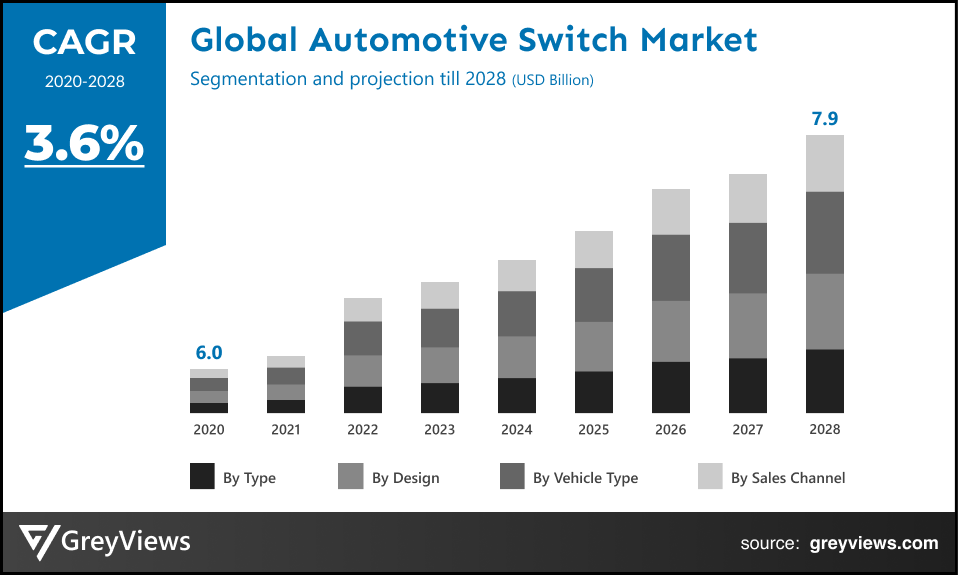

Global Automotive Switch Market Size by Type (Ignition Switches, HVAC Switches, Overhead Console Switches, Steering Wheel Switches, Window Switches, Seat Control Switches, Door Switches, Multi-Purpose Switches, Hazard Switches, and Others), Design (Rocker Switches, Toggle Switches, Rotary Switches, Push Switches, and Other Switches), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles), and Sales Channel (Original Equipment Manufacturers and Aftermarket), Regions, Segmentation and Projection till 2028

CAGR: 3.6%Current Market Size: USD 6.0 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2021-2028Base Year: 2020

Global Automotive Switch Market- Market Overview

The global Automotive Switch market is expected to grow from USD 6.0 Billion in 2020 to USD 7.9 Billion by 2028, at a CAGR of 3.6% during the Projection period 2021-2028. This growth of the automotive switch market is significantly driven by the growing demand for luxury vehicle models and heavy-duty vehicles.

Automotive switches are essential components in an automotive to control all of the electrical equipment. It controls automotive lighting along with the overall functioning of the vehicle including engine start and stops function. The number of switches used in automotive includes toggle switches, keyed switches, push & pull switches, and marine-grade switches among others. The automotive switches can be both automatic and manual. Automatic switches are rapidly being used in premium passenger cars while manual switches are being used in different kinds of automotive such as passenger cars, heavy commercial vehicles (HCV), and light commercial vehicles (LCV).

In the past few years, the automotive industry has witnessed tremendous transformation with growing demand for passenger comfort and safety. This has led to the need for vehicle manufacturers to focus on the formation of new design experiences, fueling the use of electronic parts in the vehicle. This has boosted growth in demand for automotive switches.

Request Sample:- Global Automotive Switch market

Market Dynamics

Drivers:

- Significant growth in the implementation of electronic systems in vehicles to boost the growth of the market

The implementation of electronic systems for a number of applications such as engine management, ignition, in-car entertainment systems, radio, and telematics among others fueling the need for automotive switches. There is a significant transformation from the usage of mechanical parts to electronic parts in automotive systems, fueling the need for electronic switches. For instance, switches are being used for engine start & stop applications coupled with several other automobile functions. This has boosted the growth of the automotive switch market.

- Demand for automotive switches are rising in commercial vehicles to boost the market growth

Rising industrialization and urbanization, particularly in developing countries have led to the demand for commercial vehicles. For instance, as per the Organisation Internationale des Constructeurs d'Automobiles (OICA), 2019 the commercial vehicles sale stood at 26,693,300. The electronic switching components are essential for the electrical systems used in commercial vehicles. Hence, commercial vehicle manufacturers are installing a number of automotive switches to offer convenient, comfortable, and safe settings inside a truck, bus, van, and others.

Restraints:

- Fluctuations in raw material prices to restrain market growth

Raw materials constitute about 70% of the aggregate cost of electronic switches. However, in recent years there is significant fluctuations in the prices of raw materials used for electronic switches. For instance, because of the shortage of integrated circuits, Volkswagen, Toyota, Honda, and other manufacturers have reduced production lines, with approximately one million vehicles lost because of delayed production in the first half of 2021. Hence, fluctuations in raw materials hampered the growth of the automotive switches market.

Opportunities:

- The proliferation of electric vehicles creates lucrative growth opportunities for the market

Over the past decade, electric vehicles witnessed a significant rise in sales. However, the U.S. Energy Information Administration (EIA) in October 2021, predicted that the Electric vehicles which stood in 2020 for 0.7% of the total global light-duty vehicle (LDV) fleet are projected to account for 31% in 2050 with about 672 million EVs. Electronics switches are the most essential component of electric vehicles; hence, the proliferation of electric vehicles creates lucrative growth opportunities for the automotive switch market growth.

Challenges:

- Disruptions due to COVID-19 is posing challenges to the market

Owing to the unprecedented crisis of COVID-19, a number of countries have employed nationwide lockdowns. However, as they are reopening, safety measures such as social distancing are still being applied. This has caused a significant economic downturn across the globe along with the sudden discontinuation of automotive and associated components production. Hence, the emergence of the COVID-19 pandemic has posed challenges to the global automotive switch market.

Segmentation Analysis

The global automotive switch market has been segmented based on type, design, vehicle type, sales channel, and regions.

By Type

- The type segment includes ignition switches, HVAC switches, overhead console switches, steering wheel switches, window switches, seat control switches, door switches, multi-purpose switches, hazard switches, and others. The ignition switches segment led the automotive switch market with a market share of around 26.5% in 2020. The need for the control system to activate electrical systems in the vehicle fuels growth of the ignition switches segment. In addition, electronic ignition improves the efficiency and fuel economy of the vehicle, hence, there is rising demand for electronic ignition systems, fueling demand for ignition switches.

By Design

- The design segment includes rocker switches, toggle switches, rotary switches, push switches, and others. The rocker switches segment led the automotive switch market with a market share of around 31.2% in 2020. Rocker switches are equipped with a spring-loaded button. Such types of switches are often used as ON/OFF switches on the main power supplies for electronic devices. However, automotive businesses across the globe are significantly adopting dust-proof rocker switches, fueling the growth of this segment. In addition, different automobile systems such as heated seat switches, power door lock switches, rear window defogger grids, and power window controls contain rocker switches, fueling the growth of the segment.

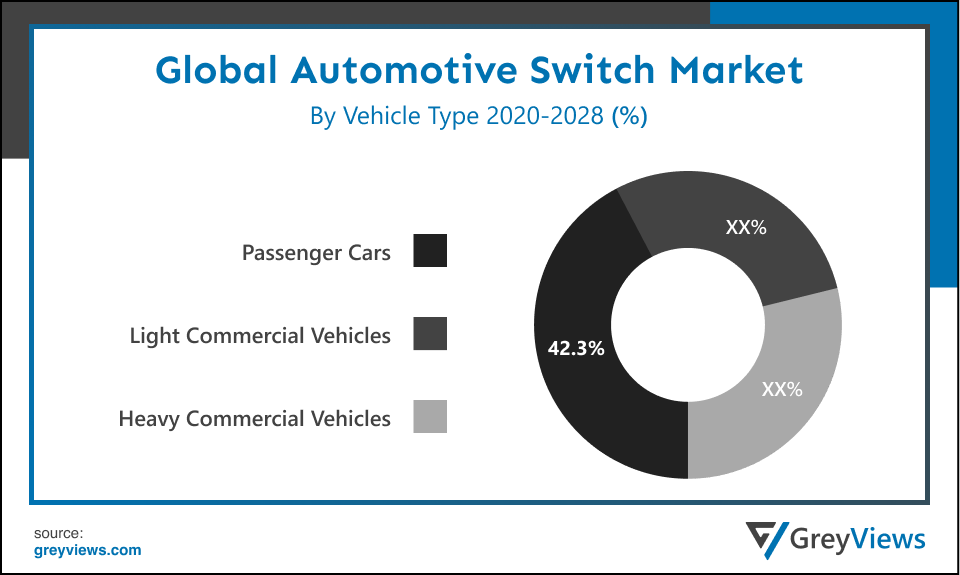

By Vehicle Type

- The vehicle type segment includes light commercial vehicles, passenger cars, and heavy commercial vehicles. The passenger cars segment held the largest market share of 42.3% in 2020. The growth of this segment is mainly driven by the rising adoption of combination or multi-function switches in luxury passenger cars which perform functions such as wiper system, cruise control, lighting system, and others. In addition, the need for superior comfort, efficiency, connectivity, and safety in passenger vehicles boosts the growth of the segment.

By Sales Channel

- The sales channel segment includes original equipment manufacturers and aftermarkets. The original equipment manufacturers segment held the largest market share of 67.1% in 2020. The growth of this segment is mainly driven by strategic integration of electronics by original equipment manufacturers for enhancing user functionality and appeal. In addition to this, electronic component manufacturers are seeing significant demand for cable assemblies, connectors, switches, and other electronic technologies for enhanced safety and comfort in commercial vehicles, boosting the growth of the segment.

By Regional Analysis

The regions analyzed for the Automotive Switch market include North America, Europe, South America, Asia Pacific, and the Middle East and Africa. The Asia Pacific region dominated the Automotive Switch market and held the 38.2% share of the market revenue in 2020.

- The growth of the Asia Pacific automotive switch market is mainly driven by a number of factors such as a large population base, increasing disposable income of populations, and rapid growth in the automotive industry in China. In addition to this, the growing popularity of luxury vehicles is projected to boost the market growth in the region.

- The North American region is likely to register significant growth during the Projection period due to the significant presence of key market players along with the high per capita income of people in the region.

Key Industry Players Analysis

Leading players are focusing on alliances to meet the demand of the market

The key players are now concentrating on implementing strategies such as adopting new technology, product innovations, mergers & acquisitions, joint venture, alliances, and partnerships to improve their market position in the global automotive switch industry.

For instance, in November 2020, one of the leaders in automotive electrification technology named Valeo introduced a fully integrated compact electric powertrain system in India. This launch will help electrification at an affordable cost for small mobility vehicles.

In July 2020, Delphi Technologies built and launched a new manufacturing site in Suzhou, China. This site gives Delphi Technologies a competitive Asian footprint.

In May 2020, one of the leading market players named ZF Friedrichshafen AG acquired WABCO which is a commercial vehicle technology supplier. This acquisition is projected to bring a new dimension of innovation as well as the capability for commercial vehicle systems technology.

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Alps Alpine Co., Ltd.

- Panasonic Corporation

- Delphi Technologies

- Leopold Kostal GmbH & Co. KG

- Valeo

- Marquardt GmbH

- Preh GmbH

Latest Development

- December 2021- Bosch launched the production of semiconductors in Germany. With the help of this strategy, the large-scale production of silicon carbide (SiC) based power semiconductors were started by Bosch started.

- August 2021- Investment in Kopernikus Automotive which is a Leipzig-based startup was announced by Continental AG. Kopernikus develops solutions for infrastructure-based maneuvering of vehicles.

- March 2021- one of the leading market players in the automotive industry named Alps Alpine Co., Ltd., has expanded its SPVQ8 Series and introduced the SPVQ8H Series of compact switches for usage in detecting the opening and closing of vehicle doors.

Report Metrics

|

Report Attribute |

Details |

|

Forecast period |

2021-2028 |

|

Base year considered |

2020 |

|

CAGR (%) |

3.6% |

|

Market Size |

6.0 Billion in 2020 |

|

Forecast unit |

Value (USD) |

|

Segments covered |

Type, Design, Vehicle Type, Sales Channel, and Regions |

|

Report Scope |

Revenue forecast, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Alps Alpine Co., Ltd., Panasonic Corporation, Delphi Technologies, Leopold Kostal GmbH & Co. KG, Valeo, Marquardt GmbH, and Preh GmbH among others. |

|

By Type |

|

|

By Design |

|

|

By Vehicle Type

|

|

|

By Sales Channel |

|

|

Regional scope |

|

Scope of the Report

Global Automotive Switch Market by Type:

- Ignition Switches

- HVAC Switches

- Overhead Console Switches

- Steering Wheel Switches

- Window Switches

- Seat Control Switches

- Door Switches

- Multi-Purpose Switches

- Hazard Switches

- Others

Global Automotive Switch Market by Design:

- Rocker Switches

- Toggle Switches

- Rotary Switches

- Push Switches

- Other Switches

Global Automotive Switch Market by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Global Automotive Switch Market by Sales Channel:

- Original Equipment Manufacturers

- Aftermarket

Global Automotive Switch Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market value of the automotive switch Market in 2020?

The market value of the automotive switch Market in 2020 is $ 6.0 Billion.

Which region has highest market share in automotive switch Market?

Asia-Pacific held the major share in the market over the Projection period 2021- 2028.

Which is the most influencing segment growing in the automotive switch report?

The ignition switches segment is the most influencing segment in the automotive switch market.

Which are the Top players active in the automotive switch market?

The leading market players active in the global automotive switch market are Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Alps Alpine Co., Ltd., Panasonic Corporation, Delphi Technologies, Leopold Kostal GmbH & Co. KG, Valeo, Marquardt GmbH, and Preh GmbH among others.

What are the segment considered in the global automotive switch market?

Type, design, vehicle type, sales channel, and regions are the five segments of the report

Does this report include the impact of COVID-19 on the automotive switch market?

Yes, the market includes qualitative and quantitative insights for COVID-19 impact on the automotive switch market.

What is the study period of this market?

The automotive switch market is studied from 2020 - 2028.

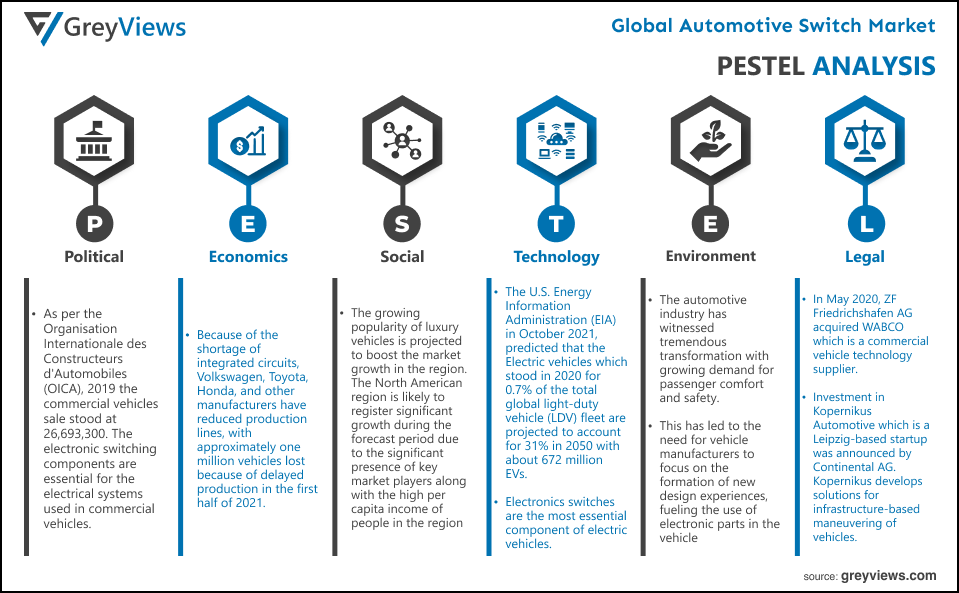

Political- Rising industrialization and urbanization, particularly in developing countries have led to the demand for commercial vehicles. For instance, as per the Organisation Internationale des Constructeurs d'Automobiles (OICA), 2019 the commercial vehicles sale stood at 26,693,300. The electronic switching components are essential for the electrical systems used in commercial vehicles. Hence, commercial vehicle manufacturers are installing a number of automotive switches to offer convenient, comfortable, and safe settings inside a truck, bus, van, and others.

Economic- Raw materials constitute about 70% of the aggregate cost of electronic switches. However, in recent years there is significant fluctuations in the prices of raw materials used for electronic switches. For instance, because of the shortage of integrated circuits, Volkswagen, Toyota, Honda, and other manufacturers have reduced production lines, with approximately one million vehicles lost because of delayed production in the first half of 2021. Hence, fluctuations in raw materials hampered the growth of the automotive switches market.

Social- The growth of the Asia Pacific automotive switch market is mainly driven by a number of factors such as a large population base, increasing disposable income of populations, and rapid growth in the automotive industry in China. In addition to this, the growing popularity of luxury vehicles is projected to boost the market growth in the region. The North American region is likely to register significant growth during the Projection period due to the significant presence of key market players along with the high per capita income of people in the region.

Technological- Over the past decade, electric vehicles witnessed a significant rise in sales. However, the U.S. Energy Information Administration (EIA) in October 2021, predicted that the Electric vehicles which stood in 2020 for 0.7% of the total global light-duty vehicle (LDV) fleet are projected to account for 31% in 2050 with about 672 million EVs. Electronics switches are the most essential component of electric vehicles; hence, the proliferation of electric vehicles creates lucrative growth opportunities for the automotive switch market growth.

Environmental- In the past few years, the automotive industry has witnessed tremendous transformation with growing demand for passenger comfort and safety. This has led to the need for vehicle manufacturers to focus on the formation of new design experiences, fueling the use of electronic parts in the vehicle. However, this also increased the pollution and caused damage to the surroundings.

Legal- In May 2020, one of the leading market players named ZF Friedrichshafen AG acquired WABCO which is a commercial vehicle technology supplier. This acquisition is projected to bring a new dimension of innovation as well as the capability for commercial vehicle systems technology. Investment in Kopernikus Automotive which is a Leipzig-based startup was announced by Continental AG. Kopernikus develops solutions for infrastructure-based maneuvering of vehicles.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Type

- Market Attractiveness Analysis By Design

- Market Attractiveness Analysis By Vehicle Type

- Market Attractiveness Analysis By Sales Channel

- Market Attractiveness Analysis By Electric Vehicle Type

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Significant growth in implementation of electronic systems in vehicles

- Rise in demand for automotive switches in commercial vehicles

- Restrains

- Fluctuations in raw material prices

- Opportunities

- The proliferation of electric vehicles

- Challenges

- Disruptions due to COVID-19

- Global Automotive Seats Market Analysis and Projection, By Type

- Segment Overview

- Ignition Switches

- HVAC Switches

- Overhead Console Switches

- Steering Wheel Switches

- Window Switches

- Seat Control Switches

- Door Switches

- Multi-Purpose Switches

- Hazard Switches

- Others

- Global Automotive Seats Market Analysis and Projection, By Design

- Segment Overview

- Rocker Switches

- Toggle Switches

- Rotary Switches

- Push Switches

- Other Switches

- Global Automotive Seats Market Analysis and Projection, By Vehicle Type

- Segment Overview

- Passenger Cars

- Light Commercial Vehicle

- Heavy Commercial Vehicles

- Global Automotive Seats Market Analysis and Projection, By Sales Channel

- Segment Overview

- Original Equipment Manufacturers

- Aftermarket

- Global Automotive Seats Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Automotive Seats Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Automotive Seats Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Type Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Robert Bosch GmbH

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Continental AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- ZF Friedrichshafen AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Alps Alpine Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Panasonic Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Delphi Technologies

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Leopold Kostal GmbH & Co. KG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Valeo

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Marquardt GmbH

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Preh GmbH

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Robert Bosch GmbH

List of Table

- Global Automotive Seats Market, By Type, 2020–2028(USD Billion)

- Global Ignition Switches Market, By Region, 2020–2028(USD Billion)

- Global HVAC Switches Market, By Region, 2020–2028(USD Billion)

- Global Overhead Console Switches Market, By Region, 2020–2028(USD Billion)

- Global Steering Wheel Switches Market, By Region, 2020–2028(USD Billion)

- Global Window Switches Market, By Region, 2020–2028(USD Billion)

- Global Seat Control Switches Market, By Region, 2020–2028(USD Billion)

- Global Door Switches Market, By Region, 2020–2028(USD Billion)

- Global Multi-Purpose Switches Market, By Region, 2020–2028(USD Billion)

- Global Hazard Switches Switches Market, By Region, 2020–2028(USD Billion)

- Global Others Market, By Region, 2020–2028(USD Billion)

- Global Automotive Seats Market, By Design, 2020–2028(USD Billion)

- Global Rocker Switches Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Toggle Switches Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Rotary Switches Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Push Switches Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Other Switches Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Automotive Seats Market, By Vehicle Type, 2020–2028(USD Billion)

- Global Passenger Cars Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Light Commercial Vehicle Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Heavy Commercial Vehicles Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Automotive Seats Market, By Sales Channel, 2020–2028(USD Billion)

- Global Original Equipment Manufacturers Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Aftermarket Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Automotive Seats Market, By Region, 2020–2028(USD Billion)

- Global Automotive Seats Market, By North America, 2020–2028(USD Billion)

- North America Automotive Seats Market, By Type, 2020–2028(USD Billion)

- North America Automotive Seats Market, By Design, 2020–2028(USD Billion)

- North America Automotive Seats Market, By Vehicle Type, 2020–2028(USD Billion)

- North America Automotive Seats Market, By Sales Channel, 2020–2028(USD Billion)

- USA Automotive Seats Market, By Type, 2020–2028(USD Billion)

- USA Automotive Seats Market, By Design, 2020–2028(USD Billion)

- USA Automotive Seats Market, By Vehicle Type, 2020–2028(USD Billion)

- USA Automotive Seats Market, By Sales Channel, 2020–2028(USD Billion)

- Canada Automotive Seats Market, By Type, 2020–2028(USD Billion)

- Canada Automotive Seats Market, By Design, 2020–2028(USD Billion)

- Canada Automotive Seats Market, By Vehicle Type, 2020–2028(USD Billion)

- Canada Automotive Seats Market, By Sales Channel, 2020–2028(USD Billion)

- Mexico Automotive Seats Market, By Type, 2020–2028(USD Billion)

- Mexico Automotive Seats Market, By Design, 2020–2028(USD Billion)

- Mexico Automotive Seats Market, By Vehicle Type, 2020–2028(USD Billion)

- Mexico Automotive Seats Market, By Sales Channel, 2020–2028(USD Billion)

- Europe Automotive Seats Market, By Type, 2020–2028(USD Billion)

- Europe Automotive Seats Market, By Design, 2020–2028(USD Billion)

- Europe Automotive Seats Market, By Vehicle Type, 2020–2028(USD Billion)

- Europe Automotive Seats Market, By Sales Channel, 2020–2028(USD Billion)

- Germany Automotive Seats Market, By Type, 2020–2028(USD Billion)

- Germany Automotive Seats Market, By Design, 2020–2028(USD Billion)

- Germany Automotive Seats Market, By Vehicle Type, 2020–2028(USD Billion)

- Germany Automotive Seats Market, By Sales Channel, 2020–2028(USD Billion)

- France Automotive Seats Market, By Type, 2020–2028(USD Billion)

- France Automotive Seats Market, By Design, 2020–2028(USD Billion)

- France Automotive Seats Market, By Vehicle Type, 2020–2028(USD Billion)

- France Automotive Seats Market, By Sales Channel, 2020–2028(USD Billion)

- UK Automotive Seats Market, By Type, 2020–2028(USD Billion)

- UK Automotive Seats Market, By Design, 2020–2028(USD Billion)

- UK Automotive Seats Market, By Vehicle Type, 2020–2028(USD Billion)

- UK Automotive Seats Market, By Sales Channel, 2020–2028(USD Billion)

- Italy Automotive Seats Market, By Type, 2020–2028(USD Billion)

- Italy Automotive Seats Market, By Design, 2020–2028(USD Billion)

- Italy Automotive Seats Market, By Vehicle Type, 2020–2028(USD Billion)

- Italy Automotive Seats Market, By Sales Channel, 2020–2028(USD Billion)

- Spain Automotive Seats Market, By Type, 2020–2028(USD Billion)

- Spain Automotive Seats Market, By Design, 2020–2028(USD Billion)

- Spain Automotive Seats Market, By Vehicle Type, 2020–2028(USD Billion)

- Spain Automotive Seats Market, By Sales Channel, 2020–2028(USD Billion)

- Asia Pacific Automotive Seats Market, By Type, 2020–2028(USD Billion)

- Asia Pacific Automotive Seats Market, By Design, 2020–2028(USD Billion)

- Asia Pacific Automotive Seats Market, By Vehicle Type, 2020–2028(USD Billion)

- Asia Pacific Automotive Seats Market, By Sales Channel, 2020–2028(USD Billion)

- Japan Automotive Seats Market, By Type, 2020–2028(USD Billion)

- Japan Automotive Seats Market, By Design, 2020–2028(USD Billion)

- Japan Automotive Seats Market, By Vehicle Type, 2020–2028(USD Billion)

- Japan Automotive Seats Market, By Sales Channel, 2020–2028(USD Billion)

- China Automotive Seats Market, By Type, 2020–2028(USD Billion)

- China Automotive Seats Market, By Design, 2020–2028(USD Billion)

- China Automotive Seats Market, By Vehicle Type, 2020–2028(USD Billion)

- China Automotive Seats Market, By Sales Channel, 2020–2028(USD Billion)

- India Automotive Seats Market, By Type, 2020–2028(USD Billion)

- India Automotive Seats Market, By Design, 2020–2028(USD Billion)

- India Automotive Seats Market, By Vehicle Type, 2020–2028(USD Billion)

- India Automotive Seats Market, By Sales Channel, 2020–2028(USD Billion)

- South America Automotive Seats Market, By Type, 2020–2028(USD Billion)

- South America Automotive Seats Market, By Design, 2020–2028(USD Billion)

- South America Automotive Seats Market, By Vehicle Type, 2020–2028(USD Billion)

- South America Automotive Seats Market, By Sales Channel, 2020–2028(USD Billion)

- Brazil Automotive Seats Market, By Type, 2020–2028(USD Billion)

- Brazil Automotive Seats Market, By Design, 2020–2028(USD Billion)

- Brazil Automotive Seats Market, By Vehicle Type, 2020–2028(USD Billion)

- Brazil Automotive Seats Market, By Sales Channel, 2020–2028(USD Billion)

- Brazil Automotive Seats Market, By Electric Vehicle Type, 2020–2028(USD Billion)

- Middle East and Africa Automotive Seats Market, By Design, 2020–2028(USD Billion)

- Middle East and Africa Automotive Seats Market, By Vehicle Type, 2020–2028(USD Billion)

- Middle East and Africa Automotive Seats Market, By Sales Channel, 2020–2028(USD Billion)

- UAE Automotive Seats Market, By Type, 2020–2028(USD Billion)

- UAE Automotive Seats Market, By Design, 2020–2028(USD Billion)

- UAE Automotive Seats Market, By Vehicle Type, 2020–2028(USD Billion)

- UAE Automotive Seats Market, By Sales Channel, 2020–2028(USD Billion)

- South Africa Automotive Seats Market, By Type, 2020–2028(USD Billion)

- South Africa Automotive Seats Market, By Design, 2020–2028(USD Billion)

- South Africa Automotive Seats Market, By Vehicle Type, 2020–2028(USD Billion)

- South Africa Automotive Seats Market, By Sales Channel, 2020–2028(USD Billion)

List of Figures

- Global Automotive Seats Market Segmentation

- Automotive Seats Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Automotive Seats Market Attractiveness Analysis By Type

- Global Automotive Seats Market Attractiveness Analysis By Design

- Global Automotive Seats Market Attractiveness Analysis By Vehicle Type

- Global Automotive Seats Market Attractiveness Analysis By Sales Channel

- Global Automotive Seats Market Attractiveness Analysis By Region

- Global Automotive Seats Market: Dynamics

- Global Automotive Seats Market Share By Type(2021 & 2028)

- Global Automotive Seats Market Share By Design(2021 & 2028)

- Global Automotive Seats Market Share By Vehicle Type(2021 & 2028)

- Global Automotive Seats Market Share By Sales Channel(2021 & 2028)

- Global Automotive Seats Market Share by Regions (2021 & 2028)

- Global Automotive Seats Market Share by Company (2020)