Global Bio solvents Market Size by Product (Lactate Ester, Soy Methyl Ester, Glycols, Alcohol, and Others), Application (Paints & Coatings, Printing Inks, Adhesives & Sealants, and Others), Regions, Segmentation and Projection till 2028.

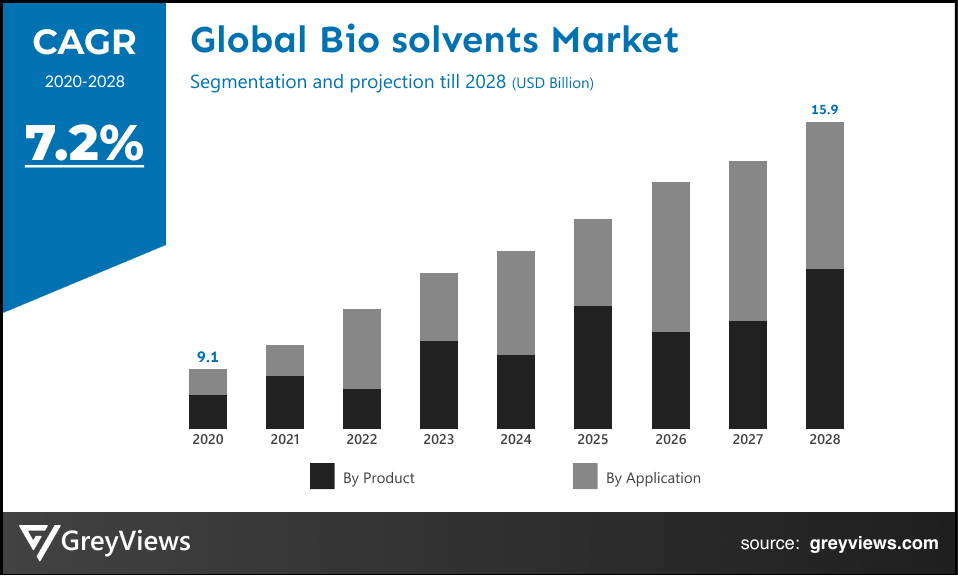

CAGR: 7.2%Current Market Size: USD 9.1 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2021-2028Base Year: 2020

Global Sio Solvents Market- Market Overview

“Boost in the Bio Solvents Market because of the strict regulations on harmful chemical reactions”

The global bio solvents market is expected to grow from USD 9.1 Billion in 2020 to USD 15.9 Billion by 2028, at a CAGR of 7.2% during the Projection period 2021-2028. This growth of the bio solvents market is mainly driven by increasing awareness regarding environmentally sustainable goods coupled with the rising environmental issues.

Solvent is a chemical substance that is being used across a number of commercial applications in a wide range of industries. However, bio solvents are derived from the agricultural sources, which includes corn, sugarcane, refined glycerin, soybean oil, lactic acid, and bio succinic acid among others. Rise in environmental concern over the past few years, has propelled national and international regulatory authorities to implement strict regulations directed to address threat of harmful chemical substances. This has boosted demand for bio solvents. On the other hand, bio solvents offers benefits such as reduced toxicity, low volatile organic compounds (VOC), biodegradability, worker safety, and environmental friendliness.

They are seeing extensive range of applications in different industries including textiles, plastics & rubber, paints & coatings, pharmaceuticals, oil & gas, construction, chemical synthesis, and others.

Request Sample:- Global Bio solvents market

Market Dynamics

Drivers:

- Rise in adoption of bio solvents in different end-use industries

There is significant rise in adoption of bio-solvents across the extensive range of industries including industrial & domestic cleaners, adhesives, paints & coatings, printing inks and others. In addition to this, a number of trade shows and expos around the globe have helped manufacturing companies in bio solvents industry to expand their customer base and contributing to the bio solvents market growth in different industry verticals.

- Environmental regulations pertaining to the VOC emissions reduction

Recently, the New England states adopted regulations that need facilities to reduce Volatile Organic Compound (VOC) emissions. In addition, VOCs are regulated by the U.S. EPA at the Federal level in 40 CFR 59, the standard emission of national volatile organic compound for commercial and consumer products. Due to such regulations, various industries are looking for environment friendly supplies & solutions and to improve energy efficiency. Paints, paint strippers, and other solvents are among the major sources of VOCs. Hence, the demand for bio solvents is increasing rapidly as they help to reduce industrial emissions of volatile organic compounds (VOCs).

Restraints:

- High cost of production

In many cases, the cost involved in the production of bio solvent exceeds the cost of petroleum-based solvents. This is mainly due to the complex production processes and fluctuations in the cost of raw materials associated with the bio solvent.

Opportunities:

- The rise in demand for bio solvent in domestic and industrial cleaning industries

Solvents are an essential part of any industrial cleaning application. In the cleaning industry, common uses of solvents are spot removers and detergents. The biobased solvents comprise derivatives including methyl soyate, or soybeans; ethyl lactate; and D-Limonene. Cleaning products containing the aforementioned solvents perform well as compared with their traditional counterparts. Hence, there is significant demand for bio solvent in domestic and industrial cleaning industries, creating lucrative growth opportunities for the market growth in upcoming years.

Challenges:

- Fluctuating demand during the COVID-19 pandemic

Owing to the unprecedented crisis of COVID-19, a number of countries have employed nationwide lockdowns. The pandemic has caused a considerable economic downturn across the globe with a huge influence on the growth of different industrial sectors. This has led to the reduction in demand for bio solvents in industrial sectors. This is one of the major challenges faced by the bio-solvents market.

Segmentation Analysis

The global bio-solvents market has been segmented based on type, application, and regions.

By Product

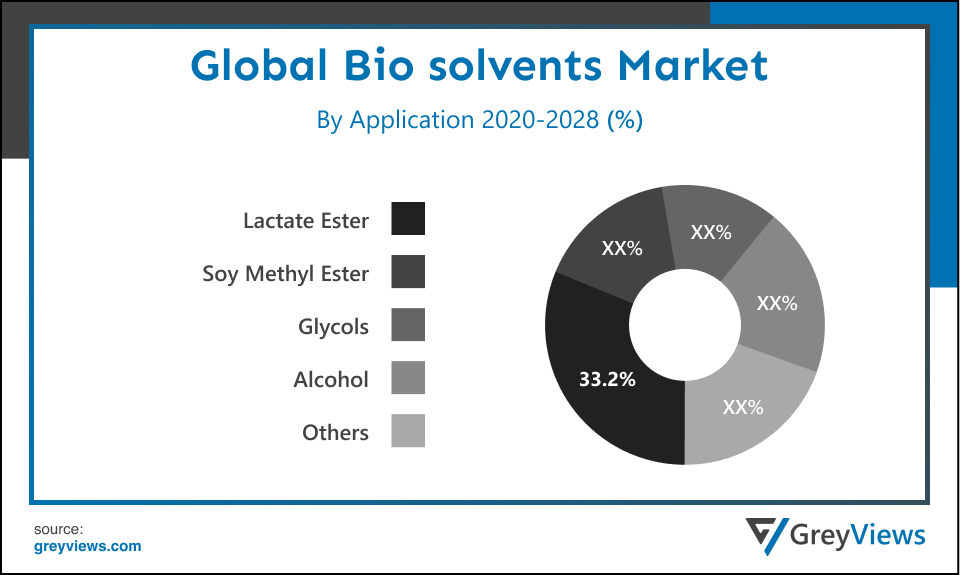

- The product segment includes lactate ester, soy methyl ester, glycols, alcohol, and others. The lactate ester segment led the bio solvents market with a market share of around 33.2% in 2020. The growth of this segment is mainly driven by rising demand across the printing inks, coatings, and industrial applications. However, the glycols solvent segment is anticipated to witness the highest growth during the Projection period owing to the growing usage of glycols solvent in automotive coatings, industrial coatings, paints, and printing inks applications.

By Application

- The application segment includes paints & coatings, printing inks, adhesives & sealants, and others. The paints & coatings segment held the largest market share of 38.2% in 2020. This is due to the rapid usage of lactate ester solvents across paints & coatings applications. Lactate ester solvents are derived from renewable carbohydrate raw materials such as ethyl lactate and cornstarch. In addition to this, worldwide demand for paints & coatings is increasing at a fast pace, owing to the housing building activities in countries such as China, Brazil, India, and Mexico. Further, urbanization and industrialization are projected to fuel demand for paints & coatings, fueling the growth of the segment.

By Regional Analysis

The regions analyzed for the bio solvents market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. The Asia-Pacific region dominated the bio solvents market and held the 39.4% share of the market revenue in 2020.

- The number of factors such as the advancing living conditions and increasing population and per capita income along with the flourishing end-user industries drive the growth of the Asia-Pacific bio solvents market. In addition to this, recently, the International Trade Administration predicted that the construction industry in China is projected to reach about $1,117.42 Million by the year 2021. While, on the other hand, the government of India is introducing initiatives to boost up its construction sector. Such factors fuel demand paints and coatings, boosting the market growth in the Asia-Pacific region.

- The North American region is likely to register significant growth during the Projection period due to the growing demand and product innovation in terms of application and quality of bio solvents. In addition to this, a number of key market players is headquartered in this region, creating lucrative growth opportunities for the growth of the market.

Key Industry Players Analysis

"Market leader engage in various strategies to spread their presence in the Global Bio solvents market"

The key players are improvising and implementing new strategies such as product innovations, adopting new technology, mergers & acquisitions, alliances, joint venture, and partnerships to improve their position in the global bio solvents industry market.

For instance, in January 2020, BASF, one of the leading bio solvents industry players acquired Solvay’s polyamide business. This acquisition has broadened BASF’s polyamide capabilities with innovation coupled with well-known products such as Technyl.

In December 2020, AkzoNobel, one of the leading bio solvents industry players collaborated with with the Dutch Advanced Research Center Chemical Building Blocks Consortium (ARC CBBC) over new possibilities for paints and coatings.

In March 2017, AkzoNobel, one of the leading bio solvents industry players launched a new tool to monitor bio-based materials in the chemical industry. This online tool tracks the usage of bio-based raw materials.

- BASF SE

- The Dow Chemical Co.

- AkzoNobel N.V.

- I. du Pont de Nemours & Co.

- Cargill Inc.

- Huntsman Corp.

- LyondellBasell

- BioAmber

- Myriant Corp.

- Vertec Biosolvents

Latest Development

- July 2021- In July 2021, Eni, an Italian multinational oil and gas company, and BASF, one of the leading bio solvents industry players signed an agreement on joint R&D initiatives for reducing the CO2 footprint across the transportation sector. The companies are projected to collaborate on the development of sustainable technology for the production of bio-propanol from industrial residues.

- June 2021- In June 2021, LyondellBasell signed a long-term commercial agreement with Neste. Under this agreement, the companies will collaborate on making chemicals and polymers from renewable feedstock more widely available to global brands.

Report Metrics

|

Report Attribute |

Details |

|

Forecast period |

2021-2028 |

|

Base year considered |

2020 |

|

CAGR (%) |

7.2% |

|

Market Size |

9.1 Billion |

|

Forecast unit |

Value (USD) |

|

Segments covered |

Product, Application, Region |

|

Report Scope |

Revenue forecast, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

BASF SE., The Dow Chemical Co., AkzoNobel N.V., E.I. du Pont de Nemours & Co., Cargill Inc., Huntsman Corp., LyondellBasell, BioAmber, Myriant Corp., Vertec Biosolvents |

|

By Product |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Bio Solvents Market by Product:

- Lactate Ester

- Soy Methyl Ester

- Glycols

- Alcohol

- Others

Global Bio Solvents Market by Application:

- Paints & Coatings

- Printing Inks

- Adhesives & Sealants

- Others

Global Bio Solvents Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market size of the bio solvents Market?

Global Bio solvents market is expected to reach USD 15.9 Billion by 2028, at a CAGR of 5.6% from 2021 to 2028.

What is the segmentation considered for the analysis of the global Bio solvents market?

The global Bio solvents market has been segmented based on product, application, and regions

Which regions have been studied for the regional analysis of the global Bio solvents market?

The regions analyzed for the Bio solvents market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa.

Which are the leading market players active in the bio solvents market?

Leading market players in the global bio solvents market are BASF SE., The Dow Chemical Co., AkzoNobel N.V., E.I. du Pont de Nemours & Co., Cargill Inc., Huntsman Corp., LyondellBasell, BioAmber, Myriant Corp., and Vertec Biosolvents among others.

What is the key driver of the bio solvents market?

Rise in the adoption of bio solvents in different end-use industries primarily drives the growth of the bio solvents market.

Which ongoing trends are expected to influence the market in the upcoming years?

Increasing awareness regarding environmentally sustainable goods coupled with the rising environmental issues.

What are the impacts of the COVID-19 pandemic on the global market?

The pandemic has caused a considerable economic downturn across the globe which has led to the reduction in demand for bio solvents in industrial sectors.

How the company profile has been selected?

Based on the sales revenue, product offering, and regional presence, the companies are selected.

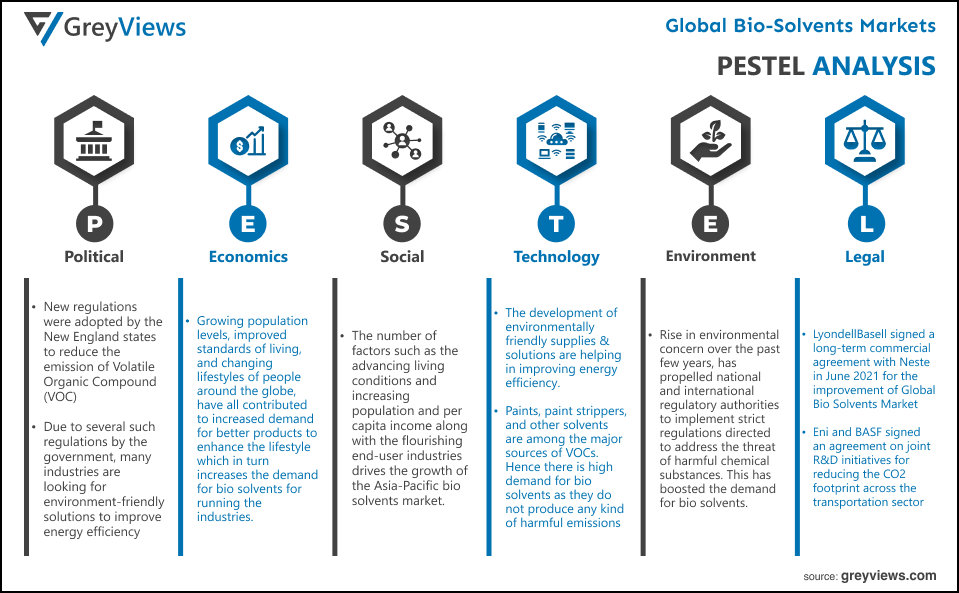

Political- New regulations were adopted by the New England states to reduce the emission of Volatile Organic Compound (VOC). In addition to this, VOCs regulations are also being regulated by the U.S. EPA at the Federal level in 40 CFR 59, the standard emission of the national volatile organic compounds for commercial and consumer products. Due to several such regulations by the government, many industries are looking for environment-friendly solutions to improve energy efficiency. Paints, paint strippers, and other solvents are among the major sources of VOCs. Hence, the demand for bio solvents is increasing rapidly as they help to reduce industrial emissions of volatile organic compounds (VOCs).

Economic- Growing population levels, improved standards of living, and changing lifestyles of people around the globe, have all contributed to increased demand for better products to enhance the lifestyle which in turn increases the demand for bio solvents for running the industries. But in many cases, the cost involved in the production of bio solvent exceeds the cost of petroleum-based solvents. This is mainly due to the complex production processes and fluctuations in the cost of raw materials associated with the bio solvent.

Social- The bio solvents market was dominated by the Asia-Pacific region and held the 39.4% share of the market revenue in 2020. The number of factors such as the advancing living conditions and increasing population and per capita income along with the flourishing end-user industries drives the growth of the Asia-Pacific bio solvents market. The North American region is likely to register significant growth during the Projection period due to the growing demand and product innovation in terms of the application and quality of bio solvents. In addition to this, a number of key market players are headquartered in this region, creating lucrative growth opportunities for the growth of the market.

Technological-The development of environmental friendly supplies & solutions helps in improving energy efficiency. This is going to help in decreasing air pollution which is caused due to industrial emissions of volatile organic compounds (VOCs). Paints, paint strippers, and other solvents are among the major sources of VOCs. Hence there is high demand for bio solvents as they do not produce any kind of harmful emissions.

Environmental- Rise in environmental concern over the past few years, has propelled national and international regulatory authorities to implement strict regulations directed to address the threat of harmful chemical substances. This has boosted the demand for bio solvents. On the other hand, bio solvents offer benefits such as reduced toxicity, low volatile organic compounds (VOC), biodegradability, worker safety, and environmental friendliness.

Legal- LyondellBasell signed a long-term commercial agreement with Neste in June 2021 for the improvement of Global Bio Solvents Market. Under this agreement, the companies will collaborate on making chemicals and polymers from renewable feedstock more widely available to global brands. In addition to this an Italian multinational oil and gas company named Eni and BASF which is one of the leading bio solvents industry players signed an agreement on joint R&D initiatives for reducing the CO2 footprint across the transportation sector. These companies are projected to collaborate on the development of sustainable technology for the production of bio-propanol from industrial residues.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Product

- Market Attractiveness Analysis By Application

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Rise in adoption of bio solvents in different end-use industries

- Environmental regulations pertaining to the VOC emissions reduction

- Restrains

- High cost of production

- Opportunities

- Rise in demand for bio solvent in domestic and industrial cleaning industries

- Challenges

- Fluctuating demand during the COVID-19 pandemic

- Global Bio solvents Market Analysis and Projection, By Product

- Segment Overview

- Lactate Ester

- Soy Methyl Ester

- Glycols

- Alcohol

- Others

- Global Bio solvents Market Analysis and Projection, By Application

- Segment Overview

- Paints & Coatings

- Printing Inks

- Adhesives & Sealants

- Others

- Global Bio solvents Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Bio solvents Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Bio solvents Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Product Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- BASF SE

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- The Dow Chemical Co.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- AkzoNobel N.V.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- I. du Pont de Nemours & Co.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Cargill Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Huntsman Corp.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- LyondellBasell

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- BioAmber

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Myriant Corp.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Vertec Biosolvents

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- BASF SE

List of Table

- Global Bio solvents Market, By Product, 2020–2028(USD Billion) (Kilotons)

- Global Lactate Ester Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Soy Methyl Ester Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Glycolss Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Alcohol Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Others Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Bio solvents Market, By Application, 2020–2028(USD Billion) (Kilotons)

- Global Paints & Coatings Bio solvents Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Printing Inks Bio solvents Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Adhesives & Sealants Bio solvents Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Others Bio solvents Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Bio solvents Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Bio solvents Market, By North America, 2020–2028(USD Billion) (Kilotons)

- North America Bio solvents Market, By Product, 2020–2028(USD Billion) (Kilotons)

- North America Bio solvents Market, By Application, 2020–2028(USD Billion) (Kilotons)

- US Bio solvents Market, By Product, 2020–2028(USD Billion) (Kilotons)

- US Bio solvents Market, By Application, 2020–2028(USD Billion) (Kilotons)

- Canada Bio solvents Market, By Product, 2020–2028(USD Billion) (Kilotons)

- Canada Bio solvents Market, By Application, 2020–2028(USD Billion) (Kilotons)

- Mexico Bio solvents Market, By Product, 2020–2028(USD Billion) (Kilotons)

- Mexico Bio solvents Market, By Application, 2020–2028(USD Billion) (Kilotons)

- Europe Bio solvents Market, By Product, 2020–2028(USD Billion) (Kilotons)

- Europe Bio solvents Market, By Application, 2020–2028(USD Billion) (Kilotons)

- Germany Bio solvents Market, By Product, 2020–2028(USD Billion) (Kilotons)

- Germany Bio solvents Market, By Application, 2020–2028(USD Billion) (Kilotons)

- France Bio solvents Market, By Product, 2020–2028(USD Billion) (Kilotons)

- France Bio solvents Market, By Application, 2020–2028(USD Billion) (Kilotons)

- UK Bio solvents Market, By Product, 2020–2028(USD Billion) (Kilotons)

- UK Bio solvents Market, By Application, 2020–2028(USD Billion) (Kilotons)

- Italy Bio solvents Market, By Product, 2020–2028(USD Billion) (Kilotons)

- Italy Bio solvents Market, By Application, 2020–2028(USD Billion) (Kilotons)

- Spain Bio solvents Market, By Product, 2020–2028(USD Billion) (Kilotons)

- Spain Bio solvents Market, By Application, 2020–2028(USD Billion) (Kilotons)

- Asia Pacific Bio solvents Market, By Product, 2020–2028(USD Billion) (Kilotons)

- Asia Pacific Bio solvents Market, By Application, 2020–2028(USD Billion) (Kilotons)

- Japan Bio solvents Market, By Product, 2020–2028(USD Billion) (Kilotons)

- Japan Bio solvents Market, By Application, 2020–2028(USD Billion) (Kilotons)

- China Bio solvents Market, By Product, 2020–2028(USD Billion) (Kilotons)

- China Bio solvents Market, By Application, 2020–2028(USD Billion) (Kilotons)

- India Bio solvents Market, By Product, 2020–2028(USD Billion) (Kilotons)

- India Bio solvents Market, By Application, 2020–2028(USD Billion) (Kilotons)

- South America Bio solvents Market, By Product, 2020–2028(USD Billion) (Kilotons)

- South America Bio solvents Market, By Application, 2020–2028(USD Billion) (Kilotons)

- Brazil Bio solvents Market, By Product, 2020–2028(USD Billion) (Kilotons)

- Brazil Bio solvents Market, By Application, 2020–2028(USD Billion) (Kilotons)

- Middle East and Africa Bio solvents Market, By Product, 2020–2028(USD Billion) (Kilotons)

- Middle East and Africa Bio solvents Market, By Application, 2020–2028(USD Billion) (Kilotons)

- UAE Bio solvents Market, By Product, 2020–2028(USD Billion) (Kilotons)

- UAE Bio solvents Market, By Application, 2020–2028(USD Billion) (Kilotons)

- South Africa Bio solvents Market, By Product, 2020–2028(USD Billion) (Kilotons)

- South Africa Bio solvents Market, By Application, 2020–2028(USD Billion) (Kilotons)

List of Figures

- Global Bio solvents Market Segmentation

- Bio solvents Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Bio solvents Market Attractiveness Analysis By Product

- Global Bio solvents Market Attractiveness Analysis By Application

- Global Bio solvents Market Attractiveness Analysis By Region

- Global Bio solvents Market: Dynamics

- Global Bio solvents Market Share By Product(2021 & 2028)

- Global Bio solvents Market Share By Application(2021 & 2028)

- Global Bio solvents Market Share by Regions (2021 & 2028)

- Global Bio solvents Market Share by Company (2020)