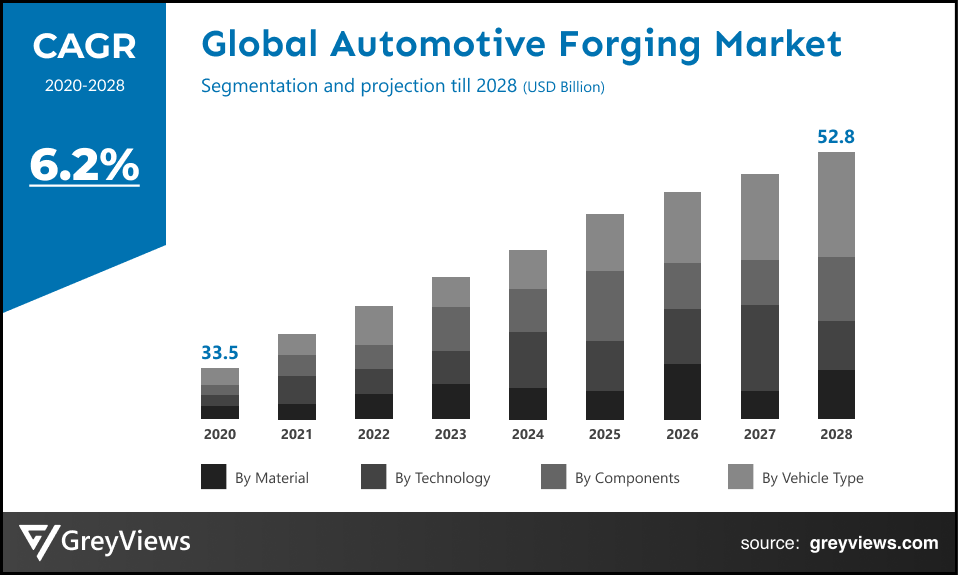

Global Automotive Forging Market Size by Material (Aluminum and Steel), By Technology (Closed Die, Open Die, and Others), Components (Engine Components, Steering/chassis components, Transmission components, Drive Components, and Other Components), and Vehicle Type (Passenger Car, Light Commercial Vehicles, and Heavy Commercial Vehicles), Regions, Segmentation and Projection till 2028

CAGR: 6.2%Current Market Size: USD 33.5 BillionFastest Growing Region: North America & Europe

Largest Market: APACProjection Time: 2021-2028Base Year: 2020

Global Automotive Forging Market- Market Overview

The global automotive forging market is expected to grow from USD 33.5 Billion in 2020 to USD 52.8 Billion by 2028, at a CAGR of 6.2% during the Projection period 2021-2028. This growth of the automotive forging market is significantly driven by increased automotive production across the globe due to rising demand for luxury vehicle models and heavy-duty vehicles.

Forging is the manufacturing process mainly associated with the shaping of metal by applying compressive forces such as pressing, hammering, or rolling. In automotive industry the forging process involves manufacturing of different automotive components such as engine parts (including connecting rods, crankshaft, camshaft, and piston among others), bearings, chassis, gears, and others. Forging process offers enhanced mechanical properties for automotive parts as well as ensures a stable working station. According to the required mechanical properties, automotive forging process is carried out on materials either in cold or hot state.

In the past years, steel had been a commonly used material in the automotive forging industry due to its availability, strength, and high resilience. However, on the other hand, Aluminum is witnessing significant traction due to rising demand for light weight vehicles.

Request Sample:- Global automotive forging market

Market Dynamics

Drivers:

- Increased automotive production across the globe

There is significant rise in economic growth, alongside the huge demand for passenger cars, buses, trucks, and other commercial vehicles. This has led to the growth in automotive production across the globe. For instance, in Canada, with about $12.5 billion contribution to GDP in 2020, it has become one of largest manufacturing sectors in the country. In addition to this, a number of factors such as robust R&D centers, availability of skilled labor at low cost, and low-cost steel production have led to the rise in automotive production in developing countries such as India and China, fueling the growth of the global automotive forging market.

- Rapid economic growth in developing countries

Rapid economic growth due to rising urbanization and industrialization coupled with the ongoing development of infrastructure in developing countries such as India, China, and Indonesia has impacted positively on the growth of the market. This factor has also led to the huge production of commercial vehicles. For instance, according to the Organisation Internationale des Constructeurs d'Automobiles (OICA), the commercial vehicles stood at 26,693,300 vehicles in 2019. Hence, economic growth in developing countries boosts the growth of the global automotive forging market.

Restraints:

- Ongoing demand for electric vehicles

There is rising demand for electric vehicles coupled with the chassis & ancillary parts that are made of polymer materials. This factor hampers the growth of the automotive forging industry. For instance, car chassis design has recently been revolutionized by plastic and polymer-composite components for the purpose of reducing weight while improving fuel efficiency as well as stiffness. On the other hand, electric vehicles do not have internal combustion engines and power transmission parts leading to the decline in demand for the automotive forging of engines and associated components. Such factors hinder the growth of the global automotive forging market.

Opportunities:

- Increased automation in forging procedures

The increasing emphasis towards automation of forging procedures has been seen among the forging companies. Along with the integration of automation, the forging companies are also looking for advanced technologies, for catalyzing the production volume. This has further created substantial growth opportunities for the market growth.

Challenges:

- Disruptions due to COVID-19

Owing to the unprecedented crisis of COVID-19, a number of countries have employed nationwide lockdowns. However, as they are reopening, safety measures such as social distancing are still being applied. This has caused a significant economic downturn across the globe along with the sudden discontinuation of automotive and associated components production. Hence, the emergence of the COVID-19 pandemic has posed challenges to the global automotive forging market.

Segmentation Analysis

The global automotive forging market has been segmented based on material, technology, components, vehicle type, and regions.

By Material

- The material segment includes aluminum and steel. The steel segment led the Automotive Forging market with a market share of around 71.2% in 2020. The growth of this segment is mainly driven by the ability of steel to design a stronger vehicle with forged components. In addition to this, its extensive availability and high resilience boost the growth of the segment size. This material is rapidly being used for the manufacture of joints & bearings, crankshafts, and axles. However, the aluminum segment is expected to witness the highest growth rate during the Projection period due to the ongoing demand for lightweight

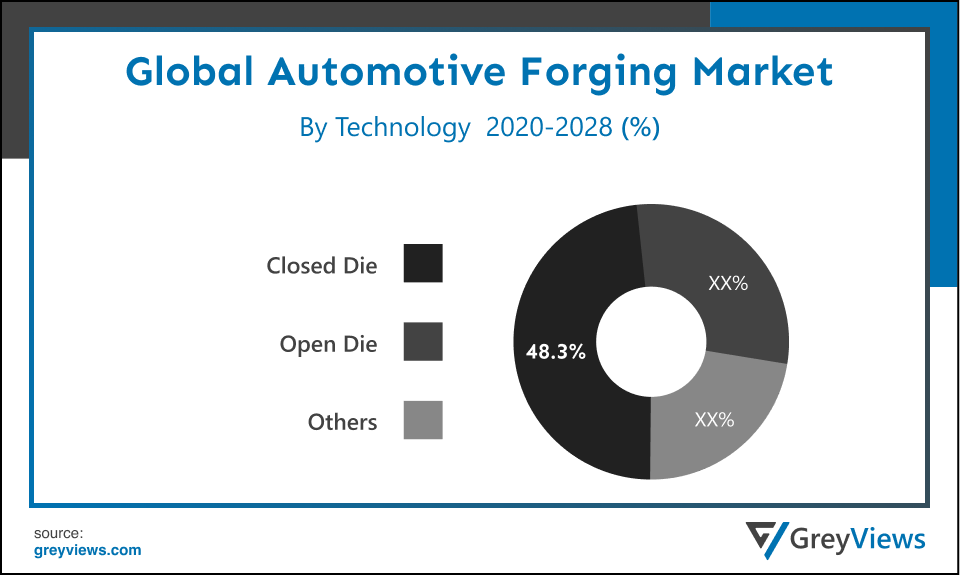

By Technology

- The technology segment includes Closed Die, Open Die, and Others. The closed die segment led the Automotive Forging market with a market share of around 48.3% in 2020. The number of benefits offers by closed die forging including enhanced surface finish and superior mechanical properties, cost-effectiveness for large production, and ability to reproduce nearly any shape and/or size primarily drives the growth of the segment. However, the open Die segment is expected to witness the highest growth rate during the Projection period.

By Components

- The components segment includes engine components, steering/chassis components, transmission components, drive components, and other components. The engine components segment held the largest market share of 35.4% in 2020. The growth of this segment is mainly driven by increasing demand for improved vehicle engine performance and the high-quality forging of engine parts including connecting rods, crankshaft, camshaft, and piston among others. However, the drive components segment is expected to witness significant growth during the Projection period.

By Vehicle Type

- The vehicle type segment includes passenger cars, light commercial vehicles, and heavy commercial vehicles. The passenger car segment held the largest market share of 38.6% in 2020. Increasing disposable income of end-users primarily drives the growth of this segment. In addition to this, the fact that passenger cars are the most essential mode of conveyance in developed countries, as well as developing countries, has boosted the segment growth. However, the lightweight commercial vehicle segment is expected to witness the highest growth rate during the Projection period.

By Regional Analysis

The regions analyzed for the automotive forging market include North America, Europe, South America, Asia Pacific, and the Middle East and Africa. The Asia Pacific region dominated the automotive forging market and held the 37.1% share of the market revenue in 2020.

- Growth of the Asia Pacific Automotive Forging market is mainly driven by a number of factors such as increasing disposable income of populations, rapid growth in the automotive industry in China, rapid economic growth, rising urbanization and industrialization, and ongoing development for infrastructure across the countries such as India, China, and Indonesia. In addition to this, supportive government initiatives for the automotive forging industry are projected to boost the market growth in the region.

- The North America and Europe region are likely to register significant growth during the Projection period due to the significant presence of key market players along with the high per capita income of people in the regions. In addition, an upsurge in demand for passenger cars and rising research & development investments in the automotive sector are expected to create lucrative growth opportunities for the market growth in these regions.

Key Industry Players Analysis

Key market players are focusing on implementing new strategies to improve market position

The key players are now concentrating on implementing strategies such as adopting new technology, product innovations, mergers & acquisitions, joint venture, alliances, and partnerships to improve their market position in the global automotive forging industry.

For instance, in September 2018, FAW Jiefang, the Chinese truck manufacturer, and ZF Friedrichshafen AG, the global automotive supplier signed a strategic partnership agreement to jointly work on providing consumers with intelligent traffic and transportation solutions.

In August 2019, ThyssenKrupp, one of the leading market players invested €80 million in building one of the most advanced forging lines in Homburg, Germany.

In April 2017, American Axle & Manufacturing Holdings, Inc., one of the leading market players acquired Metaldyne Performance Group Inc. (MPG), the provider of diverse metal-forming and advanced machining and assembly.

- ZF Friedrichshafen AG

- Bharat Forge Limited

- NTN Corporation

- American Axle & Manufacturing, Inc.

- Meritor Inc.

- ThyssenKrupp AG

- CIE Automotive, S.A.

- Dana Inc.

- Ramkrishna Forgings

- Nanjin Automobile Forging Co., Ltd.

Latest Development

- November 2020- Dana Incorporated announced the purchase of a portion of the thermal-management business of Modine Manufacturing Company's automotive segment. This acquisition strengthens Dana's Power Technologies business unit.

- May 2020- WABCO which is one of the commercial vehicle technology supplier was acquired by ZF Friedrichshafen AG which is one of the leading market players in Automotive Forging Market. This acquisition is expected to bring a new dimension of innovation as well as the capability for commercial vehicle systems technology.

Report Metrics

|

Report Attribute |

Details |

|

Projection period |

2021-2028 |

|

Base year considered |

2020 |

|

CAGR (%) |

6.2% |

|

Market Size |

33.5 Billion in 2020 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Material, Technology, Components, Vehicle Type, and Regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

ZF Friedrichshafen AG, Bharat Forge Limited, NTN Corporation, American Axle & Manufacturing, Inc., Meritor Inc., ThyssenKrupp AG, CIE Automotive, S.A., Dana Inc., Ramkrishna Forgings among others. |

|

By Material |

|

|

By Technology |

|

|

By Components

|

|

|

By Vehicle Type |

|

|

Regional scope |

|

Scope of the Report

Global Automotive Forging Market by Material:

- Aluminum

- Steel

Global Automotive Forging Market by Technology:

- Closed Die

- Open Die

- Others

Global Automotive Forging Market by Components:

- Engine Components

- Steering/chassis components

- Transmission components

- Drive Components

- Other Components

Global Automotive Forging Market by Vehicle Type:

- Passenger Car

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Global Automotive Forging Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market value of the automotive forging Market in 2020?

The market value of the Automotive Forging Market in 2020 is $ 33.5 Billion.

Which is the most influencing segment growing in the automotive forging report?

The steel segment is the most influencing segment in the Automotive Forging market.

Which region has the highest market share in the automotive forging Market?

Asia-Pacific held the major share in the market over the Projection period 2021- 2028.

Which are the Top players active in the automotive forging market?

The leading market players active in the global Automotive Forging market are ZF Friedrichshafen AG, Bharat Forge Limited, NTN Corporation, American Axle & Manufacturing, Inc., Meritor Inc., ThyssenKrupp AG, CIE Automotive, S.A., Dana Inc., and Ramkrishna Forgings among others.

What are the segments considered in the global automotive forging market?

Material, Technology, Components, Vehicle Type, and regions are the five segments of the report.

Does this report include the impact of COVID-19 on the automotive forging market?

Yes, the market includes qualitative and quantitative insights for COVID-19 impact on the Automotive Forging market.

What is the study period of this market?

The automotive forging market is studied from 2020 - 2028.

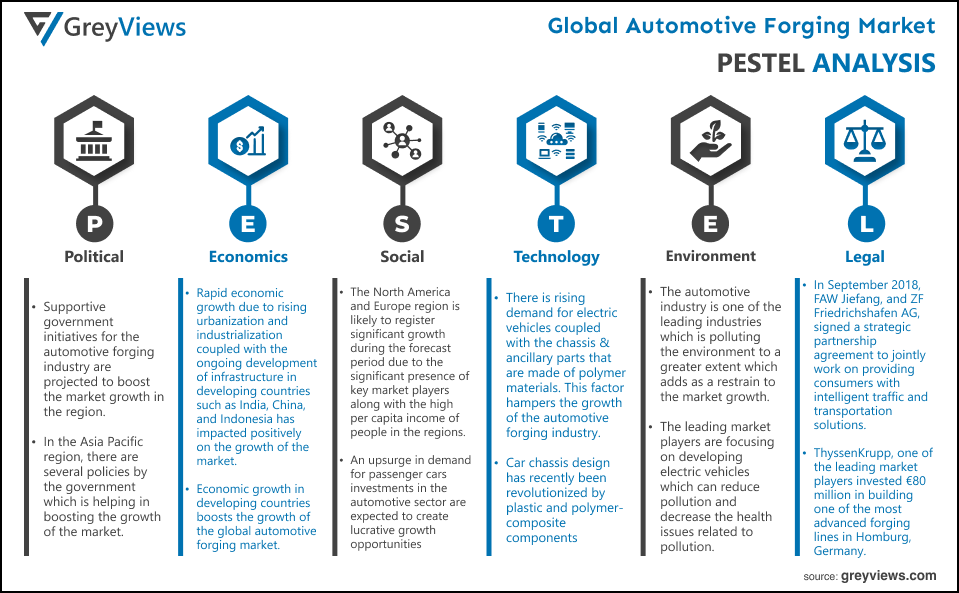

Political- Supportive government initiatives for the automotive forging industry are projected to boost the market growth in the region. In the Asia Pacific region, there are several policies by the government which is helping in boosting the growth of the market.

Economic- Rapid economic growth due to rising urbanization and industrialization coupled with the ongoing development of infrastructure in developing countries such as India, China, and Indonesia has impacted positively on the growth of the market. This factor has also led to the huge production of commercial vehicles. For instance, according to the Organisation Internationale des Constructeurs d'Automobiles (OICA), the commercial vehicles stood at 26,693,300 vehicles in 2019. Hence, economic growth in developing countries boosts the growth of the global automotive forging market.

Social- The North America and Europe region is likely to register significant growth during the Projection period due to the significant presence of key market players along with the high per capita income of people in the regions. In addition, an upsurge in demand for passenger cars and rising research & development investments in the automotive sector are expected to create lucrative growth opportunities for the market growth in these regions. Growth of the Asia Pacific Automotive Forging market is mainly driven by a number of factors such as increasing disposable income of populations, rapid growth in the automotive industry in China, rapid economic growth, rising urbanization and industrialization, and ongoing development for infrastructure across the countries such as India, China, and Indonesia.

Technological- There is rising demand for electric vehicles coupled with the chassis & ancillary parts that are made of polymer materials. This factor hampers the growth of the automotive forging industry. For instance, car chassis design has recently been revolutionized by plastic and polymer-composite components for the purpose of reducing weight while improving fuel efficiency as well as stiffness. On the other hand, electric vehicles do not have internal combustion engines and power transmission parts leading to the decline in demand for the automotive forging of engines and associated components. Such factors hinder the growth of the global automotive forging market.

Environmental- The automotive industry is one of the leading industries which is polluting the environment to a greater extent which adds as a restrain to the market growth. The leading market players are focusing on developing electric vehicles which can reduce pollution and decrease the health issues related to pollution.

Legal- In September 2018, FAW Jiefang, the Chinese truck manufacturer, and ZF Friedrichshafen AG, the global automotive supplier signed a strategic partnership agreement to jointly work on providing consumers with intelligent traffic and transportation solutions. ThyssenKrupp, one of the leading market players invested €80 million in building one of the most advanced forging lines in Homburg, Germany. American Axle & Manufacturing Holdings, Inc., one of the leading market players acquired Metaldyne Performance Group Inc. (MPG), the provider of diverse metal-forming and advanced machining and assembly.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Material

- Market Attractiveness Analysis By Technology

- Market Attractiveness Analysis By Components

- Market Attractiveness Analysis By Vehicle type

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Increased automotive production across the globe

- Rapid economic growth in developing countries

- Restrains

- Ongoing demand for electric vehicles

- Opportunities

- Increased automation in forging procedures

- Challenges

- Disruptions due to COVID-19

- Global Automotive Seats Market Analysis and Projection, By Material

- Segment Overview

- Aluminium

- Steel

- Global Automotive Seats Market Analysis and Projection, By Technology

- Segment Overview

- Closed Die

- Open Die

- Others

- Global Automotive Seats Market Analysis and Projection, By Components

- Segment Overview

- Engine Components

- Steering/chassis components

- Transmission components

- Drive Components

- Other Components

- Global Automotive Seats Market Analysis and Projection, By Vehicle type

- Segment Overview

- Passenger Car

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Global Automotive Seats Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- S.

- Canada

- Mexico

- Europe

- Germany

- France

- K.

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Automotive Seats Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Automotive Seats Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Material Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- ZF Friedrichshafen AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- Bharat Forge Limited

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- NTN Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- American Axle & Manufacturing, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- Meritor Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- ThyssenKrupp AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- CIE Automotive

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- Dana Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- Ramkrishna Forgings

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- Nanjin Automobile Forging Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- ZF Friedrichshafen AG

List of Table

- Global Automotive Seats Market, By Material, 2020–2028(USD Billion)

- Global Aluminium Market, By Region, 2020–2028(USD Billion)

- Global Steel Market, By Region, 2020–2028(USD Billion)

- Global Automotive Seats Market, By Technology, 2020–2028(USD Billion)

- Global Closed Die Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Open Die Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Others Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Automotive Seats Market, By Components, 2020–2028(USD Billion)

- Global Engine Components Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Steering/chassis components Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Transmission components Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Drive Components Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Other Components Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Automotive Seats Market, By Vehicle type, 2020–2028(USD Billion)

- Global Passenger Car Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Light Commercial Vehicles Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Heavy Commercial Vehicles Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Automotive Seats Market, By North America, 2020–2028(USD Billion)

- North America Automotive Seats Market, By Material, 2020–2028(USD Billion)

- North America Automotive Seats Market, By Technology, 2020–2028(USD Billion)

- North America Automotive Seats Market, By Components, 2020–2028(USD Billion)

- North America Automotive Seats Market, By Vehicle type, 2020–2028(USD Billion)

- US Automotive Seats Market, By Material, 2020–2028(USD Billion)

- US Automotive Seats Market, By Technology, 2020–2028(USD Billion)

- US Automotive Seats Market, By Components, 2020–2028(USD Billion)

- US Automotive Seats Market, By Vehicle type, 2020–2028(USD Billion)

- Canada Automotive Seats Market, By Material, 2020–2028(USD Billion)

- Canada Automotive Seats Market, By Technology, 2020–2028(USD Billion)

- Canada Automotive Seats Market, By Components, 2020–2028(USD Billion)

- Canada Automotive Seats Market, By Vehicle type, 2020–2028(USD Billion)

- Mexico Automotive Seats Market, By Material, 2020–2028(USD Billion)

- Mexico Automotive Seats Market, By Technology, 2020–2028(USD Billion)

- Mexico Automotive Seats Market, By Components, 2020–2028(USD Billion)

- Mexico Automotive Seats Market, By Vehicle type, 2020–2028(USD Billion)

- Europe Automotive Seats Market, By Material, 2020–2028(USD Billion)

- Europe Automotive Seats Market, By Technology, 2020–2028(USD Billion)

- Europe Automotive Seats Market, By Components, 2020–2028(USD Billion)

- Europe Automotive Seats Market, By Vehicle type, 2020–2028(USD Billion)

- Germany Automotive Seats Market, By Material, 2020–2028(USD Billion)

- Germany Automotive Seats Market, By Technology, 2020–2028(USD Billion)

- Germany Automotive Seats Market, By Components, 2020–2028(USD Billion)

- Germany Automotive Seats Market, By Vehicle type, 2020–2028(USD Billion)

- France Automotive Seats Market, By Material, 2020–2028(USD Billion)

- France Automotive Seats Market, By Technology, 2020–2028(USD Billion)

- France Automotive Seats Market, By Components, 2020–2028(USD Billion)

- France Automotive Seats Market, By Vehicle type, 2020–2028(USD Billion)

- UK Automotive Seats Market, By Material, 2020–2028(USD Billion)

- UK Automotive Seats Market, By Technology, 2020–2028(USD Billion)

- UK Automotive Seats Market, By Components, 2020–2028(USD Billion)

- UK Automotive Seats Market, By Vehicle type, 2020–2028(USD Billion)

- Italy Automotive Seats Market, By Material, 2020–2028(USD Billion)

- Italy Automotive Seats Market, By Technology, 2020–2028(USD Billion)

- Italy Automotive Seats Market, By Components, 2020–2028(USD Billion)

- Italy Automotive Seats Market, By Vehicle type, 2020–2028(USD Billion)

- Spain Automotive Seats Market, By Material, 2020–2028(USD Billion)

- Spain Automotive Seats Market, By Technology, 2020–2028(USD Billion)

- Spain Automotive Seats Market, By Components, 2020–2028(USD Billion)

- Spain Automotive Seats Market, By Vehicle type, 2020–2028(USD Billion)

- Asia Pacific Automotive Seats Market, By Material, 2020–2028(USD Billion)

- Asia Pacific Automotive Seats Market, By Technology, 2020–2028(USD Billion)

- Asia Pacific Automotive Seats Market, By Components, 2020–2028(USD Billion)

- Asia Pacific Automotive Seats Market, By Vehicle type, 2020–2028(USD Billion)

- Japan Automotive Seats Market, By Material, 2020–2028(USD Billion)

- Japan Automotive Seats Market, By Technology, 2020–2028(USD Billion)

- Japan Automotive Seats Market, By Components, 2020–2028(USD Billion)

- Japan Automotive Seats Market, By Vehicle type, 2020–2028(USD Billion)

- China Automotive Seats Market, By Material, 2020–2028(USD Billion)

- China Automotive Seats Market, By Technology, 2020–2028(USD Billion)

- China Automotive Seats Market, By Components, 2020–2028(USD Billion)

- China Automotive Seats Market, By Vehicle type, 2020–2028(USD Billion)

- India Automotive Seats Market, By Material, 2020–2028(USD Billion)

- India Automotive Seats Market, By Technology, 2020–2028(USD Billion)

- India Automotive Seats Market, By Components, 2020–2028(USD Billion)

- India Automotive Seats Market, By Vehicle type, 2020–2028(USD Billion)

- South America Automotive Seats Market, By Material, 2020–2028(USD Billion)

- South America Automotive Seats Market, By Technology, 2020–2028(USD Billion)

- South America Automotive Seats Market, By Components, 2020–2028(USD Billion)

- South America Automotive Seats Market, By Vehicle type, 2020–2028(USD Billion)

- Brazil Automotive Seats Market, By Material, 2020–2028(USD Billion)

- Brazil Automotive Seats Market, By Technology, 2020–2028(USD Billion)

- Brazil Automotive Seats Market, By Components, 2020–2028(USD Billion)

- Brazil Automotive Seats Market, By Vehicle type, 2020–2028(USD Billion)

- Brazil Automotive Seats Market, By Electric Components, 2020–2028(USD Billion)

- Middle East and Africa Automotive Seats Market, By Technology, 2020–2028(USD Billion)

- Middle East and Africa Automotive Seats Market, By Components, 2020–2028(USD Billion)

- Middle East and Africa Automotive Seats Market, By Vehicle type, 2020–2028(USD Billion)

- UAE Automotive Seats Market, By Material, 2020–2028(USD Billion)

- UAE Automotive Seats Market, By Technology, 2020–2028(USD Billion)

- UAE Automotive Seats Market, By Components, 2020–2028(USD Billion)

- UAE Automotive Seats Market, By Vehicle type, 2020–2028(USD Billion)

- South Africa Automotive Seats Market, By Material, 2020–2028(USD Billion)

- South Africa Automotive Seats Market, By Technology, 2020–2028(USD Billion)

- South Africa Automotive Seats Market, By Components, 2020–2028(USD Billion)

- South Africa Automotive Seats Market, By Vehicle type, 2020–2028(USD Billion)

List of Figures

- Global Automotive Seats Market Segmentation

- Automotive Seats Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Automotive Seats Market Attractiveness Analysis By Material

- Global Automotive Seats Market Attractiveness Analysis By Technology

- Global Automotive Seats Market Attractiveness Analysis By Components

- Global Automotive Seats Market Attractiveness Analysis By Vehicle type

- Global Automotive Seats Market Attractiveness Analysis By Region

- Global Automotive Seats Market: Dynamics

- Global Automotive Seats Market Share By Material(2021 & 2028)

- Global Automotive Seats Market Share By Technology(2021 & 2028)

- Global Automotive Seats Market Share By Components(2021 & 2028)

- Global Automotive Seats Market Share By Vehicle type(2021 & 2028)

- Global Automotive Seats Market Share by Regions (2021 & 2028)

- Global Automotive Seats Market Share by Company (2020)