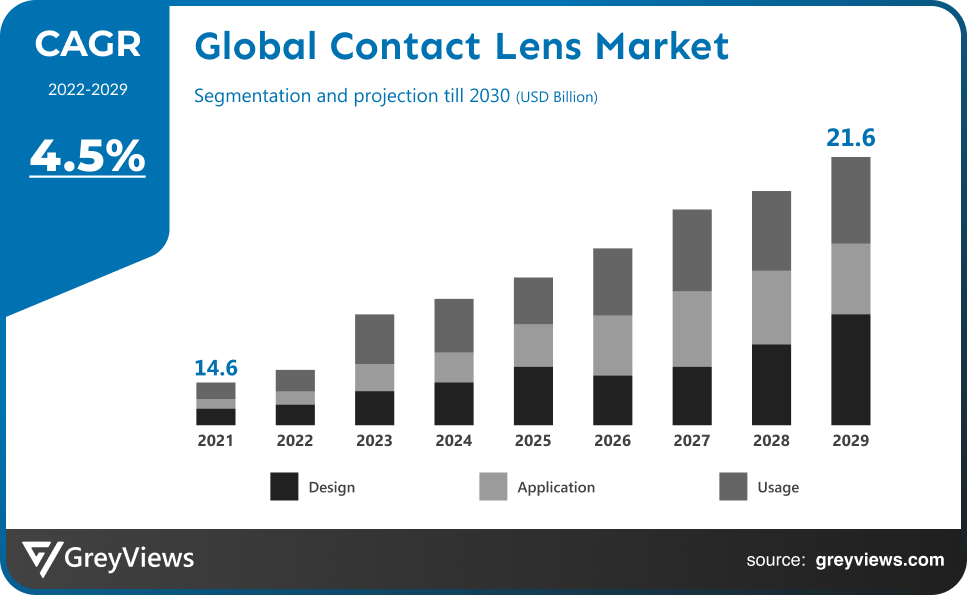

Contact Lens Market Size By Design (Spherical, Toric, Multifocal, and Others), By Application (Corrective, Therapeutic, Cosmetic, Prosthetic, and Lifestyle-Oriented), By Usage (Daily Disposable, Disposable, Frequently Replacement and Traditional), Regions, Segmentation, and Projection till 2029

CAGR: 4.5%Current Market Size: USD 14.6 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Contact Lens Market- Market Overview:

The global contact lens market is expected to grow from USD 14.6 billion in 2021 to USD 21.6 billion by 2029, at a CAGR of 4.5% during the Projection period 2022-2029. The growth of this market is mainly driven by the increasing number of outdoor activities.

Contact lenses are medical devices that are applied to the cornea's tear film to correct refractive defects such as myopia, hyperopia, astigmatism, and presbyopia. They can be given a little colour tint to enhance the colours and make handling simpler. They are created from thin, translucent plastic discs. They typically need a prescription from an eye doctor to avoid issues including infection, inflammation, vision loss, or blindness in the future. Depending on their intended use, a number of businesses today provide personalized lenses in a variety of designs. The COVID-19 pandemic is anticipated to have a substantial influence on the market under study because fewer eye care consultations will result from a drop in hospital and clinic visits and patient volume. For instance, according to the Centers for Disease Control and Prevention and the American Academy of Ophthalmology, the initial decline in ophthalmology visits was estimated to be close to 80% in August 2020, and the overall decline in ophthalmology visits in the United States was still 40% as of mid-June. Additionally, according to a January 2021 Optometry Times Journal article, the launch of COVID-19 in 2020 caused an increase in contact lens dropout among both new and seasoned users. The increased prevalence of ocular problems, the rising trend to improve aesthetics, and rising disposable incomes are all factors contributing to the expansion of the contact lens industry. For instance, the World Health Organization's October 2021 update estimates that over 2.2 billion people worldwide have near- or far-sightedness, with cataracts and untreated refractive defects being the main causes. In a similar vein, the Lancet Global Health 2020 article estimates that there will be 43,3 million blind persons worldwide in 2020, with 23.9 million of them being female. In addition, 295 million people suffer from mild to severe vision impairment, whereas 258 million suffer from it.

Sample Request: - Global Contact Lens Market

Market Dynamics:

Drivers:

- Rising Prevalence of Visual Inaccuracies

The global increase in cases of myopia, hypermetropia/hyperopia, presbyopia, and astigmatism is a major factor driving the contact lens market. Young children who use tablets and mobile devices in close proximity to their eyes risk early eyesight damage. According to the WHO, 1 billion people worldwide suffer from some form of visual impairment, including moderate to severe distant vision problems or blindness brought on by untreated refractive errors, cataracts, glaucoma, corneal opacities, diabetic retinopathy, and trachoma. Additionally, in high-income nations, conditions like age-related macular degeneration, glaucoma, and diabetic retinopathy are common causes of vision impairment.

Restraints:

- High Cost

A significant obstacle to the market's expansion will be the manufacturers' intense pricing pressure and changes in the cost of raw materials. The rapidly changing prices of raw materials hampers the market’s growth.

Opportunities:

- Increase Investments

Age-related macular degeneration (AMD), an eye condition associated with aging that impairs crisp and central vision, causes visual damage. The central vision's purpose is to provide a person with a clear perspective of the surroundings so they can carry out basic activities like reading and driving. Additionally, AMD is the main contributor to long-term impairment in seniors over 65. The U.S. Department of Health & Human Services estimates that AMD affects 1.8 million Americans who are 40 years of age and older. In 2020, 2.95 million people are anticipated to be affected by AMD.

Challenges:

- Stringent Regulations

The lack of ophthalmologists and strict regulatory restrictions for market participants will further impede market expansion. The absence of a robust distribution network in underdeveloped regions and eye discomfort would further limit the market's potential for expansion.

Segmentation Analysis:

The global contact lens market has been segmented based on design, application, usage, and region.

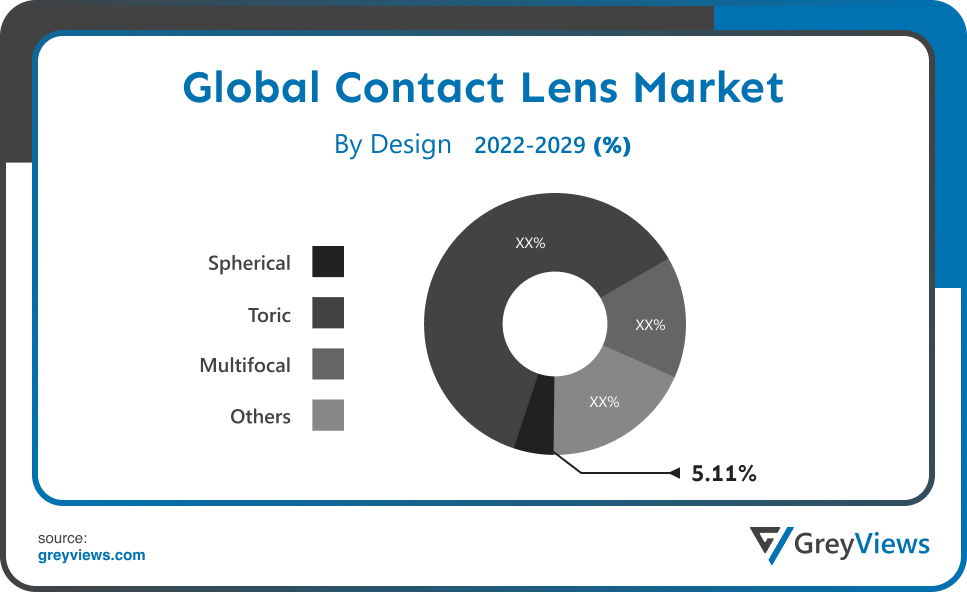

By Design

The design segment is Spherical, Toric, Multifocal, and Others. The spherical segment led the largest share of the contact lens market with a market share of around 5.11% in 2021. Due to the fact that multifocal lenses may accommodate numerous prescriptions, the market for these lenses is predicted to experience moderate demand. They are mostly employed to treat ocular conditions associated with aging, like presbyopia. It provides a number of advantages, including better visual acuity for users who need to combine several prescriptions in a single lens. For instance, CooperVision Biofinity toric Multifocal Contact Lenses were recently authorized by the FDA. The tool broadens the selection of Biofinity toric lenses for people with presbyopia.

By Usage

The usage segment includes Daily Disposable, Disposable, Frequently Replacement, and Traditional. The daily disposable segment led the contact lens market with a market share of around 4.5% in 2021. Because a fresh pair of lenses offer the wearer more comfort, daily disposable lenses have become more popular. As a result, numerous players have started to produce daily disposable lenses. Most consumers regard these lenses as the healthiest option for contact lenses. Daily disposable lenses are also recommended by eye care providers since they eliminate issues with more frequent lens replacements.

By Application

The application segment includes Corrective, Therapeutic, Cosmetic, Prosthetic, and Lifestyle-Oriented. The therapeutic segment led the contact lens market with a market share of around 3.7% in 2021. Since the lenses can potentially be used to administer medications to the cornea, the market share of the category is anticipated to rise over the Projection period. The enormous development potential in the cosmetic lens market is projected as a result of the growing consumer desire for eyes with increased visual appeal.

Global Contact Lens Market- Sales Analysis.

The sale of contact lens material, design, application, distribution channel, and usage expanded at a CAGR of 3.2% from 2015 to 2021.

One of the main drivers of market expansion is the rising prevalence of common eye problems and diseases. The global aging population is having a favorable impact on the demand for contact lenses for vision correction because vision weakens with age. In addition to this, contact lenses have a number of benefits over eyeglasses, such as improved peripheral vision, an unrestricted field of vision, and a lower risk of getting splashed. In order to reduce the danger of damage, provide better compatibility with safety equipment, and improve both persons' and athletes' performance, contact lenses are becoming more and more popular. This is due in part to the rising engagement of people in sports and physical activities.

Additionally, special glasses have been developed to halt the development of nearsightedness in kids. They aid in the treatment of keratoconus and other abnormalities of the cornea. Additionally, the major players are producing ultraviolet (UV) blocking lenses to shield eyes from sunlight, which can result in cataracts and other eye issues. Additionally, they are introducing cutting-edge colored lenses for cosmetic use, which is expected to spur market expansion.

Thus, owing to the aforementioned factors, the global contact lens market is expected to grow at a CAGR of 4.5% during the Projection period from 2022 to 2029.

By Regional Analysis:

The regions analyzed for the contact lens market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North America region dominated the contact lens market and held a 39% share of the market revenue in 2021.

- The North America region witnessed a major share. A rise in visual errors is anticipated to fuel regional market expansion. For instance, over 7 million Americans have irreversible vision loss, and over 1 million of them are blind, according to the Prevent Blindness report from May 2021, a non-governmental organization. Further as per the research study published in May 2022, titled “Census Shows High Prevalence of Pediatric Myopia in the United States”, there is a high prevalence of pediatric myopia in the United States, and in 2020, about 19.5 million children with myopia were living in the United States with the nationwide prevalence of 36.1%. As a result, there will be greater demand for contact lenses as eye problems become more prevalent.

- Asia Pacific is anticipated to experience significant growth during the Projection period. According to estimates, Asia-Pacific is the region with the fastest growth due to the prevalence of visual errors rising. The major industry participants are utilizing the market to meet the rising demand for contact lens utilization among the populace. Additionally, the industry is expanding as a result of rising fashion trends and the expanding use of cosmetic lenses.

Global Contact Lens Market- Country Analysis:

- Germany

Germany's contact lens market size was valued at USD 0.12 billion in 2021 and is expected to reach USD 0.15 billion by 2029, at a CAGR of 3.2% from 2022 to 2029.

The increased usage of contact lenses to treat various eye-related conditions such hypermetropia/hyperopia, astigmatism, and presbyopia is expanding the market for these products. Additionally, it is projected that the market would be fueled by the rising prevalence of vision problems among elderly people around the world.

- China

China’s contact lens market size was valued at USD 0.19 billion in 2021 and is expected to reach USD 0.26 billion by 2029, at a CAGR of 4% from 2022 to 2029. Due to the region's players' contributions and the rising need for contact lenses. Additionally, the socioeconomic development in the area is still expanding, and as consumer purchasing power rises, so does consumer knowledge of eye health.

- India

India's contact lens market size was valued at USD 0.18 billion in 2021 and is expected to reach USD 0.24 billion by 2029, at a CAGR of 3.8% from 2022 to 2029. Manufacturers of contact lenses are working on goods with anti-refractive and scratch-resistant coatings. These goods are also becoming more popular because of their capacity to offer ultraviolet protection, which gives users a high-quality therapeutic experience and comfort. These factors have led to a noticeable increase in the use of contact lenses, which is assisting the market's growth.

Key Industry Players Analysis:

To increase their market position in the global contact lenses business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Essilor International S.A.

- Alcon Vision LLC

- Abbott Medical Optics, Inc.

- CooperVision, Inc.

- Hoya Corporation

- SynergEyes, Inc.

- X-Cel Specialty Contacts

- Johnson & Johnson Vision Care, Inc.

- Medennium

- Seed Co., Ltd.

- STAAR Surgical Company

Latest Development:

- In April 2022, Alcon introduced the Precision, a disposable astigmatism contact lens, in Canada. For astigmatic patients, Alcon has created daily-disposable silicone hydrogel (SiHy) contact lenses as part of its ongoing effort to aid in clear vision.

- In February 2022, Alcon intended to introduce Total 30, a monthly replacement water gradient lens, in Canada. Reusable contact lens wearers have a superior wearing experience with a Total of 30.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

4.5% |

|

Market Size |

14.6 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Design, By Application, By Usage, and By Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Essilor International S.A., Alcon Vision LLC, Abbott Medical Optics, Inc., CooperVision, Inc., Hoya Corporation, SynergEyes, Inc., X-Cel Specialty Contacts, Johnson & Johnson Vision Care, Inc., Medennium, Seed Co., Ltd., and STAAR Surgical Company. |

|

By Design |

|

|

By Application |

|

|

By Usage |

|

|

Regional scope |

|

Scope of the Report

Global Contact Lens Market By Material:

- Gas Permeable

- Silicone Hydrogel

- Hybrid

Global Contact Lens Market By Design:

- Spherical

- Toric

- Multifocal

- Others

Global Contact Lens Market By Application:

- Corrective

- Therapeutic

- Cosmetic

- Prosthetic

- Lifestyle-Oriented

Global Contact Lens Market By Distribution Channel:

- E-Commerce

- Eye Care Practitioners

Global Contact Lens Market By Usage:

- Daily Disposable

- Disposable

- Frequently Replacement

- Traditional

Global Contact Lens Market By Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the expected market size of the contact lens market in 2029?

Global contact lens market is expected to reach USD 21.6 billion by 2029, at a CAGR of 4.5% from 2022 to 2029.

What is the CAGR of the contact lens market?

The contact lens market is projected to have a CAGR of 4.5%.

What is the distribution channel segment of the contact lens market?

On the basis of distribution channel, the contact lens market is segmented into E-Commerce and Eye Care Practitioners.

What are the key factors for the growth of the contact lens market?

Manufacturers of contact lenses are working on goods with anti-refractive and scratch-resistant coatings. These goods are also becoming more popular because of their capacity to offer ultraviolet protection, which gives users a high-quality therapeutic experience and comfort. These factors have led to a noticeable increase in the use of contact lenses, which is assisting the market's growth.

Which are the leading market players active in the contact lens market?

Leading market players active in the global contact lens market are Essilor International S.A., Alcon Vision LLC, Abbott Medical Optics, Inc., CooperVision, Inc., Hoya Corporation, SynergEyes, Inc., X-Cel Specialty Contacts, Johnson & Johnson Vision Care, Inc., Medennium, Seed Co., Ltd., STAAR Surgical Company among others.

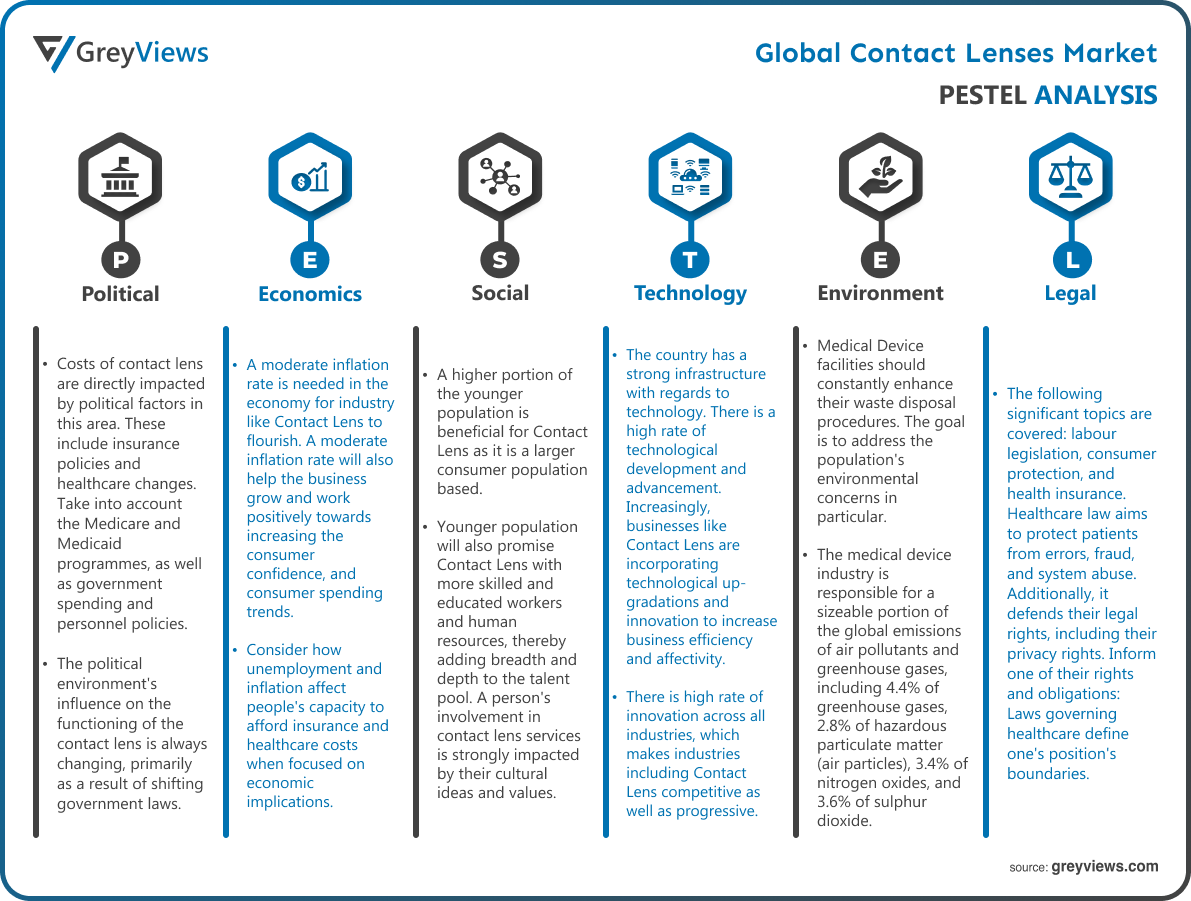

Political Factors- Costs of contact lens are directly impacted by political factors in this area. These include insurance policies and healthcare changes. Take into account the Medicare and Medicaid programmes, as well as government spending and personnel policies. The political environment's influence on the functioning of the contact lens is always changing, primarily as a result of shifting government laws. Around the world, numerous economies have implemented measures to reduce spending in the health sector. The contact lens sector may be impacted by political considerations such as shifting tax laws, employment restrictions, consumer protection laws, and insurance obligations. Further, changes in medicine import regulations and strikes by medical professionals over pay inequities are fundamental political problems that have an impact on contact lens providers. The amount of money the government spends on opthalmology is significantly impacted by changes in tax law.

Economical Factors- A moderate inflation rate is needed in the economy for industry like Contact Lens to flourish. A moderate inflation rate will also help the business grow and work positively towards increasing the consumer confidence, and consumer spending trends. Consider how unemployment and inflation affect people's capacity to afford insurance and healthcare costs when focused on economic implications. Therefore, these characteristics have a direct impact on how well contact lens vendors and other businesses operating in the field operate. Economic issues that affect the performance and operation of the contact lens sector include unemployment, interest rates, loan availability, and inflation. The spending decisions of businesses and consumer purchasing habits can be significantly impacted by these changes in the economic climate.

Social Factor- A higher portion of the younger population is beneficial for Contact Lens as it is a larger consumer population based. In addition a younger population will also promise Contact Lens with more skilled and educated workers and human resources, thereby adding breadth and depth to the talent pool. A person's involvement in contact lens services is strongly impacted by their cultural ideas and values. Some cultures, in particular, favour conventional methods. Others turn to natural remedies or alternative medical care. Socio-cultural aspects concentrate on a specific client segment's views, attitudes, and norms as well as topics like gender preference, population ageing. To avoid compromising values and beliefs, it is crucial for businesses to understand the culture of their customers.

Technological Factors- The country has a strong infrastructure with regards to technology. There is a high rate of technological development and advancement. Increasingly, businesses like Contact Lens are incorporating technological up-gradations and innovation to increase business efficiency and affectivity. There is high rate of innovation across all industries, which makes industries including Contact Lens competitive as well as progressive. Contact Lens businesses may incur costs as a result of the development of innovative technological solutions. The price of Contact Lens is directly impacted. Additionally, healthcare facilities must concentrate on instructing staff members on how to use new technologies. Medical device distribution and technological solutions are two activities that medical corporations are involved in.

Environmental Factors- Medical Device facilities should constantly enhance their waste disposal procedures. The goal is to address the population's environmental concerns in particular. As a result, they ought to incorporate such actions into their strategic planning. The basic goal of health care is being undermined by the way the health care system is damaging the environment in ways that also impair health. For instance, the medical device industry is responsible for a sizeable portion of the global emissions of air pollutants and greenhouse gases, including 4.4% of greenhouse gases, 2.8% of hazardous particulate matter (air particles), 3.4% of nitrogen oxides, and 3.6% of sulphur dioxide.

Legal Factors- Finally, it is important to discuss tax regulations in this section as they relate to contact lens. In particular, the latter should adhere to the relevant rules that regulate the sector. The following significant topics are covered: labour legislation, consumer protection, and health insurance. Healthcare law aims to protect patients from errors, fraud, and system abuse. Additionally, it defends their legal rights, including their privacy rights. Inform one of their rights and obligations: Laws governing healthcare define one's position's boundaries.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Design

- 3.2. Market Attractiveness Analysis By Application

- 3.3. Market Attractiveness Analysis By Usage

- 3.4. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Rising Prevalence of Visual Inaccuracies

- 3. Restraints

- 3.1. High Cost

- 4. Opportunities

- 4.1. Increase Investments

- 5. Challenges

- 5.1. Stringent Regulations

- Global Contact Lens Market Analysis and Projection, By Design

- 1. Segment Overview

- 2. Spherical

- 3. Toric

- 4. Multifocal

- 5. Others

- Global Contact Lens Market Analysis and Projection, By Application

- 1. Segment Overview

- 2. Corrective

- 3. Therapeutic

- 4. Cosmetic

- 5. Prosthetic

- 6. Lifestyle-Oriented

- Global Contact Lens Market Analysis and Projection, By Usage

- 1. Segment Overview

- 2. Daily Disposable

- 3. Disposable

- 4. Frequently Replacement

- 5. Traditional

- Global Contact Lens Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Contact Lens Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Contact Lens Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Essilor International S.A.

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Alcon Vision LLC

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Abbott Medical Optics, Inc.

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- CooperVision, Inc.

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Hoya Corporation

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- SynergEyes, Inc.

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- X-Cel Specialty Contacts

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Johnson & Johnson Vision Care, Inc.

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Medennium

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Seed Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- STAAR Surgical Company

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Essilor International S.A.

List of Table

- Global Contact Lens Market, By Design, 2021–2029 (USD Billion)

- Global Spherical, Contact Lens Market, By Region, 2021–2029 (USD Billion)

- Global Toric, Contact Lens Market, By Region, 2021–2029 (USD Billion)

- Global Multifocal, Contact Lens Market, By Region, 2021–2029 (USD Billion)

- Global Others, Contact Lens Market, By Region, 2021–2029 (USD Billion)

- Global Contact Lens Market, By Application, 2021–2029 (USD Billion)

- Global Corrective, Contact Lens Market, By Region, 2021–2029 (USD Billion)

- Global Therapeutic, Contact Lens Market, By Region, 2021–2029 (USD Billion)

- Global Cosmetic, Contact Lens Market, By Region, 2021–2029 (USD Billion)

- Global Prosthetic, Contact Lens Market, By Region, 2021–2029 (USD Billion)

- Global Lifestyle-Oriented, Contact Lens Market, By Region, 2021–2029 (USD Billion)

- Global Contact Lens Market, By Usage, 2021–2029 (USD Billion)

- Global Daily Disposable, Contact Lens Market, By Region, 2021–2029 (USD Billion)

- Global Disposable, Contact Lens Market, By Region, 2021–2029 (USD Billion)

- Global Frequently Replacement, Contact Lens Market, By Region, 2021–2029 (USD Billion)

- Global Traditional, Contact Lens Market, By Region, 2021–2029 (USD Billion)

- Global Contact Lens Market, By Region, 2021–2029 (USD Billion)

- North America Contact Lens Market, By Design, 2021–2029 (USD Billion)

- North America Contact Lens Market, By Application, 2021–2029 (USD Billion)

- North America Contact Lens Market, By Usage, 2021–2029 (USD Billion)

- USA Contact Lens Market, By Design, 2021–2029 (USD Billion)

- USA Contact Lens Market, By Application, 2021–2029 (USD Billion)

- USA Contact Lens Market, By Usage, 2021–2029 (USD Billion)

- Canada Contact Lens Market, By Design, 2021–2029 (USD Billion)

- Canada Contact Lens Market, By Application, 2021–2029 (USD Billion)

- Canada Contact Lens Market, By Usage, 2021–2029 (USD Billion)

- Mexico Contact Lens Market, By Design, 2021–2029 (USD Billion)

- Mexico Contact Lens Market, By Application, 2021–2029 (USD Billion)

- Mexico Contact Lens Market, By Usage, 2021–2029 (USD Billion)

- Europe Contact Lens Market, By Design, 2021–2029 (USD Billion)

- Europe Contact Lens Market, By Application, 2021–2029 (USD Billion)

- Europe Contact Lens Market, By Usage, 2021–2029 (USD Billion)

- Germany Contact Lens Market, By Design, 2021–2029 (USD Billion)

- Germany Contact Lens Market, By Application, 2021–2029 (USD Billion)

- Germany Contact Lens Market, By Usage, 2021–2029 (USD Billion)

- France Contact Lens Market, By Design, 2021–2029 (USD Billion)

- France Contact Lens Market, By Application, 2021–2029 (USD Billion)

- France Contact Lens Market, By Usage, 2021–2029 (USD Billion)

- UK Contact Lens Market, By Design, 2021–2029 (USD Billion)

- UK Contact Lens Market, By Application, 2021–2029 (USD Billion)

- UK Contact Lens Market, By Usage, 2021–2029 (USD Billion)

- Italy Contact Lens Market, By Design, 2021–2029 (USD Billion)

- Italy Contact Lens Market, By Application, 2021–2029 (USD Billion)

- Italy Contact Lens Market, By Usage, 2021–2029 (USD Billion)

- Spain Contact Lens Market, By Design, 2021–2029 (USD Billion)

- Spain Contact Lens Market, By Application, 2021–2029 (USD Billion)

- Spain Contact Lens Market, By Usage, 2021–2029 (USD Billion)

- Asia Pacific Contact Lens Market, By Design, 2021–2029 (USD Billion)

- Asia Pacific Contact Lens Market, By Application, 2021–2029 (USD Billion)

- Asia Pacific Contact Lens Market, By Usage, 2021–2029 (USD Billion)

- Japan Contact Lens Market, By Design, 2021–2029 (USD Billion)

- Japan Contact Lens Market, By Application, 2021–2029 (USD Billion)

- Japan Contact Lens Market, By Usage, 2021–2029 (USD Billion)

- China Contact Lens Market, By Design, 2021–2029 (USD Billion)

- China Contact Lens Market, By Application, 2021–2029 (USD Billion)

- China Contact Lens Market, By Usage, 2021–2029 (USD Billion)

- India Contact Lens Market, By Design, 2021–2029 (USD Billion)

- India Contact Lens Market, By Application, 2021–2029 (USD Billion)

- India Contact Lens Market, By Usage, 2021–2029 (USD Billion)

- South America Contact Lens Market, By Design, 2021–2029 (USD Billion)

- South America Contact Lens Market, By Application, 2021–2029 (USD Billion)

- South America Contact Lens Market, By Usage, 2021–2029 (USD Billion)

- Brazil Contact Lens Market, By Design, 2021–2029 (USD Billion)

- Brazil Contact Lens Market, By Application, 2021–2029 (USD Billion)

- Brazil Contact Lens Market, By Usage, 2021–2029 (USD Billion)

- Middle East and Africa Contact Lens Market, By Design, 2021–2029 (USD Billion)

- Middle East and Africa Contact Lens Market, By Application, 2021–2029 (USD Billion)

- Middle East and Africa Contact Lens Market, By Usage, 2021–2029 (USD Billion)

- UAE Contact Lens Market, By Design, 2021–2029 (USD Billion)

- UAE Contact Lens Market, By Application, 2021–2029 (USD Billion)

- UAE Contact Lens Market, By Usage, 2021–2029 (USD Billion)

- South Africa Contact Lens Market, By Design, 2021–2029 (USD Billion)

- South Africa Contact Lens Market, By Application, 2021–2029 (USD Billion)

- South Africa Contact Lens Market, By Usage, 2021–2029 (USD Billion)

List of Figures

- Global Contact Lens Market Segmentation

- Contact Lens Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Contact Lens Market Attractiveness Analysis By Design

- Global Contact Lens Market Attractiveness Analysis By Application

- Global Contact Lens Market Attractiveness Analysis By Usage

- Global Contact Lens Market Attractiveness Analysis By Region

- Global Contact Lens Market: Dynamics

- Global Contact Lens Market Share By Design (2021 & 2029)

- Global Contact Lens Market Share By Application (2021 & 2029)

- Global Contact Lens Market Share By Usage (2021 & 2029)

- Global Contact Lens Market Share by Regions (2021 & 2029)

- Global Contact Lens Market Share by Company (2020)