Flywheel Energy Storage System Market Size by Application (UPS, Distributed Energy Generation, Transport, Data Centers, and Others), Regions, Segmentation, and Projection till 2029

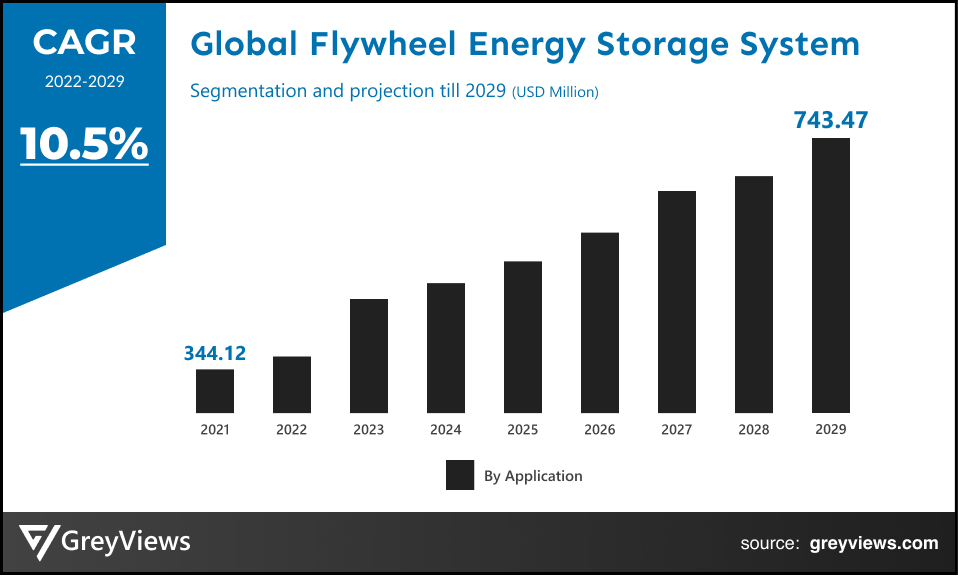

CAGR: 10.5%Current Market Size: USD 344.12 MillionFastest Growing Region: Europe

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Flywheel Energy Storage System- Market Overview:

The global flywheel energy storage system market is expected to grow from USD 344.12 million in 2021 to USD 743.47 million by 2029, at a CAGR of 10.5% during the Projection period 2022-2029. The growth of the energy storage market coupled with the flourishing automobile industry has primarily driven the growth of the global flywheel energy storage system market.

The flywheel energy storage system enables the smart method to store electricity in the form of kinetic energy. However, the flywheel is typically a mechanical battery that consists of a mass rotating around an axis. Hence, this technology has become a promising technology to replace conventional lead-acid batteries as an energy storage system. Presently, the flywheels are being made of a carbon fiber composite due to their high tensile strength and ability to store much more energy.

The Flywheel energy storage system operates in a vacuum to reduce drag, energy loss, and friction. These systems are used in energy grid storage as a reserve for momentary grid frequency regulation and balancing sudden changes between supply and consumption. In addition, these systems are finding applications in wind turbines, automobile engines, electric cars, and solar power systems.

Request Sample: - Flywheel Energy Storage System Market

Market Dynamics:

Drivers:

- The rise in demand for a reliable and clean electrical power

In the flywheel energy storage system, electrical energy is stored in a flywheel in the form of kinetic energy. The modern flywheel energy storage systems have a spinning speed of about 16,000 rpm with a capacity of up to 25 kWh. Hence, these systems provide an environmentally-friendly alternative for electrochemical batteries and play a significant role in sustainable energy transitions. In addition, this system is often used for renewable wind and solar power in remote locations. Hence, the employment of favorable government regulations associated with clean power generation and the rising need to lower reliance on fossil-fuel-based power sources has driven demand for flywheel energy storage systems. Therefore, the demand for reliable and clean electrical power is projected to boost growth of the global flywheel energy storage market.

- Need to provide electric power across the remote locations

Most of the islands and remote areas across the globe are facing problems to get reliable power from the grid. This has made flywheel, coupled with renewable energy provide a more economical and stable supply of electric power in such areas. For instance, these systems are preferred to be used in solar-powered microgrids installations across the remote locations. This is attributed to the fact that flywheels support the entire microgrid to prevent power quality problems resulting from surges and sags. Fluctuations associated with the unprotected solar installation may lead to the damage of the connected equipment along with sensitive electronics such as computers and other appliances. However, the use of flywheel energy storage systems in such installations has served as a power conditioner to absorb the fluctuations. Hence, demand for electric power in remote areas has significantly driven the growth of the global market.

Restraints:

- High costs associated with the flywheel energy storage systems

The flywheel energy storage systems have a considerable advantage over batteries to store electric power. However, the investment cost for entire system is significantly higher. For instance, the total investment costs associated with the composite rotor and steel rotor flywheel storage systems are $25.88 million and $18.28 million respectively. Therefore, as compared with the power battery energy storage technology, the large-scale application of flywheel energy storage technology has been hampered by its high initial investment cost.

Opportunities:

- Technological & product innovation and investment in the flywheel energy storage technology

The significant rise in the need for a reliable, safer, and greener approach to power backup in place of harmful, lead-acid-based batteries has led to technological and product innovation in the global flywheel energy storage systems market. Such innovations are aimed at delivering clean energy storage technology to industries. For instance, Beacon Power, energy storage and power electronics company is building the largest flywheel energy storage system in Stephentown, New York. This is a 20-megawatt system that marks a milestone in flywheel energy storage technology. In May 2020, the company has announced that 18-megawatts from the flywheel storage system are already online; however, the whole system was projected to operate at a full capacity by the end of June 2020. Such innovations are opportunistic for the growth of the global flywheel energy storage systems market.

Challenges

- Safety concerns and less maturity of the technology

The use of flywheels often leads to the safety concerns due to their high-speed rotor. In addition, these systems may possibility break loose and release all of its energy in an uncontrolled manner. On the other hand, the flywheel energy storage technology is comparatively less mature than chemical batteries. Also, these systems have considerably higher current costs due to which they are less competitive in the global energy storage systems industry. The aforementioned factors have prominently posed challenges to the market players.

Segmentation Analysis:

The global flywheel energy storage system market has been segmented based on application, and regions.

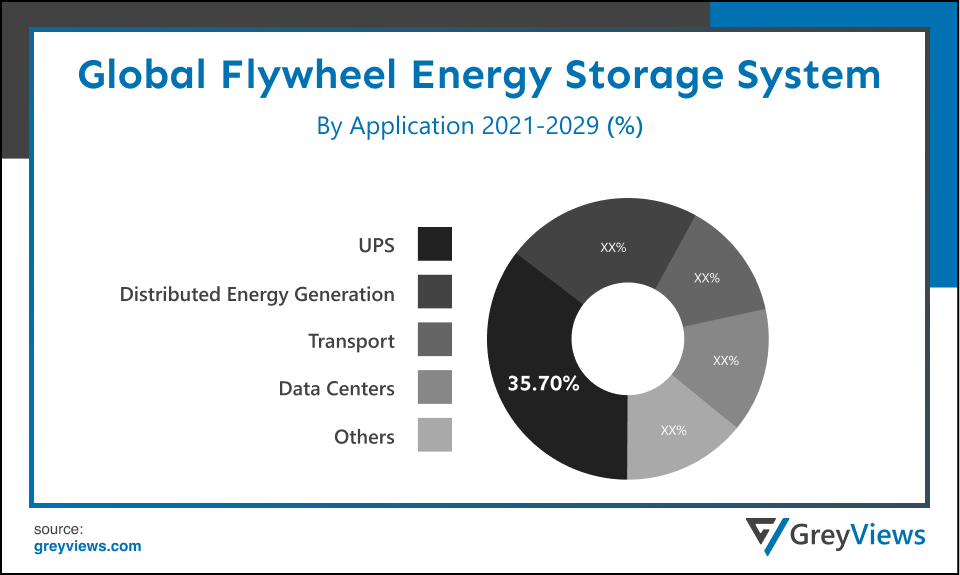

By Application

The application segment includes UPS, distributed energy generation, transport, data centers, and others. The UPS segment led the flywheel energy storage system market with a market share of around 35.70% in 2021. This is attributed to the fact that the uninterruptible power supply (UPS) is one of the major applications of flywheel energy storage systems to overcome problems faced by end-users due to sudden glitches or dips in electric and voltage supplies.

On the other hand, the global end users are looking for economical, reliable, and sustainable alternative to the lead-acid batteries used in UPS systems, creating the demand for flywheel applications in UPS. For instance, in April 2020, DataBank adopted Vycon’s Flywheel Systems solutions to solve its energy storage unpredictability issues. Vycon has helped DataBank to pair flywheels with Mitsubishi 9900B-750kVA three-phase, online, double-conversion UPS systems. According to the DataBank, this incorporation of Flywheel Systems is expected to be an economical and reliable alternative to the lead-acid batteries to be used with their UPS systems.

By Regional Analysis:

The regions analyzed for the flywheel energy storage system market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. The North American region dominated the flywheel energy storage system market and held a 72.01% share of the market revenue in 2021.

- North America region witnessed a major share as the flywheels energy storage systems are mainly being preferred to be used in combination with renewable energy sources. The U.S. is significantly focusing on reducing the carbon emissions, which is contributing to the demand for renewable technologies such as flywheel energy generation and storage. In addition, the region is seeing huge demand for UPS systems to maintain a continuous power supply intended for industrial and commercial applications. On the other hand, as the growing number of businesses are adopting cloud solutions, North America has become the largest data center region across the globe, with more than 6000 MW of commissioned power. Therefore, demand for flywheel energy storage systems is further boosting the growth of the regional market.

- Europe is expected to witness highest growth rate during the Projection period. Growth of automobile industry in this region has significantly created a demand for flywheel energy storage systems. In addition, the UK is focusing on renewable sources for energy storage purposes with about two-thirds of the energy storage capacity of the country entirely devoted to renewable energy sources. Such factors are opportunistic for growth of the UK flywheel energy storage system market.

Global Flywheel energy storage system Market- Country Analysis:

- Germany

Germany flywheel energy storage system market size was valued at USD 13.76 million in 2021 and is expected to reach USD 29.31 million by 2029, at a CAGR of 10.3%from 2022 to 2029. Significant growth of the automotive sector in this country boosts demand for flywheel energy storage systems. In addition,

The rising focus of the European Union on the reduction of CO2 emissions is further projected to create lucrative growth opportunities for commercial production of hybrid and electric vehicles which uses flywheel energy storage systems. This factor has further contributed to the growth of the market in the country.

- China

China flywheel energy storage system market size was valued at USD 18.58 million in 2021 and is expected to reach USD 38.85 million by 2029, at a CAGR of 10.1% from 2022 to 2029. Huge energy storage demand in this country boosts the growth of the market. For instance, in July 2021, China announced its plans to install over 30 gigawatts of new energy storage capacity by 2025. This strategy is part of efforts in the country to boost renewable power consumption as well as to ensure the stable operation of the electric grid system. Through this strategy, the country is expected to use novel energy storage processes that uses electrochemical, flywheel, compressed air, and supercapacitor systems. This strategy is opportunistic for the growth of the flywheel energy storage systems market.

- India

India's flywheel energy storage system market size was valued at USD 8.95 million in 2021 and is expected to reach USD 19.61 million by 2029, at a CAGR of 10.7% from 2022 to 2029. Significant demand for electric power in the country is fuelling the growth of the market. For instance, according to the U.S. Energy Information Administration, India is the third-largest electricity market with about 6.6 % of global electricity demand. In addition, this country is observing a continuous transition from fossil fuels to renewable energy sources, creating demand for flywheel energy storage systems. The country is seeing renewable integration into the grid, data centers, diesel optimization, telecom towers back up, and solar rooftop. This factor has further boosted demand for the flywheel storage system market.

Key Industry Players Analysis:

To increase their market position in the global flywheel energy storage system business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Langley Holdings plc

- Amber Kinetics, Inc.

- Stornetic GmbH

- POWERTHRU

- Energiestro

- VYCON, Inc.

- BC New Energy Co., Ltd.

- Beacon Power, LLC

- PUNCH Flybrid

- Kinetic Traction Systems, Inc.

Latest Development:

- In February 2022, Filatex announced the investment of €10 million in Energiestro, the French flywheel storage system manufacturer. Through this investment, both of the companies planned to deploy Energiestro’s flywheel storage solutions across Mauritius and Madagascar.

- In July 2021, De La Salle University, a leading university in the Philippines, partnered with Amber Kinetics to launch their project called Integrated Flywheel Storage Management System, research under the DOST CRADLE program. The research project is aimed at analyzing the developments and challenges associated with clean energy solutions in the country.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

10.5% |

|

Market Size |

344.12 million in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Application, and regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Langley Holdings plc, Amber Kinetics, Inc., Stornetic GmbH, POWERTHRU, Energiestro, VYCON, Inc., Bc New Energy (Tianjin) Co., Ltd., Beacon Power, LLC, PUNCH Flybrid, and Kinetic Traction Systems, Inc. among others |

|

By Application

|

|

|

Regional scope |

|

Scope of the Report

Global Flywheel energy storage system Market by Application:

- UPS

- Distributed Energy Generation

- Transport

- Data Centers

- Others

Global Flywheel energy storage system Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

How Big is flywheel energy storage system market?

The global flywheel energy storage system market is expected to grow from USD 344.12 million in 2021 to USD 743.47 million by 2029, at a CAGR of 10.5% during the Projection period 2022-2029.

Who are leading players in the flywheel energy storage system market?

Leading market players active in the global flywheel energy storage system market are Langley Holdings plc, Amber Kinetics, Inc., Stornetic GmbH, POWERTHRU, Energiestro, VYCON, Inc., Bc New Energy (Tianjin) Co., Ltd., Beacon Power, LLC, PUNCH Flybrid, and Kinetic Traction Systems, Inc. among others.

Which regions have been included in Global flywheel energy storage system market?

The regions analyzed for the flywheel energy storage system market include North America, Europe, South America, Asia Pacific, and the Middle East and Africa.

What are the ongoing trends In Global flywheel energy storage system market?

The significant rise in the need for a reliable, safer, and greener approach to power backup in place of harmful, lead-acid-based batteries has led to technological and product innovation in the global flywheel energy storage systems market. Such innovations are aimed at delivering clean energy storage technology to industries. For instance, Beacon Power, energy storage and power electronics company is building the largest flywheel energy storage system in Stephentown, New York

How Environment will benefit from flywheel energy storage system?

The rising focus of the European Union on the reduction of CO2 emissions is further projected to create lucrative growth opportunities for commercial production of hybrid and electric vehicles which uses flywheel energy storage systems. This factor has further contributed to the growth of the market in the country. For instance, in July 2021, China announced its plans to install over 30 gigawatts of new energy storage capacity by 2025. This strategy is part of efforts in the country to boost renewable power consumption as well as to ensure the stable operation of the electric grid system. Through this strategy, the country is expected to use novel energy storage processes that use electrochemical, flywheel, compressed air, and supercapacitor systems.

What are the segments present in Global flywheel energy storage system market?

The global flywheel energy storage system market has been segmented based on application, and regions.

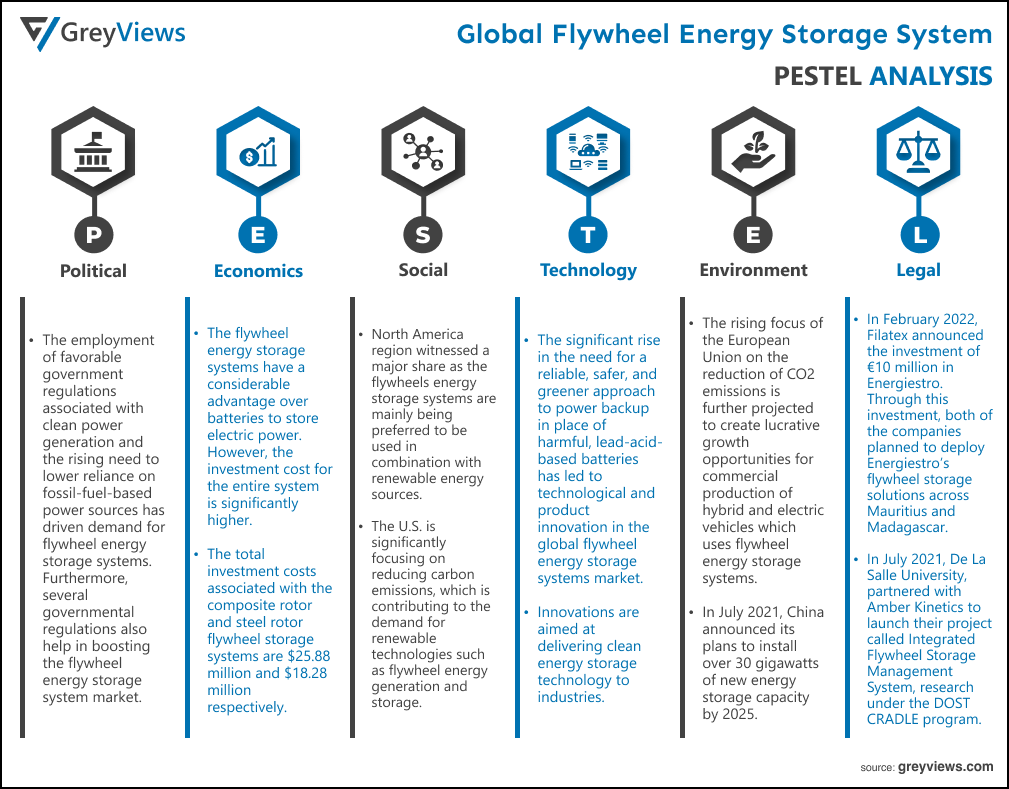

Political Factors- The employment of favorable government regulations associated with clean power generation and the rising need to lower reliance on fossil-fuel-based power sources has driven demand for flywheel energy storage systems. Furthermore, several governmental regulations also help in boosting the flywheel energy storage system market.

Economical Factors- The flywheel energy storage systems have a considerable advantage over batteries to store electric power. However, the investment cost for the entire system is significantly higher. For instance, the total investment costs associated with the composite rotor and steel rotor flywheel storage systems are $25.88 million and $18.28 million respectively. Therefore, as compared with the power battery energy storage technology, the large-scale application of flywheel energy storage technology has been hampered by its high initial investment cost.

Social Factor- North America region witnessed a major share as the flywheels energy storage systems are mainly being preferred to be used in combination with renewable energy sources. The U.S. is significantly focusing on reducing carbon emissions, which is contributing to the demand for renewable technologies such as flywheel energy generation and storage. In addition, the region is seeing huge demand for UPS systems to maintain a continuous power supply intended for industrial and commercial applications. On the other hand, as the growing number of businesses are adopting cloud solutions, North America has become the largest data center region across the globe, with more than 6000 MW of commissioned power.

Technological Factors- The significant rise in the need for a reliable, safer, and greener approach to power backup in place of harmful, lead-acid-based batteries has led to technological and product innovation in the global flywheel energy storage systems market. Such innovations are aimed at delivering clean energy storage technology to industries. For instance, Beacon Power, energy storage and power electronics company is building the largest flywheel energy storage system in Stephentown, New York. This is a 20-megawatt system that marks a milestone in flywheel energy storage technology. In May 2020, the company has announced that 18 megawatts from the flywheel storage system is already online; however, the whole system was projected to operate at a full capacity by the end of June 2020. Such innovations are opportunistic for the growth of the global flywheel energy storage systems market.

Environmental Factors- The rising focus of the European Union on the reduction of CO2 emissions is further projected to create lucrative growth opportunities for commercial production of hybrid and electric vehicles which uses flywheel energy storage systems. This factor has further contributed to the growth of the market in the country. For instance, in July 2021, China announced its plans to install over 30 gigawatts of new energy storage capacity by 2025. This strategy is part of efforts in the country to boost renewable power consumption as well as to ensure the stable operation of the electric grid system. Through this strategy, the country is expected to use novel energy storage processes that use electrochemical, flywheel, compressed air, and supercapacitor systems.

Legal Factors- In February 2022, Filatex announced the investment of €10 million in Energiestro, the French flywheel storage system manufacturers. Through this investment, both of the companies planned to deploy Energiestro’s flywheel storage solutions across Mauritius and Madagascar. In July 2021, De La Salle University, a leading university in the Philippines, partnered with Amber Kinetics to launch their project called Integrated Flywheel Storage Management System, research under the DOST CRADLE program. The research project is aimed at analyzing the developments and challenges associated with clean energy solutions in the country.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Type

- Market Attractiveness Analysis By Application

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Rise in demand for a reliable and clean electrical power

- Need to provide electric power across the remote locations

- Restrains

- High cost associated with the flywheel energy storage systems

- Opportunities

- Technological & product innovation and investment in the flywheel energy storage technology

- Challenges

- Safety concerns and less maturity of the technology

- Global Flywheel Energy Storage System Market Analysis and Projection, By Application

- Segment Overview

- UPS

- Distributed Energy Generation

- Transport

- Data Centers

- Others

- Global Flywheel Energy Storage System Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Flywheel Energy Storage System Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Flywheel Energy Storage System Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Type Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Langley Holdings plc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Amber Kinetics, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Stornetic GmbH

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- POWERTHRU

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Energiestro

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- VYCON, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- BC New Energy (Tianjin) Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Beacon Power, LLC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- PUNCH Flybrid

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Kinetic Traction Systems, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Langley Holdings plc

List of Table

- Global Flywheel Energy Storage System Market, By Application, 2021–2029(USD Million)

- Global UPS Flywheel Energy Storage System Market, By Region, 2021–2029(USD Million)

- Global Distributed Energy Generation Application Flywheel Energy Storage System Market, By Region, 2021–2029(USD Million)

- Global Transport Flywheel Energy Storage System Market, By Region, 2021–2029(USD Million)

- Global Data Centers Flywheel Energy Storage System Market, By Region, 2021–2029(USD Million)

- Global Others Flywheel Energy Storage System Market, By Region, 2021–2029(USD Million)

- Global Flywheel Energy Storage System Market, By Region, 2021–2029(USD Million)

- Global Flywheel Energy Storage System Market, By North America, 2021–2029(USD Million)

- North America Flywheel Energy Storage System Market, By Application, 2021–2029(USD Million)

- USA Flywheel Energy Storage System Market, By Application, 2021–2029(USD Million)

- Canada Flywheel Energy Storage System Market, By Application, 2021–2029(USD Million)

- Mexico Flywheel Energy Storage System Market, By Application, 2021–2029(USD Million)

- Europe Flywheel Energy Storage System Market, By Application, 2021–2029(USD Million)

- Germany Flywheel Energy Storage System Market, By Application, 2021–2029(USD Million)

- France Flywheel Energy Storage System Market, By Application, 2021–2029(USD Million)

- UK Flywheel Energy Storage System Market, By Application, 2021–2029(USD Million)

- Italy Flywheel Energy Storage System Market, By Application, 2021–2029(USD Million)

- Spain Flywheel Energy Storage System Market, By Application, 2021–2029(USD Million)

- Asia Pacific Flywheel Energy Storage System Market, By Application, 2021–2029(USD Million)

- Japan Flywheel Energy Storage System Market, By Application, 2021–2029(USD Million)

- China Flywheel Energy Storage System Market, By Application, 2021–2029(USD Million)

- India Flywheel Energy Storage System Market, By Application, 2021–2029(USD Million)

- South America Flywheel Energy Storage System Market, By Application, 2021–2029(USD Million)

- Brazil Flywheel Energy Storage System Market, By Application, 2021–2029(USD Million)

- Middle East and Africa Flywheel Energy Storage System Market, By Application, 2021–2029(USD Million)

- UAE Flywheel Energy Storage System Market, By Application, 2021–2029(USD Million)

- South Africa Flywheel Energy Storage System Market, By Application, 2021–2029(USD Million)

List of Figures

- Global Flywheel Energy Storage System Market Segmentation

- Flywheel Energy Storage System Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Flywheel Energy Storage System Market Attractiveness Analysis By Application

- Global Flywheel Energy Storage System Market Attractiveness Analysis By Region

- Global Flywheel Energy Storage System Market: Dynamics

- Global Flywheel Energy Storage System Market Share By Application(2021 & 2029)

- Global Flywheel Energy Storage System Market Share by Regions (2021 & 2029)

- Global Flywheel Energy Storage System Market Share by Company (2020)