Cigarette Rolling Paper Market Size by Material (Flax, Sisal, Hemp, Rice straw, and Esparto), By Product (Cigarette Tissue, Plug Wrap Paper, and Tipping Paper), By Weight (Up to 10 gsm, 10gsm -25 gsm, and 25 gsm & above), By Application (Machine-Rolled and Hand-Rolled) and Regions, Segmentation, and Projection till 2029

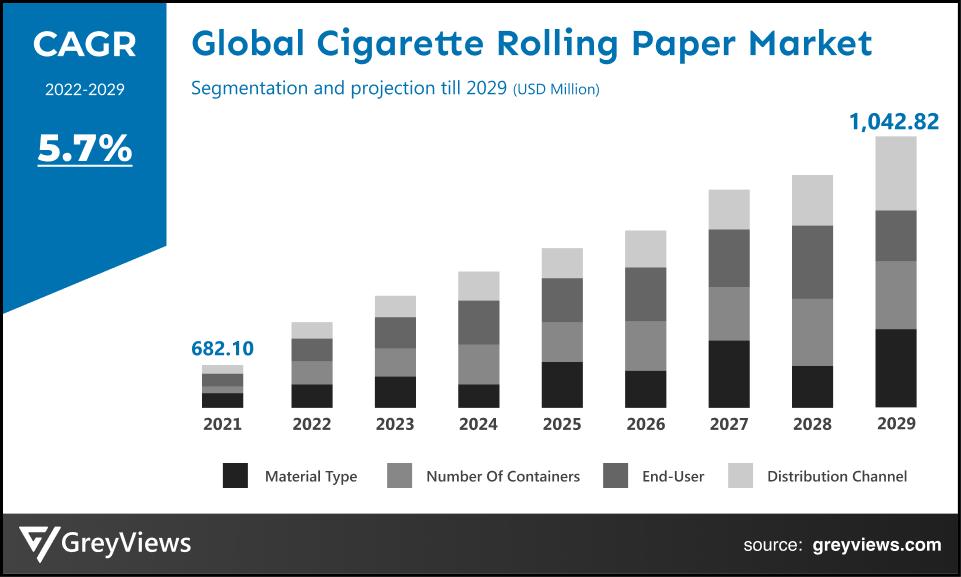

CAGR: 5.7%Current Market Size: USD 682.10 Million Fastest Growing Region: APAC

Largest Market: EuropeProjection Time: 2022-2029Base Year: 2021

Global Cigarette Rolling Paper Market- Market Overview:

Global Cigarette Rolling Paper market is expected to grow from USD 682.10 Million in 2021 to USD 1,042.82 Million by 2029, at a CAGR of 5.7% during the Projection period 2022-2029. The increase in the number of cigarette smokers and the growing disposable income of the people has primarily driven the market's growth.

Cigarette rolling paper is specially used in the making of cigarettes. These sheets of significantly thin paper encase cannabis while rolling a joint. Usually, these sheets are made of wood pulp, hemp, rice straw, or flax. These papers come in various dimensions, with a range of 70 mm to 110 mm in length. In addition, the rolling papers are flavored to enhance the taste experience. The wide-ranging variety of cigarette rolling papers includes blueberry, grape, pineapple, and double chocolate.

Moreover, the cigarette rolling paper has features such as high tearing strength, high tensile strength, high opacity, and low air permeability, along with excellent burning speed control and good runnability. The paradigm shift in consumer preference towards rolling their tobacco instead of using traditional formats has bolstered sales of rolling paper.

Request Sample: - Global Cigarette Rolling Paper Market

Market Dynamics:

Drivers:

- Increasing disposable income

Increasing disposable incomes of the population leads to the increased affordability of cigarette consumption. This drives the growth of the overall cigarette rolling paper market. For instance, different studies have indicated that the per capita cigarette consumption is higher for high-income households than for low-income households.

Moreover, health systems across low- and middle-income countries (LMICs) are seeing a considerable burden of non-communicable diseases. Hence, such countries are increasing tobacco prices as the most effective method to reduce smoking. However, the consequent increase in disposable incomes of the population across LMICs around Asia-Pacific, Latin America, and the Caribbean is boosting tobacco consumption. This factor has driven the growth of the global cigarette rolling paper market.

- A huge number of cigarette smokers

According to the U.S. Department of Health & Human Services, about 13 of every 100 U.S. adults aged 18 years and older (12.5% of the overall population) smoked cigarettes in the year 2020. Hence, more than 30.8 million adults smoke cigarettes in the country.

On the other hand, the annual Cigarette Report of the Federal Trade Commission indicated that the manufacturers sold 203.7 billion cigarettes in 2020, up from 202.9 billion in 2019. Hence, the sales of cigarettes were 0.4% higher in 2020 than in 2019. According to the report, this growth of attributed to increased advertising and promotion along with the price discounts paid to cigarette retailers by manufacturers. Hence, a huge number of cigarette smokers across the globe is significantly contributing to market growth.

Restraints:

- Increased health concerns among the population

Tobacco use is the leading cause of preventable disease, death, and disability in the United States and several other countries. This is due to increased cigarette smoking which harms almost all body organs. For instance, it is linked with heart disease, lung diseases, and multiple cancers, among other illnesses. However, abandoning the use of cigarette smoking and tobacco decreases the risk of cancer, stroke, heart disease, and lung diseases. The increased awareness among the population about such health concerns due to cigarette smoking and tobacco has primarily hampered the growth of the global cigarette rolling paper market.

Opportunities:

- The popularity of roll-your-own cigarettes among the younger generation

Roll-your-own (RYO) cigarettes are made by major application of loose tobacco and cigarette papers and are usually smoked without or with a filter. The global cigarette industry is seeing a growing preference for handmade or hand-rolled cigarettes due to relatively less associated costs than Factory-made (FM) cigarettes. In addition to this, such cigarettes are subjected to less taxation and regulations. This has increased demand for roll-your-own (RYO) cigarettes among financially stressed young consumers. This trend is expected to create lucrative growth opportunities for the global cigarette rolling paper market.

Challenges

- Initiatives to reduce cigarette smoking

Initiatives among all of the countries around the globe, such as educating consumers on the hazards of smoking, raising the prices of tobacco, and efforts to enable quitting smoking among people, are major challenges for the global cigarette rolling paper industry players. For instance, such initiatives are leading to fewer young people who start smoking, along with the rising trend of quitting among regular smokers.

Segmentation Analysis:

The global cigarette rolling paper market has been segmented based on material, product, weight, application, and region.

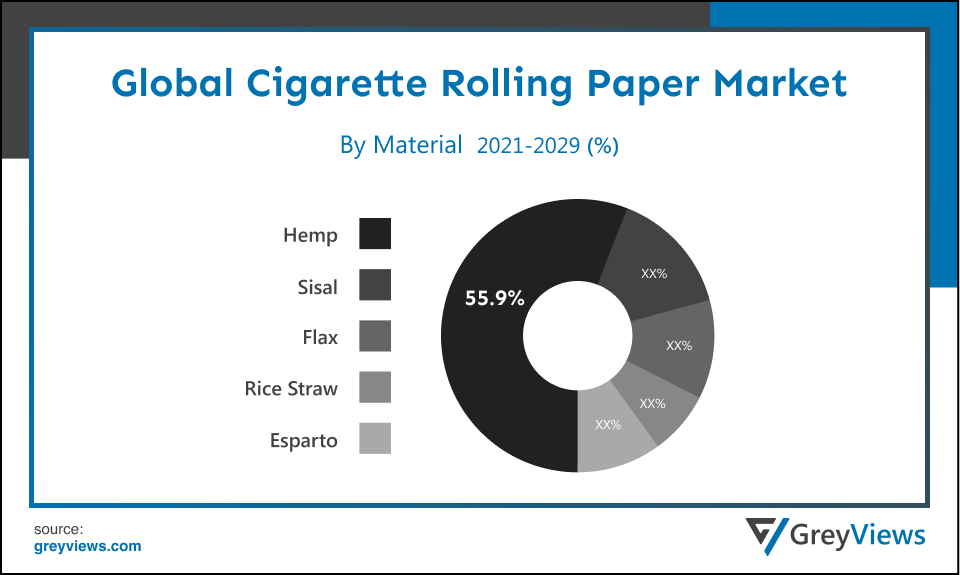

By Material

The material segment includes flax, sisal, hemp, rice straw, and esparto. The hemp segment led the Cigarette Rolling Paper market with a market share of around 55.9% in 2021. Hemp is derived from the cannabis Sativa plant. However, the fiber in hemp is suitable for creating cigarette rolling papers and clothing along with various other products. The increased popularity of hemp fiber usage worldwide has boosted this segment's growth. The demand for this material has been boosted in the past several years as the hemp rolling papers are comparatively much thicker than other options and hold plenty of cannabis.

By Application

The application segment includes machine-rolled and hand-rolled. The machine-rolled segment led the cigarette rolling paper market with a market share of around 68.92% in 2021. The mass distribution and mass marketing by large cigarette manufacturers are major factors contributing to this segment's growth. In addition, most of the commercially produced cigarettes across the globe are machine-rolled tobacco cigarettes that use medium to heavy-thickness papers. Manufacturers use thick enough papers to make the cigarettes considerably durable to stand the rigors of packaging and machine handling. This significance of machine-rolled cigarettes drives the growth of this segment.

By Regional Analysis:

The regions analyzed for the cigarette rolling paper market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Europe region dominated the Cigarette Rolling Paper market and held a 42.9% share of the market revenue in 2021.

- The Europe region witnessed a major share. The significant number of smokers in the region mainly contributes to the cigarette rolling paper market. For instance, according to the European health interview survey (EHIS) conducted in 2019, about 5.9 % of the EU population aged 15 years and above consumed more than 20 cigarettes per day; however, 12.6% of this population consumed less than 20 cigarettes per day. In addition, the upsurge in the trend of roll-your-own tobacco in Spain, Italy, and the United Kingdom has further contributed to the market growth.

- The Asia-Pacific region is expected to witness the highest growth rate during the Projection period. Increased population and rising disposable income in Asia-Pacific are fueling the growth of the cigarette rolling paper market. In addition, the penetration of emerging market players in this region has created lucrative growth opportunities for the market. Moreover, factors including an increase in urbanization, improvement in lifestyle due to a considerable rise in disposable income, and emerging markets such as the Philippines, Malaysia, India, Vietnam, Thailand, and Bangladesh are contributing to the market growth in Asia-Pacific.

Global Cigarette Rolling Paper Market- Country Analysis:

- Germany

Germany's Cigarette Rolling Paper market size was valued at USD 81.85 Million in 2021 and is expected to reach USD 123.25 Million by 2029, at a CAGR of 5.5% from 2022 to 2029.

Germany is one of the leading nations in the Europe Cigarette Rolling Paper market. This is mainly attributed to changing lifestyles, increasing disposable incomes of the population, and the rising trends of roll-your-own tobacco across the country. Sales of Cigarette Rolling Paper products in this country are projected to grow due to the increased spending capacity of consumers.

Moreover, comparatively higher tobacco consumption in Germany than in other European countries is a major factor contributing to the market growth. Also, the trend of dining out, preference for night lounges, and increasing modernization in the country is opportunistic for market growth.

- China

China's Cigarette Rolling Paper market size was valued at USD 136.42 Million in 2021 and is expected to reach USD 200.78 Million by 2029, at a CAGR of 5.2% from 2022 to 2029. China is one of the largest consumers as well as exporter of tobacco. In addition, the factors such as rapid urbanization, the flourishing Chinese cigarette manufacturing sector, and an upsurge in the number of smokers in the country have further boosted the growth of the market. For instance, according to the World Health Organisation (WHO), there are more than 300 million cigarette smokers in China, which is about one-third of the global population. This significance of cigarette smoking in the country boosts the demand for cigarette rolling papers.

- India

India's Cigarette Rolling Paper market size was valued at USD 27.28 Million in 2021 and is expected to reach USD 42.67 Million by 2029, at a CAGR of 6.0% from 2022 to 2029. India is one of the strongest growing economies in Asia. The increasing population in the country and the upsurge in tobacco consumption in the country boost the growth of the market. For instance, according to the Global Adult Tobacco Survey India, 267 million adults (29% of all adults) of the age of 15 years and above in the country are tobacco users.

In addition, the country is seeing rapid growth in the influence of social media and changing lifestyles. This has encouraged the modern population to increase Cigarette smoking. On the other hand, there is an abundance of raw materials in India. Such factors have altogether contributed to the Indian cigarette rolling paper market.

Key Industry Players Analysis:

To increase their market position in the global Cigarette Rolling Paper business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Schweitzer-Mauduit International, Inc.

- Delfort Group AG

- Republic Technologies

- Richer Paper Co., Ltd.

- Snail Custom Rolling Papers

- Moondust Paper Private Limited

- Miquel y Costas

- JOB de Jean Bardou

- Devambez

- Recon Inc.

Latest Development:

- In March 2022, Schweitzer-Mauduit International, Inc. entered into a definitive agreement with Neenah, Inc., the manufacturer of specialty materials, to combine in an all-stock transaction. This strategy is expected to position both companies to better serve customers with enhanced technologies and innovation.

- In July 2021, Republic Technologies, the leading rolling company, announced that its JOB Rolling Papers brand had introduced a line of products in partnership with the $TUNNA brand. This has enhanced the portfolio of Republic Technologies.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

5.7% |

|

Market Size |

682.10 million in 2021 |

|

Projection period |

2021-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Material, product, weight, application, and others, and Regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Schweitzer-Mauduit International, Inc., Delfort Group AG, Republic Technologies, Richer Paper Co., Ltd., Snail Custom Rolling Papers, Moondust Paper Private Limited, Miquel y Costas, JOB de Jean Bardou, Devambez, and Recon Inc. among others |

|

By Product |

|

|

By Product

|

|

|

By Weight

|

|

|

By Application

|

|

|

Regional scope |

|

Scope of the Report

Global Cigarette Rolling Paper Market by Material:

- Flax

- Sisal

- Hemp

- Rice straw

- Esparto

Global Cigarette Rolling Paper Market by Product:

- Cigarette Tissue

- Plug Wrap Paper

- Tipping Paper

Global Cigarette Rolling Paper Market by Weight:

- Up to 10 gsm

- 10gsm -25 gsm

- 25 gsm & above

Global Cigarette Rolling Paper Market by Application:

- Machine-Rolled

- Hand-Rolled

Global Cigarette Rolling Paper Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

How big market is Cigarette Rolling Paper market?

Global Cigarette Rolling Paper market Size was USD 682.10 Million in 2021 it will grow at CAGR of 5.7% during the Projection period 2022-2029

Which Region Dominate the Global Cigarette Rolling Paper Market?

Europe region dominated the Cigarette Rolling Paper market and held a 42.9% share of the market revenue in 2021.

What are the segmentation covered in global Cigarette Rolling Paper market?

The global Cigarette Rolling Paper market has been segmented based on material, product, weight, application, and regions.

Which are the leading market players active in the Cigarette Rolling Paper market?

Leading market players active in the global market are Schweitzer-Mauduit International, Inc., Delfort Group AG, Republic Technologies, Richer Paper Co., Ltd., Snail Custom Rolling Papers, Moondust Paper Private Limited, Miquel y Costas, JOB de Jean Bardou, Devambez, and Recon Inc. among others.

What is the key driver of the Cigarette Rolling Paper market?

The increase in the number of cigarette smokers and the growing disposable income of the people is primarily driving the growth of the Cigarette Rolling Paper market.

What is Prime application of Cigarette Rolling Paper?

Machine-rolled segment led the cigarette rolling paper market with a market share of around 68.92% in 2021.

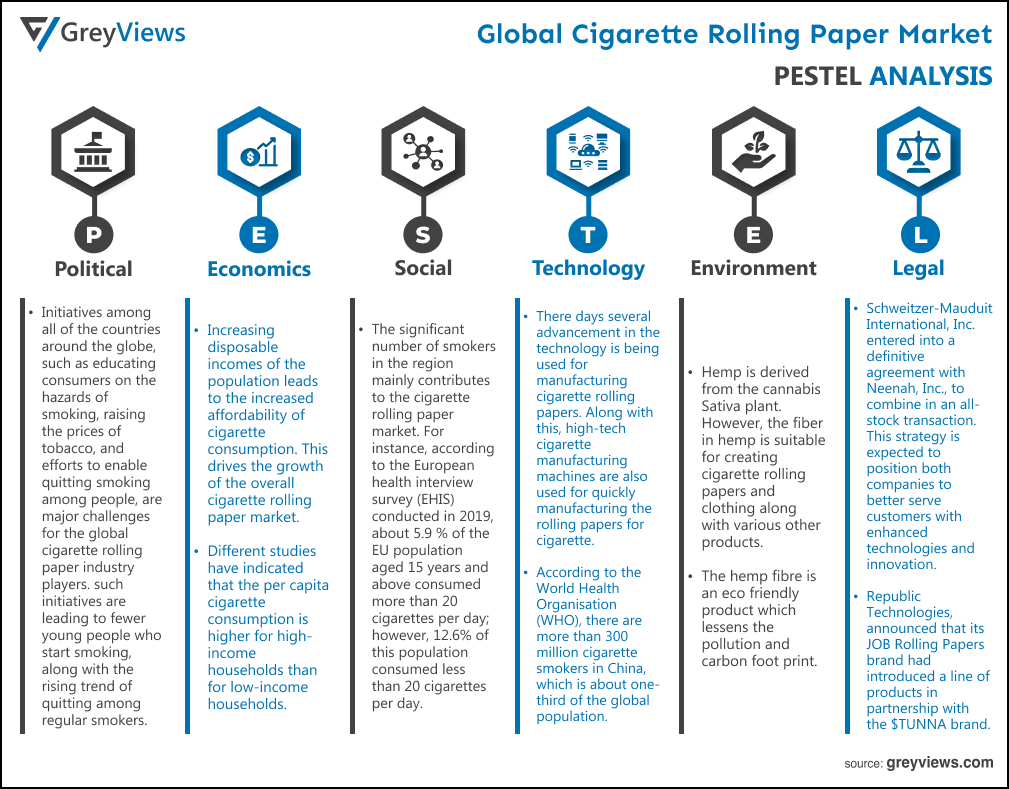

Political Factors- Initiatives among all of the countries around the globe, such as educating consumers on the hazards of smoking, raising the prices of tobacco, and efforts to enable quitting smoking among people, are major challenges for the global cigarette rolling paper industry players. For instance, such initiatives are leading to fewer young people who start smoking, along with the rising trend of quitting among regular smokers.

Economical Factors- Increasing disposable incomes of the population leads to the increased affordability of cigarette consumption. This drives the growth of the overall cigarette rolling paper market. For instance, different studies have indicated that the per capita cigarette consumption is higher for high-income households than for low-income households. Moreover, health systems across low- and middle-income countries (LMICs) are seeing a considerable burden of non-communicable diseases. Hence, such countries are increasing tobacco prices as the most effective method to reduce smoking. However, the consequent increase in disposable incomes of the population across LMICs around Asia-Pacific, Latin America, and the Caribbean is boosting tobacco consumption.

Social Factor- The significant number of smokers in the region mainly contributes to the cigarette rolling paper market. For instance, according to the European health interview survey (EHIS) conducted in 2019, about 5.9 % of the EU population aged 15 years and above consumed more than 20 cigarettes per day; however, 12.6% of this population consumed less than 20 cigarettes per day. In addition, the upsurge in the trend of roll-your-own tobacco in Spain, Italy, and the United Kingdom has further contributed to the market growth.

Technological Factors- There days several advancement in the technology is being used for manufacturing cigarette rolling papers. Along with this, high-tech cigarette manufacturing machines are also used for quickly manufacturing the rolling papers for cigarette. For instance, according to the World Health Organisation (WHO), there are more than 300 million cigarette smokers in China, which is about one-third of the global population. This significance of cigarette smoking in the country boosts the demand for cigarette rolling papers.

Environmental Factors- Hemp is derived from the cannabis Sativa plant. However, the fiber in hemp is suitable for creating cigarette rolling papers and clothing along with various other products. The hemp fibre is an eco friendly product which lessens the pollution and carbon foot print. However, the fiber in hemp is suitable for creating cigarette rolling papers and clothing along with various other products which when burn produces a lot of pollution and is harmful for the environment. Thus the government is taking up all the necessary measures to eliminate cigarettes.

Legal Factors- Schweitzer-Mauduit International, Inc. entered into a definitive agreement with Neenah, Inc., the manufacturer of specialty materials, to combine in an all-stock transaction. This strategy is expected to position both companies to better serve customers with enhanced technologies and innovation. Republic Technologies, the leading rolling company, announced that its JOB Rolling Papers brand had introduced a line of products in partnership with the $TUNNA brand. This has enhanced the portfolio of Republic Technologies.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Material

- Market Attractiveness Analysis By Product

- Market Attractiveness Analysis By Weight

- Market Attractiveness Analysis By Application

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Increasing disposable income

- Huge number of cigarette smokers

- Restrains

- Increased health concerns among population

- Opportunities

- Popularity of roll-your-own cigarettes among the younger generation

- Challenges

- Initiatives to reduce cigarette smoking

- Global Cigarette Rolling Paper Market Analysis and Projection, By Material

- Segment Overview

- Flax

- Sisal

- Hemp

- Rice straw

- Esparto

- Global Cigarette Rolling Paper Market Analysis and Projection, By Product

- Segment Overview

- Cigarette Tissue

- Plug Wrap Paper

- Tipping Paper

- Global Cigarette Rolling Paper Market Analysis and Projection, By Weight

- Segment Overview

- Up to 10 gsm

- 10gsm -25 gsm

- 25 gsm & above

- Global Cigarette Rolling Paper Market Analysis and Projection, By Application

- Segment Overview

- Machine-Rolled

- Hand-Rolled

- Global Cigarette Rolling Paper Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Cigarette Rolling Paper Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Cigarette Rolling Paper Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Material Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Schweitzer-Mauduit International, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Weight Portfolio

- Recent Developments

- SWOT Analysis

- Delfort Group AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Weight Portfolio

- Recent Developments

- SWOT Analysis

- Republic Technologies

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Weight Portfolio

- Recent Developments

- SWOT Analysis

- Richer Paper Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Weight Portfolio

- Recent Developments

- SWOT Analysis

- Snail Custom Rolling Papers

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Weight Portfolio

- Recent Developments

- SWOT Analysis

- Moondust Paper Private Limited

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Weight Portfolio

- Recent Developments

- SWOT Analysis

- Miquel y Costas

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Weight Portfolio

- Recent Developments

- SWOT Analysis

- JOB de Jean Bardou

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Weight Portfolio

- Recent Developments

- SWOT Analysis

- Devambez

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Weight Portfolio

- Recent Developments

- SWOT Analysis

- Recon Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Weight Portfolio

- Recent Developments

- SWOT Analysis

- Schweitzer-Mauduit International, Inc.

List of Table

- Global Cigarette Rolling Paper Market, By Material, 2021–2029(USD Million)

- Global Flax Cigarette Rolling Paper Market, By Region, 2021–2029(USD Million)

- Global Sisal Cigarette Rolling Paper Market, By Region, 2021–2029(USD Million)

- Global Hemp Cigarette Rolling Paper Market, By Region, 2021–2029(USD Million)

- Global Rice straw Cigarette Rolling Paper Market, By Region, 2021–2029(USD Million)

- Global Esparto Cigarette Rolling Paper Market, By Region, 2021–2029(USD Million)

- Global Cigarette Rolling Paper Market, By Product, 2021–2029(USD Million)

- Global Cigarette Tissue Cigarette Rolling Paper Market, By Region, 2021–2029(USD Million)

- Global Plug Wrap Paper Cigarette Rolling Paper Market, By Region, 2021–2029(USD Million)

- Global Tipping Paper Cigarette Rolling Paper Market, By Region, 2021–2029(USD Million)

- Global Cigarette Rolling Paper Market, By Weight, 2021–2029(USD Million)

- Global Up to 10 gsm Cigarette Rolling Paper Market, By Region, 2021–2029(USD Million)

- Global 10gsm -25 gsm Cigarette Rolling Paper Market, By Region, 2021–2029(USD Million)

- Global 25 gsm & above Cigarette Rolling Paper Market, By Region, 2021–2029(USD Million)

- Global Cigarette Rolling Paper Market, By Application, 2021–2029(USD Million)

- Global Machine-Rolled Cigarette Rolling Paper Market, By Region, 2021–2029(USD Million)

- Global Hand-Rolled Cigarette Rolling Paper Market, By Region, 2021–2029(USD Million)

- Global Cigarette Rolling Paper Market, By Region, 2021–2029(USD Million)

- Global Cigarette Rolling Paper Market, By North America, 2021–2029(USD Million)

- North America Cigarette Rolling Paper Market, By Material, 2021–2029(USD Million)

- North America Cigarette Rolling Paper Market, By Product, 2021–2029(USD Million)

- North America Cigarette Rolling Paper Market, By Weight, 2021–2029(USD Million)

- North America Cigarette Rolling Paper Market, By Application, 2021–2029(USD Million)

- USA Cigarette Rolling Paper Market, By Material, 2021–2029(USD Million)

- USA Cigarette Rolling Paper Market, By Product, 2021–2029(USD Million)

- USA Cigarette Rolling Paper Market, By Weight, 2021–2029(USD Million)

- USA Cigarette Rolling Paper Market, By Application, 2021–2029(USD Million)

- Canada Cigarette Rolling Paper Market, By Material, 2021–2029(USD Million)

- Canada Cigarette Rolling Paper Market, By Product, 2021–2029(USD Million)

- Canada Cigarette Rolling Paper Market, By Weight, 2021–2029(USD Million)

- Canada Cigarette Rolling Paper Market, By Application, 2021–2029(USD Million)

- Mexico Cigarette Rolling Paper Market, By Material, 2021–2029(USD Million)

- Mexico Cigarette Rolling Paper Market, By Product, 2021–2029(USD Million)

- Mexico Cigarette Rolling Paper Market, By Weight, 2021–2029(USD Million)

- Mexico Cigarette Rolling Paper Market, By Application, 2021–2029(USD Million)

- Europe Cigarette Rolling Paper Market, By Material, 2021–2029(USD Million)

- Europe Cigarette Rolling Paper Market, By Product, 2021–2029(USD Million)

- Europe Cigarette Rolling Paper Market, By Weight, 2021–2029(USD Million)

- Europe Cigarette Rolling Paper Market, By Application, 2021–2029(USD Million)

- Germany Cigarette Rolling Paper Market, By Material, 2021–2029(USD Million)

- Germany Cigarette Rolling Paper Market, By Product, 2021–2029(USD Million)

- Germany Cigarette Rolling Paper Market, By Weight, 2021–2029(USD Million)

- Germany Cigarette Rolling Paper Market, By Application, 2021–2029(USD Million)

- France Cigarette Rolling Paper Market, By Material, 2021–2029(USD Million)

- France Cigarette Rolling Paper Market, By Product, 2021–2029(USD Million)

- France Cigarette Rolling Paper Market, By Weight, 2021–2029(USD Million)

- France Cigarette Rolling Paper Market, By Application, 2021–2029(USD Million)

- UK Cigarette Rolling Paper Market, By Material, 2021–2029(USD Million)

- UK Cigarette Rolling Paper Market, By Product, 2021–2029(USD Million)

- UK Cigarette Rolling Paper Market, By Weight, 2021–2029(USD Million)

- UK Cigarette Rolling Paper Market, By Application, 2021–2029(USD Million)

- Italy Cigarette Rolling Paper Market, By Material, 2021–2029(USD Million)

- Italy Cigarette Rolling Paper Market, By Product, 2021–2029(USD Million)

- Italy Cigarette Rolling Paper Market, By Weight, 2021–2029(USD Million)

- Italy Cigarette Rolling Paper Market, By Application, 2021–2029(USD Million)

- Spain Cigarette Rolling Paper Market, By Material, 2021–2029(USD Million)

- Spain Cigarette Rolling Paper Market, By Product, 2021–2029(USD Million)

- Spain Cigarette Rolling Paper Market, By Weight, 2021–2029(USD Million)

- Spain Cigarette Rolling Paper Market, By Application, 2021–2029(USD Million)

- Asia Pacific Cigarette Rolling Paper Market, By Material, 2021–2029(USD Million)

- Asia Pacific Cigarette Rolling Paper Market, By Product, 2021–2029(USD Million)

- Asia Pacific Cigarette Rolling Paper Market, By Weight, 2021–2029(USD Million)

- Asia Pacific Cigarette Rolling Paper Market, By Application, 2021–2029(USD Million)

- Japan Cigarette Rolling Paper Market, By Material, 2021–2029(USD Million)

- Japan Cigarette Rolling Paper Market, By Product, 2021–2029(USD Million)

- Japan Cigarette Rolling Paper Market, By Weight, 2021–2029(USD Million)

- Japan Cigarette Rolling Paper Market, By Application, 2021–2029(USD Million)

- China Cigarette Rolling Paper Market, By Material, 2021–2029(USD Million)

- China Cigarette Rolling Paper Market, By Product, 2021–2029(USD Million)

- China Cigarette Rolling Paper Market, By Weight, 2021–2029(USD Million)

- China Cigarette Rolling Paper Market, By Application, 2021–2029(USD Million)

- India Cigarette Rolling Paper Market, By Material, 2021–2029(USD Million)

- India Cigarette Rolling Paper Market, By Product, 2021–2029(USD Million)

- India Cigarette Rolling Paper Market, By Weight, 2021–2029(USD Million)

- India Cigarette Rolling Paper Market, By Application, 2021–2029(USD Million)

- South America Cigarette Rolling Paper Market, By Material, 2021–2029(USD Million)

- South America Cigarette Rolling Paper Market, By Product, 2021–2029(USD Million)

- South America Cigarette Rolling Paper Market, By Weight, 2021–2029(USD Million)

- South America Cigarette Rolling Paper Market, By Application, 2021–2029(USD Million)

- Brazil Cigarette Rolling Paper Market, By Material, 2021–2029(USD Million)

- Brazil Cigarette Rolling Paper Market, By Product, 2021–2029(USD Million)

- Brazil Cigarette Rolling Paper Market, By Weight, 2021–2029(USD Million)

- Brazil Cigarette Rolling Paper Market, By Application, 2021–2029(USD Million)

- Middle East and Africa Cigarette Rolling Paper Market, By Material, 2021–2029(USD Million)

- Middle East and Africa Cigarette Rolling Paper Market, By Product, 2021–2029(USD Million)

- Middle East and Africa Cigarette Rolling Paper Market, By Weight, 2021–2029(USD Million)

- Middle East and Africa Cigarette Rolling Paper Market, By Application, 2021–2029(USD Million)

- UAE Cigarette Rolling Paper Market, By Material, 2021–2029(USD Million)

- UAE Cigarette Rolling Paper Market, By Product, 2021–2029(USD Million)

- UAE Cigarette Rolling Paper Market, By Weight, 2021–2029(USD Million)

- UAE Cigarette Rolling Paper Market, By Application, 2021–2029(USD Million)

- South Africa Cigarette Rolling Paper Market, By Material, 2021–2029(USD Million)

- South Africa Cigarette Rolling Paper Market, By Product, 2021–2029(USD Million)

- South Africa Cigarette Rolling Paper Market, By Weight, 2021–2029(USD Million)

- South Africa Cigarette Rolling Paper Market, By Application, 2021–2029(USD Million)

List of Figures

- Global Cigarette Rolling Paper Market Segmentation

- Cigarette Rolling Paper Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Cigarette Rolling Paper Market Attractiveness Analysis By Material

- Global Cigarette Rolling Paper Market Attractiveness Analysis By Product

- Global Cigarette Rolling Paper Market Attractiveness Analysis By Weight

- Global Cigarette Rolling Paper Market Attractiveness Analysis By Application

- Global Cigarette Rolling Paper Market Attractiveness Analysis By Region

- Global Cigarette Rolling Paper Market: Dynamics

- Global Cigarette Rolling Paper Market Share By Material(2021 & 2029)

- Global Cigarette Rolling Paper Market Share By Product(2021 & 2029)

- Global Cigarette Rolling Paper Market Share By Weight(2021 & 2029)

- Global Cigarette Rolling Paper Market Share By Application (2021 & 2029)

- Global Cigarette Rolling Paper Market Share by Regions (2021 & 2029)

- Global Cigarette Rolling Paper Market Share by Company (2020)