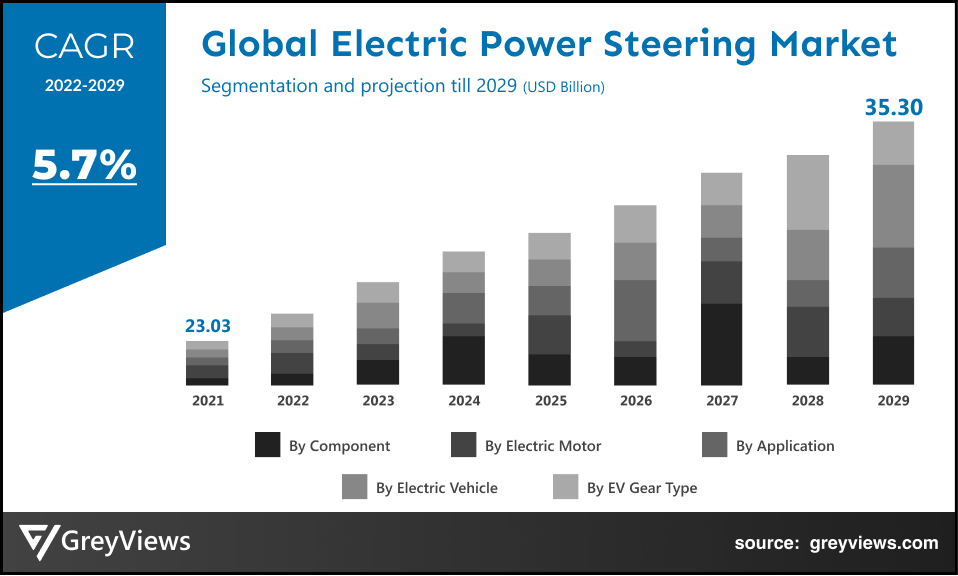

Electric Power Steering Market Size by Component (Steering column, Sensors, Steering gear, Mechanical rack and pinion, electronic control unit, Electric motor, and bearing), Electric Motor (Brush motor and Brushless motor), Application (Passenger Cars (PC) and Commercial Vehicles (CV)), Electric Vehicle (BEV, PHEV, and FCEV), EV Gear Type (Worm Gear and Ball Screw), Regions, Segmentation and Projection till 2029

CAGR: 5.7%Current Market Size: USD 23.03 billionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Electric Power Steering-Market Overview

The global electric power steering market is expected to grow from USD 23.03 billion in 2021 to USD 35.30 billion by 2029, at a CAGR of 5.7% during the Projection period 2022-2029. This growth of the market is driven by measures taken by OEMs across the globe to reduce the complexity and the weight of their vehicles coupled with government norms and mandates associated with fuel-efficient technologies.

Power steering is an essential system to reduce the efforts needed for the driver to turn the steering wheel during low-speed maneuvers such as turning a 90-degree corner in the city, pulling into a parking spot, and maneuvering in a crowded gas station. However, electric power steering has become prominent technology for automated driving. This type of power steering uses an electric motor to draw energy from the electrical system of the vehicle and deliver the steering assistance. It uses a computer system and sensors to detect torque and effort that the driver puts on the steering wheel for deciding the need for assistance.

Electric power steering enhances fuel economy in the vehicle, as the electric motor in such systems only draws power when required. In addition, it eradicates hydraulic fluid maintenance; and allows a variety of features such as automated parking & lane changes, lane-keep assist, and the capability to guide the vehicle around obstacles. Currently, electric power steering (EPS) is being linked with the system's energy savings, smart driving, and lightweight attributes.

Request Sample:- Global Electric Power Steering Market

Market Dynamics:

Drivers:

- OEMs measures to reduce the complexity and weight of vehicles

OEMs in the automotive industry are developing a lightweight vehicle design by targeting the significant weight reduction of vehicles at minimal cost increase. This has led to the demand for electric power steering due to its features such as less weight and lower mechanical complexity, along with enhanced fuel efficiency. In addition, its excellent reliability and durability have led to the applications such as ATVs (All-Terrain Vehicles) and MUVs (Multi Utility Vehicles). For instance, DENSO Corporation, a Japan-based automotive components manufacturer has recently developed an innovative EPS motor control unit (EPS-MCU), which has been featured in TOYOTA NEW HARRIER. Moreover, the manufacturers are focusing on energy-efficient passenger cars. However, due to its low power consumption, small size, lightweight, and flexibility, electric power steering has become the first choice for such vehicles.

- Government norms and mandates associated with the fuel-efficient technologies

Governments across the globe are introducing fuel efficiency rules and regulations. For instance, in April 2020, the National Highway Traffic Safety Administration (NHTSA) and the Environmental Protection Agency (EPA) issued the Safer Affordable Fuel-Efficient (SAFE) Vehicles Rule, which mandated that automakers improve fuel efficiency. Such regulations have driven demand for the electric power steering systems due to their higher energy efficiency and elimination of the need for a power steering pump, hoses, hydraulic fluids, and a drive belt and pulley on the engine.

Restraints:

- Lack of steering feel and high costs associated with the electric power steering

An electric power steering offers significant advantages; however, the cost of such systems is slightly higher than a hydraulic unit. In addition, the maintenance cost of these systems is significantly higher compared with the traditional systems. For instance, the average cost of power steering control module replacement ranges between $827 and $857. On the other hand, less feedback from the road is translated to the driver via the steering wheel as the mechanical connection to the steering rack is muted. Hence, high costs and lack of steering feel due to the deployment of electric power steering hampers the growth of the market.

Opportunities:

- Research and development in advanced steering technologies

The global automotive giants are investing considerable amounts to transform automotive production with the latest technologies in the field of power steering for commercial and passenger vehicles. For instance, in October 2020, Nexteer Automotive, a majority Chinese-owned automotive parts supplier launched High-Output Electric Power Steering (EPS) that offers advanced safety and comfort features along with the enhanced fuel efficiency for heavy-duty (HD) trucks and light commercial vehicles (LCVs). Such product innovations create lucrative growth opportunities for the global electric power steering market.

Challenges

- The COVID-19 pandemic

The global COVID-19 pandemic has forced all industries to change the way of managing assets and workforces. In addition, the global automotive sector has seen disruption in supply chains due to large-scale manufacturing interruptions within Europe, the closure of assembly plants in the U.S., and disruption in Chinese parts exports. Hence, disruption in the supply chain during the pandemic has posed considerable challenges to the electric power steering industry.

Segmentation Analysis:

The global electric power steering market has been segmented based on components, electric motor, application, electric vehicle, EV gear type, and regions.

By Component

The components segment includes steering column, sensors, steering gear, mechanical rack and pinion, electronic control unit, electric motor, and bearing. The steering column segment led the Electric Power Steering market with a market share of around 27.05% in 2021. This is attributed to the fact that the steering column is the prominent part of the vehicle intended primarily for connecting the steering wheel to the steering mechanism. The electric power steering column (EPSc) assists and controls the vehicle steering with the help of an electronically controlled electric motor.

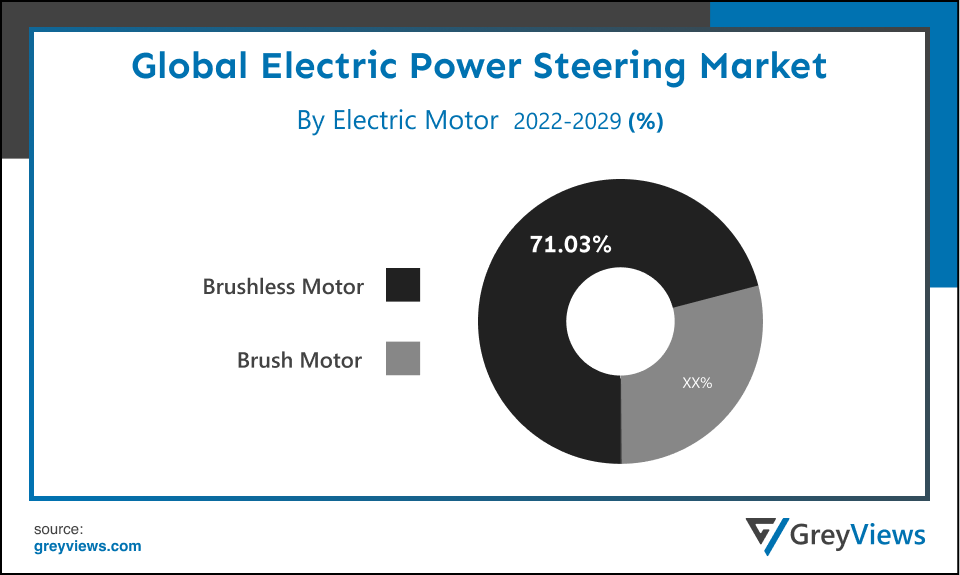

By Electric Motor

The electric motor segment includes a brush motor and a brushless motor. The brushless motor segment led the electric power steering market with a market share of around 71.03% in 2021. Most of the EPS systems use brushless DC motors to offer additional torque to the steering system, low system cost, and a compact size as compared with equivalent mechanical solutions. In addition, such motors offer improved performance, reduced noise, increased reliability, longer lifetimes, and ease of installation. Such benefits of brushless motors have driven the growth of this segment.

By Application

The application segment includes Passenger Cars (PC) and Commercial Vehicles (CV). The Passenger Cars segment led the electric power steering market with a market share of around 64.51% in 2021. The growth of this segment is mainly driven by an upsurge in the adoption of passenger cars across the globe. For instance, about 30% of the passenger cars across the globe are integrated with electric power steering technology. In addition, passenger vehicles have become the most prominent mode of conveyance in developed as well as developing countries.

By Regional Analysis:

The regions analyzed for the electric power steering market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. The North American region dominated the Electric Power Steering market and held the 36.91% share of the market revenue in 2021.

- The North American region has registered the highest value for the year 2021. The growth of this region is mainly driven by the growing popularity of autonomous cars along with the easy availability of convenient financing options by the governments to ensure in-house automotive production. On the other hand, in August 2021, the S. government introduced a national target for the adoption of electric vehicles, to represent half of all new auto sales by 2030. Such initiatives are opportunistic for the growth of the market.

- Asia-Pacific is expected to witness the highest growth rate during the Projection period. The growth of this region is driven by a surge in the production of passenger vehicles in China and India, cheap raw materials, and the presence of leading electric power steering component manufacturers. In addition, rising foreign direct investment associated with the economic development of South East Asia is opportunistic for the growth of the market.

Global Electric Power Steering Market- Country Analysis:

- Germany

Germany's electric power steering market size was valued at USD 2.07 billion in 2021 and is expected to reach USD 3.17 billion by 2029, at a CAGR of 5.6% from 2022 to 2029. Germany is one of the leading nations in the mechanical engineering, manufacturing, automotive, and electrical industries. In addition, according to the Germany Trade & Invest, the economic development agency of the Federal Republic of Germany, this country is the leading automotive market in Europe, accounting for about 25% of all passenger cars manufactured in the region.

Furthermore, according to the Capgemini “COVID -19 and the automotive consumer” study in 2020, interest in car ownership amongst under 35-year-olds is on the rise in the country. This trend of car ownership is creating demand for Electric Power Steering.

- China

China's electric power steering market size was valued at USD 4.61 billion in 2021 and is expected to reach USD 6.88 billion by 2029, at a CAGR of 5.3% from 2022 to 2029. China is the world’s largest light-vehicle manufacturer. In addition, this country is a leading automotive producer, consumer, and exporter. For instance, the country continues to be the largest vehicle market by both manufacturing output and annual sales, with domestic production anticipated to reach 35 million vehicles by 2025.

Furthermore, in January 2022, the Ministry of Commerce and the National Development and Reform Commission, the country’s top economic planning agency announced the support for full foreign ownership of passenger car manufacturing in the country. Such initiatives are anticipated to create lucrative growth opportunities for the China Electric Power Steering market.

- India

India's electric power steering market size was valued at USD 1.38 billion in 2021 and is expected to reach USD 2.14 billion by 2029, at a CAGR of 5.8% from 2022 to 2029. India is one of the strongest growing economies in Asia. In addition, the emerging popularity of electric power steering in this country is expected to create lucrative growth opportunities for the market. For instance, According to NITI Aayog and Rocky Mountain Institute (RMI), the EV finance industry in India is expected to reach about $50 Billion by 2030.

In March 2022, Yamaha India announced the development of a prototype of an Electric Power Steering (EPS) support system for motorcycles. Such innovations in the country are opportunistic for the growth of the market.

Key Industry Players Analysis:

To increase their market position in the global Electric Power Steering business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- JTEKT corporation

- Nexteer

- ZF Friedrichshafen AG

- Robert Bosch

- NSK LTD.

- Hyundai Mobis

- Hitachi Astemo, Ltd.

- Thyssenkrupp

- KYB Corporation

- Mando Corporation

Latest Development:

- In October 2021, Nexteer Automotive, an automotive parts supplier announced the expansion of its Electric Power Steering (EPS) portfolio with the introduction of its new Modular Column-Assist EPS System (mCEPS). This is a cost-efficient solution that offers flexibility to meet a wide range of OEMs' requirements.

- In December 2021, ZF Friedrichshafen AG acquired a majority stake in its Indian joint venture with Rane Group. This joint venture produces automotive components for India's domestic market as well as for exports.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year considered |

2021 |

|

CAGR (%) |

5.7% |

|

Market Size |

23.03 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Components, Electric Motor, Application, Electric Vehicle, EV Gear Type, and Regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

JTEKT corporation, Nexteer, ZF Friedrichshafen AG, Robert Bosch, NSK LTD., Hyundai Mobis, Hitachi Astemo, Ltd., Thyssenkrupp, KYB Corporation, and Mando Corporation among others |

|

By Component |

|

|

By Electric Motor |

|

|

By Application |

|

|

By Electric Vehicle |

|

|

By EV Gear Type |

|

|

Regional scope |

|

Scope of the Report

Global Electric Power Steering Market by Component:

- Steering column

- Sensors

- Steering gear

- Mechanical rack and pinion

- Electronic control unit

- Electric motor

- Bearing

Global Electric Power Steering Market by Electric Motor:

- Brush motor

- Brushless motor

Global Electric Power Steering Market by Application:

- Passenger Cars (PC)

- Commercial Vehicles (CV)

Global Electric Power Steering Market by Electric Vehicle:

- BEV

- PHEV

- FCEV

Global Electric Power Steering Market by EV Gear Type:

- Worm Gear

- Ball Screw

Global Electric Power Steering Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What was the market size of Electric Power Steering In 2021?

Global electric power steering market is was USD 23.03 billion in 2021

What is the application of Electric Power Steering?

The application segment includes Passenger Cars (PC) and Commercial Vehicles (CV). The Passenger Cars segment led the electric power steering market with a market share of around 64.51% in 2021. The growth of this segment is mainly driven by an upsurge in the adoption of passenger cars across the globe. For instance, about 30% of the passenger cars across the globe are integrated with electric power steering technology. In addition, passenger vehicles have become the most prominent mode of conveyance in developed as well as developing countries

Which Region dominate the Electric Power Steering Market?

North American region dominated the Electric Power Steering market and held the 36.91% share of the market revenue in 2021

What are the environmental factor for Electric Power Steering?

About 30% of the passenger cars across the globe are integrated with electric power steering technology. In addition, passenger vehicles have become the most prominent mode of conveyance in developed as well as developing countries. This has been done to reduce the pollution which is usually generated from the fuels driven vehicles. In August 2021, the U.S. government introduced a national target for the adoption of electric vehicles, to represent half of all new auto sales by 2030 to reduce vehicular pollution

Who are the latest Development in Electric Power Steering Market?

In October 2021, Nexteer Automotive, an automotive parts supplier announced the expansion of its Electric Power Steering (EPS) portfolio with the introduction of its new Modular Column-Assist EPS System (mCEPS). This is a cost-efficient solution that offers flexibility to meet a wide range of OEMs' requirements. In December 2021, ZF Friedrichshafen AG acquired a majority stake in its Indian joint venture with Rane Group. This joint venture produces automotive components for India's domestic market as well as for exports

Who are the major players in Electric Power Steering Market?

? JTEKT corporation ? Nexteer ? ZF Friedrichshafen AG ? Robert Bosch ? NSK LTD. ? Hyundai Mobis ? Hitachi Astemo, Ltd. ? Thyssenkrupp ? KYB Corporation ? Mando Corporation

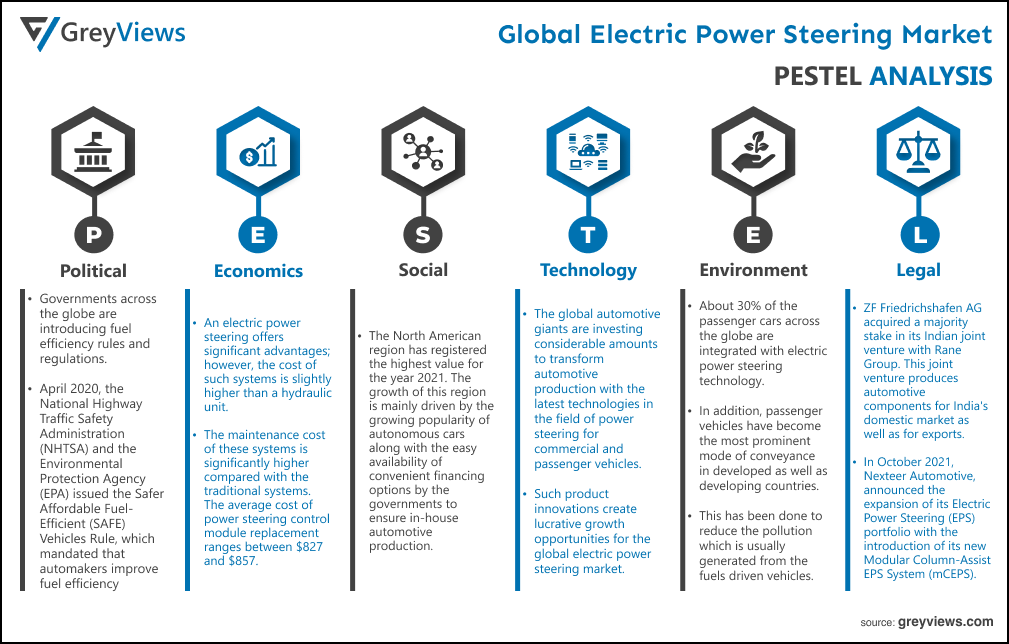

Political Factors- Governments across the globe are introducing fuel efficiency rules and regulations. For instance, in April 2020, the National Highway Traffic Safety Administration (NHTSA) and the Environmental Protection Agency (EPA) issued the Safer Affordable Fuel-Efficient (SAFE) Vehicles Rule, which mandated that automakers improve fuel efficiency. Such regulations have driven demand for the electric power steering systems due to their higher energy efficiency and elimination of the need for a power steering pump, hoses, hydraulic fluids, and a drive belt and pulley on the engine.

Economical Factors- An electric power steering offers significant advantages; however, the cost of such systems is slightly higher than a hydraulic unit. In addition, the maintenance cost of these systems is significantly higher compared with the traditional systems. For instance, the average cost of power steering control module replacement ranges between $827 and $857. On the other hand, less feedback from the road is translated to the driver via the steering wheel as the mechanical connection to the steering rack is muted. Hence, high costs and lack of steering feel due to the deployment of electric power steering hampers the growth of the market.

Social Factor- The North American region has registered the highest value for the year 2021. The growth of this region is mainly driven by the growing popularity of autonomous cars along with the easy availability of convenient financing options by the governments to ensure in-house automotive production. On the other hand, in August 2021, the U.S. government introduced a national target for the adoption of electric vehicles, to represent half of all new auto sales by 2030. Such initiatives are opportunistic for the growth of the market.

Technological Factors- The global automotive giants are investing considerable amounts to transform automotive production with the latest technologies in the field of power steering for commercial and passenger vehicles. For instance, in October 2020, Nexteer Automotive, a majority Chinese-owned automotive parts supplier launched High-Output Electric Power Steering (EPS) that offers advanced safety and comfort features along with the enhanced fuel efficiency for heavy-duty (HD) trucks and light commercial vehicles (LCVs). Such product innovations create lucrative growth opportunities for the global electric power steering market.

Environmental Factors- About 30% of the passenger cars across the globe are integrated with electric power steering technology. In addition, passenger vehicles have become the most prominent mode of conveyance in developed as well as developing countries. This has been done to reduce the pollution which is usually generated from the fuels driven vehicles. In August 2021, the U.S. government introduced a national target for the adoption of electric vehicles, to represent half of all new auto sales by 2030 to reduce vehicular pollution.

Legal Factors- ZF Friedrichshafen AG acquired a majority stake in its Indian joint venture with Rane Group. This joint venture produces automotive components for India's domestic market as well as for exports. Furthermore, in October 2021, Nexteer Automotive, an automotive parts supplier announced the expansion of its Electric Power Steering (EPS) portfolio with the introduction of its new Modular Column-Assist EPS System (mCEPS). This is a cost-efficient solution that offers flexibility to meet a wide range of OEMs' requirements.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Component

- Market Attractiveness Analysis By Electric Motor

- Market Attractiveness Analysis By Application

- Market Attractiveness Analysis By Electric Vehicle

- Market Attractiveness Analysis By EV Gear Type

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- OEMs measures to reduce complexity and weight of vehicles

- Government norms and mandates associated with the fuel-efficient technologies

- Restrains

- Lack of steering feel and high costs associated with the electric power steering

- Opportunities

- Research and development in advanced steering technologies

- Challenges

- The COVID-19 pandemic

- Global Electric Power Steering Market Analysis and Projection, By Component

- Segment Overview

- Steering Column

- Sensors

- Steering gear

- Mechanical rack and pinion

- Electronic control unit

- Electric motor

- Bearing

- Global Electric Power Steering Market Analysis and Projection, By Electric Motor

- Segment Overview

- Brush motor

- Brushless motor

- Global Electric Power Steering Market Analysis and Projection, By Application

- Segment Overview

- Passenger Cars (PC)

- Commercial Vehicles (CV)

- Global Electric Power Steering Market Analysis and Projection, By Electric Vehicle

- Segment Overview

- BEV

- PHEV

- FCEV

- Global Electric Power Steering Market Analysis and Projection, By EV Gear Type

- Segment Overview

- Worm Gear

- Ball Screw

- Global Electric Power Steering Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Electric Power Steering Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Electric Power Steering Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Component Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- JTEKT Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- Nexteer

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- ZF Friedrichshafen AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- Robert Bosch

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- NSK LTD.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- Hyundai Mobis

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- Hitachi Astemo, Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- Thyssenkrupp

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- KYB Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- Mando Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- JTEKT Corporation

List of Table

- Global Electric Power Steering Market, By Component, 2021–2029(USD Billion)

- Global Steering Column Market, By Region, 2021–2029(USD Billion)

- Global Sensors Market, By Region, 2021–2029(USD Billion)

- Global Steering Gear Market, By Region, 2021–2029(USD Billion)

- Global Mechanical Rack and Pinion Market, By Region, 2021–2029(USD Billion)

- Global Electronic Control Unit Market, By Region, 2021–2029(USD Billion)

- Global Electric Motor Market, By Region, 2021–2029(USD Billion)

- Global Bearing Market, By Region, 2021–2029(USD Billion)

- Global Electric Power Steering Market, By Electric Motor, 2021–2029(USD Billion)

- Global Brush Motor Electric Power Steering Market, By Region, 2021–2029(USD Billion)

- Global Brushless Motor Electric Power Steering Market, By Region, 2021–2029(USD Billion)

- Global Electric Power Steering Market, By Application, 2021–2029(USD Billion)

- Global Passenger Cars (PC) Electric Power Steering Market, By Region, 2021–2029(USD Billion)

- Global Commercial Vehicles (CV) Application Electric Power Steering Market, By Region, 2021–2029(USD Billion)

- Global Electric Power Steering Market, By Electric Vehicle, 2021–2029(USD Billion)

- Global BEV Electric Power Steering Market, By Region, 2021–2029(USD Billion)

- Global PHEV Electric Power Steering Market, By Region, 2021–2029(USD Billion)

- Global FCEV Electric Power Steering Market, By Region, 2021–2029(USD Billion)

- Global Electric Power Steering Market, By EV Gear Type, 2021–2029(USD Billion)

- Global Worm Gear Electric Power Steering Market, By Region, 2021–2029(USD Billion)

- Global Ball Screw Electric Power Steering Market, By Region, 2021–2029(USD Billion)

- Global Electric Power Steering Market, By Region, 2021–2029(USD Billion)

- Global Electric Power Steering Market, By North America, 2021–2029(USD Billion)

- North America Electric Power Steering Market, By Component, 2021–2029(USD Billion)

- North America Electric Power Steering Market, By Electric Motor, 2021–2029(USD Billion)

- North America Electric Power Steering Market, By Application, 2021–2029(USD Billion)

- North America Electric Power Steering Market, By Electric Vehicle, 2021–2029(USD Billion)

- North America Electric Power Steering Market, By EV Gear Type, 2021–2029(USD Billion)

- US Electric Power Steering Market, By Component, 2021–2029(USD Billion)

- US Electric Power Steering Market, By Electric Motor, 2021–2029(USD Billion)

- US Electric Power Steering Market, By Application, 2021–2029(USD Billion)

- US Electric Power Steering Market, By Electric Vehicle, 2021–2029(USD Billion)

- US Electric Power Steering Market, By EV Gear Type, 2021–2029(USD Billion)

- Canada Electric Power Steering Market, By Component, 2021–2029(USD Billion)

- Canada Electric Power Steering Market, By Electric Motor, 2021–2029(USD Billion)

- Canada Electric Power Steering Market, By Application, 2021–2029(USD Billion)

- Canada Electric Power Steering Market, By Electric Vehicle, 2021–2029(USD Billion)

- Canada Electric Power Steering Market, By EV Gear Type, 2021–2029(USD Billion)

- Mexico Electric Power Steering Market, By Component, 2021–2029(USD Billion)

- Mexico Electric Power Steering Market, By Electric Motor, 2021–2029(USD Billion)

- Mexico Electric Power Steering Market, By Application, 2021–2029(USD Billion)

- Mexico Electric Power Steering Market, By Electric Vehicle, 2021–2029(USD Billion)

- Mexico Electric Power Steering Market, By EV Gear Type, 2021–2029(USD Billion)

- Europe Electric Power Steering Market, By Component, 2021–2029(USD Billion)

- Europe Electric Power Steering Market, By Electric Motor, 2021–2029(USD Billion)

- Europe Electric Power Steering Market, By Application, 2021–2029(USD Billion)

- Europe Electric Power Steering Market, By Electric Vehicle, 2021–2029(USD Billion)

- Europe Electric Power Steering Market, By EV Gear Type, 2021–2029(USD Billion)

- Germany Electric Power Steering Market, By Component, 2021–2029(USD Billion)

- Germany Electric Power Steering Market, By Electric Motor, 2021–2029(USD Billion)

- Germany Electric Power Steering Market, By Application, 2021–2029(USD Billion)

- Germany Electric Power Steering Market, By Electric Vehicle, 2021–2029(USD Billion)

- Germany Electric Power Steering Market, By EV Gear Type, 2021–2029(USD Billion)

- France Electric Power Steering Market, By Component, 2021–2029(USD Billion)

- France Electric Power Steering Market, By Electric Motor, 2021–2029(USD Billion)

- France Electric Power Steering Market, By Application, 2021–2029(USD Billion)

- France Electric Power Steering Market, By Electric Vehicle, 2021–2029(USD Billion)

- France Electric Power Steering Market, By EV Gear Type, 2021–2029(USD Billion)

- UK Electric Power Steering Market, By Component, 2021–2029(USD Billion)

- UK Electric Power Steering Market, By Electric Motor, 2021–2029(USD Billion)

- UK Electric Power Steering Market, By Application, 2021–2029(USD Billion)

- UK Electric Power Steering Market, By Electric Vehicle, 2021–2029(USD Billion)

- UK Electric Power Steering Market, By EV Gear Type, 2021–2029(USD Billion)

- Italy Electric Power Steering Market, By Component, 2021–2029(USD Billion)

- Italy Electric Power Steering Market, By Electric Motor, 2021–2029(USD Billion)

- Italy Electric Power Steering Market, By Application, 2021–2029(USD Billion)

- Italy Electric Power Steering Market, By Electric Vehicle, 2021–2029(USD Billion)

- Italy Electric Power Steering Market, By EV Gear Type, 2021–2029(USD Billion)

- Spain Electric Power Steering Market, By Component, 2021–2029(USD Billion)

- Spain Electric Power Steering Market, By Electric Motor, 2021–2029(USD Billion)

- Spain Electric Power Steering Market, By Application, 2021–2029(USD Billion)

- Spain Electric Power Steering Market, By Electric Vehicle, 2021–2029(USD Billion)

- Spain Electric Power Steering Market, By EV Gear Type, 2021–2029(USD Billion)

- Asia Pacific Electric Power Steering Market, By Component, 2021–2029(USD Billion)

- Asia Pacific Electric Power Steering Market, By Electric Motor, 2021–2029(USD Billion)

- Asia Pacific Electric Power Steering Market, By Application, 2021–2029(USD Billion)

- Asia Pacific Electric Power Steering Market, By Electric Vehicle, 2021–2029(USD Billion)

- Asia Pacific Electric Power Steering Market, By EV Gear Type, 2021–2029(USD Billion)

- Japan Electric Power Steering Market, By Component, 2021–2029(USD Billion)

- Japan Electric Power Steering Market, By Electric Motor, 2021–2029(USD Billion)

- Japan Electric Power Steering Market, By Application, 2021–2029(USD Billion)

- Japan Electric Power Steering Market, By Electric Vehicle, 2021–2029(USD Billion)

- Japan Electric Power Steering Market, By EV Gear Type, 2021–2029(USD Billion)

- China Electric Power Steering Market, By Component, 2021–2029(USD Billion)

- China Electric Power Steering Market, By Electric Motor, 2021–2029(USD Billion)

- China Electric Power Steering Market, By Application, 2021–2029(USD Billion)

- China Electric Power Steering Market, By Electric Vehicle, 2021–2029(USD Billion)

- China Electric Power Steering Market, By EV Gear Type, 2021–2029(USD Billion)

- India Electric Power Steering Market, By Component, 2021–2029(USD Billion)

- India Electric Power Steering Market, By Electric Motor, 2021–2029(USD Billion)

- India Electric Power Steering Market, By Application, 2021–2029(USD Billion)

- India Electric Power Steering Market, By Electric Vehicle, 2021–2029(USD Billion)

- India Electric Power Steering Market, By EV Gear Type, 2021–2029(USD Billion)

- South America Electric Power Steering Market, By Component, 2021–2029(USD Billion)

- South America Electric Power Steering Market, By Electric Motor, 2021–2029(USD Billion)

- South America Electric Power Steering Market, By Application, 2021–2029(USD Billion)

- South America Electric Power Steering Market, By Electric Vehicle, 2021–2029(USD Billion)

- South America Electric Power Steering Market, By EV Gear Type, 2021–2029(USD Billion)

- Brazil Electric Power Steering Market, By Component, 2021–2029(USD Billion)

- Brazil Electric Power Steering Market, By Electric Motor, 2021–2029(USD Billion)

- Brazil Electric Power Steering Market, By Application, 2021–2029(USD Billion)

- Brazil Electric Power Steering Market, By Electric Vehicle, 2021–2029(USD Billion)

- Brazil Electric Power Steering Market, By EV Gear Type, 2021–2029(USD Billion)

- Middle East and Africa Electric Power Steering Market, By Component, 2021–2029(USD Billion)

- Middle East and Africa Electric Power Steering Market, By Electric Motor, 2021–2029(USD Billion)

- Middle East and Africa Electric Power Steering Market, By Application, 2021–2029(USD Billion)

- Middle East and Africa Electric Power Steering Market, By Electric Vehicle, 2021–2029(USD Billion)

- Middle East and Africa Electric Power Steering Market, By EV Gear Type, 2021–2029(USD Billion)

- UAE Electric Power Steering Market, By Component, 2021–2029(USD Billion)

- UAE Electric Power Steering Market, By Electric Motor, 2021–2029(USD Billion)

- UAE Electric Power Steering Market, By Application, 2021–2029(USD Billion)

- UAE Electric Power Steering Market, By Electric Vehicle, 2021–2029(USD Billion)

- UAE Electric Power Steering Market, By EV Gear Type, 2021–2029(USD Billion)

- South Africa Electric Power Steering Market, By Component, 2021–2029(USD Billion)

- South Africa Electric Power Steering Market, By Electric Motor, 2021–2029(USD Billion)

- South Africa Electric Power Steering Market, By Application, 2021–2029(USD Billion)

- South Africa Electric Power Steering Market, By Electric Vehicle, 2021–2029(USD Billion)

- South Africa Electric Power Steering Market, By EV Gear Type, 2021–2029(USD Billion)

List of Figures

- Global Electric Power Steering Market Segmentation

- Electric Power Steering Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Electric Power Steering Market Attractiveness Analysis By Component

- Global Electric Power Steering Market Attractiveness Analysis By Electric Motor

- Global Electric Power Steering Market Attractiveness Analysis By Application

- Global Electric Power Steering Market Attractiveness Analysis By Electric Vehicle

- Global Electric Power Steering Market Attractiveness Analysis By EV Gear Type

- Global Electric Power Steering Market Attractiveness Analysis By Region

- Global Electric Power Steering Market: Dynamics

- Global Electric Power Steering Market Share By Component(2021 & 2028)

- Global Electric Power Steering Market Share By Electric Motor(2021 & 2028)

- Global Electric Power Steering Market Share By Application(2021 & 2028)

- Global Electric Power Steering Market Share By Electric Vehicle(2021 & 2028)

- Global Electric Power Steering Market Share By EV Gear Type (2021 & 2028)

- Global Electric Power Steering Market Share by Regions (2021 & 2028)

- Global Electric Power Steering Market Share by Company (2020)