Food Grade Lubricants Market Size by Type (Synthetic Oil, Mineral Oil, and Bio-based), Application (Food, Beverages, Pharmaceuticals & Cosmetics, and Others), Regions, Segmentation, and Projection till 2029

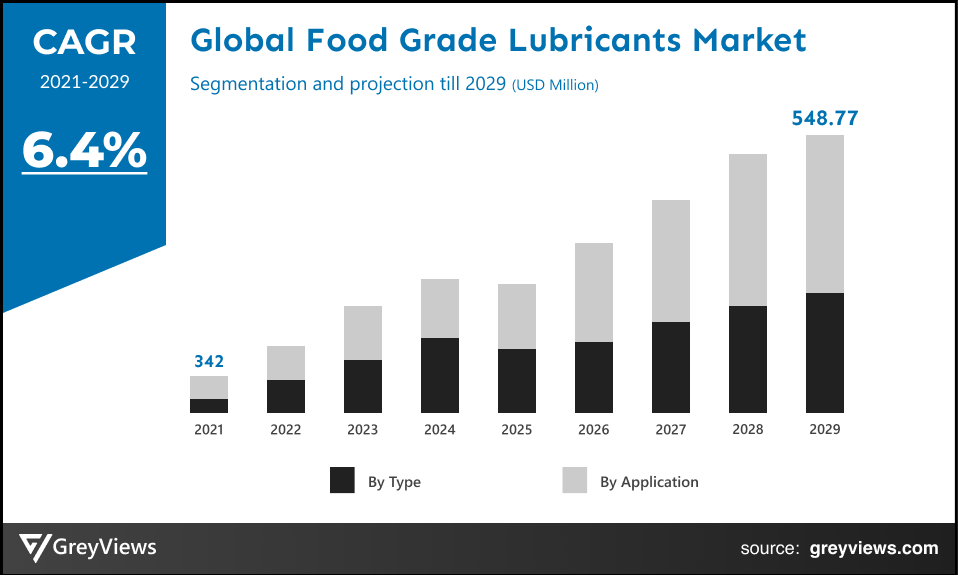

CAGR: 6.4%Current Market Size: 342.0 millionFastest Growing Region: APAC

Largest Market: EuropeProjection Time: 2022-2029Base Year: 2021

Global Food Grade Lubricants-Market Overview

The global food grade lubricants market is expected to grow from USD 342.00 million in 2021 to USD 548.77 million by 2029, at a CAGR of 6.4% during the Projection period 2022-2029. This growth is mainly driven by an upsurge in the consumption of processed food and beverages across the globe. In addition, rising concern over food safety has boosted the usage of food-grade lubricants.

In the past several years, health and safety have become priorities for drink, food, and drug manufacturers. Also, the standard of hygiene and cleanliness is essential on the shop room floor; however, lubricant leakages and maintenance are considered an inevitable part of all the industries. Hence, the demand for food-grade lubricants is growing in industries such as food and drugs among others. These lubricants perform technical functions including protection against wear, corrosion, friction, and oxidation; dissipation of heat and transfer power, and compatibility with rubber and other sealing materials. On the other hand, in food and drug businesses, such lubricants are seeing huge demand as they resist degradation from food products, chemicals, and water/steam; have the ability to dissolve sugars, and exhibit a neutral behavior toward elastomers and plastics.

According to the United States Department of Agriculture (USDA), the food-grade lubricants are classified into three designations namely, H1, H2, and H3. Among these, H1 lubricants are food-grade lubricants used in food-processing environments with the possibility of incidental food contact. While the H2 lubricants are used at the locations with no possibility of contact with food and the H3 lubricants are usually edible oils that are used in the prevention of rust on trolleys, hooks, and other similar equipment.

Request Sample:- Food Grade Lubricants Market

Market Dynamics:

Drivers:

- Growing consumption of processed food and beverages

The various findings are showing high consumption of processed food and beverages in all parts of the world and this intake has continuously increased in the majority of the population during the past 2 decades. For instance, according to the Korea National Health and Nutrition Examination Survey (2016–2018), the ultra-processed food consumption of Korean adults accounted for one-fourth of daily energy intake. However, to meet this demand for processed food, the food and beverage manufacturing plants are becoming more automated and increasing their production capacity with the help of food-grade lubricants. Therefore, the growing consumption of processed food and beverages drives the growth of the market.

- Supportive government regulations

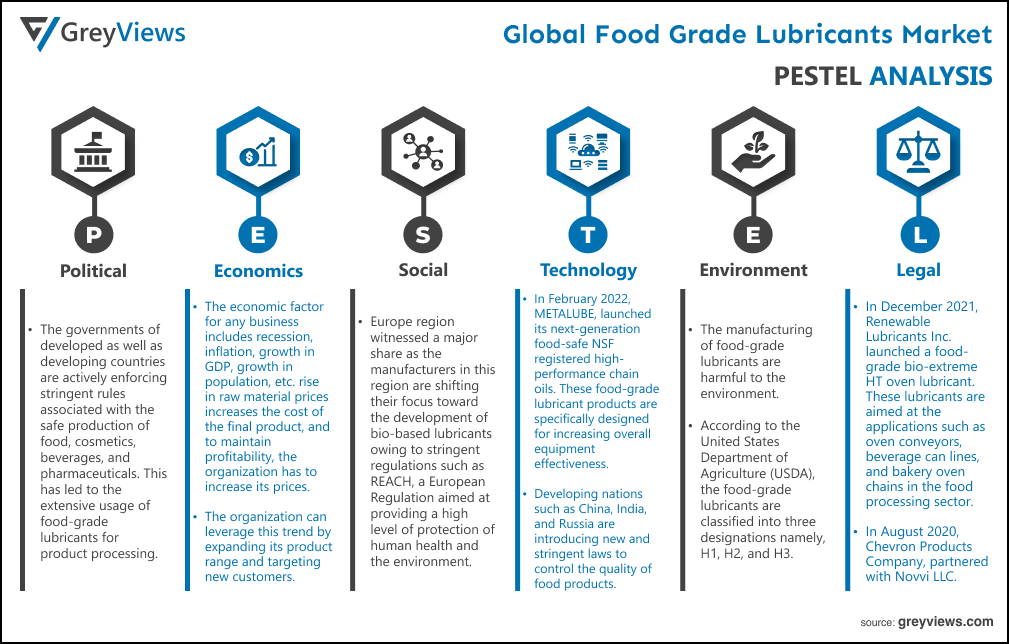

The governments of developed as well as developing countries are actively enforcing stringent rules associated with the safe production of food, cosmetics, beverages, and pharmaceuticals. This has led to the extensive usage of food-grade lubricants for product processing. For instance, the European Food Safety Authority (EFSA) in Europe and the Food and Drug Administration (FDA) in the U.S. is the prominent government regulatory authorities with strict food quality and safety laws. The stringent food safety laws increase the usage of food-grade lubricants in the production of food, cosmetics, beverages, and pharmaceuticals.

Restraints:

- Lack of product awareness and proper training

There is a need for operatives to be properly trained in lubricant application. A good understanding of the lubricant’s properties, as well as their recommended quantities of application, is essential. Hence, the machine maintenance staff are required to have proper training that reputable manufacturers provide. In addition, the countries such as China and Brazil have less awareness about food-grade lubricants. Hence, the lack of product awareness and proper training on food-grade lubricants hampers the growth of the market to some extent.

Opportunities:

- Technological & product innovation and rising emphasis on food safety in developing countries

In February 2022, METALUBE, the leading lubricant manufacturer launched its next-generation food-safe NSF registered high-performance chain oils. These food-grade lubricant products are specifically designed for increasing overall equipment effectiveness. Moreover, developing nations such as China, India, and Russia are introducing new and stringent laws to control the quality of food products. This is attributed to the increase in foodborne diseases among other food safety concerns. Therefore, technological innovations along with the emphasis on food safety in developing countries are expected to create lucrative growth opportunities for the market in upcoming years.

Challenges

- Difficulty in keeping up with new and changing requirements

The food manufacturing sector is seeing an acceleration in innovation. For instance, new types of equipment, such as 3D food printers and robotic ovens with complex moving parts and food contact surfaces, are emerging onto the market. This has led to the need for lubricant manufacturers to constantly innovate to produce high-performance products along with properties that help in the improvement of the functioning of the latest machinery in difficult environments. However, difficulty in keeping up with such new and changing requirements is projected to create significant challenges for food-grade lubricant manufacturers.

Segmentation Analysis:

The global food grade lubricants market has been segmented based on type, application, and region.

By Type

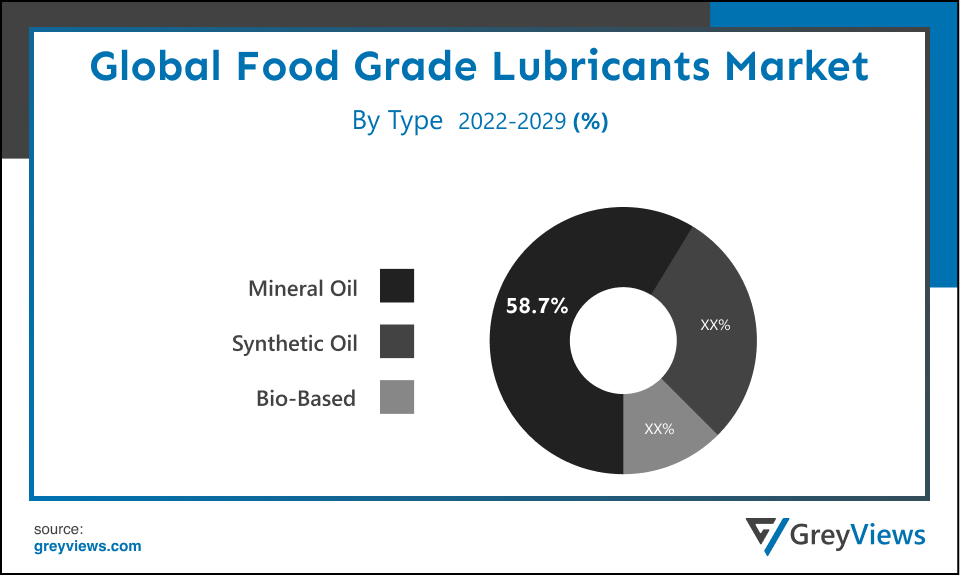

The type segment includes synthetic oil, mineral oil, and bio-based. The mineral oil segment led the food-grade lubricants market with a market share of around 58.7% in 2021. The growth of this segment is mainly attributed to the increasing application of mineral food-grade lubricants in machinery such as hydraulic systems that operate at temperatures between 120°F to 150°F. In addition, food-grade mineral oils have great coating properties and can be used on both metals and wood. On the other hand, refined mineral oil, in small amounts, is ‘generally recognized as safe (GRAS) food additives by agencies such as the European Food Safety Authority (EFSA) and the Food and Drug Administration (FDA).

By Application

The application segment includes food, beverages, pharmaceuticals & cosmetics, and others. The food segment led the food grade lubricants market with a market share of around 61.02% in 2021. Increased consumption of food-grade lubricants in bakery, meat, confectionery, dairy, sauces and dressings, poultry and seafood, and others applications has primarily driven the growth of the food segment. In addition, increasing stringency of food safety regulations and rising global food safety awareness are fueling demand for applications in the food sector.

By Regional Analysis

The regions analyzed for the food grade lubricants market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. The Europe region dominated the food grade lubricants market and held the 41.30% share of the market revenue in 2021.

- Europe region witnessed a major share as the manufacturers in this region are shifting their focus toward the development of bio-based lubricants owing to stringent regulations such as REACH, a European Regulation aimed at providing a high level of protection of human health and the environment. In addition, significant growth in food and beverages sales in this region has created a demand for food-grade

- Asia-Pacific is expected to witness the highest growth rate during the Projection period. A number of factors such as growing population, high economic growth rate, and heavy investment across industries such as pharmaceuticals, food & beverages, machinery, and others are fueling the growth of the Asia-Pacific food grade lubricants market.

Global Food Grade Lubricants Market- Country Analysis

- Germany

Germany is the biggest market for food and beverages in the EU. For instance, according to the Global Agricultural Information Network (GAIN), in 2019, the country produced an estimated $221.7 billion of processed food and drinks. Hence, the huge processed food and drinks industry in this country is fueling the growth of the grade lubricants market. Germany food grade lubricants market size was valued at USD 37.62 million in 2021 and is expected to reach USD 62.24 million by 2029, at a CAGR of 6.7%from 2022 to 2029.

Further, this is one of the major countries with the most rapidly aging population in the world; hence, the growth of the pharmaceutical industry and demand for cosmetics solutions in boost the growth of the market in the country.

- China

China's food grade lubricants market size was valued at USD 54.72 million in 2021 and is expected to reach USD 85.84 million by 2029, at a CAGR of 6.1% from 2022 to 2029. In this country, the rising demand for food-grade lubricants from the food and beverages industry has primarily driven the growth of the food-grade lubricants market. For instance, according to the China Chain Store & Franchise Association, the food and beverage sector in this country reached about $595 billion in 2019, a 7.8% increase over 2018. In addition, the Food Hygiene Law of the People’s Republic of China ensures food hygiene and prevents food contamination as well as harmful substances from injuring human health. Such laws create demand for food-grade lubricants in the country.

- India

India's food grade lubricants market size was valued at USD 27.36 million in 2021 and is expected to reach USD 47.32 million by 2029, at a CAGR of 7.4% from 2022 to 2029. India is one of the strongest growing economies in Asia. Increasing focus on personal hygiene and health, the growing food and beverages sector, and economic growth in this country has fueled the growth of the Indian food grade lubricants market. In addition, the Indian pharmaceutical industry ranks third worldwide for production by volume; hence, demand for food-grade lubricants in the pharmaceutical manufacturing sector is expected to create lucrative growth opportunities for the market.

Key Industry Players Analysis

To increase their market position in the global food grade lubricants business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- ExxonMobil Corporation

- TotalEnergies SE

- FUCHS Petrolub AG

- BP plc.

- Petro-Canada Lubricants Inc.

- Chevron Corporation

- The DOW Chemical Company

- Kluber Lubrication Munchen SE & Co. KG

- SKF

- Illinois Tools Works Inc.

Latest Development

- In December 2021, Renewable Lubricants Inc. launched a food-grade bio-extreme HT oven lubricant. These lubricants are aimed at the applications such as oven conveyors, beverage can line, and bakery oven chains in the food processing sector.

- In August 2020, Chevron Products Company, a division of Chevron U.S.A. Inc., partnered with Novvi LLC, one of the leaders in the renewable oils industry. Through this partnership, the companies announced the first production of 100% renewable base oil from Novvi’s Deer Park, Houston Facility.

Report Metrics

|

Report Attribute |

Details |

|

Market size available for years |

2021-2029 |

|

Base year considered |

2021 |

|

CAGR (%) |

6.4% |

|

Market Size |

342.0 million in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Type, application, and regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

ExxonMobil Corporation, TotalEnergies SE, FUCHS Petrolub AG, BP plc., Petro-Canada Lubricants Inc., Chevron Corporation, The DOW Chemical Company, Kluber Lubrication Munchen SE & Co. KG, SKF , and Illinois Tools Works Inc. among others |

|

By Type |

|

|

By Application

|

|

|

Regional scope |

|

Scope of the Report

Global Food-grade Lubricants Market by Type:

- Synthetic Oil

- PAO

- PAG

- Others

- Mineral Oil

- Bio-based

Global Food-grade Lubricants Market by Application:

- Food

- Bakery

- Dairy

- Sugar

- Meat, poultry & seafood

- Animal feed

- Others

- Beverages

- Pharmaceuticals & Cosmetics

- Others

Global Food-grade Lubricants Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is current market size of Global Food Grade Lubricants Market?

Global food grade lubricants market Size is USD 342.00 million in 2021 and it expected to grow to USD 548.77 million by 2029, at a CAGR of 6.4%

Which companies is working in Global Food Grade Lubricants Market?

ExxonMobil Corporation, TotalEnergies SE, FUCHS Petrolub AG, BP plc., Petro-Canada Lubricants Inc., Chevron Corporation, The DOW Chemical Company, Kluber Lubrication Munchen SE & Co. KG, SKF , and Illinois Tools Works Inc. among others

Which Region Dominate the Food Grade Lubricants Market?

Europe region dominated the food grade lubricants market and held the 41.30% share of the market revenue in 2021

What is the Market size of China Food Grade Lubricants?

China's food grade lubricants market size was valued at USD 54.72 million in 2021 and is expected to reach USD 85.84 million by 2029, at a CAGR of 6.1% from 2022 to 2029

What are the Challenges in Global Food Grade Lubricants Market?

The food manufacturing sector is seeing an acceleration in innovation. For instance, new types of equipment, such as 3D food printers and robotic ovens with complex moving parts and food contact surfaces, are emerging onto the market. This has led to the need for lubricant manufacturers to constantly innovate to produce high-performance products along with properties that help in the improvement of the functioning of the latest machinery in difficult environments. However, difficulty in keeping up with such new and changing requirements is projected to create significant challenges for food-grade lubricant manufacturers

What is Technological Factor in Food Grade Lubricants Market?

In February 2022, METALUBE, the leading lubricant manufacturer launched its next-generation food-safe NSF registered high-performance chain oils. These food-grade lubricant products are specifically designed for increasing overall equipment effectiveness. Moreover, developing nations such as China, India, and Russia are introducing new and stringent laws to control the quality of food products. This is attributed to the increase in foodborne diseases among other food safety concerns. Therefore, technological innovations along with the emphasis on food safety in developing countries are expected to create lucrative growth opportunities for the market in upcoming years

Political Factors- The governments of developed as well as developing countries are actively enforcing stringent rules associated with the safe production of food, cosmetics, beverages, and pharmaceuticals. This has led to the extensive usage of food-grade lubricants for product processing. For instance, the European Food Safety Authority (EFSA) in Europe and the Food and Drug Administration (FDA) in the U.S. is the prominent government regulatory authorities with strict food quality and safety laws. The stringent food safety laws increase the usage of food-grade lubricants in the production of food, cosmetics, beverages, and pharmaceuticals.

Economic Factors- The economic factor for any business includes recession, inflation, growth in GDP, growth in population, etc. rise in raw material prices increases the cost of the final product, and to maintain profitability, the organization has to increase its prices. The organization can leverage this trend by expanding its product range and targeting new customers. For instance, according to the China Chain Store & Franchise Association, the food and beverage sector in this country reached about $595 billion in 2019, a 7.8% increase over 2018. In addition, the Food Hygiene Law of the People’s Republic of China ensures food hygiene and prevents food contamination as well as harmful substances from injuring human health. Such laws create demand for food-grade lubricants in the country.

Social Factor- Europe region witnessed a major share as the manufacturers in this region are shifting their focus toward the development of bio-based lubricants owing to stringent regulations such as REACH, a European Regulation aimed at providing a high level of protection of human health and the environment. In addition, significant growth in food and beverages sales in this region has created a demand for food-grade lubricants.

Technological Factors- In February 2022, METALUBE, the leading lubricant manufacturer launched its next-generation food-safe NSF registered high-performance chain oils. These food-grade lubricant products are specifically designed for increasing overall equipment effectiveness. Moreover, developing nations such as China, India, and Russia are introducing new and stringent laws to control the quality of food products. This is attributed to the increase in foodborne diseases among other food safety concerns. Therefore, technological innovations along with the emphasis on food safety in developing countries are expected to create lucrative growth opportunities for the market in upcoming years.

Environmental Factors- The manufacturing of food-grade lubricants are harmful to the environment. According to the United States Department of Agriculture (USDA), the food-grade lubricants are classified into three designations namely, H1, H2, and H3. Among these, H1 lubricants are food-grade lubricants used in food-processing environments with the possibility of incidental food contact. While the H2 lubricants are used at the locations with no possibility of contact with food and the H3 lubricants are usually edible oils that are used in the prevention of rust on trolleys, hooks, and other similar equipment.

Legal Factors- In December 2021, Renewable Lubricants Inc. launched a food-grade bio-extreme HT oven lubricant. These lubricants are aimed at the applications such as oven conveyors, beverage can lines, and bakery oven chains in the food processing sector. In August 2020, Chevron Products Company, a division of Chevron U.S.A. Inc., partnered with Novvi LLC, one of the leaders in the renewable oils industry. Through this partnership, the companies announced the first production of 100% renewable base oil from Novvi’s Deer Park, Houston Facility.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Type

- Market Attractiveness Analysis By Application

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Growing consumption of processed food and beverages

- Supportive government regulations

- Restrains

- Lack of product awareness and proper training

- Opportunities

- Technological & product innovation and rising emphasis on food safety in developing countries

- Challenges

- Difficulty in keeping up with new and changing requirements

- Global Food Grade Lubricants Market Analysis and Projection, By Type

- Segment Overview

- Synthetic Oil

- Mineral Oil

- Bio-based

- Global Food Grade Lubricants Market Analysis and Projection, By Application

- Segment Overview

- Food

- Beverages

- Pharmaceuticals & Cosmetics

- Others

- Global Food Grade Lubricants Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- S.

- Canada

- Mexico

- Europe

- Germany

- France

- K.

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Food Grade Lubricants Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Food Grade Lubricants Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Type Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- ExxonMobil Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- TotalEnergies SE

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- FUCHS Petrolub AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- BP plc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Petro-Canada Lubricants Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Chevron Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- The DOW Chemical Company

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Kluber Lubrication Munchen SE & Co. KG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- SKF

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Illinois Tools Works Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- ExxonMobil Corporation

List of Table

- Global Food Grade Lubricants Market, By Type, 2021–2029(USD Million)

- Global Synthetic Oil Market, By Region, 2021–2029(USD Million)

- Global Mineral Oil Market, By Region, 2021–2029(USD Million)

- Global Bio-based Market, By Region, 2021–2029(USD Million)

- Global Food Grade Lubricants Market, By Application, 2021–2029(USD Million)

- Global Food Food Grade Lubricants Market, By Region, 2021–2029(USD Million)

- Global Beverages Application Food Grade Lubricants Market, By Region, 2021–2029(USD Million)

- Global Pharmaceuticals & Cosmetics Food Grade Lubricants Market, By Region, 2021–2029(USD Million)

- Global Others Food Grade Lubricants Market, By Region, 2021–2029(USD Million)

- Global Food Grade Lubricants Market, By Region, 2021–2029(USD Million)

- Global Food Grade Lubricants Market, By North America, 2021–2029(USD Million)

- North America Food Grade Lubricants Market, By Type, 2021–2029(USD Million)

- North America Food Grade Lubricants Market, By Application, 2021–2029(USD Million)

- US Food Grade Lubricants Market, By Type, 2021–2029(USD Million)

- US Food Grade Lubricants Market, By Application, 2021–2029(USD Million)

- Canada Food Grade Lubricants Market, By Type, 2021–2029(USD Million)

- Canada Food Grade Lubricants Market, By Application, 2021–2029(USD Million)

- Mexico Food Grade Lubricants Market, By Type, 2021–2029(USD Million)

- Mexico Food Grade Lubricants Market, By Application, 2021–2029(USD Million)

- Europe Food Grade Lubricants Market, By Type, 2021–2029(USD Million)

- Europe Food Grade Lubricants Market, By Application, 2021–2029(USD Million)

- Germany Food Grade Lubricants Market, By Type, 2021–2029(USD Million)

- Germany Food Grade Lubricants Market, By Application, 2021–2029(USD Million)

- France Food Grade Lubricants Market, By Type, 2021–2029(USD Million)

- France Food Grade Lubricants Market, By Application, 2021–2029(USD Million)

- UK Food Grade Lubricants Market, By Type, 2021–2029(USD Million)

- UK Food Grade Lubricants Market, By Application, 2021–2029(USD Million)

- Italy Food Grade Lubricants Market, By Type, 2021–2029(USD Million)

- Italy Food Grade Lubricants Market, By Application, 2021–2029(USD Million)

- Spain Food Grade Lubricants Market, By Type, 2021–2029(USD Million)

- Spain Food Grade Lubricants Market, By Application, 2021–2029(USD Million)

- Asia Pacific Food Grade Lubricants Market, By Type, 2021–2029(USD Million)

- Asia Pacific Food Grade Lubricants Market, By Application, 2021–2029(USD Million)

- Japan Food Grade Lubricants Market, By Type, 2021–2029(USD Million)

- Japan Food Grade Lubricants Market, By Application, 2021–2029(USD Million)

- China Food Grade Lubricants Market, By Type, 2021–2029(USD Million)

- China Food Grade Lubricants Market, By Application, 2021–2029(USD Million)

- India Food Grade Lubricants Market, By Type, 2021–2029(USD Million)

- India Food Grade Lubricants Market, By Application, 2021–2029(USD Million)

- South America Food Grade Lubricants Market, By Type, 2021–2029(USD Million)

- South America Food Grade Lubricants Market, By Application, 2021–2029(USD Million)

- Brazil Food Grade Lubricants Market, By Type, 2021–2029(USD Million)

- Brazil Food Grade Lubricants Market, By Application, 2021–2029(USD Million)

- Middle East and Africa Food Grade Lubricants Market, By Type, 2021–2029(USD Million)

- Middle East and Africa Food Grade Lubricants Market, By Application, 2021–2029(USD Million)

- UAE Food Grade Lubricants Market, By Type, 2021–2029(USD Million)

- UAE Food Grade Lubricants Market, By Application, 2021–2029(USD Million)

- South Africa Food Grade Lubricants Market, By Type, 2021–2029(USD Million)

- South Africa Food Grade Lubricants Market, By Application, 2021–2029(USD Million)

List of Figures

- Global Food Grade Lubricants Market Segmentation

- Food Grade Lubricants Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Food Grade Lubricants Market Attractiveness Analysis By Type

- Global Food Grade Lubricants Market Attractiveness Analysis By Application

- Global Food Grade Lubricants Market Attractiveness Analysis By Region

- Global Food Grade Lubricants Market: Dynamics

- Global Food Grade Lubricants Market Share By Type(2021 & 2029)

- Global Food Grade Lubricants Market Share By Application(2021 & 2029)

- Global Food Grade Lubricants Market Share by Regions (2021 & 2029)

- Global Food Grade Lubricants Market Share by Company (2020)