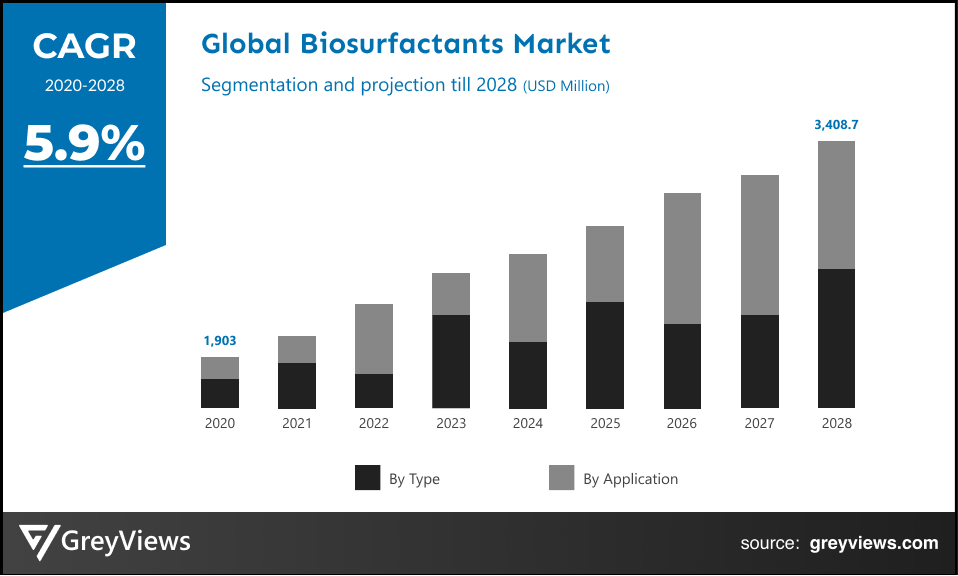

Global Biosurfactants Market Size by Type (Glycolipids, Lipopeptides and Lipoproteins, Phospholipids and Fatty Acids, Polymeric Biosurfactants, and Particulate Biosurfactants), Application (Detergents, Personal Care, Food Processing, Agricultural Chemicals, and Others), Regions, Segmentation, and Projection till 2028.

CAGR: 5.9%Current Market Size: USD 1,903.0 MillionFastest Growing Region: North America

Largest Market: EuropeProjection Time: 2021-2028Base Year: 2020

Global Biosurfactants Market- Market Overview

The global biosurfactants market is expected to grow from USD 1,903.0 Million in 2020 to USD 3,408.7 Million by 2028, at a CAGR of 5.9% during the Projection period 2021-2028. This growth of the Global biosurfactants market is significantly driven by rising consumer demand and awareness about bio-based products coupled with the eco-friendly quality of biosurfactants.

Biosurfactants are surface-active substances that can be produced extracellularly or are synthesized by microorganisms. They are molecules derived from microorganisms and possess both hydrophobic and hydrophilic ends. Several microorganisms including Acinetobacter sp., Candida Antarctica, Bacillus sp, and Pseudomonas aeruginosa are used for producing the biosurfactants. They offer benefits such as low toxicity, biodegradability, better surface, environmentally friendly, and interfacial activity. Such advantages over synthetic surfactants attract several surfactant manufacturers to enter in biosurfactant market.

“Biosurfactants market is expected to see a boost driven by the rising demand for ecofriendly products”

Moreover, biosurfactants are finding wide-ranging applications across agriculture, medicine, industrial, and petroleum sectors. For instance, they have become the potential replacements for synthetic surfactants in industrial processes, such as lubrication, softening, wetting, fixing dyes, stabilizing dispersions, preventing foaming, making emulsions, foaming, as well as in the food and biomedical & pharmaceutical industry.

Request Sample:- Global Biosurfactants market

Market Dynamics

Drivers:

- Rising consumer demand and awareness about bio-based products

In Europe and North America, considerable growth has been observed in consumer awareness as well as preference regarding the use of bio-based products. The biosurfactant’s properties such as non-toxic, environmentally friendly, and biodegradability primarily create consumer demand for bio-based products. In addition to this, biosurfactants are offering advantages over synthetic surfactants, which is further fueling its demand.

- Demand for biosurfactants in different applications

Applications associated with personal care, soaps & detergents, and industrial cleaning are creating demand for biosurfactants. In addition to this, synthetic surfactants in number of industrial processes, such as lubrication, making emulsions, wetting, stabilizing dispersions, softening, foaming, fixing dyes, and preventing foaming are also being replaced by biosurfactants, fueling the market growth.

Restraints:

- Cost competitiveness as compared with conventional surfactants

Regardless of its properties as well as a potential application across extensive industrial and environmental processes, biosurfactants are yet not much cost-competitive when compared with their synthetic counterparts. In addition, the production of biosurfactants includes high costs, hindering the growth of the market.

Opportunities:

- Emergence of cost-effective production techniques

The production cost of biosurfactant is higher than that of its synthetic counterparts, this increases the demand for synthetic surfactants. However, for the production of biosurfactants agro waste can be used. There is emerging usage of agro industrial wastes such as banana peel which can reduce the biosurfactants production costs.

Challenges:

- Disruptions due to COVID-19

Owing to the unprecedented crisis of COVID-19, a number of countries have employed nationwide lockdowns. However, as they are reopening, safety measures such as social distancing are still being applied. This has caused a significant economic downturn across the globe. Due to slowdown in industrial activities and consumer markets, the surfactants industry has been impacted. Hence, the emergence of the COVID-19 pandemic has posed challenges to the global biosurfactants market.

Segmentation Analysis

“The global biosurfactants market has been segmented based on type, application, and region”

By Type

The glycolipids segment led the by type market for Global Biosurfactants

- The type segment includes glycolipids, polymeric biosurfactants, phospholipids, lipopeptides & lipoproteins, and fatty acids, and particulate biosurfactants. The glycolipids segment led the Global biosurfactants market with a market share of around 35% in 2020. This segment is further categorized into sophorolipids and rhamnolipids. The growth of this segment is attributed to wide applications of rhamnolipids in agricultural chemicals, hydrocarbon recovery & oil tank cleaning, and personal care & household products. In addition to this, sophorolipids are the popular active ingredient in cosmetic products for skin and body applications; hence, growing cosmetics demand boosts the growth of the glycolipids segment.

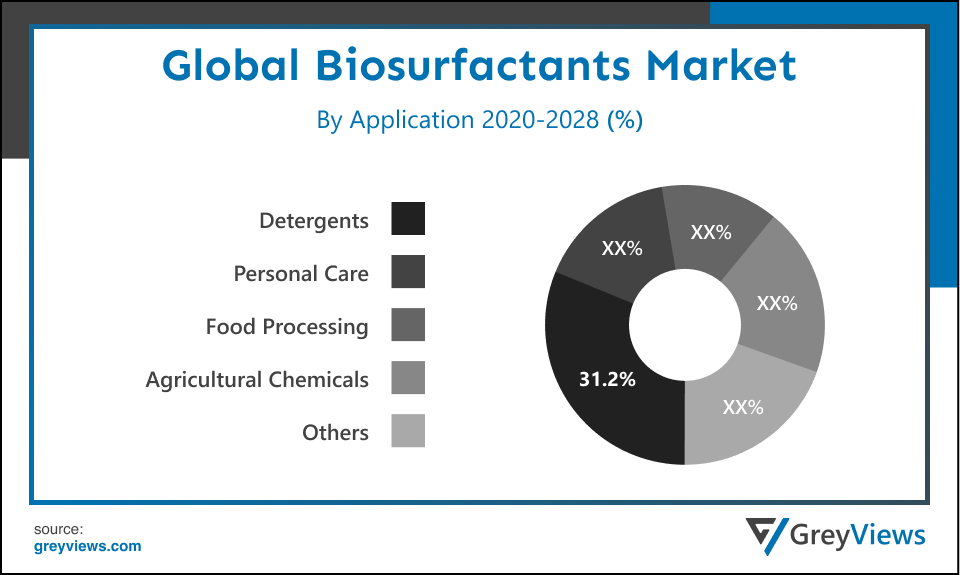

By Application

Detergents segment held the largest market share by application

- Based on application, the application segment includes detergents, personal care, food processing, agricultural chemicals, and others. The detergents segment held the largest market share of 31.20% in 2020. The growth of this segment is mainly driven by emerging demand for sustainable products in cleaning applications. In addition, home care is the leading industry using surfactants; thus, demand for household detergent boosts the growth of this segment. However, the personal care applications segment is projected to witness the highest growth rate during the Projection period owing to the rising consumer awareness about the benefits of bio-based personal care products.

By Regional Analysis

The regions analyzed for the Global biosurfactants market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. The European region dominated the Global biosurfactants market and held the 39.40% share of the market revenue in 2020.

- A rise in awareness among consumers about the health hazards of chemical surfactants boosts demand for biosurfactants in Europe. In addition, the consumers in Europe are concerned about the protection of the environment from toxic chemicals, due to stringent laws enforced by regulatory bodies, monitored by Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH), a European Union regulation.

- The North American region is likely to register significant growth during the Projection period due to huge growth in per capita disposable income coupled with the spending on personal care products. In addition, the region is home to leading personal care products manufacturers such as Johnsons & Johnsons, Unilever, Procter & Gamble, and L’Oreal. This factor further creates lucrative growth opportunities for the market in North America.

Key Industry Players Analysis

“Key market players are focusing on new strategies to improve their market position”

The key players of the Global Biosurfactants market are concentrating on creating new strategies to improve their market position such as product innovations, adopting new technology, mergers & acquisitions, alliances, joint venture, and partnerships to improve their market position in the global biosurfactants industry.

For instance, In November 2020, Givaudan SA, a Swiss multinational manufacturer of fragrances, flavors, and active cosmetic ingredients, and Novozymes announced a research partnership for the development of synergistic innovative technologies and ingredients for customers.

In October 2020, Croda International Plc. (Croda) officially announced the launch and certification of its ECO range of bio-based surfactants. This launch is aimed to meet the increasing demand for sustainable and high-performance ingredient options.

In August 2018, Givaudan SA, a Swiss multinational manufacturer of fragrances, flavors, and active cosmetic ingredients partnered with Synthite for the development of innovative natural ingredients for its Fragrance business.

- BASF (Cognis)

- AkzoNobel N.V.

- Evonik Industries AG

- Lion Corporation

- Ecover

- Jeneil Biotech, Inc.

- Givaudan SA (Soliance)

- Croda International PLC

- Daqing VICTEX Chemical Industries Co., Ltd.

- Henkel Corporation

- Kao Corporation

- Biotensidon GmbH

- Boruta Zachem SA

Latest Development

- March 2021- BASF signed two partnerships agreements with ACS and Holiferm which is a UK-based start-up company. These partnerships are expected to expand BASF’s position at the global level in the bio-based actives and surfactants industry.

- October 2021- Kao Corporation and KOSÉ Corporation agreed for a collaboration in the cosmetics sustainability domain. This collaboration is aimed at realizing a sustainable society.

Report Metrics

|

Report Attribute |

Details |

|

Projection period |

2021-2028 |

|

Base year considered |

2020 |

|

CAGR (%) |

5.9% |

|

Market Size |

1,903.0 million |

|

Projection unit |

Value (USD) |

|

Segments covered |

Type, Application, Region |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

BASF (Cognis), AkzoNobel N.V.,Evonik Industries AG, Lion Corporation, Ecover, Jeneil Biotech, Inc., Givaudan SA (Soliance), Croda International PLC, Daqing VICTEX Chemical Industries Co., Ltd., Henkel Corporation, Kao Corporation, Biotensidon GmbH, and Boruta Zachem SA among others |

|

By Type |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Biosurfactants Market by Type:

- Glycolipids

- Lipopeptides and Lipoproteins

- Phospholipids and Fatty Acids

- Polymeric Biosurfactants

- Particulate Biosurfactants

Global Biosurfactants Market by Application:

- Detergents

- Personal Care

- Food Processing

- Agricultural Chemicals

- Others

Global Biosurfactants Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market size of the Biosurfactants Market?

Global Biosurfactants market is expected to reach USD 3,408.7 million by 2028, at a CAGR of 5.9% from 2021 to 2028.

Which regions have been studied for the regional analysis of the global Biosurfactants market?

The regions analyzed for the Biosurfactants market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa.

What is the segmentation considered for the analysis of the global Biosurfactants market?

The global Biosurfactants market has been segmented based on type, application, and regions.

Which are the leading market players active in the global biosurfactants market?

leading market players active in the global biosurfactants market are BASF (Cognis), AkzoNobel N.V., Evonik Industries AG, Lion Corporation, Ecover, Jeneil Biotech, Inc., Givaudan SA (Soliance), Croda International PLC, Daqing VICTEX Chemical Industries Co., Ltd., Henkel Corporation, Kao Corporation, Biotensidon GmbH, and Boruta Zachem SA among others.

What is the key driver of the Global biosurfactants market?

Rising consumer demand and awareness about bio-based products primarily drive the growth of the global biosurfactants market.

What are the trends are expected to influence the market in the upcoming years?

Rising consumer demand and awareness about bio-based products. In addition, biosurfactants are the potential replacements for synthetic surfactants.

What are the detailed impacts of the COVID-19 pandemic on the global market?

The pandemic temporarily suspended manufacturing activities, travel bans, and production shutdowns. However, there is huge growth in demand for industrial cleaners and household detergents during the pandemic, fuelling the growth of the market.

How the company profile has been selected?

Based on the sales revenue, product offering, and regional presence, the companies are selected.

Political- a Swiss multinational manufacturer of fragrances, flavors, and active cosmetic ingredients namely Givaudan SA and Novozymes announced a research partnership on a political front for the development of synergistic innovative technologies and ingredients for customers. In addition to this Croda International Plc. (Croda) officially announced the launch and certification of its ECO range of bio-based surfactants. This launch is aimed to meet the increasing demand for sustainable and high-performance ingredient options.

Economic- Regardless of the properties of biosurfactants as well as its potential application across extensive industrial and environmental processes,these are yet not much cost-competitive when compared with their synthetic counterparts. In addition, the production of biosurfactants includes high costs, hindering the growth of the market. The production cost of biosurfactant is higher than that of its synthetic counterparts, this increases the demand for synthetic surfactants. However, for the production of biosurfactants agro waste can be used. There is emerging usage of agro industrial wastes such as banana peel which can reduce the biosurfactants production costs.

Social- The North American region is likely to register significant growth because of the huge growth in per capita disposable income. In North American region people are increasingly spending more money on personal careproducts which increases the demand for biosurfactants products. In addition to all this, the North American region is home to many popular and leading personal care products manufacturers such as Johnsons & Johnsons, Unilever, Procter & Gamble, and L’Oreal. This factor further creates lucrative growth opportunities for the market in North America.

Technological- Biosurfactants are technologically advance are being used in manufacture of Detergents, Personal Care, Food Processing, Agricultural Chemicals, and Other cosmetic products. active cosmetic ingredients partnered with Synthite for the development of innovative natural ingredients for its Fragrance business. Biosurfactants are surface-active substances that can be produced extracellularly or are synthesized by microorganisms. They offer benefits such as low toxicity, biodegradability, better surface, environmentally friendly, and interfacial activity. Such advantages over synthetic surfactants attract several surfactant manufacturers to enter in biosurfactant market.

Environmental- A rise in awareness among consumers about the health hazards of chemical surfactants abd also the negative impact that these chemical surfactants leave on the environment is also boosting the market for biosurfactants. In addition, the consumers are concerned about the protection of the environment from toxic chemicals, due to stringent laws enforced by regulatory bodies.

Legal- In Europe stringent laws are being enforced by regulatory bodies, monitored by Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH), a European Union regulation to protect the environment from toxic chemical which harm the environment to a greater extent. These legal laws are very much strict and looks for legal action when any firm is seen not abiding by it. This also makes the usage of biosurfactants more compulsory in European country and companies functional in these areas.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Type

- Market Attractiveness Analysis By Application

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Rising consumer demand and awareness about bio-based Types

- Demand for biosurfactants in different applications

- Restrains

- Cost competitiveness as compared with conventional surfactants

- Opportunities

- Emergence of cost-effective production techniques

- Challenges

- Disruptions due to COVID-19

- Global Biosurfactants Market Analysis and Projection, By Type

- Segment Overview

- Glycolipids

- Lipopeptides and Lipoproteins

- Phospholipids and Fatty Acid

- Polymeric Biosurfactants

- Particulate Biosurfactants

- Global Biosurfactants Market Analysis and Projection, By Application

- Segment Overview

- Detergents

- Personal Care

- Food Processing

- Agricultural Chemicals

- Others

- Global Biosurfactants Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Biosurfactants Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Biosurfactants Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Type Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- BASF (Cognis)

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- AkzoNobel N.V.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Evonik Industries AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Lion Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Ecover

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Jeneil Biotech, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Givaudan SA (Soliance)

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Croda International PLC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Daqing VICTEX Chemical Industries Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Henkel Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Kao Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Biotensidon GmbH

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Boruta Zachem SA

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- BASF (Cognis)

List of Table

- Global Biosurfactants Market, By Type, 2020–2028(USD Million) (Kilotons)

- Global Glycolipids Market, By Region, 2020–2028(USD Million) (Kilotons)

- Global Lipopeptides and lipoproteins Market, By Region, 2020–2028(USD Million) (Kilotons)

- Global Phospholipids and Fatty Acids Market, By Region, 2020–2028(USD Million) (Kilotons)

- Global Polymeric Biosurfactants Market, By Region, 2020–2028(USD Million) (Kilotons)

- Global Particulate Biosurfactants Market, By Region, 2020–2028(USD Million) (Kilotons)

- Global Biosurfactants Market, By Application, 2020–2028(USD Million) (Kilotons)

- Global Detergents Biosurfactants Market, By Region, 2020–2028(USD Million) (Kilotons)

- Global Personal Care Biosurfactants Market, By Region, 2020–2028(USD Million) (Kilotons)

- Global Food Processing Biosurfactants Market, By Region, 2020–2028(USD Million) (Kilotons)

- Global Agricultural Chemicals Biosurfactants Market, By Region, 2020–2028(USD Million) (Kilotons)

- Global Others Biosurfactants Market, By Region, 2020–2028(USD Million) (Kilotons)

- Global Biosurfactants Market, By Region, 2020–2028(USD Million) (Kilotons)

- Global Biosurfactants Market, By North America, 2020–2028(USD Million) (Kilotons)

- North America Biosurfactants Market, By Type, 2020–2028(USD Million) (Kilotons)

- North America Biosurfactants Market, By Application, 2020–2028(USD Million) (Kilotons)

- US Biosurfactants Market, By Type, 2020–2028(USD Million) (Kilotons)

- US Biosurfactants Market, By Application, 2020–2028(USD Million) (Kilotons)

- Canada Biosurfactants Market, By Type, 2020–2028(USD Million) (Kilotons)

- Canada Biosurfactants Market, By Application, 2020–2028(USD Million) (Kilotons)

- Mexico Biosurfactants Market, By Type, 2020–2028(USD Million) (Kilotons)

- Mexico Biosurfactants Market, By Application, 2020–2028(USD Million) (Kilotons)

- Europe Biosurfactants Market, By Type, 2020–2028(USD Million) (Kilotons)

- Europe Biosurfactants Market, By Application, 2020–2028(USD Million) (Kilotons)

- Germany Biosurfactants Market, By Type, 2020–2028(USD Million) (Kilotons)

- Germany Biosurfactants Market, By Application, 2020–2028(USD Million) (Kilotons)

- France Biosurfactants Market, By Type, 2020–2028(USD Million) (Kilotons)

- France Biosurfactants Market, By Application, 2020–2028(USD Million) (Kilotons)

- UK Biosurfactants Market, By Type, 2020–2028(USD Million) (Kilotons)

- UK Biosurfactants Market, By Application, 2020–2028(USD Million) (Kilotons)

- Italy Biosurfactants Market, By Type, 2020–2028(USD Million) (Kilotons)

- Italy Biosurfactants Market, By Application, 2020–2028(USD Million) (Kilotons)

- Spain Biosurfactants Market, By Type, 2020–2028(USD Million) (Kilotons)

- Spain Biosurfactants Market, By Application, 2020–2028(USD Million) (Kilotons)

- Asia Pacific Biosurfactants Market, By Type, 2020–2028(USD Million) (Kilotons)

- Asia Pacific Biosurfactants Market, By Application, 2020–2028(USD Million) (Kilotons)

- Japan Biosurfactants Market, By Type, 2020–2028(USD Million) (Kilotons)

- Japan Biosurfactants Market, By Application, 2020–2028(USD Million) (Kilotons)

- China Biosurfactants Market, By Type, 2020–2028(USD Million) (Kilotons)

- China Biosurfactants Market, By Application, 2020–2028(USD Million) (Kilotons)

- India Biosurfactants Market, By Type, 2020–2028(USD Million) (Kilotons)

- India Biosurfactants Market, By Application, 2020–2028(USD Million) (Kilotons)

- South America Biosurfactants Market, By Type, 2020–2028(USD Million) (Kilotons)

- South America Biosurfactants Market, By Application, 2020–2028(USD Million) (Kilotons)

- Brazil Biosurfactants Market, By Type, 2020–2028(USD Million) (Kilotons)

- Brazil Biosurfactants Market, By Application, 2020–2028(USD Million) (Kilotons)

- Middle East and Africa Biosurfactants Market, By Type, 2020–2028(USD Million) (Kilotons)

- Middle East and Africa Biosurfactants Market, By Application, 2020–2028(USD Million) (Kilotons)

- UAE Biosurfactants Market, By Type, 2020–2028(USD Million) (Kilotons)

- UAE Biosurfactants Market, By Application, 2020–2028(USD Million) (Kilotons)

- South Africa Biosurfactants Market, By Type, 2020–2028(USD Million) (Kilotons)

- South Africa Biosurfactants Market, By Application, 2020–2028(USD Million) (Kilotons)

List of Figures

- Global Biosurfactants Market Segmentation

- Biosurfactants Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Biosurfactants Market Attractiveness Analysis By Type

- Global Biosurfactants Market Attractiveness Analysis By Application

- Global Biosurfactants Market Attractiveness Analysis By Region

- Global Biosurfactants Market: Dynamics

- Global Biosurfactants Market Share By Type(2021 & 2028)

- Global Biosurfactants Market Share By Application(2021 & 2028)

- Global Biosurfactants Market Share by Regions (2021 & 2028)

- Global Biosurfactants Market Share by Company (2020)