Flat Glass Market Size by Product Type (Basic Float Glass, Toughened Glass, Coated Glass, Laminated Glass, Extra Clear Glass, and Others), Technology (Float, Rolled, and Sheet), End-Use Industry (Construction & Infrastructure, Automotive & Transportation, Solar Energy, and Others), Regions, Segmentation, and Projection till 2029

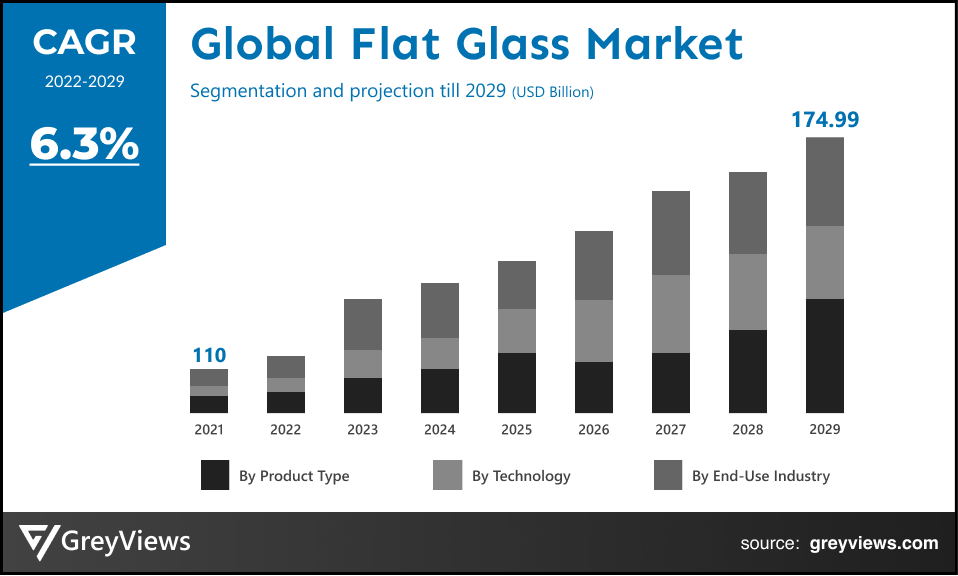

CAGR: 6.3%Current Market Size: USD 110.00 BillionFastest Growing Region: Europe

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Flat Glass- Market Overview

The global flat glass market is expected to grow from USD 110.00 billion in 2021 to USD 174.99 billion by 2029, at a CAGR of 6.3% during the Projection period 2022-2029. The growth of the flat glass market is primarily driven by the rising penetration of glass architecture in non-residential as well as residential constructions, along with a growing number of solar energy installations across the globe.

Flat glass is manufactured by spreading molten glass in sheets on a metal plane to form glass as flat as sheets of paper. It mainly refers to all types of glass manufactured in sheets, such as cast glass, float glass, and blown flat glass. This type of glass is produced via controlled chemical and thermal reactions to ensure toughness in the structural formation. Glass made in this way has a significantly smooth surface and is ideal for finishing. The flat glass industry, coupled with the flat glass finishing & processing industry players, is rapidly manufacturing flat glass products for construction, architecture, automotive, and furniture applications.

The most commonly used type of flat glass is float glass, which has now replaced most glass manufacturing processes and is used for the applications such as vehicle safety glass and mirror glass.

Request Sample:- Global Flat Glass Market

Market Dynamics:

Drivers:

- Increasing demand for flat glass in the construction & infrastructure industry

The ongoing trend of environmentally friendly practices across the workplace and domestic settings has led to the adoption of flat glass in large commercial building construction. The building industry has used glass as insulation material, external glazing material, structural components, and cladding material. In addition, the glass is rapidly being used to make delicate-looking fenestrations on conventional windows as well as facades. Hence, the growth of the global construction and infrastructure industry is boosting the growth of the global flat glass market.

- Rising penetration of flat glass in passenger cars, trains, and buses

High-quality windshield glass in automobiles to protect drivers and passengers from dust, dirt, and debris has driven demand for flat glass. In addition, wide usage of flat tempered glass in city buses and curved windows in coaches and intercity buses is seen across the globe. Therefore, the increasing number of passenger cars and buses across the world is fueling the growth of the flat glass market.

Restraints:

- Stringent government regulations on carbon dioxide emission

The global glass manufacturing industry produces about 86 million tons of carbon dioxide annually. The source of these emissions in glass manufacturing is high-temperature heat from fuel combustion for melting. However, the government agencies such as the U.S. Environmental Protection Agency (EPA) regulate carbon dioxide emissions. Hence, global environmental protection industries' regulations hamper the global market growth.

Opportunities:

- Rising investments in infrastructure projects across developing countries

According to the Asian Development Bank report, developing countries in the Asia-Pacific region annually invest about $881 billion in infrastructure. In addition, the infrastructure sector has become the most significant focus area for the countries such as India and China. For instance, India planned to spend about $1.4 trillion on infrastructure development during 2019-to 23 to have a sustainable development of the country. Such investments are expected to create demand for flat glass in the construction sector in developing countries.

Challenges

- Volatile raw material prices during the COVID-19 pandemic

The global COVID-19 pandemic has forced all industries to change the way of managing assets and workforces. In addition, the global automotive and construction sector saw supply chain disruptions due to large-scale manufacturing interruptions within Europe, the closure of assembly plants in the U.S., and disturbance in Chinese parts exports. Also, the pandemic has caused a decline in construction activities across the globe. Hence, disruption in the supply chain during the pandemic has posed considerable challenges to the flat glass industry.

Segmentation Analysis:

The global flat glass market has been segmented based on product type, technology, end-use industry, and regions.

By Product Type

The product type segment includes basic float glass, toughened glass, coated glass, laminated glass, extra clear glass, and others. The primary float glass segment led the flat glass market with a market share of around 52.71% in 2021. This is attributed to the rising application of float glass for smaller windows in domestic housing. In addition, this type of glass is extremely smooth and distortion-free. Moreover, float glass is considered to be of better visual quality and more accessible to transport and fabricate than sheet manufactured glass. The properties mentioned above of float glass have primarily driven the growth of this segment.

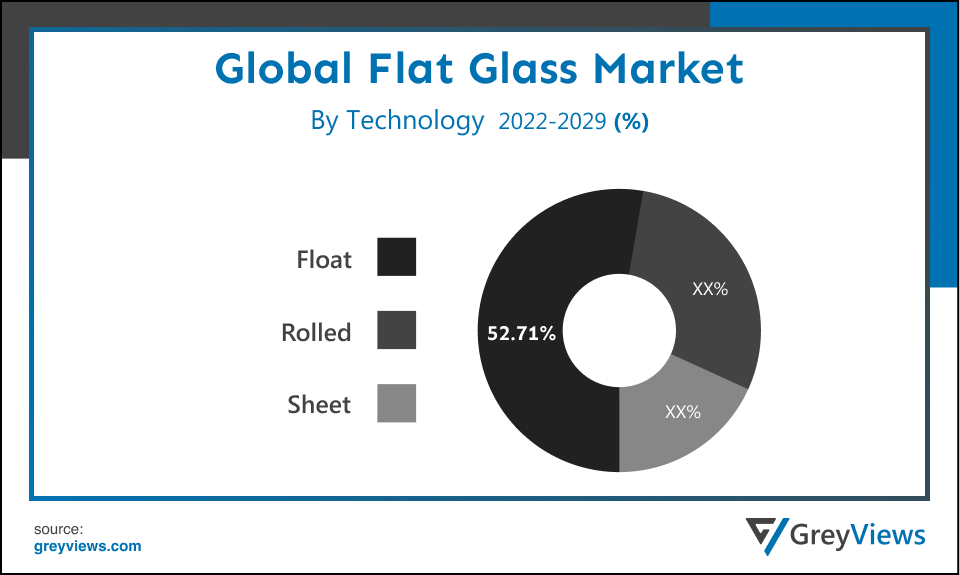

By Technology

The technology segment includes float, rolled, and sheet. The float segment led the flat glass market with a share of around 62.09% in 2021. The glass produced by float technology is considered to be of enhanced visual quality and more accessible to transport and fabricate as compared with the sheet manufactured glass. In addition, the float technology process enables much larger sizes for thinner glass products. The factors above have primarily driven the growth of the floating segment.

By End-Use Industry

The end-use industry segment includes construction & infrastructure, automotive & transportation, solar energy, and others. The construction & infrastructure segment led the flat glass market with a market share of around 61.01% in 2021. Rapid urbanization and a growing population have led to a surge in construction activities and infrastructural developments across the globe. This has primarily driven the growth of the construction & infrastructure segment. In addition, the rising investment in infrastructural developments across developing countries further fuels the growth of this segment.

By Regional Analysis

The regions analyzed for the flat glass market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. The Asia-Pacific region dominated the flat glass market and held the 53.01% share of the market revenue in 2021.

- The Asia-Pacific region witnessed a significant Increasing infrastructural developments across the developing economies such as India and China, substantial automotive production, and increasing installation of solar panels have primarily driven the growth of the Asia-Pacific flat glass market. For instance, this region will remain the critical construction and real estate industry, accounting for about 40% of the global construction industry’s output value by 2030.

- Europe is expected to witness a considerable growth rate during the Projection period. The market growth in this region is mainly driven by increasing applications of flat glass in commercial and residential construction due to the need for enhanced flexibility, fire protection, noise protection, self-cleaning, and insulation properties.

Global Flat Glass Market- Country Analysis:

- Germany

Germany's flat glass market size was valued at USD 8.80 billion in 2021 and is expected to reach USD 13.79 billion by 2029, at a CAGR of 6.1% from 2022 to 2029.

Germany is one of the leading nations in the mechanical engineering, manufacturing, automotive, and electrical industries. In addition, according to the Germany Trade & Invest, the economic development agency of the Federal Republic of Germany, this country is the leading automotive market in Europe, accounting for about 25% of all passenger cars manufactured in the region. Hence, the rising demand for flat glass from the automotive sector in the country fuels the growth of the flat glass market.

- China

China's flat glass market size was valued at USD 28.60 billion in 2021 and is expected to reach USD 44.48 billion by 2029, at a CAGR of 6.0% from 2022 to 2029. China is the world’s largest light-vehicle manufacturer. In addition, this country is a leading automotive producer, consumer, and exporter. In addition, the country is significantly investing in construction and infrastructure development. For instance, China’s 14th Five-Year Plan (2021-2025) is a well-calibrated layout for developing the country's new infrastructure. The above factors have driven demand for flat glass in the automotive and the country's construction sectors.

- India

India's flat glass market size was valued at USD 7.37 billion in 2021 and is expected to reach USD 12.79 billion by 2029, at a CAGR of 7.5% from 2022 to 2029. India is one of the strongest growing economies in Asia. In addition, the emerging popularity of flat glass in this country is expected to create lucrative growth opportunities for the flat glass market. On the other hand, in the past few years, the Indian construction industry has become an attractive destination for foreign investment. Hence, the growth of the country's construction sector is opportunistic for market growth.

Key Industry Players Analysis:

To increase their market position in the global flat glass business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Asahi Glass

- Saint-Gobain

- Nippon Sheet Glass

- Guardian Industries

- Taiwan Glass Ind. Corp.

- Sisecam Group

- Fuyao Glass Industry Group

- Vitro, S.A.B. De C.V.

- CSG Holding Co., Ltd.

- Central Glass

Latest Development:

- In May 2022, NSG Group launched a new "High-Performance Materials Website", a communication platform for promoting the unique values and functions of its different functional glass products.

- In June 2021, Cardinal Glass Industries signed a contract to acquire the assets of AGC Glass in Churchill, Tenn.; Abingdon, Va.; and Spring Hill, Kan. This acquisition is expected to expand the float, coating, and tempering capacity of Cardinal Glass Industries, allowing it to stay responsive to the needs of its increasing customer base.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year considered |

2021 |

|

CAGR (%) |

6.3% |

|

Market Size |

110.00 billion in 2021 |

|

Projection period |

2021-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Product Type, Technology, End-Use Industry, and Region |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Asahi Glass, Saint-Gobain, Nippon Sheet Glass, Guardian Industries, Taiwan Glass Ind. Corp., Sisecam Group, Fuyao Glass Industry Group, Vitro, S.A.B. De C.V., CSG Holding Co., Ltd., Central Glass among others |

|

By Product Type |

|

|

By Technology |

|

|

By End-Use Industry |

|

|

Regional scope |

|

Scope of the Report

Global Flat Glass Market by Product Type:

- Basic Float Glass

- Toughened Glass

- Coated Glass

- Laminated Glass

- Extra Clear Glass

- Others

Global Flat Glass Market by Technology:

- Float

- Rolled

- Sheet

Global Flat Glass Market by End-Use Industry:

- Construction & Infrastructure

- Automotive & Transportation

- Solar Energy

- Others

Global Flat Glass Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- The Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the Size of Flat Glass Market?

Global flat glass market Size is USD 110.00 billion in 2021 and will Grow To USD 174.99 billion by 2029, at a CAGR of 6.3% Throughout the Projection period 2022-2029

Who are the End User of Flat Glass?

End-user are construction & infrastructure, automotive & transportation, solar energy, and others. Rapid urbanization and a growing population have led to a surge in construction activities and infrastructural developments across the globe. This has primarily driven the growth of the construction & infrastructure segment. In addition, the rising investment in infrastructural developments across developing countries further fuels the growth of this segment

Which Region Dominate The Global Flat Glass Market?

Asia-Pacific region dominated the flat glass market and held the 53.01% share of the market revenue in 2021

What are the Challenges in Global Flat Glass Market?

The global COVID-19 pandemic has forced all industries to change the way of managing assets and workforces. In addition, the global automotive and construction sector saw supply chain disruptions due to large-scale manufacturing interruptions within Europe, the closure of assembly plants in the U.S., and disturbance in Chinese parts exports. Also, the pandemic has caused a decline in construction activities across the globe. Hence, disruption in the supply chain during the pandemic has posed considerable challenges to the flat glass industry

What is the Latest Development in Flat Glass Market?

In May 2022, NSG Group launched a new "High-Performance Materials Website", a communication platform for promoting the unique values and functions of its different functional glass products.

What are the Economical factor in Flat Glass?

The economic factor for any business includes recession, inflation, growth in GDP, population growth, etc. rise in raw material prices increases the cost of the final product, and to maintain profitability, the organization has to increase its prices. The organization can leverage this trend by expanding its product range and targeting new customers. For instance, according to the Asian Development Bank report, developing countries in the Asia-Pacific region annually invest about $881 billion in infrastructure. In addition, the infrastructure sector has become the most significant focus area for the countries such as India and China. For instance, India planned to spend about $1.4 trillion on infrastructure development during 2019-to 23 to have a sustainable development of the country. Such investments are expected to create demand for flat glass in the construction sector in developing countries.

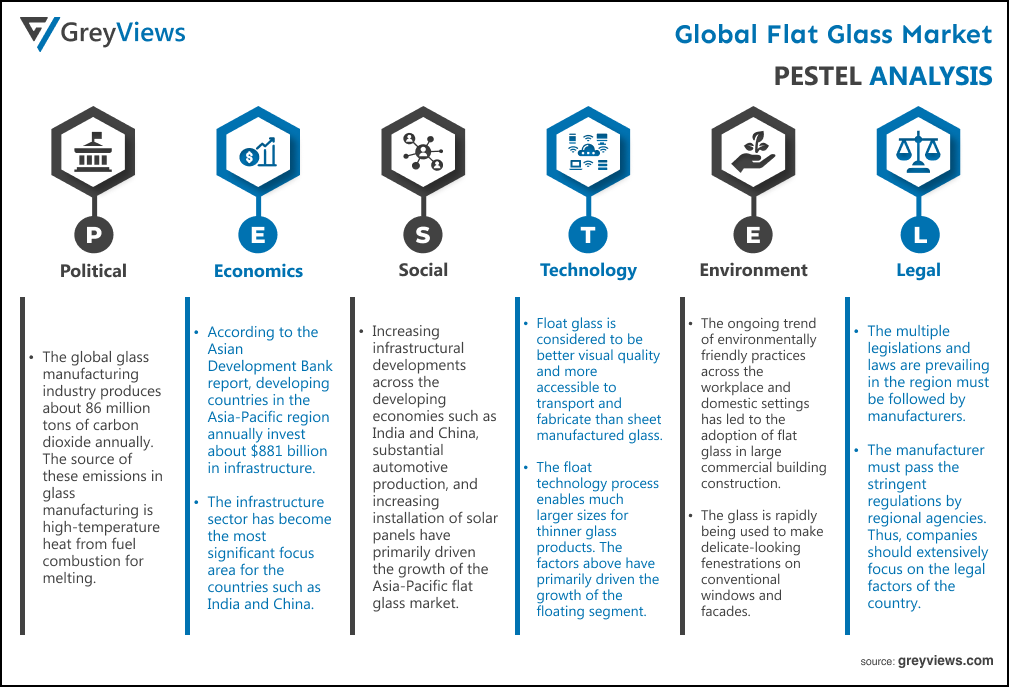

Political Factors- The global glass manufacturing industry produces about 86 million tons of carbon dioxide annually. The source of these emissions in glass manufacturing is high-temperature heat from fuel combustion for melting. However, the government agencies such as the U.S. Environmental Protection Agency (EPA) regulate carbon dioxide emissions. Hence, global environmental protection industries' regulations hamper the global market growth.

Economical Factors- The economic factor for any business includes recession, inflation, growth in GDP, population growth, etc. rise in raw material prices increases the cost of the final product, and to maintain profitability, the organization has to increase its prices. The organization can leverage this trend by expanding its product range and targeting new customers. For instance, according to the Asian Development Bank report, developing countries in the Asia-Pacific region annually invest about $881 billion in infrastructure. In addition, the infrastructure sector has become the most significant focus area for the countries such as India and China. For instance, India planned to spend about $1.4 trillion on infrastructure development during 2019-to 23 to have a sustainable development of the country. Such investments are expected to create demand for flat glass in the construction sector in developing countries.

Social Factor- Increasing infrastructural developments across the developing economies such as India and China, substantial automotive production, and increasing installation of solar panels have primarily driven the growth of the Asia-Pacific flat glass market. For instance, this region will remain the critical construction and real estate industry, accounting for about 40% of the global construction industry’s output value by 2030. The market growth in this region is mainly driven by increasing applications of flat glass in commercial and residential construction due to the need for enhanced flexibility, fire protection, noise protection, self-cleaning, and insulation properties.

Technological Factors- Float glass is considered to be better visual quality and more accessible to transport and fabricate than sheet manufactured glass. Several research and development activities are being conducted to enhance the features of the float glass. The glass produced by float technology is considered to be of enhanced visual quality and more accessible to transport and fabricate as compared with the sheet manufactured glass. In addition, the float technology process enables much larger sizes for thinner glass products. The factors above have primarily driven the growth of the floating segment.

Environmental Factors- The ongoing trend of environmentally friendly practices across the workplace and domestic settings has led to the adoption of flat glass in large commercial building construction. The building industry has used glass as insulation material, outer glazing material, structural components, and cladding material. In addition, the glass is rapidly being used to make delicate-looking fenestrations on conventional windows and facades. Hence, the growth of the global construction and infrastructure industry is boosting the growth of the global flat glass market.

Legal Factors- The multiple legislations and laws are prevailing in the region must be followed by manufacturers. To set up a business, the manufacturer must pass the stringent regulations by regional agencies. Thus, companies should extensively focus on the legal factors of the country. Moreover, the laws related to employment laws, import and export, and labor laws must be taken care of. A lawful and legal organization can effectively survive in the long run. For instance, in June 2021, Cardinal Glass Industries signed a contract to acquire the assets of AGC Glass in Churchill, Tenn.; Abingdon, Va.; and Spring Hill, Kan. This acquisition is expected to expand the float, coating, and tempering capacity of Cardinal Glass Industries, allowing it to stay responsive to the needs of its increasing customer base. In May 2022, NSG Group launched a new "High-Performance Materials Website", a communication platform for promoting the unique values and functions of its different functional glass products.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Product Type

- Market Attractiveness Analysis By Technology

- Market Attractiveness Analysis By End-Use Industry

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Increasing demand for flat glass in construction & infrastructure industry

- Rising penetration of flat glass in passenger cars, trains, and buses

- Restrains

- Stringent government regulations on carbon dioxide emission

- Opportunities

- Rising investments in infrastructure projects across developing countries

- Challenges

- Volatile raw material prices during COVID-19 pandemic

- Global Flat Glass Market Analysis and Projection, By Product Type

- Segment Overview

- Basic Float Glass

- Toughened Glass

- Coated Glass

- Laminated Glass

- Extra Clear Glass

- Others

- Global Flat Glass Market Analysis and Projection, By Technology

- Segment Overview

- Float

- Rolled

- Sheet

- Global Flat Glass Market Analysis and Projection, By End-Use Industry

- Segment Overview

- Construction & Infrastructure

- Automotive & Transportation

- Solar Energy

- Others

- Global Flat Glass Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Flat Glass Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Flat Glass Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Product Type Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Asahi Glass

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Saint-Gobain

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Nippon Sheet Glass

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Guardian Industries

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Taiwan Glass Ind. Corp.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Sisecam Group

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Fuyao Glass Industry Group

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Vitro, S.A.B. De C.V.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- CSG Holding Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Central Glass

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Asahi Glass

List of Table

- Global Flat Glass Market, By Product Type, 2021–2029(USD Billion)

- Global Basic Float Glass Flat Glass Market, By Region, 2021–2029(USD Billion)

- Global Toughened Glass Flat Glass Market, By Region, 2021–2029(USD Billion)

- Global Coated Glass Flat Glass Market, By Region, 2021–2029(USD Billion)

- Global Laminated Glass Flat Glass Market, By Region, 2021–2029(USD Billion)

- Global Extra Clear Glass Flat Glass Market, By Region, 2021–2029(USD Billion)

- Global Others Flat Glass Market, By Region, 2021–2029(USD Billion)

- Global Flat Glass Market, By Technology, 2021–2029(USD Billion)

- Global Float Flat Glass Market, By Region, 2021–2029(USD Billion)

- Global Rolled Flat Glass Market, By Region, 2021–2029(USD Billion)

- Global Sheet Flat Glass Market, By Region, 2021–2029(USD Billion)

- Global Flat Glass Market, By End-Use Industry, 2021–2029(USD Billion)

- Global Construction & Infrastructure Flat Glass Market, By Region, 2021–2029(USD Billion)

- Global Automotive & Transportation Flat Glass Market, By Region, 2021–2029(USD Billion)

- Global Solar Energy Flat Glass Market, By Region, 2021–2029(USD Billion)

- Global Others Flat Glass Market, By Region, 2021–2029(USD Billion)

- Global Flat Glass Market, By Region, 2021–2029(USD Billion)

- Global Flat Glass Market, By North America, 2021–2029(USD Billion)

- North America Flat Glass Market, By Product Type, 2021–2029(USD Billion)

- North America Flat Glass Market, By Technology, 2021–2029(USD Billion)

- North America Flat Glass Market, By End-Use Industry, 2021–2029(USD Billion)

- USA Flat Glass Market, By Product Type, 2021–2029(USD Billion)

- USA Flat Glass Market, By Technology, 2021–2029(USD Billion)

- USA Flat Glass Market, By End-Use Industry, 2021–2029(USD Billion)

- Canada Flat Glass Market, By Product Type, 2021–2029(USD Billion)

- Canada Flat Glass Market, By Technology, 2021–2029(USD Billion)

- Canada Flat Glass Market, By End-Use Industry, 2021–2029(USD Billion)

- Mexico Flat Glass Market, By Product Type, 2021–2029(USD Billion)

- Mexico Flat Glass Market, By Technology, 2021–2029(USD Billion)

- Mexico Flat Glass Market, By End-Use Industry, 2021–2029(USD Billion)

- Europe Flat Glass Market, By Product Type, 2021–2029(USD Billion)

- Europe Flat Glass Market, By Technology, 2021–2029(USD Billion)

- Europe Flat Glass Market, By End-Use Industry, 2021–2029(USD Billion)

- Germany Flat Glass Market, By Product Type, 2021–2029(USD Billion)

- Germany Flat Glass Market, By Technology, 2021–2029(USD Billion)

- Germany Flat Glass Market, By End-Use Industry, 2021–2029(USD Billion)

- France Flat Glass Market, By Product Type, 2021–2029(USD Billion)

- France Flat Glass Market, By Technology, 2021–2029(USD Billion)

- France Flat Glass Market, By End-Use Industry, 2021–2029(USD Billion)

- UK Flat Glass Market, By Product Type, 2021–2029(USD Billion)

- UK Flat Glass Market, By Technology, 2021–2029(USD Billion)

- UK Flat Glass Market, By End-Use Industry, 2021–2029(USD Billion)

- Italy Flat Glass Market, By Product Type, 2021–2029(USD Billion)

- Italy Flat Glass Market, By Technology, 2021–2029(USD Billion)

- Italy Flat Glass Market, By End-Use Industry, 2021–2029(USD Billion)

- Spain Flat Glass Market, By Product Type, 2021–2029(USD Billion)

- Spain Flat Glass Market, By Technology, 2021–2029(USD Billion)

- Spain Flat Glass Market, By End-Use Industry, 2021–2029(USD Billion)

- Asia Pacific Flat Glass Market, By Product Type, 2021–2029(USD Billion)

- Asia Pacific Flat Glass Market, By Technology, 2021–2029(USD Billion)

- Asia Pacific Flat Glass Market, By End-Use Industry, 2021–2029(USD Billion)

- Japan Flat Glass Market, By Product Type, 2021–2029(USD Billion)

- Japan Flat Glass Market, By Technology, 2021–2029(USD Billion)

- Japan Flat Glass Market, By End-Use Industry, 2021–2029(USD Billion)

- China Flat Glass Market, By Product Type, 2021–2029(USD Billion)

- China Flat Glass Market, By Technology, 2021–2029(USD Billion)

- China Flat Glass Market, By End-Use Industry, 2021–2029(USD Billion)

- India Flat Glass Market, By Product Type, 2021–2029(USD Billion)

- India Flat Glass Market, By Technology, 2021–2029(USD Billion)

- India Flat Glass Market, By End-Use Industry, 2021–2029(USD Billion)

- South America Flat Glass Market, By Product Type, 2021–2029(USD Billion)

- South America Flat Glass Market, By Technology, 2021–2029(USD Billion)

- South America Flat Glass Market, By End-Use Industry, 2021–2029(USD Billion)

- Brazil Flat Glass Market, By Product Type, 2021–2029(USD Billion)

- Brazil Flat Glass Market, By Technology, 2021–2029(USD Billion)

- Brazil Flat Glass Market, By End-Use Industry, 2021–2029(USD Billion)

- Middle East and Africa Flat Glass Market, By Product Type, 2021–2029(USD Billion)

- Middle East and Africa Flat Glass Market, By Technology, 2021–2029(USD Billion)

- Middle East and Africa Flat Glass Market, By End-Use Industry, 2021–2029(USD Billion)

- UAE Flat Glass Market, By Product Type, 2021–2029(USD Billion)

- UAE Flat Glass Market, By Technology, 2021–2029(USD Billion)

- UAE Flat Glass Market, By End-Use Industry, 2021–2029(USD Billion)

- South Africa Flat Glass Market, By Product Type, 2021–2029(USD Billion)

- South Africa Flat Glass Market, By Technology, 2021–2029(USD Billion)

- South Africa Flat Glass Market, By End-Use Industry, 2021–2029(USD Billion)

List of Figures

- Global Flat Glass Market Segmentation

- Flat Glass Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Flat Glass Market Attractiveness Analysis By Product Type

- Global Flat Glass Market Attractiveness Analysis By Technology

- Global Flat Glass Market Attractiveness Analysis By End-Use Industry

- Global Flat Glass Market Attractiveness Analysis By Region

- Global Flat Glass Market: Dynamics

- Global Flat Glass Market Share By Product Type(2021 & 2029)

- Global Flat Glass Market Share By Technology(2021 & 2029)

- Global Flat Glass Market Share By End-Use Industry(2021 & 2029)

- Global Flat Glass Market Share by Regions (2021 & 2029)

- Global Flat Glass Market Share by Company (2020)