Global Aramid Fiber Market Size by Type (Meta Aramid, Para Aramid and Copolyamide), Application (Friction Materials, Industrial Filtration, Security and Protection, Rubber Reinforcement, Optical Fibers, Tire Reinforcement, Electrical Insulation and Others), End-user (Aerospace, Automotive, Electronics and Telecommunication, Industrial and Others), Distribution Channel (Online and Offline) Regions, Segmentation, and Projection till 2028.

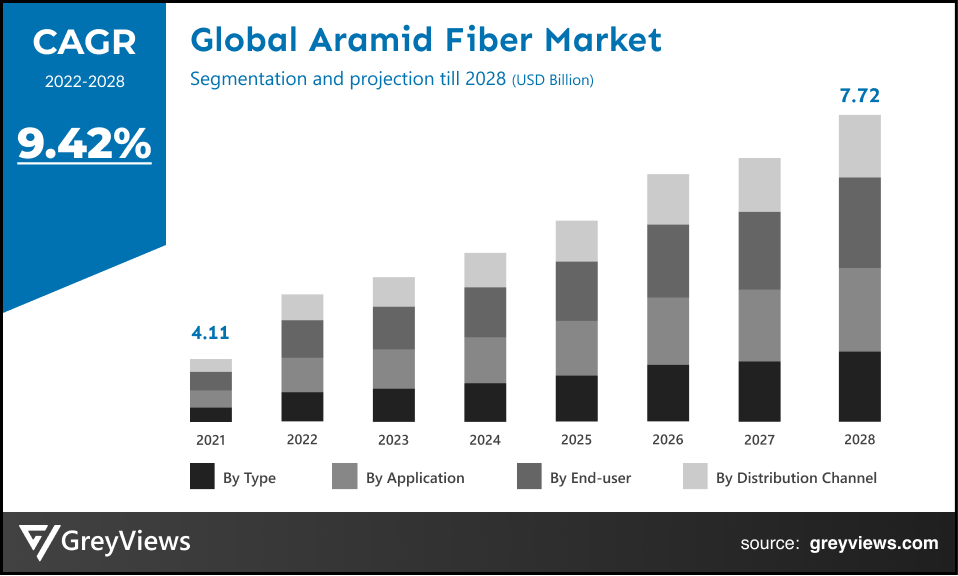

CAGR: 9.42% Current Market Size: USD 4.11 billionFastest Growing Region: North America

Largest Market: EuropeProjection Time: 2022-2028Base Year: 2020

Global Aramid Fiber Market- Market Overview

Global aramid fiber market is expected to reach USD 7.72 billion by 2028, at a CAGR of 9.42% from 2022 to 2028. This growth of the aramid fiber market is significantly driven by the rising use of such materials in the manufacturing of automotive and aerospace industry. The increasing demand for lightweight materials in several application has led to high sales in the past few years. The developing countries are the major end-users of aramid fiber owing to the expansion of automobile industry.

Aramid fiber is known to be one of the first organically developed fiber which was used as a reinforcement in manufacturing of advance components. Aramid fibers have exceptional properties such as high tensile strength and modulus. These fibers have inherent heat and flame resistant. These characteristics helps to maintain the properties even at high temperatures. Aramid term is specifically designated for aromatic polyamide type which have 85% of their amide bonds directly attached to two aromatic rings. The configuration of such bonds is used to classify the type of aramid fiber. The first aramid fiber was commercialized in 1960s and was even used as a ballistic protection back then. The set of properties which these fibers consist of makes them suitable to be used in clothing, armor and other such applications.

Request Sample:- Global aramid fiber market

Market Dynamics

Drivers:

- Requirement for light-weight materials

The manufacturers present in end-user industries, especially, in automobile and aerospace industry have immense requirement for materials that can lower the overall weight of the components. The imposition of stringent regulations by different global and regional agencies. The United States Environment Agency and European Union had imposed regulation for vehicle emissions. These agencies provide regular and modified several norms in order to reduce CO2 emissions. Thus, the need for lightweight materials has increased owing to these regulations. Manufacturers are opting for aramid fiber in order to manufacture fuel efficient vehicles.

- Increasing demand for safety and protection materials

The use of aramid fiber is increasing in safety and protection equipment in end-use industry such as defense, automotive, healthcare, etc. The aramid fiber makes the consumer goods fire and stab resistant. These fibers are even used in protective clothing including footwear, gloves, helmets and coveralls. The defense applications require the use of high tensile materials in order to withstand extreme conditions. Improvisation in protective clothing is necessary for upgrading the quality especially for defense application.

Restraints:

- Fluctuating prices of raw materials

The aramid fiber market's expansion is being hampered by the variable cost of raw materials necessary for product development. The total costs are influenced by the raw material prices connected with the development of aramid fiber. The upstream price of raw materials has an impact on the production's final price. As a result, the shifting cost of raw materials has an impact on the market expansion of aramid fiber companies.

Opportunities:

- Expansion of aerospace and defense industry

The expansion of defense and aerospace industry is providing lucrative opportunities to the market. The composites used in equipment and protective components are manufactured using aramid fiber. The government of developed and developing countries are investing hugely on defense services and are always willing to strengthen their armed forces. The properties of aramid fiber make it compatible to be used in such equipment. Some of it’ properties include resistance against heat, high strength, lower creep, high toughness, and thermal dimensional stability. The increasing concerns over border disputes especially in countries such as US, China and India, has led to strengthening of their military base.

Challenges

- Complex research and development process

The aramid fiber requires the extensive research and development processes in order to be launched in the market. The technology used for manufacturing of aramid fiber are rigorous and require the use of high-end equipment. Further, the process is also lengthy and thus this leads to delay in commercialization of the product.

Segmentation Analysis

The global aramid fiber market has been segmented based on type, application, end-user, distribution channel, and regions.

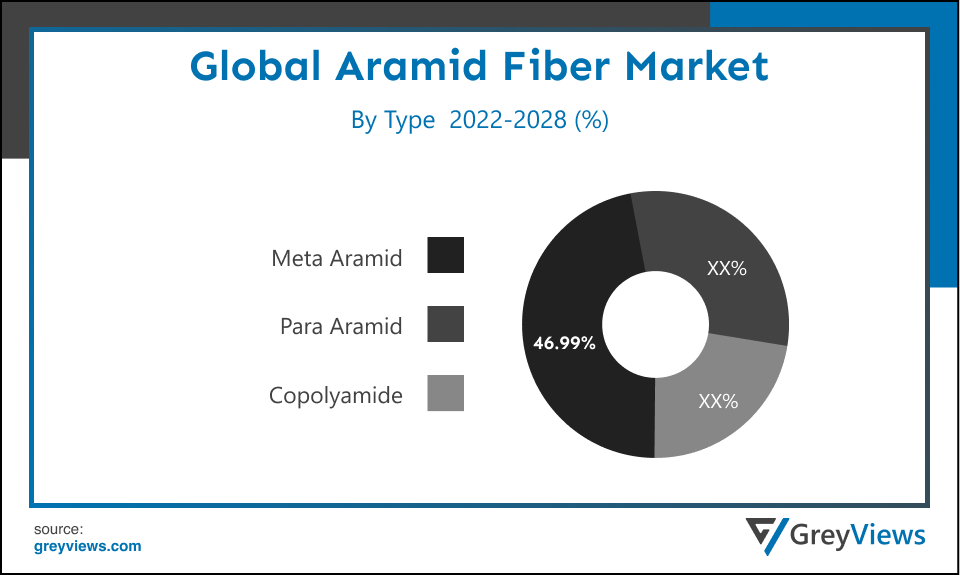

By Type

The type segment includes meta aramid, para aramid and copolyamide. The para aramid segment led the aramid fiber market with a market share of around 46.99% in 2021. Para aramid fibers have excellent properties such as high tensile strength, modulus behavior and resistance against chemical and heat. The para aramid fibers have higher flame resistance and effective ballistic properties. It even has high cut resistant and thus is widely used in safety and protection equipment.

By Application

The application segment includes friction materials, industrial filtration, security and protection, rubber reinforcement, optical fibers, tire reinforcement, electrical insulation and others. The security and protection segment led the aramid fiber market with a market share of around 31.93% in 2021. Security and protection applications are being more emphasized upon by the manufacturers. Aramid fiber are stab-resistant and bullet-resistant and thus the manufacturers of safety and protection equipment prefer using it in the manufacturing. Also, with the growing number of incidents in workplaces, the employers are also opting for safety equipment in their facilities.

By End-user

The end-user segment includes aerospace, automotive, electronics and telecommunication, industrial and others. The aerospace segment led the aramid fiber market with a market share of around 35.02% in 2021. Aerospace industry constantly performs research and development in order to upgrade the quality of components used in different aircrafts. Aircraft’s components are required to be light weight and fuel efficient. The use of efficient material is crucial in the aerospace industry. Aramid fibers have been used as a novel material in the manufacturing of aircrafts for over decades.

By Distribution Channel

The distribution channel segment includes online and offline. The compression moulding segment led the aramid fiber market with a market share of around 29.17% in 2021. Aramid fiber are majorly used by the end-users of aerospace, automotive, electronics and telecommunication industries. Thus, the end-users usually buy the product in bulk quantity, as it is used in manufacturing of various equipment and component. Manufacturers would prefer to check the quality in accordance with their requirement.

By Regional Analysis

The regions analyzed for the aramid fiber market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. Europe region dominated the aramid fiber market and held the 37.09% share of the market revenue in 2021.

- Europe region has registered highest value for the year 2021. The increasing production of aircrafts, automobile, safety equipment and electric and electronic product has led to rise in demand for the aramid fiber. The countries such as UK, Germany, Russia, France are the major end-users of aramid fiber. The increasing spending on defense and aerospace industry, is providing lucrative opportunities to the market growth of aramid fiber. Further, the presence of multiple manufacturers in the regional countries have increased the supply of product.

- North America is likely to register the substantial growth during the Projection period due to the use of aramid fiber in aerospace industry. The increasing use of private jets, helicopters, etc. and rise in number of air passengers has led to high demand of aramid fiber in Moreover, USA and Canada are some of the key countries for the aramid fiber market in the North America region. Further, the rising automobile spending is fueling up the market growth.

Key Industry Players Analysis

To increase their market position in the global aramid fiber business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Teijin Ltd.

- DuPont De Numerous Inc.

- Hyosung Corporation

- Kolon Industries

- Kermel

- SRO Aramid Co. Ltd.

- Yantai Tayho Advanced Materials Co. Ltd.

- Toray Industries

- Huvis Corporation

- China National Bluestar

- X-FIPER New Material Co. Ltd.

- Toyobo Co. Ltd.

Latest Development

In May 2020, a major player, HYOSUNG, had planned the expansion of the aramid fiber factory in Ulsan, South Korea. The company had also signed a Memorandum of Understanding for investment of USD 54 millions in this particular facility. The company had decided to expand the production to 3700 tons every year.

In November 2019, Teijin Ltd., which is a Netherlands based company, had announced to increase it’s production capacity by 25%. This has been done as a response to the increased demand from various end-users.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2018-2028 |

|

Base Year |

2021 |

|

Projection Period |

2022-2028 |

|

Market Share Unit |

USD Billion |

|

Segments Covered |

Type, Application, End-use and Distribution Channel |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle-East and Africa |

|

Major Players |

Teijin Ltd., DuPont De Numerous Inc., Hyosung Corporation, Kolon Industries, Kermel, SRO Aramid Co. Ltd., Yantai Tayho Advanced Materials Co. Ltd., Toray Industries, Huvis Corporation, China National Bluestar, X-FIPER New Material Co. Ltd. and Toyobo Co. Ltd. |

Scope of the Report

Global Aramid Fiber Market by Type:

- Meta Aramid

- Para Aramid

- Copolyamide

Global Aramid Fiber Market by Application:

- Friction Materials

- Industrial Filtration

- Security and Protection

- Rubber Reinforcement

- Optical Fibers

- Tire Reinforcement

- Electrical Insulation

- Others

Global Aramid Fiber Market by End-user:

- Aerospace

- Automotive

- Electronics

- Telecommunication

- Industrial

- Others

Global Aramid Fiber Market by Distribution Channel:

- Online

- Offline

Global Aramid fiber Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market size of the aramid fiber market?

Global aramid fiber market is expected to reach USD 7.72 billion by 2028, at a CAGR of 9.42% from 2022 to 2028.

What is the segmentation considered for the analysis of global aramid fiber market?

The global aramid fiber market has been segmented based on type, application, end-user, distribution channel and regions.

Which regions have been studied for the regional analysis of the global aramid fiber market?

The regions analyzed for the aramid fiber market include North America, Europe, South America, Asia Pacific, and the Middle East and Africa.

Which are the leading market players active in the aramid fiber market?

Leading market players active in the global aramid fiber market are Teijin Ltd., DuPont De Numerous Inc., Hyosung Corporation, Kolon Industries, Kermel, SRO Aramid Co. Ltd., Yantai Tayho Advanced Materials Co. Ltd., Toray Industries, Huvis Corporation, China National Bluestar, X-FIPER New Material Co. Ltd. and Toyobo Co. Ltd. among others.

What are the ongoing trends that are projected to influence the market in the upcoming years?

Manufacturers in the aramid fiber market are using advanced production technologies to incorporate better results, and performance of the whole process. In addition, the rising number of investments will contribute to demand for the aramid fiber.

What are the key driver of the aramid fiber market?

Rising demand for use of high strength, low weight and durable products, in manufacturing of safety equipment, automobile and aerospace components, is primarily driving the growth of the aramid fiber market.

What are the detailed impacts of COVID-19 pandemic on the global market?

The pandemic has significantly affected several industries and has caused a worldwide economic slowdown. Many regions imposed various lockdowns during the fiscal year 2020. These lockdowns led to closure of the regional industries and all type of manufacturing facilities, which has led to shortage of supply in the market. Additionally, all the end-users industries were temporarily closed during this period, which in turn has decreased the sales for aramid fiber.

How the company profile has been selected?

Based on the sales revenue, product offering, and regional presence, the companies are selected.

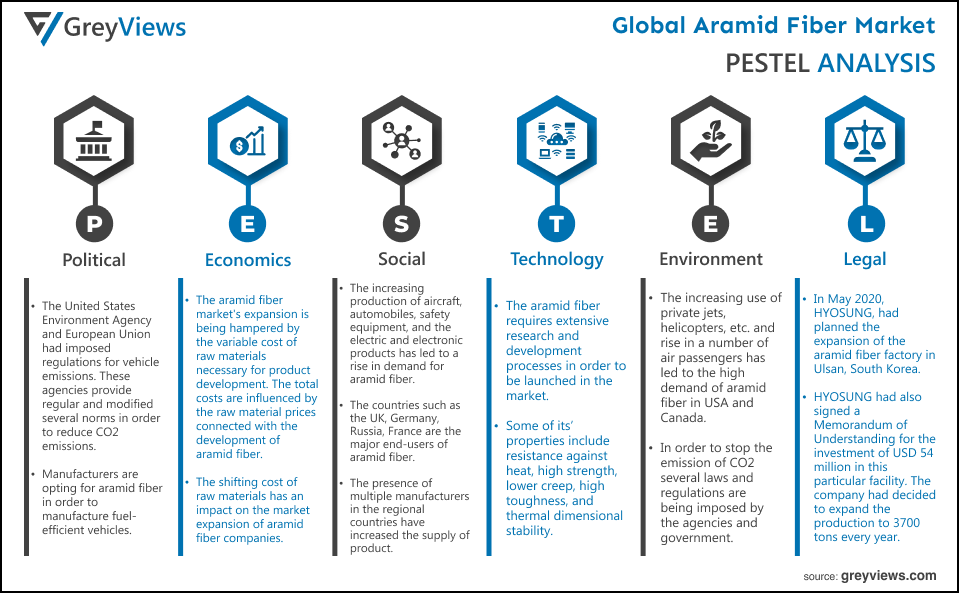

Political- The United States Environment Agency and European Union had imposed regulations for vehicle emissions. These agencies provide regular and modified several norms in order to reduce CO2 emissions. Thus, the need for lightweight materials has increased owing to these regulations. Manufacturers are opting for aramid fiber in order to manufacture fuel-efficient vehicles.

Economic- The aramid fiber market's expansion is being hampered by the variable cost of raw materials necessary for product development. The total costs are influenced by the raw material prices connected with the development of aramid fiber. The upstream price of raw materials has an impact on the production's final price. As a result, the shifting cost of raw materials has an impact on the market expansion of aramid fiber companies. The government of developed and developing countries are investing hugely in defense services and are always willing to strengthen their armed forces.

Social- The increasing production of aircraft, automobiles, safety equipment, and the electric and electronic products has led to a rise in demand for aramid fiber. The countries such as the UK, Germany, Russia, France are the major end-users of aramid fiber. The increasing spending on the defense and aerospace industry is providing lucrative opportunities to the market growth of aramid fiber. Further, the presence of multiple manufacturers in the regional countries have increased the supply of product.

Technological- The aramid fiber requires extensive research and development processes in order to be launched in the market. The technology used for the manufacturing of aramid fiber is rigorous and requires the use of high-end equipment. Further, the process is also lengthy and thus this leads to delay in the commercialization of the product. The properties of aramid fiber make it compatible to be used in such equipment. Some of its’ properties include resistance against heat, high strength, lower creep, high toughness, and thermal dimensional stability.

Environmental- The increasing use of private jets, helicopters, etc. and rise in a number of air passengers has led to the high demand of aramid fiber in Moreover, USA and Canada are some of the key factors polluting the environment. So, in order to stop the emission of CO2 several laws and regulations are being imposed by the agencies and government.

Legal- In May 2020, a major player, HYOSUNG, had planned the expansion of the aramid fiber factory in Ulsan, South Korea. The company had also signed a Memorandum of Understanding for the investment of USD 54 million in this particular facility. The company had decided to expand the production to 3700 tons every year.

- Introduction

- Objective Of The Study

- Overview Of Aramid Fiber Market

- Markets Covered

- Geographic Scope

- Years Considered For The Study

- Currency And Pricing

- Executive Summary

- Premium Insights

- Market Attractiveness Analysis

- Market Attractiveness Analysis By Type

- Market Attractiveness Analysis By Application

- Market Attractiveness Analysis By End-user

- Market Attractiveness Analysis By Distribution Channel

- Market Attractiveness Analysis By Region

- Industry SWOT

- Industry Trends

- Porter’s Five Forces Analysis

- Country Level Analysis

- Factors Considered For The Study

- Pointers Covered At Macro Level

- Pointers Covered At Micro Level

- Year On Year Growth Rate

- Technology Road Map

- Market Attractiveness Analysis

- Market Overview and Key Dynamics

- Drivers

- Restraints

- Opportunities

- Challenges

- Global Aramid Fiber Market Analysis and Projection, By Type

- Segment Overview

- Compression Moulding

- Meta Aramid

- Para Aramid

- Copolyamide

- Global Aramid Fiber Market Analysis and Projection, By Application

- Segment Overview

- Friction Materials

- Industrial Filtration

- Security and Protection

- Rubber Reinforcement

- Optical Fibers

- Tire Reinforcement

- Electrical Insulation

- Others

- Global Aramid Fiber Market Analysis and Projection, By End-user

- Segment Overview

- Aerospace

- Automotive

- Electronics and Telecommunication

- Industrial

- Others

- Global Aramid Fiber Market Analysis and Projection, By Distribution Channel

- Segment Overview

- Online

- Offline

- Global Aramid Fiber Market Analysis and Projection, By Regional Analysis

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- North America

- Global Aramid Fiber Market-Competitive Landscape

- Overview

- Market Share of Key Players in Global Aramid Fiber Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Product Launches and Developments

- Partnerships, Collaborations and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Teijin Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- DuPont De Numerous Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Hyosung Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Kolon Industries

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Kermel

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- SRO Aramid Co. Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Yantai Tayho Advanced Materials Co. Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Toray Industries

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Huvis Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- China National Bluestar

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- X-FIPER New Material Co. Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Toyobo Co. Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Teijin Ltd.

List of Table

- Global Aramid Fiber Market, By Type, 2021-2028 (USD Billion)

- Global Meta Aramid, Aramid Fiber Market, By Region, 2021-2028 (USD Billion)

- Global Para Aramid, Aramid Fiber Market, By Region, 2021-2028 (USD Billion)

- Global Copolyamide, Aramid Fiber Market, By Region, 2021-2028 (USD Billion)

- Global Aramid Fiber Market, By Application, 2021-2028 (USD Billion)

- Global Friction Materials, Aramid Fiber Market, By Region, 2021-2028 (USD Billion)

- Global Industrial Filtration, Aramid Fiber Market, By Region, 2021-2028 (USD Billion)

- Global Security and Protection, Aramid Fiber Market, By Region, 2021-2028 (USD Billion)

- Global Rubber Reinforcement, Aramid Fiber Market, By Region, 2021-2028 (USD Billion)

- Global Optical Fibers, Aramid Fiber Market, By Region, 2021-2028 (USD Billion)

- Global Tire Reinforcement, Aramid Fiber Market, By Region, 2021-2028 (USD Billion)

- Global Electrical Insulation, Aramid Fiber Market, By Region, 2021-2028 (USD Billion)

- Global Others, Aramid Fiber Market, By Region, 2021-2028 (USD Billion)

- Global Aramid Fiber Market, By End-user, 2021-2028 (USD Billion)

- Global Aerospace, Aramid Fiber Market, By Region, 2021-2028 (USD Billion)

- Global Automotive, Aramid Fiber Market, By Region, 2021-2028 (USD Billion)

- Global Electronics and Telecommunication, Aramid Fiber Market, By Region, 2021-2028 (USD Billion)

- Global Industrial, Aramid Fiber Market, By Region, 2021-2028 (USD Billion)

- Global Others, Aramid Fiber Market, By Region, 2021-2028 (USD Billion)

- Global Aramid Fiber Market, By Distribution Channel, 2021-2028 (USD Billion)

- Global Online, Aramid Fiber Market, By Region, 2021-2028 (USD Billion)

- Global Offline, Aramid Fiber Market, By Region, 2021-2028 (USD Billion)

- North America Aramid Fiber Market, By Type, 2021-2028 (USD Billion)

- North America Aramid Fiber Market, By Application, 2021-2028 (USD Billion)

- North America Aramid Fiber Market, By End-user, 2021-2028 (USD Billion)

- North America Aramid Fiber Market, By Distribution Channel 2021-2028 (USD Billion)

- US Aramid Fiber Market, By Type, 2021-2028 (USD Billion)

- US Aramid Fiber Market, By Application, 2021-2028 (USD Billion)

- US Aramid Fiber Market, By End-user, 2021-2028 (USD Billion)

- US Aramid Fiber Market, By Distribution Channel, 2021-2028 (USD Billion)

- Canada Aramid Fiber Market, By Type, 2021-2028 (USD Billion)

- Canada Aramid Fiber Market, By Application, 2021-2028 (USD Billion)

- Canada Aramid Fiber Market, By End-user, 2021-2028 (USD Billion)

- Canada Aramid Fiber Market, By Distribution Channel, 2021-2028 (USD Billion)

- Mexico Aramid Fiber Market, By Type, 2021-2028 (USD Billion)

- Mexico Aramid Fiber Market, By Application, 2021-2028 (USD Billion)

- Mexico Aramid Fiber Market, By End-user, 2021-2028 (USD Billion)

- Mexico Aramid Fiber Market, By Distribution Channel, 2021-2028 (USD Billion)

- Europe Aramid Fiber Market, By Type, 2021-2028 (USD Billion)

- Europe Aramid Fiber Market, By Application, 2021-2028 (USD Billion)

- Europe Aramid Fiber Market, By End-user, 2021-2028 (USD Billion)

- Europe Aramid Fiber Market, By Distribution Channel, 2021-2028 (USD Billion)

- Germany Aramid Fiber Market, By Type, 2021-2028 (USD Billion)

- Germany Aramid Fiber Market, By Application, 2021-2028 (USD Billion)

- Germany Aramid Fiber Market, By End-user, 2021-2028 (USD Billion)

- Germany Aramid Fiber Market, By Distribution Channel, 2021-2028 (USD Billion)

- France Aramid Fiber Market, By Type, 2021-2028 (USD Billion)

- France Aramid Fiber Market, By Application, 2021-2028 (USD Billion)

- France Aramid Fiber Market, By End-user, 2021-2028 (USD Billion)

- France Aramid Fiber Market, By Distribution Channel, 2021-2028 (USD Billion)

- UK Aramid Fiber Market, By Type, 2021-2028 (USD Billion)

- UK Aramid Fiber Market, By Application, 2021-2028 (USD Billion)

- UK Aramid Fiber Market, By End-user, 2021-2028 (USD Billion)

- UK Aramid Fiber Market, By Distribution Channel, 2021-2028 (USD Billion)

- Italy Aramid Fiber Market, By Type, 2021-2028 (USD Billion)

- Italy Aramid Fiber Market, By Application, 2021-2028 (USD Billion)

- Italy Aramid Fiber Market, By End-user, 2021-2028 (USD Billion)

- Italy Aramid Fiber Market, By Distribution Channel, 2021-2028 (USD Billion)

- Spain Aramid Fiber Market, By Type, 2021-2028 (USD Billion)

- Spain Aramid Fiber Market, By Application, 2021-2028 (USD Billion)

- Spain Aramid Fiber Market, By End-user, 2021-2028 (USD Billion)

- Spain Aramid Fiber Market, By Distribution Channel, 2021-2028 (USD Billion)

- Asia Pacific Aramid Fiber Market, By Type, 2021-2028 (USD Billion)

- Asia Pacific Aramid Fiber Market, By Application, 2021-2028 (USD Billion)

- Asia Pacific Aramid Fiber Market, By End-user, 2021-2028 (USD Billion)

- Asia Pacific Aramid Fiber Market, By Distribution Channel, 2021-2028 (USD Billion)

- Japan Aramid Fiber Market, By Type, 2021-2028 (USD Billion)

- Japan Aramid Fiber Market, By Application, 2021-2028 (USD Billion)

- Japan Aramid Fiber Market, By End-user, 2021-2028 (USD Billion)

- Japan Aramid Fiber Market, By Distribution Channel, 2021-2028 (USD Billion)

- China Aramid Fiber Market, By Type, 2021-2028 (USD Billion)

- China Aramid Fiber Market, By Application, 2021-2028 (USD Billion)

- China Aramid Fiber Market, By End-user, 2021-2028 (USD Billion)

- China Aramid Fiber Market, By Distribution Channel, 2021-2028 (USD Billion)

- India Aramid Fiber Market, By Type, 2021-2028 (USD Billion)

- India Aramid Fiber Market, By Application, 2021-2028 (USD Billion)

- India Aramid Fiber Market, By End-user, 2021-2028 (USD Billion)

- India Aramid Fiber Market, By Distribution Channel, 2021-2028 (USD Billion)

- South America Aramid Fiber Market, By Type, 2021-2028 (USD Billion)

- South America Aramid Fiber Market, By Application, 2021-2028 (USD Billion)

- South America Aramid Fiber Market, By End-user, 2021-2028 (USD Billion)

- South America Aramid Fiber Market, By Distribution Channel, 2021-2028 (USD Billion)

- Brazil Aramid Fiber Market, By Type, 2021-2028 (USD Billion)

- Brazil Aramid Fiber Market, By Application, 2021-2028 (USD Billion)

- Brazil Aramid Fiber Market, By End-user, 2021-2028 (USD Billion)

- Brazil Aramid Fiber Market, By Distribution Channel, 2021-2028 (USD Billion)

- Middle East and Africa Aramid Fiber Market, By Type, 2021-2028 (USD Billion)

- Middle East and Africa Aramid Fiber Market, By Application, 2021-2028 (USD Billion)

- Middle East and Africa Aramid Fiber Market, By End-user, 2021-2028 (USD Billion)

- Middle East and Africa Aramid Fiber Market, By Distribution Channel, 2021-2028 (USD Billion)

- UAE Aramid Fiber Market, By Type, 2021-2028 (USD Billion)

- UAE Aramid Fiber Market, By Application, 2021-2028 (USD Billion)

- UAE Aramid Fiber Market, By End-user, 2021-2028 (USD Billion)

- UAE Aramid Fiber Market, By Distribution Channel, 2021-2028 (USD Billion)

- South Africa Aramid Fiber Market, By Type, 2021-2028 (USD Billion)

- South Africa Aramid Fiber Market, By Application, 2021-2028 (USD Billion)

- South Africa Aramid Fiber Market, By End-user, 2021-2028 (USD Billion)

- South Africa Aramid Fiber Market, By Distribution Channel, 2021-2028 (USD Billion)

List of Figures

- Global Aramid Fiber Market Segmentation

- Global Aramid Fiber Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Aramid Fiber Market Attractiveness Analysis By Type

- Global Aramid Fiber Market Attractiveness Analysis By Application

- Global Aramid Fiber Market Attractiveness Analysis By End-user

- Global Aramid Fiber Market Attractiveness Analysis By Distribution Channel

- Global Aramid Fiber Market Attractiveness Analysis By Region

- Global Aramid Fiber Market: Dynamics

- Global Aramid Fiber Market Share By Type (2021 & 2028)

- Global Aramid Fiber Market Share By Application (2021 & 2028)

- Global Aramid Fiber Market Share By End-user (2021 & 2028)

- Global Aramid Fiber Market Share By Distribution Channel (2021 & 2028)

- Global Aramid Fiber Market Share By Regions (2021 & 2028)

- Global Aramid Fiber Market Share By Company (2021)