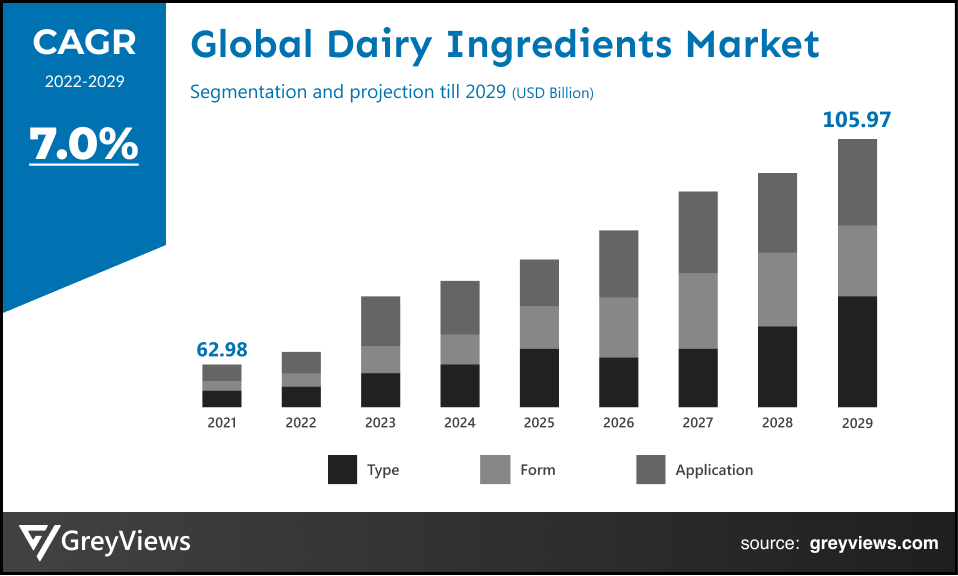

Dairy Ingredients Market Size by Type (Proteins, Milk Powder, Milk Fat Concentrates, Lactose & Its Derivatives), Form (Powder, Liquid), Application (Bakery & Confectionery, Dairy Products, Sports Nutrition Products, Infant Formulas), Regions, Segmentation, and Projection till 2029

CAGR: 7.0%Current Market Size: USD 62.98 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Dairy Ingredients Market- Market Overview:

The global Dairy Ingredients market is expected to grow from USD 62.98 billion in 2021 to USD 105.97 billion by 2029, at a CAGR of 7.0% during the Projection period 2022-2029. The growing population, rising economies, and increasing consumption of ready-to-eat and functional foods around the globe are mainly driving the growth of the global market.

Dairy ingredients comprise components that are obtained from milk. These ingredients are a rich source of proteins, minerals & vitamins, amino acids, carbohydrates, and probiotics. Various food and beverage products, including spice blends, bakery products, dairy products, desserts, and dry baking mixes, makes use of dairy ingredients. They provide nutritional and health benefits, along with an enhanced flavor and unique texture. Due to their benefits, dairy ingredients are considered extremely valuable in the food & beverages sector due to their multi-functionality.

Furthermore, dairy proteins have numerous applications in protein supplements and animal feed. Also, the ability to provide hydration to the hair and skin has led to the growing application of dairy ingredients in personal care products.

Request Sample: - Global Dairy Ingredients Market

Market Dynamics:

Drivers:

- Increasing consumption of ready-to-eat foods

In recent times, ready-to-eat meals have become a significantly convenient option for those who cannot afford to spend time in the kitchen cooking. Such meals comprise pre-packaged dishes available at fast-food restaurants and grocery stores. According to the National Center for Biotechnology Information, a part of the United States National Library of Medicine, about 97% of consumers in Luxembourger reported consumption of ready-to-eat food daily. Such food products are one of the major applications of milk ingredients due to the need for the heavy presence of protein, fat, saturated fatty acids, and sodium.

- Rising awareness regarding maintenance of a healthy lifestyle

According to Population Reference Bureau (PRB), the worldwide human population is anticipated to grow at 1.1% per year (75 million annually). This growth in population boosts demand for food products with dairy ingredients as more people are getting health conscious. For instance, according to Harvard Business Publishing, global food demand is projected to increase anywhere between 59% to 98% by 2050.

On the other hand, the growing population has led to the rising prevalence of various diseases among people, coupled with an upsurge in the geriatric population. This has created a demand for nutritious food. Thus, rising awareness about maintaining a healthy lifestyle among the growing population boosts the dairy ingredients market.

Restraints:

- Rising demand for alternatives, such as plant protein

In the past few years, soy milk has been one of the most popular non-dairy substitutes owing to the close resemblance of its nutrition profile to cow's milk. Also, the 2015–2020 Dietary Guidelines for Americans recommends people with lactose intolerance should consume soy beverages as a substitute for cow's milk. Also, other alternatives are available, such as hemp, almond, and oat milk. The availability of such alternatives to milk protein is projected to hamper global market growth.

Opportunities:

- Ongoing investments in dairy businesses

Global dairy and allied industries are seeing rapid investment growth around developed and developing countries. For instance, in March 2022, The United States Department of Agriculture (USDA) introduced an investment of about $80 million in Dairy Business Innovation (DBI) Initiatives. According to the agency, DBI Initiatives support dairy businesses in developing, producing, marketing, and distributing dairy products. They provide direct technical assistance and grants to dairy businesses.

Challenges

- Consumer tendency towards vegan food

Consumer tendency towards vegan alternatives has been affecting the sales of animal-based milk and associated products. For instance, according to the U.S. Department of Agriculture's economic research, there was a 22% decline in the consumption of dairy milk products from 2000 to 2016. On the other hand, the Plant Based Foods Association (PBFA) has recently indicated that the worth of the vegan retail food industry grew by 11.4% in March 2020. This trend of vegan food consumption has posed a significant challenge for global dairy ingredient industry players.

Segmentation Analysis:

The global Dairy Ingredients market has been segmented based on type, form, application, and region.

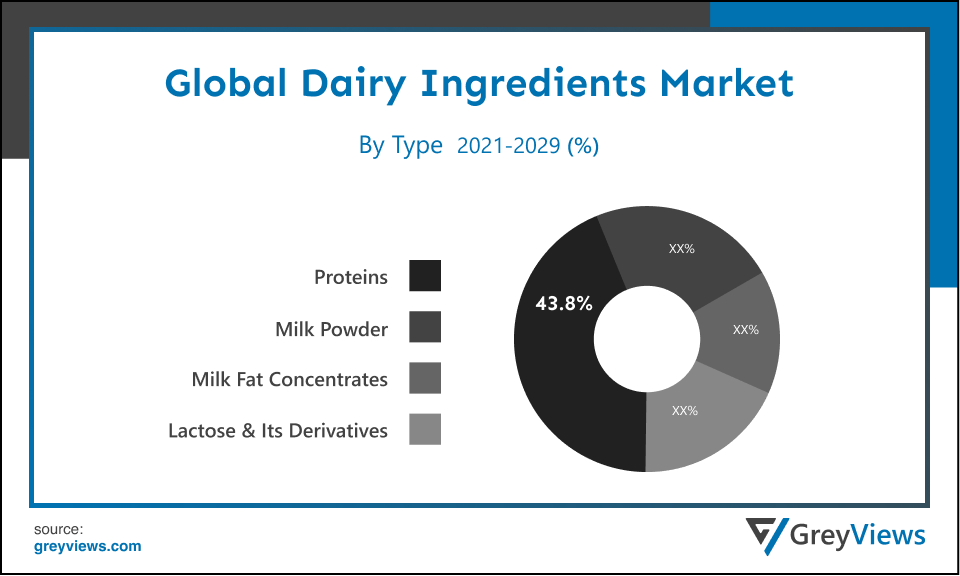

By Type

The type segment includes proteins, milk powder, milk fat concentrates, and lactose & its derivatives. The proteins segment led the Dairy Ingredients market with a market share of around 43.8% in 2021. The rapid increase in consumer awareness regarding the usage of dairy ingredients for protein content has mainly boosted the growth of this segment. Milk protein concentrates are rich in caseinates and caseins. Hence, rising health awareness among end users has enabled dairy products industry players to increase the use of protein ingredients to manufacture products.

By Form

The form segment includes powder and liquid. The powder segment led the Dairy Ingredients market with a market share of around 66.95% in 2021. The powder has a greater shelf life and is comparatively easier to store than liquid form. Also, powdered dairy ingredients have wide-ranging applications in infant foods and other food products. Hence, increasing consumption of confectionery and ready-to-eat bakery products, along with the rapid use of trending products such as ready-to-drink coffee, tea, and other milky beverages, create demand for dairy ingredients in the powder form.

By Application

The application segment includes bakery & confectionery, dairy products, sports nutrition products, and infant formulas. The dairy products segment led the Dairy Ingredients market with a market share of around 36.95% in 2021. The rise in demand for milk, yogurt, cheese, buttermilk, and butter, among other dairy products is fueling the market's growth. The demand for such products is driven by higher incomes worldwide, a growing population, and more health consciousness among end users. According to the United States Department of Agriculture (USDA), demand for U.S. dairy products from domestic and international buyers is expected to remain robust after the COVID-19 pandemic. This boosts the growth of the dairy products segment.

Global Dairy Ingredients Market- By Regional Analysis:

The regions analyzed for the Dairy Ingredients market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Asia-Pacific region dominated the Dairy Ingredients market and held a 42.5% share of the market revenue in 2021.

- Asia Pacific region witnessed a major share. The surge in consumer awareness about healthy food, increasing demand for infant food products, and huge consumption of customized bakery ingredients products such as cakes & pastries, dairy products, and cookies fuel the growth of the Asia-Pacific dairy ingredients market. In addition, due to the favorable demographic trends, the dairy ingredients market is anticipated to increase significantly in this area, which is home to the two most populous nations globally, China and India.

- North America is expected to witness a considerable growth rate during the Projection period. The flourishing dairy products industry and rise in demand for healthy, ready-to-eat, and convenient food products have boosted the market's growth in this region. In addition, consumers in U.S. and Canada are shifting their preference toward minimally processed, protein-rich bakery products with lesser additives and preservatives. This trend is opportunistic for the growth of the market in North America.

Global Dairy Ingredients Market- Country Analysis:

- Germany

Germany's Dairy Ingredients market size was valued at USD 5.61 billion in 2021 and is expected to reach USD 9.52 billion by 2029, at a CAGR of 7.1% from 2022 to 2029. In Europe, Germany is one of the leading shareholders in the dairy ingredients market. In addition, the country is the largest EU milk producer - with an output of over 32 million tons of cows' milk in 2020. Moreover, the huge spending power of the population in this country has been a major contributor to market growth.

Furthermore, the bakery & confectionery industry manufacturers in this country are responsible for creating some of the most widely known bakery products. Moreover, increased consumer awareness about baking ingredients and mounting chocolate consumption among the teenage population in this country has driven demand for dairy ingredients.

- China

China's Dairy Ingredients market size was valued at USD 12.60 billion in 2021 and is expected to reach USD 20.30 billion by 2029, at a CAGR of 6.4% from 2022 to 2029. The factors such as the rising population and increased disposable income have driven the growth of the China Dairy Ingredients market. In addition, this country is a leading consumer of dairy and baked products. This has significantly boosted the growth of the dairy ingredients sector in the country.

Moreover, according to The United States Department of Agriculture (USDA), China is the main cow milk producer worldwide, producing about 31 million metric tonnes of milk in 2019. USDA anticipated this milk production to increase by 4.5% to 34.5 MMT in 2021. This significance of milk production in the country is opportunistic for the growth of the dairy ingredients market.

- India

India's Dairy Ingredients market size was valued at USD 4.41 billion in 2021 and is expected to reach USD 7.56 billion by 2029, at a CAGR of 7.2% from 2022 to 2029. India is one of the highest growing economies in Asia. The increasing population, rising middle-class population, ongoing upsurge in awareness about healthy foods, and huge milk production in the country are driving the growth of the Dairy Ingredients market. In addition, the country is seeing an upsurge in biscuits, cakes, and other fast-moving consumer goods consumption, which fuels demand for dairy ingredients.

Furthermore, this country has the highest level of milk production and consumption of all countries. The country’s milk production accounts for nearly 23% of global milk production. As of 2020, about 4.2% of the GDP of India was due to dairy production. Hence, the growth of the Indian dairy sector is projected to create lucrative growth opportunities for the Dairy Ingredients market.

Key Industry Players Analysis:

To increase their market position in the global Dairy Ingredients business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Nestle S.A.

- Fonterra Cooperative Group

- Royal FrieslandCampina N.V.

- Arla Foods

- Lactalis Group

- Dairy Farmers of America Inc.

- Agropur Cooperative

- Schreiber Foods Inc.

- Gujarat Cooperative Milk Marketing Federation Ltd. (AMUL)

- Meiji Holdings Co., Ltd.

Latest Development:

- In May 2022, Nestlé East and Southern African Region (ESAR) introduced NESTLÉ EVERYDAY, an affordable, medium-fat dairy powder. This launch aims to eradicate South Africa’s challenging micronutrient deficiencies in the population.

- In October 2021, Royal FrieslandCampina N.V., a Dutch multinational dairy cooperative, launched its Innovation Experience Centre (IEC) in Xintiandi, China. This innovation center is expected to cater to dairy preferences in the country.

Report Metrics

|

Report Attribute |

Details |

|

Market size |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

7.0% |

|

Market Size |

62.98 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Type, form, application, and Regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Nestle S.A., Fonterra Cooperative Group, Royal FrieslandCampina N.V., Arla Foods, Lactalis Group, Dairy Farmers of America Inc., Agropur Cooperative, Schreiber Foods Inc., Gujarat Cooperative Milk Marketing Federation Ltd. (AMUL), and Meiji Holdings Co., Ltd. among others |

|

By Type |

|

|

By Form |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Dairy Ingredients Market by Type:

- Proteins

- Milk Powder

- Milk Fat Concentrates

- Lactose & Its Derivatives

Global Dairy Ingredients Market by Form:

- Powder

- Liquid

Global Dairy Ingredients Market by Application:

- Bakery & Confectionery

- Dairy Products

- Sports Nutrition Products

- Infant Formulas

Global Dairy Ingredients Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market size of Dairy Ingredients market?

Global Dairy Ingredients market size was valued USD 62.98 billion in 2021

What will be the growth rate of Dairy Ingredients market throughout the projected period?

The growth rate of Diary ingredient market will CAGR of 7.0% from 2022 to 2029 and its market size will reach to USD 105.97 billion by 2029

What is the most significant application of Dairy Ingredients?

Dairy products segment led the Dairy Ingredients market with a market share of around 36.95% in 2021

What is the key driver of the Dairy Ingredients market?

Growing population, rising economies, and increasing consumption of ready-to-eat, as well as functional foods around the globe, are primarily driving the growth of the Dairy Ingredients market.

Which are the leading market players active in the Dairy Ingredients market?

Leading market players active in the global Dairy Ingredients market are Nestle S.A., Fonterra Cooperative Group, Royal FrieslandCampina N.V., Arla Foods, Lactalis Group, Dairy Farmers of America Inc., Agropur Cooperative, Schreiber Foods Inc., Gujarat Cooperative Milk Marketing Federation Ltd. (AMUL), and Meiji Holdings Co., Ltd. among others.

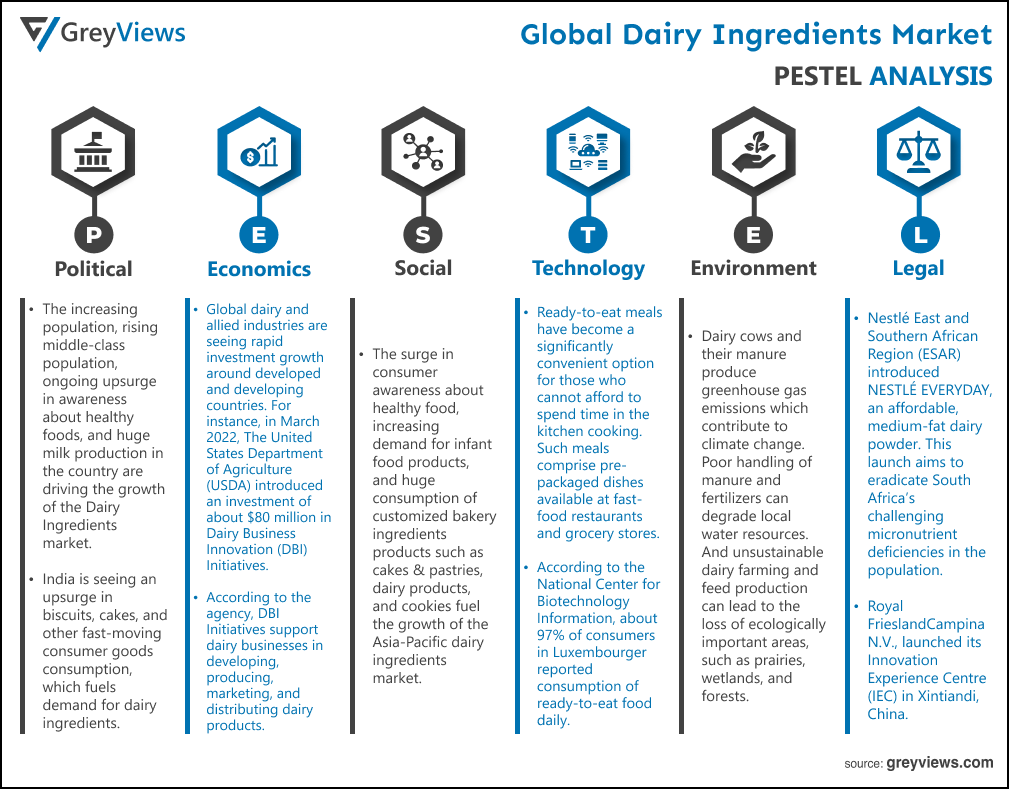

Political Factors- The increasing population, rising middle-class population, ongoing upsurge in awareness about healthy foods, and huge milk production in the country are driving the growth of the Dairy Ingredients market. In addition, the country is seeing an upsurge in biscuits, cakes, and other fast-moving consumer goods consumption, which fuels demand for dairy ingredients. Furthermore, this country has the highest milk production and consumption level of all countries. The country’s milk production accounts for nearly 23% of global milk production. As of 2020, about 4.2% of the GDP of India was due to dairy production. Hence, the growth of the Indian dairy sector is projected to create lucrative growth opportunities for the Dairy Ingredients market.

Economical Factors- Global dairy and allied industries are seeing rapid investment growth around developed and developing countries. For instance, in March 2022, The United States Department of Agriculture (USDA) introduced an investment of about $80 million in Dairy Business Innovation (DBI) Initiatives. According to the agency, DBI Initiatives support dairy businesses in developing, producing, marketing, and distributing dairy products. Consumer tendency towards vegan alternatives has been affecting the sales of animal-based milk and associated products. For instance, according to the U.S. Department of Agriculture's economic research, there was a 22% decline in the consumption of dairy milk products from 2000 to 2016. On the other hand, the Plant Based Foods Association (PBFA) has recently indicated that the worth of the vegan retail food industry grew by 11.4% in March 2020.

Social Factor- The surge in consumer awareness about healthy food, increasing demand for infant food products, and huge consumption of customized bakery ingredients products such as cakes & pastries, dairy products, and cookies fuel the growth of the Asia-Pacific dairy ingredients market. In addition, due to the favorable demographic trends, the dairy ingredients market is anticipated to increase significantly in this area, which is home to the two most populous nations globally, China and India. The flourishing dairy products industry and rise in demand for healthy, ready-to-eat, and convenient food products have boosted the market's growth in this region. In addition, consumers in U.S. and Canada are shifting their preference toward minimally processed, protein-rich bakery products with lesser additives and preservatives.

Technological Factors- ready-to-eat meals have become a significantly convenient option for those who cannot afford to spend time in the kitchen cooking. Such meals comprise pre-packaged dishes available at fast-food restaurants and grocery stores. According to the National Center for Biotechnology Information, a part of the United States National Library of Medicine, about 97% of consumers in Luxembourger reported consumption of ready-to-eat food daily. Such food products are one of the major applications of milk ingredients due to the need for the heavy presence of protein, fat, saturated fatty acids, and sodium.

Environmental Factors- Dairy cows and their manure produce greenhouse gas emissions which contribute to climate change. Poor handling of manure and fertilizers can degrade local water resources. And unsustainable dairy farming and feed production can lead to the loss of ecologically important areas, such as prairies, wetlands, and forests. Millions of farmers worldwide tend approximately 270 million dairy cows to produce milk. Milk production impacts the environment in various ways, and the scale of these impacts depends on the practices of dairy farmers and feed growers.

Legal Factors- Nestlé East and Southern African Region (ESAR) introduced NESTLÉ EVERYDAY, an affordable, medium-fat dairy powder. This launch aims to eradicate South Africa’s challenging micronutrient deficiencies in the population. Royal FrieslandCampina N.V., a Dutch multinational dairy cooperative, launched its Innovation Experience Centre (IEC) in Xintiandi, China. This innovation center is expected to cater to dairy preferences in the country.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Type

- Market Attractiveness Analysis By Form

- Market Attractiveness Analysis By Application

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Increasing consumption of ready-to-eat foods

- Rising awareness regarding maintenance of a healthy lifestyle

- Restrains

- Rising demand for alternatives, such as plant protein

- Opportunities

- Ongoing investments in dairy businesses

- Challenges

- Consumer tendency towards vegan food

- Global Dairy Ingredients Market Analysis and Projection, By Type

- Segment Overview

- Proteins

- Milk Powder

- Milk Fat Concentrates

- Lactose & Its Derivatives

- Global Dairy Ingredients Market Analysis and Projection, By Form

- Segment Overview

- Powder

- Liquid

- Global Dairy Ingredients Market Analysis and Projection, By Application

- Segment Overview

- Bakery & Confectionery

- Dairy Products

- Sports Nutrition Products

- Infant Formulas

- Global Dairy Ingredients Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Dairy Ingredients Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Dairy Ingredients Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Product Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Nestle S.A.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Fonterra Cooperative Group

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Royal FrieslandCampina N.V.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Arla Foods

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Lactalis Group

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Dairy Farmers of America Inc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Agropur Cooperative

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Schreiber Foods Inc.,

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Gujarat Cooperative Milk Marketing Federation Ltd. (AMUL)

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Meiji Holdings Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Nestle S.A.

List of Table

- Global Dairy Ingredients Market, By Type, 2021–2029(USD Billion)

- Global Proteins Dairy Ingredients Market, By Region, 2021–2029(USD Billion)

- Global Milk Powder Dairy Ingredients Market, By Region, 2021–2029(USD Billion)

- Global Milk Fat Concentrates Dairy Ingredients Market, By Region, 2021–2029(USD Billion)

- Global Lactose & Its Derivatives Dairy Ingredients Market, By Region, 2021–2029(USD Billion)

- Global Dairy Ingredients Market, By Form, 2021–2029(USD Billion)

- Global Powder Dairy Ingredients Market, By Region, 2021–2029(USD Billion)

- Global Liquid Dairy Ingredients Market, By Region, 2021–2029(USD Billion)

- Global Dairy Ingredients Market, By Application, 2021–2029(USD Billion)

- Global Bakery & Confectionery Dairy Ingredients Market, By Region, 2021–2029(USD Billion)

- Global Dairy Products Dairy Ingredients Market, By Region, 2021–2029(USD Billion)

- Global Sports Nutrition Products Dairy Ingredients Market, By Region, 2021–2029(USD Billion)

- Global Infant Formulas Dairy Ingredients Market, By Region, 2021–2029(USD Billion)

- Global Dairy Ingredients Market, By Region, 2021–2029(USD Billion)

- Global Dairy Ingredients Market, By North America, 2021–2029(USD Billion)

- North America Dairy Ingredients Market, By Type, 2021–2029(USD Billion)

- North America Dairy Ingredients Market, By Form, 2021–2029(USD Billion)

- North America Dairy Ingredients Market, By Application, 2021–2029(USD Billion)

- USA Dairy Ingredients Market, By Type, 2021–2029(USD Billion)

- USA Dairy Ingredients Market, By Form, 2021–2029(USD Billion)

- USA Dairy Ingredients Market, By Application, 2021–2029(USD Billion)

- Canada Dairy Ingredients Market, By Type, 2021–2029(USD Billion)

- Canada Dairy Ingredients Market, By Form, 2021–2029(USD Billion)

- Canada Dairy Ingredients Market, By Application, 2021–2029(USD Billion)

- Mexico Dairy Ingredients Market, By Type, 2021–2029(USD Billion)

- Mexico Dairy Ingredients Market, By Form, 2021–2029(USD Billion)

- Mexico Dairy Ingredients Market, By Application, 2021–2029(USD Billion)

- Europe Dairy Ingredients Market, By Type, 2021–2029(USD Billion)

- Europe Dairy Ingredients Market, By Form, 2021–2029(USD Billion)

- Europe Dairy Ingredients Market, By Application, 2021–2029(USD Billion)

- Germany Dairy Ingredients Market, By Type, 2021–2029(USD Billion)

- Germany Dairy Ingredients Market, By Form, 2021–2029(USD Billion)

- Germany Dairy Ingredients Market, By Application, 2021–2029(USD Billion)

- France Dairy Ingredients Market, By Type, 2021–2029(USD Billion)

- France Dairy Ingredients Market, By Form, 2021–2029(USD Billion)

- France Dairy Ingredients Market, By Application, 2021–2029(USD Billion)

- UK Dairy Ingredients Market, By Type, 2021–2029(USD Billion)

- UK Dairy Ingredients Market, By Form, 2021–2029(USD Billion)

- UK Dairy Ingredients Market, By Application, 2021–2029(USD Billion)

- Italy Dairy Ingredients Market, By Type, 2021–2029(USD Billion)

- Italy Dairy Ingredients Market, By Form, 2021–2029(USD Billion)

- Italy Dairy Ingredients Market, By Application, 2021–2029(USD Billion)

- Spain Dairy Ingredients Market, By Type, 2021–2029(USD Billion)

- Spain Dairy Ingredients Market, By Form, 2021–2029(USD Billion)

- Spain Dairy Ingredients Market, By Application, 2021–2029(USD Billion)

- Asia Pacific Dairy Ingredients Market, By Type, 2021–2029(USD Billion)

- Asia Pacific Dairy Ingredients Market, By Form, 2021–2029(USD Billion)

- Asia Pacific Dairy Ingredients Market, By Application, 2021–2029(USD Billion)

- Japan Dairy Ingredients Market, By Type, 2021–2029(USD Billion)

- Japan Dairy Ingredients Market, By Form, 2021–2029(USD Billion)

- Japan Dairy Ingredients Market, By Application, 2021–2029(USD Billion)

- China Dairy Ingredients Market, By Type, 2021–2029(USD Billion)

- China Dairy Ingredients Market, By Form, 2021–2029(USD Billion)

- China Dairy Ingredients Market, By Application, 2021–2029(USD Billion)

- India Dairy Ingredients Market, By Type, 2021–2029(USD Billion)

- India Dairy Ingredients Market, By Form, 2021–2029(USD Billion)

- India Dairy Ingredients Market, By Application, 2021–2029(USD Billion)

- South America Dairy Ingredients Market, By Type, 2021–2029(USD Billion)

- South America Dairy Ingredients Market, By Form, 2021–2029(USD Billion)

- South America Dairy Ingredients Market, By Application, 2021–2029(USD Billion)

- Brazil Dairy Ingredients Market, By Type, 2021–2029(USD Billion)

- Brazil Dairy Ingredients Market, By Form, 2021–2029(USD Billion)

- Brazil Dairy Ingredients Market, By Application, 2021–2029(USD Billion)

- Middle East and Africa Dairy Ingredients Market, By Type, 2021–2029(USD Billion)

- Middle East and Africa Dairy Ingredients Market, By Form, 2021–2029(USD Billion)

- Middle East and Africa Dairy Ingredients Market, By Application, 2021–2029(USD Billion)

- UAE Dairy Ingredients Market, By Type, 2021–2029(USD Billion)

- UAE Dairy Ingredients Market, By Form, 2021–2029(USD Billion)

- UAE Dairy Ingredients Market, By Application, 2021–2029(USD Billion)

- South Africa Dairy Ingredients Market, By Type, 2021–2029(USD Billion)

- South Africa Dairy Ingredients Market, By Form, 2021–2029(USD Billion)

- South Africa Dairy Ingredients Market, By Application, 2021–2029(USD Billion)

List of Figures

- Global Dairy Ingredients Market Segmentation

- Dairy Ingredients Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Dairy Ingredients Market Attractiveness Analysis By Type

- Global Dairy Ingredients Market Attractiveness Analysis By Form

- Global Dairy Ingredients Market Attractiveness Analysis By Application

- Global Dairy Ingredients Market Attractiveness Analysis By Region

- Global Dairy Ingredients Market: Dynamics

- Global Dairy Ingredients Market Share By Type(2021 & 2029)

- Global Dairy Ingredients Market Share By Form(2021 & 2029)

- Global Dairy Ingredients Market Share By Application(2021 & 2029)

- Global Dairy Ingredients Market Share by Regions (2021 & 2029)

- Global Dairy Ingredients Market Share by Company (2020)