District Heating Pipes Market Size By Pipe (Pre-insulated Steel [20 to 100 mm, 101 to 300 mm, above 300 mm], Polymer [20 to 100 mm, 101 to 300 mm, above 300 mm]), By Diameter (20 to 100 mm, 101 to 300 mm, above 300 mm), By Application (Residential, Commercial [College/University, Office Buildings, Government/Military], Industrial [Chemical, Refinery, Paper]), End-User, Regions, Segmentation, and Projection till 2029

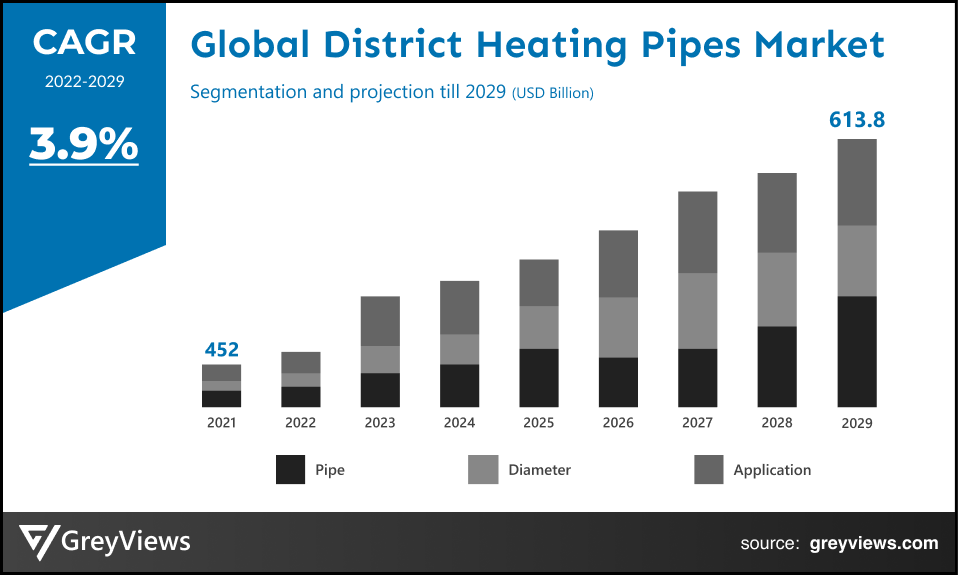

CAGR: 3.9%Current Market Size: USD 452 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global District Heating Pipes Market- Market Overview:

Global District Heating Pipes market is expected to grow from USD 452 billion in 2021 to USD 613.8 billion by 2029, at a CAGR of 3.9% during the Projection period 2022-2029. The rising concerns about the increasing carbon emissions, coupled with growing government initiatives toward accepting district heating pipes, will boost market growth.

A District heating system is a system that is used for distributing heat generated in a centralized location with the help of insulated pipes for distributing heat to commercial, industrial, and residential heating requirements such as water heating and space heating. District heating pipes are usually equipped with a pair of electric wires for moisture surveillance. District heating pipes are used to distribute heat for domestic hot water and space heating in buildings, commercial complexes, and industrial processes.

Rising concerns about the increasing carbon emissions propel the market’s growth. Moreover, the growing initiatives by the government towards the acceptance of district heating systems are expected to provide impetus to the market’s growth. Rapid urbanization and industrialization across developing economies will further supplement the market’s growth. Most European countries have extreme climatic conditions, which also impetus to the market’s growth.

Request Sample:- Global District Heating Pipes market

Market Dynamics:

Drivers:

- The increasing demand for energy-efficient solutions

District heating pipes are extremely flexible as they can be heated using various sources such as coal, oil, or natural gas, which clearly states that when it comes to the choice of the heat source; it can accommodate all heat sources, including wind and solar, surplus heat from industrial, CHP, and boilers. The larger district heating systems with several heat sources can easily switch from one fuel to another depending upon the fuel's availability, price, and environmental ambitions. These factors drive the market’s growth.

Restraints:

- High infrastructure cost

The infrastructure required for district heating pipes includes a heat generation unit, which consists of a boiler that is being fueled by gas, wood chips, oil, etc.; along with a distribution network of well-insulated pipes that are used for transferring heat to the end user sector and other equipment such as heat meters and heat exchanger cost a lot which restraint the market’s growth. The complete establishment of district heating systems requires a huge investment which hampers the market's growth.

Opportunities:

- Technological advancement

Digitalization and advancement are expected to provide lucrative growth opportunities for the district heating pipes market. The advancement of new products and solutions such as smart meters, smart infrastructure, home automation, demand-based heating solutions, and many others with the latest technologies provide an opportunity for the market’s growth. These solutions and products help consumers take an active part in balancing future heating requirements. Rapid technological development also helps in reducing the cost of the whole district heating pipes and also increases their efficiency.

Challenges

- Impact of COVID-19 pandemic

The COVID-19 pandemic has posed significant challenges in the global District Heating Pipes industry. This has forced everyone associated with the chemical to work from home, and players were compelled to follow quarantine restrictions imposed by government orders. Moreover, the factories manufacturing District Heating Pipes were temporarily closed to stop the spread of the disease, which challenged the market’s growth. There was also disruption in the raw material supply chain as well, challenging the market’s growth.

Segmentation Analysis:

The global District Heating Pipes market has been segmented based on pipe, diameter, application, and region.

By Pipe

The pipe segment includes pre-insulated Steel [20 – 100 mm, 101 – 300 mm, ≥300 mm], polymer [20 – 100 mm, 101 – 300 mm, ≥300 mm]. The pre-insulated steel pipes segment led the District Heating Pipes market with a market share of around 68.7% in 2021. The pre-insulated steel pipes come in a wide range of diameters ranging from 20 mm to 1,200 mm, increasing their demand in the market. Furthermore, these are also fused with polyurethane foams inside the pipes and HDPE material coverings outside that offer high insulation driving the segment’s growth.

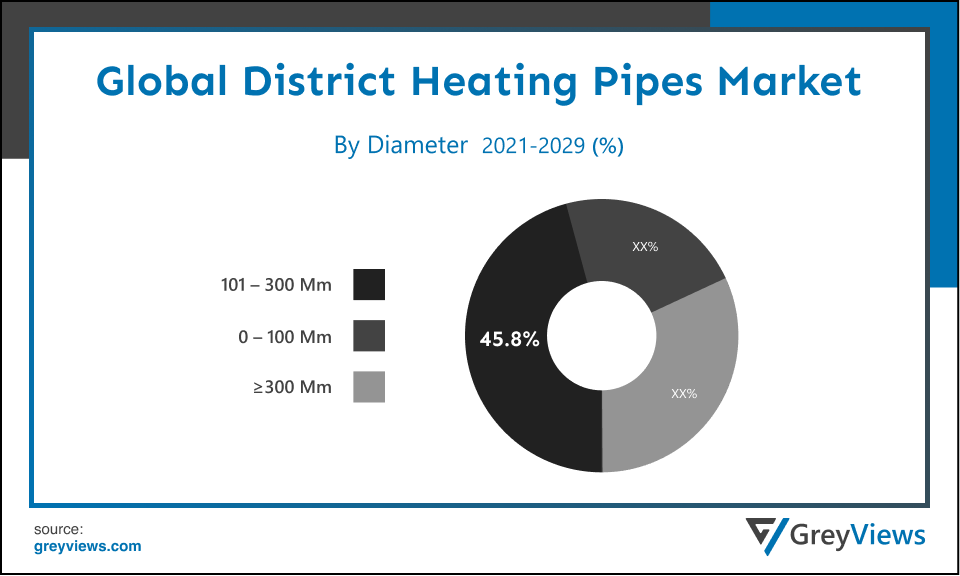

By Diameter

The diameter segment includes online 0 – 100 mm, 101 – 300 mm, and ≥300 mm. The 101-300mm segment led the District Heating Pipes market with a market share of around 45.8% in 2021. The 101 - 300 mm diameter pipes segment has been growing owing to the increasing investments in residential and commercial establishments. The pipes of this diameter help reduce the heat losses coupled with significant investment by manufacturers in developing innovative insulating materials.

By Application

The application segment includes residential, commercial [College/University, Office Buildings, Government/Military], and industrial [Chemical, Refinery, Paper]. The commercial segment led the District Heating Pipes market with a market share of around 49.7% in 2021. The ongoing development of IT parts, SEZs, and data centers are expected to increase the demand for district heating pipes. The introduction of stringent building emission norms also propels the market’s growth.

By Regional Analysis:

The regions analyzed for the District Heating Pipes market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Asia Pacific region dominated the District Heating Pipes market and held a 42.6% share of the market revenue in 2021.

- The Asia Pacific region has registered the highest value for the year 2021. The increasing government initiatives to reduce carbon emission propel the market’s growth in the region Furthermore, the increasing demand for energy-efficient and cost-effective heating solutions coupled with growing urbanization propels the market’s growth region. The increasing developments of IT parts, SEZs, and data centers also propel the market’s growth in the region.

- North America is expected to witness a considerable growth rate during the Projection period. The ongoing political, social, and economic significance of North America's district heating pipes industry has mainly boosted demand for District Heating Pipes in the region. Increasing developmental activities in the region propel the market’s growth. Furthermore, strict regulations toward reducing carbon emissions add impetus to the market’s growth.

Global District Heating Pipes Market- Country Analysis

- Germany

Germany's District Heating Pipes market size was valued at USD 63.5 billion in 2021 and is expected to reach USD 92.3 billion by 2029, at a CAGR of 4.8% from 2022 to 2029. Germany's district heating pipe market will increase due to the growing concern toward limiting carbon emissions and favorable government policies. Increasing investments in developing new infrastructure facilities and manufacturing units will favor the market’s growth. Additionally, the presence of high penetration of variable renewable energy sources will energize the industry dynamic.

- China

China's District Heating Pipes market was valued at USD 82.79 billion in 2021 and is expected to reach USD 114.1 billion by 2029, at a CAGR of 4.1% from 2022 to 2029. China is one of the largest District Heating Pipes markets. This is mainly attributed to the rising urbanization and industrialization in the region coupled with the increasing population. There is a huge demand for heat in the region which is fulfilled using the Combined heat and power (CHP), heat-only boiler (HOB), and heat pumps (HPs).

- India

India's District Heating Pipes market size was valued at USD 65.4 billion in 2021 and is expected to reach USD 91.48 billion by 2029, at a CAGR of 3.8% from 2022 to 2029. India is one of the strongest growing economies in Asia. In addition, rising awareness regarding the increasing carbon emission increases the need for renewable sources of heat production. Rapid urbanization and industrialization across the country will further supplement the market’s growth.

Key Industry Players Analysis:

To increase their market position in the global District Heating Pipes business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Fortum

- Vattenfall AB

- Engie

- Danfoss

- Clearway Energy Inc.

- Statkraft

- SHINRYO CORPORATION

- LOGSTOR A/S

- Vital Energi Ltd.

- Kelag

Latest Development:

- In March 2020, Uniper SE was acquired by Fortum for more than US$ 7 Bn. Through this acquisition, Fortum aims to expand its bases across Europe.

- In 2021, Serbia signed a coal boilers replacement contract for a district heating system in Kragujevac with a consortium of local companies Energotehnika, Reming, Jadran and AG Institute.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

3.9% |

|

Market Size |

452 billion in 2021 |

|

Forecast period |

2022-2029 |

|

Forecast unit |

Value (USD) |

|

Segments covered |

Pipe, diameter, application, and Regions |

|

Report Scope |

Revenue forecast, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Fortum, Vattenfall AB, Engie, Danfoss, Clearway Energy Inc., Statkraft, SHINRYO CORPORATION, LOGSTOR A/S, Vital Energi Ltd., Kelag, among others |

|

By Pipe |

? Pre-insulated Steel [20 – 100 mm, 101 – 300 mm, ≥300 mm] ? Polymer [20 – 100 mm, 101 – 300 mm, ≥300 mm] |

|

By Diameter |

? 20 – 100 mm ? 101 – 300 mm ? ≥300 mm |

|

By Application |

? Residential ? Commercial [College/University, Office Buildings, Government/Military] ? Industrial [Chemical, Refinery, Paper] |

|

Regional scope |

? North America ? Europe ? Asia-Pacific ? South America ? Middle East and Africa |

Scope of the Report

Global District Heating Pipes Market by Pipe:

- Pre-insulated Steel [20 – 100 mm, 101 – 300 mm, ≥300 mm]

- Polymer [20 – 100 mm, 101 – 300 mm, ≥300 mm]

Global District Heating Pipes Market by Diameter:

- 20 – 100 mm

- 101 – 300 mm

- ≥300 mm

Global District Heating Pipes Market by Application:

- Residential

- Commercial [College/University, Office Buildings, Government/Military]

- Industrial [Chemical, Refinery, Paper]

Global District Heating Pipes Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market size of the District Heating Pipes market?

Global District Heating Pipes market is expected to reach USD 452 billion in 2021 to USD 613.8 billion by 2029, at a CAGR of 3.9% from 2022 to 2029.

Where are the district healing pipes used predominantly for?

The District Heating Pipes are predominantly used in the commercial sector, with a market share of around 49.7% in 2021.

Which are the leading market players active in the District Heating Pipes market?

Leading market players active in the global District Heating Pipes market are Fortum, Vattenfall AB, Engie, Danfoss, Clearway Energy Inc., Statkraft, SHINRYO CORPORATION, LOGSTOR A/S, Vital Energi Ltd., Kelag, among others.

What Drive the growth of District Heating Pipes market?

The increasing demand for energy efficient solutions are projected to influence the market during the Projection period.

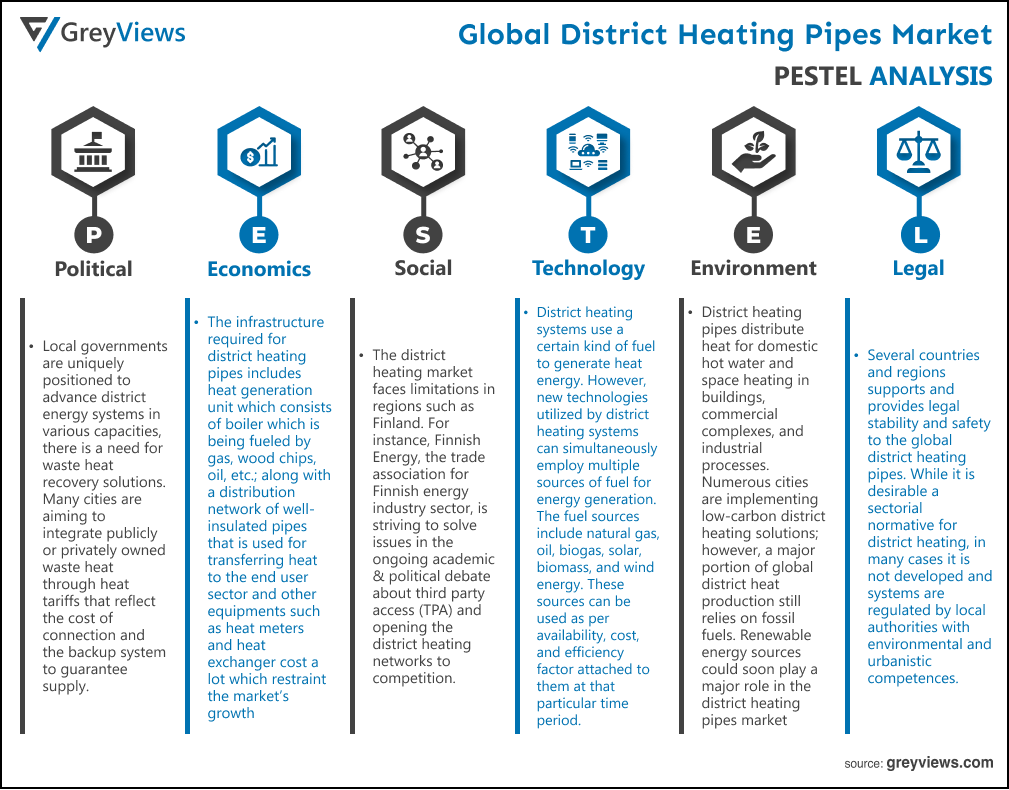

Political Factors- Local governments are uniquely positioned to advance district energy systems in various capacities, there is a need for waste heat recovery solutions. Many cities are aiming to integrate publicly or privately owned waste heat through heat tariffs that reflect the cost of connection and the backup system to guarantee supply.

Economical Factors- The infrastructure required for district heating pipes includes heat generation unit which consists of boiler which is being fueled by gas, wood chips, oil, etc.; along with a distribution network of well-insulated pipes that is used for transferring heat to the end user sector and other equipment’s such as heat meters and heat exchanger cost a lot which restraint the market’s growth. The complete establishment of district heating systems requires a huge investment which hampers the growth of the market.

Social Factor- The district heating market faces limitations in regions such as Finland. For instance, Finnish Energy, the trade association for Finnish energy industry sector, is striving to solve issues in the ongoing academic & political debate about third party access (TPA) and opening the district heating networks to competition. Thus, market stakeholders are gaining cognizance about potential policy proposals such as the freedom to choose among various heating methods and possible legal barriers that restrict the development of the service business.

Technological Factors- District heating systems use a certain kind of fuel to generate heat energy. However, new technologies utilized by district heating systems can simultaneously employ multiple sources of fuel for energy generation. The fuel sources include natural gas, oil, biogas, solar, biomass, and wind energy. These sources can be used as per availability, cost, and efficiency factor attached to them at that particular time period. Simultaneous use of different fuels can reduce the cost and fuel risks prevalent in certain regions. These new hybrid systems can be utilized as new schemes or can also be refurbished and optimized in existing district heating pipes.

Environmental Factors- District heating pipes distribute heat for domestic hot water and space heating in buildings, commercial complexes, and industrial processes. Numerous cities are implementing low-carbon district heating solutions; however, a major portion of global district heat production still relies on fossil fuels. Renewable energy sources could soon play a major role in the district heating pipes market. According to the International Energy Agency, in the Net Zero Emissions by 2050 Scenario, the combined share of renewable sources and electricity in global district heat supplies is expected to be around 35%, helping to slash heat generation carbon emissions by more than one-third.

Legal Factors- Several countries and regions support and provides legal stability and safety to the global district heating pipes. While it is desirable a sectorial normative for district heating, in many cases it is not developed and systems are regulated by local authorities with environmental and urbanistic competences. For the case under analysis, biomass forestry, the legal subsystem should interact with the mountain manager for assuring supply and maintenance. However, this interaction is not always possible because forestry use and biomass recollection/exploitation are adjudicated by economic auction without linking both actors.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Pipe

- Market Attractiveness Analysis By Diameter

- Market Attractiveness Analysis By Application

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- The increasing demand for energy efficient solutions

- Restrains

- High infrastructure cost

- Opportunities

- Technological advancement

- Challenges

- Impact of COVID-19 pandemic

- Global District Heating Pipes Market Analysis and Projection, By Pipe

- Segment Overview

- Pre-insulated Steel [20 – 100 mm, 101 – 300 mm, ≥300 mm]

- Polymer [20 – 100 mm, 101 – 300 mm, ≥300 mm]

- Global District Heating Pipes Market Analysis and Projection, By Diameter

- Segment Overview

- 20 – 100 mm

- 101 – 300 mm

- ≥300 mm

- Global District Heating Pipes Market Analysis and Projection, By Application

- Segment Overview

- Residential

- Commercial [College/University, Office Buildings, Government/Military]

- Industrial [Chemical, Refinery, Paper]

- Global District Heating Pipes Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global District Heating Pipes Market-Competitive Landscape

- Overview

- Market Share of Key Players in the District Heating Pipes Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Pipe Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Fortum

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Pipe Portfolio

- Recent Developments

- SWOT Analysis

- Vattenfall AB

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Pipe Portfolio

- Recent Developments

- SWOT Analysis

- Engie

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Pipe Portfolio

- Recent Developments

- SWOT Analysis

- Danfoss

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Pipe Portfolio

- Recent Developments

- SWOT Analysis

- Clearway Energy Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Pipe Portfolio

- Recent Developments

- SWOT Analysis

- Statkraft

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Pipe Portfolio

- Recent Developments

- SWOT Analysis

- SHINRYO CORPORATION

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Pipe Portfolio

- Recent Developments

- SWOT Analysis

- LOGSTOR A/S

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Pipe Portfolio

- Recent Developments

- SWOT Analysis

- Vital Energi Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Pipe Portfolio

- Recent Developments

- SWOT Analysis

- Kelag

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Pipe Portfolio

- Recent Developments

- SWOT Analysis

- Fortum

List of Table

- Global District Heating Pipes Market, By Pipe, 2021–2029(USD Billion)

- Global Pre-insulated Steel [20 – 100 mm, 101 – 300 mm, ≥300 mm] District Heating Pipes Market, By Region, 2021–2029(USD Billion)

- Global Polymer [20 – 100 mm, 101 – 300 mm, ≥300 mm] District Heating Pipes Market, By Region, 2021–2029(USD Billion)

- Global District Heating Pipes Market, By Diameter, 2021–2029(USD Billion)

- Global 20 – 100 mm District Heating Pipes Market, By Region, 2021–2029(USD Billion)

- Global 101 – 300 mm District Heating Pipes Market, By Region, 2021–2029(USD Billion)

- Global ≥300 mm District Heating Pipes Market, By Region, 2021–2029(USD Billion)

- Global District Heating Pipes Market, By Application, 2021–2029(USD Billion)

- Global Residential District Heating Pipes Market, By Region, 2021–2029(USD Billion)

- Global Commercial [College/University, Office Buildings, Government/Military] District Heating Pipes Market, By Region, 2021–2029(USD Billion)

- Global Industrial [Chemical, Refinery, Paper] District Heating Pipes Market, By Region, 2021–2029(USD Billion)

- Global District Heating Pipes Market, By Region, 2021–2029(USD Billion)

- North America District Heating Pipes Market, By Pipe, 2021–2029(USD Billion)

- North America District Heating Pipes Market, By Diameter, 2021–2029(USD Billion)

- North America District Heating Pipes Market, By Application, 2021–2029(USD Billion)

- USA District Heating Pipes Market, By Pipe, 2021–2029(USD Billion)

- USA District Heating Pipes Market, By Diameter, 2021–2029(USD Billion)

- USA District Heating Pipes Market, By Application, 2021–2029(USD Billion)

- Canada District Heating Pipes Market, By Pipe, 2021–2029(USD Billion)

- Canada District Heating Pipes Market, By Diameter, 2021–2029(USD Billion)

- Canada District Heating Pipes Market, By Application, 2021–2029(USD Billion)

- Mexico District Heating Pipes Market, By Pipe, 2021–2029(USD Billion)

- Mexico District Heating Pipes Market, By Diameter, 2021–2029(USD Billion)

- Mexico District Heating Pipes Market, By Application, 2021–2029(USD Billion)

- Europe District Heating Pipes Market, By Pipe, 2021–2029(USD Billion)

- Europe District Heating Pipes Market, By Diameter, 2021–2029(USD Billion)

- Europe District Heating Pipes Market, By Application, 2021–2029(USD Billion)

- Germany District Heating Pipes Market, By Pipe, 2021–2029(USD Billion)

- Germany District Heating Pipes Market, By Diameter, 2021–2029(USD Billion)

- Germany District Heating Pipes Market, By Application, 2021–2029(USD Billion)

- France District Heating Pipes Market, By Pipe, 2021–2029(USD Billion)

- France District Heating Pipes Market, By Diameter, 2021–2029(USD Billion)

- France District Heating Pipes Market, By Application, 2021–2029(USD Billion)

- UK District Heating Pipes Market, By Pipe, 2021–2029(USD Billion)

- UK District Heating Pipes Market, By Diameter, 2021–2029(USD Billion)

- UK District Heating Pipes Market, By Application, 2021–2029(USD Billion)

- Italy District Heating Pipes Market, By Pipe, 2021–2029(USD Billion)

- Italy District Heating Pipes Market, By Diameter, 2021–2029(USD Billion)

- Italy District Heating Pipes Market, By Application, 2021–2029(USD Billion)

- Spain District Heating Pipes Market, By Pipe, 2021–2029(USD Billion)

- Spain District Heating Pipes Market, By Diameter, 2021–2029(USD Billion)

- Spain District Heating Pipes Market, By Application, 2021–2029(USD Billion)

- Asia Pacific District Heating Pipes Market, By Pipe, 2021–2029(USD Billion)

- Asia Pacific District Heating Pipes Market, By Diameter, 2021–2029(USD Billion)

- Asia Pacific District Heating Pipes Market, By Application, 2021–2029(USD Billion)

- Japan District Heating Pipes Market, By Pipe, 2021–2029(USD Billion)

- Japan District Heating Pipes Market, By Diameter, 2021–2029(USD Billion)

- Japan District Heating Pipes Market, By Application, 2021–2029(USD Billion)

- China District Heating Pipes Market, By Pipe, 2021–2029(USD Billion)

- China District Heating Pipes Market, By Diameter, 2021–2029(USD Billion)

- China District Heating Pipes Market, By Application, 2021–2029(USD Billion)

- India District Heating Pipes Market, By Pipe, 2021–2029(USD Billion)

- India District Heating Pipes Market, By Diameter, 2021–2029(USD Billion)

- India District Heating Pipes Market, By Application, 2021–2029(USD Billion)

- South America District Heating Pipes Market, By Pipe, 2021–2029(USD Billion)

- South America District Heating Pipes Market, By Diameter, 2021–2029(USD Billion)

- South America District Heating Pipes Market, By Application, 2021–2029(USD Billion)

- Brazil District Heating Pipes Market, By Pipe, 2021–2029(USD Billion)

- Brazil District Heating Pipes Market, By Diameter, 2021–2029(USD Billion)

- Brazil District Heating Pipes Market, By Application, 2021–2029(USD Billion)

- Middle East and Africa District Heating Pipes Market, By Pipe, 2021–2029(USD Billion)

- Middle East and Africa District Heating Pipes Market, By Diameter, 2021–2029(USD Billion)

- Middle East and Africa District Heating Pipes Market, By Application, 2021–2029(USD Billion)

- UAE District Heating Pipes Market, By Pipe, 2021–2029(USD Billion)

- UAE District Heating Pipes Market, By Diameter, 2021–2029(USD Billion)

- UAE District Heating Pipes Market, By Application, 2021–2029(USD Billion)

- South Africa District Heating Pipes Market, By Pipe, 2021–2029(USD Billion)

- South Africa District Heating Pipes Market, By Diameter, 2021–2029(USD Billion)

- South Africa District Heating Pipes Market, By Application, 2021–2029(USD Billion)

List of Figures

- Global District Heating Pipes Market Segmentation

- District Heating Pipes Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global District Heating Pipes Market Attractiveness Analysis By Pipe

- Global District Heating Pipes Market Attractiveness Analysis By Diameter

- Global District Heating Pipes Market Attractiveness Analysis By Application

- Global District Heating Pipes Market Attractiveness Analysis By Region

- Global District Heating Pipes Market: Dynamics

- Global District Heating Pipes Market Share By Pipe (2021 & 2029)

- Global District Heating Pipes Market Share By Diameter (2021 & 2029)

- Global District Heating Pipes Market Share By Application (2021 & 2029)

- Global District Heating Pipes Market Share by Regions (2021 & 2029)

- Global District Heating Pipes Market Share by Company (2020)