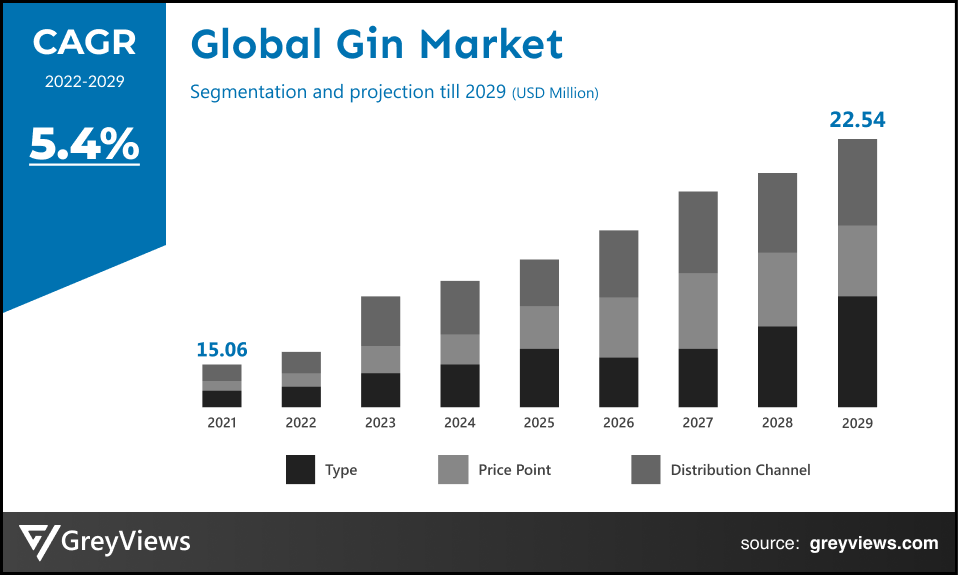

Gin Market Size by Type (London Dry Gin, Old Tom Gin, Plymouth Gin, and Others), Price Point (Standard, Premium, and Luxury), and Distribution Channel (On-trade and Off-trade), Regions, Segmentation, and Projection till 2029

CAGR: 5.4%Current Market Size: USD 15.06 BillionFastest Growing Region: North America

Largest Market: EuropeProjection Time: 2022-2029Base Year: 2021

Global Gin Market- Market Overview:

The global Gin market is expected to grow from USD 15.06 billion in 2021 to USD 22.54 billion by 2029, at a CAGR of 5.4% during the Projection period 2022-2029. This market growth is mainly attributed to an upsurge in the consumption of alcoholic beverages among end users around the globe.

Gin is a distilled alcoholic beverage made from a base of grain, including barley or wheat. It is made with the help of a neutral and clear spirit created by distilling grains, including rye, barley, corn, and wheat. It usually comes in a transparent to pale yellow color made of purified spirits acquired from grain mash. Gin is basically pure ethanol; however, the flavors are further added to it through a re-distillation process. Some common types of gin include London dry gin, new western dry gin, Plymouth gin, old tom gin, and genever gin.

The most common methods used for distillation include the steep method of gin distillation, vacuum distillation method, and vapor infusion method of gin distillation. Such methods are used for the creation of different flavors of Gin.

Request Sample:- Global Gin Market

Market Dynamics:

Drivers:

- The rise in demand for premium ready-to-drink and luxury spirits

The rise in the spending power of consumers and improved awareness among them has led to the demand for premium ready-to-drink and luxury spirits. Moreover, consumers continue to support quality over quantity, which is positively impacting the sales of premium spirits. According to the Distilled Spirits Council of the United States (DISCUS) 2020, the sale of ready-to-drink spirits rose by 39.1%, and the trend will continue in 2021. On the other hand, the revenue growth of luxury spirits in North America represented 40% in 2020.

Furthermore, the steadily increasing consumption of premium and & luxury spirits category and rising rapid modernization in developing economies further boost the demand for premium gin products.

- The advent of modern on-trade

A place with an attractive ambiance is always the reason for consumers to choose a certain bar or pub. Presently, alcohol consumption is rapidly associated with a memorable drinking experience and a well-served meal, as consumers are becoming more experimental and social. Gin is one of the drinks that is utilized in huge quantities to meet the demand for quality and innovative drinks in these pubs and bars. Thus, the focus of marketers and investors is shifting toward the innovations and opening of new on-trade channels to serve consumers in the market.

According to the Office for National Statistics (ONS) 2020, the number of pubs and bars in the UK rose by 315 for the first time in a while in the past few years. An increase in the number of such on-trade channels across the globe is expected to increase gin sales over the coming years.

Restraints:

- Consumer inclination towards low or non-alcoholic drinks

As per the IWSR Drinks Market Analysis report 2020, about 52% of adult people across the globe are trying to reduce or stop the consumption of alcohol in the U.S. Owing to this trend, customers are actively switching their preference from spirits such as vodka and gin to zero or low alcoholic drinks. Also, consumers are becoming more health conscious and increasingly aware of healthy intake of food & drinks. This factor is expected to hamper the growth of the global market considerably.

Opportunities:

- The emergence of craft spirits

The number of distilleries is rapidly increasing, with huge demand for varied spirits worldwide. Craft spirits are the next potential drinks in the market that will emerge as a new trend in developing and developed economies. For instance, according to various studies, the number of spirits distilleries has grown by approximately 35% per year from the year 2011 to 2019 in the U.S. Craft spirits sale have increased by about 20% (in terms of value) per year since 2012, and it is anticipated to reach 15–20% per year by 2022. The figures clearly indicate that the market for craft spirits in the U.S. and other regions is expected to be booming significantly from 2021 to 2028.

Challenges

- Availability of other dominating white Spirits

The spirit’s market is highly competitive, with the presence of several giants serving numerous drinks such as rum, whisky, and white spirits. The white spirits category is majorly dominated by vodka, followed by tequila, white liquor, and gin. According to the report by the Exodo Spirits Company 2018, vodka represented approximately 32% and tequila with 10% of overall spirits sales in the U.S. and is expected to increase the market share over the coming years. Hence, the availability of such dominating white Spirits is projected to create a considerable challenge for the market players.

Segmentation Analysis:

The global Gin market has been segmented based on type, price point, distribution channel, and regions.

By Type

The type segment includes London dry gin, old tom gin, Plymouth gin, and others. The London dry gin segment led the gin market with a market share of around 48.50% in 2021. London dry gin is first made in and around London in the 17th century. Nowadays, it has become a common beverage garnering a significant share in the market and is extensively available globally. This increase in the popularity of London dry gin is attributed to its superior taste.

The specialty of this beverage is that it is obtained exclusively from ethanol derived from agricultural origin. It is a colorless and light-bodied beverage alcohol mostly added in the preparation of cocktails and mixed drinks. The specialty of this beverage is that it is obtained exclusively from ethanol derived from agricultural origin.

By Distribution Channel

The distribution channel segment includes on-trade and off-trade. The on-trade segment led the Gin market with a market share of around 68.5% in 2021. The on-trade distribution channel consists of modern places such as pubs, restaurants, hotels, bars, etc. A serving of any gin drink, food, and other services is way higher in price than off-trade channels. Thus, the on-trade sales channel remains high in value generation but low in volume consumption globally.

The trend of dining out is often not to accomplish appetite; instead, it is to socialize and try out new places. According to the International Journal of Experiential Learning & Case Studies 2018, consumers' lifestyle improvement elaborates on the impact of increasing dining out habits among them. Consumers in Asia-Pacific are adopting the westernized culture, which is expected to impact the growth of on-trade channels worldwide positively.

By Regional Analysis:

The regions analyzed for the Gin market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Europe region dominated the Gin market and held the 42.20% share of the market revenue in 2021.

- The Europe region witnessed a major share. Gin typically originated in the province of Europe in the 17th century and currently is consumed globally. The region has emerged as a hotspot in the market, holding a major share in revenue generation for the past several decades. The UK is the major market in the region, contributing maximum revenue share by operating more than 320 gin distilleries. Small and old distilleries are crucial to supporting the craft gin movement, as the consumer’s interest is growing toward the authentic manufacturing process and brand stories. Rapid expansion in the exports of craft gin and availability of low-alcoholic but high-quality gin will ensure the performance of local gin in the overseas market.

- The north American region is expected to witness a considerable growth rate during the Projection period. The appeal of several popular cocktails established by the emerging mixed drinks trend explains Americans’ appetite for gin. Consumers seek gin’s taste and flavors to form a perfect base for their classic and mixed drinks. The millennial generation is a key force in increasing gin consumption and will continue to impact the market positively. This region imported gin in large quantities in 2020 worth more than $500 million to meet consumers' growing demand. The three-tier system for alcoholic distribution network is an effective sales structure for gin in the U.S. These three-tier consists of producers, distributors, and retailers that prohibit direct-to-consumer shipping from exporting countries.

Global Gin Market- Country Analysis:

- Germany

Germany's Gin's market size was valued at USD 1.51 billion in 2021 and is expected to reach USD 2.22 billion by 2029, at a CAGR of 5.2% from 2022 to 2029. In the Europe region, Germany is one of the major shareholders in the Gin market. In addition, the huge spending power of the population in this country has been a major contributor to market growth. Moreover, steady GDP per capita growth coupled with the low inflation in the country has led to the country's gin industry's proliferation.

This country is more of a late adopter of gin than the UK. However, the ongoing trend of more sophisticated drinking, coupled with a momentous interest in classic cocktails and perfect service in the country, is opportunistic for the growth of the gin market.

- China

China's Gin market size was valued at USD 2.41 billion in 2021 and is expected to reach USD 3.49 billion by 2029, at a CAGR of 5.0% from 2022 to 2029. The factors such as increasing consumer income and rising interest in gin as compared with other alcoholic drink category in this country are mainly driving the growth of the Gin market. Also, the country is seeing bourgeoning interest in the juniper-based drinks, which is attributed to the trend among local distilleries to trade on unique regional flavors and full-throated branding efforts.

In addition, the huge demand for Shanghai Dry Gin in the country is projected to create lucrative growth opportunities for the market. This type of gin must contain at least 90% of its botanicals sourced from China.

- India

India Gin's market size was valued at USD 0.90 billion in 2021 and is expected to reach USD 1.37 billion by 2029, at a CAGR of 5.6% from 2022 to 2029. India is one of the highest growing economies in Asia. Increasing population, expanding urbanization, and changing lifestyle in the country is driving the growth of the Gin market. According to the research, this country has become the fifth-largest gin consumer, behind the U.K., the U.S., Germany, and Spain. The growing influence of western culture in this country has increased gin consumption among people.

The factors such as availability, affordability, and innovation in taste further create interest for gin among the Indian urban population. This is opportunistic for the growth of the India Gin market.

Key Industry Players Analysis:

To increase their market position in the global Gin business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Diageo plc

- Southwestern Distillery

- Davide Campari-Milano N.V.

- Bacardi Limited

- Pernod Ricard S.A.

- Remy Cointreau

- William Grant & Sons Limited

- San Miguel Corporation

- Lucas Bols

- Forest Spirits’ Gin

Latest Development:

- In March 2022, United Spirits Ltd (USL), the Diageo-controlled company, announced the acquisition of a minority 22.5% stake in Nao Spirits & Beverages Private Ltd. This acquisition aims to strengthen Diageo plc's participation in India's fast-growing premium gin segment.

- In May 2022, Southwestern Distillery (Tarquin’s handcrafted Cornish Gin introduced Tarquin’s Pink Dry Gin, the latest addition to its range of craft gins. According to the company, this is a beautifully balanced offering with a perfect combination of the sweetness of fruit gins and traditional dry gin's botanical notes.

Report Metrics

|

Report Attribute |

Details |

|

Market size |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

5.4% |

|

Market Size |

15.06 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Type, price point, distribution channel, and Regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Diageo plc, Southwestern Distillery, Davide Campari-Milano N.V., Bacardi Limited, Pernod Ricard S.A., Remy Cointreau, William Grant & Sons Limited, San Miguel Corporation, Lucas Bols, Forest Spirits’ Gin among others |

|

By Type |

|

|

By Price Point |

|

|

By Distribution Channel |

|

|

Regional scope |

|

Scope of the Report

Global Gin Market by Type:

- London Dry Gin

- Old Tom Gin

- Plymouth Gin

- Others

Global Gin Market by Price Point:

- Standard

- Premium

- Luxury

Global Gin Market by Distribution Channel:

- On-trade

- Off-trade

Global Gin Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the market size of the Gin market in 2029?

Global Gin market is expected to reach USD 22.54 billion by 2029, at a CAGR of 5.4% from 2022 to 2029.

What is the key reason to growth of Global Gin Market

Introduction of innovations in gin products, the craft beer and spirits movement, and the versatility and affordability of gin is projected to influence market growth in upcoming years.

What are the top 5 exporter countries of Gin?

UK, Germany, Spain, France, and the Netherlands

What is the most significant distribution channel?

On-trade segment led the Gin market with a market share of around 58.50% in 2021

What is the key driver of the Gin market?

Upsurge in consumption of alcoholic beverages among end users around the globe is primarily driving the growth of the Gin market.

Which are the leading market players active in the Gin market?

Leading market players active in the global Gin market are Diageo plc, Southwestern Distillery, Davide Campari-Milano N.V., Bacardi Limited, Pernod Ricard S.A., Remy Cointreau, William Grant & Sons Limited, San Miguel Corporation, Lucas Bols, and Forest Spirits’ Gin among others.

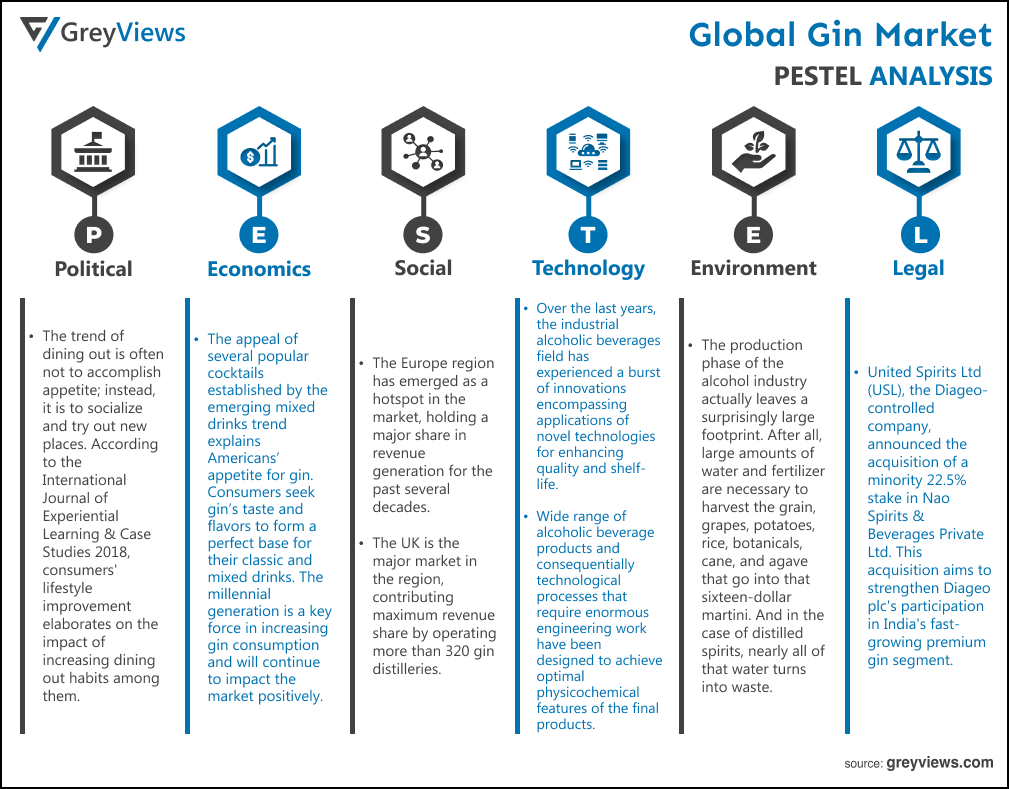

Political Factors- The trend of dining out is often not to accomplish appetite; instead, it is to socialize and try out new places. According to the International Journal of Experiential Learning & Case Studies 2018, consumers' lifestyle improvement elaborates on the impact of increasing dining out habits among them. Consumers in Asia-Pacific are adopting the westernized culture, which is expected to impact the growth of on-trade channels worldwide positively.

Economical Factors- The appeal of several popular cocktails established by the emerging mixed drinks trend explains Americans’ appetite for gin. Consumers seek gin’s taste and flavors to form a perfect base for their classic and mixed drinks. The millennial generation is a key force in increasing gin consumption and will continue to impact the market positively. This region imported gin in large quantities in 2020 worth more than $500 million to meet consumers' growing demand. The three-tier system for alcoholic distribution network is an effective sales structure for gin in the U.S. These three-tier consists of producers, distributors, and retailers that prohibit direct-to-consumer shipping from exporting countries.

Social Factor- The Europe region has emerged as a hotspot in the market, holding a major share in revenue generation for the past several decades. The UK is the major market in the region, contributing maximum revenue share by operating more than 320 gin distilleries. Small and old distilleries are crucial to supporting the craft gin movement, as the consumer’s interest is growing toward the authentic manufacturing process and brand stories. Rapid expansion in the exports of craft gin and availability of low-alcoholic but high-quality gin will ensure the performance of local gin in the overseas market.

Technological Factors- Over the last years, the industrial alcoholic beverages field has experienced a burst of innovations encompassing applications of novel technologies for enhancing quality and shelf-life. These novel technologies include the formulation of novel alcoholic beverages and functionalization of beverages for human health, innovations in the storage process, and the response of new consumer tendencies, which were many of the answers that were intended to obtain with the introduction of new technologies in the production of the alcoholic beverage. As a result, a wide range of alcoholic beverage products and consequentially technological processes that require enormous engineering work have been designed to achieve optimal physicochemical features of the final products.

Environmental Factors- The production phase of the alcohol industry actually leaves a surprisingly large footprint. After all, large amounts of water and fertilizer are necessary to harvest the grain, grapes, potatoes, rice, botanicals, cane, and agave that go into that sixteen-dollar martini. And in the case of distilled spirits, nearly all of that water turns into waste. According to the National Beer Wholesalers Association, the U.S. beer industry shipped 2.8 billion cases in 2018. That’s a huge operation and one that requires energy and fuel for refrigeration and transportation.

Legal Factors- United Spirits Ltd (USL), the Diageo-controlled company, announced the acquisition of a minority 22.5% stake in Nao Spirits & Beverages Private Ltd. This acquisition aims to strengthen Diageo plc's participation in India's fast-growing premium gin segment. Southwestern Distillery (Tarquin’s handcrafted Cornish Gin introduced Tarquin’s Pink Dry Gin, the latest addition to its range of craft gins. According to the company, this is a beautifully balanced offering with a perfect combination of the sweetness of fruit gins and traditional dry gin's botanical notes.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Type

- Market Attractiveness Analysis By Price Point

- Market Attractiveness Analysis By Distribution Channel

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Rise in demand for premium ready-to-drink and luxury spirits

- Advent of modern on-trade

- Restrains

- Consumer inclination towards low or non-alcoholic drinks

- Opportunities

- Emergence of craft spirits

- Challenges

- Availability of other dominating white Spirits

- Global Gin Market Analysis and Projection, By Type

- Segment Overview

- London Dry Gin

- Old Tom Gin

- Plymouth Gin

- Others

- Global Gin Market Analysis and Projection, By Price Point

- Segment Overview

- Standard

- Premium

- Luxury

- Global Gin Market Analysis and Projection, By Distribution Channel

- Segment Overview

- On-trade

- Off-trade

- Global Gin Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Gin Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Gin Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Product Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Diageo plc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Southwestern Distillery

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Davide Campari-Milano N.V.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Bacardi Limited

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Pernod Ricard S.A.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Remy Cointreau

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- William Grant & Sons Limited

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- San Miguel Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Lucas Bols

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Forest Spirits’ Gin

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Diageo plc

List of Table

- Global Gin Market, By Type, 2021–2029(USD Billion)

- Global London Dry Gin Gin Market, By Region, 2021–2029(USD Billion)

- Global Old Tom Gin Gin Market, By Region, 2021–2029(USD Billion)

- Global Plymouth Gin Gin Market, By Region, 2021–2029(USD Billion)

- Global Others Gin Market, By Region, 2021–2029(USD Billion)

- Global Gin Market, By Price Point, 2021–2029(USD Billion)

- Global Standard Gin Market, By Region, 2021–2029(USD Billion)

- Global Premium Gin Market, By Region, 2021–2029(USD Billion)

- Global Luxury Gin Market, By Region, 2021–2029(USD Billion)

- Global Gin Market, By Distribution Channel, 2021–2029(USD Billion)

- Global On-trade Gin Market, By Region, 2021–2029(USD Billion)

- Global Off-trade Gin Market, By Region, 2021–2029(USD Billion)

- Global Gin Market, By Region, 2021–2029(USD Billion)

- Global Gin Market, By North America, 2021–2029(USD Billion)

- North America Gin Market, By Type, 2021–2029(USD Billion)

- North America Gin Market, By Price Point, 2021–2029(USD Billion)

- North America Gin Market, By Distribution Channel, 2021–2029(USD Billion)

- USA Gin Market, By Type, 2021–2029(USD Billion)

- USA Gin Market, By Price Point, 2021–2029(USD Billion)

- USA Gin Market, By Distribution Channel, 2021–2029(USD Billion)

- Canada Gin Market, By Type, 2021–2029(USD Billion)

- Canada Gin Market, By Price Point, 2021–2029(USD Billion)

- Canada Gin Market, By Distribution Channel, 2021–2029(USD Billion)

- Mexico Gin Market, By Type, 2021–2029(USD Billion)

- Mexico Gin Market, By Price Point, 2021–2029(USD Billion)

- Mexico Gin Market, By Distribution Channel, 2021–2029(USD Billion)

- Europe Gin Market, By Type, 2021–2029(USD Billion)

- Europe Gin Market, By Price Point, 2021–2029(USD Billion)

- Europe Gin Market, By Distribution Channel, 2021–2029(USD Billion)

- Germany Gin Market, By Type, 2021–2029(USD Billion)

- Germany Gin Market, By Price Point, 2021–2029(USD Billion)

- Germany Gin Market, By Distribution Channel, 2021–2029(USD Billion)

- France Gin Market, By Type, 2021–2029(USD Billion)

- France Gin Market, By Price Point, 2021–2029(USD Billion)

- France Gin Market, By Distribution Channel, 2021–2029(USD Billion)

- UK Gin Market, By Type, 2021–2029(USD Billion)

- UK Gin Market, By Price Point, 2021–2029(USD Billion)

- UK Gin Market, By Distribution Channel, 2021–2029(USD Billion)

- Italy Gin Market, By Type, 2021–2029(USD Billion)

- Italy Gin Market, By Price Point, 2021–2029(USD Billion)

- Italy Gin Market, By Distribution Channel, 2021–2029(USD Billion)

- Spain Gin Market, By Type, 2021–2029(USD Billion)

- Spain Gin Market, By Price Point, 2021–2029(USD Billion)

- Spain Gin Market, By Distribution Channel, 2021–2029(USD Billion)

- Asia Pacific Gin Market, By Type, 2021–2029(USD Billion)

- Asia Pacific Gin Market, By Price Point, 2021–2029(USD Billion)

- Asia Pacific Gin Market, By Distribution Channel, 2021–2029(USD Billion)

- Japan Gin Market, By Type, 2021–2029(USD Billion)

- Japan Gin Market, By Price Point, 2021–2029(USD Billion)

- Japan Gin Market, By Distribution Channel, 2021–2029(USD Billion)

- China Gin Market, By Type, 2021–2029(USD Billion)

- China Gin Market, By Price Point, 2021–2029(USD Billion)

- China Gin Market, By Distribution Channel, 2021–2029(USD Billion)

- India Gin Market, By Type, 2021–2029(USD Billion)

- India Gin Market, By Price Point, 2021–2029(USD Billion)

- India Gin Market, By Distribution Channel, 2021–2029(USD Billion)

- South America Gin Market, By Type, 2021–2029(USD Billion)

- South America Gin Market, By Price Point, 2021–2029(USD Billion)

- South America Gin Market, By Distribution Channel, 2021–2029(USD Billion)

- Brazil Gin Market, By Type, 2021–2029(USD Billion)

- Brazil Gin Market, By Price Point, 2021–2029(USD Billion)

- Brazil Gin Market, By Distribution Channel, 2021–2029(USD Billion)

- Middle East and Africa Gin Market, By Type, 2021–2029(USD Billion)

- Middle East and Africa Gin Market, By Price Point, 2021–2029(USD Billion)

- Middle East and Africa Gin Market, By Distribution Channel, 2021–2029(USD Billion)

- UAE Gin Market, By Type, 2021–2029(USD Billion)

- UAE Gin Market, By Price Point, 2021–2029(USD Billion)

- UAE Gin Market, By Distribution Channel, 2021–2029(USD Billion)

- South Africa Gin Market, By Type, 2021–2029(USD Billion)

- South Africa Gin Market, By Price Point, 2021–2029(USD Billion)

- South Africa Gin Market, By Distribution Channel, 2021–2029(USD Billion)

List of Figures

- Global Gin Market Segmentation

- Gin Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Gin Market Attractiveness Analysis By Type

- Global Gin Market Attractiveness Analysis By Price Point

- Global Gin Market Attractiveness Analysis By Distribution Channel

- Global Gin Market Attractiveness Analysis By Region

- Global Gin Market: Dynamics

- Global Gin Market Share By Type(2021 & 2029)

- Global Gin Market Share By Price Point(2021 & 2029)

- Global Gin Market Share By Distribution Channel(2021 & 2029)

- Global Gin Market Share by Regions (2021 & 2029)

- Global Gin Market Share by Company (2020)