Global Ethyl Acetate Market Size by Application (Adhesives and Sealants, Paints and Coatings, Process Solvents, Intermediates, Pigments, and Other), End-user Industry (Food and Beverage, Pharmaceutical, Packaging, Automotive, Artificial Leather, and Others), Regions, Segmentation and Projection till 2028.

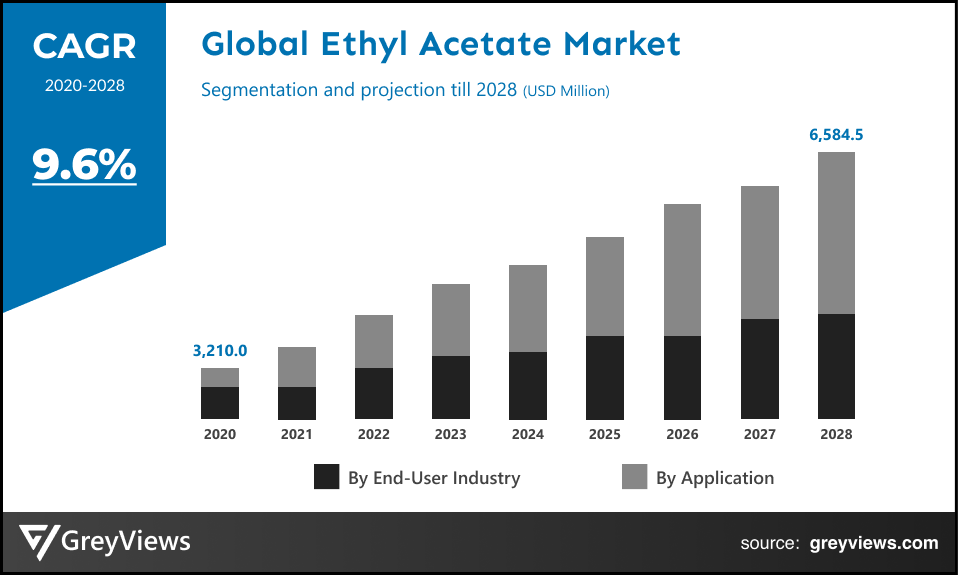

CAGR: 9.6%Current Market Size: USD 3,210.0 MillionFastest Growing Region: Europe

Largest Market: APACProjection Time: 2021-2028Base Year: 2020

Global Ethyl Acetate Market- Market Overview

The global ethyl acetate market is expected to grow from USD 3,210.0 Million in 2020 to USD 6,584.5 Million by 2028, at a CAGR of 9.6% during the Projection period 2021-2028. This growth of the ethyl acetate market is mainly driven by extensive usage of ethyl acetate in paints and coatings due to its properties coupled with the significant growth in the global building and construction sector.

Ethyl acetate is an organic compound and a widely used solvent, especially for paints, varnishes, cleaning mixtures, lacquers, and perfumes. It is a colorless liquid and the ester of ethanol & acetic acid with a characteristic sweet smell. This chemical compound is highly flammable with a flashpoint of -4° C as well as toxic when inhaled or ingested, and can be extremely damaging to the internal organs in the case of prolonged or repeated exposure.

Ethyl acetate is seeing an extensive range of applications in different industries. For instance, it is used primarily as a coatings solvent for lacquers, paints, and varnishes; a process solvent in the pharmaceutical industry; an extraction solvent for various processes, including decaffeination of tea and coffee; and a carrier solvent for printing inks, nail polish, and adhesives.

Request Sample:- Global ethyl acetate market

Market Dynamics

Drivers:

- Extensive usage of ethyl acetate in paints and coatings

Ethyl acetate is an economical solvent and it ensures superior performance. In addition to this, it has properties such as low toxicity and odor. Such properties make it the most preferred solvent in the paints and coating industry. In addition, paints utilize ethyl acetate as an activator or a hardener. Hence, the growing paints and coatings sector across the globe fuels the ethyl acetate market.

- A significant rise in the printing ink industry

Ethyl acetate is rapidly being consumed for the manufacture of printing ink. However, the printing ink is flourishing at a rapid pace due to demand from commercial printing & publishing, flexible packaging, and packaging labels. In addition to this, the rapid growth of the packaging industry further boosted growth in the application of digital printing creating demand for printing ink. This growth of the printing industry drives the growth of the ethyl acetate market.

Restraints:

- Demand for water-based paints and coatings

Ongoing growth in environmental concerns has led to the emergence of stringent regulations and environmental norms for reducing the impact of harmful chemicals. This has led to the replacement of solvent-based paints and coatings with water-based solutions. Ethyl acetate chemical compounds are highly flammable and can be extremely damaging to the internal organs in the case of prolonged or repeated exposure. This preference towards water-based paints and coatings may hamper the growth of the ethyl acetate market to some extent.

Opportunities:

- Emerging usage of ethyl acetate in different end-use industries

Ethyl acetate is seeing emerging use cases across different industry verticals such as food and beverage, pharmaceutical, packaging, automotive, and artificial leather. For instance, the manufacture of artificial leather products such as bags, purses, wallets, and other accessories creates demand for ethyl acetate. While on the other hand, the food and beverage industry uses ethyl acetate to add artificial flavors, creating growth opportunities for the ethyl acetate market.

Challenges:

- Declined demand during the COVID-19 pandemic

Owing to the unprecedented crisis of COVID-19, a number of countries have employed nationwide lockdowns. The pandemic has caused a considerable economic downturn across the globe with a huge influence on the growth of different industrial sectors. This has led to the reduction in demand for ethyl acetate in industrial sectors. In addition to this, sales of paints and coatings have also been hampered due to halted construction activities.

Hence, the emergence of the COVID-19 pandemic is projected to be one of the major challenges faced by the ethyl acetate industry.

Segmentation Analysis

The global ethyl acetate market has been segmented based on application, end-user industry, and regions.

By Application

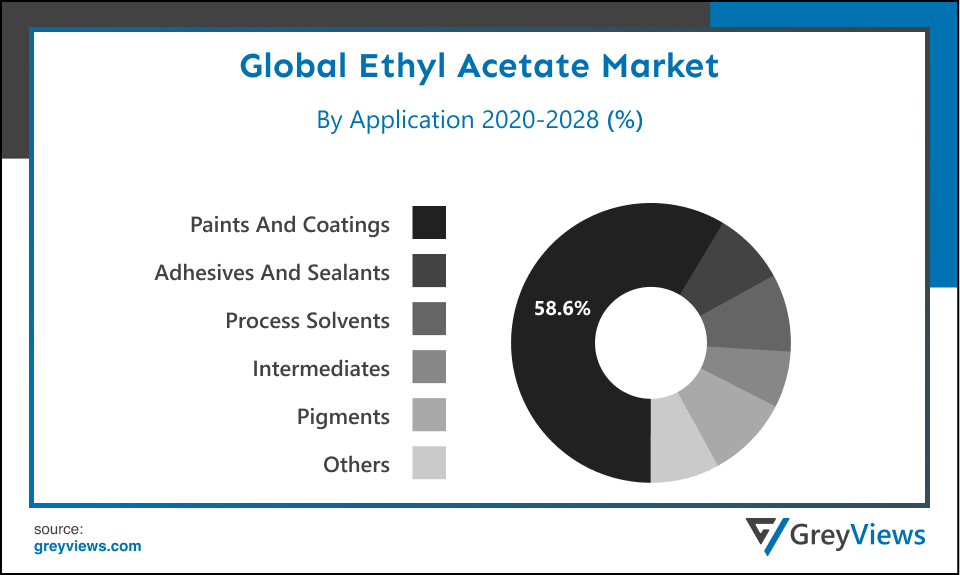

- The application segment includes adhesives and sealants, paints and coatings, process solvents, intermediates, pigments, and others. The paints and coatings segment led the ethyl acetate market with a market share of around 58.6% in 2020. The growth of this segment is mainly driven by rising demand for ethyl acetate in the manufacture of coatings, varnishes, and paints. For instance, the coatings, varnishes, and paints that are employed in building & construction and automotive industries mostly prefer ethyl acetate solvent. However, the adhesives and sealants segment is anticipated to witness the highest growth during the Projection period.

By End-User Industry

- The end-user industry segment includes food and beverage, pharmaceutical, packaging, automotive, artificial leather, and others. The food and beverage segment held the largest market share of 32.1% in 2020. This is due to the wide-ranging applications of ethyl acetate in the food and beverage sector. For instance, ethyl acetate is used to add artificial flavors such as strawberries, bananas, pineapple, and others in food. However, the artificial leather segment is expected to witness the highest growth rate during the Projection period.

By Regional Analysis

The regions analyzed for the ethyl acetate market include North America, Europe, South America, Asia Pacific, and the Middle East and Africa. The Asia-Pacific region dominated the ethyl acetate market and held the 39.2% share of the market revenue in 2020.

- The number of factors such as increasing household incomes and rapid urbanizations in countries such as India, China, and Malaysia drives the growth of the Asia-Pacific ethyl acetate market. In addition to this, an upsurge in the production of chemicals across the countries such as China, India, Taiwan, and Indonesia fuels the Asia-Pacific ethyl acetate market size. For instance, China is the major manufacturer as well as exporter of ethyl acetate across the globe with India exporting considerable quantities of ethyl acetate to the European countries.

- The European region is likely to register significant growth during the Projection period due to the significant presence of major paints & coating manufacturing companies including Jotun, Akzo Nobel, and BASF among others in the region. In addition to this, the region has been investing highly in the pharmaceutical industry, creating lucrative growth opportunities for the market.

Key Industry Players Analysis

Key market players are focusing on developments to improve their market position

The key players are now concentrating on implementing strategies such as adopting new technology, product innovations, mergers & acquisitions, joint venture, alliances, and partnerships to improve their market position in the global ethyl acetate industry.

For instance, in August 2019, Celanese Corporation, one of the leading players in the ethyl acetate industry, has increased the price of its ethyl acetate product across the European market. The company has increased its cost by around EUR 110 per ton.

- INEOS

- Celanese

- Eastman Chemical

- Jiangsu Sopo

- Sekab

- Korea Alcohol

- Jiangmen Handsome

- Wuxi Baichuan

- Jubliant

- GODAVARI BIOREFINERIES LTD.

- IOL Chemicals and Pharmaceuticals

Latest Development

- February 2021- INEOS Styrolution collaborated with Polystyvert to convert post-consumer polystyrene plastic into high-quality polystyrene (PS) raw material resin. Polystyvert uses dissolution technology to process polystyrene waste into high-quality recycled polystyrene.

- June 2020- INEOS acquired BP's global paraxylene (PX), purified terephthalic acid (PTA), and acetyls businesses. This acquisition has strengthened the products portfolio of INEOS.

Report Metrics

|

Report Attribute |

Details |

|

Projection period |

2021-2028 |

|

Base year considered |

2020 |

|

CAGR (%) |

9.6% |

|

Market Size |

3,210.0 Million in 2020 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Application, End-user Industry, and Regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

INEOS, Celanese, Eastman Chemical, Jiangsu Sopo, Sekab, Korea Alcohol, Jiangmen Handsome, Wuxi Baichuan, Jubliant, GODAVARI BIOREFINERIES LTD., and IOL Chemicals and Pharmaceuticals among others. |

|

By Application |

|

|

By End-user Industry |

|

|

Regional scope |

|

Scope of the Report

Global Ethyl Acetate Market by Application:

- Adhesives and sealants

- Paints and coatings

- Process solvents

- Intermediates

- Pigments

- Other

Global Ethyl Acetate Market by End-user Industry:

- Food and Beverage

- Pharmaceutical

- Packaging

- Automotive

- Artificial Leather

- Other

Global Ethyl acetate Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market value of the Ethyl Acetate Market in 2020?

The market value of the Ethyl Acetate Market in 2020 is $3,210.0 Million.

Which region has the highest market share in Ethyl Acetate Market?

Asia-Pacific held the major share in the market over the Projection period 2021- 2028.

Which is the most influencing segment growing in the Ethyl Acetate report?

Paints and coatings segment is the most influencing segment in the Ethyl Acetate market.

Which are the Top players active in the Ethyl Acetate market?

The leading market players active in the global Ethyl Acetate market are INEOS, Celanese, Eastman Chemical, Jiangsu Sopo, Sekab, Korea Alcohol, Jiangmen Handsome, Wuxi Baichuan, Jubliant, GODAVARI BIOREFINERIES LTD., IOL Chemicals, and Pharmaceuticals among others.

What are the segment considered in the global Ethyl Acetate market?

Application, End-user Industry, and regions are the three segments of the report.

Does this report include the impact of COVID-19 on the Ethyl Acetate market?

Yes, the market includes qualitative and quantitative insights for COVID-19 impact on the Ethyl Acetate market.

What is the study period of this market?

The Ethyl Acetate market is studied from 2020 - 2028.

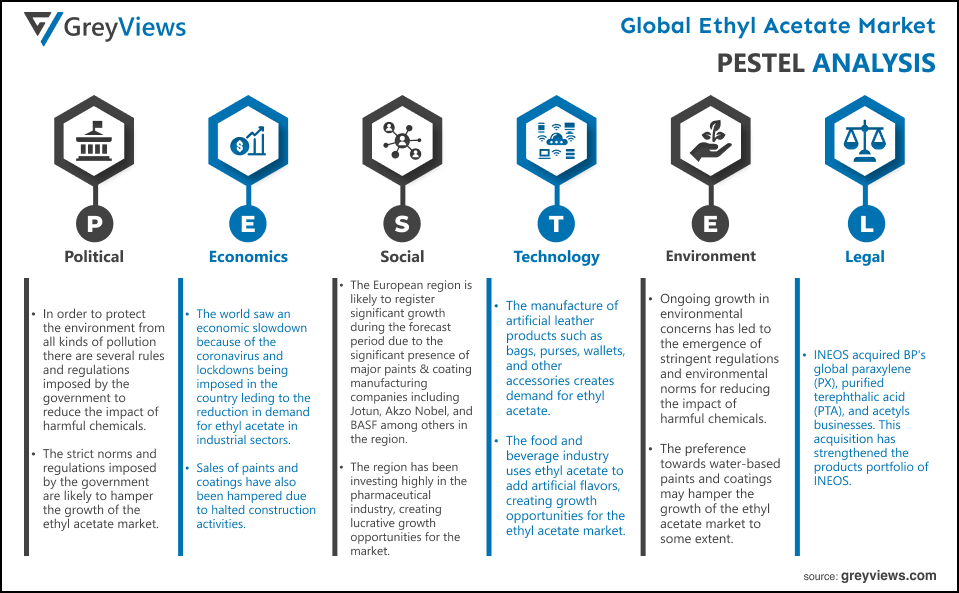

Political- In order to protect the environment from all kinds of pollution there are several rules and regulations imposed by the government to reduce the impact of harmful chemicals. The strict norms and regulations imposed by the government are likely to hamper the growth of the ethyl acetate market.

Economic- The world saw an economic slowdown because of the coronavirus and lockdowns being imposed in the country. This has led to the reduction in demand for ethyl acetate in industrial sectors. In addition to this, sales of paints and coatings have also been hampered due to halted construction activities. Hence, the emergence of the COVID-19 pandemic is projected to be one of the major challenges faced by the ethyl acetate industry.

Social- The European region is likely to register significant growth during the Projection period due to the significant presence of major paints & coating manufacturing companies including Jotun, Akzo Nobel, and BASF among others in the region. In addition to this, the region has been investing highly in the pharmaceutical industry, creating lucrative growth opportunities for the market. China is the major manufacturer as well as exporter of ethyl acetate across the globe with India exporting considerable quantities of ethyl acetate to the European countries.

Technological- The manufacture of artificial leather products such as bags, purses, wallets, and other accessories creates demand for ethyl acetate. While on the other hand, the food and beverage industry uses ethyl acetate to add artificial flavors, creating growth opportunities for the ethyl acetate market.

Environmental- Ongoing growth in environmental concerns has led to the emergence of stringent regulations and environmental norms for reducing the impact of harmful chemicals. This has led to the replacement of solvent-based paints and coatings with water-based solutions. Ethyl acetate chemical compounds are highly flammable and can be extremely damaging to the internal organs in the case of prolonged or repeated exposure. This preference towards water-based paints and coatings may hamper the growth of the ethyl acetate market to some extent.

Legal- INEOS acquired BP's global paraxylene (PX), purified terephthalic acid (PTA), and acetyls businesses. This acquisition has strengthened the products portfolio of INEOS.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Application

- Market Attractiveness Analysis By End-user Industry

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Extensive usage of ethyl acetate in paints and coatings

- Significant rise of printing ink industry

- Restrains

- Demand for water-based paints and coatings

- Opportunities

- Emerging usage of ethyl acetate in different end use industries

- Challenges

- Declined demand during the COVID-19 pandemic

- Global Ethyl Acetate Market Analysis and Projection, By Application

- Segment Overview

- Adhesives and Sealants

- Paints and Coatings

- Process Solvents

- Intermediates

- Pigments

- Others

- Global Ethyl Acetate Market Analysis and Projection, By End-user Industry

- Segment Overview

- Food and Beverage

- Pharmaceutical

- Packaging

- Automotive

- Artificial Leather

- Others

- Global Ethyl Acetate Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Ethyl Acetate Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Ethyl Acetate Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Application Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- INEOS

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Application Portfolio

- Recent Developments

- SWOT Analysis

- Celanese

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Application Portfolio

- Recent Developments

- SWOT Analysis

- Eastman Chemical

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Application Portfolio

- Recent Developments

- SWOT Analysis

- Jiangsu Sopo

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Application Portfolio

- Recent Developments

- SWOT Analysis

- Sekab

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Application Portfolio

- Recent Developments

- SWOT Analysis

- Korea Alcohol

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Application Portfolio

- Recent Developments

- SWOT Analysis

- Jiangmen Handsome

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Application Portfolio

- Recent Developments

- SWOT Analysis

- Wuxi Baichuan

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Application Portfolio

- Recent Developments

- SWOT Analysis

- Jubliant

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Application Portfolio

- Recent Developments

- SWOT Analysis

- GODAVARI BIOREFINERIES LTD.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Application Portfolio

- Recent Developments

- SWOT Analysis

- IOL Chemicals and Pharmaceuticals

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Application Portfolio

- Recent Developments

- SWOT Analysis

- INEOS

List of Table

- Global Ethyl Acetate Market, By Application, 2020–2028(USD Billion) (Kilotons)

- Global Adhesives and Sealants Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Paints and Coatings Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Process Solvents Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Intermediates Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Pigments Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Others Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Ethyl Acetate Market, By End-user Industry, 2020–2028(USD Billion) (Kilotons)

- Global Food and Beverage Ethyl Acetate Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Pharmaceutical Ethyl Acetate Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Packaging Ethyl Acetate Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Automotive Ethyl Acetate Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Artificial Leather Ethyl Acetate Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Others Ethyl Acetate Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Ethyl Acetate Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Ethyl Acetate Market, By North America, 2020–2028(USD Billion) (Kilotons)

- North America Ethyl Acetate Market, By Application, 2020–2028(USD Billion) (Kilotons)

- North America Ethyl Acetate Market, By End-user Industry, 2020–2028(USD Billion) (Kilotons)

- US Ethyl Acetate Market, By Application, 2020–2028(USD Billion) (Kilotons)

- US Ethyl Acetate Market, By End-user Industry, 2020–2028(USD Billion) (Kilotons)

- Canada Ethyl Acetate Market, By Application, 2020–2028(USD Billion) (Kilotons)

- Canada Ethyl Acetate Market, By End-user Industry, 2020–2028(USD Billion) (Kilotons)

- Mexico Ethyl Acetate Market, By Application, 2020–2028(USD Billion) (Kilotons)

- Mexico Ethyl Acetate Market, By End-user Industry, 2020–2028(USD Billion) (Kilotons)

- Europe Ethyl Acetate Market, By Application, 2020–2028(USD Billion) (Kilotons)

- Europe Ethyl Acetate Market, By End-user Industry, 2020–2028(USD Billion) (Kilotons)

- Germany Ethyl Acetate Market, By Application, 2020–2028(USD Billion) (Kilotons)

- Germany Ethyl Acetate Market, By End-user Industry, 2020–2028(USD Billion) (Kilotons)

- France Ethyl Acetate Market, By Application, 2020–2028(USD Billion) (Kilotons)

- France Ethyl Acetate Market, By End-user Industry, 2020–2028(USD Billion) (Kilotons)

- UK Ethyl Acetate Market, By Application, 2020–2028(USD Billion) (Kilotons)

- UK Ethyl Acetate Market, By End-user Industry, 2020–2028(USD Billion) (Kilotons)

- Italy Ethyl Acetate Market, By Application, 2020–2028(USD Billion) (Kilotons)

- Italy Ethyl Acetate Market, By End-user Industry, 2020–2028(USD Billion) (Kilotons)

- Spain Ethyl Acetate Market, By Application, 2020–2028(USD Billion) (Kilotons)

- Spain Ethyl Acetate Market, By End-user Industry, 2020–2028(USD Billion) (Kilotons)

- Asia Pacific Ethyl Acetate Market, By Application, 2020–2028(USD Billion) (Kilotons)

- Asia Pacific Ethyl Acetate Market, By End-user Industry, 2020–2028(USD Billion) (Kilotons)

- Japan Ethyl Acetate Market, By Application, 2020–2028(USD Billion) (Kilotons)

- Japan Ethyl Acetate Market, By End-user Industry, 2020–2028(USD Billion) (Kilotons)

- China Ethyl Acetate Market, By Application, 2020–2028(USD Billion) (Kilotons)

- China Ethyl Acetate Market, By End-user Industry, 2020–2028(USD Billion) (Kilotons)

- India Ethyl Acetate Market, By Application, 2020–2028(USD Billion) (Kilotons)

- India Ethyl Acetate Market, By End-user Industry, 2020–2028(USD Billion) (Kilotons)

- South America Ethyl Acetate Market, By Application, 2020–2028(USD Billion) (Kilotons)

- South America Ethyl Acetate Market, By End-user Industry, 2020–2028(USD Billion) (Kilotons)

- Brazil Ethyl Acetate Market, By Application, 2020–2028(USD Billion) (Kilotons)

- Brazil Ethyl Acetate Market, By End-user Industry, 2020–2028(USD Billion) (Kilotons)

- Middle East and Africa Ethyl Acetate Market, By Application, 2020–2028(USD Billion) (Kilotons)

- Middle East and Africa Ethyl Acetate Market, By End-user Industry, 2020–2028(USD Billion) (Kilotons)

- UAE Ethyl Acetate Market, By Application, 2020–2028(USD Billion) (Kilotons)

- UAE Ethyl Acetate Market, By End-user Industry, 2020–2028(USD Billion) (Kilotons)

- South Africa Ethyl Acetate Market, By Application, 2020–2028(USD Billion) (Kilotons)

- South Africa Ethyl Acetate Market, By End-user Industry, 2020–2028(USD Billion) (Kilotons)

List of Figures

- Global Ethyl Acetate Market Segmentation

- Ethyl Acetate Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Ethyl Acetate Market Attractiveness Analysis By Application

- Global Ethyl Acetate Market Attractiveness Analysis By End-user Industry

- Global Ethyl Acetate Market Attractiveness Analysis By Region

- Global Ethyl Acetate Market: Dynamics

- Global Ethyl Acetate Market Share By Application(2021 & 2028)

- Global Ethyl Acetate Market Share By End-user Industry(2021 & 2028)

- Global Ethyl Acetate Market Share by Regions (2021 & 2028)

- Global Ethyl Acetate Market Share by Company (2020)