Food Packaging Films Market Size By Material Type (Polypropylene, Polyethylene, Polyethylene Terephthalate, Polyamide, Polyvinyl Chloride, Ethyl Vinyl Alcohol), Product Type (Bags & Sacks, Pouches, Tubes, Sachets & Stick Packs, Liners), End-user (Beverages, Food, Homecare Products) Regions, Segmentation, and Projection till 2029

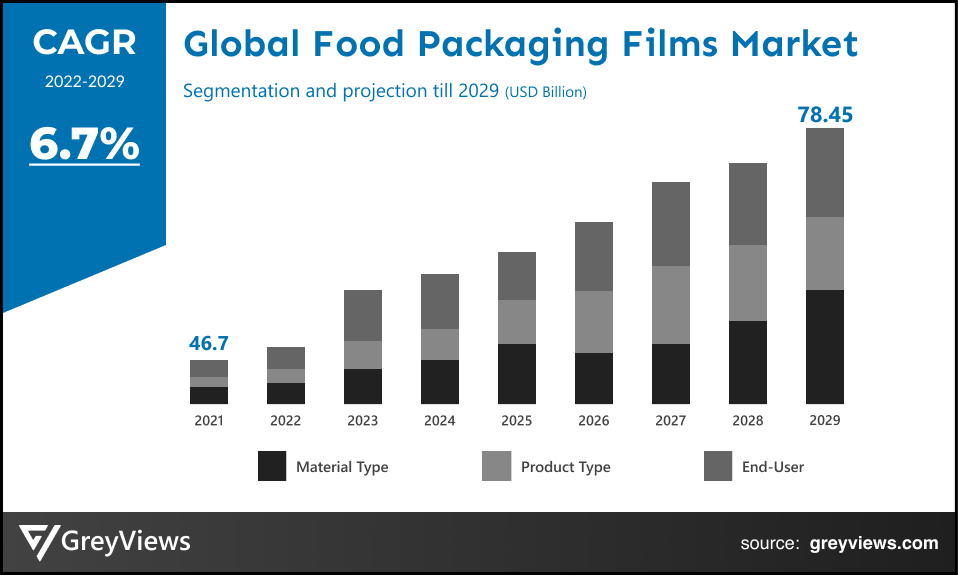

CAGR: 6.7% Current Market Size: USD 46.7 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Food Packaging Films market- Market Overview:

The global Food Packaging Films market is expected to grow from USD 46.7 billion in 2021 to USD 78.45 billion by 2029, at a CAGR of 6.7% during the Projection period 2022-2029. This growth of the Food Packaging Films market is significantly driven by the rising demand for fresh and damage-free food. Food packaging film is also an efficient marketing tool for the food and beverages industry. Packaging films are used in various industries like beverages, food, home care, healthcare, personal care, electronics & electrical, and other industrial goods. In the food industry, different sub-industries such as meat, ready-to-eat meals, seafood and poultry, bakery and confectionery, dairy products, and other food products are using different kinds of food packaging films for different purposes. Because they are lightweight, convenient, affordable, safe, and sustainable, packaging films are increasingly being used in homes, restaurants, etc for packing food and keeping it safe from any kind of contaminants.

Market Dynamics:

Drivers:

- Rising demand for oriented films

The rising demand for biaxially oriented films has encouraged several packaging film manufacturers to divert their manufacturing efforts and invest in biaxially oriented film packaging. Biaxial films are stretched in both transverse direction (TD) and machine direction (MD) to provide better optical, mechanical, and barrier properties, propelling the market’s growth. These films are used in various applications in the food and non-food industries. Biaxially oriented films are manufactured from various materials, including polyethylene terephthalate (PET), polypropylene (PP), polystyrene (ps), polyamide (PA), polyvinyl chloride (PVC), and others, driving the growth of the market.

Restraints:

- Changing raw material prices

The cost of the food packaging films depends upon the cost of raw materials used. The polymers used in manufacturing food packaging films are derived from petroleum. The changing prices of crude oil and increasing demand for polymers in various applications hinder the market’s growth. The fluctuating process of raw materials and less availability is a major restraint to the growth of the food packaging film market. Raw materials prices also depend on logistics, trading costs, labor costs, and tariffs. All these factors affect the price of polymers, affecting the growth of the food packaging film market.

Opportunities:

- Innovation of eco-friendly packaging films

Increasing environmental pollution is one of the biggest challenges for the environment. So, food packaging film manufacturers across the globe are focusing on reducing environmental pollution by encouraging end-user sectors to choose eco-friendly food packaging films. Given this, the packaging companies are focusing on developing eco-friendly food packaging films for environmental sustainability. Green packaging products are manufactured to follow the three ‘R’s of eco-friendly packaging: renew, reuse, and recycle. Introducing eco-friendly food packaging films such as bioplastics, forest wood, recycled paper, and palm leaf is expected to provide lucrative growth opportunities for the market during the Projection period.

Challenges

- Manufacturers' concentration on downsizing packaging

Manufacturers has been using fewer materials and raw materials to reduce the packaging size and weight which challenges the market’s growth. Manufacturers have done Downsizing to reduce the waste generated from packaging materials. Under its packaging reduction guidelines, the Department of Environmental Conservation of New York City recommends using shrink wrap or poly wrap over box packaging to reduce bag packaging and packaging size. Manufacturers are increasingly using smaller and lighter packaging films with fewer materials, challenging the market’s growth.

Sample Request: - Global Food Packaging Films market

Segmentation Analysis:

The global Food Packaging Films market has been segmented based on material type, product type, end-users, and regions.

By material type

The material type segment includes polypropylene, polyethylene, polyethylene terephthalate, polyamide, polyvinyl chloride, and ethyl vinyl alcohol. The polypropylene segment led the Food Packaging Films market with a market share of around 23.7% in 2021. The polypropylene material used in making the food packaging film is not affected by humidity which drives the segment’s growth. It gives very moderate permeability to odors and gases and a higher barrier to water vapor. The food packaging films made with polypropylene are very light in weight and do not require much storage space.

By product type

The product type segment includes bags & sacks, pouches, tubes, sachets & stick packs, and liners. The liners segment led the Food Packaging Films market with a market share of around 39.11% in 2021. The liners food packaging films are easy to use and are easily available in supermarkets and online stores, which drives the segment’s growth. Furthermore, the liner packaging films can be used to pack any kind of food and beverages, adding impetus to the segment’s growth.

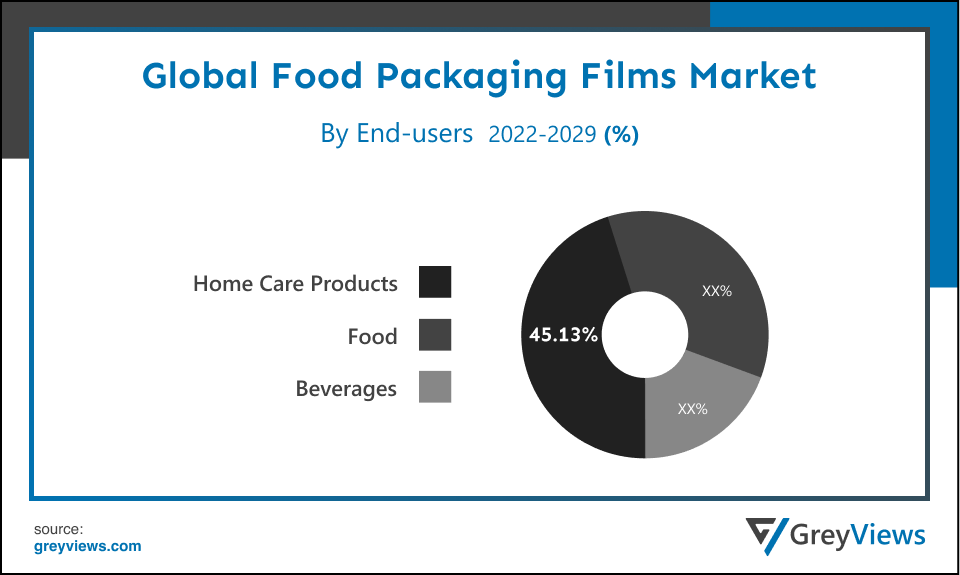

By End-users

The end-users segment includes beverages, food, and home care products. The food segment led the Food Packaging Films market with a market share of around 45.13% in 2021. The rising awareness regarding nutritional values and the increasing health concerns increases the need for packaging food products in packaging films. Food packaging helps prevent contamination caused by pathogens, bacteria, and other microorganisms. Furthermore, the increasing awareness about airborne diseases increases the demand for safely packaged food items.

By Regional Analysis:

The regions analyzed for the Food Packaging Films market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. The Asia-Pacific region dominated the Food Packaging Films market and held the 38.10% share of the market revenue in 2021.

- Asia-Pacific region has registered the highest value for the year 2021. The presence of large in the region coupled with growing demand for convenience food products drives the market’s growth in the region. Moreover, the raw materials required for manufacturing food packaging films are also available at cheaper prices in the region, adding impetus to the market’s growth. The people in the Asia Pacific countries such as China and India are becoming more cautious about the foodborne diseases caused due to contamination, increasing the demand for the food packaging film market.

- North America is likely to register substantial growth during the Projection period due to the rising urbanization and rapid and increasing disposable income propelling the market’s growth in the region. Furthermore, the presence of prominent market players such as Berry Global, Charter Next Generation, WestRock, etc. adds impetus to the market’s growth in the region.

Global Food Packaging Films Market- Country Analysis:

- China

China is the largest Food Packaging Films market across the globe, with an estimated market share of 29% across the Asia-Pacific region by 2022. The demand for food packaging films in the country has been rising owing to the growing need for convenience as the lifestyle of people in China is busy, and they have a diverse culture. Furthermore, the increasing number of health-conscious people in the region propels the market’s growth.

- Germany

In the Europe region, Germany is the largest market shareholder in the Food Packaging Films market, with an estimated market share of around 25.11% by the end of 2022. Germany is one of the leading producers of plastic, which is expected to drive the market’s growth in the country. Europe holds nearly 16% market share in global plastic production, which propels the market’s growth.

- India

India is the fastest market for food packaging films, with 21% of the market share. The market for food packaging films in India is growing because it is the fastest-growing economy with the highest population in the world. They are now seeing massive growth in terms of the usage of packaging films. India will see an increment of US$ 9 bn and will grow by 1.8x during the Projectioned period to reach a market size of US$ 21 bn.

Key Industry Players Analysis:

To increase their market position in the global Food Packaging Films business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Amcor plc

- Berry Global

- Coveris (Austria)

- DS Smith

- Sealed Air Corporation

- Graphic Packaging Holding Company

- Charter Next Generation

- Mondi Group

- DuPont Teijin Films

- WestRock

Latest Development:

- In January 2021, Domo Chemicals’ nylon films business was acquired by Jindal films. This acquisition aims at supporting the company’s growth by increasing the production capacity of nylon films.

- In February 2022, next-generation stretch films were launched by Coveris with 30% recycled content to minimize reliance on virgin plastic films for packaging.

- In January 2022, Pioneer packaging worldwide was acquired by B2B Industrial packaging. The main aim of this acquisition is to increase consumer reach, especially in untapped markets.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

8.7% |

|

Market Size |

USD 46.7 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Material Type, Product Type, End-user, and Regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Amcor plc, Berry Global, Coveris, DS Smith, Sealed Air Corporation, Graphic Packaging Holding Company, Charter Next Generation, Mondi Group, DuPont Teijin Films, and WestRock, among others. |

|

By Material Type |

? Polypropylene ? Polyethylene ? Polyethylene Terephthalate ? Polyamide ? Polyvinyl Chloride ? Ethyl Vinyl Alcohol |

|

By Product Type |

? Bags & Sacks, Pouches ? Tubes ? Sachets & Stick Packs ? Liners |

|

By End-User |

? Beverages ? Food ? Homecare Products |

|

Regional scope |

? North America ? Europe ? Asia-Pacific ? South America ? Middle East and Africa |

Scope of the Report

Global Food Packaging Films Market by material type:

- Polypropylene

- Polyethylene

- Polyethylene Terephthalate

- Polyamide

- Polyvinyl Chloride

- Ethyl Vinyl Alcohol

Global Food Packaging Films Market by product type:

- Bags & Sacks

- Pouches

- Tubes

- Sachets & Stick Packs

- Liners

Global Food Packaging Films Market by End-users:

- Beverages

- Food

- Homecare Products

Global Food Packaging Films Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market current size of the Food Packaging Films market?

Global Food Packaging Films market size is USD 46.7 billion in 2021.

What will be the market size of Food Packaging Films market in year 2029?

Global Food Packaging Films market will have estimated market size USD 78.45 billion by 2029.

Which are the leading market players active in the Food Packaging Films market?

Leading market players active in the global Food Packaging Films market are Amcor plc, Berry Global, Coveris, DS Smith, Sealed Air Corporation, Graphic Packaging Holding Company, Charter Next Generation, Mondi Group, DuPont Teijin Films, and WestRock. among others.

What are the key drivers of the Food Packaging Films market?

Rising demand for oriented films, is primarily driving the growth of the Food Packaging Films market.

What are the trends that are projected to influence the market in coming years?

Manufacturers in the Food Packaging Films market are using advanced production technologies to incorporate better results, and capacity expansion of the storage systems. In addition, the rising number of investments will contribute to demand for the Food Packaging Films.

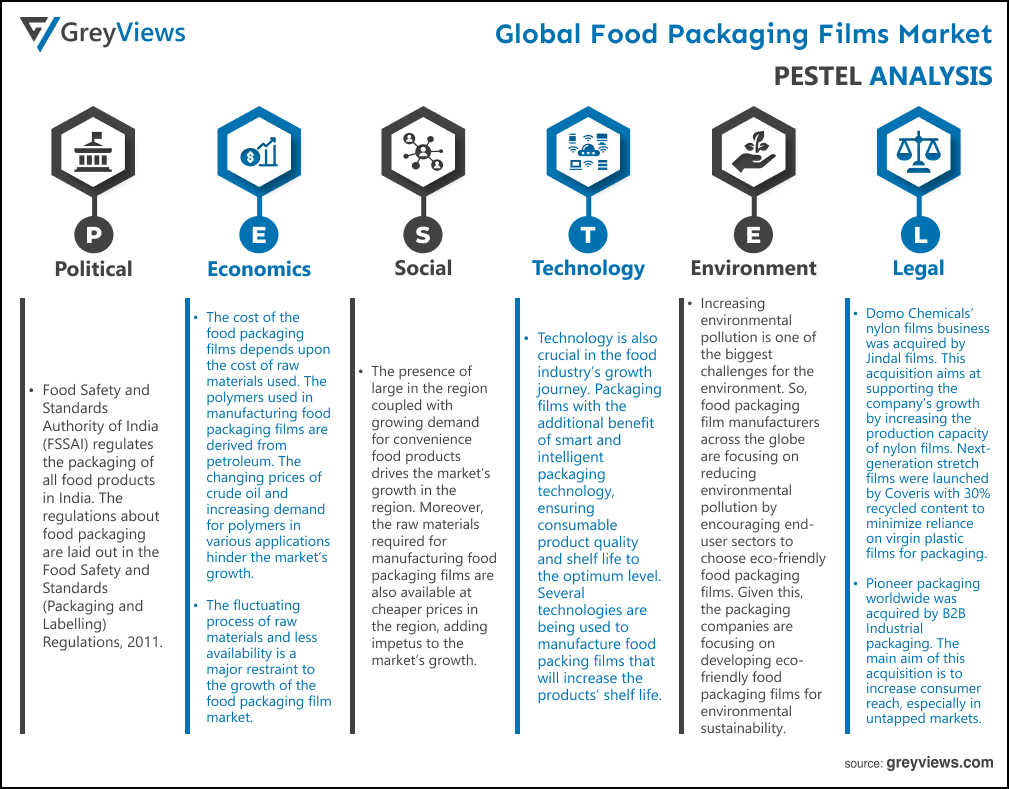

Political Factors- Food Safety and Standards Authority of India (FSSAI) regulates the packaging of all food products in India. The regulations about food packaging are laid out in the Food Safety and Standards (Packaging and Labelling) Regulations, 2011. All food that is placed in a package of any nature, in such a manner that the contents cannot be changed without tampering it and which is ready for sale to the consumer, must comply with the food packaging regulations in India.

Economical Factors- The cost of the food packaging films depends upon the cost of raw materials used. The polymers used in manufacturing food packaging films are derived from petroleum. The changing prices of crude oil and increasing demand for polymers in various applications hinder the market’s growth. The fluctuating process of raw materials and less availability is a major restraint to the growth of the food packaging film market. Raw materials prices depend on logistics, trading costs, labor, and tariffs. All these factors affect the price of polymers, affecting the growth of the food packaging film market.

Social Factor- The presence of large in the region coupled with growing demand for convenience food products drives the market’s growth in the region. Moreover, the raw materials required for manufacturing food packaging films are also available at cheaper prices in the region, adding impetus to the market’s growth. The people in the Asia Pacific countries, such as China and India, are becoming more cautious about the foodborne diseases caused due to contamination, increasing the demand for the food packaging film market.

Technological Factors- Technology is also crucial in the food industry’s growth journey. Packaging films with the additional benefit of smart and intelligent packaging technology, ensuring consumable product quality and shelf life to the optimum level. Several technologies are being used to manufacture food packing films that will increase the products' shelf life.

Environmental Factors- Increasing environmental pollution is one of the biggest challenges for the environment. So, food packaging film manufacturers across the globe are focusing on reducing environmental pollution by encouraging end-user sectors to choose eco-friendly food packaging films. Given this, the packaging companies are focusing on developing eco-friendly food packaging films for environmental sustainability. Green packaging products are manufactured to follow the three ‘R’s of eco-friendly packaging: renew, reuse, and recycle. Introducing eco-friendly food packaging films such as bioplastics, forest wood, recycled paper, and palm leaf is expected to provide lucrative growth opportunities for the market during the Projection period.

Legal Factors- Domo Chemicals’ nylon films business was acquired by Jindal films. This acquisition aims at supporting the company’s growth by increasing the production capacity of nylon films. Next-generation stretch films were launched by Coveris with 30% recycled content to minimize reliance on virgin plastic films for packaging. Pioneer packaging worldwide was acquired by B2B Industrial packaging. The main aim of this acquisition is to increase consumer reach, especially in untapped markets.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Material Type

- Market Attractiveness Analysis By Product Type

- Market Attractiveness Analysis By End-User

- Market Attractiveness Analysis By Region

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Rising demand for oriented films

- Restraints

- Changing raw material prices

- Opportunities

- Innovation of eco-friendly packaging films

- Challenges

- Manufacturers' concentration on downsizing packaging

- Global Food Packaging Films Market Analysis and Projection, By Material Type

- Segment Overview

- Polypropylene

- Polyethylene

- Polyethylene Terephthalate

- Polyamide

- Polyvinyl Chloride

- Ethyl Vinyl Alcohol

- Global Food Packaging Films Market Analysis and Projection, By Product Type

- Segment Overview

- Bags & Sacks, Pouches

- Tubes

- Sachets & Stick Packs

- Liners

- Global Food Packaging Films Market Analysis and Projection, By End-User

- Segment Overview

- Beverages

- Food

- Homecare Products

- Global Food Packaging Films Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Food Packaging Films Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Food Packaging Films Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Material Type Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Amcor plc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Type Portfolio

- Recent Developments

- SWOT Analysis

- Berry Global

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Type Portfolio

- Recent Developments

- SWOT Analysis

- Coveris

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Type Portfolio

- Recent Developments

- SWOT Analysis

- DS Smith

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Type Portfolio

- Recent Developments

- SWOT Analysis

- Sealed Air Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Type Portfolio

- Recent Developments

- SWOT Analysis

- Graphic Packaging Holding Company

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Type Portfolio

- Recent Developments

- SWOT Analysis

- Charter Next Generation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Type Portfolio

- Recent Developments

- SWOT Analysis

- Mondi Group

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Type Portfolio

- Recent Developments

- SWOT Analysis

- DuPont Teijin Films

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Type Portfolio

- Recent Developments

- SWOT Analysis

- WestRock

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Type Portfolio

- Recent Developments

- SWOT Analysis

- Amcor plc

List of Table

- Global Food Packaging Films Market, By Material Type, 2021–2029(USD Billion)

- Global Polypropylene Food Packaging Films Market, By Region, 2021–2029(USD Billion)

- Global Polyethylene Food Packaging Films Market, By Region, 2021–2029(USD Billion)

- Global Polyethylene Terephthalate Food Packaging Films Market, By Region, 2021–2029(USD Billion)

- Global Polyamide Food Packaging Films Market, By Region, 2021–2029(USD Billion)

- Global Polyvinyl Chloride Food Packaging Films Market, By Region, 2021–2029(USD Billion)

- Global Ethyl Vinyl Alcohol Food Packaging Films Market, By Region, 2021–2029(USD Billion)

- Global Food Packaging Films Market, By Product Type, 2021–2029(USD Billion)

- Global Bags & Sacks Food Packaging Films Market, By Region, 2021–2029(USD Billion)

- Global Pouches Food Packaging Films Market, By Region, 2021–2029(USD Billion)

- Global Tubes Food Packaging Films Market, By Region, 2021–2029(USD Billion)

- Global Sachets & Stick Packs Food Packaging Films Market, By Region, 2021–2029(USD Billion)

- Global Liners Food Packaging Films Market, By Region, 2021–2029(USD Billion)

- Global Food Packaging Films Market, By End-User, 2021–2029(USD Billion)

- Global Beverages Food Packaging Films Market, By Region, 2021–2029(USD Billion)

- Global Food Food Packaging Films Market, By Region, 2021–2029(USD Billion)

- Global Homecare Products Food Packaging Films Market, By Region, 2021–2029(USD Billion)

- Global Food Packaging Films Market, By Region, 2021–2029(USD Billion)

- North America Food Packaging Films Market, By Material Type, 2021–2029(USD Billion)

- North America Food Packaging Films Market, By Product Type, 2021–2029(USD Billion)

- North America Food Packaging Films Market, By End-User, 2021–2029(USD Billion)

- USA Food Packaging Films Market, By Material Type, 2021–2029(USD Billion)

- USA Food Packaging Films Market, By Product Type, 2021–2029(USD Billion)

- USA Food Packaging Films Market, By End-User, 2021–2029(USD Billion)

- Canada Food Packaging Films Market, By Material Type, 2021–2029(USD Billion)

- Canada Food Packaging Films Market, By Product Type, 2021–2029(USD Billion)

- Canada Food Packaging Films Market, By End-User, 2021–2029(USD Billion)

- Mexico Food Packaging Films Market, By Material Type, 2021–2029(USD Billion)

- Mexico Food Packaging Films Market, By Product Type, 2021–2029(USD Billion)

- Mexico Food Packaging Films Market, By End-User, 2021–2029(USD Billion)

- Europe Food Packaging Films Market, By Material Type, 2021–2029(USD Billion)

- Europe Food Packaging Films Market, By Product Type, 2021–2029(USD Billion)

- Europe Food Packaging Films Market, By End-User, 2021–2029(USD Billion)

- Germany Food Packaging Films Market, By Material Type, 2021–2029(USD Billion)

- Germany Food Packaging Films Market, By Product Type, 2021–2029(USD Billion)

- Germany Food Packaging Films Market, By End-User, 2021–2029(USD Billion)

- France Food Packaging Films Market, By Material Type, 2021–2029(USD Billion)

- France Food Packaging Films Market, By Product Type, 2021–2029(USD Billion)

- France Food Packaging Films Market, By End-User, 2021–2029(USD Billion)

- UK Food Packaging Films Market, By Material Type, 2021–2029(USD Billion)

- UK Food Packaging Films Market, By Product Type, 2021–2029(USD Billion)

- UK Food Packaging Films Market, By End-User, 2021–2029(USD Billion)

- Italy Food Packaging Films Market, By Material Type, 2021–2029(USD Billion)

- Italy Food Packaging Films Market, By Product Type, 2021–2029(USD Billion)

- Italy Food Packaging Films Market, By End-User, 2021–2029(USD Billion)

- Spain Food Packaging Films Market, By Material Type, 2021–2029(USD Billion)

- Spain Food Packaging Films Market, By Product Type, 2021–2029(USD Billion)

- Spain Food Packaging Films Market, By End-User, 2021–2029(USD Billion)

- Asia Pacific Food Packaging Films Market, By Material Type, 2021–2029(USD Billion)

- Asia Pacific Food Packaging Films Market, By Product Type, 2021–2029(USD Billion)

- Asia Pacific Food Packaging Films Market, By End-User, 2021–2029(USD Billion)

- Japan Food Packaging Films Market, By Material Type, 2021–2029(USD Billion)

- Japan Food Packaging Films Market, By Product Type, 2021–2029(USD Billion)

- Japan Food Packaging Films Market, By End-User, 2021–2029(USD Billion)

- China Food Packaging Films Market, By Material Type, 2021–2029(USD Billion)

- China Food Packaging Films Market, By Product Type, 2021–2029(USD Billion)

- China Food Packaging Films Market, By End-User, 2021–2029(USD Billion)

- India Food Packaging Films Market, By Material Type, 2021–2029(USD Billion)

- India Food Packaging Films Market, By Product Type, 2021–2029(USD Billion)

- India Food Packaging Films Market, By End-User, 2021–2029(USD Billion)

- South America Food Packaging Films Market, By Material Type, 2021–2029(USD Billion)

- South America Food Packaging Films Market, By Product Type, 2021–2029(USD Billion)

- South America Food Packaging Films Market, By End-User, 2021–2029(USD Billion)

- Brazil Food Packaging Films Market, By Material Type, 2021–2029(USD Billion)

- Brazil Food Packaging Films Market, By Product Type, 2021–2029(USD Billion)

- Brazil Food Packaging Films Market, By End-User, 2021–2029(USD Billion)

- Middle East and Africa Food Packaging Films Market, By Material Type, 2021–2029(USD Billion)

- Middle East and Africa Food Packaging Films Market, By Product Type, 2021–2029(USD Billion)

- Middle East and Africa Food Packaging Films Market, By End-User, 2021–2029(USD Billion)

- UAE Food Packaging Films Market, By Material Type, 2021–2029(USD Billion)

- UAE Food Packaging Films Market, By Product Type, 2021–2029(USD Billion)

- UAE Food Packaging Films Market, By End-User, 2021–2029(USD Billion)

- South Africa Food Packaging Films Market, By Material Type, 2021–2029(USD Billion)

- South Africa Food Packaging Films Market, By Product Type, 2021–2029(USD Billion)

- South Africa Food Packaging Films Market, By End-User, 2021–2029(USD Billion)

List of Figures

- Global Food Packaging Films Market Segmentation

- Food Packaging Films Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Food Packaging Films Market Attractiveness Analysis By Material Type

- Global Food Packaging Films Market Attractiveness Analysis By Product Type

- Global Food Packaging Films Market Attractiveness Analysis By End-User

- Global Food Packaging Films Market Attractiveness Analysis By Region

- Global Food Packaging Films Market: Dynamics

- Global Food Packaging Films Market Share By Material Type (2021 & 2029)

- Global Food Packaging Films Market Share By Product Type (2021 & 2029)

- Global Food Packaging Films Market Share By End-User (2021 & 2029)

- Global Food Packaging Films Market Share by Regions (2021 & 2029)

- Global Food Packaging Films Market Share by Company (2020)