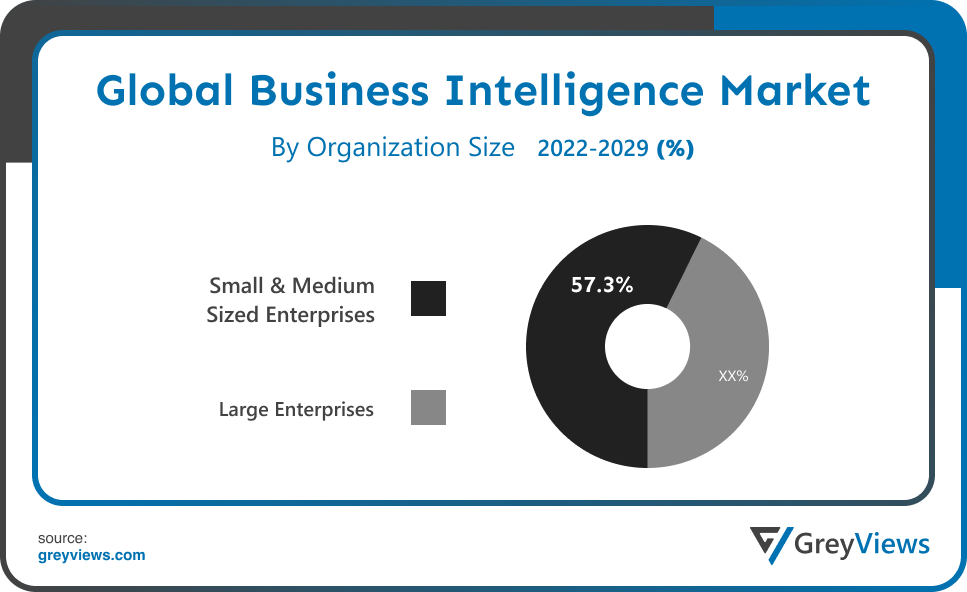

By Organization Size

The Organization Size segment includes Large Enterprises and Small & Medium sized Enterprises (SMEs). The SMEs segment led the largest share of the Business Intelligence market with a market share of around 57.3% in 2021. In order to grow market share and customer satisfaction through focused marketing initiatives and promotions, SMEs are encouraged to use business intelligence solutions. In addition, resource efficiency and ongoing productivity review are two more drivers that drive SMEs' demand for advanced BI solutions.

By Deployment Mode

The Deployment Mode segment includes Cloud and On-premises. The Cloud segment led the Business Intelligence market with a market share of around 53.08% in 2021. Throughout the anticipated period, the cloud segment is anticipated to rule the market. With cloud deployments, a business may manage BI applications by contracting with a BI infrastructure provider. This helps the business boost production, cut operational expenses, and shorten implementation times. As a result, it is anticipated that cloud adoption would grow quickly.

By Business Function

The Business Function segment includes Human Resource, Finance, Operations and Sales & Marketing. The Human Resource segment led the Business Intelligence market with a market share of around 30.08% in 2021. Because of the increasing need for workforce management, the HR business function industry is anticipated to grow quicker throughout the Projection period. To give HR managers the ability to make personnel decisions in real-time, many firms are deploying business intelligence solutions.

By Vertical

The Vertical segment includes Retail, Manufacturing, Government and Public Services, Media and Entertainment, Transportation and Logistics, BFSI, Telecom and IT, Healthcare and Life Sciences, Tourism and Hospitality, and Others. The Passenger segment led the Business Intelligence market with a market share of around 11.08% in 2021. Over the anticipated period, the BFSI sector is anticipated to hold the most market share. Business intelligence application in the BFSI industry is motivated by factors including enhancing marketing strategies and customer retention policies, creating new investment plans, and reducing risks. The largest market is anticipated to be in the healthcare and life sciences sector over the projection period. Due to the increasing complexity of the healthcare sector vertical, there is a growing need for remote and real-time insights from disorganized clinical data in the healthcare and life sciences sectors.

Global Business Intelligence Market- Sales Analysis.

The sale of synthetic biology products expanded at a CAGR of 4.7% from 2015 to 2021.

The increasing demand for real-time data analysis is one of the major factors propelling the growth of the business intelligence market. Due to growing market competition, real-time data analysis is becoming a top requirement in many businesses. The market is comprehensively evaluated in the study on the global business intelligence industry. The research provides a thorough analysis of the market's key segments, trends, drivers, restraints, competitive environment, and other important elements.The incorporation of predictive decision-making using artificial intelligence and machine learning is blamed for the growing trend in the business intelligence market. The utilisation of big data platforms, analytics apps, and master data management are other trends.

It helps companies integrate data using metrics, dimensions, and funnels, which ultimately drives the business intelligence industry. Additionally, it reveals the operational areas where the business is succeeding and failing. In this manner, businesses concentrate on their long-term strategies that incorporate new tools and technologies.

Businesses can segment and prioritise their key performance indicators with the assistance of business intelligence systems' data visualisation features, eliminating all the extraneous data that won't be used in future business decisions. This promotes the sales of business intelligence platforms and integrated systems by assisting the brand in identifying fresh trends and patterns, which it then uses to inform future business initiatives.

Thus, owing to the aforementioned factors, the global Business Intelligence Market is expected to grow at a CAGR of 5.7% during the Projection period from 2022 to 2029.

By Regional Analysis:

The regions analyzed for the Business Intelligence market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Asia Pacific region dominated the Business Intelligence market and held the 32.1% share of the market revenue in 2021.

- The Asia Pacific region witnessed a major share. Due to the commercialization of loT technology and the growing use of cutting-edge technologies in nations like China, Japan, and India, which are boosting the need for business intelligence products and services, APAC is predicted to develop at the greatest CAGR over the projection period. Additionally, the business intelligence industry now has a more precise and trustworthy edge because to the growing market and need for IOT and big data.

- North America is anticipated to experience significant growth during the predicted period. Due to its technical advancement in business management analytics for sales, production, and innovation, North America is expected to have the largest market. North America is home to the bulk of the key participants in the business intelligence industry. Due to the commercialization of IoT technology and the increased usage of advanced technologies in nations like China, Japan, and India, APAC is predicted to grow at the quickest rate throughout the projection period, driving demand for business intelligence products and services.

Global Business Intelligence Market- Country Analysis:

- Germany

Germany Business Intelligence market size was valued at USD 16.38 billion in 2021 and is expected to reach USD 24.29 billion by 2029, at a CAGR of 5.3% from 2022 to 2029.

One of the developing markets for technology products and services is the Germany market for business intelligence and analytics applications. The platform's main benefit is that it enhances overall decision-making as well as the caliber of company research and reporting. As a result, the use of BI and analytics apps opens up new business prospects, which helps the Germany market expand.

- China

China Business Intelligence’s market size was valued at USD 29.78 billion in 2021 and is expected to reach USD 43.50 billion by 2029, at a CAGR of 5.1% from 2022 to 2029.

In this regard, the market in the nation is anticipated to retain its quick rise over the following years. China is likewise making an effort to advance business intelligence in the healthcare industry. For example, the Beijing-based business Beijing Keya Medical said that the CFDA has certified their imaging system for cardiac care in January 2020. It has become China's first artificial intelligence (AI) medical gadget as a consequence.

- India

India's Business Intelligence market size was valued at USD 5.96 billion in 2021 and is expected to reach USD 9.32 billion by 2029, at a CAGR of 6.0% from 2022 to 2029. The Indian The majority of India's market growth may be attributed to Indian businesses switching from traditional enterprise reporting to augmented analytics technologies, which hastens data preparation and purification. Additionally, the government of the nation places a strong emphasis on improved technology-enabled delivery systems for many initiatives. With the introduction of programmes like Startup India and Digital India, the domestic market for software services is anticipated to increase significantly as well.

Key Industry Players Analysis:

To increase their market position in the global Business Intelligence business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Alphabet Inc

- Alteryx Inc

- com Inc

- Hitachi Ltd

- Idera Inc

- International Business Machines Corp

- Microsoft Corp

- MicroStrategy Inc

- Oracle Corp

- Palantir Technologies Inc

- Panorama Software Inc

Latest Development:

- In August 2022, In order to change patient care with the use of big data, Sisense, the top AI-driven platform for data analytics, teams up with Gerimedica, a multidisciplinary electronic medical record (EMR) provider that caters to the aged-care market. Since using Sisense, Gerimedica has witnessed an average drop of 6% in the number of days each patient spends in the hospital, saving each patient €540.

- In May 2022, The Analytics Automation Company, Alteryx Inc., presented new innovations that enable businesses to implement cloud analytics, democratise insights, and maintain data governance. By providing intelligent data transformation and insights in the cloud at scale, Alteryx meets these demands.

Report Metrics

| Report Attribute | Details |

| Study Period | 2021-2029 |

| Base year | 2021 |

| CAGR (%) | 5.7% |

| Market Size | 25.5 billion in 2021 |

| Projection period | 2022-2029 |

| Projection unit | Value (USD) |

| Segments covered | By Organization Size, By Deployment Mode, By Business Function, By Vertical and By Region. |

| Report Scope | Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

Companies covered | Alphabet Inc, Alteryx Inc, Amazon.com Inc, Hitachi Ltd, Idera Inc, International Business Machines Corp, Microsoft Corp, MicroStrategy Inc, Oracle Corp, Palantir Technologies Inc, and Panorama Software Inc. |

| By Organization Size |

|

| By Deployment Mode |

|

| By Business Function |

|

| By Vertical |

|

Regional scope |

|

Scope of the Report

Organization Size, Deployment Mode, Business Function, Vertical

Global Business Intelligence Market by Organization Size:

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

Global Business Intelligence Market by Deployment Mode:

- Cloud

- On-Premises

Global Business Intelligence Market by Business Function:

- Human Resource

- Finance

- Operations

- Sales and Marketing

Global Business Intelligence Market by Vertical:

- Retail

- Manufacturing

- Government and Public Services

- Media and Entertainment

- Transportation and Logistics

- BFSI

- Telecom and IT

- Healthcare and Life Sciences

- Tourism and Hospitality

- Others

Global Business Intelligence Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the expected market size of the Business Intelligence market in 2029?

Global Business Intelligence market is expected to reach USD 39.73 billion by 2029, at a CAGR of 5.7% from 2022 to 2029.

What are the key driving factors of the market?

The increasing demand for real-time data analysis is one of the major factors propelling the growth of the business intelligence market. Due to growing market competition, real-time data analysis is becoming a top requirement in many businesses.

What are the factors restraining the market�s growth?

BI solution costs hinder adoption for small and medium-scale enterprises restraining the market�s growth.

Which are the leading market players active in the Business Intelligence market?

Leading market players active in the global Business Intelligence market are BW Group, Dorian LPG Ltd., EXMAR, Hyundai Heavy Industries Co., Ltd, Kawasaki Heavy Industries, Ltd, Mitsubishi Heavy Industries, Ltd., Namura Shipbuilding Co., Ltd., PT Pertamina (Persero), StealthGas Inc., The Great Eastern Shipping Co. Ltd., Teekay Corporation among others.

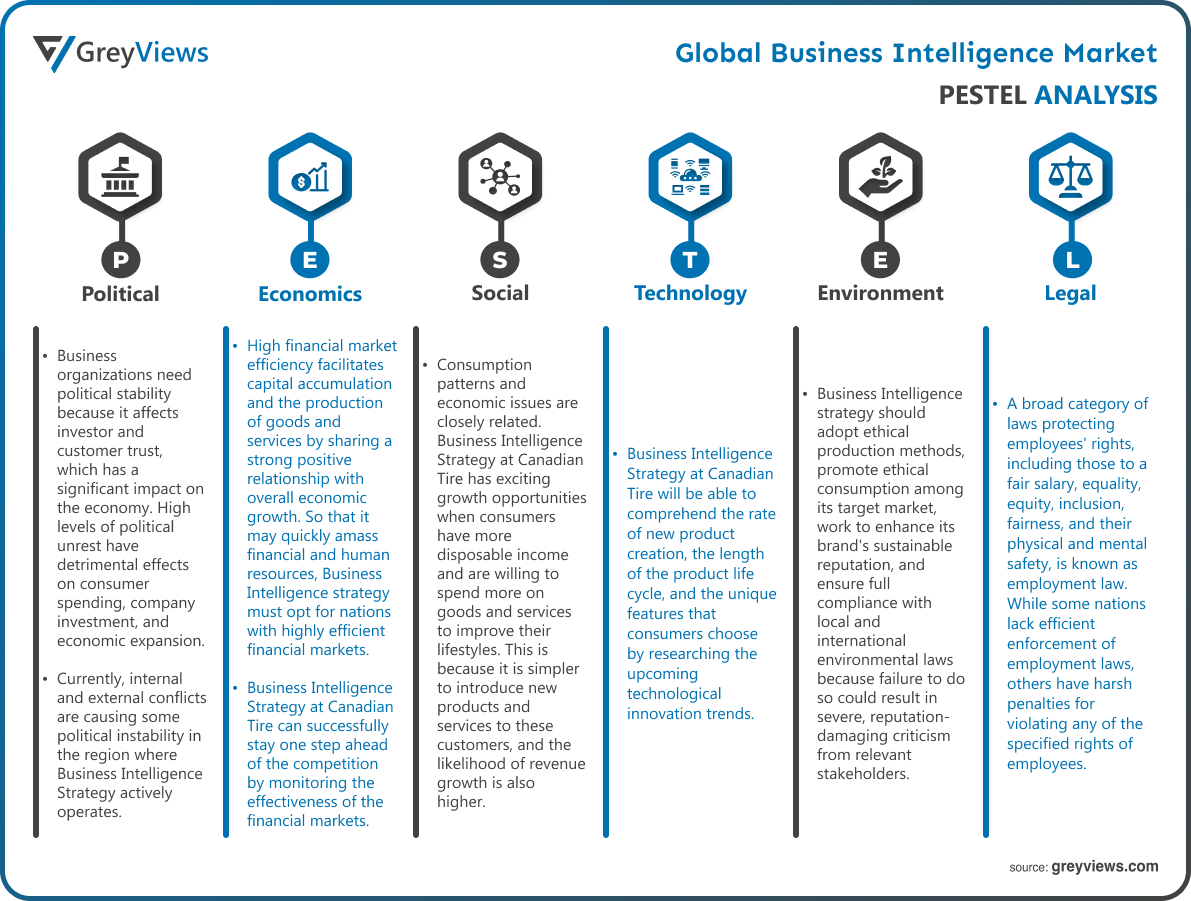

Political Factors- Business organizations need political stability because it affects investor and customer trust, which has a significant impact on the economy. High levels of political unrest have detrimental effects on consumer spending, company investment, and economic expansion. Currently, internal and external conflicts are causing some political instability in the region where Business Intelligence Strategy actively operates. The corporation may be unable to meet its growth goals if management is unable to comprehend and manage the current political upheaval, and it may be reluctant to spend additional funds.

Economical Factors- High financial market efficiency facilitates capital accumulation and the production of goods and services by sharing a strong positive relationship with overall economic growth. So that it may quickly amass financial and human resources, Business Intelligence strategy must opt for nations with highly efficient financial markets. Business Intelligence Strategy at Canadian Tire can successfully stay one step ahead of the competition by monitoring the effectiveness of the financial markets. When deciding whether to expand internationally, Business Intelligence strategy should consider the economic growth rates of the various nations. More options to pursue long-term growth goals exist in nations with high economic growth rates. Consumer purchasing becomes more cautious when the economy is growing slowly, which might directly impact business intelligence strategy.

Social Factor- Consumption patterns and economic issues are closely related. Business Intelligence Strategy at Canadian Tire has exciting growth opportunities when consumers have more disposable income and are willing to spend more on goods and services to improve their lifestyles. This is because it is simpler to introduce new products and services to these customers, and the likelihood of revenue growth is also higher. However, because contemporary consumers are growing more demanding, it is crucial for Business Intelligence Strategy to carefully examine their consumption/spending patterns preferences in order to modify the marketing mix methods. It's crucial for Business Intelligence Strategy to know whether hedonic or utilitarian incentives are behind consumer behavior.

Technological Factors- Technological innovation's velocity and progress can impact the market and industry as a whole. Business Intelligence Strategy at Canadian Tire will be able to comprehend the rate of new product creation, the length of the product life cycle, and the unique features that consumers choose by researching the upcoming technological innovation trends. Business Intelligence Strategy at Canadian Tire can benefit from research into consumers' opinions about cutting-edge digital technology to better determine whether moving to e-commerce will be more advantageous than establishing a physical location. The Business Intelligence Strategy at Canadian Tire may be forced to switch from manual to automated processes if competitors invest in automation technologies to cut costs, especially if the general populace of that society is tech-savvy.

Environmental Factors- Businesses are under pressure to lessen environmental harm due to strict environmental legislation in many different countries. In response, Business Intelligence strategy should adopt ethical production methods, promote ethical consumption among its target market, work to enhance its brand's sustainable reputation, and ensure full compliance with local and international environmental laws because failure to do so could result in severe, reputation-damaging criticism from relevant stakeholders. Renewable technology development to lessen reliance on natural resources has become a strong industry. To capitalise on this environmental trend, Business Intelligence strategy should assess how well a nation's technology infrastructure supports the usage of renewable technologies.

Legal Factors- A broad category of laws protecting employees' rights, including those to a fair salary, equality, equity, inclusion, fairness, and their physical and mental safety, is known as employment law. While some nations lack efficient enforcement of employment laws, others have harsh penalties for violating any of the specified rights of employees. Business Intelligence Strategy at Canadian Tire should guarantee the security of the working environment while entering or operating in those nations. There must be appropriate systems in place to prevent both direct and indirect discrimination. Business Intelligence Strategy at Canadian Tire can benefit from effective compliance with employment rules by improving its employer brand reputation, which is crucial for luring and keeping top personnel in the market amid the current talent war.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Organization Size

- 3.2. Market Attractiveness Analysis By Deployment Mode

- 3.3. Market Attractiveness Analysis By Business Function

- 3.4. Market Attractiveness Analysis By Vertical

- 3.5. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Cloud computing and big data analytics are major contributors to the success of BI solutions

- 3. Restraints

- 3.1. BI solution costs hinder adoption for small and medium-scale enterprises

- 4. Opportunities

- 4.1. Leveraging business intelligence and data visualizations during COVID-19

- 5. Challenges

- 5.1. Data integration

- Global Business Intelligence Market Analysis and Projection, By Organization Size

- 1. Segment Overview

- 2. Large Enterprises

- 3. Small and Medium-Sized Enterprises (SMEs)

- Global Business Intelligence Market Analysis and Projection, By Deployment Mode

- 1. Segment Overview

- 2. Cloud

- 3. On-Premises

- Global Business Intelligence Market Analysis and Projection, By Business Function

- 1. Segment Overview

- 2. Human Resource

- 3. Finance

- 4. Operations

- 5. Sales and Marketing

- Global Business Intelligence Market Analysis and Projection, By Vertical

- 1. Segment Overview

- 2. Retail

- 3. Manufacturing

- 4. Government and Public Services

- 5. Media and Entertainment

- 6. Transportation and Logistics

- 7. BFSI

- 8. Telecom and IT

- 9. Healthcare and Life Sciences

- Tourism and Hospitality

- Others

- Global Business Intelligence Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- South America

- 5.1. Brazil

- Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Business Intelligence Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Business Intelligence Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Alphabet Inc

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Alteryx Inc

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- com Inc

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Hitachi Ltd

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Idera Inc

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- International Business Machines Corp

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Microsoft Corp

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- MicroStrategy Inc

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Oracle Corp

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Palantir Technologies Inc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Panorama Software Inc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Alphabet Inc

List of Table

- Global Business Intelligence Market, By Organization Size, 2021–2029 (USD Billion)

- Global Large Enterprises, Business Intelligence Market, By Region, 2021–2029 (USD Billion)

- Global Small and Medium-Sized Enterprises (SMEs), Business Intelligence Market, By Region, 2021–2029 (USD Billion)

- Global Business Intelligence Market, By Deployment Mode, 2021–2029 (USD Billion)

- Global Cloud, Business Intelligence Market, By Region, 2021–2029 (USD Billion)

- Global On-Premises, Business Intelligence Market, By Region, 2021–2029 (USD Billion)

- Global Business Intelligence Market, By Business Function, 2021–2029 (USD Billion)

- Global Human Resource, Business Intelligence Market, By Region, 2021–2029 (USD Billion)

- Global Finance, Business Intelligence Market, By Region, 2021–2029 (USD Billion)

- Global Operations, Business Intelligence Market, By Region, 2021–2029 (USD Billion)

- Global Sales and Marketing, Business Intelligence Market, By Region, 2021–2029 (USD Billion)

- Global Business Intelligence Market, By Vertical, 2021–2029 (USD Billion)

- Global Retail, Business Intelligence Market, By Region, 2021–2029 (USD Billion)

- Global Manufacturing, Business Intelligence Market, By Region, 2021–2029 (USD Billion)

- Global Government and Public Services, Business Intelligence Market, By Region, 2021–2029 (USD Billion)

- Global Media and Entertainment, Business Intelligence Market, By Region, 2021–2029 (USD Billion)

- Global Transportation and Logistics, Business Intelligence Market, By Region, 2021–2029 (USD Billion)

- Global BFSI, Business Intelligence Market, By Region, 2021–2029 (USD Billion)

- Global Telecom and IT, Business Intelligence Market, By Region, 2021–2029 (USD Billion)

- Global Healthcare and Life Sciences, Business Intelligence Market, By Region, 2021–2029 (USD Billion)

- Global Tourism and Hospitality, Business Intelligence Market, By Region, 2021–2029 (USD Billion)

- Global Others, Business Intelligence Market, By Region, 2021–2029 (USD Billion)

- Global Business Intelligence Market, By Region, 2021–2029 (USD Billion)

- North America Business Intelligence Market, By Organization Size, 2021–2029 (USD Billion)

- North America Business Intelligence Market, By Deployment Mode, 2021–2029 (USD Billion)

- North America Business Intelligence Market, By Business Function, 2021–2029 (USD Billion)

- North America Business Intelligence Market, By Vertical, 2021–2029 (USD Billion)

- USA Business Intelligence Market, By Organization Size, 2021–2029 (USD Billion)

- USA Business Intelligence Market, By Deployment Mode, 2021–2029 (USD Billion)

- USA Business Intelligence Market, By Business Function, 2021–2029 (USD Billion)

- USA Business Intelligence Market, By Vertical, 2021–2029 (USD Billion)

- Canada Business Intelligence Market, By Organization Size, 2021–2029 (USD Billion)

- Canada Business Intelligence Market, By Deployment Mode, 2021–2029 (USD Billion)

- Canada Business Intelligence Market, By Business Function, 2021–2029 (USD Billion)

- Canada Business Intelligence Market, By Vertical, 2021–2029 (USD Billion)

- Mexico Business Intelligence Market, By Organization Size, 2021–2029 (USD Billion)

- Mexico Business Intelligence Market, By Deployment Mode, 2021–2029 (USD Billion)

- Mexico Business Intelligence Market, By Business Function, 2021–2029 (USD Billion)

- Mexico Business Intelligence Market, By Vertical, 2021–2029 (USD Billion)

- Europe Business Intelligence Market, By Organization Size, 2021–2029 (USD Billion)

- Europe Business Intelligence Market, By Deployment Mode, 2021–2029 (USD Billion)

- Europe Business Intelligence Market, By Business Function, 2021–2029 (USD Billion)

- Europe Business Intelligence Market, By Vertical, 2021–2029 (USD Billion)

- Germany Business Intelligence Market, By Organization Size, 2021–2029 (USD Billion)

- Germany Business Intelligence Market, By Deployment Mode, 2021–2029 (USD Billion)

- Germany Business Intelligence Market, By Business Function, 2021–2029 (USD Billion)

- Germany Business Intelligence Market, By Vertical, 2021–2029 (USD Billion)

- France Business Intelligence Market, By Organization Size, 2021–2029 (USD Billion)

- France Business Intelligence Market, By Deployment Mode, 2021–2029 (USD Billion)

- France Business Intelligence Market, By Business Function, 2021–2029 (USD Billion)

- France Business Intelligence Market, By Vertical, 2021–2029 (USD Billion)

- UK Business Intelligence Market, By Organization Size, 2021–2029 (USD Billion)

- UK Business Intelligence Market, By Deployment Mode, 2021–2029 (USD Billion)

- UK Business Intelligence Market, By Business Function, 2021–2029 (USD Billion)

- UK Business Intelligence Market, By Vertical, 2021–2029 (USD Billion)

- Italy Business Intelligence Market, By Organization Size, 2021–2029 (USD Billion)

- Italy Business Intelligence Market, By Deployment Mode, 2021–2029 (USD Billion)

- Italy Business Intelligence Market, By Business Function, 2021–2029 (USD Billion)

- Italy Business Intelligence Market, By Vertical, 2021–2029 (USD Billion)

- Spain Business Intelligence Market, By Organization Size, 2021–2029 (USD Billion)

- Spain Business Intelligence Market, By Deployment Mode, 2021–2029 (USD Billion)

- Spain Business Intelligence Market, By Business Function, 2021–2029 (USD Billion)

- Spain Business Intelligence Market, By Vertical, 2021–2029 (USD Billion)

- Asia Pacific Business Intelligence Market, By Organization Size, 2021–2029 (USD Billion)

- Asia Pacific Business Intelligence Market, By Deployment Mode, 2021–2029 (USD Billion)

- Asia Pacific Business Intelligence Market, By Business Function, 2021–2029 (USD Billion)

- Asia Pacific Business Intelligence Market, By Vertical, 2021–2029 (USD Billion)

- Japan Business Intelligence Market, By Organization Size, 2021–2029 (USD Billion)

- Japan Business Intelligence Market, By Deployment Mode, 2021–2029 (USD Billion)

- Japan Business Intelligence Market, By Business Function, 2021–2029 (USD Billion)

- Japan Business Intelligence Market, By Vertical, 2021–2029 (USD Billion)

- China Business Intelligence Market, By Organization Size, 2021–2029 (USD Billion)

- China Business Intelligence Market, By Deployment Mode, 2021–2029 (USD Billion)

- China Business Intelligence Market, By Business Function, 2021–2029 (USD Billion)

- China Business Intelligence Market, By Vertical, 2021–2029 (USD Billion)

- India Business Intelligence Market, By Organization Size, 2021–2029 (USD Billion)

- India Business Intelligence Market, By Deployment Mode, 2021–2029 (USD Billion)

- India Business Intelligence Market, By Business Function, 2021–2029 (USD Billion)

- India Business Intelligence Market, By Vertical, 2021–2029 (USD Billion)

- South America Business Intelligence Market, By Organization Size, 2021–2029 (USD Billion)

- South America Business Intelligence Market, By Deployment Mode, 2021–2029 (USD Billion)

- South America Business Intelligence Market, By Business Function, 2021–2029 (USD Billion)

- South America Business Intelligence Market, By Vertical, 2021–2029 (USD Billion)

- Brazil Business Intelligence Market, By Organization Size, 2021–2029 (USD Billion)

- Brazil Business Intelligence Market, By Deployment Mode, 2021–2029 (USD Billion)

- Brazil Business Intelligence Market, By Business Function, 2021–2029 (USD Billion)

- Brazil Business Intelligence Market, By Vertical, 2021–2029 (USD Billion)

- Middle East and Africa Business Intelligence Market, By Organization Size, 2021–2029 (USD Billion)

- Middle East and Africa Business Intelligence Market, By Deployment Mode, 2021–2029 (USD Billion)

- Middle East and Africa Business Intelligence Market, By Business Function, 2021–2029 (USD Billion)

- Middle East and Africa Business Intelligence Market, By Vertical, 2021–2029 (USD Billion)

- UAE Business Intelligence Market, By Organization Size, 2021–2029 (USD Billion)

- UAE Business Intelligence Market, By Deployment Mode, 2021–2029 (USD Billion)

- UAE Business Intelligence Market, By Business Function, 2021–2029 (USD Billion)

- UAE Business Intelligence Market, By Vertical, 2021–2029 (USD Billion)

- South Africa Business Intelligence Market, By Organization Size, 2021–2029 (USD Billion)

- South Africa Business Intelligence Market, By Deployment Mode, 2021–2029 (USD Billion)

- South Africa Business Intelligence Market, By Business Function, 2021–2029 (USD Billion)

- South Africa Business Intelligence Market, By Vertical, 2021–2029 (USD Billion)

List of Figures

- Global Business Intelligence Market Segmentation

- Business Intelligence Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Business Intelligence Market Attractiveness Analysis By Organization Size

- Global Business Intelligence Market Attractiveness Analysis By Deployment Mode

- Global Business Intelligence Market Attractiveness Analysis By Business Function

- Global Business Intelligence Market Attractiveness Analysis By Vertical

- Global Business Intelligence Market Attractiveness Analysis By Region

- Global Business Intelligence Market: Dynamics

- Global Business Intelligence Market Share By Organization Size (2021 & 2029)

- Global Business Intelligence Market Share By Deployment Mode (2021 & 2029)

- Global Business Intelligence Market Share By Business Function (2021 & 2029)

- Global Business Intelligence Market Share By Vertical (2021 & 2029)

- Global Business Intelligence Market Share by Regions (2021 & 2029)

- Global Business Intelligence Market Share by Company (2020)