Global Epoxy Composites Market Size by Manufacturing Technology (Compression Moulding, Lay-up, Filament Winding, Resin Injection, Resin Transfer Moulding, Pultrusion, and Others), Fiber Type (Carbon, Glass, and Others), Application (Electronics and Electrical, Marine, Automotive and Transportation, Wind Energy, Aerospace and Defense, Sporting and Consumer Goods, Construction, and Others), Distribution Channel (Online and Offline) Regions, Segmentation, and Projection till 2028

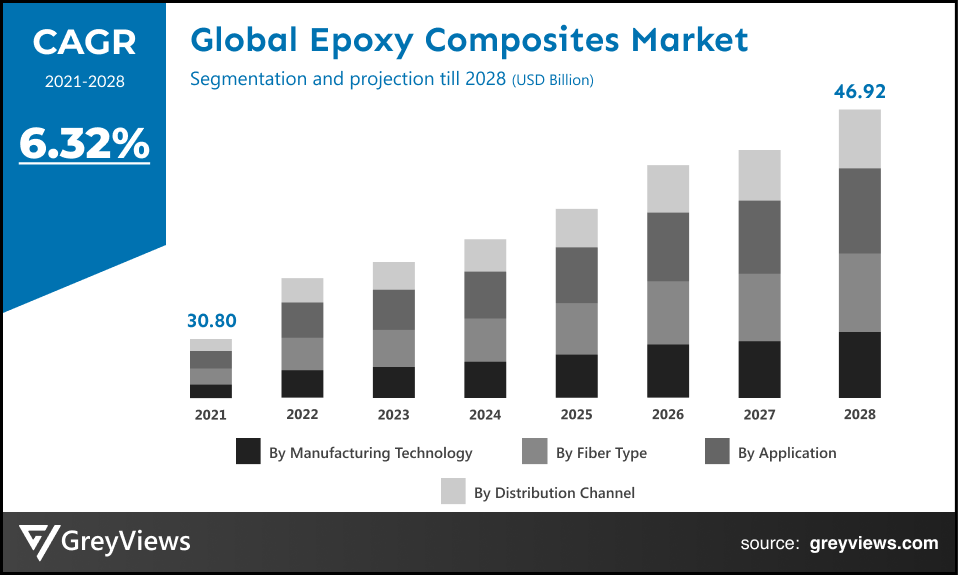

CAGR: 6.32%Current Market Size: USD 30.80 billionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2028Base Year: 2021

Global Epoxy Composites Market- Market Overview

Global epoxy composites market is expected to reach USD 46.92 billion by 2028, at a CAGR of 6.32% from 2022 to 2028. This growth of the epoxy composites market is significantly driven by the rising use of light materials in the manufacturing automotive and construction industries. The increasing demand for such materials in several application has led to high sales in the past few years. The developing countries are the major end-users of epoxy composites owing to the expansion of the semiconductor and construction industry.

Epoxy composites are polymer materials type that involves the use of epoxy for the creation of the polymer matrix. This particular polymer matrix made from epoxy is of high strength and also lasts longer. The epoxy composites have a lower density in comparison to the metals, which results in a substantial amount of fuel savings in the automotive and aerospace industries. The epoxy composite-based materials are superior to the conventional construction materials. These epoxy composites are resistant to rotting, spalling and corrosion. The viscosity of the material can be lowered with the help of epoxy composites, owing to their lightweight. The low viscosity helps in maximizing the adhesion in between the reinforcing fiber and polymer matrix. The epoxy composites can be tailored to the exact requirements of the application.

Request Sample:- Global epoxy composites market

Market Dynamics

Drivers:

- Increasing demand from construction and wind energy

The increase in construction activities has led to the high use of epoxy composites. The developing countries have a high demand for advanced construction materials which can help in decreasing the weight of the infrastructure. Due to the expansion of urbanization and industrialization, the construction industry is keen on using materials that can help in resisting corrosion and rotting. The epoxy composites provide freedom of design and effective processing in wind energy infrastructure installments.

- Rising use in sports products

Sports products should be light in weight and high on strength. Thus, manufacturers have found that epoxy composites are beneficial to manufacture in golf equipment, table tennis boards, bats, hiking equipment, etc. The use of such materials helps in providing high tensile strength to the product. There are many companies that are willing to use epoxy composite in the manufacturing of various sports equipment in order to make them durable.

Restraints:

- Fluctuating prices of raw materials

The epoxy composites market's expansion is being hampered by the variable cost of raw materials necessary for product development. The total costs are influenced by the raw material prices connected with the development of epoxy composites. The upstream price of raw materials has an impact on the production's final price. As a result, the shifting cost of raw materials has an impact on the market expansion of epoxy composites companies.

Opportunities:

- Increasing adoption of cost-effective materials

Several end-user industries are opting for low-cost materials for manufacturing processes. The use of cost-effective materials leads to huge savings for the end-users. Epoxy composites are low-cost and have all the beneficial properties such as high strength, low weight, and ease of processing. The use of such cost-effective materials helps the manufacturers to deploy their processing costs elsewhere. Thus, the manufacturers present in electronics and electrical, consumer goods, sports, construction industry, are willing to source bulk amount of epoxy composites.

Challenges

- Complex research and development process

The epoxy composites require extensive research and development processes in order to be launched in the market. The technology used for the manufacturing of epoxy composites is rigorous and requires the use of high-end equipment. Further, the process is also lengthy and thus this leads to delay in the commercialization of the product.

Segmentation Analysis

The global epoxy composites market has been segmented based on manufacturing technology, fiber type, application, distribution channel, and regions.

By Manufacturing Technology

The manufacturing technology segment includes compression molding, lay-up, filament winding, resin injection, resin transfer molding, pultrusion, and others. The compression molding segment led the epoxy composites market with a market share of around 29.17% in 2021. Compression molding is one of the most used technologies used for manufacturing epoxy composites. The raw material is placed inside the heated cavity. This particularly heated cavity is closed with a plug on top and then compressed by a hydraulic press. This process results in the formulation of uniform epoxy composites which can be used in multiple applications.

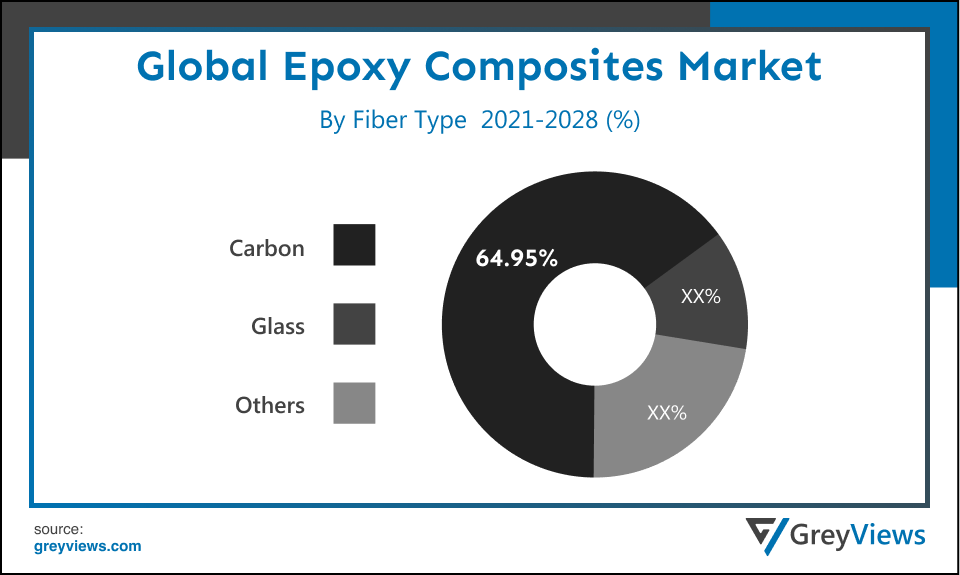

By Fiber Type

The fiber type segment includes carbon, glass, and others. The glass segment led the epoxy composites market with a market share of around 64.95% in 2021. The use of glass fiber provides desired ratio of strength and weight in various applications. Marine and automotive applications demand the use of glass fiber-based epoxy composites owing to their low cost. Glass fibers provide efficiency of fuel in the automotive application and hence the end-users are keen to use such material. Glass fibers are also easily available and can be processed effectively according to the requirements.

By Application

The application segment includes electronics and electrical, marine, automotive and transportation, wind energy, aerospace and defense, sporting and consumer goods, construction, and others. The automotive and transportation segment led the epoxy composites market with a market share of around 26.02% in 2021. Automotive and transportation requires the use of a lightweight and durable raw materials for the manufacturing of different components. Epoxy resin provides structural strength to the automotive components which increase their durability and thus are considered to be one of the most effective materials for automotive and transportation applications. Further, they also increase the fuel efficiency which attracts a huge number of manufacturers to use them in manufacturing.

By Distribution Channel

The end-user segment includes online and offline. The offline segment led the epoxy composites market with a market share of around 78.43% in 2021. Epoxy composites are majorly used by the end-users of construction, marine, electric and electronics, aerospace, and automotive industries. Thus, the end-users usually buy the product in bulk quantity, as it is used in the manufacturing of various equipment and component. Manufacturers would prefer to check the quality in accordance with their requirements.

By Regional Analysis:

The regions analyzed for the epoxy composites market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. The Asia-Pacific region dominated the epoxy composites market and held the 36.82% share of the market revenue in 2021.

- The Asia-Pacific region has registered the highest value for the year 2021. The increasing production of automobiles and electric and electronic products has led to a rise in demand for epoxy composites. The countries such as China, India, Japan, Malaysia, and Singapore are the major end-users of epoxy composites. The increasing industrialization and urbanization, is providing lucrative opportunities to the market growth of epoxy composites. Further, the presence of multiple manufacturers in the regional countries have increased the supply of product.

- North America is likely to register substantial growth during the Projection period due to the use of epoxy composites in the aerospace industry. The increasing use of private jets, helicopters, etc., and the rise in the number of air passengers has led to the high demand of epoxy composites Moreover, USA and Canada are some of the key countries for the epoxy composites market in the North America region. Further, the rising defense spending is fueling up the market growth.

Key Industry Players Analysis

To increase their market position in the global epoxy composites business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Toray Industries

- Gurit Holdings AG

- Park Electrochemical Corporation

- Teijin Limited

- Cytec Solvay Group

- Hexcel Corporation

- Huntsman Corp. LLC

- SGL Carbon

- Arkema

- Avient Corp.

- Olin Corp.

- Axiom Materials Inc.

- Koninklijke Ten Cate NV.

- Mitsubishi Rayon Co. Ltd.

- Rotec Composite Group B.V.

- Gordon Composites, Inc.

Latest Development

In July 2019, a known global manufacturer, Aditya Birla Chemicals India Ltd., had announced the acquisition of a Recyclamine technology, of the Connora Technologies Inc. The recyclamine technology is a zero-waste manufacturing and easy recyclability, for the epoxy composite manufacturers.

In October 2021, Retrac Group has introduced various sustainable types of epoxy composites. The objective of this new line of composites is to provide the customer with more choices coupled with effective performance products along with better sustainability.

In September 2021, Norplex had announced Norplex Advanced Composites, which is a cost-effective solution for high and mid-volume applications. The product portfolio of Norplex Advanced Composites includes unidirectional and fabric glass epoxy resins. The newly launched product portfolio is suitable for different applications such as medical, aerospace, transportation, renewable energy goods, etc.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2018-2028 |

|

Base Year |

2021 |

|

Projection Period |

2022-2028 |

|

Market Share Unit |

USD Billion |

|

Segments Covered |

Manufacturing Technology, Fiber Type, Application and Distribution Channel |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle-East and Africa |

|

Major Players |

Toray Industries, Gurit Holdings AG, Park Electrochemical Corporation, Teijin Limited, Cytec Solvay Group, Hexcel Corporation, Huntsman Corp. LLC, SGL Carbon, Arkema, Avient Corp., Olin Corp., Axiom Materials Inc., Koninklijke Ten Cate NV., Mitsubishi Rayon Co. Ltd., Rotec Composite Group B.V., Gordon Composites, Inc. |

Scope of the Report

Global Epoxy Composites Market by Manufacturing Technology:

- Compression Moulding

- Lay-up

- Filament Winding

- Resin Injection

- Resin Transfer Moulding

- Pultrusion

- Others

Global Epoxy Composites Market by Fiber Type:

- Carbon

- Glass

- Others

Global Epoxy Composites Market by Application:

- Electronics and Electrical

- Marine

- Automotive and Transportation

- Wind Energy

- Aerospace and Defense

- Sporting and Consumer Goods

- Construction

- Others

Global Epoxy Composites Market by Distribution Channel:

- Online

- Offline

Global Epoxy Composites Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market size of the epoxy composites market?

Global epoxy composites market is expected to reach USD 46.92 billion by 2028, at a CAGR of 6.32% from 2022 to 2028.

Which regions have been studied for the regional analysis of the global epoxy composites market?

The regions analyzed for the epoxy composites market include North America, Europe, South America, Asia Pacific, and the Middle East and Africa.

What is the segmentation considered for the analysis of the global epoxy composites market?

The global epoxy composites market has been segmented based on manufacturing technology, fiber type, application, distribution channel, and regions.

Which are the leading market players active in the epoxy composites market?

Leading market players active in the global epoxy composites market are Toray Industries, Gurit Holdings AG, Park Electrochemical Corporation, Teijin Limited, Cytec Solvay Group, Hexcel Corporation, Huntsman Corp. LLC, SGL Carbon, Arkema, Avient Corp., Olin Corp., Axiom Materials Inc., Koninklijke Ten Cate NV., Mitsubishi Rayon Co. Ltd., Rotec Composite Group B.V., Gordon Composites, Inc. among others.

What are the key driver of the epoxy composites market?

Rising demand for use of high strength, low weight, and durable products, in the manufacturing of construction, automobile, and aerospace components, is primarily driving the growth of the epoxy composites market.

What are the detailed impacts of the COVID-19 pandemic on the global market?

The pandemic has significantly affected several industries and has caused a worldwide economic slowdown. Many regions imposed various lockdowns during the fiscal year 2020. These lockdowns led to the closure of the regional industries and all types of manufacturing facilities, which has led to a shortage of supply in the market. Additionally, all the end-users industries were temporarily closed during this period, which in turn has decreased the sales for epoxy composites.

What are the ongoing trends that are projected to influence the market in the upcoming years?

Manufacturers in the epoxy composites market are using advanced production technologies to incorporate better results and performance of the whole process. In addition, the rising number of investments will contribute to demand for epoxy composites.

How the company profile has been selected?

Based on the sales revenue, product offering, and regional presence, the companies are selected.

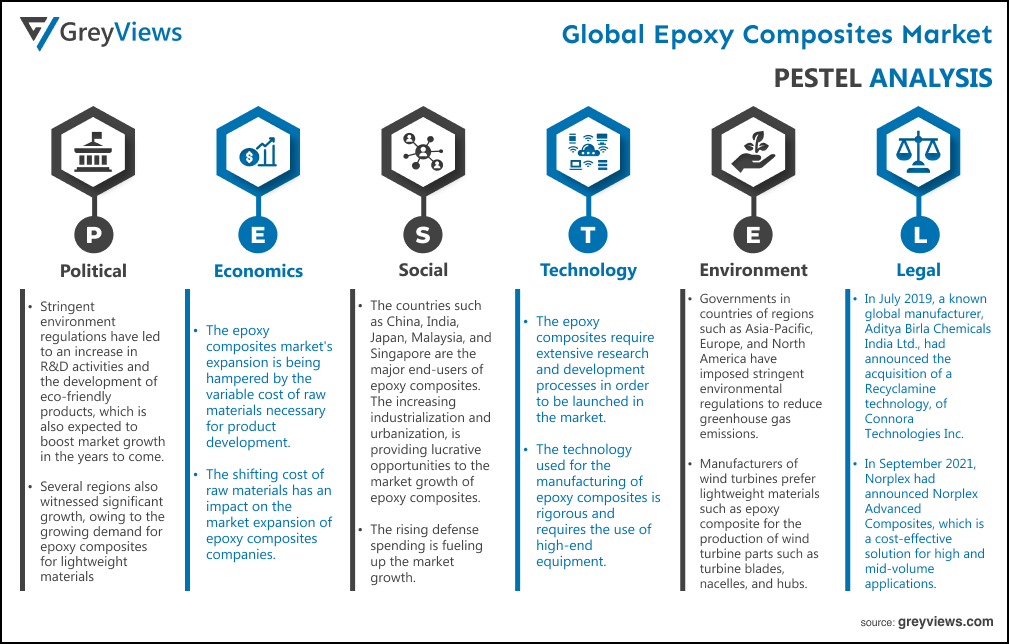

Political- Stringent environment regulations have led to an increase in R&D activities and the development of eco-friendly products, which is also expected to boost market growth in the years to come. Several regions also witnessed significant growth, owing to the growing demand for epoxy composites for lightweight materials, primarily in fuel-efficient automotive designs, due to the implementation of strict environmental regulations in the country.

Economic- The epoxy composites market's expansion is being hampered by the variable cost of raw materials necessary for product development. The total costs are influenced by the raw material prices connected with the development of epoxy composites. The upstream price of raw materials has an impact on the production's final price. As a result, the shifting cost of raw materials has an impact on the market expansion of epoxy composites companies.

Social- The increasing production of automobiles and electric and electronic products has led to a rise in demand for epoxy composites. The countries such as China, India, Japan, Malaysia, and Singapore are the major end-users of epoxy composites. The increasing industrialization and urbanization, is providing lucrative opportunities to the market growth of epoxy composites. Further, the presence of multiple manufacturers in the regional countries have increased the supply of product. The increasing use of private jets, helicopters, etc., and the rise in the number of air passengers has led to the high demand of epoxy composites Moreover, USA and Canada are some of the key countries for the epoxy composites market in North America region. Further, the rising defense spending is fueling up the market growth.

Technological-The epoxy composites require extensive research and development processes in order to be launched in the market. The technology used for the manufacturing of epoxy composites is rigorous and requires the use of high-end equipment. Further, the process is also lengthy and thus this leads to delay in the commercialization of the product.

Environmental- Governments in countries of regions such as Asia-Pacific, Europe, and North America have imposed stringent environmental regulations to reduce greenhouse gas emissions. This has led to the shift towards renewable energy for energy generation. Wind energy capacity installation is increasing at a rapid pace in these regions to reduce carbon emissions. Manufacturers of wind turbines prefer lightweight materials such as epoxy composite for the production of wind turbine parts such as turbine blades, nacelles, and hubs.

Legal- In July 2019, a known global manufacturer, Aditya Birla Chemicals India Ltd., had announced the acquisition of a Recyclamine technology, of Connora Technologies Inc. The recyclamine technology is a zero-waste manufacturing and easy recyclability, for the epoxy composite manufacturers. In September 2021, Norplex had announced Norplex Advanced Composites, which is a cost-effective solution for high and mid-volume applications. The product portfolio of Norplex Advanced Composites includes unidirectional and fabric glass epoxy resins. The newly launched product portfolio is suitable for different applications such as medical, aerospace, transportation, renewable energy goods, etc.

- Introduction

- Objective Of The Study

- Overview Of Epoxy Composites Market

- Markets Covered

- Geographic Scope

- Years Considered For The Study

- Currency And Pricing

- Executive Summary

- Premium Insights

- Market Attractiveness Analysis

- Market Attractiveness Analysis By Manufacturing Technology

- Market Attractiveness Analysis By Fiber Type

- Market Attractiveness Analysis By Application

- Market Attractiveness Analysis By Distribution Channel

- Market Attractiveness Analysis By Region

- Industry SWOT

- Industry Trends

- Porter’s Five Forces Analysis

- Country Level Analysis

- Factors Considered For The Study

- Pointers Covered At Macro Level

- Pointers Covered At Micro Level

- Year On Year Growth Rate

- Technology Road Map

- Market Attractiveness Analysis

- Market Overview and Key Dynamics

- Drivers

- Restraints

- Opportunities

- Challenges

- Global Epoxy Composites Market Analysis and Projection, By Manufacturing Technology

- Segment Overview

- Compression Moulding

- Lay-up

- Filament Winding

- Resin Injection

- Resin Transfer Moulding

- Pultrusion

- Others

- Global Epoxy Composites Market Analysis and Projection, By Fiber Type

- Segment Overview

- Carbon

- Glass

- Others

- Global Epoxy Composites Market Analysis and Projection, By Application

- Segment Overview

- Electronics and Electrical

- Marine

- Automotive and Transportation

- Wind Energy

- Aerospace and Defense

- Sporting and Consumer Goods

- Construction

- Others

- Global Epoxy Composites Market Analysis and Projection, By Distribution Channel

- Segment Overview

- Online

- Offline

- Global Epoxy Composites Market Analysis and Projection, By Regional Analysis

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- North America

- Global Epoxy Composites Market-Competitive Landscape

- Overview

- Market Share of Key Players in Global Epoxy Composites Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Product Launches and Developments

- Partnerships, Collaborations and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Toray Industries

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Gurit Holdings AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Park Electrochemical Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Teijin Limited

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Cytec Solvay Group

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Hexcel Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Huntsman Corp. LLC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- SGL Carbon

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Arkema

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Avient Corp.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Olin Corp.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Axiom Materials Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Koninklijke Ten Cate NV.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Mitsubishi Rayon Co. Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Rotec Composite Group B.V.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Gordon Composites, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Toray Industries

List of Table

- Global Epoxy Composites Market, By Manufacturing Technology, 2021-2028 (USD Billion)

- Global Compression Moulding, Epoxy Composites Market, By Region, 2021-2028 (USD Billion)

- Global Lay-up, Epoxy Composites Market, By Region, 2021-2028 (USD Billion)

- Global Filament Winding, Epoxy Composites Market, By Region, 2021-2028 (USD Billion)

- Global Resin Injection, Epoxy Composites Market, By Region, 2021-2028 (USD Billion)

- Global Resin Transfer Moulding, Epoxy Composites Market, By Region, 2021-2028 (USD Billion)

- Global Pultrusion, Epoxy Composites Market, By Region, 2021-2028 (USD Billion)

- Global Others, Epoxy Composites Market, By Region, 2021-2028 (USD Billion)

- Global Epoxy Composites Market, By Fiber Type, 2021-2028 (USD Billion)

- Global Carbon, Epoxy Composites Market, By Region, 2021-2028 (USD Billion)

- Global Glass, Epoxy Composites Market, By Region, 2021-2028 (USD Billion)

- Global Others, Epoxy Composites Market, By Region, 2021-2028 (USD Billion)

- Global Epoxy Composites Market, By Application, 2021-2028 (USD Billion)

- Global Electronics and Electrical, Epoxy Composites Market, By Region, 2021-2028 (USD Billion)

- Global Marine, Epoxy Composites Market, By Region, 2021-2028 (USD Billion)

- Global Automotive and Transportation, Epoxy Composites Market, By Region, 2021-2028 (USD Billion)

- Global Wind Energy, Epoxy Composites Market, By Region, 2021-2028 (USD Billion)

- Global Aerospace and Defense, Epoxy Composites Market, By Region, 2021-2028 (USD Billion)

- Global Sporting and Consumer Goods, Epoxy Composites Market, By Region, 2021-2028 (USD Billion)

- Global Construction, Epoxy Composites Market, By Region, 2021-2028 (USD Billion)

- Global Others, Epoxy Composites Market, By Region, 2021-2028 (USD Billion)

- Global Epoxy Composites Market, By Distribution Channel, 2021-2028 (USD Billion)

- Global Online, Epoxy Composites Market, By Region, 2021-2028 (USD Billion)

- Global Offline, Epoxy Composites Market, By Region, 2021-2028 (USD Billion)

- North America Epoxy Composites Market, By Manufacturing Technology, 2021-2028 (USD Billion)

- North America Epoxy Composites Market, By Fiber Type, 2021-2028 (USD Billion)

- North America Epoxy Composites Market, By Application, 2021-2028 (USD Billion)

- North America Epoxy Composites Market, By Distribution Channel 2021-2028 (USD Billion)

- US Epoxy Composites Market, By Manufacturing Technology, 2021-2028 (USD Billion)

- US Epoxy Composites Market, By Fiber Type, 2021-2028 (USD Billion)

- US Epoxy Composites Market, By Application, 2021-2028 (USD Billion)

- US Epoxy Composites Market, By Distribution Channel, 2021-2028 (USD Billion)

- Canada Epoxy Composites Market, By Manufacturing Technology, 2021-2028 (USD Billion)

- Canada Epoxy Composites Market, By Fiber Type, 2021-2028 (USD Billion)

- Canada Epoxy Composites Market, By Application, 2021-2028 (USD Billion)

- Canada Epoxy Composites Market, By Distribution Channel, 2021-2028 (USD Billion)

- Mexico Epoxy Composites Market, By Manufacturing Technology, 2021-2028 (USD Billion)

- Mexico Epoxy Composites Market, By Fiber Type, 2021-2028 (USD Billion)

- Mexico Epoxy Composites Market, By Application, 2021-2028 (USD Billion)

- Mexico Epoxy Composites Market, By Distribution Channel, 2021-2028 (USD Billion)

- Europe Epoxy Composites Market, By Manufacturing Technology, 2021-2028 (USD Billion)

- Europe Epoxy Composites Market, By Fiber Type, 2021-2028 (USD Billion)

- Europe Epoxy Composites Market, By Application, 2021-2028 (USD Billion)

- Europe Epoxy Composites Market, By Distribution Channel, 2021-2028 (USD Billion)

- Germany Epoxy Composites Market, By Manufacturing Technology, 2021-2028 (USD Billion)

- Germany Epoxy Composites Market, By Fiber Type, 2021-2028 (USD Billion)

- Germany Epoxy Composites Market, By Application, 2021-2028 (USD Billion)

- Germany Epoxy Composites Market, By Distribution Channel, 2021-2028 (USD Billion)

- France Epoxy Composites Market, By Manufacturing Technology, 2021-2028 (USD Billion)

- France Epoxy Composites Market, By Fiber Type, 2021-2028 (USD Billion)

- France Epoxy Composites Market, By Application, 2021-2028 (USD Billion)

- France Epoxy Composites Market, By Distribution Channel, 2021-2028 (USD Billion)

- UK Epoxy Composites Market, By Manufacturing Technology, 2021-2028 (USD Billion)

- UK Epoxy Composites Market, By Fiber Type, 2021-2028 (USD Billion)

- UK Epoxy Composites Market, By Application, 2021-2028 (USD Billion)

- UK Epoxy Composites Market, By Distribution Channel, 2021-2028 (USD Billion)

- Italy Epoxy Composites Market, By Manufacturing Technology, 2021-2028 (USD Billion)

- Italy Epoxy Composites Market, By Fiber Type, 2021-2028 (USD Billion)

- Italy Epoxy Composites Market, By Application, 2021-2028 (USD Billion)

- Italy Epoxy Composites Market, By Distribution Channel, 2021-2028 (USD Billion)

- Spain Epoxy Composites Market, By Manufacturing Technology, 2021-2028 (USD Billion)

- Spain Epoxy Composites Market, By Fiber Type, 2021-2028 (USD Billion)

- Spain Epoxy Composites Market, By Application, 2021-2028 (USD Billion)

- Spain Epoxy Composites Market, By Distribution Channel, 2021-2028 (USD Billion)

- Asia Pacific Epoxy Composites Market, By Manufacturing Technology, 2021-2028 (USD Billion)

- Asia Pacific Epoxy Composites Market, By Fiber Type, 2021-2028 (USD Billion)

- Asia Pacific Epoxy Composites Market, By Application, 2021-2028 (USD Billion)

- Asia Pacific Epoxy Composites Market, By Distribution Channel, 2021-2028 (USD Billion)

- Japan Epoxy Composites Market, By Manufacturing Technology, 2021-2028 (USD Billion)

- Japan Epoxy Composites Market, By Fiber Type, 2021-2028 (USD Billion)

- Japan Epoxy Composites Market, By Application, 2021-2028 (USD Billion)

- Japan Epoxy Composites Market, By Distribution Channel, 2021-2028 (USD Billion)

- China Epoxy Composites Market, By Manufacturing Technology, 2021-2028 (USD Billion)

- China Epoxy Composites Market, By Fiber Type, 2021-2028 (USD Billion)

- China Epoxy Composites Market, By Application, 2021-2028 (USD Billion)

- China Epoxy Composites Market, By Distribution Channel, 2021-2028 (USD Billion)

- India Epoxy Composites Market, By Manufacturing Technology, 2021-2028 (USD Billion)

- India Epoxy Composites Market, By Fiber Type, 2021-2028 (USD Billion)

- India Epoxy Composites Market, By Application, 2021-2028 (USD Billion)

- India Epoxy Composites Market, By Distribution Channel, 2021-2028 (USD Billion)

- South America Epoxy Composites Market, By Manufacturing Technology, 2021-2028 (USD Billion)

- South America Epoxy Composites Market, By Fiber Type, 2021-2028 (USD Billion)

- South America Epoxy Composites Market, By Application, 2021-2028 (USD Billion)

- South America Epoxy Composites Market, By Distribution Channel, 2021-2028 (USD Billion)

- Brazil Epoxy Composites Market, By Manufacturing Technology, 2021-2028 (USD Billion)

- Brazil Epoxy Composites Market, By Fiber Type, 2021-2028 (USD Billion)

- Brazil Epoxy Composites Market, By Application, 2021-2028 (USD Billion)

- Brazil Epoxy Composites Market, By Distribution Channel, 2021-2028 (USD Billion)

- Middle East and Africa Epoxy Composites Market, By Manufacturing Technology, 2021-2028 (USD Billion)

- Middle East and Africa Epoxy Composites Market, By Fiber Type, 2021-2028 (USD Billion)

- Middle East and Africa Epoxy Composites Market, By Application, 2021-2028 (USD Billion)

- Middle East and Africa Epoxy Composites Market, By Distribution Channel, 2021-2028 (USD Billion)

- UAE Epoxy Composites Market, By Manufacturing Technology, 2021-2028 (USD Billion)

- UAE Epoxy Composites Market, By Fiber Type, 2021-2028 (USD Billion)

- UAE Epoxy Composites Market, By Application, 2021-2028 (USD Billion)

- UAE Epoxy Composites Market, By Distribution Channel, 2021-2028 (USD Billion)

- South Africa Epoxy Composites Market, By Manufacturing Technology, 2021-2028 (USD Billion)

- South Africa Epoxy Composites Market, By Fiber Type, 2021-2028 (USD Billion)

- South Africa Epoxy Composites Market, By Application, 2021-2028 (USD Billion)

- South Africa Epoxy Composites Market, By Distribution Channel, 2021-2028 (USD Billion)

List of Figures

- Global Epoxy Composites Market Segmentation

- Global Epoxy Composites Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Epoxy Composites Market Attractiveness Analysis By Manufacturing Technology

- Global Epoxy Composites Market Attractiveness Analysis By Fiber Type

- Global Epoxy Composites Market Attractiveness Analysis By Application

- Global Epoxy Composites Market Attractiveness Analysis By Distribution Channel

- Global Epoxy Composites Market Attractiveness Analysis By Region

- Global Epoxy Composites Market: Dynamics

- Global Epoxy Composites Market Share By Manufacturing Technology (2021 & 2028)

- Global Epoxy Composites Market Share By Fiber Type (2021 & 2028)

- Global Epoxy Composites Market Share By Application (2021 & 2028)

- Global Epoxy Composites Market Share By Distribution Channel (2021 & 2028)

- Global Epoxy Composites Market Share By Regions (2021 & 2028)

- Global Epoxy Composites Market Share By Company (2021)