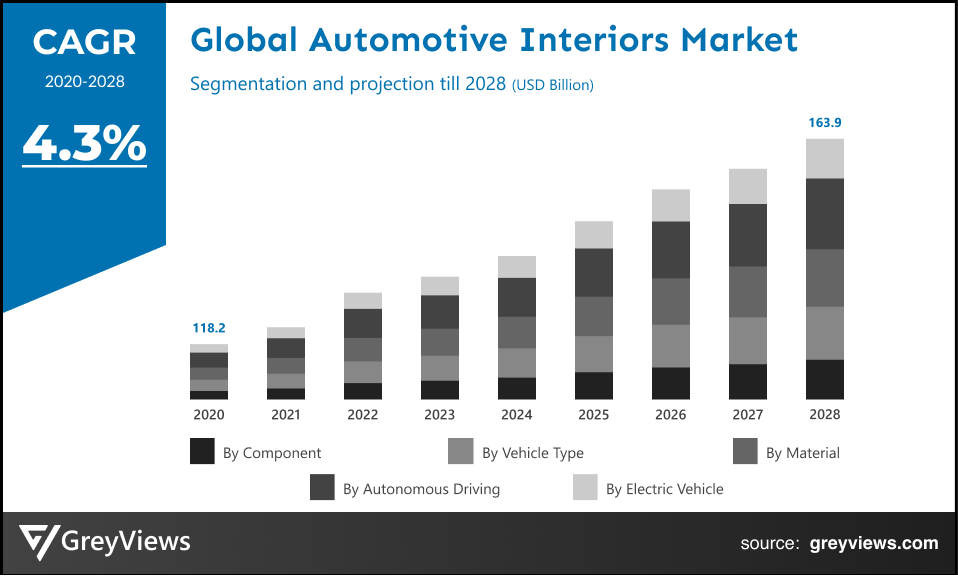

Global Automotive Interiors Market Size by Component (Cockpit Module, Flooring, Automotive Seat, Door Panel, Interior Lighting, and Other) Vehicle Type (Passenger Car, Light Commercial Vehicle and Heavy Commercial Vehicle), Material (Leather Fabric, Vinyl, Wood, Glass Fiber Composite, Carbon fiber Composite, and Metal), Autonomous Driving (Semi-Autonomous and Autonomous), and Electric Vehicle (BEV, FCEV, HEV, and PHEV) Regions, Segmentation and Projection till 2028.

CAGR: 4.3%Current Market Size: USD 118.2 BillionFastest Growing Region: MEA

Largest Market: APACProjection Time: 2021-2028Base Year: 2020

Global Automotive Interiors Market- Market Overview

The global Automotive Interiors market is expected to grow from USD 118.2 Billion in 2020 to USD 163.9 Billion by 2028, at a CAGR of 4.3% during the Projection period 2021-2028. This growth of the automotive interiors market is significantly driven by an upsurge in production and sales volumes of vehicles around the globe coupled with the rising customer preference toward premium features, convenience, and safety.

Automotive Interiors are all of the components that are inside a vehicle. It includes the steering wheel, dashboard, door panels, seats, and so on. The interiors ensure the safety of passengers while providing and assuring the functions of the instrument panels, doors, seats, and windows. The range of interior components comprises seat adjusters and locking mechanisms, door panels, lashing eyes and fitting components, height and backrest adjusters, and actuators and footrests. This component offers grip, comfort, and sound insulation for the vehicle cabin. Along with enhancing user comfort, automotive Interiors boost the vehicle's aesthetic appearance and efficiency.

Further, the automotive interior is the foremost factor that influences the perception of buyers regarding the quality of a vehicle; hence it is an essential part of any vehicle.

Request Sample:- Global automotive interiors market

Market Dynamics

Drivers:

- Huge demand for passenger vehicles across the globe

Passenger vehicles are the most common mode of transportation across developed countries. Also, there is a rise in demand for passenger vehicles in developing countries due to significant growth in per capita income. Moreover, demand for Special Utility Vehicles (SUVs) has increased in past few years due to increasing tour and leisure activities globally. The aforementioned factors are projected to tremendous growth in the number of passenger vehicles; thus, eventually boosting growth of the automotive interior market.

- Growth focus on the well-being of drivers and improvement of the driving experience

In the past few years, cars are being equipped with cutting-edge gadgets such as hands-free connectivity, entertainment system, and global position system (GPS) to enhance driving experiences. For instance, in September 2021, Hyundai Motor Company launched a new Hyundai Casper Micro SUV in South Korea. It is one of the smallest passenger vehicles in the company’s global portfolio. This vehicle also features a neat dashboard as well as an 8.0-inch touchscreen infotainment system, a 4.2-inch digital instrument cluster, air purifier, and an electric sunroof. The emergence of such vehicles focused on the well-being of drivers and improvement of the driving experience boosts demand for the automotive interior.

Restraints:

- Increasing raw material prices

Steel, plastics, rubber, and aluminum are the most commonly used commodities in vehicles. However, increasing prices of this raw material are one of the major concerns for the automotive interior market. This is attributed to the fact that steel, iron, and plastics prices have soared to high levels in recent times. On the other hand, rising automotive import tariffs hampers the growth of the automotive interior market.

Opportunities:

- Expected growth in demand for electric vehicles (EV)

Over the past decade, EV sales have grown significantly mainly across the China and Europe regions. These types of vehicles have the potential to decrease emissions and address climate change. Hence, demand for such vehicles is anticipated to increase significantly in upcoming years. This will provide lucrative growth opportunities for the automotive interior market.

Challenges:

- Fluctuations due to COVID-19

Owing to the unprecedented crisis of COVID-19, a number of countries have employed nationwide lockdowns. However, as they are reopening, safety measures such as social distancing are still being applied. This has caused a significant economic downturn across the globe. Due to the slowdown in industrial activities and consumer markets, the automotive Interiors industry has been impacted as the production of vehicles has been hampered during the pandemic. The market players needed to embrace various strategies to cope with the pandemic. Thus, the emergence of the COVID-19 pandemic has posed challenges to the global Automotive Interiors market.

Segmentation Analysis

The global automotive interiors market has been segmented based on components, vehicle type, material, autonomous driving, electric vehicle, and regions.

By Component

- The component segment includes cockpit module, flooring, automotive seat, door panel, interior lighting, and others. The cockpit module segment led the automotive interiors market with a market share of around 31.2% in 2020. This is due to the rise in demands for the premium cockpit in the car as well as to focus on augmenting the appeal of a cabin and modifying it to be a feature-full cockpit. The cockpit module is the main interface for the passengers and the driver on board. In addition to this, an increase in demand for advanced and digital modules further boosts the growth of this segment.

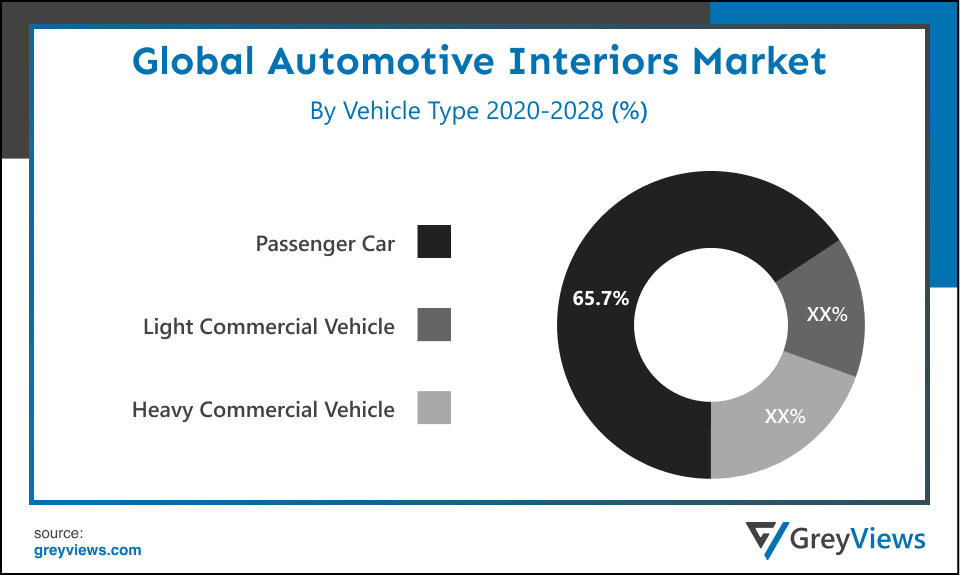

By Vehicle Type

- The vehicle type segment includes passenger cars, light commercial vehicles, and heavy commercial vehicles. The passenger car segment held the largest market share of 65.7% in 2020. Growth of this segment is mainly driven by rapidly growing usage of passenger cars for conveyance in developed as well as developing countries. In addition to this, car manufacturers are introducing a wide range of designs and features, giving the buyers a number of options to choose from. This has further boosted the growth of the passenger car segment in the global automotive interiors market. However, a commercial vehicle is expected to grow at the highest growth rate during the Projection period.

By Material

- The material segment includes leather fabric, vinyl, wood, glass fiber composite, carbon fiber composite, and metal. The glass fiber composite segment held the largest market share of 34.5% in 2020. Glass fiber composites are rapidly being used in a number of automotive interior applications such as doors, headliners, dashboards, and insulation. In addition to this, glass fiber composite offers benefits including high impact resistance, less brittle, low cost, and light in weight. The aforementioned factors boost the growth of the segment.

By Autonomous Driving

- The autonomous driving segment includes semi-autonomous and autonomous. The semi-autonomous segment held the largest market share of 62.7% in 2020. Ongoing demand for efficient and safer driving systems encourages the development and adoption of semi-autonomous vehicles boosts the growth of the segment. In addition, enhanced driving control and driver safety features have fueled demand for semi-autonomous vehicles, driving the growth of the automotive interiors market.

By Electric Vehicle

- The electric vehicle segment includes BEV, FCEV, HEV, and PHEV. The BEV segment held the largest market share of 40.2% in 2020. Battery Electric Vehicle (BEV) uses a battery pack that is charged up to store electric energy. The growth of this segment is driven by factors such as supporting government regulations & policies and improvement in battery technology.

By Regional Analysis

The regions analyzed for the automotive interiors market include North America, Europe, South America, Asia Pacific, and the Middle East and Africa. The Asia-Pacific region dominated the Automotive Interiors market and held the 35.40% share of the market revenue in 2020.

- In Asia-Pacific, an upsurge in vehicle production along with the rising demand for luxury and comfort fuels the growth of the automotive interiors market. In addition to this, positive regulations and government support in terms of subsidies are projected to attract a number of automotive manufacturers such as Toyota, Honda, and Hyundai to set up their plants in the region. On the other hand, the emergence of electric vehicles in major economies, such as China, Japan, and India, is further supporting the market value.

- The Middle East and Africa region are likely to register significant growth during the Projection period. The growth of this region is mainly driven by the rising trends among the automotive manufacturers to set up their manufacturing plants. For instance, in July 2018, BAIC, the Chinese car-maker set up an automotive assembly plant in South Africa, which is expected to build 50,000 vehicles by 2022.

Key Industry Players Analysis

Partnership between companies is likely to boost the growth of the market

The key players are now concentrating on implementing strategies such as adopting new technology, product innovations, mergers & acquisitions, joint venture, alliances, and partnerships to improve their market position in the global Automotive Interiors industry.

For instance, in February 2019, Yanfeng Automotive Interiors (YFAI), the supplier of automotive interiors partnered with Startup Autobahn in Stuttgart, the capital of southwest Germany’s Baden-Württemberg state.

In December 2018, Grupo Antolin entered into a strategic partnership with Walter Pack to strengthen its product offering and develop integrated products with advanced technology.

In January 2019, Gentherm, the global developer of innovative thermal management technologies, and Lear Corporation, the automotive technology provider announced a strategic development partnership to drive the future of passenger thermal seating solutions.

- ADIENT

- Grupo Antolin

- Hyundai Mobis Company, ltd.

- Calsonic Kansei Corporation

- Faurecia S.A

- Robert Bosch

- Visteon Corporation

- International Automotive Components Group S.A. (IAC)

- Lear Corporation

- Yanfeng Automotive Interiors

Latest Development

- October 2021- Lear Corporation, one of the automotive technology leaders in Seating and E-Systems acquired substantially all of Kongsberg Automotive's Interior Comfort Systems (ICS) business unit.

- July 2020- Grupo Antolin partnered with AED Engineering, the German integrated electronics provider. Through this partnership, Grupo Antolin is projected to improve its electronic capabilities and consolidate the company as a global provider of technological solutions for the automotive interior.

Report Metrics

|

Report Attribute |

Details |

|

Projection period |

2021-2028 |

|

Base year considered |

2020 |

|

CAGR (%) |

4.3% |

|

Market Size |

118.2 Billion in 2020 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Component, Vehicle Type, Material , Autonomous Driving, Electric Vehicle, and Region |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

ADIENT, Grupo Antolin, Hyundai Mobis Company, ltd., Calsonic Kansei Corporation, Faurecia S.A, Robert Bosch, Visteon Corporation, International Automotive Components Group S.A. (IAC), Lear Corporation, and Yanfeng Automotive Interiors |

|

By Component |

|

|

By Vehicle Type |

|

|

By Material |

|

|

By Autonomous Driving |

|

|

By Electric Vehicle |

|

|

Regional scope |

|

Scope of the Report

Global Automotive Interiors Market by Component:

- Cockpit Module

- Flooring

- Automotive Seat

- Door Panel

- Interior Lighting

- Other

Global Automotive Interiors Market by Vehicle Type:

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Global Automotive Interiors Market by Material:

- Leather Fabric

- Vinyl

- Wood

- Glass Fiber Composite

- Carbon fiber Composite

- Metal

Global Automotive Interiors Market by Autonomous Driving:

- Semi-Autonomous

- Autonomous

Global Automotive Interiors Market by Electric Vehicle:

- BEV

- FCEV

- HEV

- PHEV

Global Automotive Interiors Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market size of the Automotive Interiors Market?

Global Automotive Interiors market is expected to reach USD 163.9 Billion by 2028, at a CAGR of 4.3% from 2021 to 2028.

Which regions have been studied for the regional analysis of the global Automotive Interiors market?

The regions analyzed for the Automotive Interiors market include North America, Europe, South America, Asia Pacific, and the Middle East and Africa.

What is the segmentation considered for the analysis of the global Automotive Interiors market?

The global Automotive Interiors market has been segmented based on component, vehicle type, material, autonomous driving, electric vehicle, and region.

Which are the leading market players active in the Automotive Interiors market?

Leading market players active in the global Automotive Interiors market are ADIENT, Grupo Antolin, Hyundai Mobis Company, ltd., Calsonic Kansei Corporation, Faurecia S.A, Robert Bosch, Visteon Corporation, International Automotive Components Group S.A. (IAC), Lear Corporation, and Yanfeng Automotive Interiors among others.

What are the ongoing trends that are projected to influence the market in the upcoming years?

Upsurge in production and sales volumes of vehicles around the globe coupled with the rising customer preference toward premium features, convenience, and safety.

What are the detailed impacts of the COVID-19 pandemic on the global market?

Lockdowns imposed by the governments in various countries have temporarily suspended manufacturing activities. Due to a slowdown in industrial activities and consumer markets, the automotive Interiors industry has been impacted as the production of vehicles has been hampered during the pandemic.

What are the key drivers of the Automotive Interiors market?

Huge demand for passenger vehicles across the globe is one of the major factors driving the growth of the Automotive Interiors market

How the company profile has been selected?

Based on the sales revenue, product offering, and regional presence, the companies are selected.

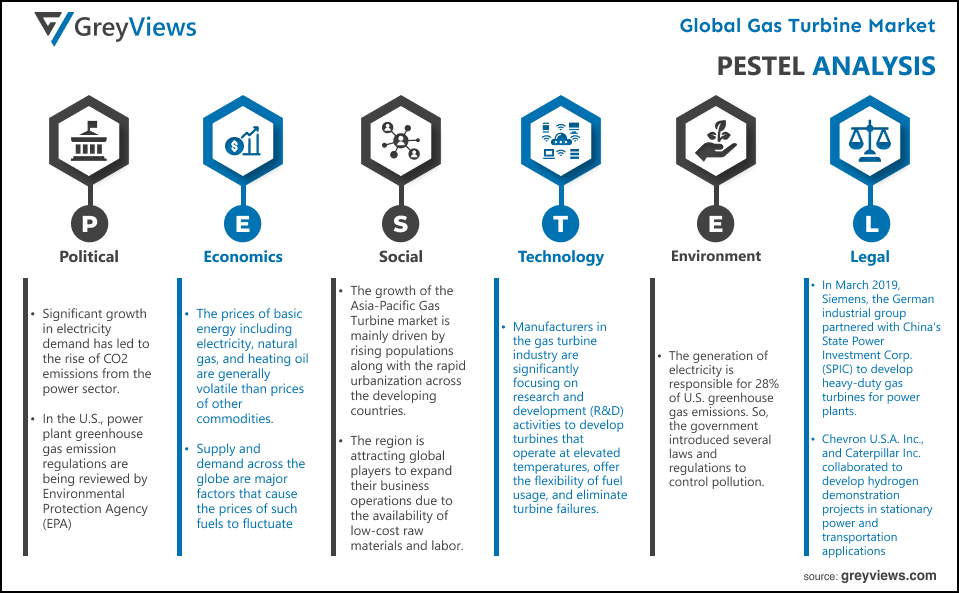

Political- Battery Electric Vehicle (BEV) uses a battery pack that is charged up to store electric energy. The growth of this segment is driven by factors such as supporting government regulations & policies and improvement in battery technology. positive regulations and government support in terms of subsidies are projected to attract a number of automotive manufacturers such as Toyota, Honda, and Hyundai to set up their plants in the Asia Pacific.

Economic- Passenger vehicles are the most common mode of transportation across developed countries. Also, there is a rise in demand for passenger vehicles in developing countries due to significant growth in per capita income. Moreover, demand for Special Utility Vehicles (SUVs) has increased in past few years due to increasing tour and leisure activities globally. The aforementioned factors are projected to tremendous growth in the number of passenger vehicles; thus, eventually boosting the growth of the automotive interior market. Steel, plastics, rubber, and aluminum are the most commonly used commodities in vehicles. However, increasing prices of this raw material are one of the major concerns for the automotive interior market. This is attributed to the fact that steel, iron, and plastics prices have soared to high levels in recent times. On the other hand, rising automotive import tariffs hampers the growth of the automotive interior market.

Social- In Asia-Pacific, an upsurge in vehicle production along with the rising demand for luxury and comfort fuels the growth of the automotive interiors market. In addition to this, positive regulations and government support in terms of subsidies are projected to attract a number of automotive manufacturers such as Toyota, Honda, and Hyundai to set up their plants in the region. On the other hand, the emergence of electric vehicles in major economies, such as China, Japan, and India, is further supporting the market value.

Technological- Over the past decade, EV sales have grown significantly mainly across the China and Europe regions. These types of vehicles have the potential to decrease emissions and address climate change. Hence, demand for such vehicles is anticipated to increase significantly in upcoming years. This will provide lucrative growth opportunities for the automotive interior market.

Environmental- The global automotive interiors market is likely to affect the environment at a lesser intensity as they are focusing on creating electric vehicles which will reduce the pollution to a greater extent and thus will act as a strong reason to boost the growth of the market at a global level.

Legal- Lear Corporation, one of the automotive technology leaders in Seating and E-Systems acquired substantially all of Kongsberg Automotive's Interior Comfort Systems (ICS) business unit in October 2021. In July 2020, Grupo Antolin partnered with AED Engineering, the German integrated electronics provider. Through this partnership, Grupo Antolin is projected to improve its electronic capabilities and consolidate the company as a global provider of technological solutions for the automotive interior.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Component

- Market Attractiveness Analysis By Vehicle Type

- Market Attractiveness Analysis By Material

- Market Attractiveness Analysis By Autonomous Driving

- Market Attractiveness Analysis By Electrical Vehicle

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Huge demand for passenger vehicles across the globe

- Growth focus on well-being of drivers and improvement of the driving experience

- Restrains

- Increasing raw material prices

- Opportunities

- Emergence of cost-effective production techniques

- Challenges

- Expected growth in demand for electric vehicles (EV)

- Global Automotive Interiors Market Analysis and Projection, By Component

- Segment Overview

- Cockpit Module

- Flooring

- Automotive Seat

- Industrial

- Door Panel

- Interior Lighting

- Others

- Global Automotive Interiors Market Analysis and Projection, By Vehicle Type

- Segment Overview

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Global Automotive Interiors Market Analysis and Projection, By Material

- Segment Overview

- Leather

- Fabric

- Vinyl

- Wood

- Glass Fiber Composite

- Carbon Fiber Composite

- Metal

- Global Automotive Interiors Market Analysis and Projection, By Autonomous Driving

- Segment Overview

- Semi-Autonomous

- Autonomous

- Global Automotive Interiors Market Analysis and Projection, By Electric Vehicle

- Segment Overview

- BEV

- FCEV

- HEV

- PHEV

- Global Automotive Interiors Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Automotive Interiors Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Automotive Interiors Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Component Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- ADIENT

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- Grupo Antolin

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- Hyundai Mobis Company, ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- Calsonic Kansei Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- Faurecia S.A

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- Robert Bosch

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- Visteon Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- International Automotive Components Group S.A. (IAC)

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- Lear Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- Yanfeng Automotive Interiors

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Component Portfolio

- Recent Developments

- SWOT Analysis

- ADIENT

List of Table

- Global Automotive Interiors Market, By Component, 2020–2028(USD Billion)

- Global Cockpit Module Market, By Region, 2020–2028(USD Billion)

- Global Flooring Market, By Region, 2020–2028(USD Billion)

- Global Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Door Panel Market, By Region, 2020–2028(USD Billion)

- Global Interior Lighting, Market, By Region, 2020–2028(USD Billion)

- Global Others Market, By Region, 2020–2028(USD Billion)

- Global Automotive Interiors Market, By Vehicle Type, 2020–2028(USD Billion)

- Global Passenger Car Automotive Interiors Market, By Region, 2020–2028(USD Billion)

- Global Light Commercial Vehicle Automotive Interiors Market, By Region, 2020–2028(USD Billion)

- Global Heavy Commercial Vehicle Automotive Interiors Market, By Region, 2020–2028(USD Billion)

- Global Automotive Interiors Market, By Material, 2020–2028(USD Billion)

- Global Leather Automotive Interiors Market, By Region, 2020–2028(USD Billion)

- Global Fabric Automotive Interiors Market, By Region, 2020–2028(USD Billion)

- Global Vinly Automotive Interiors Market, By Region, 2020–2028(USD Billion)

- Global Wood Automotive Interiors Market, By Region, 2020–2028(USD Billion)

- Global Glass Fiber Composite Automotive Interiors Market, By Region, 2020–2028(USD Billion)

- Global Glass Fiber Composite Automotive Interiors Market, By Region, 2020–2028(USD Billion)

- Global Metal Automotive Interiors Market, By Region, 2020–2028(USD Billion)

- Global Automotive Interiors Market, By Autonomous Driving, 2020–2028(USD Billion)

- Global Semi-Autonomous Automotive Interiors Market, By Region, 2020–2028(USD Billion)

- Global Autonomous Automotive Interiors Market, By Region, 2020–2028(USD Billion)

- Global Automotive Interiors Market, By Electric Vehicle, 2020–2028(USD Billion)

- Global BEV Automotive Interiors Market, By Region, 2020–2028(USD Billion)

- Global FCEV Automotive Interiors Market, By Region, 2020–2028(USD Billion)

- Global HEV Automotive Interiors Market, By Region, 2020–2028(USD Billion)

- Global PHEV Automotive Interiors Market, By Region, 2020–2028(USD Billion)

- Global Automotive Interiors Market, By Region, 2020–2028(USD Billion)

- Global Automotive Interiors Market, By North America, 2020–2028(USD Billion)

- North America Automotive Interiors Market, By Component, 2020–2028(USD Billion)

- North America Automotive Interiors Market, By Vehicle Type, 2020–2028(USD Billion)

- North America Automotive Interiors Market, By Material, 2020–2028(USD Billion)

- North America Automotive Interiors Market, By Autonomous Driving, 2020–2028(USD Billion)

- North America Automotive Interiors Market, By Electric Vehicle, 2020–2028(USD Billion)

- USA Automotive Interiors Market, By Component, 2020–2028(USD Billion)

- USA Automotive Interiors Market, By Vehicle Type, 2020–2028(USD Billion)

- USA Automotive Interiors Market, By Material, 2020–2028(USD Billion)

- USA Automotive Interiors Market, By Autonomous Driving, 2020–2028(USD Billion)

- USA Automotive Interiors Market, By Electric Vehicle, 2020–2028(USD Billion)

- Canada Automotive Interiors Market, By Component, 2020–2028(USD Billion)

- Canada Automotive Interiors Market, By Vehicle Type, 2020–2028(USD Billion)

- Canada Automotive Interiors Market, By Material, 2020–2028(USD Billion)

- Canada Automotive Interiors Market, By Autonomous Driving, 2020–2028(USD Billion)

- Canada Automotive Interiors Market, By Electric Vehicle, 2020–2028(USD Billion)

- Mexico Automotive Interiors Market, By Component, 2020–2028(USD Billion)

- Mexico Automotive Interiors Market, By Vehicle Type, 2020–2028(USD Billion)

- Mexico Automotive Interiors Market, By Material, 2020–2028(USD Billion)

- Mexico Automotive Interiors Market, By Autonomous Driving, 2020–2028(USD Billion)

- Mexico Automotive Interiors Market, By Electric Vehicle, 2020–2028(USD Billion)

- Europe Automotive Interiors Market, By Component, 2020–2028(USD Billion)

- Europe Automotive Interiors Market, By Vehicle Type, 2020–2028(USD Billion)

- Europe Automotive Interiors Market, By Material, 2020–2028(USD Billion)

- Europe Automotive Interiors Market, By Autonomous Driving, 2020–2028(USD Billion)

- Europe Automotive Interiors Market, By Electric Vehicle, 2020–2028(USD Billion)

- Germany Automotive Interiors Market, By Component, 2020–2028(USD Billion)

- Germany Automotive Interiors Market, By Vehicle Type, 2020–2028(USD Billion)

- Germany Automotive Interiors Market, By Material, 2020–2028(USD Billion)

- Germany Automotive Interiors Market, By Autonomous Driving, 2020–2028(USD Billion)

- Germany Automotive Interiors Market, By Electric Vehicle, 2020–2028(USD Billion)

- France Automotive Interiors Market, By Component, 2020–2028(USD Billion)

- France Automotive Interiors Market, By Vehicle Type, 2020–2028(USD Billion)

- France Automotive Interiors Market, By Material, 2020–2028(USD Billion)

- France Automotive Interiors Market, By Autonomous Driving, 2020–2028(USD Billion)

- France Automotive Interiors Market, By Electric Vehicle, 2020–2028(USD Billion)

- UK Automotive Interiors Market, By Component, 2020–2028(USD Billion)

- UK Automotive Interiors Market, By Vehicle Type, 2020–2028(USD Billion)

- UK Automotive Interiors Market, By Material, 2020–2028(USD Billion)

- UK Automotive Interiors Market, By Autonomous Driving, 2020–2028(USD Billion)

- UK Automotive Interiors Market, By Electric Vehicle, 2020–2028(USD Billion)

- Italy Automotive Interiors Market, By Component, 2020–2028(USD Billion)

- Italy Automotive Interiors Market, By Vehicle Type, 2020–2028(USD Billion)

- Italy Automotive Interiors Market, By Material, 2020–2028(USD Billion)

- Italy Automotive Interiors Market, By Autonomous Driving, 2020–2028(USD Billion)

- Italy Automotive Interiors Market, By Electric Vehicle, 2020–2028(USD Billion)

- Spain Automotive Interiors Market, By Component, 2020–2028(USD Billion)

- Spain Automotive Interiors Market, By Vehicle Type, 2020–2028(USD Billion)

- Spain Automotive Interiors Market, By Material, 2020–2028(USD Billion)

- Spain Automotive Interiors Market, By Autonomous Driving, 2020–2028(USD Billion)

- Spain Automotive Interiors Market, By Electric Vehicle, 2020–2028(USD Billion)

- Asia Pacific Automotive Interiors Market, By Component, 2020–2028(USD Billion)

- Asia Pacific Automotive Interiors Market, By Vehicle Type, 2020–2028(USD Billion)

- Asia Pacific Automotive Interiors Market, By Material, 2020–2028(USD Billion)

- Asia Pacific Automotive Interiors Market, By Autonomous Driving, 2020–2028(USD Billion)

- Asia Pacific Automotive Interiors Market, By Electric Vehicle, 2020–2028(USD Billion)

- Japan Automotive Interiors Market, By Component, 2020–2028(USD Billion)

- Japan Automotive Interiors Market, By Vehicle Type, 2020–2028(USD Billion)

- Japan Automotive Interiors Market, By Material, 2020–2028(USD Billion)

- Japan Automotive Interiors Market, By Autonomous Driving, 2020–2028(USD Billion)

- Japan Automotive Interiors Market, By Electric Vehicle, 2020–2028(USD Billion)

- China Automotive Interiors Market, By Component, 2020–2028(USD Billion)

- China Automotive Interiors Market, By Vehicle Type, 2020–2028(USD Billion)

- China Automotive Interiors Market, By Material, 2020–2028(USD Billion)

- China Automotive Interiors Market, By Autonomous Driving, 2020–2028(USD Billion)

- China Automotive Interiors Market, By Electric Vehicle, 2020–2028(USD Billion)

- India Automotive Interiors Market, By Component, 2020–2028(USD Billion)

- India Automotive Interiors Market, By Vehicle Type, 2020–2028(USD Billion)

- India Automotive Interiors Market, By Material, 2020–2028(USD Billion)

- India Automotive Interiors Market, By Autonomous Driving, 2020–2028(USD Billion)

- India Automotive Interiors Market, By Electric Vehicle, 2020–2028(USD Billion)

- South America Automotive Interiors Market, By Component, 2020–2028(USD Billion)

- South America Automotive Interiors Market, By Vehicle Type, 2020–2028(USD Billion)

- South America Automotive Interiors Market, By Material, 2020–2028(USD Billion)

- South America Automotive Interiors Market, By Autonomous Driving, 2020–2028(USD Billion)

- South America Automotive Interiors Market, By Electric Vehicle, 2020–2028(USD Billion)

- Brazil Automotive Interiors Market, By Component, 2020–2028(USD Billion)

- Brazil Automotive Interiors Market, By Vehicle Type, 2020–2028(USD Billion)

- Brazil Automotive Interiors Market, By Material, 2020–2028(USD Billion)

- Brazil Automotive Interiors Market, By Autonomous Driving, 2020–2028(USD Billion)

- Brazil Automotive Interiors Market, By Electric Vehicle, 2020–2028(USD Billion)

- Middle East and Africa Automotive Interiors Market, By Component, 2020–2028(USD Billion)

- Middle East and Africa Automotive Interiors Market, By Vehicle Type, 2020–2028(USD Billion)

- Middle East and Africa Automotive Interiors Market, By Material, 2020–2028(USD Billion)

- Middle East and Africa Automotive Interiors Market, By Autonomous Driving, 2020–2028(USD Billion)

- Middle East and Africa Automotive Interiors Market, By Electric Vehicle, 2020–2028(USD Billion)

- UAE Automotive Interiors Market, By Component, 2020–2028(USD Billion)

- UAE Automotive Interiors Market, By Vehicle Type, 2020–2028(USD Billion)

- UAE Automotive Interiors Market, By Material, 2020–2028(USD Billion)

- UAE Automotive Interiors Market, By Autonomous Driving, 2020–2028(USD Billion)

- UAE Automotive Interiors Market, By Electric Vehicle, 2020–2028(USD Billion)

- South Africa Automotive Interiors Market, By Component, 2020–2028(USD Billion)

- South Africa Automotive Interiors Market, By Vehicle Type, 2020–2028(USD Billion)

- South Africa Automotive Interiors Market, By Material, 2020–2028(USD Billion)

- South Africa Automotive Interiors Market, By Autonomous Driving, 2020–2028(USD Billion)

- South Africa Automotive Interiors Market, By Electric Vehicle, 2020–2028(USD Billion)

List of Figures

- Global Automotive Interiors Market Segmentation

- Automotive Interiors Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Automotive Interiors Market Attractiveness Analysis By Component

- Global Automotive Interiors Market Attractiveness Analysis By Vehicle Type

- Global Automotive Interiors Market Attractiveness Analysis By Material

- Global Automotive Interiors Market Attractiveness Analysis By Autonomous Driving

- Global Automotive Interiors Market Attractiveness Analysis By Electric Vehicle

- Global Automotive Interiors Market Attractiveness Analysis By Region

- Global Automotive Interiors Market: Dynamics

- Global Automotive Interiors Market Share By Component(2021 & 2028)

- Global Automotive Interiors Market Share By Vehicle Type(2021 & 2028)

- Global Automotive Interiors Market Share By Material (2021 & 2028)

- Global Automotive Interiors Market Share By Autonomous Driving (2021 & 2028)

- Global Automotive Interiors Market Share By Electric Vehicle (2021 & 2028)

- Global Automotive Interiors Market Share by Regions (2021 & 2028)

- Global Automotive Interiors Market Share by Company (2020)