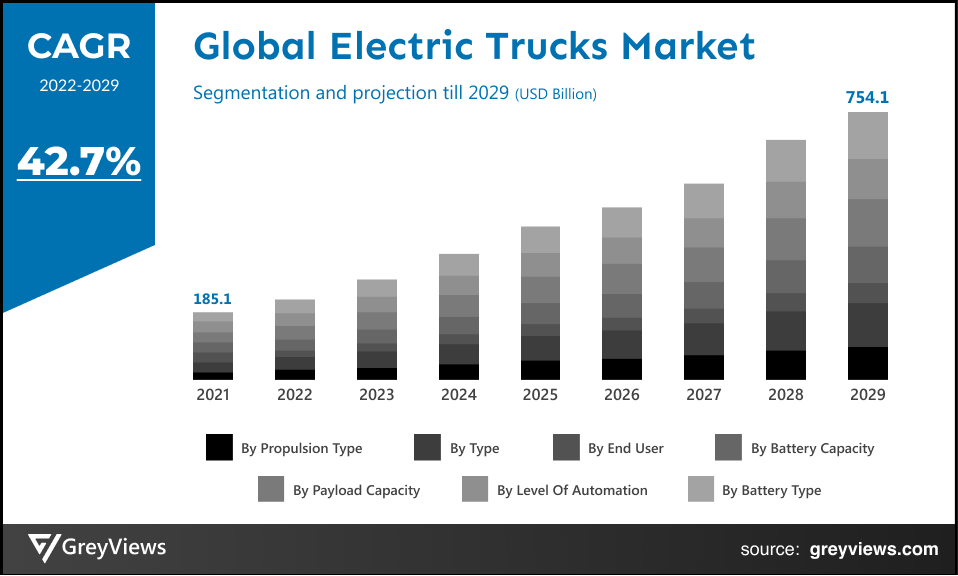

Electric Trucks Market Size by Propulsion Type (BEV, PHEV, and FCEV), Type (Light Duty Trucks, Medium Duty Trucks, and Heavy Duty Trucks), End-User (Last-Mile Delivery, Long Haul Transportation, Refuse Services, Field Services, and Distribution services), Battery Capacity (Less Than 50kwh, 50-250 Kwh, and Above 250 Kwh), Payload Capacity (Up to 10,000 lbs, 10,001-26,000 lbs, and Above 26,001 lbs), and Level of Automation (Semi-autonomous and Autonomous), Battery Type (Lithium-Nickel-Manganese-Cobalt Oxide, Lithium-Iron-Phosphate, and Others), Regions, Segmentation, and Projection till 2029

CAGR: 42.7%Current Market Size: USD 2.60 billionFastest Growing Region: North America

Largest Market: EuropeProjection Time: 2022-2029Base Year: 2021

Global Electric Truck- Market Overview:

The global electric truck market is expected to grow from USD 2.60 billion in 2021 to USD 43.85 billion by 2029, at a CAGR of 42.7% during the Projection period 2022-2029. This growth of the electric trucks market is mainly driven by an upsurge in demand for trucks with low emissions in the logistics sector and the rising need to reduce fuel and maintenance costs of the trucks.

Electric trucks are commercial battery electric vehicles that are powered by batteries and help in carrying the heavy payloads as well as the transportation of cargo. The fully electric-powered electric trucks operate on an electric motor instead of an internal combustion (IC) engine. These vehicles do not require fuel, which is one of the leading advantages. Moreover, in past few years, electric mobility has become the answer to issues about environmental protection, urban air quality and noise, and efforts to decrease global warming. This has led to the rise in popularity of electric trucks owing to their benefits such as cost efficiency, lower maintenance, lower noise disturbance, lower emissions, and better performance.

In the past few years, the demand for electric trucks is growing at a rapid pace as it outperforms conventional trucks. This is attributed to the fact that electric trucks are about 50% more efficient to operate as compared to diesel trucks and decrease greenhouse gas emissions by about 50%.

Request Sample: - Electric Trucks Market

Market Dynamics:

Drivers:

- Upsurge in demand for trucks with low emission

Out of the global vehicle stock, large diesel trucks account for about 9%; however, the engines of these trucks represent around 40% of the greenhouse gas emissions from the transport sector. However, electric trucks are environmentally friendly as they do not emit pollutants. In addition, these vehicles are energy efficient and need lower maintenance owing to an efficient electric motor. This has led to a significant rise in demand for zero-emissions trucks; while, leading manufacturers such as Ford, Tesla, GM, Peterbilt, and Volvo are actively investing in all-electric trucks. On the other hand, Hyundai, Daimler, and Toyota are working on fuel-cell-powered vehicles. Hence, demand for trucks with low emissions has boosted the global electric trucks market growth.

- The declining cost of EV batteries

Generally, electric vehicles are comparatively more expensive than traditional vehicles which are mainly attributed to the use of expensive batteries. Hence, the unaffordability of electric vehicles (EVs) as compared with the traditional internal combustion (IC) engine vehicles has been one of the major barriers to the transition toward EVs. However, the rising preference for electric vehicles and technological innovations has boosted the production of EV batteries on a mass scale, reducing the cost of batteries. For instance, according to BNEFβs 2020 Battery Price Survey, prices of electric batteries in 2020 were 13% lesser than in 2019 owing to the emergence of new battery pack designs and increasing order sizes. Thus, the declining cost of batteries has further driven the growth of the global electric truck market.

Restraints:

- High initial investment and Inadequate EV charging infrastructure

The initial investment needed for the production of electric trucks is comparatively much higher than that of diesel, petroleum, or CNG trucks. For instance, Forbes, presently, the manufacturing cost related to the electric trucks is higher than diesel or petrol trucks; however, it will be 50% cheaper than diesel or petrol trucks due to falling battery prices by 2030. Hence, the high initial investment for manufacture of the electric trucks is projected to hamper the growth of the market.

Moreover, an increasing number of countries are investing in Electric Truck charging infrastructure; however, there is still a very less number of EV charging stations around the globe. For instance, the U.S. government is anticipated to need over 100,000 EV charging stations to support widespread electric vehicle usage. Therefore, inadequate EV charging infrastructure has hampered the growth of the market.

Opportunities:

- Technological advancements and increased investments in electric trucks

Electric truck manufacturers are continuously transforming and improving their trucks. For instance, the Volvo VNR Electric is one of the six all-electric heavy truck models by the Volvo Group. In January 2022, the company launched the second generation of the Volvo eVNR tractor-trailer that can recharge to 80% within 90 minutes. The emergence of such technologically advanced electric trucks is expected to create lucrative growth opportunities for the market.

On the other hand, vehicle manufacturers are seeing continuous investment in the production of electric trucks. For instance, in December 2019, Rivian, an electric truck start-up received a $1.3 billion investment led by T. Rowe Price Group, Inc., an American publicly owned global investment management firm. Such investments are further opportunistic for the growth of the global market.

Challenges

- Need for high initial investments to install EV charging infrastructure

A number of countries is planning to increase the number of EV fast-charging stations; however, the need for high initial investment has become a major challenge to the market. Also, an estimated installation cost of a fast-charging station is comparatively higher than an A/C charging station. According to McKinseyβs survey in the U.S., it is estimated that the country will need a cumulative 13 million chargers as well as about $11 billion of investment by 2030 for the installation of EV charging infrastructure. Thus, high initial investments to install EV charging infrastructure is a major challenge in the global electric truck market.

Segmentation Analysis:

The global Electric Trucks market has been segmented based on propulsion type, type, end-user, battery capacity, payload capacity, level of automation, battery type, and regions.

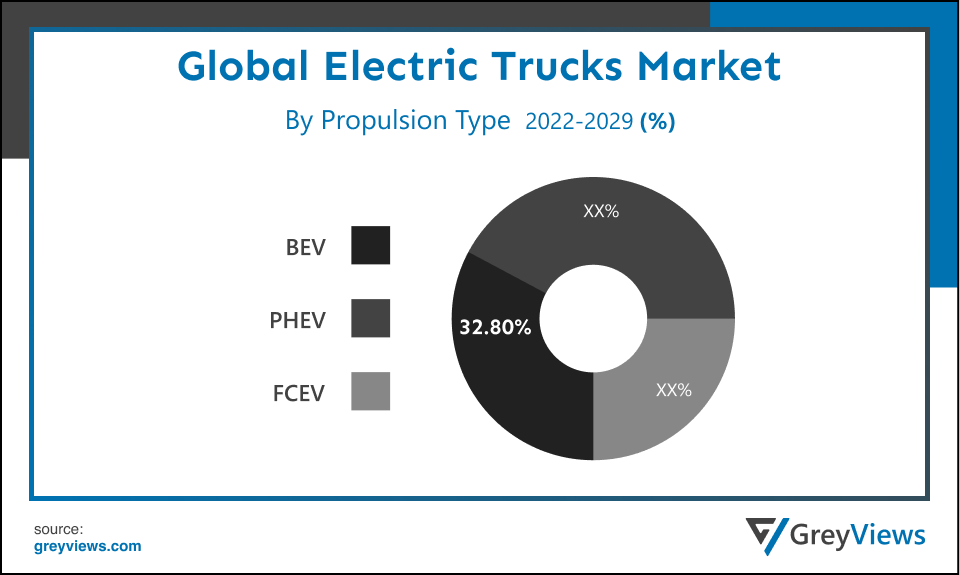

By Propulsion Type

The propulsion type segment includes BEV, PHEV, and FCEV. The BEV segment led the Electric Trucks market with a market share of around 32.80% in 2021. Battery-powered Electric vehicles (BEVs) is mainly powered by rechargeable battery packs without any secondary sources of power. Such vehicles can run much farther on a single charge than hybrid vehicles. The growth of this segment is mainly driven by increased investments from governments as well as private companies for the development of EV charging infrastructures. Also, the rising production trend of all-battery electric trucks in the electric vehicle industry is opportunistic for the growth of this segment. For instance, in March 2022, Nikola Corp. announced that it has started production of electric semi-trucks. The company has planned to deliver about 300 to 500 BEV semi-trucks by the end of the year.

By Vehicle Type

The Vehicle type segment includes light-duty trucks, medium-duty trucks, and heavy-duty trucks. The heavy-duty trucks segment led the Electric Trucks market with a market share of around 52.07% in 2021. This is attributed to the increasing number of regulations on vehicle emissions, the rapid growth of the retail, logistics, and e-commerce sectors, and significant advancements in vehicle safety. In addition, the need for powerful trucks with high payload capacity to handle weights and the rising need for fuel-efficient trucks have further boosted the growth of this segment. For instance, in June 2022, Scania, the Swedish commercial vehicle manufacturer launched a new line of battery-electric heavy-duty trucks designed for regional operations. These heavy-duty trucks are equipped with 624kWh battery packs with a range of about 350 kilometers.

By Level of Automation

The level of automation segment includes semi-autonomous and autonomous. The semi-autonomous segment led the electric trucks market with a market share of around 66.02% in 2021. The semi-autonomous trucks require the intervention of human to control the vehicle while using advanced technologies such as Adaptive Cruise Control, Blind Spot Detection, Intelligent Park Assist, and Lane Assist among others. In October 2020, Tesla, Inc. an American automotive and clean energy company announced that the company will produce Tesla Semi, the safe and comfortable truck alongside Cyber truck, Model 3, and Model Y. This focus of leading manufacturers on semi-autonomous electric trucks has primarily boosted the growth of this segment.

Global Electric Trucks Market- By Regional Analysis:

The regions analyzed for the Electric Trucks market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North American region dominated the Electric Trucks market and held the 34.02% share of the market revenue in 2021.

- The North American region has registered the highest value for the year 2021. Growth of this region is mainly driven by the presence of key market players such as Rivian, Tesla Inc., and Nikola Motors; easy availability of convenient financing options; and the significant emphasis by the governments to ensure in-house automotive production. The significant focus of the government in this region on reducing air pollution is opportunistic for the growth of the market. For instance, the California Governor introduced order to the sales of new gasoline cars by 2035 in the state previously the government of California also planned to phase out sales of new diesel trucks by 2045.

Moreover, in December 2021, the U.S. Department of Energy (DOE) and the Department of Telecommunications (DOT) signed a memorandum of understanding (MoU) to create a Joint Office of Energy and Transportation to support the deployment of a national electric vehicle charging network with an investment of $7.5 billion. In addition, aggressive investments in infrastructure development in this region have driven the growth of the North American electric trucks market.

- Europe is expected to witness a considerable growth rate during the Projection period. The stringent emission regulation standards in the region have primarily promoted the usage of electric trucks. In addition, this region is home to prominent electric truck manufacturers such as Daimler, Volvo, and others. Such factors are contributing to the growth of the Europe electric truck market.

Global Electric Trucks Market- Country Analysis:

- Germany

Germany Electric Trucks' market size was valued at USD 0.29 billion in 2021 and is expected to reach USD 4.69 billion by 2029, at a CAGR of 42.2% from 2022 to 2029.

Germany is one of the leading nations in the mechanical engineering, manufacturing, automotive, and electrical industries. In May 2019, Germany has launched the first electric highway to recharge hybrid trucks. This e-highway is about 6 miles long and is located on the A5 motorway south of Frankfurt, a central German city. Such innovations in this country are primarily fueling the growth of the electric truck market.

In addition, the government in this country has announced plans to double the number of purchase incentives already in place for battery Electric trucks (BEVs) as part of its EUR 130 billion stimulus package intended to shore up the countryβs post-coronavirus economy. Hence, the promotion of the electric vehicle industry in this country is anticipated to create lucrative growth opportunities for the market.

- China

China Electric Trucks' market size was valued at USD 0.56 billion in 2021 and is expected to reach USD 8.96 billion by 2029, at a CAGR of 41.8% from 2022 to 2029. China is the worldβs largest light-vehicle manufacturer. This country is a leading automotive producer, consumer, and exporter. The key players including Dongfeng Motor Corporation, Daimler AG, BYD Auto Co. Ltd., and FAW Group Co., Ltd. in the China electric trucks market are seeing huge growth in production. This is mainly attributed to the zero-emissions vehicle mandate imposed by the Chinese government for each vehicle manufacturer and importer in the country which requires them to make or import at least 10% electric vehicles. Such initiatives are anticipated to create lucrative growth opportunities for China's electric truck market.

- India

India Electric Trucks' market size was valued at USD 0.18 billion in 2021 and is expected to reach USD 3.14 billion by 2029, at a CAGR of 43.1% from 2022 to 2029. India is one of the strongest growing economies in Asia. The transportation sector is accountable for over 14% of total greenhouse gas emissions in India. Hence, need to reduce greenhouse gas emissions is mainly fueling growth of the electric trucks in the country.

In addition, the emerging popularity and expansion of the electric trucks sector is expected to create lucrative growth opportunities for the market. For instance, Olectra Greentech Ltd, a leader in electric bus manufacturing in India, has begun trials of a 6x4 heavy-duty electric tipper under its strategy to expand into the electric truck sector.

Key Industry Players Analysis:

To increase their market position in the global Electric Trucks business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- AB Volvo

- BYD Auto Co. Ltd

- Daimler AG

- Dongfeng Motor Corporation

- FAW Group Co., Ltd.

- Foton Motor Inc.

- Isuzu Motors Ltd

- Navistar, Inc.

- PACCAR Inc.

- Scania

Latest Development:

- In May 2022, Scania and Einride, the Swedish freight technology company signed an agreement for accelerating the electrification of road freight with 110 electric trucks. Through this agreement, The Einride is further planning to drive innovation as well as product development in the worldwide transport industry in collaboration with Scania.

- In January 2022, Volvo Trucks launched Active Grip Control, a new safety feature for electric trucks. This feature is projected to improve acceleration, stability, and braking in slippery conditions.

Scope of the Report

Global Electric Trucks Market by Propulsion Type:

- BEV

- PHEV

- FCEV

Global Electric Trucks Market by Type:

- Light Duty Trucks

- Medium Duty Trucks

- Heavy Duty Trucks

Global Electric Trucks Market by End User:

- Last-Mile Delivery

- Long Haul Transportation

- Refuse Services

- Field Services

- Distribution services

Global Electric Trucks Market by Battery Capacity:

- Less Than 50kwh

- 50-250 Kwh

- Above 250 Kwh

Global Electric Trucks Market by Payload Capacity:

- Upto 10,000 lbs

- 10,001-26,000 lbs

- Above 26,001 lbs

Global Electric Trucks Market by Level of Automation:

- Semi-autonomous

- Autonomous

Global Electric Trucks Market by Battery Type:

- Lithium-Nickel-Manganese-Cobalt Oxide

- Lithium-Iron-Phosphate

- Others

Global Electric Trucks Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the size of Global Electric Trucks Market?

Global Electric Trucks Market size is USD 2.60 billion in 2021 and it will grow to USD 43.85 billion by 2029, at a CAGR of 42.7% from 2022 to 2029.

Which Country in Asia Pacific leading in Electric Trucks Market?

China is the worlds largest light-vehicle manufacturer. This country is a leading automotive producer, consumer, and exporter. The key players including Dongfeng Motor Corporation, Daimler AG, BYD Auto Co. Ltd., and FAW Group Co., Ltd. in the China electric trucks market are seeing huge growth in production. This is mainly attributed to the zero-emissions vehicle mandate imposed by the Chinese government for each vehicle manufacturer and importer in the country which requires them to make or import at least 10% electric vehicles. Such initiatives are anticipated to create lucrative growth opportunities for China's electric truck market

Which Region Currently dominate the Global Electric Trucks Market?

North American region dominate the Electric Trucks market and held the 34.02% share of the market revenue in 2021

Who is leading market players in the Electric Trucks Market?

Leading market players active in the global electric trucks market are AB Volvo, BYD Auto Co. Ltd., Daimler AG, Dongfeng Motor Corporation, FAW Group Co., Ltd., Foton Motor Inc., Isuzu Motors Ltd., Navistar, Inc., PACCAR Inc., and Scania among others.

What are the opportunities in Global Electric Trucks Market?

Electric truck manufacturers are continuously transforming and improving their trucks. For instance, the Volvo VNR Electric is one of the six all-electric heavy truck models by the Volvo Group. In January 2022, the company launched the second generation of the Volvo eVNR tractor-trailer that can recharge to 80% within 90 minutes. The emergence of such technologically advanced electric trucks is expected to create lucrative growth opportunities for the market.

What are the Vehicle Type in Electric Trucks Market?

The Vehicle type segment includes light-duty trucks, medium-duty trucks, and heavy-duty trucks.

How Environment will benefit from Electric Trucks?

Out of the global vehicle stock, large diesel trucks account for about 9%; however, the engines of these trucks represent around 40% of the greenhouse gas emissions from the transport sector. However, electric trucks are environmentally friendly as they do not emit pollutants. In addition, these vehicles are energy efficient and need lower maintenance owing to an efficient electric motor. This has led to a significant rise in demand for zero-emissions trucks; while, leading manufacturers such as Ford, Tesla, GM, Peterbilt, and Volvo are actively investing in all-electric trucks. On the other hand, Hyundai, Daimler, and Toyota are working on fuel-cell-powered vehicles. Hence, demand for trucks with low emissions has boosted the global electric trucks market growth.

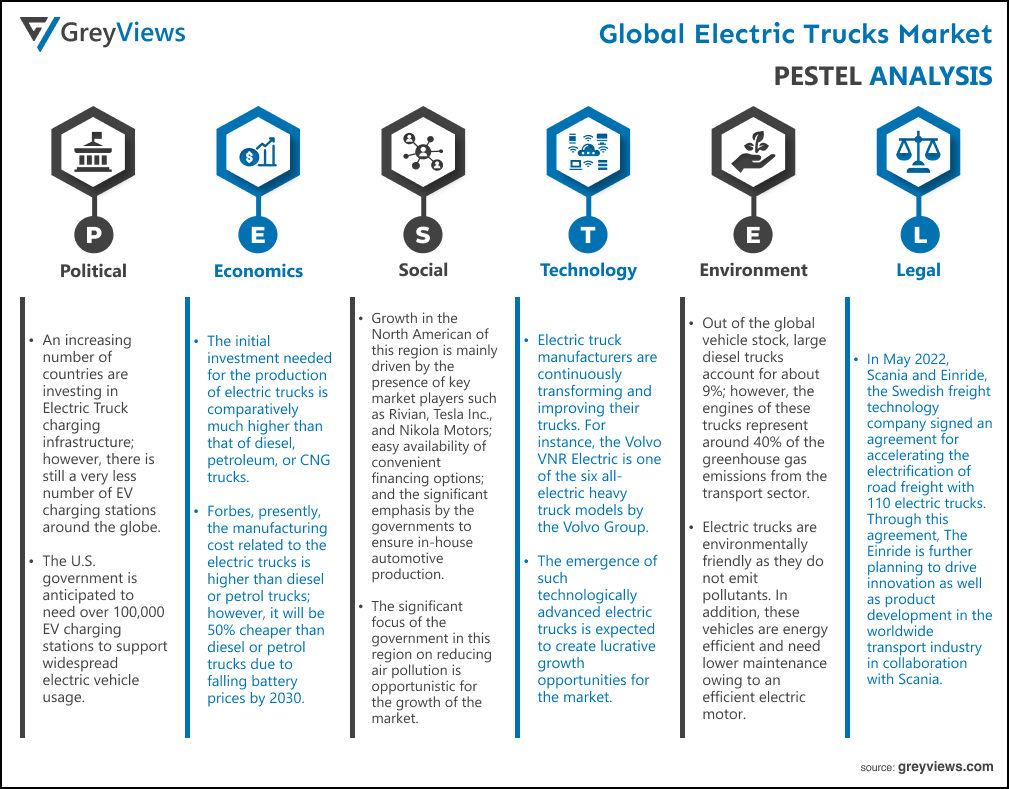

Political Factors- An increasing number of countries are investing in Electric Truck charging infrastructure; however, there is still a very less number of EV charging stations around the globe. For instance, the U.S. government is anticipated to need over 100,000 EV charging stations to support widespread electric vehicle usage. Therefore, inadequate EV charging infrastructure has hampered the growth of the market. the U.S. Department of Energy (DOE) and the Department of Telecommunications (DOT) signed a memorandum of understanding (MoU) to create a Joint Office of Energy and Transportation to support the deployment of a national electric vehicle charging network with an investment of $7.5 billion.

Economical Factors- The initial investment needed for the production of electric trucks is comparatively much higher than that of diesel, petroleum, or CNG trucks. For instance, Forbes, presently, the manufacturing cost related to the electric trucks is higher than diesel or petrol trucks; however, it will be 50% cheaper than diesel or petrol trucks due to falling battery prices by 2030. Hence, the high initial investment in the manufacture of electric trucks is projected to hamper the growth of the market. For instance, in December 2019, Rivian, an electric truck start-up received a $1.3 billion investment led by T. Rowe Price Group, Inc., an American publicly owned global investment management firm. Such investments are further opportunistic for the growth of the global market.

Social Factor- Growth in the North American of this region is mainly driven by the presence of key market players such as Rivian, Tesla Inc., and Nikola Motors; easy availability of convenient financing options; and the significant emphasis by the governments to ensure in-house automotive production. The significant focus of the government in this region on reducing air pollution is opportunistic for the growth of the market. For instance, the California Governor introduced an order to the sales of new gasoline cars by 2035 in the state previously the government of California also planned to phase out sales of new diesel trucks by 2045.

Technological Factors- Electric truck manufacturers are continuously transforming and improving their trucks. For instance, the Volvo VNR Electric is one of the six all-electric heavy truck models by the Volvo Group. In January 2022, the company launched the second generation of the Volvo eVNR tractor-trailer that can recharge to 80% within 90 minutes. The emergence of such technologically advanced electric trucks is expected to create lucrative growth opportunities for the market. Semi-autonomous trucks require the intervention of humans to control the vehicle while using advanced technologies such as Adaptive Cruise Control, Blind Spot Detection, Intelligent Park Assist, and Lane Assist among others. In October 2020, Tesla, Inc. an American automotive and clean energy company announced that the company will produce Tesla Semi, the safe and comfortable truck alongside Cybertruck, Model 3, and Model Y.

Environmental Factors- Out of the global vehicle stock, large diesel trucks account for about 9%; however, the engines of these trucks represent around 40% of the greenhouse gas emissions from the transport sector. However, electric trucks are environmentally friendly as they do not emit pollutants. In addition, these vehicles are energy efficient and need lower maintenance owing to an efficient electric motor. This has led to a significant rise in demand for zero-emissions trucks; while, leading manufacturers such as Ford, Tesla, GM, Peterbilt, and Volvo are actively investing in all-electric trucks. On the other hand, Hyundai, Daimler, and Toyota are working on fuel-cell-powered vehicles. Hence, demand for trucks with low emissions has boosted the global electric trucks market growth.

Legal Factors- In May 2022, Scania and Einride, the Swedish freight technology company signed an agreement for accelerating the electrification of road freight with 110 electric trucks. Through this agreement, The Einride is further planning to drive innovation as well as product development in the worldwide transport industry in collaboration with Scania. In January 2022, Volvo Trucks launched Active Grip Control, a new safety feature for electric trucks. This feature is projected to improve acceleration, stability, and braking in slippery conditions.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porterβs Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Propulsion Type

- Market Attractiveness Analysis By Type

- Market Attractiveness Analysis By End User

- Market Attractiveness Analysis By Battery Capacity

- Market Attractiveness Analysis By Payload Capacity

- Market Attractiveness Analysis By Level of Automation

- Market Attractiveness Analysis By Battery Type

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Upsurge in demand for trucks with low emission

- Declining cost of EV batteries

- Restrains

- High initial investment and Inadequate EV charging infrastructure

- Opportunities

- Technological advancements and increased investments in electric trucks

- Challenges

- Need for high initial investments to install EV charging infrastructure

- Global Electric Trucks Market Analysis and Projection, By Propulsion Type

- Segment Overview

- BEV

- PHEV

- FCEV

- Global Electric Trucks Market Analysis and Projection, By Type

- Segment Overview

- Light Duty Trucks

- Medium Duty Trucks

- Heavy Duty Trucks

- Global Electric Trucks Market Analysis and Projection, By End User

- Segment Overview

- Last Mile Delivery

- Long Haul Transportation

- Refuse Services

- Field Services

- Distribution services

- Global Electric Trucks Market Analysis and Projection, By Battery Capacity

- Segment Overview

- Less Than 50kwh

- 50-250 Kwh

- Above 250 Kwh

- Global Electric Trucks Market Analysis and Projection, By Payload Capacity

- Segment Overview

- Upto 10,000 lbs

- 10,001-26,000 lbs

- Above 26,001 lbs

- Global Electric Trucks Market Analysis and Projection, By Level of Automation

- Segment Overview

- Semi-autonomous

- Autonomous

- Global Electric Trucks Market Analysis and Projection, By Battery Type

- Segment Overview

- Lithium-Nickel-Manganese-Cobalt Oxide

- Lithium-Iron-Phosphate

- Others

- Global Electric Trucks Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Electric Trucks Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Electric Trucks Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Propulsion Type Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- AB Volvo

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Propulsion Type Portfolio

- Recent Developments

- SWOT Analysis

- BYD Auto Co. Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Propulsion Type Portfolio

- Recent Developments

- SWOT Analysis

- Daimler AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Propulsion Type Portfolio

- Recent Developments

- SWOT Analysis

- Dongfeng Motor Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Propulsion Type Portfolio

- Recent Developments

- SWOT Analysis

- FAW Group Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Propulsion Type Portfolio

- Recent Developments

- SWOT Analysis

- Foton Motor Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Propulsion Type Portfolio

- Recent Developments

- SWOT Analysis

- Isuzu Motors Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Propulsion Type Portfolio

- Recent Developments

- SWOT Analysis

- Navistar, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Propulsion Type Portfolio

- Recent Developments

- SWOT Analysis

- PACCAR Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Propulsion Type Portfolio

- Recent Developments

- SWOT Analysis

- Scania

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Propulsion Type Portfolio

- Recent Developments

- SWOT Analysis

- AB Volvo

List of Table

- Global Electric Trucks Market, By Propulsion Type, 2020β2029(USD Billion)

- Global BEV Electric Trucks Market, By Region, 2020β2029(USD Billion)

- Global PHEV Electric Trucks Market, By Region, 2020β2029(USD Billion)

- Global FCEV Electric Trucks Market, By Region, 2020β2029(USD Billion)

- Global Electric Trucks Market, By Type, 2020β2029(USD Billion)

- Global Light Duty Trucks Electric Trucks Market, By Region, 2020β2029(USD Billion)

- Global Medium Duty Trucks Electric Trucks Market, By Region, 2020β2029(USD Billion)

- Global Heavy Duty Trucks Electric Trucks Market, By Region, 2020β2029(USD Billion)

- Global Electric Trucks Market, By End User, 2020β2029(USD Billion)

- Global Last Mile Delivery Electric Trucks Market, By Region, 2020β2029(USD Billion)

- Global Long Haul Transportation Electric Trucks Market, By Region, 2020β2029(USD Billion)

- Global Refuse Services Electric Trucks Market, By Region, 2020β2029(USD Billion)

- Global Field Services Electric Trucks Market, By Region, 2020β2029(USD Billion)

- Global Distribution services Electric Trucks Market, By Region, 2020β2029(USD Billion)

- Global Electric Trucks Market, By Battery Capacity, 2020β2029(USD Billion)

- Global Less Than 50kwh Electric Trucks Market, By Region, 2020β2029(USD Billion)

- Global 50-250 Kwh Electric Trucks Market, By Region, 2020β2029(USD Billion)

- Global Above 250 Kwh Electric Trucks Market, By Region, 2020β2029(USD Billion)

- Global Electric Trucks Market, By Payload Capacity, 2020β2029(USD Billion)

- Global Upto 10,000 lbs Electric Trucks Market, By Region, 2020β2029(USD Billion)

- Global 10,001-26,000 lbs Electric Trucks Market, By Region, 2020β2029(USD Billion)

- Global Above 26,001 lbs Electric Trucks Market, By Region, 2020β2029(USD Billion)

- Global Electric Trucks Market, By Level of Automation, 2020β2029(USD Billion)

- Global Semi-autonomous Electric Trucks Market, By Region, 2020β2029(USD Billion)

- Global Autonomous Electric Trucks Market, By Region, 2020β2029(USD Billion)

- Global Electric Trucks Market, By Battery Type, 2020β2029(USD Billion)

- Global Lithium-Nickel-Manganese-Cobalt Oxide Electric Trucks Market, By Region, 2020β2029(USD Billion)

- Global Lithium-Iron-Phosphate Electric Trucks Market, By Region, 2020β2029(USD Billion)

- Global Others Electric Trucks Market, By Region, 2020β2029(USD Billion)

- Global Electric Trucks Market, By Region, 2020β2029(USD Billion)

- Global Electric Trucks Market, By North America, 2020β2029(USD Billion)

- North America Electric Trucks Market, By Propulsion Type, 2020β2029(USD Billion)

- North America Electric Trucks Market, By Type, 2020β2029(USD Billion)

- North America Electric Trucks Market, By End User, 2020β2029(USD Billion)

- North America Electric Trucks Market, By Battery Capacity, 2020β2029(USD Billion)

- North America Electric Trucks Market, By Payload Capacity, 2020β2029(USD Billion)

- North America Electric Trucks Market, By Level of Automation, 2020β2029(USD Billion)

- North America Electric Trucks Market, By Battery Type, 2020β2029(USD Billion)

- USA. Electric Trucks Market, By Propulsion Type, 2020β2029(USD Billion)

- USA. Electric Trucks Market, By Type, 2020β2029(USD Billion)

- USA. Electric Trucks Market, By End User, 2020β2029(USD Billion)

- USA. Electric Trucks Market, By Battery Capacity, 2020β2029(USD Billion)

- USA. Electric Trucks Market, By Payload Capacity, 2020β2029(USD Billion)

- USA. Electric Trucks Market, By Level of Automation, 2020β2029(USD Billion)

- USA. Electric Trucks Market, By Battery Type, 2020β2029(USD Billion)

- Canada Electric Trucks Market, By Propulsion Type, 2020β2029(USD Billion)

- Canada Electric Trucks Market, By Type, 2020β2029(USD Billion)

- Canada Electric Trucks Market, By End User, 2020β2029(USD Billion)

- Canada Electric Trucks Market, By Battery Capacity, 2020β2029(USD Billion)

- Canada Electric Trucks Market, By Payload Capacity, 2020β2029(USD Billion)

- Canada Electric Trucks Market, By Level of Automation, 2020β2029(USD Billion)

- Canada Electric Trucks Market, By Battery Type, 2020β2029(USD Billion)

- Mexico Electric Trucks Market, By Propulsion Type, 2020β2029(USD Billion)

- Mexico Electric Trucks Market, By Type, 2020β2029(USD Billion)

- Mexico Electric Trucks Market, By End User, 2020β2029(USD Billion)

- Mexico Electric Trucks Market, By Battery Capacity, 2020β2029(USD Billion)

- Mexico Electric Trucks Market, By Payload Capacity, 2020β2029(USD Billion)

- Mexico Electric Trucks Market, By Level of Automation, 2020β2029(USD Billion)

- Mexico Electric Trucks Market, By Battery Type, 2020β2029(USD Billion)

- Europe Electric Trucks Market, By Propulsion Type, 2020β2029(USD Billion)

- Europe Electric Trucks Market, By Type, 2020β2029(USD Billion)

- Europe Electric Trucks Market, By End User, 2020β2029(USD Billion)

- Europe Electric Trucks Market, By Battery Capacity, 2020β2029(USD Billion)

- Europe Electric Trucks Market, By Payload Capacity, 2020β2029(USD Billion)

- Europe Electric Trucks Market, By Level of Automation, 2020β2029(USD Billion)

- Europe Electric Trucks Market, By Battery Type, 2020β2029(USD Billion)

- Germany Electric Trucks Market, By Propulsion Type, 2020β2029(USD Billion)

- Germany Electric Trucks Market, By Type, 2020β2029(USD Billion)

- Germany Electric Trucks Market, By End User, 2020β2029(USD Billion)

- Germany Electric Trucks Market, By Battery Capacity, 2020β2029(USD Billion)

- Germany Electric Trucks Market, By Payload Capacity, 2020β2029(USD Billion)

- Germany Electric Trucks Market, By Level of Automation, 2020β2029(USD Billion)

- Germany Electric Trucks Market, By Battery Type, 2020β2029(USD Billion)

- France Electric Trucks Market, By Propulsion Type, 2020β2029(USD Billion)

- France Electric Trucks Market, By Type, 2020β2029(USD Billion)

- France Electric Trucks Market, By End User, 2020β2029(USD Billion)

- France Electric Trucks Market, By Battery Capacity, 2020β2029(USD Billion)

- France Electric Trucks Market, By Payload Capacity, 2020β2029(USD Billion)

- France Electric Trucks Market, By Level of Automation, 2020β2029(USD Billion)

- France Electric Trucks Market, By Battery Type, 2020β2029(USD Billion)

- UK. Electric Trucks Market, By Propulsion Type, 2020β2029(USD Billion)

- UK. Electric Trucks Market, By Type, 2020β2029(USD Billion)

- UK. Electric Trucks Market, By End User, 2020β2029(USD Billion)

- UK. Electric Trucks Market, By Battery Capacity, 2020β2029(USD Billion)

- UK. Electric Trucks Market, By Payload Capacity, 2020β2029(USD Billion)

- UK. Electric Trucks Market, By Level of Automation, 2020β2029(USD Billion)

- UK. Electric Trucks Market, By Battery Type, 2020β2029(USD Billion)

- Italy Electric Trucks Market, By Propulsion Type, 2020β2029(USD Billion)

- Italy Electric Trucks Market, By Type, 2020β2029(USD Billion)

- Italy Electric Trucks Market, By End User, 2020β2029(USD Billion)

- Italy Electric Trucks Market, By Battery Capacity, 2020β2029(USD Billion)

- Italy Electric Trucks Market, By Payload Capacity, 2020β2029(USD Billion)

- Italy Electric Trucks Market, By Level of Automation, 2020β2029(USD Billion)

- Italy Electric Trucks Market, By Battery Type, 2020β2029(USD Billion)

- Spain Electric Trucks Market, By Propulsion Type, 2020β2029(USD Billion)

- Spain Electric Trucks Market, By Type, 2020β2029(USD Billion)

- Spain Electric Trucks Market, By End User, 2020β2029(USD Billion)

- Spain Electric Trucks Market, By Battery Capacity, 2020β2029(USD Billion)

- Spain Electric Trucks Market, By Payload Capacity, 2020β2029(USD Billion)

- Spain Electric Trucks Market, By Level of Automation, 2020β2029(USD Billion)

- Spain Electric Trucks Market, By Battery Type, 2020β2029(USD Billion)

- Asia Pacific Electric Trucks Market, By Propulsion Type, 2020β2029(USD Billion)

- Asia Pacific Electric Trucks Market, By Type, 2020β2029(USD Billion)

- Asia Pacific Electric Trucks Market, By End User, 2020β2029(USD Billion)

- Asia Pacific Electric Trucks Market, By Battery Capacity, 2020β2029(USD Billion)

- Asia Pacific Electric Trucks Market, By Payload Capacity, 2020β2029(USD Billion)

- Asia Pacific Electric Trucks Market, By Level of Automation, 2020β2029(USD Billion)

- Asia Pacific Electric Trucks Market, By Battery Type, 2020β2029(USD Billion)

- Japan Electric Trucks Market, By Propulsion Type, 2020β2029(USD Billion)

- Japan Electric Trucks Market, By Type, 2020β2029(USD Billion)

- Japan Electric Trucks Market, By End User, 2020β2029(USD Billion)

- Japan Electric Trucks Market, By Battery Capacity, 2020β2029(USD Billion)

- Japan Electric Trucks Market, By Payload Capacity, 2020β2029(USD Billion)

- Japan Electric Trucks Market, By Level of Automation, 2020β2029(USD Billion)

- Japan Electric Trucks Market, By Battery Type, 2020β2029(USD Billion)

- China Electric Trucks Market, By Propulsion Type, 2020β2029(USD Billion)

- China Electric Trucks Market, By Type, 2020β2029(USD Billion)

- China Electric Trucks Market, By End User, 2020β2029(USD Billion)

- China Electric Trucks Market, By Battery Capacity, 2020β2029(USD Billion)

- China Electric Trucks Market, By Payload Capacity, 2020β2029(USD Billion)

- China Electric Trucks Market, By Level of Automation, 2020β2029(USD Billion)

- China Electric Trucks Market, By Battery Type, 2020β2029(USD Billion)

- India Electric Trucks Market, By Propulsion Type, 2020β2029(USD Billion)

- India Electric Trucks Market, By Type, 2020β2029(USD Billion)

- India Electric Trucks Market, By End User, 2020β2029(USD Billion)

- India Electric Trucks Market, By Battery Capacity, 2020β2029(USD Billion)

- India Electric Trucks Market, By Payload Capacity, 2020β2029(USD Billion)

- India Electric Trucks Market, By Level of Automation, 2020β2029(USD Billion)

- India Electric Trucks Market, By Battery Type, 2020β2029(USD Billion)

- South America Electric Trucks Market, By Propulsion Type, 2020β2029(USD Billion)

- South America Electric Trucks Market, By Type, 2020β2029(USD Billion)

- South America Electric Trucks Market, By End User, 2020β2029(USD Billion)

- South America Electric Trucks Market, By Battery Capacity, 2020β2029(USD Billion)

- South America Electric Trucks Market, By Payload Capacity, 2020β2029(USD Billion)

- South America Electric Trucks Market, By Level of Automation, 2020β2029(USD Billion)

- South America Electric Trucks Market, By Battery Type, 2020β2029(USD Billion)

- Brazil Electric Trucks Market, By Propulsion Type, 2020β2029(USD Billion)

- Brazil Electric Trucks Market, By Type, 2020β2029(USD Billion)

- Brazil Electric Trucks Market, By End User, 2020β2029(USD Billion)

- Brazil Electric Trucks Market, By Battery Capacity, 2020β2029(USD Billion)

- Brazil Electric Trucks Market, By Payload Capacity, 2020β2029(USD Billion)

- Brazil Electric Trucks Market, By Level of Automation, 2020β2029(USD Billion)

- Brazil Electric Trucks Market, By Battery Type, 2020β2029(USD Billion)

- Middle East and Africa Electric Trucks Market, By Propulsion Type, 2020β2029(USD Billion)

- Middle East and Africa Electric Trucks Market, By Type, 2020β2029(USD Billion)

- Middle East and Africa Electric Trucks Market, By End User, 2020β2029(USD Billion)

- Middle East and Africa Electric Trucks Market, By Battery Capacity, 2020β2029(USD Billion)

- Middle East and Africa Electric Trucks Market, By Payload Capacity, 2020β2029(USD Billion)

- Middle East and Africa Electric Trucks Market, By Level of Automation, 2020β2029(USD Billion)

- Middle East and Africa Electric Trucks Market, By Battery Type, 2020β2029(USD Billion)

- UAE Electric Trucks Market, By Propulsion Type, 2020β2029(USD Billion)

- UAE Electric Trucks Market, By Type, 2020β2029(USD Billion)

- UAE Electric Trucks Market, By End User, 2020β2029(USD Billion)

- UAE Electric Trucks Market, By Battery Capacity, 2020β2029(USD Billion)

- UAE Electric Trucks Market, By Payload Capacity, 2020β2029(USD Billion)

- UAE Electric Trucks Market, By Level of Automation, 2020β2029(USD Billion)

- UAE Electric Trucks Market, By Battery Type, 2020β2029(USD Billion)

- South Africa Electric Trucks Market, By Propulsion Type, 2020β2029(USD Billion)

- South Africa Electric Trucks Market, By Type, 2020β2029(USD Billion)

- South Africa Electric Trucks Market, By End User, 2020β2029(USD Billion)

- South Africa Electric Trucks Market, By Battery Capacity, 2020β2029(USD Billion)

- South Africa Electric Trucks Market, By Payload Capacity, 2020β2029(USD Billion)

- South Africa Electric Trucks Market, By Level of Automation, 2020β2029(USD Billion)

- South Africa Electric Trucks Market, By Battery Type, 2020β2029(USD Billion)

List of Figures

- Global Electric Trucks Market Segmentation

- Electric Trucks Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porterβs Five Forces Analysis

- Value Chain Analysis

- Global Electric Trucks Market Attractiveness Analysis By Propulsion Type

- Global Electric Trucks Market Attractiveness Analysis By Type

- Global Electric Trucks Market Attractiveness Analysis By End User

- Global Electric Trucks Market Attractiveness Analysis By Battery Capacity

- Global Electric Trucks Market Attractiveness Analysis By Payload Capacity

- Global Electric Trucks Market Attractiveness Analysis By Level of Automation

- Global Electric Trucks Market Attractiveness Analysis By Battery Type

- Global Electric Trucks Market Attractiveness Analysis By Region

- Global Electric Trucks Market: Dynamics

- Global Electric Trucks Market Share By Propulsion Type(2021 & 2029)

- Global Electric Trucks Market Share By Type(2021 & 2029)

- Global Electric Trucks Market Share By End User(2021 & 2029)

- Global Electric Trucks Market Share By Battery Capacity(2021 & 2029)

- Global Electric Trucks Market Share By Payload Capacity (2021 & 2029)

- Global Electric Trucks Market Share By Level of Automation (2021 & 2029)

- Global Electric Trucks Market Share By Battery Type (2021 & 2029)

- Global Electric Trucks Market Share by Regions (2021 & 2029)

- Global Electric Trucks Market Share by Company (2020)