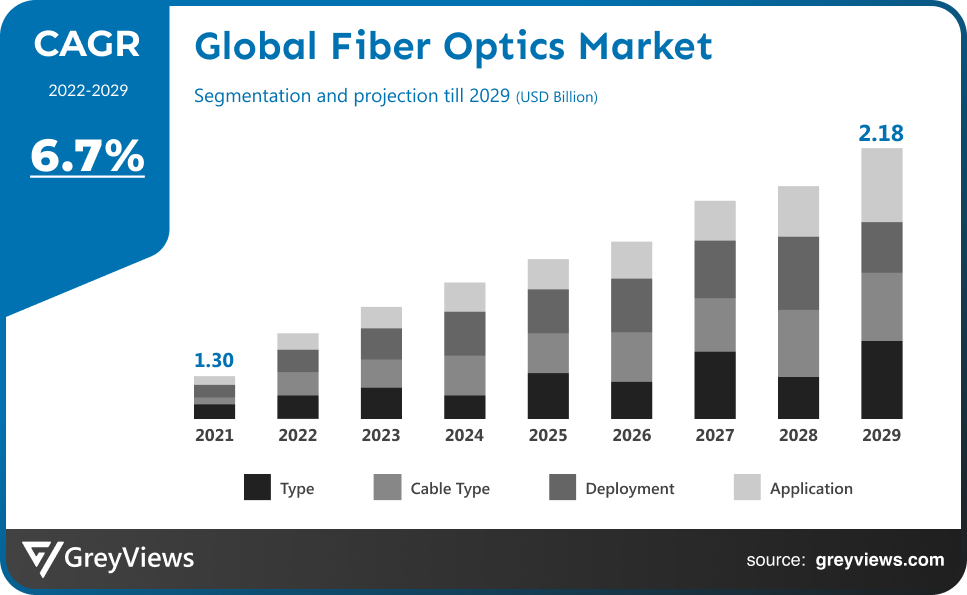

Fiber Optics Market Size By Type (Glass and Plastic), By Cable Type (Single-mode and Multi-mode), By Deployment (Underground, Underwater and Aerial), By Application (Communication (Telecom, Premises, Utility, CATV, Military, Industrial and Others) and Non-communication (Sensors and Fiber Optic Lighting)), Regions, Segmentation, and Projection till 2029

CAGR: 6.7%Current Market Size: USD 1.30 billionFastest Growing Region: MEA

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Fiber Optics Market- Market Overview:

The Global Fiber optics market is expected to grow from USD 1.30 billion in 2021 to USD 2.18 billion by 2029, at a CAGR of 6.7% during the Projection period 2022-2029. The growth of this market is mainly driven by increasing research and development to leverage capabilities of the technology, prevalence of chronic and lifestyle-related diseases.

Fiber optics is a field of technology that deals with the transfer of data through optical fibres, with light serving as the carrier. Data is transferred through threads of glass or plastic that are as thin as a human hair. Despite having many similarities to the conventional copper wire approach, this technology is nevertheless considered innovative since it offers advantages like high bandwidth, long distance communication, high safety, and security along with cables that are lighter and thinner than metal wires. A glass or plastic core and one or more layers of cladding material make up a fibre optic cable. Light is prevented from escaping by being reflected back into the core by the cladding. As a result, signals may be sent across vast distances without losing their power. Fiber optics facilitates the transfer of digital material at extremely high rates across very long distances, computer networking, and video-on-demand. There are two methods to apply the technology: In the field of telecommunications, fibre optics has essentially taken the place of copper wire as the preferred method of long-distance voice, data, and video traffic transport. Fiber optics are used in cable television (CATV) to bring digital television and other services to households and businesses. The market for fibre optics is expanding since fibre optics are being used more often in data and telecommunications. Fiber optics have lower attenuation than metal cables and are used to transmit light signals across great distances. Higher bandwidth, reduced weight, less electromagnetic energy leakage, and tolerance to weather conditions like humidity, heat, and corrosion are all benefits of fibre optics over conventional copper cables.

Sample Request: - Global Fiber Optics Market

Market Dynamics:

Drivers:

- Adoption of Fiber Optic Technology

One of the key reasons driving the growth of the fibre optics market is the increase in the usage of fibre optic technologies throughout the world. The rise in high bandwidth communication preferences and the growth of the healthcare industry positively impacts the market.

Restraints:

- Concerns associated with lost signal and no possible data recovery

For certain real-world applications, fibre optics has a variety of restrictions and is less reliable than conventional wires or cables used for various applications and purposes. Due to the nature of the materials used for the core and cladding, cables are prone to harm, including breaking or snapping. They can also be damaged if bent too much over an angle. Additionally, fibre optic cables have comparatively greater production and installation costs compared to copper or aluminium cables.

Opportunities:

- Surging deployment of 5G communication networks

The widespread use of 5G in established and developing countries would present advantageous market possibilities for vendors of fibre optics. The deployment of optical fibres is crucial to the development of 5G infrastructure. These optical fibres are capable of transmitting a significant quantity of data quickly between two locations.

Challenges:

- Challenges in installing fiber optics networks in difficult terrains and high cost of installation

There are major difficulties in establishing the conduits along trenchless installations, even though fibre optic cables are normally put within conduits beside the pipeline. Technical and administrative issues might be the cause of challenges in fibre utilisation. With subsea fibre optic cable networks, several telecom corporations have telecommunications infrastructure around the world.

Segmentation Analysis:

The global Fiber optics market has been segmented based on Fiber Type, Cable Type, Deployment, Application and Regions.

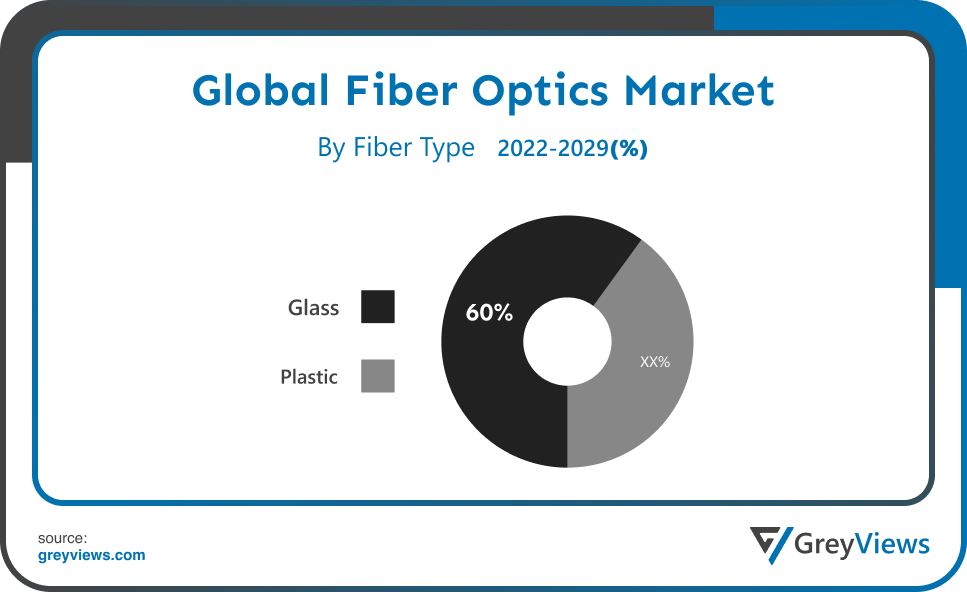

By Fiber Type

The type segment includes Glass and Plastic. The Glass segment led the largest share of the Fiber optics market with a market share of around 60% in 2021. The sector is anticipated to grow at a quicker rate throughout the course of the projected period. The numerical aperture of glass optical fibres is higher than that of plastic optical fibres, allowing more light to enter the system. They have a much wider range, spanning 200 to 2200 nm. The exceptional performance of glass fibre optics in harsh environments with high temperatures and corrosive chemicals, as well as its capacity to transmit both visible and infrared light, are significant factors promoting this market's expansion.

By Cable Type

The Cable Type segment includes Single-mode and Multi-mode. The Single-mode segment led the Fiber optics market with a market share of around 52% in 2021. Compared to multi-mode fibre optic cables, which have core diameters of 50 m or more, single-mode fibre optic cables have a core diameter of around 9 m. Single-mode fibre optic cables are capable of substantially faster and further signal transmission than multi-mode fibres. The dominance of single-mode fibre optic cable is mostly due to the growth in long-distance transmission application demand. Single-mode fibres are frequently used by the telecom industry for long-distance and high-bandwidth needs. Along with schools and colleges, cable television companies also use them.

By Deployment

The Deployment segment includes Underground, Underwater and Aerial. The Aerial segment led the Fiber optics market with a market share of around 40.08% in 2021. With more people utilising Fiber to the Home (FTTH) services, aerial fibre deployments are set to increase. Aerial deployment provides for quicker fibre optics installation than underground deployment. It also offers low maintenance and repair costs, which will aid in the market's continued growth. Telecom operators all around the globe choose aerial fibre optic deployment due to advantages including cost effectiveness, rapid deployment, and flexibility. For instance, the French telecom company Orange S.A. (France) said in January 2022 that it had deployed optical fibre to almost 63% of the 29 million FTTH-eligible premises in France.

By Application

The Application segment includes Communication (Telecom, Premises, Utility, CATV, Military, Industrial and Others) and Non-communication (Sensors and Fiber Optic Lighting). The Communication segment led the Fiber optics market with a market share of around 58.08% in 2021. The significant market share is partly attributable to the rising use of fibre optics in the telecom industry. Point-to-point communication, entertainment, content delivery networks, access to Internet-enabled services, critical communication, and news & infotainment are just a few of the uses for fibre optics in the telecom sector. Its growth is due to a variety of causes, including an increase in Internet users, low-cost services offered by service providers, the availability of low-cost communication equipment, and a rise in subscribers for various wireless and fixed-point communication devices.

Global Fiber optics Market- Sales Analysis

The sale of Fiber optics types expanded at a CAGR of 4.2% from 2015 to 2021.

In endoscopes, fibre optics are used to assist the medical imaging and lighting parts of the instruments. Biomedical sensors are another area where fibre optics are used in medical equipment. Biomedical sensors may be used both internally and externally, and they can monitor a wide range of bodily parameters, including heart rate, blood pressure, body temperature, muscle displacement, and many other parameters.

Fiber optics are a vital instrument in medicine because of their non-toxic nature, compact size, and flexibility. They are also very helpful for many treatments. Their use has resulted in safer operations, efficient processes, quicker recoveries, and thorough exams.

The industry is further influenced by the widespread use of fibre optic technology in the military, aerospace, and railway industries due to the growing popularity of Plastic Optical Fiber (POF). For a wide range of marine, space, ground, and air requirements, including ground support systems and avionics testing equipment modules in fighter planes, the optical connection technology is employed in the military.

Thus, owing to the aforementioned factors, the global Fiber Optics Market is expected to grow at a CAGR of 6.7% during the Projection period from 2022 to 2029.

By Regional Analysis:

The regions analysed for the Fiber optics market include North America, Europe, South America, Asia Pacific, the Middle East and Africa. The Asia Pacific region dominated the Fiber optics market and held a 35% share of the market revenue in 2021.

- The Asia Pacific region witnessed a major share. Supporting governmental efforts, enhancing the region's healthcare system, and raising people's standards of life are a few of the elements boosting the market's expansion. In addition, rising medical tourism in nations like South Korea, Thailand, and Singapore is anticipated to fuel the expansion of fibre optics in the area. Additionally, the major players want to invest in developing nations like China and India, which is anticipated to fuel market expansion.

- Middle East and Africa is anticipated to experience significant growth during the predicted period. Due to rising interest for aesthetic laser procedures and rising knowledge of less invasive procedures. The region's expanding senior population and rising cancer prevalence are anticipated to further fuel the market. Additionally, it is anticipated that throughout the projected period, the rising need for early illness detection would have a beneficial influence on market growth.

Global Fiber Optics Market- Country Analysis:

- Germany

Germany’s Fiber optics market size was valued at USD 0.06 billion in 2021 and is expected to reach USD 0.18 billion by 2029, at a CAGR of 15% from 2022 to 2029. Manufacturers of electronics and semiconductors as well as end customers may be found in great numbers in Germany. Additionally, a larger number of COVID-19 infection cases have been reported, and the fight against the spread is currently ongoing. The governments have relaxed the lockdown regulations and enabled the production facilities to function, but the shrinking market for fibre optic sensors has been negatively impacted. Due to the severe impact on the whole electronics and semiconductor manufacturing sector, the recovery phase is anticipated to end by late 2021.

- China

China’s Fiber optics’ market size was valued at USD 0.054 billion in 2021 and is expected to reach USD 0.13 billion by 2029, at a CAGR of 12% from 2022 to 2029. The china economy continues to expand at a fast rate, which has been driven by long-term improvements in industrial output, import and export, consumer spending, and capital investment. In a recent research, China's economic trends, investment climate, industry development, supply and demand, industry capacity, industry structure, marketing channels, and important industry participants were examined.

- India

India's Fiber optics market size was valued at USD 0.049 billion in 2021 and is expected to reach USD 0.11 billion by 2029, at a CAGR of 11% from 2022 to 2029. An optical fibre is a flexible, transparent fibre used to transport light that is created by drawing glass or plastic. In fiber-optic communications, where they enable transmission over greater distances and at higher bandwidths than wire lines, the optical fibre is widely used. Fiber optic cables are increasingly being used to transmit communications with minimal signal loss, which is what is driving the market's expansion.

Key Industry Players Analysis:

To increase their market position in the global Fiber optics business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, type developments, collaborations, partnerships, joint ventures, etc.

- Adtell Integration

- Adtran, Inc.

- ADVA Optical Networking

- Broadcom, Inc.

- Ciena Corporation

- Cisco Systems, Inc.

- CommScope

- Corning, Inc.

- Finisar Corporation

- Fujitsu Optical Components Ltd.

- Furukawa Electric

- Hamamatsu Photonics K.K.

- Hengtong

- Huawei Technologies Co., Ltd.

- HUBER+SUHNER AG

Latest Development:

- In January 2022, Ability One Inc. (NYSE: CABO) revealed that it has purchased Clearwave Communications, a supplier of fiber-optic services, for an unknown price. The move will enable Cable One provide its customers with even better internet connections and improve the company's current broadband footprint.

- In March 2020, For an undisclosed sum, Clearwave Communications, a provider of fiber-optic services, was acquired by Ability One Inc. (NYSE: CABO). With the change, Cable One will be able to provide its clients even better internet connections and expand its present broadband reach.

Report Metrics

| Report Attribute | Details |

| Study Period | 2021-2029 |

| Base year | 2021 |

| CAGR (%) | 6.7% |

| Market Size | 1.30 billion in 2021 |

| Projection period | 2022-2029 |

| Projection unit | Value (USD) |

| Segments covered | By Type, By Cable Type, By Deployment, By Application and By Region. |

| Report Scope | Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

Companies covered | Adtell Integration, Adtran, Inc., ADVA Optical Networking, Broadcom, Inc., Ciena Corporation, Cisco Systems, Inc., CommScope, Corning, Inc., Finisar Corporation, Fujitsu Optical Components Ltd. among others. |

| By Type |

|

| By Cable Type |

|

| By Deployment |

|

| BY Application |

|

Regional scope |

|

Scope of the Report

Global Fiber Optics Market by Fiber Type:

- Glass

- Plastic

Global Fiber Optics Market by Cable Type:

- Single-mode

- Multi-mode

Global Fiber Optics Market by Deployment:

- Underground

- Underwater

- Aerial

Global Fiber Optics Market by Application:

- Communication

- Telecom

- Premises

- Utility

- CATV

- Military

- Industrial

- Others

- Non-communication

- Sensors

- Fiber Optic Lighting

Global Fiber Optics Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the growth rate of the global Fiber optics market during the Projection period?

The global Fiber optics market is expected to grow with a 6.7% CAGR during the Projection period.

How is the North American Fiber optics market projected to grow?

The North American Fiber optics market was projected to gain a global market share of 39% in 2021.

What is the major driving factor of the Fiber optics market?

Increased adoption of Fiber Optic Technology drives the market�s growth.

Who are the key players in global Fiber optics market?

Global Fiber optics key market players are Abbott Laboratories, Thermo Fisher Scientific Inc., Bio Rad Laboratories Inc., Roche Holding AG, GE Healthcare, Illumina, Inc., Siemens AG, Bristol-Myers Squibb, Toshiba Medical Systems Corporation, Koninklijke Philips N.V., and Agilent Technologies Inc.

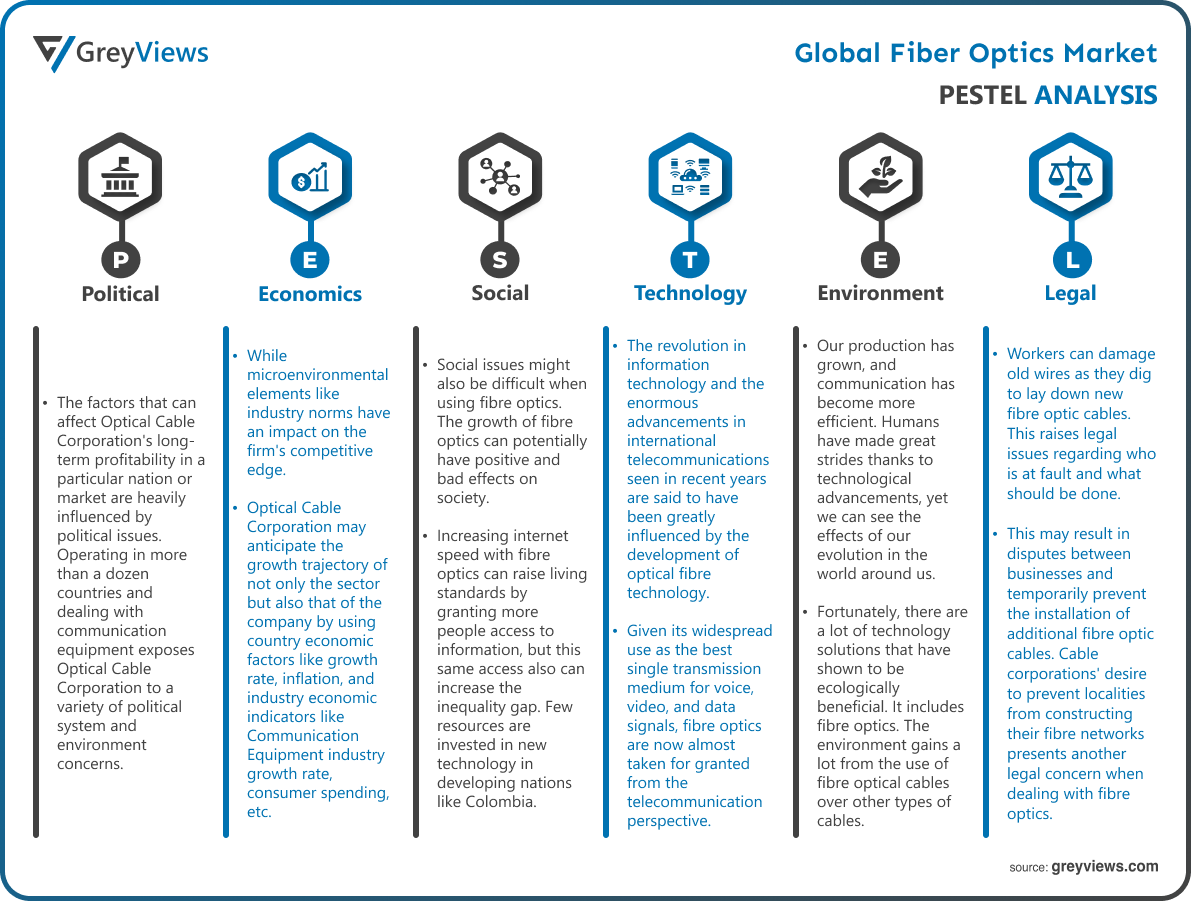

Political Factors- The factors that can affect Optical Cable Corporation's long-term profitability in a particular nation or market are heavily influenced by political issues. Operating in more than a dozen countries and dealing with communication equipment exposes Optical Cable Corporation to a variety of political system and environment concerns. Diversifying the systemic risks of the political environment is necessary to succeed in such a dynamic business as communication equipment across numerous nations. Political stability and the sector's significance to the economy of the nation. Product labelling requirements and related matters for communication equipment affect the market growth.

Economical Factors- The aggregate demand and aggregate investment in an economy are determined by the macroenvironmental factors, such as the inflation rate, savings rate, interest rate, foreign exchange rate, and economic cycle. While microenvironmental elements like industry norms have an impact on the firm's competitive edge. Optical Cable Corporation may anticipate the growth trajectory of not only the sector but also that of the company by using country economic factors like growth rate, inflation, and industry economic indicators like Communication Equipment industry growth rate, consumer spending, etc. What kind of economic structure exists in the nations where we operate and how stable it is affect the market’s growth.

Social Factor- Social issues might also be difficult when using fibre optics. The growth of fibre optics can potentially have positive and bad effects on society. Increasing internet speed with fibre optics can raise living standards by granting more people access to information, but this same access also can increase the inequality gap. Few resources are invested in new technology in developing nations like Colombia. In exchange, there isn't much information available on the internet. When having good internet is feasible, it is expensive. Due to this, the technological access to knowledge gap is getting wider. Further democratic societies, increased public participation in decision-making, and an increase in expertise that could spur more growth could all result from universal internet access. Social issues might be reduced if fibre optics technologies spread to additional nations. The same internet speed disparity in the United States might lead to social problems. When fibre optic internet speeds are unavailable in a community, people become irate. Because of this, social challenges arise that businesses must address. The company's reputation could be damaged, hindering some of its recent growth.

Technological Factors- The revolution in information technology and the enormous advancements in international telecommunications seen in recent years are said to have been greatly influenced by the development of optical fibre technology. Given its widespread use as the best single transmission medium for voice, video, and data signals, fibre optics are now almost taken for granted from the telecommunication perspective. This remarkable expansion within such a short time, which was rarely seen in any other technology, has largely been attributed to the Internet revolution and the deregulation of the telecommunications sector from government constraints, which took happened practically globally in the recent past. The initial focus of research and development (R&D) in this area had been on obtaining optical transparency through the use of the high-silica optical fibres' low-loss and low-dispersion transmission wavelength windows.

Environmental Factors- Technology's inception has significantly improved people's lives. Our production has grown, and communication has become more efficient. Humans have made great strides thanks to technological advancements, yet we can see the effects of our evolution in the world around us. Fortunately, there are a lot of technology solutions that have shown to be ecologically beneficial. It includes fibre optics. The environment gains a lot from the use of fibre optical cables over other types of cables. It is a long-lasting solution that uses less energy and lessens greenhouse gas emissions. The majority of the optical fibres in fibre networks are constructed of glass, which is produced from silicon dioxide (SiO2). On earth, silicon is thought to be the second most prevalent element. Sand, clay, rocks, and water all contain it naturally. Production has no negative environmental consequences, and harvesting has no adverse side effects.

Legal Factors- The installation of fibre optic cables raises one legal concern related to developing fibre optics. Workers can damage old wires as they dig to lay down new fibre optic cables. This raises legal issues regarding who is at fault and what should be done. This may result in disputes between businesses and temporarily prevent the installation of additional fibre optic cables. Cable corporations' desire to prevent localities from constructing their fibre networks presents another legal concern when dealing with fibre optics. The installation of fibre optic cables raises one legal concern related to developing fibre optics. Workers can damage old wires as they dig to lay down new fibre optic cables. This raises legal issues regarding who is at fault and what should be done. This may result in disputes between businesses and temporarily prevent the installation of additional fibre optic cables. Cable corporations' desire to prevent localities from constructing their fibre networks presents another legal concern when dealing with fibre optics. In recent years, cable companies and cities have clashed over who gets to put fibre optic connections in which locations. While the city wants to construct to increase tax revenue, cable corporations want to develop in communities to increase their profits. In order to decide who can install the wires, cable corporations engage in intricate legal fights and lobbying.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Type

- 3.2. Market Attractiveness Analysis By Cable Type

- 3.3. Market Attractiveness Analysis By Deployment

- 3.4. Market Attractiveness Analysis By Application

- 3.5. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Adoption of Fiber Optic Technology

- 3. Restraints

- 3.1. Concerns associated with lost signal and no possible data recovery

- 4. Opportunities

- 4.1. Surging deployment of 5G communication networks

- 5. Challenges

- 5.1. Challenges in installing fiber optics networks in difficult terrains and high cost of installation

- 6. COVID-19 Impact

- Global Fiber optics Market Analysis and Projection, By Type

- 1. Segment Overview

- 2. Glass

- 3. Plastic

- 4. Powder

- 5. Water

- Global Fiber optics Market Analysis and Projection, By Cable Type

- 1. Segment Overview

- 2. Ingle-mode

- 3. Multi-mode

- Global Fiber optics Market Analysis and Projection, By Deployment

- 1. Segment Overview

- 2. Underground

- 3. Underwater

- 4. Aerial

- Global Fiber optics Market Analysis and Projection, By Deployment

- 1. Communication

- 1.1. Telecom

- 1.2. Premises

- 1.3. Utility

- 1.4. CATV

- 1.5. Military

- 1.6. Industrial

- 1.7. Others

- 2. Non-communication

- 2.1. Sensors

- 2.2. Fiber Optic Lighting

- 1. Communication

- Global Fiber optics Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- South America

- 5.1. Brazil

- Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Fiber optics Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Fiber optics Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Adtell Integration

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Adtran, Inc.

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- ADVA Optical Networking

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Broadcom, Inc.

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Ciena Corporation

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Cisco Systems, Inc.

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- CommScope

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Corning, Inc.

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Finisar Corporation

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Fujitsu Optical Components Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Adtell Integration

List of Table

- Global Fiber optics Market, By Type, 2021–2029 (USD Billion)

- Global Glass, Fiber optics Market, By Region, 2021–2029 (USD Billion)

- Global Plastic, Fiber optics Market, By Region, 2021–2029 (USD Billion)

- Global Fiber optics Market, By Cable Type, 2021–2029 (USD Billion)

- Global Ingle-mode, Fiber optics Market, By Region, 2021–2029 (USD Billion)

- Global Multi-mode, Fiber optics Market, By Region, 2021–2029 (USD Billion)

- Global Fiber optics Market, By Deployment, 2021–2029 (USD Billion)

- Global Underground, Fiber optics Market, By Region, 2021–2029 (USD Billion)

- Global Underwater, Fiber optics Market, By Region, 2021–2029 (USD Billion)

- Global Aerial, Fiber optics Market, By Region, 2021–2029 (USD Billion)

- Global Fiber optics Market, By Application, 2021–2029 (USD Billion)

- Global Communication, Fiber optics Market, By Region, 2021–2029 (USD Billion)

- Global Non-communication, Fiber optics Market, By Region, 2021–2029 (USD Billion)

- Global Fiber optics Market, By Region, 2021–2029 (USD Billion)

- North America Fiber optics Market, By Type, 2021–2029 (USD Billion)

- North America Fiber optics Market, By Cable Type, 2021–2029 (USD Billion)

- North America Fiber optics Market, By Deployment, 2021–2029 (USD Billion)

- North America Fiber optics Market, By Application, 2021–2029 (USD Billion)

- USA Fiber optics Market, By Type, 2021–2029 (USD Billion)

- USA Fiber optics Market, By Cable Type, 2021–2029 (USD Billion)

- USA Fiber optics Market, By Deployment, 2021–2029 (USD Billion)

- USA Fiber optics Market, By Application, 2021–2029 (USD Billion)

- Canada Fiber optics Market, By Type, 2021–2029 (USD Billion)

- Canada Fiber optics Market, By Cable Type, 2021–2029 (USD Billion)

- Canada Fiber optics Market, By Deployment, 2021–2029 (USD Billion)

- Canada Fiber optics Market, By Application, 2021–2029 (USD Billion)

- Mexico Fiber optics Market, By Type, 2021–2029 (USD Billion)

- Mexico Fiber optics Market, By Cable Type, 2021–2029 (USD Billion)

- Mexico Fiber optics Market, By Deployment, 2021–2029 (USD Billion)

- Mexico Fiber optics Market, By Application, 2021–2029 (USD Billion)

- Europe Fiber optics Market, By Type, 2021–2029 (USD Billion)

- Europe Fiber optics Market, By Cable Type, 2021–2029 (USD Billion)

- Europe Fiber optics Market, By Deployment, 2021–2029 (USD Billion)

- Europe Fiber optics Market, By Application, 2021–2029 (USD Billion)

- Germany Fiber optics Market, By Type, 2021–2029 (USD Billion)

- Germany Fiber optics Market, By Cable Type, 2021–2029 (USD Billion)

- Germany Fiber optics Market, By Deployment, 2021–2029 (USD Billion)

- Germany Fiber optics Market, By Application, 2021–2029 (USD Billion)

- France Fiber optics Market, By Type, 2021–2029 (USD Billion)

- France Fiber optics Market, By Cable Type, 2021–2029 (USD Billion)

- France Fiber optics Market, By Deployment, 2021–2029 (USD Billion)

- France Fiber optics Market, By Application, 2021–2029 (USD Billion)

- UK Fiber optics Market, By Type, 2021–2029 (USD Billion)

- UK Fiber optics Market, By Cable Type, 2021–2029 (USD Billion)

- UK Fiber optics Market, By Deployment, 2021–2029 (USD Billion)

- UK Fiber optics Market, By Application, 2021–2029 (USD Billion)

- Italy Fiber optics Market, By Type, 2021–2029 (USD Billion)

- Italy Fiber optics Market, By Cable Type, 2021–2029 (USD Billion)

- Italy Fiber optics Market, By Deployment, 2021–2029 (USD Billion)

- Italy Fiber optics Market, By Application, 2021–2029 (USD Billion)

- Spain Fiber optics Market, By Type, 2021–2029 (USD Billion)

- Spain Fiber optics Market, By Cable Type, 2021–2029 (USD Billion)

- Spain Fiber optics Market, By Deployment, 2021–2029 (USD Billion)

- Spain Fiber optics Market, By Application, 2021–2029 (USD Billion)

- Asia Pacific Fiber optics Market, By Type, 2021–2029 (USD Billion)

- Asia Pacific Fiber optics Market, By Cable Type, 2021–2029 (USD Billion)

- Asia Pacific Fiber optics Market, By Deployment, 2021–2029 (USD Billion)

- Asia Pacific Fiber optics Market, By Application, 2021–2029 (USD Billion)

- Japan Fiber optics Market, By Type, 2021–2029 (USD Billion)

- Japan Fiber optics Market, By Cable Type, 2021–2029 (USD Billion)

- Japan Fiber optics Market, By Deployment, 2021–2029 (USD Billion)

- Japan Fiber optics Market, By Application, 2021–2029 (USD Billion)

- China Fiber optics Market, By Type, 2021–2029 (USD Billion)

- China Fiber optics Market, By Cable Type, 2021–2029 (USD Billion)

- China Fiber optics Market, By Deployment, 2021–2029 (USD Billion)

- China Fiber optics Market, By Application, 2021–2029 (USD Billion)

- India Fiber optics Market, By Type, 2021–2029 (USD Billion)

- India Fiber optics Market, By Cable Type, 2021–2029 (USD Billion)

- India Fiber optics Market, By Deployment, 2021–2029 (USD Billion)

- India Fiber optics Market, By Application, 2021–2029 (USD Billion)

- South America Fiber optics Market, By Type, 2021–2029 (USD Billion)

- South America Fiber optics Market, By Cable Type, 2021–2029 (USD Billion)

- South America Fiber optics Market, By Deployment, 2021–2029 (USD Billion)

- South America Fiber optics Market, By Application, 2021–2029 (USD Billion)

- Brazil Fiber optics Market, By Type, 2021–2029 (USD Billion)

- Brazil Fiber optics Market, By Cable Type, 2021–2029 (USD Billion)

- Brazil Fiber optics Market, By Deployment, 2021–2029 (USD Billion)

- Brazil Fiber optics Market, By Application, 2021–2029 (USD Billion)

- Middle East and Africa Fiber optics Market, By Type, 2021–2029 (USD Billion)

- Middle East and Africa Fiber optics Market, By Cable Type, 2021–2029 (USD Billion)

- Middle East and Africa Fiber optics Market, By Deployment, 2021–2029 (USD Billion)

- Middle East and Africa Fiber optics Market, By Application, 2021–2029 (USD Billion)

- UAE Fiber optics Market, By Type, 2021–2029 (USD Billion)

- UAE Fiber optics Market, By Cable Type, 2021–2029 (USD Billion)

- UAE Fiber optics Market, By Deployment, 2021–2029 (USD Billion)

- UAE Fiber optics Market, By Application, 2021–2029 (USD Billion)

- South Africa Fiber optics Market, By Type, 2021–2029 (USD Billion)

- South Africa Fiber optics Market, By Cable Type, 2021–2029 (USD Billion)

- South Africa Fiber optics Market, By Deployment, 2021–2029 (USD Billion)

- South Africa Fiber optics Market, By Application, 2021–2029 (USD Billion)

List of Figures

- Global Fiber optics Market Segmentation

- Fiber optics Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Fiber optics Market Attractiveness Analysis By Type

- Global Fiber optics Market Attractiveness Analysis By Cable Type

- Global Fiber optics Market Attractiveness Analysis By Deployment

- Global Fiber optics Market Attractiveness Analysis By Application

- Global Fiber optics Market Attractiveness Analysis By Region

- Global Fiber optics Market: Dynamics

- Global Fiber optics Market Share By Type (2021 & 2029)

- Global Fiber optics Market Share By Cable Type (2021 & 2029)

- Global Fiber optics Market Share By Deployment (2021 & 2029)

- Global Fiber optics Market Share By Application(2021 & 2029)

- Global Fiber optics Market Share by Regions (2021 & 2029)

- Global Fiber optics Market Share by Company (2020)