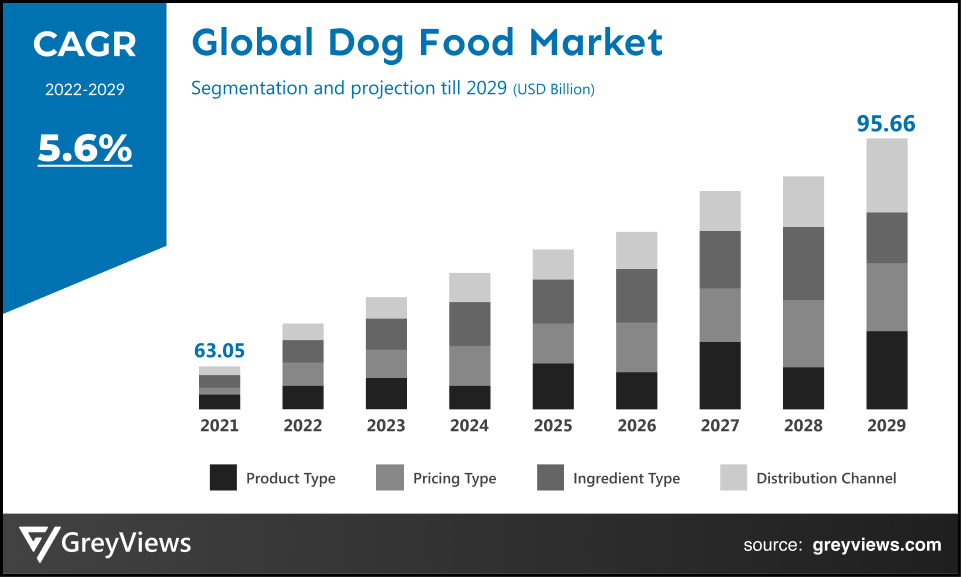

Dog Food Market Size by Product Type (Dry Dog Food, Dog Treats, and Wet Dog Food), Pricing Type (Premium Products and Mass Products), Ingredient Type (Animal Derived and Plant Derived), and Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online, and Others) and Regions, Segmentation, and Projection till 2029

CAGR: 5.6%Current Market Size: USD 63.05 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Dog Food Market- Market Overview:

The Global Dog Food market is expected to grow from USD 63.05 billion in 2021 to USD 95.66 billion by 2029, at a CAGR of 5.6% during the Projection period 2022-2029. The increasing pet population, along with increases in people's per capita disposable income, has primarily driven the market's growth.

Dog food is mainly formulated and projected to be consumed by dogs and other related canines. This food's exact composition differs from manufacturer to manufacturer; however, the common dog food consists of meats, cereals, meat byproducts, grains, minerals, and vitamins. Government authorities regulate this food; hence, pet food manufacturers must meet such regulations. For instance, the U.S. Food and Drug Administration (FDA) regulates pet food products and their ingredients. In addition, these regulations include rules associated with pet food labels, ingredient approvals, and ingredient definitions.

Moreover, due to dog food regulations, manufacturers in the global market typically offer to dig food with high-quality ingredients that include some form of fat, protein, and carbohydrates, along with vital minerals and vitamins. These ingredients provide essential nutrition and taste to support the dog's requirements.

Request Sample: - Global Dog Food Market

Market Dynamics:

Drivers:

- Increasing pet population

Dogs and cats are the most popular pet companions across the globe. In addition, pet ownership is growing at a rapid pace across the globe. For instance, according to the 2021-2022 National Pet Owners Survey by the American Pet Products Association (APPA), 70% of U.S. households, or about 90.5 million families, own a pet. Also, this survey indicated that U.S. spending on dog food increased by about 11%.

Moreover, the lockdown environment across the globe has encouraged people across the globe to buy or adopt dogs for companionship. This is further projected to boost the number of pet dogs across the globe. Hence, the growth of the pet population is driving the growth of the global dog food market.

- Increasing awareness about the dietary requirements of the dog

A balanced and nutritious diet is important to keep the dog healthy. Hence, a good dog diet must comprise a combination of carbohydrates, proteins, vitamins, fats, minerals, and water. An absence of good nutrition leads to the inability of dogs to fight off infection, repair teeth & bones, and maintain their muscle tone.

However, pet owners have become considerably aware of dog dietary requirements in the past few years. This has boosted the demand for high-quality dog food products. This factor is projected to drive the market's growth in the upcoming years.

Restraints:

- Quality issues associated with Dog Food

Dogs may become chronically deprived of a better diet if dog food ingredients don't supply the required levels of nutrients. However, some pet food manufacturers around the globe cut manufacturing costs by incorporating low-quality ingredients in their dog food products. This nutrient-deficient diet may lead to increased shedding, gassiness, vomiting, chronically loose stools, or obesity in dogs. Such risks associated with using low-quality dog food may hamper the market's growth to some extent during the Projection period.

Opportunities:

- Rapid urbanization around the globe

A dramatic increase in urbanization has been observed globally in the past few years. This trend has led to the improved access to medical care, job opportunities, education, and social activities. In addition, urbanization is creating a growing interest in pet ownership among the population.

Moreover, the incidence of non-communicable diseases, such as mental illness, cancer, diabetes, and cardiovascular diseases, has become a major global health concern in urban areas, which is responsible for about 71% of deaths worldwide. This has further created the demand for dog ownership, fueling the growth of the global dog food market.

Challenges

- Increased incidence of pet food recalls

There is an increase in incidences of pet food recalls around the globe. Pet food manufacturers usually conduct a recall when it is found that their product may cause animal or human health issues due to packaging material, ingredients, or finished product. For instance, as stated by the Food Safety News, Primal Pet Foods, the manufacturer of foods and treats for dogs and cats, recalled its 396 units of Raw Frozen Primal Patties for Dogs Beef Formula as it was potentially contaminated with listeria. Such recalls may pose challenges in the global dog food market.

Segmentation Analysis:

The global Dog Food market has been segmented based on product type, pricing type, ingredient type, distribution channel, and regions.

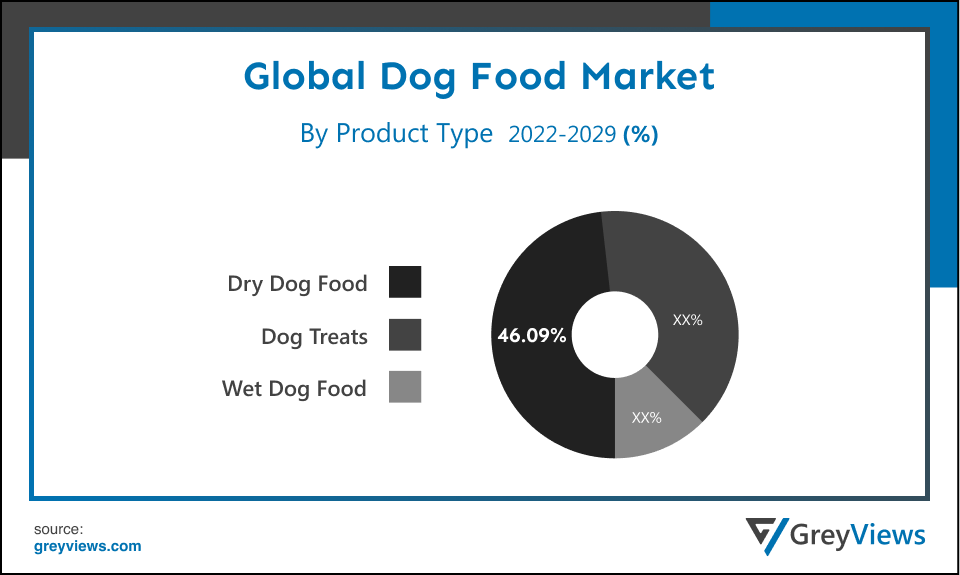

By Product Type

The product type segment includes dry dog food, dog treats, and wet dog food. The dry dog food segment led the Dog Food market with a market share of around 46.09% in 2021. The main advantage of dry dog food is the non-requirement of refrigeration as it contains about 90% dry matter and only about 10% of water. Owing to this, dry food is easier to store. In addition, dry food is mainly prepared by cooking and combining ingredients such as meat and grains. This destroys toxins and converts the food into an easily digested form. Such benefits of dry food are mainly fueling the growth of this segment.

By Ingredient Type

The ingredient type segment includes animal-derived and plant-derived. The animal-derived segment led the Dog Food market with a market share of around 66.5% in 2021. Meat and animal derivatives or animal by-products are mainly preferred as an ingredient in most dog foods. This ingredient is typically a surplus from the human food chain, and it has a high nutritional value, providing a significant amount of protein and other nutrients required for dogs. Most dog owners prefer this animal-derived dog food as it provides pets with energy and maintains well-being and health.

By Distribution Channel

The distribution channel segment includes supermarkets, hypermarkets, specialty stores, and online stores. The supermarkets and hypermarkets segment led the Dog Food market with a market share of around 44.82% in 2021. The ability of supermarkets and hypermarkets to have wide-ranging options for dog food has mainly driven the growth of this segment. In addition, most consumers prefer offline stores as they consider offline stores more trustworthy as they can examine the product and its quality before making a purchase decision. Also, consumer preference for packaged dog food products further boosted the growth of this segment.

The online segment is expected to witness the highest CAGR during the Projection period. The growth of this segment is mainly attributed to the factors such as the rising preference for personalization, extensive availability of greater discounts compared to offline stores, and more consumer convenience. Moreover, according to the November 2021 survey by the American Pet Products Association (APPA), even after the COVID-19 pandemic, about 22% of pet owners are planning to continue purchasing pet food products online. This trend has contributed to global market growth.

By Regional Analysis:

The regions analyzed for the Dog Food market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North American region dominated the Dog Food market and held a 45.52% share of the market revenue in 2021.

- North America region witnessed a major share. The increasing trend of humanization of pets and upsurge in awareness about pet health has mainly driven the market growth in this region. Moreover, most of the households in this region own pets, further contributing to the demand for dog food. For instance, according to the 2021-2022 National Pet Owners Survey by American Pet Products Association (APPA), 70% of households in the U.S. own

- Asia-Pacific is expected to witness a considerable growth rate during the Projection period. Increased disposable income and changes in consumer lifestyles in the region have primarily driven the growth of the Asia-Pacific market. Moreover, the rising trend of pet ownership in Asia is opportunistic for the growth of the dog food market. For instance, according to the survey from Rakuten Insight, as of 2021, about 59% of people in Asia have a pet in their homes.

Global Dog Food Market- Country Analysis:

- Germany

Germany's Dog Food market size was valued at USD 6.94 billion in 2021 and is expected to reach USD 10.44 billion by 2029, at a CAGR of 5.5% from 2022 to 2029.

Germany is one of the leading nations in the Europe dog food market. This is mainly attributed to changing lifestyles, increasing disposable incomes of the population, and rising online sales of dog food products.

In addition, the country is seeing rapid growth in pet ownership. For instance, according to the German Pet Trade and Industry Association (ZZF) and the Industrial Association of Pet Care Producers, about 43% of households in this country own a pet. This huge pet ownership in Germany further boosts the demand for dog food.

- China

China's Dog Food market size was valued at USD 12.61 billion in 2021 and is expected to reach USD 18.70 billion by 2029, at a CAGR of 5.3% from 2022 to 2029. China is one of the leading consuming and exporting countries of Dog Food. The increasing spending power of the population, burgeoning middle class, growing humanization of pets, and significant exports and imports of dog food is primarily boosting the growth of the market. For instance, according to Chinese Customs data, the export value of pet foods from this country accounted for $983 million in 2020.

- India

India's Dog Food market size was valued at USD 2.52 billion in 2021 and is expected to reach USD 3.89 billion by 2029, at a CAGR of 5.8% from 2022 to 2029. India is one of the strongest growing economies in Asia. The significant rise in the pet population across the country has primarily driven market growth in India. In addition, the rapid growth in influence of social media, rising disposable income, and increased awareness about dogs' health are further fueling the demand for dog food.

Moreover, according to the Animal Welfare Board of India (AWBI), the country is facing pet food supply challenges, with an estimated pet animal population of about 29 million.

Key Industry Players Analysis:

To increase their market position in the global dog food business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Mars Petcare, Inc.

- Nestlé Purina Pet Care

- Hill's Pet Nutrition

- Del Monte Foods

- The J.M. 0053mucker Company

- The Hartz Mountain Corporation

- Total Alimentos SA

- WellPet LLC

- Diamond Pet Foods

- Lupus Alimentos

Latest Development:

- In November 2021, Hill's Pet Nutrition, a provider of pet nutrition, partnered with Bond Pet Foods, Inc. to develop an alternative for one of Hill's most popular meat proteins. This advancement mainly addresses the dietary needs of dogs and cats.

- In July 2021, Mars Petcare, Inc. launched KARMA, a brand mainly focused on plant-first dog food. Under this brand, the company is expected to provide high-quality protein and plant-based superfoods that nourishes their whole-body vitality.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

5.6% |

|

Market Size |

63.05 billion in 2021 |

|

Forecast period |

2021-2029 |

|

Forecast unit |

Value (USD) |

|

Segments covered |

Product type, pricing type, ingredient type, distribution channel, and Regions |

|

Report Scope |

Revenue forecast, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Mars Petcare, Inc., Nestlé Purina Pet Care, Hill's Pet Nutrition, Del Monte Foods, The J.M. 0053mucker Company, The Hartz Mountain Corporation, Total Alimentos SA, WellPet LLC, Diamond Pet Foods, Lupus Alimentos among others |

|

By Product Type |

|

|

By Ingredient Type

|

|

|

By End User

|

|

|

By Distribution Channel

|

|

|

Regional scope |

|

Scope of the Report

Global Dog Food Market by Product Type:

- Dry Dog Food

- Dog Treats

- Wet Dog Food

Global Dog Food Market by Pricing Type:

- Premium Products

- Mass Products

Global Dog Food Market by Ingredient Type:

- Animal Derived

- Plant Derived

Global Dog Food Market by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Others

Global Dog Food Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market size of the Dog Food market?

Global Dog Food market size is USD 63.05 billion in 2021 and it will reach to USD 95.66 billion by 2029 at a CAGR of 5.6%

What are the distributor channels for Global Dog Food?

The distribution channel in Dog Food is supermarkets, hypermarkets, specialty stores, and online stores.

Which are the leading market players active in the Dog Food market?

Leading market players active in the global Mars Petcare, Inc., Nestlé Purina Pet Care, Hill's Pet Nutrition, Del Monte Foods, The J.M. 0053mucker Company, The Hartz Mountain Corporation, Total Alimentos SA, WellPet LLC, Diamond Pet Foods, and Lupus Alimentos among others.

What are the top 5 importer countries of Dog Food?

U.S., Germany, France, China, and the Netherlands.

What are the trends going on Global Dog Food Market?

New product launches, a rise in e-commerce, and the rising humanization of pets around the globe is projected to influence the market in the upcoming years.

What is the key driver of the Dog Food market?

Increasing pet population, along with increases in people's per capita disposable income, is primarily driving the growth of the Dog Food market.

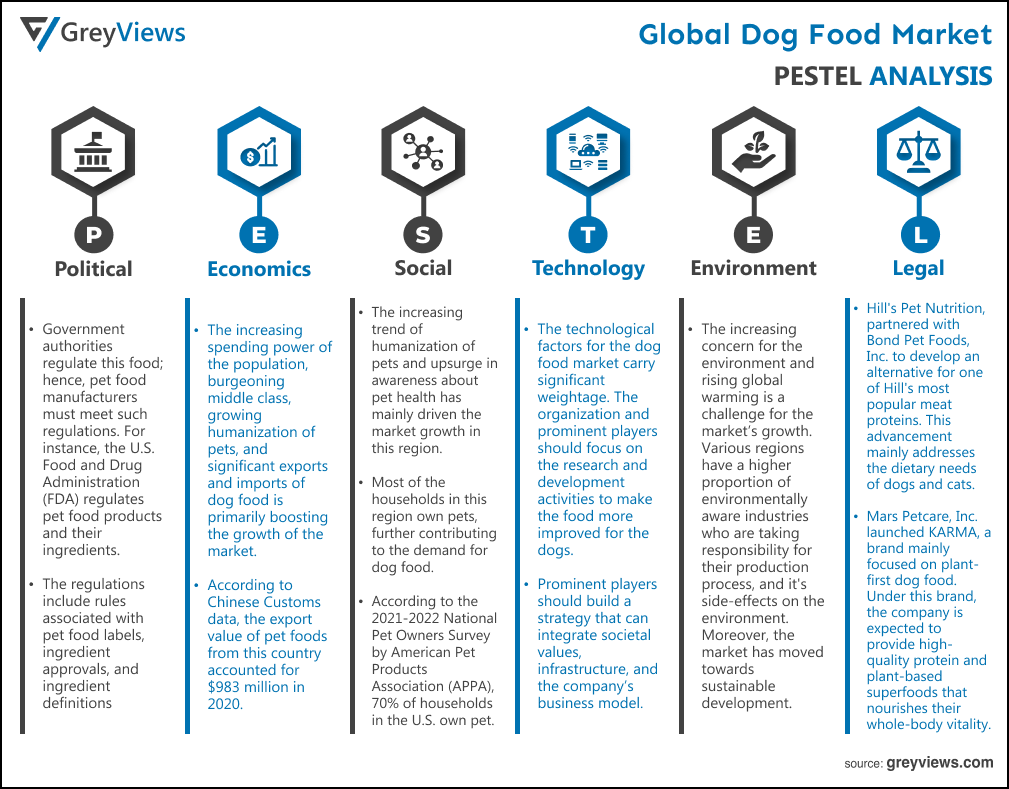

Political Factors- Government authorities regulate this food; hence, pet food manufacturers must meet such regulations. For instance, the U.S. Food and Drug Administration (FDA) regulates pet food products and their ingredients. In addition, these regulations include rules associated with pet food labels, ingredient approvals, and ingredient definitions. Moreover, due to dog food regulations, manufacturers in the global market typically offer to dig food with high-quality ingredients that include some form of fat, protein, and carbohydrates, along with vital minerals and vitamins.

Economical Factors- The increasing spending power of the population, burgeoning middle class, growing humanization of pets, and significant exports and imports of dog food is primarily boosting the growth of the market. For instance, according to Chinese Customs data, the export value of pet foods from this country accounted for $983 million in 2020.

Social Factor- The increasing trend of humanization of pets and upsurge in awareness about pet health has mainly driven the market growth in this region. Moreover, most of the households in this region own pets, further contributing to the demand for dog food. For instance, according to the 2021-2022 National Pet Owners Survey by American Pet Products Association (APPA), 70% of households in the U.S. own pet. Increased disposable income and changes in consumer lifestyles in the region have primarily driven the growth of the Asia-Pacific market. Moreover, the rising trend of pet ownership in Asia is opportunistic for the growth of the dog food market. For instance, according to the survey from Rakuten Insight, as of 2021, about 59% of people in Asia have a pet in their home

Technological Factors- The technological factors for the dog food market carry significant weightage. The organization and prominent players should focus on the research and development activities to make the food more improved for the dogs. Prominent players should build a strategy that can integrate societal values, infrastructure, and the company’s business model. The organization must analyze the region & technological advancement to understand the industry’s requirements. The organization should analyze areas where technology can empower supply chain partners.

Environmental Factors- The increasing concern for the environment and rising global warming is a challenge for the market’s growth. Various regions have a higher proportion of environmentally aware industries who are taking responsibility for their production process, and it's side-effects on the environment. Moreover, the market has moved towards sustainable development, i.e., the focus on the development of innovative technologies, which helps to increase the productivity and efficiency of the organization by not impacting the environment even for the production process and also providing guidelines to the customers for doing the same.

Legal Factors- Hill's Pet Nutrition, a provider of pet nutrition, partnered with Bond Pet Foods, Inc. to develop an alternative for one of Hill's most popular meat proteins. This advancement mainly addresses the dietary needs of dogs and cats. Mars Petcare, Inc. launched KARMA, a brand mainly focused on plant-first dog food. Under this brand, the company is expected to provide high-quality protein and plant-based superfoods that nourishes their whole-body vitality.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Product Type

- Market Attractiveness Analysis By Pricing Type

- Market Attractiveness Analysis By Ingredient Type

- Market Attractiveness Analysis By Distribution Channel

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Increasing pet population

- Increasing awareness about dietary requirements of dog

- Restrains

- Quality issues associated with Dog Food

- Opportunities

- Rapid urbanization around the globe

- Challenges

- Increased incidence of pet food recalls

- Global Dog Food Market Analysis and Projection, By Product Type

- Segment Overview

- Dry Dog Food

- Dog Treats

- Wet Dog Food

- Global Dog Food Market Analysis and Projection, By Pricing Type

- Segment Overview

- Premium Products

- Mass Products

- Global Dog Food Market Analysis and Projection, By Ingredient Type

- Segment Overview

- Animal Derived

- Plant Derived

- Global Dog Food Market Analysis and Projection, By Distribution Channel

- Segment Overview

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Others

- Global Dog Food Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Dog Food Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Dog Food Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Product Type Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Mars Petcare, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Ingredient Type Portfolio

- Recent Developments

- SWOT Analysis

- Nestlé Purina Pet Care

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Ingredient Type Portfolio

- Recent Developments

- SWOT Analysis

- Hill's Pet Nutrition

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Ingredient Type Portfolio

- Recent Developments

- SWOT Analysis

- Del Monte Foods

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Ingredient Type Portfolio

- Recent Developments

- SWOT Analysis

- The J.M. 0053mucker Company

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Ingredient Type Portfolio

- Recent Developments

- SWOT Analysis

- The Hartz Mountain Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Ingredient Type Portfolio

- Recent Developments

- SWOT Analysis

- Total Alimentos SA

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Ingredient Type Portfolio

- Recent Developments

- SWOT Analysis

- WellPet LLC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Ingredient Type Portfolio

- Recent Developments

- SWOT Analysis

- Diamond Pet Foods

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Ingredient Type Portfolio

- Recent Developments

- SWOT Analysis

- Lupus Alimentos

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Ingredient Type Portfolio

- Recent Developments

- SWOT Analysis

- Mars Petcare, Inc.

List of Table

- Global Dog Food Market, By Product Type, 2021–2029(USD Billion)

- Global Dry Dog Food Dog Food Market, By Region, 2021–2029(USD Billion)

- Global Dog Treats Dog Food Market, By Region, 2021–2029(USD Billion)

- Global Wet Dog Food Dog Food Market, By Region, 2021–2029(USD Billion)

- Global Dog Food Market, By Pricing Type, 2021–2029(USD Billion)

- Global Premium Products Dog Food Market, By Region, 2021–2029(USD Billion)

- Global Mass Products Dog Food Market, By Region, 2021–2029(USD Billion)

- Global Dog Food Market, By Ingredient Type, 2021–2029(USD Billion)

- Global Animal Derived Dog Food Dog Food Market, By Region, 2021–2029(USD Billion)

- Global Plant Derived Dog Food Dog Food Market, By Region, 2021–2029(USD Billion)

- Global Dog Food Market, By Distribution Channel, 2021–2029(USD Billion)

- Global Supermarkets and Hypermarkets Dog Food Market, By Region, 2021–2029(USD Billion)

- Global Specialty Stores Dog Food Market, By Region, 2021–2029(USD Billion)

- Global Online Dog Food Market, By Region, 2021–2029(USD Billion)

- Global Others Dog Food Market, By Region, 2021–2029(USD Billion)

- Global Dog Food Market, By Region, 2021–2029(USD Billion)

- Global Dog Food Market, By North America, 2021–2029(USD Billion)

- North America Dog Food Market, By Product Type, 2021–2029(USD Billion)

- North America Dog Food Market, By Pricing Type, 2021–2029(USD Billion)

- North America Dog Food Market, By Ingredient Type, 2021–2029(USD Billion)

- North America Dog Food Market, By Distribution Channel, 2021–2029(USD Billion)

- USA Dog Food Market, By Product Type, 2021–2029(USD Billion)

- USA Dog Food Market, By Pricing Type, 2021–2029(USD Billion)

- USA Dog Food Market, By Ingredient Type, 2021–2029(USD Billion)

- USA Dog Food Market, By Distribution Channel, 2021–2029(USD Billion)

- Canada Dog Food Market, By Product Type, 2021–2029(USD Billion)

- Canada Dog Food Market, By Pricing Type, 2021–2029(USD Billion)

- Canada Dog Food Market, By Ingredient Type, 2021–2029(USD Billion)

- Canada Dog Food Market, By Distribution Channel, 2021–2029(USD Billion)

- Mexico Dog Food Market, By Product Type, 2021–2029(USD Billion)

- Mexico Dog Food Market, By Pricing Type, 2021–2029(USD Billion)

- Mexico Dog Food Market, By Ingredient Type, 2021–2029(USD Billion)

- Mexico Dog Food Market, By Distribution Channel, 2021–2029(USD Billion)

- Europe Dog Food Market, By Product Type, 2021–2029(USD Billion)

- Europe Dog Food Market, By Pricing Type, 2021–2029(USD Billion)

- Europe Dog Food Market, By Ingredient Type, 2021–2029(USD Billion)

- Europe Dog Food Market, By Distribution Channel, 2021–2029(USD Billion)

- Germany Dog Food Market, By Product Type, 2021–2029(USD Billion)

- Germany Dog Food Market, By Pricing Type, 2021–2029(USD Billion)

- Germany Dog Food Market, By Ingredient Type, 2021–2029(USD Billion)

- Germany Dog Food Market, By Distribution Channel, 2021–2029(USD Billion)

- France Dog Food Market, By Product Type, 2021–2029(USD Billion)

- France Dog Food Market, By Pricing Type, 2021–2029(USD Billion)

- France Dog Food Market, By Ingredient Type, 2021–2029(USD Billion)

- France Dog Food Market, By Distribution Channel, 2021–2029(USD Billion)

- UK Dog Food Market, By Product Type, 2021–2029(USD Billion)

- UK Dog Food Market, By Pricing Type, 2021–2029(USD Billion)

- UK Dog Food Market, By Ingredient Type, 2021–2029(USD Billion)

- UK Dog Food Market, By Distribution Channel, 2021–2029(USD Billion)

- Italy Dog Food Market, By Product Type, 2021–2029(USD Billion)

- Italy Dog Food Market, By Pricing Type, 2021–2029(USD Billion)

- Italy Dog Food Market, By Ingredient Type, 2021–2029(USD Billion)

- Italy Dog Food Market, By Distribution Channel, 2021–2029(USD Billion)

- Spain Dog Food Market, By Product Type, 2021–2029(USD Billion)

- Spain Dog Food Market, By Pricing Type, 2021–2029(USD Billion)

- Spain Dog Food Market, By Ingredient Type, 2021–2029(USD Billion)

- Spain Dog Food Market, By Distribution Channel, 2021–2029(USD Billion)

- Asia Pacific Dog Food Market, By Product Type, 2021–2029(USD Billion)

- Asia Pacific Dog Food Market, By Pricing Type, 2021–2029(USD Billion)

- Asia Pacific Dog Food Market, By Ingredient Type, 2021–2029(USD Billion)

- Asia Pacific Dog Food Market, By Distribution Channel, 2021–2029(USD Billion)

- Japan Dog Food Market, By Product Type, 2021–2029(USD Billion)

- Japan Dog Food Market, By Pricing Type, 2021–2029(USD Billion)

- Japan Dog Food Market, By Ingredient Type, 2021–2029(USD Billion)

- Japan Dog Food Market, By Distribution Channel, 2021–2029(USD Billion)

- China Dog Food Market, By Product Type, 2021–2029(USD Billion)

- China Dog Food Market, By Pricing Type, 2021–2029(USD Billion)

- China Dog Food Market, By Ingredient Type, 2021–2029(USD Billion)

- China Dog Food Market, By Distribution Channel, 2021–2029(USD Billion)

- India Dog Food Market, By Product Type, 2021–2029(USD Billion)

- India Dog Food Market, By Pricing Type, 2021–2029(USD Billion)

- India Dog Food Market, By Ingredient Type, 2021–2029(USD Billion)

- India Dog Food Market, By Distribution Channel, 2021–2029(USD Billion)

- South America Dog Food Market, By Product Type, 2021–2029(USD Billion)

- South America Dog Food Market, By Pricing Type, 2021–2029(USD Billion)

- South America Dog Food Market, By Ingredient Type, 2021–2029(USD Billion)

- South America Dog Food Market, By Distribution Channel, 2021–2029(USD Billion)

- Brazil Dog Food Market, By Product Type, 2021–2029(USD Billion)

- Brazil Dog Food Market, By Pricing Type, 2021–2029(USD Billion)

- Brazil Dog Food Market, By Ingredient Type, 2021–2029(USD Billion)

- Brazil Dog Food Market, By Distribution Channel, 2021–2029(USD Billion)

- Middle East and Africa Dog Food Market, By Product Type, 2021–2029(USD Billion)

- Middle East and Africa Dog Food Market, By Pricing Type, 2021–2029(USD Billion)

- Middle East and Africa Dog Food Market, By Ingredient Type, 2021–2029(USD Billion)

- Middle East and Africa Dog Food Market, By Distribution Channel, 2021–2029(USD Billion)

- UAE Dog Food Market, By Product Type, 2021–2029(USD Billion)

- UAE Dog Food Market, By Pricing Type, 2021–2029(USD Billion)

- UAE Dog Food Market, By Ingredient Type, 2021–2029(USD Billion)

- UAE Dog Food Market, By Distribution Channel, 2021–2029(USD Billion)

- South Africa Dog Food Market, By Product Type, 2021–2029(USD Billion)

- South Africa Dog Food Market, By Pricing Type, 2021–2029(USD Billion)

- South Africa Dog Food Market, By Ingredient Type, 2021–2029(USD Billion)

- South Africa Dog Food Market, By Distribution Channel, 2021–2029(USD Billion)

List of Figures

- Global Dog Food Market Segmentation

- Dog Food Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Dog Food Market Attractiveness Analysis By Product Type

- Global Dog Food Market Attractiveness Analysis By Pricing Type

- Global Dog Food Market Attractiveness Analysis By Ingredient Type

- Global Dog Food Market Attractiveness Analysis By Distribution Channel

- Global Dog Food Market Attractiveness Analysis By Region

- Global Dog Food Market: Dynamics

- Global Dog Food Market Share By Product Type(2021 & 2029)

- Global Dog Food Market Share By Pricing Type(2021 & 2029)

- Global Dog Food Market Share By Ingredient Type(2021 & 2029)

- Global Dog Food Market Share By Distribution Channel (2021 & 2029)

- Global Dog Food Market Share by Regions (2021 & 2029)

- Global Dog Food Market Share by Company (2020)